Introduction

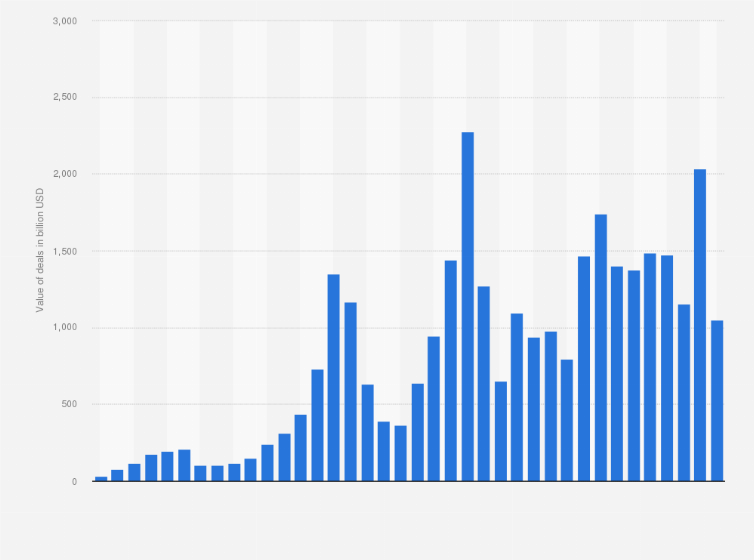

In the dynamic landscape of global business, cross-border mergers and acquisitions (M&A) are increasingly becoming a common strategy for companies looking to expand their reach, gain a competitive edge, or access new markets. Europe, with its diverse economies and vibrant business environment, has emerged as a hotbed for cross-border M&A activity. In this article, we’ll delve into the world of cross-border M&A in Europe, exploring the driving factors, challenges, and the impact of this dynamic business strategy.

As businesses continue to seek opportunities for growth and diversification, cross-border mergers and acquisitions (M&A) have become a prominent feature of the global economic landscape. These strategic moves often involve companies from different countries coming together to create synergies, enhance their market presence, and drive innovation. Europe, with its rich tapestry of cultures, economies, and industries, has seen a surge in cross-border M&A activity, underscoring its significance in the global business arena.

The Drivers of Cross-Border M&A in Europe

Several key drivers fuel the increasing trend of cross-border M&A in Europe:

Market Expansion: One of the primary motivations behind cross-border M&A is the desire to expand into new markets. Companies seek opportunities to tap into the diverse consumer bases and economic landscapes that different European countries offer. This can be a strategic move to reduce reliance on a single market or to capitalize on emerging markets.

Access to Talent: Acquiring a foreign company often means gaining access to a new pool of talent with diverse skills and perspectives. This can be especially valuable in industries where specialized expertise is crucial, such as technology, research, and development.

Cost Efficiency: Mergers and acquisitions can generate cost efficiencies through economies of scale. Companies can streamline operations, eliminate redundancies, and negotiate better deals with suppliers. This cost optimization can enhance profitability and competitiveness.

Innovation and Technology: Acquiring innovative startups or technology-driven companies is a common strategy for businesses looking to stay at the forefront of their industries. Europe’s thriving tech hubs, like Silicon Valley in the United States, have attracted significant M&A activity.

Globalization: As the world becomes more interconnected, companies often seek a global footprint. Cross-border M&A can provide the international presence required to compete in a globalized economy.

Challenges in Cross-Border M&A

While the benefits of cross-border M&A are compelling, they come with their share of challenges:

Cultural Differences: Differences in language, culture, and business practices can lead to miscommunication and misunderstandings during the integration process. Effective cultural integration is crucial for a successful merger or acquisition.

Regulatory Hurdles: Navigating the regulatory landscape in different countries can be complex and time-consuming. Companies must ensure compliance with various laws, including antitrust regulations, taxation rules, and labor laws.

Integration Risks: Integrating two distinct organizations can be a risky endeavor. Challenges may arise in aligning corporate cultures, harmonizing IT systems, and retaining key talent.

Valuation and Due Diligence: Accurately valuing a target company and conducting thorough due diligence are critical. Overpaying for an acquisition or overlooking potential risks can lead to financial setbacks.

The Impact on European Economies

The wave of cross-border M&A in Europe has far-reaching implications for the region’s economies. It can stimulate economic growth by creating larger, more competitive companies with increased market share. Additionally, the infusion of foreign capital and expertise can drive innovation and job creation.

However, it also raises concerns about market concentration and potential job losses due to consolidation. Regulators often scrutinize these deals to ensure they do not harm competition or consumers.

In conclusion, cross-border mergers and acquisitions have become a defining feature of Europe’s business landscape. As companies seek opportunities to grow and adapt in an increasingly globalized world, cross-border M&A will continue to shape the region’s business environment. Success in this dynamic arena requires careful planning, thorough due diligence, and a strategic approach to harness the benefits while mitigating the challenges.

Additionally, you can find further information on this topic by visiting this page: Unlocking challenges and opportunities presented by COVID-19 …

Driving Factors: Several factors fuel the surge in cross-border M&A activity in Europe

Market Access: Companies often seek cross-border M&A as a means to access new markets or customer segments. Acquiring a local business can provide a strategic foothold in a foreign market, saving time and resources compared to starting from scratch.

Competitive Advantage: M&A can provide companies with a competitive edge by enhancing their product/service portfolio, expanding their geographical reach, or gaining access to valuable technologies or intellectual property.

Cost Efficiencies: Consolidation through M&A can lead to cost savings and operational efficiencies. Companies can streamline operations, eliminate redundancies, and negotiate better terms with suppliers or customers.

Diversification: M&A allows companies to diversify their risk by entering new industries or geographic regions. This diversification can be particularly valuable in times of economic uncertainty.

Explore this link for a more extensive examination of the topic: 2019 Global M&A Outlook – Unlocking value in a dynamic market

Challenges and Considerations: While cross-border M&A offers compelling benefits, it also presents challenges and complexities

Cultural Differences: Merging companies from different countries often entails dealing with diverse corporate cultures, management styles, and employee expectations. Bridging these cultural gaps is crucial for a successful integration.

Regulatory Hurdles: Navigating the regulatory landscape across multiple countries can be a complex process. Antitrust laws, tax regulations, and foreign ownership restrictions can impact the feasibility of a deal.

Integration Risks: Integrating two companies smoothly requires careful planning and execution. Mismatches in technology, processes, or workforce can hinder the realization of expected synergies.

Political and Economic Uncertainty: Economic and political factors can introduce unpredictability into cross-border deals. Changes in government policies or economic conditions in the target country can affect the deal’s success.

Explore this link for a more extensive examination of the topic: Engaging and Integrating a Global Workforce

Impact and Future Trends

Cross-border M&A activity in Europe shows no signs of slowing down. The impact of these deals extends beyond the companies involved; they influence job markets, supply chains, and overall economic growth. Moreover, the COVID-19 pandemic has prompted companies to rethink their strategies, leading to a potential surge in M&A activity as businesses adapt to the evolving landscape.

In conclusion, cross-border mergers and acquisitions in Europe offer significant growth prospects and competitive advantages for businesses willing to navigate the complexities involved. As companies continue to seek opportunities for expansion and diversification, the European market remains a fertile ground for strategic M&A deals. However, success in cross-border M&A demands thorough due diligence, strategic planning, and an acute understanding of the unique challenges presented by international transactions.

To recap, cross-border mergers and acquisitions in Europe present a compelling avenue for businesses aiming to expand their reach and gain a competitive edge. The European market, with its diverse economies and industries, is ripe with opportunities for strategic growth and diversification. Nevertheless, it’s essential to recognize that achieving success in cross-border M&A ventures requires more than just ambition; it demands a meticulous approach:

In-Depth Due Diligence: Thorough due diligence is the foundation of a successful cross-border M&A. Understanding the legal, financial, and operational aspects of the target company and assessing potential risks are vital. Engaging local experts and legal counsel with a deep understanding of the European market can be invaluable.

Cultural Sensitivity: Europe’s diversity extends beyond its economies; it includes a myriad of cultures, languages, and business practices. Companies undertaking cross-border M&A must be culturally sensitive and adaptable. Building strong relationships with local teams and stakeholders can smooth the transition.

Strategic Planning: A well-defined strategy is essential. Businesses should clearly articulate their goals, whether it’s market expansion, technology acquisition, or talent acquisition. Aligning the M&A strategy with the overall corporate strategy ensures a coherent approach.

Regulatory Compliance: Europe has complex regulatory frameworks that vary from one country to another. Staying compliant with local laws, tax regulations, and competition rules is non-negotiable. Expert legal advice is crucial to navigate these intricacies.

Integration Planning: Successful integration is often the make-or-break factor in M&A. Having a detailed integration plan that addresses cultural integration, technology harmonization, and workforce consolidation is key to realizing the full potential of the acquisition.

Continuous Communication: Open and transparent communication with all stakeholders, including employees, customers, and investors, is vital. Managing expectations and addressing concerns can help maintain stability during the transition.

Risk Mitigation: Risk is inherent in any M&A, especially cross-border ones. Companies should identify potential risks and develop strategies to mitigate them. This includes financial risks, operational challenges, and unforeseen market shifts.

Post-Acquisition Evaluation: The work doesn’t end with the acquisition; ongoing evaluation and adjustment are necessary. Regularly assessing the performance and impact of the acquisition against initial goals can guide future decisions.

In essence, cross-border M&A in Europe is a dynamic journey filled with opportunities and challenges. While the road may be complex, the rewards can be substantial. By diligently addressing the intricacies, staying adaptable, and nurturing the acquired assets, businesses can leverage cross-border M&A as a powerful tool for growth and competitiveness in the European market.

To delve further into this matter, we encourage you to check out the additional resources provided here: Global Economic Effects of COVID-19