Building a successful business is a remarkable achievement, but what’s equally significant is ensuring that your business legacy endures for generations to come. Passing down a family business involves careful planning, effective communication, and a commitment to preserving your entrepreneurial vision. In this article, we’ll explore the steps and considerations involved in the process of passing down a business through generations.

“Securing the continuity of a family business across generations is not just about maintaining financial assets; it’s about safeguarding a legacy built on dedication, hard work, and entrepreneurial spirit. To successfully pass down your business, consider these essential steps and key considerations:

Clarify Your Vision: Begin by articulating your long-term vision for the business. What values, principles, and goals define your company? This vision will serve as a guiding light for future generations.

Plan Early: Passing down a business is a process that should commence well in advance. Start planning for succession early, allowing sufficient time to navigate complexities and make informed decisions.

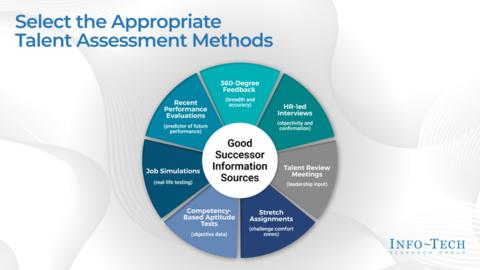

Identify Potential Successors: Evaluate family members or key employees who could take on leadership roles in the company. Assess their qualifications, commitment, and alignment with your vision.

Develop a Succession Plan: Work with legal and financial advisors to create a comprehensive succession plan. This plan should address ownership transfer, leadership transition, and decision-making processes.

Open Communication: Foster open and honest communication with all stakeholders. Discuss your intentions, expectations, and the future of the business. Encourage feedback and input from family members and key employees.

Preserve Company Culture: Ensure that the unique culture and values that define your business are passed down along with the company. Communicate the importance of these cultural aspects to future leaders.

Financial Planning: Consider the financial implications of succession. Explore options for funding the transition, such as life insurance, trusts, or financing arrangements.

Mentorship and Training: Invest in the development and training of potential successors. Provide them with opportunities to learn and gain experience in different facets of the business.

Legal Documentation: Create legal documents, such as wills, trusts, and buy-sell agreements, to formalize the succession plan and protect the interests of all parties involved.

Seek Professional Guidance: Consult with legal, financial, and business advisors who specialize in succession planning. Their expertise can help navigate complex legal and financial aspects.

Transition Period: Consider a gradual transition period during which you and the next generation work together. This allows for knowledge transfer and a smoother handover of responsibilities.

Monitor and Adjust: Continuously monitor the progress of the succession plan. Be prepared to adapt and make adjustments as circumstances change or new challenges arise.

Document Processes: Document key processes, procedures, and institutional knowledge. This documentation ensures that critical information is not lost during the transition.

Family Harmony: Emphasize the importance of maintaining family harmony throughout the succession process. Conflict resolution mechanisms can help address disputes constructively.

Legacy Preservation: Beyond the business itself, consider how you want your entrepreneurial legacy to be remembered. This may include philanthropic endeavors or contributions to the community.

Celebrate Milestones: Acknowledge and celebrate key milestones in the succession process. Recognize the efforts of those involved and reinforce the sense of accomplishment.

Passing down a family business is a profound commitment to preserving a legacy of entrepreneurship. With careful planning, effective communication, and a focus on both the business’s continuity and the family’s well-being, you can ensure that your entrepreneurial journey continues to inspire and benefit generations to come.”

For a comprehensive look at this subject, we invite you to read more on this dedicated page: What Is Legacy Thinking? – Beginning With the End in Mind

The journey of handing over your business legacy starts with an open and honest conversation with your family members. Clearly communicate your intentions, values, and expectations regarding the business’s future. Encourage family members to express their thoughts, aspirations, and concerns.

“Family discussions about your business legacy should be transparent and open. Share your intentions, values, and expectations, and listen to your family’s thoughts and concerns. This dialogue fosters understanding and paves the way for a successful transition.”

To expand your knowledge on this subject, make sure to read on at this location: Generational wealth: What it is & how to build it|Empower

Assess the interests, skills, and dedication of potential family successors. Consider their qualifications and commitment to maintaining the business’s values and goals. Sometimes, the most suitable candidate might not be a family member, so be open to other options.

When choosing a family successor for your business, it’s crucial to assess their qualifications, skills, and dedication. While family ties can be a motivating factor, it’s equally important to prioritize the individual’s ability to maintain the business’s values and goals. In some cases, the best choice for a successor might not be a family member, so it’s essential to remain open to other options and select the person who is best equipped to lead the business into the future.

You can also read more about this here: Sustaining Your Legacy and Empowering Future Generations (Part …

A well-structured succession plan is essential. It should outline the transition process, roles and responsibilities, and a timeline. Include details about how ownership and management will be transferred and any necessary training or mentorship for the successor(s).

Crafting a robust succession plan is not just a matter of business acumen; it’s a strategic imperative that ensures the continuity and sustainability of your enterprise. Here’s an expanded perspective on the critical elements that make up an effective succession plan:

Clear Objectives: Start by defining the overarching objectives of the succession plan. What are your goals? Is it to ensure a smooth transition, maintain family ownership, or maximize the value of the business? Having clear objectives provides a guiding framework for the entire process.

Identify Key Stakeholders: Identify all relevant stakeholders, including family members, key employees, and potential successors. Consider their aspirations, skills, and commitment to the business. In some cases, it may involve external candidates with the right expertise.

Detailed Transition Process: The heart of the succession plan lies in the transition process itself. Outline every step, from identifying potential successors to formalizing the handover. Clearly define the roles and responsibilities of each party involved, including the outgoing owner(s), incoming leader(s), and any advisors or consultants.

Timeline and Milestones: Establish a realistic timeline for the succession process. Break it down into milestones and specific deadlines. This not only adds structure but also creates a sense of accountability for all involved parties.

Ownership and Management Transfer: Address the crucial aspects of ownership and management transfer. Specify how ownership shares will be transferred, whether it’s through a buy-sell agreement, gifting, or other methods. Detail the transfer of managerial authority and decision-making powers, emphasizing a smooth transition.

Training and Mentorship: Provide a comprehensive plan for the training and mentorship of successors. This includes on-the-job training, exposure to key business functions, and guidance from the outgoing owner(s) or mentors within the organization.

Conflict Resolution Mechanisms: Acknowledge that succession can be a source of conflict. Develop mechanisms for conflict resolution to address disputes or disagreements that may arise during the transition process.

Financial Considerations: Delve into the financial aspects, such as valuation methods, funding sources for the buyout, and any tax implications. Ensure that the financial aspects align with the broader succession goals.

Communication Strategy: Communication is vital throughout the succession process. Develop a clear strategy for how you’ll communicate the plan to all stakeholders, including employees, customers, and suppliers. Transparency can help alleviate uncertainty and maintain trust.

Contingency Plans: Anticipate unforeseen challenges or changes in circumstances. Establish contingency plans that outline what happens in case of unexpected events, such as illness, disability, or a sudden departure of key individuals.

Legal and Governance Matters: Address legal and governance issues, such as updating legal documents (e.g., wills, contracts) and ensuring compliance with regulatory requirements related to ownership and management transfers.

Regular Review and Adjustment: A succession plan is not static; it should evolve with changing circumstances. Schedule regular reviews of the plan to ensure it remains aligned with your goals and adapt it as necessary.

Professional Advisors: Engage professional advisors, such as lawyers, accountants, and financial planners, who specialize in succession planning. Their expertise can be invaluable in navigating complex legal and financial aspects.

Fostering Trust and Confidence: Lastly, emphasize the importance of trust and open communication among family members and stakeholders. A succession plan built on trust is more likely to succeed.

In conclusion, a well-structured succession plan is not just a document; it’s a strategic roadmap for the future of your business. It ensures a seamless transition, minimizes disruptions, and safeguards the legacy you’ve built. By addressing these critical elements, you lay the foundation for a successful and sustainable succession process.

Don’t stop here; you can continue your exploration by following this link for more details: Building a Legacy: Passing Down a Family Business Successfully

Consult with legal and financial experts to navigate the complexities of transferring ownership. This may involve estate planning, tax implications, and business valuation. Ensure that all necessary legal documents, such as wills and buy-sell agreements, are in place.

Transferring ownership of a business across generations is a complex process that often involves legal, financial, and emotional considerations. To successfully build a legacy and ensure the continuity of your business, it’s crucial to plan carefully and seek expert guidance. Here are some key steps to help you navigate this important journey:

Start Early and Communicate: Begin the succession planning process well in advance. Early discussions with family members and key stakeholders can help align everyone’s expectations and avoid conflicts later on. Effective communication is the foundation of a smooth transition.

Identify and Develop Successors: Identify potential successors within the family or your team. Assess their skills, strengths, and areas where they may need development. Providing training and mentorship to the chosen successors can prepare them for leadership roles.

Create a Succession Plan: Work with legal and financial experts to create a comprehensive succession plan. This plan should outline the transition timeline, ownership structure, and key responsibilities of the successors. It should also address any potential challenges and contingency plans.

Consider Tax and Financial Implications: Transferring ownership can have significant tax implications. Consult with financial advisors to explore tax-efficient strategies that minimize the financial burden on both the business and the individuals involved.

Review Estate Planning: Estate planning is crucial in business succession. Ensure that your estate plan aligns with your succession goals. Wills, trusts, and other legal documents should be updated to reflect your wishes for the business’s future.

Preserve the Company Culture: Your business likely has a unique culture and values that have contributed to its success. Take steps to preserve and pass down these cultural elements to maintain the company’s identity and reputation.

Seek Professional Advice: Succession planning involves complex legal and financial considerations. Engage with attorneys, accountants, and business advisors who specialize in this area. Their expertise can help you navigate the intricacies of the process.

Test the Waters: Consider a gradual transition that allows successors to gain experience and confidence. This can involve having them take on increasing responsibilities over time, providing a smoother handover.

Review and Adjust: Business and family dynamics can change over time. Periodically review your succession plan and make adjustments as needed. Stay adaptable and open to evolving circumstances.

Document Everything: Keep thorough records of all succession-related decisions, meetings, and agreements. Documentation provides clarity and can be essential in case of disputes or unexpected challenges.

Building a legacy through generational business transfer is a profound endeavor that requires careful planning and execution. With the right strategy, open communication, and professional guidance, you can pass down your business successfully, ensuring its continuity and preserving your entrepreneurial legacy for future generations.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Generational wealth: What it is & how to build it|Empower

Passing down a business isn’t just about transferring assets; it’s about preserving the unique culture and values that define your company. Make sure your successor(s) understand and embrace these principles.

“Passing down a business isn’t just about transferring assets; it’s about preserving the unique culture and values that define your company. Make sure your successor(s) understand and embrace these principles. This ensures continuity and honors the legacy you’ve built.”

Should you desire more in-depth information, it’s available for your perusal on this page: Preserving Legacy and Fostering Identity: Capturing Your Family’s …

Rather than a sudden change of ownership, consider a gradual transition. This allows the successor(s) to learn the ropes, gain experience, and build relationships with employees, customers, and suppliers.

Transitioning a business gradually, as opposed to abrupt ownership changes, offers numerous advantages and a smoother succession process. Let’s explore this idea in more depth:

Knowledge Transfer: A gradual transition allows the current owner to transfer their knowledge, expertise, and insights to the successor(s). This knowledge transfer is invaluable for understanding the intricacies of the business, its unique challenges, and the strategies that have led to its success.

Experience Accumulation: Successors have the opportunity to accumulate hands-on experience while working alongside the current owner. This gradual learning curve ensures that they become familiar with every aspect of the business, from day-to-day operations to long-term strategic planning.

Relationship Building: Business success often hinges on relationships—with employees, customers, suppliers, and partners. A gradual transition provides successors with the time to build and nurture these critical relationships. Customers and employees can become accustomed to the new leadership gradually, reducing the risk of disruptions.

Employee Morale: Employees may experience uncertainty and anxiety during ownership changes. A gradual transition can help maintain employee morale and confidence in the business’s stability. It sends a clear message that leadership is committed to a smooth transition and preserving the company’s culture.

Customer Confidence: Customers often prefer stability and consistency in the businesses they rely on. A gradual transition helps maintain customer confidence by minimizing disruptions to product quality, service, and reliability. Customers can adjust to the changes more smoothly.

Supplier Relationships: Suppliers are vital partners for many businesses. Maintaining strong relationships with suppliers ensures a reliable supply chain. During a gradual transition, the successor(s) can continue to nurture these supplier relationships, ensuring a seamless flow of goods and services.

Strategic Alignment: The current owner can work closely with the successor(s) to align their strategic vision for the business. This alignment is crucial for ensuring that the business continues to thrive and grow under new leadership.

Risk Mitigation: Abrupt ownership changes can pose risks to the business’s continuity and financial stability. A gradual transition allows for a more controlled and risk-mitigated handover process.

Legal and Financial Considerations: Transitioning ownership gradually provides more time to address legal and financial matters, such as contracts, licenses, permits, and tax implications. This thorough approach helps avoid potential legal and financial complications.

Business Reputation: A business’s reputation is a valuable asset. A gradual transition can help protect and preserve the business’s reputation, ensuring that it continues to be seen as reliable and trustworthy by customers, employees, and stakeholders.

Successor’s Confidence: Successors gain confidence and a sense of ownership over time. Gradual transitions provide them with opportunities to make decisions, take on leadership roles, and demonstrate their commitment to the business’s success.

Planning for Challenges: Unexpected challenges can arise during a transition. A gradual approach allows for more flexibility in addressing these challenges, with ample time to develop and implement solutions.

In conclusion, a gradual transition of business ownership offers numerous benefits, including knowledge transfer, relationship building, employee and customer confidence, and risk mitigation. It ensures a smoother and more successful succession process, allowing the business to thrive under new leadership while maintaining its stability, reputation, and operational excellence.

Should you desire more in-depth information, it’s available for your perusal on this page: How to Ensure a Lasting Legacy for Your Family-Owned Business

Emphasize the importance of professionalism within the family business. All family members involved should adhere to the same standards and expectations as non-family employees. This ensures a smooth transition and a harmonious work environment.

Promote meritocracy within the family business. While family ties are important, it’s crucial to reward competence and hard work. Recognize and reward family members based on their skills and contributions, just as you would with non-family employees. This approach fosters a culture of fairness and motivates everyone to excel. Remember, a successful family business is built on a foundation of professionalism and meritocracy.

Looking for more insights? You’ll find them right here in our extended coverage: 7 Ways to Build Your Legacy at Work

Don’t hesitate to seek guidance from business advisors or mentors who have experience with succession planning. Their insights can be invaluable in navigating the complexities of generational transitions.

“Experienced advisors or mentors can provide invaluable guidance in navigating the intricacies of generational transitions within your business. Don’t hesitate to seek their insights and wisdom.”

To delve further into this matter, we encourage you to check out the additional resources provided here: Experts on the Future of Work, Jobs Training and Skills | Pew …

Succession planning is not a one-time task but an ongoing process. Regularly review and adapt your plan as circumstances change. Keep the lines of communication open within the family and the business.

“Succession Planning: A Continuous Journey for Family Businesses

Succession planning isn’t a one-and-done affair; it’s an ever-evolving process that demands vigilance and adaptability. To ensure a seamless transition and the long-term prosperity of your family business, consider these key principles:

Continuous Review: The business landscape is dynamic, and family dynamics evolve. Regularly review your succession plan to ensure it remains aligned with both your family’s aspirations and the business’s needs. This ongoing assessment enables you to make necessary adjustments promptly.

Adaptability: Be prepared to adapt your plan. Unexpected circumstances can arise, such as changes in market conditions, health issues, or shifts in family members’ interests. A flexible plan can respond effectively to unforeseen challenges.

Open Communication: Foster a culture of open and transparent communication within the family and the business. Encourage family members to express their goals, concerns, and ideas regarding the succession plan. Constructive dialogue helps build consensus and ensures everyone feels heard.

Successor Development: Identify and nurture potential successors from an early stage. Provide them with mentorship, training, and exposure to different aspects of the business. This proactive approach grooms them for leadership roles.

Contingency Planning: Develop contingency plans for unforeseen events that may disrupt the succession process. Consider scenarios like sudden illness, incapacity, or the need for an interim leader. Having backup plans in place ensures business continuity.

Legal and Financial Expertise: Seek professional guidance from legal and financial advisors experienced in family business succession. They can help you navigate complex issues, tax implications, and legal documentation.

Family Governance: Establish clear family governance structures and mechanisms to address conflicts and make decisions collaboratively. A well-defined family constitution or charter can outline roles, responsibilities, and dispute resolution processes.

Fairness and Equity: Strive for fairness and equity in your succession plan. Ensure all family members are treated fairly, whether they’re actively involved in the business or not. Fairness promotes harmony within the family.

Professional Management: Consider the option of professional management if there are no suitable family successors. Bringing in external leadership can be a strategic choice to sustain the business’s growth.

Alignment with Values: Ensure that the succession plan aligns with the core values and mission of the business. A values-driven approach helps maintain the company’s identity and purpose.

Timely Transition: Avoid delaying the transition unnecessarily. An efficient handover of leadership can inject fresh energy and ideas into the business. Timeliness is key to maintaining competitiveness.

Family Retreats: Schedule regular family retreats or meetings dedicated to discussing the family’s role in the business. These gatherings foster unity, trust, and a shared vision for the future.

Professional Mediation: In cases of family conflicts that cannot be resolved internally, consider professional mediation. A neutral mediator can help facilitate discussions and find mutually acceptable solutions.

Monitor Progress: Implement a system for tracking the progress of your succession plan. Regularly assess milestones and evaluate the effectiveness of your strategies.

Celebrate Milestones: Celebrate achievements along the succession journey. Recognizing milestones, both big and small, can boost morale and reinforce the commitment of family members to the plan.

In conclusion, succession planning is a dynamic and multifaceted process that requires continuous attention and adaptation. By adhering to these principles and maintaining open channels of communication, family businesses can navigate the complexities of succession successfully, ensuring a harmonious transition and a prosperous future.”

For additional details, consider exploring the related content available here Linda Southwood on LinkedIn: How Dare They! Is a slogan on …

Acknowledge and celebrate milestones in the succession process. These can include the successful completion of training, the official transfer of ownership, or achieving specific business goals.

Celebrating milestones in the succession process is essential for recognizing the hard work and dedication of everyone involved. It helps build morale, fosters a sense of accomplishment, and creates positive momentum for the transition. Acknowledging achievements such as the successful completion of training programs ensures that the incoming leadership is well-prepared for their roles.

The official transfer of ownership is a significant milestone that symbolizes the passing of the torch to the next generation of leaders. It marks the culmination of careful planning and preparation and should be celebrated as a pivotal moment in the company’s history.

In addition to these formal milestones, it’s important to recognize and celebrate smaller victories along the way. Achieving specific business goals, whether it’s increasing revenue, expanding market reach, or improving operational efficiency, deserves recognition. These accomplishments demonstrate that the succession plan is on track and that the organization is thriving under the new leadership.

Celebrations can take various forms, from formal ceremonies and announcements to more casual gatherings and team-building activities. Regardless of the format, the key is to make these milestones memorable and meaningful for all involved. This not only boosts morale but also reinforces the positive aspects of the succession process, making it a smoother and more successful transition for everyone.

You can also read more about this here: Articles – Land for Sale | Alabama Land Company

Passing down a family business through generations is a profound journey that requires careful planning, communication, and a commitment to preserving your entrepreneurial legacy. By following these steps and maintaining a strong focus on family values and business culture, you can ensure that your business thrives in the hands of the next generation and continues to build upon the legacy you’ve created.

“Passing down a family business through generations is a profound journey that requires careful planning, communication, and a commitment to preserving your entrepreneurial legacy. By following these steps and maintaining a strong focus on family values and business culture, you can ensure that your business thrives in the hands of the next generation and continues to build upon the legacy you’ve created.

- Start Early: Begin the succession planning process well in advance to allow for a smooth transition.

- Identify Potential Successors: Identify family members or key employees who have the skills and passion to take over the business.

- Establish a Clear Succession Plan: Develop a detailed plan outlining roles, responsibilities, and timelines for the transition.

- Provide Training and Mentorship: Invest in the training and mentorship of the next generation to prepare them for leadership roles.

- Maintain Family Harmony: Open and honest communication is key to resolving conflicts and maintaining family cohesion.

- Seek Professional Advice: Consult with legal, financial, and business advisors to ensure a legally sound and financially viable transition.

- Preserve the Company Culture: Ensure that the values and culture that built the business are passed down.

- Plan for Retirement: Consider your financial security and retirement plans as you transition out of the business.

- Celebrate Milestones: Acknowledge and celebrate the achievements and milestones of both the retiring and incoming generations.

- Adapt and Innovate: Encourage innovation and adaptability to keep the business competitive in changing markets.

By following these steps, your family business can thrive for generations to come, leaving a lasting legacy.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: Generational wealth: What it is & how to build it|Empower

More links

Explore this link for a more extensive examination of the topic: Building A Legacy in Business- Consulting Resources & Corporate …