Introduction

In the world of investing, opportunities and innovations continue to emerge, reshaping how individuals participate in financial markets. One such innovation that has gained significant attention is fractional share trading. This approach allows investors to buy and own a portion of a share, rather than a whole share, making it more accessible and affordable for a broader range of market participants. In this article, we will explore the concept of fractional share trading, the associated risks, and the potential rewards it offers to investors.

The ever-evolving landscape of investing is marked by constant innovations that redefine how individuals engage with financial markets. One of the noteworthy advancements that has garnered considerable attention in recent times is fractional share trading. This innovative approach has the potential to reshape the investment landscape, making it more inclusive and accessible to a wider array of investors. In this article, we will delve deeper into the concept of fractional share trading, discussing its mechanics, the risks it entails, and the enticing rewards it holds for investors.

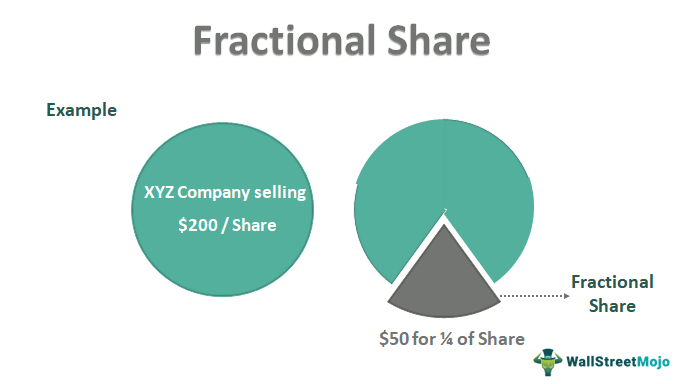

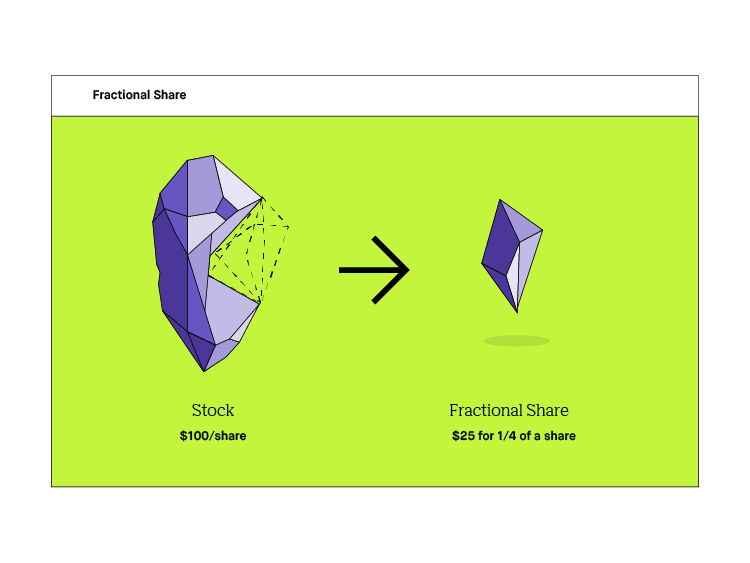

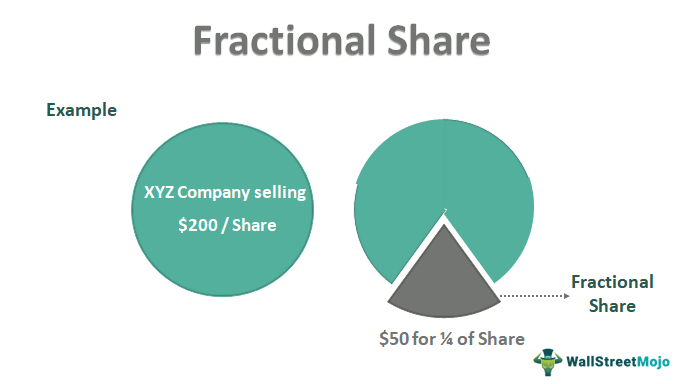

Fractional Share Trading Explained:

Fractional share trading, also known as micro-investing, fundamentally alters the way investors can access the stock market. Traditionally, investors were required to purchase whole shares of a company’s stock. However, fractional share trading allows individuals to buy and own a portion of a share, breaking down the traditional barriers associated with high share prices. This democratizes investing, making it feasible for those with limited capital to participate in the market.

Accessibility and Affordability:

One of the most significant advantages of fractional share trading is its ability to democratize the investment process. Investors no longer need substantial sums of money to buy shares of high-priced stocks like Amazon or Google. Instead, they can invest whatever amount they can comfortably afford, as little as a few dollars. This accessibility opens up investment opportunities to a more diverse range of individuals, from young adults just starting to invest to those looking to diversify their portfolios with limited resources.

Risk Mitigation:

While fractional share trading lowers the barriers to entry, it’s essential to recognize that it doesn’t eliminate investment risks. The value of a fractional share will still fluctuate with the underlying stock’s performance. Therefore, investors should be mindful of the risks associated with the specific stocks they choose, including market volatility, company performance, and economic conditions.

Diversification Benefits:

Fractional share trading can also facilitate diversification within an investment portfolio. Investors can spread their resources across multiple stocks or exchange-traded funds (ETFs) to reduce the impact of a poor-performing asset. Diversification is a time-tested strategy for managing risk and potentially improving overall portfolio performance.

Long-Term Potential:

One of the key rewards of fractional share trading lies in its long-term potential. By investing small amounts regularly, individuals can harness the power of compounding. Over time, these modest investments can grow into substantial holdings. This long-term perspective aligns well with traditional investment principles, emphasizing consistency and patience.

Education and Due Diligence:

To make the most of fractional share trading, investors should prioritize education and due diligence. Research the companies or funds you’re interested in, understand their financials, and consider your investment goals and risk tolerance. Staying informed and making informed decisions is crucial, regardless of the investment size.

Conclusion:

Fractional share trading represents a groundbreaking innovation in the world of investing, removing barriers to entry and providing opportunities for a more diverse range of participants. While it offers accessibility and affordability, investors should approach it with a clear understanding of the associated risks and the potential rewards it can offer over the long term. Ultimately, fractional share trading empowers individuals to take control of their financial futures and participate actively in the world of finance, regardless of their initial capital.

Don’t stop here; you can continue your exploration by following this link for more details: Interactive Brokers Review

Fractional shares, as the name suggests, represent a fraction or portion of a single share of a stock or an exchange-traded fund (ETF). Traditionally, investors could only purchase whole shares, which could be cost-prohibitive for high-priced stocks like tech giants or popular companies like Amazon or Google. Fractional shares break down this barrier, allowing investors to invest in these companies with smaller amounts of capital.

Unlocking Investment Opportunities with Fractional Shares

Fractional shares have revolutionized the world of investing by making it more accessible and affordable for a broader spectrum of investors. Beyond breaking down the barriers posed by high-priced stocks, fractional shares open up a wealth of possibilities. Here’s an extended idea:

1. Access to Iconic Stocks:

Fractional shares provide a gateway to iconic stocks that were once considered out of reach for many investors. Names like Amazon, Google, and Tesla, with their high share prices, can now be included in diversified portfolios without requiring a substantial upfront investment.

2. Portfolio Diversification:

Diversification is a cornerstone of sound investing. Fractional shares allow investors to spread their investments across various assets, industries, and sectors, even with limited capital. This risk-reduction strategy can enhance long-term portfolio stability.

3. Risk Mitigation:

By breaking down the cost barrier, fractional shares enable investors to manage risk more effectively. They can allocate their capital across multiple fractional shares, reducing exposure to any single stock or asset. This risk mitigation approach aligns with prudent investment principles.

4. Dollar-Cost Averaging:

Fractional shares seamlessly integrate with dollar-cost averaging (DCA) strategies. Investors can automate recurring investments in fractional shares, regardless of the stock’s price. DCA reduces the impact of market volatility, potentially resulting in better long-term returns.

5. Investment Flexibility:

Investors have greater flexibility in allocating their capital. They can invest exactly how much they’re comfortable with, whether it’s $10 or $1,000. This flexibility empowers individuals to align their investments with their financial goals and risk tolerance.

6. Learning and Experimentation:

Fractional shares are an ideal tool for novice investors to learn and experiment without risking significant capital. Aspiring investors can dip their toes into the stock market, gain experience, and build confidence over time.

7. Accessibility for All:

Fractional shares embody the democratization of investing. They remove socioeconomic barriers, enabling individuals from diverse backgrounds to participate in wealth-building opportunities. This inclusive approach aligns with the principles of financial equity.

8. Customized Portfolios:

Investors can create highly customized portfolios by combining fractional shares of individual stocks and ETFs. This level of customization allows for precise alignment with investment objectives, whether it’s income generation, growth, or a specific thematic focus.

9. Impactful Micro-Investing:

Micro-investing platforms leverage fractional shares to encourage individuals to save and invest small amounts regularly. Even spare change from daily transactions can be invested in fractional shares, fostering a savings culture.

10. Future Growth Potential:

As fractional shares gain popularity, the range of available assets continues to expand. Investors may soon have access to a broader selection of stocks, ETFs, and even alternative investments as the financial industry adapts to this transformative trend.

In conclusion, fractional shares have reshaped the investment landscape, making it more inclusive, flexible, and accessible than ever before. Whether you’re aiming to invest in high-priced stocks, diversify your portfolio, or simply dip your toes into the world of investing, fractional shares offer a versatile and powerful tool to help you achieve your financial goals.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Robinhood joins a wave of fractional stock-trading offers

One of the primary advantages of fractional share trading is its democratizing effect on investing. It makes the stock market accessible to individuals who may not have substantial sums of money to invest. With fractional shares, you can start investing with as little as a few dollars, opening up a world of opportunities to a broader audience.

The advent of fractional share trading represents a profound shift in the landscape of investing, offering a host of advantages that go beyond just accessibility. Let’s delve further into the multifaceted benefits of fractional shares:

Diverse Portfolio Building: Fractional shares empower investors to build diversified portfolios effortlessly. Instead of channeling all their capital into a single stock, they can spread their investments across a wide array of assets, mitigating risk and potentially enhancing returns. This diversified approach is a cornerstone of responsible and strategic investing.

Risk Management: Fractional shares enable precise risk management. Investors can allocate their funds meticulously, investing only what they are comfortable with in each asset. This level of control allows for tailored risk management strategies that align with individual financial goals and risk tolerance.

Cost Averaging: Fractional shares are particularly conducive to dollar-cost averaging (DCA) strategies. DCA involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. Fractional shares make it easy to execute DCA strategies even when dealing with high-priced assets, ensuring a disciplined and consistent investment approach over time.

Accessibility to Premium Stocks: One of the most compelling advantages is the ability to invest in high-priced stocks that were once out of reach for many. Now, even if you only have a modest amount of capital to invest, you can own a piece of premium companies like Amazon, Apple, or Tesla. This opens doors to potential gains from some of the market’s most prominent players.

Dividend Reinvestment: Fractional shares facilitate dividend reinvestment. When a stock pays dividends, investors can automatically reinvest those earnings into more fractional shares of the same stock. This reinvestment accelerates wealth accumulation over time through the power of compounding.

Liquidity and Flexibility: Fractional shares offer liquidity and flexibility. Investors can easily liquidate a portion of their holdings when needed, without the constraints of whole shares. This liquidity ensures that investors can access their investments when opportunities or financial needs arise.

Educational Tool: Investing in fractional shares can be an invaluable educational tool, especially for novice investors. It provides a hands-on learning experience without requiring substantial capital upfront. New investors can experiment, make informed decisions, and gain valuable insights into how financial markets work before committing larger sums.

Long-Term Wealth Building: Fractional shares, when used wisely, can be a vital tool for long-term wealth building. Investors can gradually build a well-diversified portfolio, harness the power of compounding returns, and work toward their financial goals over time. This approach promotes financial discipline and a commitment to long-term financial success.

In conclusion, fractional share trading is a transformative development that democratizes investing, but its benefits extend far beyond accessibility. It fosters diversification, precise risk management, cost averaging, and the opportunity to invest in premium stocks. It empowers individuals to take control of their financial futures, learn about investing, and build wealth over time. As the financial landscape continues to evolve, fractional shares are poised to play an increasingly pivotal role in shaping the investment landscape for a broader and more diverse audience.

Additionally, you can find further information on this topic by visiting this page: Best Investing Apps Of September 2023

Fractional share trading facilitates diversification of investment portfolios. Instead of concentrating funds on a limited number of stocks, investors can spread their investments across a more extensive range of assets. This diversification can help manage risk by reducing exposure to the price fluctuations of a single stock.

Fractional share trading not only promotes diversification but also opens up a world of possibilities for investors seeking to optimize their portfolios. Here’s how this innovative approach can enhance your investment strategy:

Access to Premium Stocks: Fractional shares enable investors to access high-priced stocks, such as tech giants like Amazon or Google, without having to buy a whole share. This democratizes investing, allowing you to build a portfolio with a broader spectrum of assets, including those that were previously out of reach.

Risk Mitigation: Diversification remains a cornerstone of risk management in investing. By spreading your investments across various stocks and asset classes, you can reduce the impact of poor-performing assets on your overall portfolio. Fractional shares make diversification even more accessible.

Portfolio Customization: With fractional shares, you have the flexibility to tailor your portfolio to align with your risk tolerance and financial goals. You can allocate precise amounts to different stocks or ETFs, ensuring your investments align with your preferred asset allocation strategy.

Compound Growth: Fractional share trading allows you to reinvest dividends more effectively. Instead of waiting until you can afford a full share of a dividend-paying stock, you can immediately reinvest smaller dividend amounts to benefit from the power of compounding.

Cost-Efficiency: Fractional shares make it cost-effective to achieve diversification. Rather than spending large sums to buy full shares of numerous stocks, you can invest smaller amounts in multiple assets. This cost-efficiency is especially advantageous for investors with limited capital.

Risk Reduction for Individual Stocks: By holding fractional shares of individual stocks, you reduce your exposure to the price fluctuations of a single company. Even if a stock you own performs poorly, its impact on your overall portfolio is proportionally smaller.

Easier Rebalancing: Periodic portfolio rebalancing is essential to maintain your desired asset allocation. Fractional shares simplify this process, as you can adjust your holdings with precision. This ensures that your portfolio remains aligned with your investment strategy.

Long-Term Strategy: Fractional share investing is ideal for long-term investors. It allows you to gradually build a well-diversified portfolio over time, benefiting from dollar-cost averaging and compounding, without the need for substantial upfront capital.

Education and Experimentation: Fractional shares are an excellent tool for novice investors who want to learn and experiment without risking large sums of money. You can gain valuable experience by investing in small fractions of various assets.

Global Diversification: Accessing international markets becomes more straightforward with fractional shares. You can diversify globally by investing in companies and assets from different regions, reducing geographical risk.

In conclusion, fractional share trading is a game-changer for investors, offering them an array of benefits that go beyond diversification. It empowers investors to tailor their portfolios, manage risk, and access premium assets with ease. As this approach continues to gain popularity, it will likely play a significant role in shaping the future of investing.

Looking for more insights? You’ll find them right here in our extended coverage: Fractional Real Estate vs. Stock Market Investing: – Fintor

Fractional share trading aligns well with the dollar-cost averaging (DCA) investment strategy. DCA involves investing a fixed amount of money at regular intervals, regardless of market conditions. Fractional shares make it easier to implement DCA, as you can consistently invest a set dollar amount, even if it doesn’t correspond to a whole share purchase.

Fractional share trading is not just a convenient option; it harmonizes seamlessly with the time-tested investment strategy of dollar-cost averaging (DCA). Dollar-cost averaging revolves around the principle of consistency and resilience in the face of market volatility. This strategy involves committing a fixed sum of money at regular intervals, irrespective of the prevailing market conditions.

Now, here’s where fractional shares emerge as a game-changer in the world of investing. With traditional share trading, you might find yourself constrained by the need to purchase whole shares. This can be a hindrance to implementing the DCA strategy effectively, especially when the set dollar amount you wish to invest doesn’t align neatly with the price of a full share.

Fractional shares eliminate this constraint. They allow you to invest precisely the amount you desire, down to the cent, regardless of whether it equates to a complete share or not. This newfound flexibility ensures that your DCA strategy remains steadfast. You can consistently allocate the same amount of capital at your chosen intervals, irrespective of how the market values individual shares at any given time.

This approach has several advantages. Firstly, it removes the emotional element from your investment decisions. Instead of trying to time the market, you focus on consistency, which can ultimately lead to better outcomes over the long term. Secondly, it enables you to benefit from market fluctuations. When share prices are high, your fixed investment buys fewer shares, and when prices are lower, you acquire more. This dynamic inherently embodies the “buy low, sell high” principle of successful investing.

Moreover, fractional share investing makes it easier to diversify your portfolio effectively. With smaller investment increments, you can spread your capital across a broader spectrum of assets, reducing risk and increasing the potential for long-term growth.

In essence, fractional share trading and the dollar-cost averaging strategy form a harmonious partnership. This combination empowers investors to navigate the markets with discipline, flexibility, and resilience. By consistently investing a fixed sum, regardless of market conditions, and leveraging fractional shares to do so, you not only sidestep the pitfalls of emotional investing but also position yourself for the potential rewards of disciplined, long-term wealth accumulation.

If you’d like to dive deeper into this subject, there’s more to discover on this page: What To Know About Dollar-Cost Averaging Investing Strategy

While fractional share trading offers many benefits, it’s essential to be aware of the associated risks:

While fractional share trading undoubtedly presents numerous advantages for investors, it is equally crucial to maintain a keen awareness of the potential risks that come hand in hand with these opportunities. Embracing this financial innovation can empower individuals to access a broader range of assets and build diversified portfolios, yet it’s essential to proceed with caution and a comprehensive understanding of the following associated risks:

Market Volatility: Fractional share trading doesn’t shield investors from market fluctuations. The value of fractional shares can still rise and fall, and in some instances, smaller positions may experience more significant percentage swings. Being prepared for market volatility and having a well-thought-out investment strategy is key to managing this risk.

Lack of Voting Rights: In some cases, fractional shareholders may not have voting rights in the companies they’ve invested in. This means you won’t have a say in important company decisions, such as board elections or major policy changes. Be sure to understand the terms and conditions of your fractional investments to determine if this applies to you.

Liquidity Issues: Fractional shares may not be as liquid as whole shares, especially for less popular or thinly-traded stocks. This can affect your ability to buy or sell your fractional positions quickly, particularly during market fluctuations.

Fractional Fees: Some brokerage platforms may charge fees or commissions for executing fractional share trades. These fees can accumulate over time and may impact your overall returns, especially for frequent traders. Always review the fee structure of your chosen brokerage to assess the cost-effectiveness of fractional trading.

Account Security: As with any online financial activity, there’s a risk of data breaches or unauthorized access to your fractional share trading account. Ensure that you’re using a reputable and secure brokerage platform and follow best practices for online security, such as using strong passwords and enabling two-factor authentication.

Regulatory Changes: The regulatory environment around fractional share trading is still evolving. Changes in regulations could impact how these investments are treated, potentially affecting their tax treatment or the availability of certain assets for fractional trading.

Overdiversification: While diversification is a fundamental risk management strategy, investing in too many fractional shares can lead to overdiversification. This can dilute potential gains and make it challenging to keep track of your investments effectively.

To navigate the world of fractional share trading successfully, it’s essential to strike a balance between the benefits and risks. Developing a well-defined investment strategy, staying informed about market conditions, and regularly reviewing your portfolio are all key steps to mitigating the potential downsides and maximizing the advantages of this innovative approach to investing.

You can also read more about this here: Age of Discovery: Navigating the Risks and Rewards of Our New …

Fractional shares may have lower liquidity compared to whole shares, which can affect the ease of buying or selling.

Fractional shares offer a revolutionary way for investors to access the stock market, particularly for those who might not have the capital to purchase whole shares of high-priced stocks. However, it’s crucial to understand that fractional shares can come with some trade-offs, one of which is potentially lower liquidity compared to whole shares.

Liquidity, in the context of investing, refers to the ease and speed at which you can buy or sell an asset without significantly impacting its price. Whole shares, being standard units of ownership, typically enjoy higher liquidity. They are often in greater demand in the market, which means that you can buy or sell them quickly, and the price fluctuation due to your trade is minimal.

In contrast, fractional shares represent a portion of a whole share, and they might not be in as high demand. This lower demand can sometimes translate into lower liquidity, especially for stocks that are not heavily traded. When selling a fractional share, it may take longer to find a buyer willing to purchase that exact fraction at your desired price, and this could result in a slight delay in the execution of your trade.

It’s worth noting that for many investors, especially those with a long-term perspective, the slightly lower liquidity of fractional shares might not be a significant concern. Fractional shares are particularly valuable for dollar-cost averaging, where investors regularly invest a fixed amount of money into the market. With fractional shares, every dollar can be invested efficiently, regardless of the stock’s price.

Additionally, the impact of lower liquidity on the ease of buying or selling fractional shares can vary depending on the platform or brokerage you use. Some brokerage platforms have mechanisms in place to facilitate the trading of fractional shares with minimal delays, while others may have limitations.

In conclusion, while fractional shares offer accessibility and flexibility, investors should be aware of their potential lower liquidity compared to whole shares. It’s essential to consider your investment strategy, goals, and the specific stocks you plan to trade when deciding whether to use fractional shares or whole shares in your portfolio. Understanding these trade-offs allows you to make informed decisions that align with your financial objectives.

To expand your knowledge on this subject, make sure to read on at this location: Fractional Real Estate vs. Stock Market Investing: – Fintor

Fractional shares are still subject to market fluctuations, and the value of your investment can rise or fall based on market conditions.

Fractional shares offer an accessible entry point into the world of investing, allowing individuals to own a portion of high-priced stocks they might not have been able to afford otherwise. However, it’s essential to recognize that while fractional shares democratize investing, they are not immune to the dynamics of the financial markets. Here’s a deeper exploration of the concept:

Market Volatility Impact: Just like whole shares, fractional shares are influenced by market fluctuations. The value of your fractional investment can experience ups and downs, driven by factors such as economic news, geopolitical events, and company-specific developments. It’s crucial to understand that even a small ownership stake can be affected by significant market movements.

Diversification Considerations: Diversification is a key strategy for managing risk in your investment portfolio. While fractional shares enable you to spread your investment across multiple assets, it’s essential to assess the overall diversification of your holdings. Overconcentration in a specific stock or sector, even through fractional shares, can expose you to higher levels of risk.

Long-Term Perspective: Fractional share investing can be particularly beneficial for those with long-term financial goals. Over time, market fluctuations tend to smooth out, and investments have historically shown an upward trajectory. Maintaining a long-term perspective can help you weather short-term market volatility and capitalize on the potential for your investments to grow over time.

Risk Management: Just as with any investment, it’s important to evaluate your risk tolerance when dealing with fractional shares. Understand how much market fluctuation you are comfortable with and adjust your investment strategy accordingly. Diversifying across different asset classes, including bonds and other less volatile options, can help mitigate risk.

Continuous Monitoring: Staying informed about your fractional share investments is crucial. Regularly review your portfolio, monitor the performance of the underlying assets, and assess whether your investment goals and risk tolerance have changed. You can make adjustments to your portfolio as needed to align with your evolving financial objectives.

Costs and Fees: Be aware of any fees associated with fractional share investing. While the costs are typically lower than those of traditional brokerage services, they can still impact your overall returns. Compare fees across different platforms and choose one that aligns with your investment strategy.

Educational Resources: As with any investment, ongoing education is key. Take advantage of educational resources and tools provided by your brokerage platform to enhance your understanding of investing principles, strategies, and market dynamics.

In summary, fractional shares are a valuable tool for investors looking to start or diversify their portfolios without a significant upfront capital requirement. However, it’s vital to approach fractional share investing with an awareness of market fluctuations and a long-term perspective. By understanding the dynamics of fractional shares and managing risk effectively, you can harness their potential to help you achieve your financial goals.

Should you desire more in-depth information, it’s available for your perusal on this page: Age of Discovery: Navigating the Risks and Rewards of Our New …

As a fractional share owner, you may not have voting rights or receive dividends in the same way as whole share owners.

Being a fractional share owner offers certain advantages, such as accessibility to high-priced stocks and the ability to diversify your portfolio with smaller investments. However, it’s important to understand that there are some unique considerations and potential limitations associated with owning fractions of shares:

Limited Voting Rights: One of the key differences is the limitation on voting rights. In many cases, fractional share owners may not have the same voting power as those who own whole shares. Voting rights are typically tied to whole shares, and fractional owners may not be able to directly participate in shareholder votes or influence company decisions.

Dividend Payments: Dividend payments can also differ for fractional share owners. While some brokerage platforms offer dividend reinvestment for fractions of shares, others may not. This means that you might receive dividends in the form of cash rather than additional fractional shares. It’s essential to check with your broker regarding their dividend policies for fractional shares.

Aggregation of Dividends: In some cases, brokerage platforms may aggregate dividends from multiple fractional share holdings and distribute them as a lump sum. This can make it slightly more challenging to track the performance of individual holdings if you’re interested in managing your investments on a granular level.

Liquidity Considerations: Fractional shares can be less liquid compared to whole shares, particularly for less popular or thinly traded stocks. When it comes to selling fractional shares, you might encounter slightly wider bid-ask spreads, which could affect the price at which you can execute your trades.

Costs and Fees: Be aware of any fees associated with fractional share ownership. While many brokerages offer commission-free trading for fractional shares, some might have fees or charges that can impact your overall returns.

Portfolio Management: Owning fractional shares can make portfolio management more complex, especially if you hold numerous fractional positions across different stocks. Keeping track of these holdings and making strategic decisions can require more attention and organization.

Access to Certain Features: Depending on your brokerage, some advanced features, such as options trading or certain types of orders, may not be available for fractional shares. Ensure that the features you require align with your investment strategy.

Tax Considerations: Fractional share ownership can introduce complexities when it comes to tax reporting. You may need to keep track of fractional share cost bases and capital gains or losses separately.

In conclusion, fractional share ownership offers accessibility and diversification benefits, but it’s essential to be aware of the potential differences in voting rights, dividend handling, and other considerations compared to owning whole shares. Before diving into fractional share investing, thoroughly research and understand the specific policies and limitations associated with fractional shares on your chosen brokerage platform. This knowledge will help you make informed investment decisions and effectively manage your portfolio.

Additionally, you can find further information on this topic by visiting this page: The Rise of Fractional Real Estate Investing – Fintor

Investors can participate in the growth potential of high-priced stocks without the need for a substantial upfront investment.

Certainly, let’s delve deeper into the concept of how fractional share trading allows investors to tap into the growth potential of high-priced stocks:

1. Access to Market Giants:

High-priced stocks often include some of the market’s most influential and well-established companies. These giants, such as Amazon, Apple, or Google parent company Alphabet, have a track record of delivering robust returns over time. With fractional share trading, investors can participate in the growth and success of these industry leaders without the financial burden of purchasing full shares.

2. Building a Diversified Portfolio:

Diversification is a fundamental principle of investment strategy. By spreading investments across various asset classes, sectors, and companies, investors can reduce risk. Fractional share trading facilitates diversification by allowing investors to allocate smaller sums of money to multiple high-priced stocks, achieving a well-rounded and balanced portfolio.

3. Risk Management:

Investing in high-priced stocks as a whole share may expose investors to more significant financial risk, especially if a substantial portion of their capital is tied up in a single stock. Fractional shares enable risk management by reducing the size of each position, thereby decreasing the overall risk associated with a particular stock’s performance.

4. Dollar-Cost Averaging (DCA):

Dollar-cost averaging is a disciplined investment strategy that involves regularly investing a fixed amount of money at predefined intervals, regardless of market conditions. Fractional share trading complements DCA by allowing investors to invest the same amount consistently, even in high-priced stocks. This approach mitigates the risk of making large, lump-sum investments at potentially unfavorable moments in the market.

5. Long-Term Growth Potential:

Many high-priced stocks are renowned for their long-term growth potential. They may operate in industries with high barriers to entry, have innovative business models, or enjoy dominant market positions. Fractional share trading enables investors to hold onto these stocks for extended periods, potentially benefiting from the compounding effect and capitalizing on the stocks’ sustained growth.

6. Smoother Entry and Exit Points:

Fractional share trading can provide more flexibility in entering and exiting positions. Investors can initiate investments in high-priced stocks incrementally, gradually building their position over time. Similarly, they can exit positions in a more controlled manner, liquidating a portion of their holdings when market conditions align with their financial goals.

7. Educational Opportunities:

Fractional share trading is an educational tool for novice investors who want to learn about investing in high-priced stocks. It allows them to get a firsthand experience of owning shares in renowned companies and observing how these stocks perform over time. This hands-on experience can contribute to their financial literacy and investment knowledge.

In summary, fractional share trading offers a pathway for investors to tap into the growth potential of high-priced stocks while managing risk, diversifying their portfolios, and adopting disciplined investment strategies. It democratizes access to these market giants, empowering a broader range of individuals to participate in the wealth-building opportunities offered by established and innovative companies.

Additionally, you can find further information on this topic by visiting this page: Best Investing Apps Of September 2023

Fractional shares enable diversification across a wide range of assets, helping to spread risk.

Fractional shares have transformed the landscape of investing, offering a host of benefits that go beyond diversification:

Accessibility: Fractional shares make investing accessible to a broader audience. They allow individuals to invest in high-priced assets like stocks of popular companies or expensive ETFs with whatever funds they have available, no matter how small.

Risk Mitigation: While diversification is a key advantage, fractional shares also help manage risk within individual assets. Investors can allocate their funds across a variety of stocks or other assets, reducing their exposure to a single company or sector. This risk mitigation strategy can be especially valuable during market downturns.

Cost Efficiency: Traditional investments often come with high minimum investment requirements. Fractional shares eliminate this barrier, allowing you to invest your money more efficiently. This can lead to better allocation of your capital and ultimately higher returns.

Portfolio Customization: Fractional shares empower investors to create highly customized portfolios. You can fine-tune your investments to match your specific financial goals, risk tolerance, and preferences. This level of control can be empowering and align your portfolio more closely with your objectives.

Reinvestment of Dividends: Even with a small investment, fractional share owners can benefit from dividend reinvestment. When a company pays dividends, those earnings can automatically be reinvested in additional fractional shares, helping your portfolio grow over time.

Accessibility to Premium Assets: Some investors may aspire to own shares of premium assets like Berkshire Hathaway or Amazon, which trade at very high prices. Fractional shares make these aspirations attainable, allowing you to participate in the growth of these companies without the need for a substantial upfront investment.

Liquidity and Flexibility: Fractional shares offer liquidity and flexibility in managing your investments. You can buy or sell fractions of shares at any time, responding to changing market conditions, financial goals, or life events without constraints.

Educational Value: For novice investors or those looking to learn, fractional shares provide an educational opportunity. You can start small, experiment with different investment strategies, and gain hands-on experience without risking significant capital.

Long-Term Wealth Building: Fractional shares support a disciplined approach to long-term wealth building. Regularly investing small amounts can accumulate over time, potentially leading to significant wealth growth and financial security.

Diverse Asset Classes: Fractional shares aren’t limited to stocks. They extend to various asset classes like real estate, bonds, and cryptocurrencies. This opens up a world of investment opportunities that can help you build a well-rounded portfolio.

In conclusion, fractional shares offer a versatile and accessible way to diversify your investments, spreading risk while providing numerous other advantages. They empower investors to take control of their financial futures, no matter their initial capital, and participate in a wide range of assets that were once out of reach.

To expand your knowledge on this subject, make sure to read on at this location: Equity Markets vs. Fixed-Income Markets

Fractional shares promote financial inclusion by allowing individuals with limited resources to participate in the stock market.

Indeed, fractional shares have emerged as a powerful tool for promoting financial inclusion and expanding access to the stock market. Here’s an extended perspective on this idea:

Democratizing Wealth Creation: Fractional shares democratize wealth creation by breaking down the barriers to entry for aspiring investors. Even those with limited financial resources can now invest in high-value stocks, thereby benefiting from the long-term wealth-building potential of the stock market.

Reducing Risk and Enhancing Diversification: Investing in fractional shares allows individuals to diversify their portfolios more effectively. Instead of putting all their funds into a single stock, investors can spread their resources across a range of assets, reducing risk and increasing the potential for stable returns.

Accessible to Younger Generations: Younger generations, such as Millennials and Gen Z, who may not have substantial savings, are particularly drawn to fractional share investing. It aligns with their preference for digital platforms and offers a gradual introduction to the world of investing, fostering a savings and investment mindset early in life.

Cost Efficiency: Fractional shares enable investors to make the most of their available funds. They can allocate their money precisely, ensuring that no capital goes unused. This efficient use of resources can result in greater long-term gains.

Educational Opportunities: Fractional share investing provides an excellent educational opportunity. New investors can learn about the stock market, investment strategies, and risk management without putting large sums of money at stake. This hands-on experience can be invaluable in building financial literacy.

Long-Term Wealth Building: While fractional shares make investing accessible to those with limited resources, they also encourage a long-term investment perspective. Investing even small amounts consistently over time can lead to substantial wealth accumulation, aligning with the principles of dollar-cost averaging.

Access to Premium Stocks: Many premium stocks have high price tags, making them unaffordable for many investors in whole share form. Fractional shares allow access to these sought-after stocks, which may include tech giants like Amazon or Tesla, offering an opportunity to share in the growth of these companies.

Supporting Financial Goals: Fractional shares are versatile and can be used to work toward various financial goals, whether it’s saving for retirement, buying a home, or funding a dream vacation. This accessibility empowers individuals to tailor their investments to align with their unique objectives.

Investment Clubs and Communities: Fractional shares have also led to the formation of investment clubs and online communities. These groups provide a collaborative space for members to discuss investment strategies, share insights, and collectively invest in stocks or ETFs.

Global Investment Access: Fractional shares can extend beyond domestic markets, providing individuals with the opportunity to invest in international stocks and ETFs. This global access can further diversify portfolios and capture growth from various regions.

In conclusion, fractional shares represent a significant step toward greater financial inclusion. They offer a gateway for individuals with limited resources to participate in the stock market, build wealth over time, and enhance their financial literacy. As the accessibility of fractional share investing continues to grow, it has the potential to transform the way people think about wealth creation and financial security, ultimately contributing to a more inclusive and empowered society.

Looking for more insights? You’ll find them right here in our extended coverage: Fractional Real Estate vs. Stock Market Investing: – Fintor

Fractional share trading is not limited to individual stocks but extends to ETFs and other investment products. This means investors can access various asset classes, from stocks and bonds to real estate and commodities, in fractional form.

The beauty of fractional share trading lies in its versatility. It’s not confined solely to individual stocks; it offers access to a broad spectrum of investment products, including Exchange-Traded Funds (ETFs) and a diverse array of asset classes. This expansion of possibilities empowers investors to diversify their portfolios, manage risk, and explore a wide range of investment opportunities. Let’s explore this idea further:

1. ETFs and Diversification: ETFs are an excellent fit for fractional share trading because they represent diversified portfolios of assets. These can include stocks, bonds, or other investment instruments. With fractional shares, investors can own a piece of an ETF, even if its share price is relatively high. This diversification is invaluable for spreading risk and optimizing investment returns.

2. Bonds: Fractional share trading extends to bonds, allowing investors to access fixed-income securities without needing to purchase entire bonds. This opens up opportunities for income generation and risk mitigation within a balanced portfolio.

3. Real Estate: Real estate investment trusts (REITs) are another asset class that benefits from fractional share trading. Investors can participate in the real estate market without the large capital requirements associated with physical property ownership. Whether it’s commercial, residential, or specialized real estate sectors, fractional shares in REITs provide exposure to this asset class.

4. Commodities: Commodity ETFs enable investors to gain exposure to commodities like gold, silver, oil, or agricultural products. Fractional shares make it feasible for individuals to diversify their portfolios with commodities, which can act as hedges against inflation or provide alternative investment options.

5. Sector and Theme-Based Investments: Many ETFs are designed to track specific sectors or themes. Fractional share trading allows investors to target sectors such as technology, healthcare, or renewable energy, or invest in themes like ESG (Environmental, Social, and Governance) responsibly. This flexibility aligns with investors’ evolving preferences and priorities.

6. Dollar-Cost Averaging: Fractional share trading also supports the practice of dollar-cost averaging. Investors can allocate a set amount of money regularly to purchase fractional shares, regardless of the asset’s price. This disciplined approach can reduce the impact of market volatility over time and promote a long-term investment strategy.

7. Risk Management: The ability to invest in fractional shares of various asset classes enhances risk management. Diversifying across stocks, bonds, real estate, and commodities can help mitigate the impact of poor-performing assets and create a balanced portfolio that aligns with an individual’s risk tolerance and financial goals.

8. Accessibility and Financial Inclusion: Fractional shares empower a broader range of investors, including those with limited resources, to engage in diversified investing. This promotes financial inclusion, allowing individuals to build diverse portfolios regardless of their initial capital.

In conclusion, fractional share trading’s extension beyond individual stocks to encompass ETFs and diverse asset classes provides investors with a wealth of opportunities to craft balanced portfolios, manage risk, and pursue their investment objectives. The flexibility it offers aligns with the evolving landscape of investment preferences and opens doors for individuals to explore various markets and asset classes with greater accessibility and affordability.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Investing Explained: Types of Investments and How To Get Started

Conclusion

In conclusion, fractional share trading has revolutionized the investment landscape by making the stock market more accessible and affordable to a broader audience. It offers potential rewards such as diversification and access to high-priced stocks, but it’s crucial to navigate this innovative approach with an understanding of the associated risks. Fractional share trading is a powerful tool for investors looking to build diversified portfolios and embark on their investment journey with greater flexibility and inclusivity.

The Transformative Power of Fractional Share Trading: A New Era of Investment

In the ever-evolving world of finance, fractional share trading has emerged as a game-changer, democratizing the stock market and expanding opportunities for a diverse range of investors. While it certainly comes with remarkable benefits, it’s essential to appreciate the full spectrum of its impact. Here’s an extended exploration:

1. Expanding Investment Horizons:

Fractional share trading is a passport to a wider universe of investment possibilities. It empowers individuals to explore a multitude of stocks, from blue-chip giants to innovative startups, without being restricted by share prices. This expanded horizon opens the door to a world of potential growth and diversification.

2. Mitigating Risk Through Diversification:

Diversification is the bedrock of a resilient investment portfolio. Fractional shares facilitate diversification by allowing investors to spread their capital across numerous assets. This risk-management strategy can help shield portfolios from the volatility of individual stocks and sectors.

3. Accessible High-Priced Stocks:

Gaining exposure to high-priced stocks has never been easier. Fractional shares democratize access to renowned companies like Amazon, Apple, and Google, enabling even modest investors to participate in the potential gains of these market giants.

4. Financial Inclusivity:

Fractional shares embrace the spirit of financial inclusivity. They dismantle traditional barriers, making investing accessible to individuals from diverse backgrounds and income levels. This inclusive approach fosters economic empowerment and promotes wealth-building opportunities for all.

5. Flexibility Tailored to You:

Investing should be a reflection of your financial goals and comfort levels. Fractional shares offer the flexibility to invest precisely the amount you choose, whether it’s a few dollars or a substantial sum. This tailored approach empowers you to craft an investment strategy aligned with your unique objectives.

6. Nurturing Financial Education:

Fractional share trading serves as an educational platform for aspiring investors. It encourages learning by doing, allowing individuals to gain practical experience while minimizing financial risk. This hands-on education is invaluable for building financial literacy and confidence.

7. Navigating Risks Responsibly:

While fractional shares present myriad opportunities, they are not without risk. Investors should be aware of the potential downsides, including market volatility and the risk of over-diversification. A balanced approach to risk management is essential for sustainable investing.

8. Sustainable Wealth Building:

Fractional share trading is not a quick fix but a pathway to sustainable wealth building. By consistently investing small amounts over time, you can harness the power of compounding and work toward your long-term financial objectives.

9. The Evolution Continues:

The world of fractional shares is still evolving. As this innovative approach gains traction, it’s likely to pave the way for even more diverse investment opportunities, including access to alternative assets and global markets.

In conclusion, fractional share trading marks a pivotal moment in the democratization of finance. It offers an array of benefits, from diversification to accessibility, while also emphasizing the importance of financial education and responsible risk management. As investors embrace this transformative tool, they stand to benefit not only from the potential rewards it offers but also from the ability to shape their financial futures with greater flexibility and inclusivity.

Additionally, you can find further information on this topic by visiting this page: bridging-the-digital-gender-divide.pdf

More links

Don’t stop here; you can continue your exploration by following this link for more details: Fractional Real Estate vs. Stock Market Investing: – Fintor