Introduction

In the world of business, financial data is a universal language spoken and understood by entrepreneurs, investors, and decision-makers alike. It’s the backbone of informed decision-making, strategic planning, and financial health assessment. But how do businesses translate raw financial data into actionable insights? The answer lies in the art and science of accounting.

Accounting professionals are the linguistic experts in this financial language, meticulously recording, organizing, and interpreting financial transactions. They play a crucial role in turning complex numbers into meaningful narratives that guide businesses toward profitability and sustainability. In this article, we’ll delve into the language of business, exploring how accounting transforms raw financial data into valuable insights that drive financial strategies and business growth.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Accounting & Data Analytics: What You Need To Know | Franklin …

Accounting is more than just number-crunching and ledger management; it’s the process of systematically recording, summarizing, and analyzing financial transactions. It serves as the language that conveys a company’s financial performance, health, and stability to internal and external stakeholders.

“Accounting is more than just number-crunching and ledger management; it’s the process of systematically recording, summarizing, and analyzing financial transactions. It serves as the language that conveys a company’s financial performance, health, and stability to internal and external stakeholders. Without accurate and transparent accounting, businesses would struggle to make informed decisions, attract investors, secure loans, or comply with regulatory requirements. In essence, accounting is the foundation upon which sound financial management and strategic planning are built.”

Don’t stop here; you can continue your exploration by following this link for more details: Financial Accounting Meaning, Principles, and Why It Matters

At its core, accounting transforms a plethora of transactions—sales, purchases, investments, expenses, and more—into organized financial statements. These statements include the:

Indeed, accounting is the backbone of any organization’s financial management, playing a crucial role in transforming a multitude of transactions into comprehensible and insightful financial statements. Here, we delve into the essential components of financial statements and how accounting orchestrates this transformation:

Balance Sheet: At the heart of financial statements lies the balance sheet, also known as the statement of financial position. This document provides a snapshot of a company’s financial health at a specific point in time. It encompasses assets, liabilities, and equity. Accounting ensures that every asset, from cash to inventory, is accurately recorded and categorized. Liabilities, including debts and obligations, are meticulously tracked. Equity, representing ownership interests, reflects the contributions and retained earnings.

Income Statement: The income statement, or profit and loss statement, portrays a company’s financial performance over a defined period. Accounting captures revenue from sales, interest, investments, and other sources. It also records various expenses, such as cost of goods sold, operating expenses, and taxes. The net result—profit or loss—is a testament to accounting’s ability to synthesize revenue and expenditure data into a cohesive narrative of financial performance.

Cash Flow Statement: Accounting plays a pivotal role in constructing the cash flow statement, which delineates the inflow and outflow of cash during a specified period. It tracks operating cash flow generated from day-to-day business activities, cash flow from investing activities (e.g., buying or selling assets), and cash flow from financing activities (e.g., issuing or repurchasing stock). This statement ensures that the organization maintains a healthy cash position to meet its obligations and strategic objectives.

Statement of Changes in Equity: For corporations, accounting is instrumental in preparing the statement of changes in equity. This statement provides a detailed account of the changes in the company’s equity during the reporting period. It encompasses various components, including the issuance of new shares, dividends paid, and retained earnings. Accounting ensures that every transaction impacting equity is accurately recorded and traced.

Notes to Financial Statements: Beyond the core financial statements, accounting encompasses the creation of detailed notes to financial statements. These notes offer additional insights into the organization’s financial position and performance. They explain accounting policies, contingent liabilities, significant events, and other relevant disclosures. These notes enhance transparency and aid stakeholders in comprehending the financial statements’ nuances.

Auditing and Assurance: Accounting also extends its reach into the realm of auditing and assurance services. External auditors, often certified public accountants (CPAs), assess the accuracy and reliability of financial statements. They review the company’s accounting records, internal controls, and financial reporting processes to provide independent assurance to investors, creditors, and other stakeholders.

Compliance and Regulations: In today’s complex regulatory landscape, accounting ensures that financial statements adhere to industry-specific standards and legal requirements. This includes compliance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the jurisdiction. Accounting professionals stay abreast of evolving regulations to ensure the organization’s financial statements meet the highest standards of accuracy and transparency.

Decision Support: Beyond financial statements, accounting equips decision-makers with essential data for strategic planning and informed choices. By interpreting financial statements, stakeholders gain insights into the company’s financial health, enabling them to make decisions related to investments, financing, and operational improvements.

In essence, accounting is a transformative force that converts raw financial data into a structured narrative of an organization’s financial journey. It facilitates transparency, accountability, and informed decision-making, making it an indispensable tool for businesses, investors, and regulators alike. Accounting’s ability to distill intricate financial transactions into coherent statements empowers organizations to navigate the complexities of finance and drive sustainable success.

Looking for more insights? You’ll find them right here in our extended coverage: Financial History: The Evolution of Accounting

This snapshot of a company’s financial position at a specific point in time lists its assets, liabilities, and equity. It tells stakeholders what the company owns, owes, and the residual interest.

The balance sheet, often referred to as the “statement of financial position,” serves as a financial snapshot of a company at a particular moment in time. It’s akin to taking a photograph of a business’s financial health, capturing its assets, liabilities, and equity in one frame. Let’s delve deeper into why this snapshot is essential and how it benefits various stakeholders:

Assets – What the Company Owns: The assets section of the balance sheet outlines all the resources owned by the company. This includes tangible assets like cash, buildings, equipment, and inventory, as well as intangible assets like patents, trademarks, and goodwill. For stakeholders, this information is crucial because it shows the company’s capacity to generate future cash flows and its ability to cover its obligations.

Liabilities – What the Company Owes: Liabilities represent the company’s obligations and debts to external parties, such as loans, accounts payable, and bonds. This section also includes the company’s estimated future obligations, like employee pensions and warranties. Knowing the extent of these liabilities helps stakeholders gauge the company’s financial risk and its ability to meet its commitments.

Equity – The Residual Interest: Equity, sometimes referred to as “owner’s equity” or “shareholders’ equity,” is the residual interest in the assets of the company after deducting liabilities. It’s essentially what’s left for the owners (shareholders) of the company. Equity includes common stock, retained earnings, and additional paid-in capital. For investors and shareholders, this section shows their ownership stake and the company’s book value.

So, why is this financial snapshot so valuable?

Investors: Investors use the balance sheet to assess a company’s financial stability and its ability to generate returns. They examine the composition of assets, looking for valuable assets and low levels of debt. They also analyze equity to understand their potential returns as shareholders.

Lenders: Lenders, such as banks and bondholders, review the balance sheet to evaluate a company’s creditworthiness. They want to ensure that the company has sufficient assets to cover its debts and can meet its interest and principal payments.

Management: For company executives and management, the balance sheet aids in making informed decisions. It provides insights into liquidity (the ability to cover short-term obligations), solvency (the ability to meet long-term obligations), and the allocation of resources.

Regulators: Regulatory bodies use balance sheets to monitor compliance with financial reporting standards and to ensure accurate financial disclosure to protect investors and the public.

Internal Use: Internally, the balance sheet helps in budgeting, financial planning, and setting performance goals. It also guides investment decisions, such as whether to acquire new assets or pay down debt.

In summary, the balance sheet is like a financial compass, guiding stakeholders and decision-makers through the complexities of a company’s financial health. It provides a clear picture of what a company owns, owes, and the value it delivers to its shareholders. For anyone involved with a business, from investors to management, understanding this snapshot is crucial for informed decision-making and financial well-being.

For additional details, consider exploring the related content available here Accounting & Data Analytics: What You Need To Know | Franklin …

This report outlines a company’s revenues, expenses, gains, and losses over a defined period. It shows whether the company made a profit or incurred a loss during that time.

The income statement, often referred to as the profit and loss statement (P&L), serves as a financial snapshot of a company’s performance. It provides a comprehensive overview of the company’s earnings, expenditures, gains, and losses during a specific timeframe. By examining the income statement, stakeholders can determine whether the company operated at a profit or sustained a loss over that period, gaining valuable insights into its financial health and performance.

Explore this link for a more extensive examination of the topic: How to Prepare an Income Statement | HBS Online

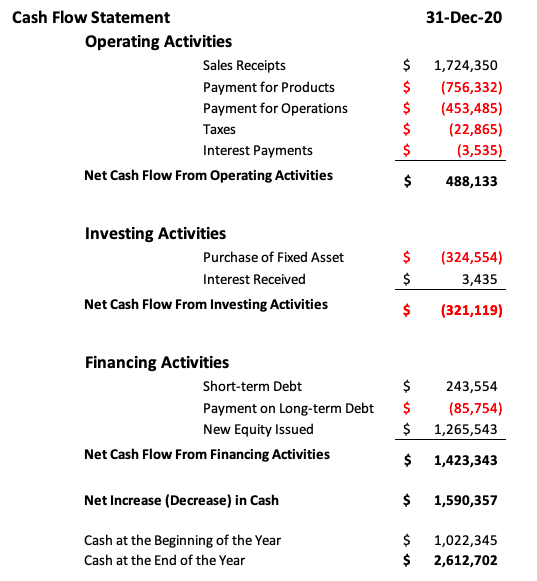

It tracks the cash inflows and outflows resulting from operating, investing, and financing activities. This statement helps assess a company’s liquidity and cash management.

“The Cash Flow Statement: Managing a Company’s Financial Health

The cash flow statement is a vital financial document that tracks the movement of cash in and out of a company. It provides valuable insights into how a business manages its liquidity and cash resources. Here’s a deeper look at the significance of the cash flow statement:

1. Operating Activities: This section of the statement focuses on the core operations of the business. It tracks cash generated or used in day-to-day activities such as sales, expenses, and taxes. A positive cash flow from operating activities indicates that the business can generate enough cash to sustain and grow its operations.

2. Investing Activities: Businesses often invest in assets like property, equipment, or marketable securities. This section reveals how much cash is spent on acquiring or selling such assets. It helps assess the efficiency of capital allocation and long-term investment decisions.

3. Financing Activities: The financing activities section outlines cash inflows and outflows related to raising and repaying capital. This includes activities like issuing or repurchasing shares, taking on or repaying loans, and paying dividends. It provides insights into how a company manages its capital structure and debt obligations.

4. Liquidity Assessment: The cash flow statement plays a crucial role in assessing a company’s liquidity. It reveals whether a business has enough cash on hand to meet its short-term obligations and fund ongoing operations. This is essential for financial stability and business continuity.

5. Cash Management: Effective cash management is vital for the day-to-day operations of a company. The cash flow statement helps identify periods of surplus cash that can be invested or used to pay down debt. Conversely, it highlights times when additional financing may be required.

6. Investment and Strategic Decisions: Investors and analysts use the cash flow statement to evaluate a company’s financial health. Positive cash flow from operating activities can signal a well-managed business, while negative cash flow may raise concerns. This information influences investment and strategic decisions.

7. Forecasting and Planning: The historical data in the cash flow statement can be used to forecast future cash flows. This aids in financial planning, budgeting, and setting performance targets. It also helps businesses anticipate and mitigate potential cash flow challenges.

8. Transparency and Accountability: The cash flow statement enhances transparency and accountability in financial reporting. It provides a clear breakdown of how cash is generated and used, reducing the risk of financial mismanagement or fraud.

In summary, the cash flow statement is a crucial tool for assessing a company’s financial health and cash management practices. It offers valuable insights into the sources and uses of cash, aiding in decision-making, planning, and maintaining the financial stability of a business.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: Mastering the data maze: Exploring business intelligence within …

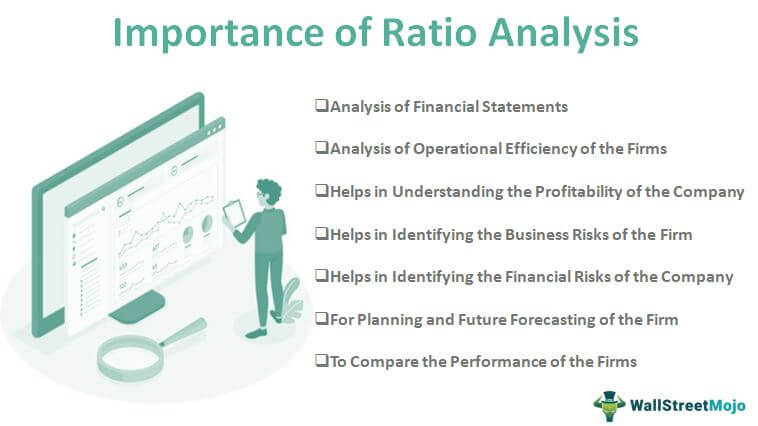

Financial statements, while informative on their own, become truly insightful when analyzed through financial ratios. Ratios are like the magnifying glass through which accountants and financial analysts uncover a company’s strengths and weaknesses.

Financial ratios provide a deeper understanding of a company’s financial health by comparing different aspects of its financial statements. These ratios can reveal crucial insights about a company’s liquidity, profitability, efficiency, and overall stability. By analyzing these ratios, investors, creditors, and business leaders can make informed decisions about investments, loans, and strategic planning. It’s like seeing the financial picture in high definition, allowing for more precise assessments and better financial management.

Additionally, you can find further information on this topic by visiting this page: 8 Financial Accounting Skills for Business Success | HBS Online

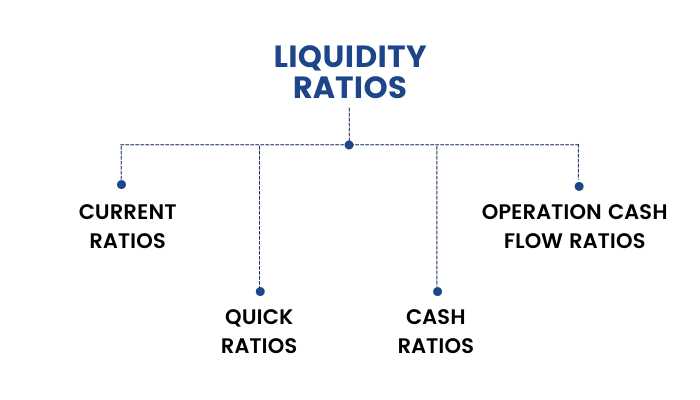

These reveal a company’s ability to meet its short-term obligations. The current ratio, for instance, divides current assets by current liabilities to assess liquidity.

Understanding a company’s liquidity is crucial for investors and creditors. It indicates the company’s ability to pay off its short-term obligations using its current assets. Key liquidity ratios include the current ratio and the quick ratio. The current ratio divides current assets by current liabilities, while the quick ratio focuses on more liquid assets like cash, accounts receivable, and marketable securities. By analyzing these ratios, stakeholders can make informed decisions regarding a company’s financial health and stability.

Should you desire more in-depth information, it’s available for your perusal on this page: Financial Graphs And Charts – See 30 Business Examples

These measure how efficiently a company generates profit. The gross profit margin, for example, compares gross profit to revenue.

“Efficiency in profit generation is a fundamental metric for assessing a company’s financial health. Key indicators, such as gross profit margin, provide valuable insights into a business’s performance. Let’s delve deeper into this essential concept:

Gross Profit Margin: This metric examines the relationship between a company’s gross profit (total revenue minus the cost of goods sold) and its total revenue. A high gross profit margin indicates that a company is effectively managing its production costs and pricing strategy. It’s a critical measure of a company’s core profitability before considering operating expenses.

Operating Profit Margin: Moving beyond gross profit, the operating profit margin takes into account all operating expenses, such as marketing, salaries, and rent. It reveals how efficiently a company is managing its day-to-day operations to generate profit. A healthy operating profit margin demonstrates effective cost control.

Net Profit Margin: This metric represents the bottom line, revealing the company’s overall profitability after accounting for all expenses, including taxes and interest. A strong net profit margin is a sign of sound financial management and sustainable profitability.

Return on Investment (ROI): ROI assesses the profitability of an investment, such as a marketing campaign or new product launch. It measures the gain or loss relative to the cost of the investment. A positive ROI indicates a profitable venture, while a negative ROI suggests that the investment did not yield returns.

Return on Equity (ROE): ROE gauges the profitability of a company’s equity investment. It compares net income to shareholders’ equity, reflecting how effectively the company is using its equity capital to generate profits. A high ROE signifies efficient capital utilization.

Earnings Before Interest and Taxes (EBIT): EBIT assesses a company’s operating performance by excluding interest and taxes. It provides a clear view of a company’s ability to generate income from its core operations.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): EBITDA further refines the assessment by excluding non-cash expenses like depreciation and amortization. It’s a useful measure for comparing the profitability of companies with different asset structures.

Operating Cash Flow Margin: This metric evaluates a company’s ability to generate cash from its core operations. It assesses how effectively a company converts its revenue into cash flow, which is vital for meeting financial obligations and investing in growth.

Efficiency in profit generation extends beyond mere revenue growth. It’s about managing costs, optimizing processes, and making strategic decisions that enhance the bottom line. These metrics collectively provide a comprehensive picture of a company’s financial performance, guiding business leaders in making informed decisions to drive sustainable profitability and success.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: Financial Accounting Meaning, Principles, and Why It Matters

These indicate a company’s leverage and solvency. The debt-to-equity ratio, for instance, quantifies the proportion of debt in the capital structure.

Understanding a company’s financial health requires a comprehensive analysis of various ratios and metrics. The debt-to-equity ratio, a key indicator, compares a company’s debt to its equity. It’s a crucial metric because it provides insights into the company’s financial structure and risk level. By examining this ratio, investors and analysts can assess how the company funds its operations and growth.

The debt-to-equity ratio is calculated by dividing a company’s total debt by its total equity. Total debt includes long-term and short-term liabilities, such as loans, bonds, and credit lines, while total equity comprises shareholders’ equity, which includes common stock, retained earnings, and additional paid-in capital.

A low debt-to-equity ratio indicates that a company relies less on debt financing and has a more conservative financial structure. This can be seen as a positive sign, as it suggests lower financial risk and greater financial stability. On the other hand, a high debt-to-equity ratio may indicate that the company has a significant amount of debt relative to its equity, which can be a concern for investors and lenders.

Investors use the debt-to-equity ratio to assess a company’s risk profile and financial stability. A higher ratio suggests that the company has a higher degree of financial leverage, which can amplify returns during good times but also increase the risk of financial distress during economic downturns. Conversely, a lower ratio may indicate a more conservative financial approach.

It’s important to note that the ideal debt-to-equity ratio varies by industry and the company’s specific circumstances. Industries with stable cash flows and low capital requirements may tolerate higher ratios, while others with cyclical revenues and heavy capital needs may aim for lower ratios.

In summary, the debt-to-equity ratio is a critical financial metric that provides valuable insights into a company’s financial health and risk profile. It helps investors, analysts, and lenders make informed decisions about a company’s creditworthiness and long-term prospects. When used in conjunction with other financial ratios and qualitative analysis, it forms a comprehensive picture of a company’s financial well-being.

Looking for more insights? You’ll find them right here in our extended coverage: 8 Financial Accounting Skills for Business Success | HBS Online

These gauge how effectively a company utilizes its assets. Inventory turnover, for example, assesses how quickly a company sells its inventory.

Another crucial financial ratio is the accounts receivable turnover, which evaluates how efficiently a company collects payments from customers. High turnover rates in both inventory and accounts receivable indicate a company’s effectiveness in managing its resources and cash flow. These metrics provide valuable insights into a business’s operational efficiency and financial health.

Additionally, you can find further information on this topic by visiting this page: 20 Ways To Effectively Communicate Financial Reports To …

The insights derived from accounting and financial analysis guide decision-making on multiple fronts:

The insights derived from accounting and financial analysis are the compass that guides decision-making on multiple fronts, providing a clear and strategic direction for businesses and individuals alike:

Resource Allocation: In the corporate landscape, financial data helps leaders allocate resources effectively. It informs budgeting decisions, allowing organizations to channel funds toward projects, departments, or investments that offer the greatest return on investment.

Investment Strategies: For investors, financial analysis is the bedrock of sound investment decisions. It provides essential data for evaluating the potential risks and rewards of various investment opportunities, whether in stocks, real estate, bonds, or startups.

Business Growth: Entrepreneurs and business owners rely on financial insights to chart the course for growth. By understanding revenue trends, profit margins, and cash flow, they can make informed decisions about expanding operations, entering new markets, or launching innovative products.

Risk Management: Financial analysis helps organizations and individuals assess and mitigate risks. It enables the identification of vulnerabilities in financial structures and the development of strategies to safeguard against economic downturns, market fluctuations, or unexpected expenses.

Creditworthiness: For individuals, maintaining a strong financial profile is crucial for securing loans, mortgages, or credit lines. Lenders use financial data to evaluate creditworthiness, interest rates, and loan terms.

Cost Control: Effective cost management is essential for businesses to remain competitive. Financial analysis reveals areas of excessive spending, enabling cost-cutting measures without compromising quality or customer satisfaction.

Profitability Assessment: For companies, analyzing profitability by product, service, or customer segment is vital. It helps identify the most lucrative areas of the business and informs strategic decisions to optimize revenue streams.

Strategic Planning: Businesses leverage financial insights for strategic planning. Whether developing a business plan, setting growth targets, or establishing pricing strategies, financial analysis informs every aspect of long-term planning.

Compliance: Adhering to financial regulations and accounting standards is a fundamental requirement for businesses. Financial analysis ensures that financial statements meet regulatory requirements and maintain transparency.

Tax Optimization: Individuals and businesses alike use financial analysis to optimize tax strategies. By identifying tax-efficient investments, deductions, and credits, they can legally minimize tax liabilities.

Wealth Management: High-net-worth individuals and families rely on financial analysis to manage their wealth. It helps with asset allocation, estate planning, and philanthropic endeavors to ensure a secure and impactful legacy.

Performance Evaluation: Financial analysis provides a framework for assessing performance against key performance indicators (KPIs) and benchmarks. This is crucial for individuals and organizations to measure progress toward their goals.

In essence, financial analysis is not merely a set of numbers but a powerful tool that empowers individuals and organizations to make informed, strategic, and forward-thinking decisions. It is the cornerstone of financial success and prudent planning, driving prosperity and stability in an ever-changing economic landscape.

Looking for more insights? You’ll find them right here in our extended coverage: Accounting & Data Analytics: What You Need To Know | Franklin …

Managers use financial data to control costs, allocate resources, and optimize day-to-day operations.

Moreover, investors and shareholders rely on financial reports to gauge a company’s financial health and performance. They use these insights to make investment decisions, assess the company’s ability to generate returns, and determine the potential risks associated with their investments.

Accounting also aids in regulatory compliance, ensuring that businesses adhere to financial reporting standards and tax regulations. This not only helps companies avoid legal troubles but also builds trust with stakeholders and the broader financial community.

In essence, the language of business, as spoken through accounting, serves as a bridge between numbers and strategic decisions. It empowers businesses to adapt to changing environments, make informed choices, and thrive in the dynamic landscape of commerce. Understanding this language is an essential skill for entrepreneurs, managers, and anyone seeking to navigate the intricate world of finance and commerce successfully.

You can also read more about this here: How to Read & Understand a Cash Flow Statement | HBS Online

Investors and creditors rely on financial statements to assess the risk and return of investing in or lending to a company.

Investors and creditors rely on financial statements to assess the risk and return of investing in or lending to a company. These statements provide critical insights into a company’s profitability, liquidity, solvency, and overall financial health. For investors, financial statements are like a compass, guiding them in making decisions about where to allocate their capital. They scrutinize income statements, balance sheets, and cash flow statements to evaluate the company’s past performance, current position, and future prospects. Likewise, creditors, such as banks and bondholders, analyze financial statements to determine a borrower’s creditworthiness and the terms of financing. In this way, financial statements serve as a bridge of trust and transparency between businesses and those who provide them with the necessary capital to grow and thrive.

Explore this link for a more extensive examination of the topic: Economic potential of generative AI | McKinsey

Businesses use financial insights to formulate long-term strategies, set growth targets, and identify opportunities for improvement.

Financial insights serve as a compass guiding businesses through the intricate terrain of decision-making, strategy development, and sustainable growth. Here, we explore the profound impact of financial insights on shaping long-term strategies, setting growth targets, and uncovering avenues for continuous improvement:

Strategic Formulation: Financial insights are the bedrock upon which strategic decisions are built. They provide a panoramic view of a company’s financial health, shedding light on strengths, weaknesses, opportunities, and threats. Armed with this knowledge, businesses can chart a course that aligns with their overarching mission and objectives. Whether it involves market expansion, diversification, or cost optimization, financial insights provide the necessary data to devise and refine strategic blueprints.

Growth Target Setting: Setting growth targets is a fundamental aspect of business planning. Financial insights enable organizations to establish realistic and measurable growth goals. By assessing historical performance, market dynamics, and financial projections, businesses can determine achievable targets for revenue, profitability, market share, and customer acquisition. These targets serve as milestones that guide operational and tactical decisions on the path to expansion.

Resource Allocation: Efficient resource allocation is paramount for success. Financial insights empower businesses to allocate resources—capital, personnel, technology, and more—with precision. By scrutinizing cost structures, analyzing return on investment (ROI), and assessing resource utilization, organizations can make informed decisions on where to allocate resources for maximum impact. This allocation, in turn, fuels growth initiatives and fosters resource efficiency.

Risk Mitigation: The business landscape is riddled with uncertainties and risks. Financial insights act as a compass for risk management. By conducting financial risk assessments, organizations can identify potential threats and vulnerabilities. This proactive approach allows businesses to develop risk mitigation strategies, implement contingency plans, and fortify their financial resilience. In doing so, they safeguard their long-term viability.

Operational Excellence: Operational efficiency is the linchpin of sustainable growth. Financial insights provide the foundation for evaluating operational performance. By scrutinizing key financial metrics such as cost of goods sold (COGS), operating expenses, and profitability ratios, businesses can pinpoint areas of improvement. This data-driven approach enables them to streamline processes, reduce waste, and enhance overall operational excellence.

Investor and Stakeholder Confidence: Investors, lenders, and stakeholders seek assurance and transparency. Financial insights serve as a testament to an organization’s fiscal responsibility. By presenting well-structured financial reports and forecasts, businesses instill confidence in external parties. This, in turn, facilitates access to capital, fosters investor trust, and paves the way for partnerships that support growth initiatives.

Continuous Improvement: Continuous improvement is a cornerstone of sustained success. Financial insights provide the feedback loop needed for ongoing enhancement. By comparing actual results against budgets and benchmarks, businesses can identify performance gaps and areas requiring attention. This iterative process drives continuous improvement across all facets of the organization.

Competitive Advantage: In a competitive landscape, the ability to leverage financial insights can be a potent differentiator. Businesses that harness data-driven decision-making gain a competitive edge. They can adapt swiftly to changing market conditions, seize emerging opportunities, and optimize their operations for efficiency and profitability.

In conclusion, financial insights are not mere numbers on a spreadsheet; they are the guiding stars that illuminate the path toward long-term success. Businesses that leverage these insights strategically are better equipped to navigate complexities, seize opportunities, and thrive in an ever-evolving business environment. Whether charting strategic courses, setting growth targets, or fostering continuous improvement, financial insights are the compass that empowers businesses to reach their destinations with confidence and resilience.

Explore this link for a more extensive examination of the topic: Accounting & Data Analytics: What You Need To Know | Franklin …

Accounting ensures that businesses adhere to financial reporting standards and regulatory requirements.

Accounting, often referred to as the “language of business,” serves as a critical foundation for the functioning and credibility of both individual companies and the broader financial system. Its role goes beyond just adhering to financial reporting standards and regulatory requirements; it encompasses several vital aspects:

Accurate Financial Reporting: Accounting ensures that businesses maintain accurate and reliable financial records. This is essential for transparency and accountability to stakeholders, such as shareholders, investors, creditors, and regulatory bodies. Accurate financial reporting is the cornerstone of trust in the business world.

Compliance with Regulatory Standards: Businesses must adhere to various regulatory frameworks and financial reporting standards, depending on their location and industry. Accounting professionals play a central role in ensuring that companies meet these requirements. This not only helps prevent fraud and financial misconduct but also promotes fair and consistent reporting practices across industries.

Informed Decision-Making: Accounting provides crucial financial information that guides decision-making at all levels of an organization. From setting budgets and making investment choices to determining pricing strategies and assessing the viability of expansion, accurate financial data empowers businesses to make informed and strategic decisions.

Risk Management: Accounting helps identify and mitigate financial risks. By closely monitoring financial statements and analyzing key financial ratios, businesses can detect warning signs of potential financial troubles early on. This proactive approach allows for adjustments in strategy or operations to minimize risk and ensure long-term sustainability.

Resource Allocation: Effective accounting allows businesses to allocate resources efficiently. By tracking income and expenses, companies can allocate funds to areas that need investment or expansion while identifying areas where cost containment or optimization is necessary.

Tax Compliance: Taxation is a significant financial obligation for businesses. Accounting professionals help companies comply with tax laws and regulations, ensuring that they pay the appropriate amount of taxes while taking advantage of available deductions and credits to minimize the tax burden legally.

Investor Confidence: For publicly traded companies, accounting practices play a crucial role in attracting and retaining investors. Investors rely on financial statements and audited reports to assess a company’s financial health and performance. Clear and transparent accounting practices enhance investor confidence and can positively impact a company’s stock price.

Ethical Financial Practices: Accounting professionals are expected to adhere to ethical principles and codes of conduct. This commitment to ethical financial practices helps maintain the integrity of the profession and builds trust with clients and stakeholders.

Global Business: In an increasingly globalized world, accounting standards and practices facilitate international trade and investment. Common accounting standards, such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), enable businesses to communicate financial information consistently worldwide.

In essence, accounting serves as the backbone of financial integrity and transparency in the business world. Its impact extends far beyond the balance sheet and income statement, influencing everything from day-to-day financial operations to strategic planning and the overall health of the economy. Whether for small businesses or multinational corporations, accounting is an indispensable tool for maintaining financial health, compliance, and ethical standards.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Accounting Explained With Brief History and Modern Job …

As technology advances, accounting is undergoing a transformation. Automation, artificial intelligence, and data analytics are enhancing the speed and accuracy of financial data analysis. These tools allow businesses to gain even deeper insights into their operations, customers, and markets.

The integration of technology into the field of accounting is revolutionizing the way financial data is managed and analyzed. Automation, powered by artificial intelligence and data analytics, is streamlining complex accounting processes, reducing human error, and significantly improving the speed and accuracy of financial data analysis. This technological shift empowers businesses to delve deeper into their financial data, unlocking valuable insights that can inform strategic decisions. Moreover, it enables accountants and financial professionals to shift their focus from manual data entry to more strategic roles, such as financial analysis and advising, ultimately contributing to the growth and success of the organizations they serve.

For additional details, consider exploring the related content available here Financial Accounting Meaning, Principles, and Why It Matters

Conclusion

In conclusion, accounting is the universal language of business that translates raw financial data into actionable insights. Whether you’re a business owner, investor, or decision-maker, understanding this language is essential for navigating the complex world of finance and making informed choices that drive success. So, embrace the power of accounting, and let it be your guide in the dynamic realm of business.

“Unlocking the Power of Accounting: Your Path to Informed Decision-Making

Accounting is more than just numbers on a page; it’s the universal language of business. It transforms raw financial data into meaningful insights that drive informed decisions. Whether you’re a business owner, investor, or decision-maker, here’s why embracing the power of accounting is essential in today’s dynamic business world:

1. Financial Clarity: Accounting provides a clear and structured view of a company’s financial health. It summarizes complex transactions, making it easier to understand revenue, expenses, assets, and liabilities. This clarity is essential for evaluating a business’s performance.

2. Informed Decision-Making: With accurate financial information at your fingertips, you can make informed decisions that impact the future of your business. Whether it’s assessing profitability, setting budgets, or planning investments, accounting guides your choices.

3. Compliance and Accountability: Accounting ensures compliance with financial regulations and standards. It helps businesses meet tax obligations, report to stakeholders, and maintain transparency. Accountability is essential for building trust with investors, customers, and partners.

4. Performance Measurement: Accounting offers tools to measure a company’s performance. Key performance indicators (KPIs) and financial ratios help assess efficiency, profitability, and solvency. These metrics guide strategic planning and goal setting.

5. Strategic Planning: Businesses that harness accounting can develop robust strategic plans. Financial forecasts, budgeting, and trend analysis enable proactive strategies for growth, cost management, and risk mitigation.

6. Risk Management: Accounting helps identify financial risks and uncertainties. By analyzing financial data, you can spot potential issues early, allowing for corrective actions and risk mitigation strategies.

7. Investor Confidence: Investors rely on accurate financial statements to evaluate opportunities. Accounting provides the foundation for attracting investment and demonstrating a company’s growth potential.

8. Continuous Improvement: Regular financial reporting and analysis encourage continuous improvement. Businesses can identify areas for optimization, cost reduction, and efficiency enhancement.

9. Global Business: In today’s interconnected world, accounting transcends borders. It’s the language that facilitates international trade, mergers, and acquisitions. Understanding accounting principles is crucial for global business success.

10. Lifelong Learning: Accounting is a skill that evolves with your career. Lifelong learning in accounting enables you to adapt to changing regulations, industry trends, and technology. It’s a valuable asset for professional growth.

In conclusion, accounting is your compass in the vast sea of business. It translates financial data into actionable insights, guiding your decisions and driving success. Whether you’re steering a company, investing, or influencing business outcomes, embracing the power of accounting empowers you to navigate the dynamic and competitive landscape of modern business.”

To expand your knowledge on this subject, make sure to read on at this location: What is data visualization and why is it important?

More links

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Financial Accounting Meaning, Principles, and Why It Matters