Introduction

In the ever-evolving landscape of business, financial management stands as a critical pillar of success. It’s the art of steering a company’s financial resources to achieve its goals and maximize profits. At the heart of this strategic process lies accounting, the language of business that translates financial data into actionable insights. In this article, we’ll explore the vital role of strategic financial management and how accounting practices drive businesses towards success.

Strategic financial management is like a compass guiding a business through uncharted waters. It involves making informed decisions about investments, budgeting, and financial planning to ensure long-term sustainability and growth. Accounting serves as the navigator, providing the data and insights necessary to chart a course towards financial success. In this article, we’ll delve into the symbiotic relationship between financial management and accounting and how it propels businesses to new heights.

Don’t stop here; you can continue your exploration by following this link for more details: A Manager’s Guide to Successful Strategy Implementation | HBS …

Financial management encompasses a range of activities, including budgeting, financial forecasting, risk assessment, and investment analysis. At the core of these activities is accounting, which provides the foundation for informed decision-making. Accounting records and processes financial transactions, presenting them in a structured manner that allows business leaders to analyze and interpret the company’s financial health.

“Mastering the Art of Financial Management: The Role of Accounting

Financial management is the heartbeat of every successful business. It encompasses a spectrum of critical activities that underpin the organization’s stability and growth. At the heart of this intricate web of financial strategies lies accounting—a fundamental discipline that provides the bedrock for informed decision-making. Here’s a closer look at how accounting serves as the cornerstone of effective financial management:

1. Budgeting: Creating a budget is one of the first steps in financial management. It outlines a roadmap for allocating resources, setting financial goals, and managing expenses. Accounting data, such as historical financial records and revenue projections, informs the budgeting process, ensuring it’s realistic and achievable.

2. Financial Forecasting: Accurate financial forecasting is essential for planning future financial strategies. Accounting provides the historical data needed to make informed predictions about revenue, expenses, and cash flow. This insight is vital for assessing the feasibility of business plans and making necessary adjustments.

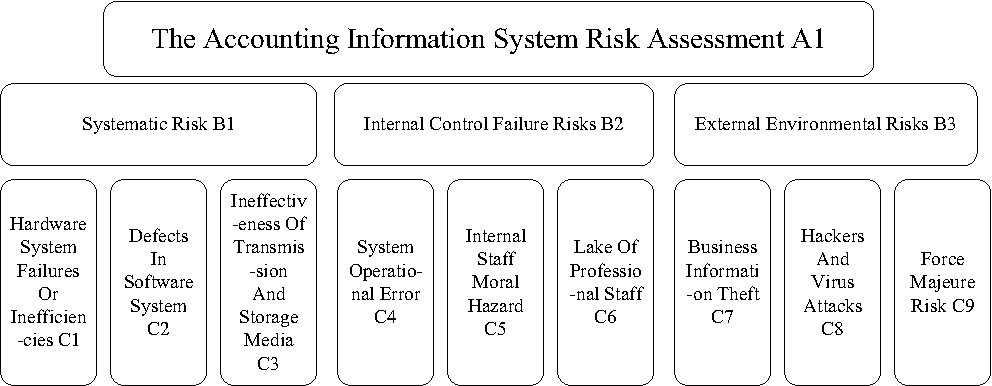

3. Risk Assessment: Identifying and mitigating financial risks is a core aspect of financial management. Accounting helps by offering a clear view of a company’s financial health and potential vulnerabilities. It enables business leaders to assess risk factors and develop strategies to safeguard against unforeseen challenges.

4. Investment Analysis: Making sound investment decisions is a key driver of financial growth. Accounting data, such as return on investment (ROI), helps evaluate the potential benefits and risks of investment opportunities. It empowers decision-makers to allocate capital wisely.

5. Financial Transactions: Accounting records and processes all financial transactions within a company. It captures the inflow and outflow of money, categorizes expenditures, and maintains a comprehensive ledger. This meticulous record-keeping is indispensable for financial transparency and accountability.

6. Financial Reporting: Accounting transforms raw financial data into meaningful reports, such as income statements, balance sheets, and cash flow statements. These reports offer a snapshot of a company’s financial performance, enabling stakeholders to gauge profitability, liquidity, and solvency.

7. Compliance: Accounting ensures that a business complies with financial regulations, tax laws, and reporting standards. It minimizes the risk of legal issues and financial penalties, safeguarding the company’s reputation.

8. Decision Support: Accounting data provides a factual basis for making critical decisions. Whether it’s determining pricing strategies, assessing the viability of expansion plans, or evaluating the need for cost-cutting measures, accounting serves as a compass for effective decision-making.

9. Resource Allocation: Accounting helps allocate resources efficiently. It aids in identifying areas of overspending or underinvestment, ensuring that resources are distributed in a way that aligns with strategic goals.

10. Strategic Planning: Financial management, guided by accounting insights, informs strategic planning. It helps set short-term and long-term objectives, allocate resources, and measure progress toward achieving financial milestones.

In essence, accounting is the guardian of financial management. It transforms raw data into meaningful insights, enabling business leaders to steer their organizations toward prosperity and sustainability. From budgeting and forecasting to risk assessment and investment analysis, accounting is the compass that guides every financial decision, ensuring that resources are used wisely and growth is achieved purposefully.”

To delve further into this matter, we encourage you to check out the additional resources provided here: The Advantages of Data-Driven Decision-Making | HBS Online

A strategic financial management approach begins with setting clear financial goals and objectives. Whether it’s achieving a specific level of profitability, expanding into new markets, or managing cash flow efficiently, these goals guide a company’s financial strategies. Accounting helps in quantifying these objectives, breaking them down into actionable steps, and tracking progress towards their achievement.

Setting clear financial goals and objectives is the cornerstone of strategic financial management. Whether a company aims to increase profitability, expand into new markets, or optimize cash flow, these objectives serve as a roadmap for financial strategies. Accounting plays a pivotal role by translating these goals into quantifiable targets, breaking them down into manageable steps, and providing the means to monitor progress. With accounting as a guiding tool, businesses can navigate their financial journey with precision, ensuring that every financial decision aligns with their strategic vision.

Should you desire more in-depth information, it’s available for your perusal on this page: Financial Management Explained: Scope, Objectives & Importance …

Budgeting and financial forecasting are essential components of strategic financial management. Through proper accounting practices, businesses can create budgets that allocate resources effectively, ensuring that income matches or exceeds expenses. This process aids in maintaining financial stability and identifying areas for improvement.

Budgeting and financial forecasting serve as the backbone of sound financial management. By employing robust accounting practices, businesses can meticulously craft budgets that efficiently allocate resources, aiming to match or surpass income with expenses. This systematic approach not only fosters financial stability but also provides a roadmap for identifying areas ripe for enhancement. With the insights derived from financial forecasting, companies can adapt and thrive in dynamic economic landscapes, ensuring long-term sustainability and resilience in an ever-evolving marketplace.

You can also read more about this here: Strategic Financial Management: Definition, Benefits, and Example

Businesses face various financial risks, from market fluctuations to credit risks. Strategic financial management relies on accounting data to assess these risks and develop mitigation strategies. By analyzing historical financial data and market trends, companies can make informed decisions that safeguard their financial well-being.

“Financial risks are an ever-present challenge for businesses, demanding strategic foresight and proactive measures. The role of accounting data in this context is indispensable:

Market Fluctuations: Financial data serves as a historical record of market dynamics. By closely scrutinizing trends and patterns, businesses can anticipate market fluctuations. For example, analyzing past data may reveal seasonal sales patterns, enabling better inventory management. This understanding empowers companies to adapt pricing strategies, production schedules, and marketing campaigns to mitigate the impact of market volatility.

Credit Risks: Credit is the lifeblood of many businesses, yet it poses significant risks. Accounting data helps assess the creditworthiness of customers, suppliers, and partners. By analyzing payment histories and financial stability indicators, companies can make informed decisions about extending credit or negotiating favorable terms. This minimizes the risk of bad debt and ensures a healthier cash flow.

Operational Risks: Effective financial management extends beyond revenue and expenses. It involves scrutinizing the operational aspects of the business. Accounting data reveals cost structures, operational inefficiencies, and potential areas for improvement. By identifying operational risks, companies can streamline processes, reduce waste, and enhance productivity.

Investment Decisions: When considering investments, whether in new projects, technologies, or acquisitions, businesses rely on financial data. Historical performance metrics, such as return on investment (ROI) and payback periods, guide investment decisions. This data-driven approach helps allocate resources effectively and align investments with strategic goals.

Regulatory Compliance: Staying compliant with financial regulations is paramount. Accounting data ensures accurate financial reporting, enabling businesses to meet legal requirements and avoid penalties. Additionally, it fosters transparency, which can enhance investor confidence and trust.

Budgeting and Forecasting: Accounting data forms the foundation of budgeting and financial forecasting. By analyzing historical financials and market data, companies can set realistic financial goals and allocate resources efficiently. This proactive approach minimizes the risk of budget shortfalls and helps secure financial stability.

Risk Mitigation Strategies: Armed with comprehensive financial insights, businesses can develop risk mitigation strategies. For instance, they may choose to diversify their product lines or customer base to spread risk. They can also establish contingency funds or insurance policies to buffer against unforeseen financial challenges.

In essence, accounting data is the compass that guides businesses through the turbulent waters of financial risks. It empowers organizations to make informed decisions, adapt to changing market conditions, and proactively address potential threats. By leveraging financial data effectively, companies not only safeguard their financial well-being but also position themselves for sustainable growth and success.”

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Managing Risks: A New Framework

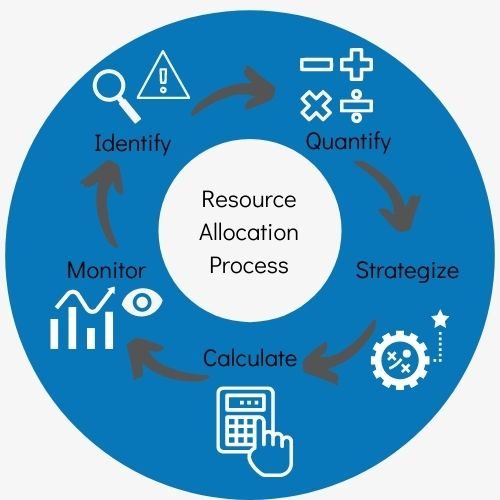

Effective resource allocation is a hallmark of strategic financial management. Accounting data helps businesses identify areas where resources can be optimized, whether it’s reallocating budgets, renegotiating contracts, or eliminating inefficiencies. This optimization leads to improved financial performance and profitability.

Effective resource allocation is a cornerstone of strategic financial management. Accounting data serves as a guiding compass, helping businesses pinpoint opportunities to optimize resources. This might involve reallocating budgets to high-impact areas, renegotiating contracts for cost savings, or eliminating inefficiencies in operations. The result? Enhanced financial performance and increased profitability, allowing businesses to thrive in a competitive landscape.

Additionally, you can find further information on this topic by visiting this page: Aerospace and Defense Finance KPIs – 8020 Consulting Posts

Strategic financial management involves making sound investment and financing decisions. Accounting provides the necessary information for evaluating investment opportunities and choosing the most suitable financing options. By assessing the return on investments and the cost of capital, companies can ensure that their financial decisions align with their strategic objectives.

“Additionally, strategic financial management extends to risk management. Accountants play a crucial role in identifying and assessing financial risks, allowing businesses to implement strategies to mitigate these risks effectively. By integrating financial data with risk analysis, companies can make informed decisions that safeguard their financial stability and support their long-term growth.”

Additionally, you can find further information on this topic by visiting this page: Strategic Financial Management: Definition, Benefits, and Example

Regular monitoring of financial performance is crucial for strategic financial management. Accounting generates financial reports and statements that provide insights into a company’s financial health. Business leaders can use these reports to assess progress, make necessary adjustments, and communicate financial information to stakeholders.

Regular monitoring of financial performance is the keystone of strategic financial management. Accounting serves as the compass, consistently generating comprehensive financial reports and statements. These invaluable documents serve several pivotal functions:

Performance Evaluation: Financial statements offer an x-ray view of a company’s performance. Business leaders can gauge revenue growth, profit margins, and cost control, enabling them to celebrate successes and pinpoint areas that require attention.

Forecasting and Planning: Past financial data is a crystal ball that guides future decisions. By analyzing historical performance, companies can develop realistic budgets, set achievable goals, and create strategic plans that align with their financial capabilities and ambitions.

Risk Management: Financial reports unveil potential financial risks. Whether it’s excessive debt, liquidity concerns, or irregularities in cash flow, early detection allows for proactive risk mitigation strategies, safeguarding the company’s stability.

Stakeholder Communication: Transparency is paramount in the business world. Financial reports provide a common language for communicating a company’s financial health to stakeholders, including investors, lenders, shareholders, and employees.

Investor Confidence: Investors rely on financial statements to make informed decisions about investing in a company. Accurate and transparent financial data bolsters investor confidence and can attract vital funding for growth.

Resource Allocation: Every dollar counts in business. Financial reports help leaders allocate resources wisely. Whether it’s determining capital investments, R&D budgets, or marketing spend, data-driven decisions optimize resource allocation.

Compliance: Financial statements ensure compliance with legal and regulatory requirements. This protects the company from potential legal issues and financial penalties.

Benchmarking: Industry benchmarks and standards provide valuable context for financial data. Companies can compare their performance to industry peers, revealing areas where they excel and areas that may require improvement.

Mergers and Acquisitions: During mergers or acquisitions, financial statements play a pivotal role in due diligence. They provide insights into the target company’s financial history, helping buyers assess its value and potential risks.

Tax Planning: Financial data informs tax strategies. Accurate reporting can uncover tax-saving opportunities and ensure compliance with tax regulations.

Creditworthiness: Lenders rely on financial reports to assess a company’s creditworthiness. A strong financial profile can lead to favorable loan terms and lower interest rates.

Strategic Decision-Making: Ultimately, financial reports empower leaders to make strategic decisions. They act as a compass, guiding leaders through the dynamic business landscape, helping them navigate challenges and seize opportunities.

In essence, accounting is not a mundane task but a dynamic process that transforms financial data into actionable insights. These insights are the lifeblood of informed decisions, strategic planning, and sustained financial health. Whether a business is charting a growth trajectory, adapting to market shifts, or navigating financial complexities, accounting remains the linchpin that transforms data into wisdom.

Explore this link for a more extensive examination of the topic: Financial Management Explained: Scope, Objectives & Importance …

The business landscape is dynamic, with constant changes in market conditions, regulations, and consumer behavior. Strategic financial management, driven by accounting, enables companies to adapt to these changes effectively. By staying agile and responsive, businesses can seize opportunities and mitigate potential threats.

Certainly! Here’s an extended idea for your article:

“In today’s rapidly evolving business environment, strategic financial management guided by accounting principles is not just a choice but a necessity for long-term success. It involves the continuous evaluation of financial data, performance metrics, and market trends to make informed decisions that steer a company toward its objectives. Strategic financial management allows businesses to not only navigate uncertainties but also leverage them as stepping stones to growth and prosperity. In this article, we’ll explore how businesses can harness the power of accounting to craft and execute strategic financial management strategies that drive sustainable success in an ever-changing world.”

To expand your knowledge on this subject, make sure to read on at this location: 5 Steps in the Change Management Process | HBS Online

Conclusion

In conclusion, strategic financial management is a cornerstone of business success, and accounting is the tool that empowers companies to navigate their financial journeys. By setting clear goals, making informed decisions, and leveraging accounting data, businesses can chart a course to prosperity and sustainability in an ever-evolving world.

“Strategic financial management is the compass guiding businesses to success. Accounting, the indispensable tool, illuminates the path toward prosperity and sustainability in a dynamic world. With clear goals and informed decisions, companies can navigate their financial journeys.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: AS 2201: An Audit of Internal Control Over Financial Reporting That …

More links

To expand your knowledge on this subject, make sure to read on at this location: What Is Finance Management? | Coursera