Introduction

The GameStop frenzy that unfolded in early 2021 captivated the financial world and drew attention to the significant influence of retail investors in the stock market. This unprecedented event, characterized by a meteoric rise in the stock price of the struggling video game retailer GameStop (GME), raised questions about the dynamics of market volatility and the evolving landscape of stock trading. In this article, we will delve into the GameStop phenomenon and explore the role of retail investors in market volatility.

The GameStop frenzy of early 2021 stands as a compelling testament to the ever-evolving nature of the financial markets and the newfound power of retail investors. This extraordinary episode, where the stock price of GameStop (GME) skyrocketed to unprecedented heights, not only captured the attention of seasoned investors but also ignited a global conversation about the democratization of finance.

At its core, the GameStop saga was a David-and-Goliath narrative. A swarm of individual investors, predominantly organized through online forums like Reddit’s WallStreetBets, collectively took on established hedge funds that had bet against GameStop’s success. This collision of retail investors and institutional giants showcased the collective influence and disruptive potential of the masses. It was a striking example of how social media and online communities could galvanize retail investors into a force capable of reshaping the traditional dynamics of the stock market.

The GameStop phenomenon also shone a spotlight on market volatility, prompting discussions about the role of speculative trading, short selling, and the influence of social sentiment on stock prices. It raised important questions about the regulation of financial markets and whether existing mechanisms are equipped to handle such sudden, large-scale, and coordinated retail trading activities.

In the wake of GameStop, regulators and market participants have been evaluating the need for reforms to maintain market integrity while preserving the newfound accessibility of investing for retail traders. This includes considerations around enhanced transparency, more robust risk management protocols, and a balance between allowing individual investors to express their views and safeguarding against excessive market manipulation.

Furthermore, the GameStop event underscores the importance of financial education and literacy among retail investors. While democratizing finance is a laudable goal, it also comes with responsibilities. Encouraging informed decision-making, risk management, and a deeper understanding of market dynamics is essential to empower retail investors to navigate the complexities of stock trading effectively.

In this article, we will delve into the GameStop phenomenon, not only as a historical anomaly but as a harbinger of a changing financial landscape. We will explore the enduring impact of this event on the relationship between retail investors and the stock market, and we will examine the ongoing dialogue about market volatility in an era when anyone with an internet connection can potentially influence the movements of global markets.

Looking for more insights? You’ll find them right here in our extended coverage: Staff Report on Equity and Options Market Structure Conditions in …

The GameStop saga began when a group of individual retail investors, primarily organized through social media platforms like Reddit’s WallStreetBets, collectively decided to invest in GameStop. Their motivation was to counteract the massive short positions taken by hedge funds betting on the company’s stock price to decline. The retail investors initiated a buying spree, causing GameStop’s share price to soar exponentially.

The GameStop saga serves as a remarkable testament to the power of the collective individual investor in the digital age. This extraordinary chain of events not only captured headlines worldwide but also brought several crucial aspects to the forefront:

Social Media as a Catalyst: Social media platforms have transformed into powerful tools for information sharing and organization. The GameStop story showcased how online communities, like Reddit’s WallStreetBets, can quickly mobilize a large group of retail investors. These platforms enable individuals to pool their resources, share insights, and challenge traditional financial institutions.

Retail Investors vs. Hedge Funds: The battle between retail investors and hedge funds highlighted a new dynamic in financial markets. The narrative shifted from a David vs. Goliath struggle, with retail investors using readily available information to challenge institutional investors with substantial resources.

Market Volatility and Regulation: The unprecedented surge in GameStop’s share price raised concerns about market volatility and the need for regulatory oversight. It prompted discussions about whether new rules were necessary to govern the influence of social media-driven trading on stock prices.

Short Selling Scrutiny: The GameStop saga shone a spotlight on the practice of short selling. While it’s a legitimate investment strategy, the story prompted a reevaluation of its risks and ethical implications.

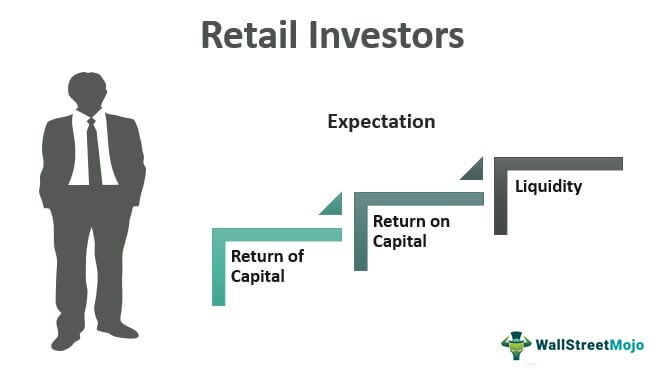

Retail Investor Empowerment: The episode underscored the growing influence of retail investors in financial markets. It encouraged more individuals to take an active interest in investing and highlighted the importance of financial education to navigate complex market dynamics.

The Role of Technology: The GameStop saga showcased the role of technology and digital platforms in democratizing finance. Apps like Robinhood, which provided easy access to trading, played a significant role in enabling retail investors to participate in the market.

Long-Term vs. Short-Term Investing: The incident prompted discussions about the differences between short-term speculation and long-term investing. It emphasized the importance of having a well-thought-out investment strategy that aligns with one’s financial goals.

Transparency and Information Sharing: The story highlighted the need for greater transparency in financial markets. Retail investors sought to expose vulnerabilities in the system and ensure that information was not monopolized by institutional players.

In essence, the GameStop saga was a pivotal moment in the financial world, reflecting the changing landscape of investing and the influence of online communities. It raised important questions about the role of technology, market regulation, and the power of collective action. As financial markets continue to evolve, the GameStop saga will likely be remembered as a defining moment that reshaped the dynamics between individual investors and traditional financial institutions.

To delve further into this matter, we encourage you to check out the additional resources provided here: Long, tense with cat photo for relief; how the GameStop hearing …

One of the defining aspects of the GameStop frenzy was the role of online communities in coordinating investment actions. Retail investors, often referred to as “retail traders,” used forums and social media platforms to share research, insights, and investment strategies. This collective effort showcased the potential for organized retail investors to have a substantial impact on market sentiment.

The GameStop frenzy highlighted the power of online communities in reshaping the landscape of financial markets. This phenomenon brought forth several key lessons and opportunities for the future:

The Democratization of Information: The GameStop saga underscored the democratization of financial information. Retail traders, armed with readily accessible data and research tools, could compete on a more level playing field with institutional investors. This trend is likely to continue, as more individual investors harness the internet’s vast resources for financial education.

Transparency and Accountability: The episode shed light on the need for increased transparency and accountability in financial markets. Regulatory bodies and market participants are now more attuned to the potential for market manipulation and are exploring ways to ensure a fair and orderly market.

New Avenues for Collaboration: The coordinated efforts of retail traders through online communities demonstrated the potential for collective action in financial markets. This could lead to the emergence of more organized retail investor groups that focus on responsible and informed investing practices.

The Role of Social Media: Social media platforms have become instrumental in disseminating financial information and facilitating discussions among retail investors. Investors now turn to platforms like Reddit, Twitter, and investment-focused forums to share insights, though these platforms also present challenges, such as misinformation and hype-driven trading.

Market Regulation: The GameStop incident prompted discussions about the need for updated market regulations that account for the evolving dynamics of online investing. Regulators are considering changes to address market volatility, short-selling practices, and the influence of social media on trading.

Risk Management: Retail traders learned valuable lessons about risk management during this period of heightened volatility. It emphasized the importance of setting clear investment goals, diversifying portfolios, and avoiding excessive risk-taking.

Educational Initiatives: The GameStop frenzy spurred interest in financial literacy and education. Many new investors recognized the need for a deeper understanding of financial markets. Consequently, educational initiatives and resources have emerged to empower individuals with the knowledge they need to make informed investment decisions.

Long-Term Investing vs. Speculation: The events surrounding GameStop brought to the forefront the distinction between long-term investing and speculative trading. It prompted discussions on the importance of a well-defined investment strategy aligned with one’s financial goals.

Market Sentiment and Social Listening: The impact of online communities on market sentiment cannot be underestimated. Investors and analysts are increasingly turning to social listening tools to gauge market sentiment and anticipate potential market moves.

Collaboration Between Retail and Institutional Investors: There is an opportunity for more collaboration and dialogue between retail and institutional investors. The collective wisdom and insights from both groups can lead to more robust market assessments and investment strategies.

In conclusion, the GameStop frenzy was a watershed moment in the financial world, emphasizing the transformative influence of online communities and the need for adaptation in financial markets. As online investing continues to evolve, market participants, regulators, and investors alike will need to navigate this new landscape while upholding principles of transparency, accountability, and informed decision-making.

To expand your knowledge on this subject, make sure to read on at this location: GameStop or Game Just Started? Leveling the Playing Field for …

The GameStop situation exemplified the concept of a “short squeeze.” As the stock price surged, investors who had bet against GameStop by short-selling found themselves in a precarious position. To cover their short positions, they had to buy the stock at inflated prices, driving the price even higher. This feedback loop of buying created extreme volatility.

Certainly, let’s explore the concept of a “short squeeze” in greater detail and its implications within the context of the GameStop situation:

1. Understanding Short Selling:

Short selling is a trading strategy where investors borrow shares of a stock, typically from a brokerage or another investor, and sell them with the expectation that the stock’s price will decline. The goal is to repurchase the shares at a lower price in the future, return them to the lender, and profit from the price difference.

2. The Short Squeeze Mechanism:

A short squeeze occurs when a stock experiences a rapid price increase, forcing short sellers to cover their positions. Here’s how it works:

- Short sellers sell borrowed shares of a stock, betting that the price will fall.

- If the stock’s price starts to rise instead, short sellers face potential losses.

- To limit their losses, short sellers may decide to buy back the shares they borrowed and sold (known as “covering” their short positions).

- When multiple short sellers rush to cover their positions simultaneously, it creates significant buying pressure on the stock.

- This surge in buying activity drives the stock’s price even higher, creating a feedback loop.

3. The GameStop Short Squeeze:

In the GameStop situation, hedge funds and institutional investors had taken substantial short positions, essentially betting that GameStop’s stock price would decline due to the company’s financial challenges. However, the coordinated efforts of retail investors from online forums like WallStreetBets drove up GameStop’s share price.

As the stock price surged, short sellers faced mounting losses and decided to cover their positions by buying GameStop shares. This massive rush to buy GameStop stock to cover short positions contributed to the stock’s extraordinary price spike. The resulting short squeeze created extreme volatility and amplified the price fluctuations.

4. Lessons and Implications:

The GameStop short squeeze highlighted several important lessons and implications:

Market Dynamics: Short squeezes can have a profound impact on market dynamics. They can lead to rapid price movements that may not necessarily reflect the underlying fundamentals of a company.

Risk Management: Short selling carries inherent risks, as losses can theoretically be unlimited if a stock’s price keeps rising. The GameStop saga underscored the importance of sound risk management practices for all types of investors.

Regulatory Scrutiny: The extreme volatility and rapid price swings observed during the GameStop frenzy prompted regulators to review market practices, including short selling rules and market manipulation concerns.

Empowerment of Retail Investors: The GameStop episode demonstrated the collective power of retail investors in challenging established market norms. It showcased how organized retail communities can influence stock prices and disrupt traditional trading strategies.

In summary, the GameStop short squeeze serves as a vivid example of how market dynamics can be influenced by the interplay of different types of investors. It also underscores the need for a nuanced understanding of trading strategies and risk management in today’s complex financial landscape.

Should you desire more in-depth information, it’s available for your perusal on this page: The GameStop Episode: What Happened and What Does It Mean …

The GameStop frenzy raised questions about market regulation. Regulators and policymakers scrutinized the situation, considering potential measures to ensure market stability and protect investors. The incident prompted discussions on topics such as payment for order flow, market manipulation, and the need for greater transparency in financial markets.

The GameStop frenzy served as a wake-up call for the financial world, sparking a deep examination of market dynamics and the need for regulatory reforms. Here’s an extended exploration of the impact and implications of this event:

Market Volatility and Resilience: The GameStop episode underscored the vulnerability of financial markets to sudden and extreme price fluctuations. Regulators and market participants began to assess the resilience of the market infrastructure, with a focus on mechanisms that can absorb shocks and prevent systemic risks.

Payment for Order Flow (PFOF): The practice of payment for order flow, where brokerage firms receive compensation for directing customer orders to certain market makers, came under intense scrutiny. This practice was at the heart of the GameStop saga, as it raised questions about potential conflicts of interest and whether it prioritizes the best interests of retail investors.

Market Manipulation and Fairness: The incident shed light on the evolving landscape of market manipulation. It highlighted the potential for retail investors, often organized through social media platforms, to influence stock prices significantly. Regulators are reevaluating the rules and oversight mechanisms to ensure fair and orderly markets for all participants.

Transparency and Disclosure: The GameStop frenzy emphasized the importance of transparency in financial markets. Policymakers are exploring ways to enhance transparency, not only in the disclosure of short positions but also in market data dissemination. This includes considering the need for real-time reporting and more detailed information on trading practices.

Market Access and Retail Participation: The surge in retail investor participation during the GameStop event raised questions about access to financial markets. Policymakers are evaluating ways to facilitate greater access while ensuring that retail investors are adequately informed and protected from potential risks.

Short Selling Regulations: Short selling, a practice targeted by retail investors during the GameStop saga, has come under review. Regulators are considering whether adjustments are needed in short selling regulations to prevent excessive speculation and market disruptions.

Social Media Influence: The influence of social media on financial markets gained prominence. Regulators are examining the role of social media platforms in disseminating financial information and whether they should be subject to new regulations to prevent market manipulation.

Investor Education: The GameStop frenzy highlighted the importance of investor education. Policymakers are exploring initiatives to enhance financial literacy among retail investors, helping them make more informed decisions and navigate the complexities of the market.

Global Implications: The GameStop event had global repercussions, prompting discussions on the need for coordinated international efforts to address market stability, investor protection, and regulatory harmonization.

Regulatory Adaptation: In response to the GameStop frenzy, regulators and policymakers are adapting to the changing landscape of financial markets. This includes revisiting and updating existing regulations to ensure they remain effective and relevant in the digital age.

In conclusion, the GameStop frenzy served as a catalyst for a broader conversation about the structure and regulation of financial markets. It highlighted the need for ongoing vigilance, regulatory adaptation, and transparency to maintain market stability and protect the interests of all investors, both retail and institutional. The lessons learned from this event are shaping the future of financial regulation and market oversight.

Looking for more insights? You’ll find them right here in our extended coverage: The Future of Capital Markets: Democratization of Retail Investing In …

The GameStop episode demonstrated the growing power of retail investors and their ability to challenge institutional investors and hedge funds. It highlighted the democratization of investing, as retail investors harnessed technology and information-sharing to make informed investment decisions collectively. This empowerment could reshape the financial landscape, with retail investors playing a more influential role in the future.

The GameStop saga was a pivotal moment that underscored the changing dynamics in the world of finance, and it offers several noteworthy insights into the evolving relationship between retail and institutional investors:

Strength in Numbers: The GameStop episode vividly illustrated the power of collective action among retail investors. Through online forums and social media platforms, individual investors rallied together to drive significant changes in the stock market. This event highlights how a large, coordinated group of retail investors can disrupt traditional market dynamics.

Information Transparency: In the digital age, information flows more freely than ever before. Retail investors are increasingly leveraging online resources, news outlets, and social networks to access market data and share insights. This democratization of information allows retail investors to make more informed decisions and level the playing field with institutional investors.

Technological Advancements: Technology has played a central role in empowering retail investors. Trading apps and platforms have become more user-friendly and accessible, enabling retail investors to execute trades efficiently. Additionally, these platforms often offer educational resources and tools that empower retail investors to understand complex financial instruments.

Market Sentiment as a Force: The GameStop episode demonstrated that market sentiment can be a powerful force. Social media-driven sentiment can drive rapid price movements, and retail investors are increasingly tapping into this phenomenon. This development adds a new layer of complexity to market analysis and trading strategies.

Regulatory Scrutiny: The GameStop episode has prompted regulatory bodies to scrutinize market practices and consider potential rule changes. Regulators are evaluating the need for more transparency in short-selling practices, market manipulation prevention, and investor protection measures.

Institutional Adaptation: In response to the changing landscape, some institutional investors are adjusting their strategies. They are monitoring online forums and social media platforms to gauge market sentiment and identify potential opportunities or risks. This adaptation reflects a recognition of the shifting balance of influence.

Investor Education: As retail investors gain prominence, there is an increasing emphasis on investor education. Retail investors are encouraged to understand the risks and complexities of investing, diversify their portfolios, and adopt a long-term perspective. Education remains a crucial tool for responsible investing.

Long-Term Implications: The GameStop episode may have long-term implications for how financial markets operate. It could lead to changes in market regulations, greater transparency in short-selling, and adjustments in risk management practices by both retail and institutional investors.

Social Investing Communities: Online communities of retail investors are becoming more influential. These communities foster knowledge sharing, support, and collective decision-making. They are likely to continue to shape investment trends and strategies.

Evolving Dynamics: The relationship between retail and institutional investors is evolving. While institutional investors still wield significant influence, the GameStop episode demonstrated that retail investors can no longer be underestimated. The future may see a more balanced power dynamic in the financial markets.

In conclusion, the GameStop episode is a clear indication of the shifting tides in the financial world. It serves as a reminder that the democratization of investing, driven by technology and information-sharing, has the potential to reshape the financial landscape and redefine the roles of retail and institutional investors. As both groups adapt to this changing environment, the financial industry is likely to undergo significant transformations in the years to come.

To delve further into this matter, we encourage you to check out the additional resources provided here: WHITE PAPER

While the GameStop frenzy showcased the potential for retail investors to disrupt market dynamics, it also highlighted the risks associated with speculative trading. Many retail investors incurred substantial losses when the stock’s price eventually plummeted. It served as a reminder that market volatility can lead to unpredictable outcomes, and investments should be made with careful consideration of risk tolerance.

The GameStop frenzy was undoubtedly a captivating and unprecedented event that provided valuable lessons for both seasoned investors and newcomers to the world of trading. Expanding on this idea:

Retail Investor Empowerment: The GameStop saga was a clear demonstration of how retail investors, often seen as the underdogs of the financial world, can wield significant influence in the markets. Online communities, like Reddit’s WallStreetBets, showed the power of collective action, challenging traditional norms and highlighting the democratization of financial information.

Speculative Risks: However, it also underscored the inherent risks of speculative trading. Many individuals were drawn into the frenzy by the promise of quick riches, often without fully understanding the risks involved. This led to significant losses when the stock’s price inevitably corrected. It’s essential to recognize that speculative trading strategies can be high-risk endeavors and should be approached with caution.

Volatility’s Unpredictable Nature: The GameStop episode emphasized the unpredictability of market volatility. While some investors profited immensely, others suffered substantial losses. It serves as a reminder that market dynamics can change rapidly, and even well-thought-out strategies may not always yield the expected results.

Risk Management: Every investor should carefully assess their risk tolerance before engaging in any form of trading or investing. Understanding how much risk you can comfortably bear is a fundamental step in constructing a well-balanced and resilient portfolio. Diversification and a long-term investment horizon can help mitigate the impact of short-term market turbulence.

Education and Due Diligence: The GameStop incident underscores the importance of education and due diligence. Investors should thoroughly research and understand the assets they invest in, rather than succumbing to the hype of speculative trading trends. A well-informed investor is better equipped to make rational decisions and weather market volatility.

Regulatory Implications: The frenzy also prompted regulatory scrutiny and discussions about the need for enhanced market oversight and transparency. Investors should stay informed about potential regulatory changes that could impact their trading activities and adhere to existing regulations.

Investment Strategies: Rather than chasing short-term market trends, consider adopting long-term, evidence-based investment strategies that align with your financial goals and risk tolerance. Diversification across asset classes and periodic portfolio rebalancing can help manage risk while aiming for steady, sustainable growth.

Community and Collaboration: While the GameStop event had speculative aspects, it also fostered a sense of community and collaboration among retail investors. Engaging in open discussions, sharing knowledge, and learning from experienced investors can be valuable for anyone looking to navigate the financial markets successfully.

In conclusion, the GameStop frenzy was a significant moment in the world of finance, showcasing both the empowerment of retail investors and the dangers of speculative trading. It serves as a reminder that financial markets are complex and unpredictable, highlighting the need for prudent risk management, education, and careful consideration of long-term investment goals. By approaching investing with a balanced perspective and an understanding of the associated risks, individuals can make more informed and resilient financial decisions.

To delve further into this matter, we encourage you to check out the additional resources provided here: Who participated in the GameStop frenzy? Evidence from brokerage …

The GameStop frenzy was not an isolated event but rather part of the ongoing evolution of finance. It underscored the need for market participants, regulators, and financial institutions to adapt to the changing dynamics of the digital age. It also emphasized the importance of financial education and responsible investing practices for all participants.

The GameStop Frenzy: A Catalyst for Financial Transformation

The GameStop frenzy that captured global attention was far more than a singular incident; it marked a significant turning point in the financial landscape. It served as a wake-up call for all stakeholders—market participants, regulators, and financial institutions alike. Here’s an extended idea:

1. The Digital Age Revolution:

The GameStop saga illuminated the profound changes underway in the world of finance. The digital age has ushered in a new era of accessibility, connectivity, and democratization. Individuals can now readily access information and participate in markets that were once the exclusive domain of financial institutions. This transformation is reshaping the very core of finance.

2. Adaptation in Progress:

Market participants, regulators, and financial institutions are in the midst of adapting to this evolving financial landscape. Regulatory bodies are revisiting their frameworks to ensure market integrity and investor protection in the digital age. Financial institutions are reevaluating their strategies to meet the changing demands of tech-savvy investors.

3. Market Resilience:

The GameStop incident highlighted the resilience of markets in the face of rapid, unexpected fluctuations. It spurred discussions on the need for circuit breakers, enhanced risk management, and improved transparency. These adaptations are critical to maintain market stability and protect investors.

4. Empowerment Through Education:

One of the most vital lessons from GameStop is the importance of financial education. It’s not just the responsibility of regulators and institutions; individuals must also equip themselves with the knowledge and skills necessary to navigate today’s complex financial ecosystem. Financial education empowers individuals to make informed decisions, manage risks, and seize opportunities.

5. Responsible Investing Practices:

GameStop demonstrated the power of retail investors banding together to challenge the status quo. However, it also underscored the importance of responsible investing practices. Diversification, risk assessment, and a long-term perspective are crucial for managing investments wisely.

6. Transparency and Ethics:

The GameStop frenzy raised ethical questions around market manipulation and social media influence. It emphasized the need for transparency in financial communications and the importance of adhering to ethical standards. Upholding ethical principles is essential for maintaining trust in financial markets.

7. Investor Protection:

Regulators are revisiting their roles in safeguarding investors in the digital age. Ensuring that investors have access to accurate information, understand the risks, and are protected from fraudulent practices is paramount. Regulatory frameworks must evolve to meet these challenges.

8. Innovation and Inclusion:

The digital transformation of finance is also fostering innovation and inclusion. Fintech companies are creating new ways to access financial services and invest, opening doors for a more diverse group of investors. Embracing these innovations while ensuring they are regulated appropriately will be a delicate balance.

In summary, the GameStop frenzy was a pivotal moment in the ongoing evolution of finance. It reminded us that finance is no longer confined to the traditional models, and adaptation is imperative for all stakeholders. As finance continues to evolve, embracing change, promoting financial education, and practicing responsible investing will be instrumental in shaping a more inclusive, transparent, and resilient financial ecosystem for the digital age.

Should you desire more in-depth information, it’s available for your perusal on this page: A Note on GameStop, Short Squeezes, and Autodidactic Herding …

Conclusion

In conclusion, the GameStop frenzy was a watershed moment in the world of finance, shedding light on the power of retail investors in shaping market volatility. It challenged traditional perceptions of investing and demonstrated the potential for organized retail investors to influence stock prices. As financial markets continue to evolve, the role of retail investors and their impact on market dynamics will remain a subject of significant interest and debate.

In conclusion, the GameStop frenzy marked a pivotal juncture in the financial world, serving as a stark reminder of the shifting landscape of investing and the undeniable influence of retail investors. This unprecedented event not only captivated the attention of seasoned traders but also laid bare the democratizing power of the digital age in reshaping market dynamics.

The GameStop episode challenged long-held notions about the sanctity of established financial institutions and underscored the remarkable potential of collective action among retail investors. It was a resounding testament to the fact that the stock market, once primarily the domain of institutional players, had evolved into a more inclusive and participatory arena.

This uprising also sparked fervent debates about the merits and risks of retail investors banding together through social media platforms to target specific stocks. It raised questions about market regulation, short-selling practices, and the role of platforms like Reddit and Robinhood in facilitating such movements.

As financial markets continue their perpetual evolution, one thing remains certain: the role of retail investors will persist as a captivating subject of scrutiny and discourse. Their ability to mobilize and influence market behavior has shifted the balance of power in trading. As a result, market participants, regulators, and investors alike are forced to reevaluate long-standing paradigms and adapt to a new era where the collective voices of individual investors can echo just as loudly as those of institutional giants.

The GameStop saga has not only left a lasting impact on the financial industry but has also left an indelible mark on the broader cultural and societal understanding of the stock market. It has inspired a new generation of retail investors to engage with financial markets actively, emphasizing the importance of education, responsible investing practices, and the need for ongoing dialogue regarding the evolving role of retail investors in shaping the future of finance.

If you’d like to dive deeper into this subject, there’s more to discover on this page: GameStop and the Rise of Retail Trading | Cato Institute

More links

Additionally, you can find further information on this topic by visiting this page: Stirred by GameStop-Robinhood saga, Senate panel explores …