Introduction

Retail therapy is a delightful way to indulge in some much-needed self-care and update your wardrobe or home. However, the allure of shopping can sometimes lead to overspending. The good news is that retail therapy can be both satisfying and budget-friendly with the right approach. Here are some smart shopping tips and tricks to help you enjoy retail therapy without breaking the bank.

Retail therapy, often seen as a remedy for lifting spirits and refreshing your surroundings, can indeed be a fulfilling form of self-care. However, keeping the allure of shopping in check and maintaining a budget-friendly approach is key to a truly satisfying experience. Here are some savvy shopping strategies to ensure that retail therapy remains a delightful and wallet-conscious activity:

Set a Spending Limit: Before embarking on a shopping trip, establish a clear budget. Determine the maximum amount you’re willing to spend, taking into account your financial situation and priorities. Having this limit in mind provides a structured framework for your retail therapy.

Prioritize Needs Over Wants: Distinguish between necessities and desires. Prioritize purchasing items that fulfill genuine needs, such as essential clothing or household items, over impulse buys. Addressing practical requirements ensures your retail therapy aligns with responsible spending.

Make a Shopping List: Prepare a list of items you intend to purchase. This list helps you stay focused and minimizes the temptation to buy on impulse. Stick to your list as closely as possible to avoid unplanned spending.

Research and Compare Prices: Do your homework before hitting the stores or shopping online. Research products, compare prices from different retailers, and read reviews to make informed choices. This diligence can lead to cost savings and better-quality purchases.

Seek Discounts and Promotions: Take advantage of discounts, promotions, and loyalty programs offered by retailers. Look for sales, coupons, and cashback offers to reduce the overall cost of your retail therapy.

Set Time Limits: Allocate a specific amount of time for your shopping excursion. This prevents wandering aimlessly and making impulsive purchases due to extended browsing. Time constraints encourage efficient and purposeful shopping.

Cash or Card Control: Consider using cash for your retail therapy. It provides a tangible representation of your spending limit and reduces the risk of overspending with credit cards. If using a card, monitor your expenditures closely to avoid exceeding your budget.

Quality Over Quantity: Opt for quality over quantity when making purchases. Investing in durable and long-lasting items, even if they are slightly more expensive, can be a better choice in the long run. Quality items tend to require fewer replacements.

Reflect Before Purchasing: Take a moment to reflect on each potential purchase. Ask yourself if the item genuinely adds value to your life or if it’s a fleeting desire. Practicing mindfulness in your shopping decisions helps prevent impulse buys.

Enjoy the Experience: Lastly, savor the entire retail therapy experience. Appreciate the process of browsing, selecting items, and making deliberate choices. Shopping can be a gratifying and mindful activity when approached with intention.

In conclusion, retail therapy can be a rewarding form of self-care without straining your finances. By setting limits, making informed choices, and prioritizing needs over wants, you can enjoy the benefits of retail therapy while maintaining a budget-friendly approach. Remember that responsible spending can lead to a more satisfying and sustainable retail therapy experience.

To expand your knowledge on this subject, make sure to read on at this location: The rise of artificial intelligence in healthcare applications – PMC

Before you embark on your shopping journey, it’s essential to determine how much you can comfortably spend. Create a budget that includes your essentials, such as bills and savings, and allocate a specific amount for discretionary spending on shopping. Having a budget in place helps you stay financially responsible while enjoying retail therapy.

Budgeting is a crucial step in practicing smart shopping. It helps you manage your finances effectively while indulging in some retail therapy. Once you have your budget in place, the next step is to identify your shopping priorities and set spending limits for different categories. This way, you can strike a balance between treating yourself and maintaining financial responsibility.

Prioritize Your Shopping List: Start by making a list of the items you genuinely need or have been saving up for. Whether it’s a new wardrobe for the upcoming season or upgrading your tech gadgets, prioritizing your purchases ensures that you’re spending on what matters most to you.

Set Spending Limits: Assign a specific amount to each category on your shopping list. For example, if you plan to buy clothing, allocate a certain budget for that category. This approach prevents overspending and helps you stick to your financial plan.

Shop with Cash or a Debit Card: Leave your credit cards at home or limit their use during your shopping trip. Paying with cash or a debit card makes you more aware of your spending and less likely to go over budget.

Take Advantage of Sales and Discounts: Keep an eye out for sales, promotions, and discounts. Sign up for newsletters from your favorite stores to receive notifications about upcoming sales events. Shopping during these times can stretch your budget further.

Use Shopping Apps and Coupons: Many shopping apps and websites offer exclusive deals and coupons. Before making a purchase, check if there are any discounts available for the items on your list. Apps like Honey and Rakuten can help you find the best deals and earn cashback.

Compare Prices: Don’t settle for the first price you see. Take the time to compare prices online and in-store. You might find the same item at a lower cost from a different retailer or during a different season.

Avoid Impulse Buying: Impulse purchases can quickly derail your budget. Before adding an item to your cart, ask yourself if it aligns with your priorities and if you truly need it. If not, consider postponing the purchase.

Sleep on It: If you’re unsure about a non-essential purchase, give yourself some time to think it over. Delaying the decision for a day or two can help you determine if it’s a worthwhile investment.

Shop Off-Peak Hours: Shopping during less crowded times can reduce the temptation to make impulse buys. You’ll have a calmer shopping experience and can focus on finding the items you planned for.

Practice Mindful Shopping: While shopping, stay mindful of your budget and financial goals. Remind yourself of the bigger picture, such as saving for a vacation or paying off debt. This mindfulness can keep you on track and prevent overspending.

Remember, retail therapy can be enjoyable and satisfying when done mindfully within your budget. By following these tips and staying disciplined, you can make the most of your shopping trips without breaking the bank.

Additionally, you can find further information on this topic by visiting this page: Smart Grocery Shopping Tips – Penn Medicine

Impulse buying often leads to overspending. Combat this by making a shopping list before you hit the stores or browse online. List the items you genuinely need or have been wanting for a while. Stick to your list as closely as possible to avoid unnecessary purchases.

Impulse buying can take a toll on your budget and lead to unnecessary clutter. One effective strategy to curb this habit is to create a shopping list before you start your shopping trip, whether it’s at the mall or online. By listing the items you truly need or have been planning to purchase, you can stay focused and avoid getting sidetracked by tempting deals or flashy displays. Sticking to your list helps you make more intentional and budget-conscious choices, ensuring that your shopping experience is both satisfying and financially responsible.

To delve further into this matter, we encourage you to check out the additional resources provided here: Site Map

Before making a purchase, check for discounts, sales, and promotional offers. Many stores offer seasonal sales, holiday discounts, and clearance events. Additionally, consider using coupons or cashback apps that can provide extra savings on your purchases.

When it comes to savvy shopping, being proactive about finding discounts and savings opportunities can significantly impact your overall shopping experience. Let’s delve deeper into this money-saving strategy:

Sale Seasons: Keep an eye on the calendar for sale seasons and special occasions when stores typically offer significant discounts. These can include holiday sales, back-to-school promotions, Black Friday, Cyber Monday, and end-of-season clearance events. Planning your shopping around these times can lead to substantial savings.

Clearance Sections: Explore the clearance sections of stores. These areas often house items from the previous season or overstocked inventory at deeply discounted prices. You might find hidden gems at a fraction of their original cost.

Coupon Clipping: Embrace the art of couponing. Many stores and brands distribute coupons through various channels, including newspapers, magazines, and online platforms. Collecting and using these coupons can result in instant savings on your purchases.

Online Coupons and Promo Codes: Before making an online purchase, search for promo codes or coupons related to the store or product you’re interested in. Websites and browser extensions dedicated to coupon hunting can help you uncover exclusive discounts and deals.

Cashback Apps: Consider using cashback apps and websites when shopping online. These platforms offer cashback rewards for making purchases through their affiliate links. Over time, these small cashback amounts can add up to substantial savings.

Store Loyalty Programs: Join store loyalty programs or reward clubs. These programs often provide members with exclusive discounts, early access to sales, and rewards points that can be redeemed for future purchases.

Price Comparison Tools: Use price comparison tools and apps to ensure you’re getting the best deal. These tools allow you to compare prices from different retailers and online marketplaces to find the most competitive offer.

Student and Military Discounts: If you’re a student or a member of the military, inquire about discounts that may be available to you. Many stores and service providers offer special pricing for these groups.

Social Media and Newsletters: Follow your favorite brands and stores on social media and subscribe to their newsletters. Retailers often share exclusive promotions and discounts with their online communities and subscribers.

Bulk Buying: Consider buying in bulk for items you frequently use or consume. Warehouse clubs and bulk stores often offer lower unit prices for items purchased in larger quantities.

Cashback Credit Cards: If you have a cashback credit card, use it strategically for your purchases. These cards offer cashback rewards based on your spending, which can translate into significant savings over time.

Negotiation Skills: Don’t hesitate to negotiate, especially in smaller or independent stores. Polite negotiation can sometimes lead to discounts or extra perks.

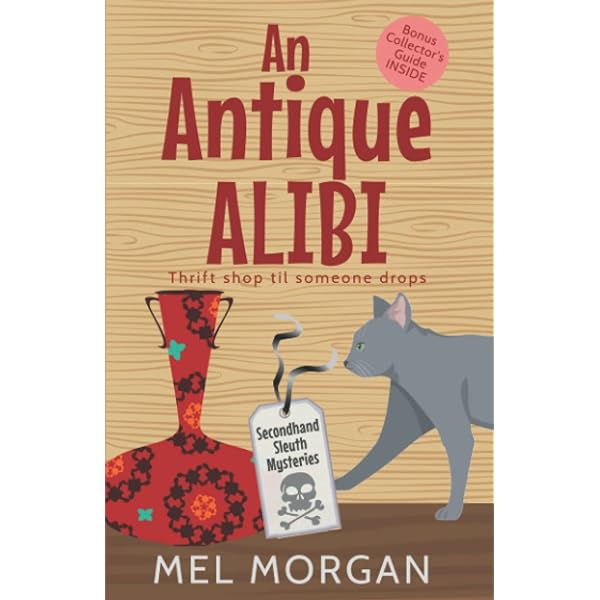

Shop Secondhand: For certain items, like clothing and furniture, explore secondhand or thrift stores. You can find high-quality items at a fraction of the price of new ones.

Stacking Discounts: When possible, stack discounts. This means combining multiple savings methods, such as using a coupon on a sale item or applying cashback rewards to an already discounted purchase.

By actively seeking out discounts, sales, and promotional offers, you can maximize your purchasing power and ensure that you get the most value from your shopping trips. Implementing these strategies can result in significant savings over time while allowing you to enjoy the thrill of finding great deals.

To delve further into this matter, we encourage you to check out the additional resources provided here: 10 Things Smart Shoppers Always Do at the Grocery Store …

Buying seasonal items when they’re out of season can save you a significant amount. Retailers often mark down prices on clothing, accessories, and even holiday decorations during off-season periods. Plan your retail therapy around these sales to snag great deals.

“Whether you’re shopping for winter coats in summer or swimsuits in winter, buying out-of-season items can save you big bucks. Retailers typically offer significant discounts on seasonal items during their off-peak times. Keep an eye out for these sales and plan your shopping accordingly to score fantastic deals on clothing, accessories, and even holiday decorations.”

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Academy of Nutrition and Dietetics: eatright.org

Don’t settle for the first price you see. Compare prices for the items you want across different retailers, both in-store and online. Price comparison websites and apps can be valuable tools for finding the best deals.

“Exploring Price Comparison Tools”

Should you desire more in-depth information, it’s available for your perusal on this page: 10 Things Smart Shoppers Always Do at the Grocery Store …

Instead of buying many inexpensive items, consider investing in a few high-quality pieces that will last longer. Quality clothing, electronics, and home goods may have a higher upfront cost but can save you money in the long run by reducing the need for frequent replacements.

“When it comes to shopping and making purchase decisions, a shift in perspective can lead to not only better quality of life but also a more sustainable and financially responsible approach. Here’s why choosing quality over quantity is a wise investment strategy:

Long-Term Savings: Investing in high-quality items often translates into long-term savings. Quality products are built to last, which means you won’t need to replace them as frequently as cheaper alternatives. This can add up to significant savings over time.

Durability: Quality items are typically designed and manufactured to withstand wear and tear. They are built with superior materials and craftsmanship, ensuring they remain functional and attractive for years. This durability reduces the need for repairs and replacements.

Lower Total Cost of Ownership: While the upfront cost of quality items may be higher, the total cost of ownership is often lower. Cheaper items may seem like a bargain initially, but when you factor in replacements and repairs, they can end up costing more in the long run.

Environmental Impact: Choosing quality over quantity is also an environmentally responsible choice. Fast fashion and disposable products contribute to waste and environmental degradation. Quality items, on the other hand, promote sustainability by reducing the demand for constant production and disposal.

Enhanced Performance: Quality products often outperform their cheaper counterparts. Whether it’s a high-performance laptop, a comfortable mattress, or a durable winter coat, investing in quality can enhance your overall experience and satisfaction.

Time Savings: High-quality items are designed to function efficiently, saving you time and hassle. For example, a reliable car requires fewer trips to the mechanic, and a quality kitchen appliance can simplify meal preparation.

Aesthetic Appeal: Quality items tend to have a timeless and appealing design. They retain their aesthetic value, whether it’s a well-crafted piece of furniture or a classic piece of clothing. This means you can enjoy them for longer without feeling the need to keep up with trends.

Peace of Mind: Owning quality products provides peace of mind. You can trust that they will perform as expected and won’t let you down in critical moments. This peace of mind is invaluable, especially when it comes to important investments like a reliable vehicle or a sturdy home appliance.

Resale Value: Quality items often hold their resale value better. If you ever decide to upgrade or part with them, you can recoup a significant portion of your initial investment.

Reduced Clutter: Opting for quality over quantity also helps reduce clutter in your life. You’ll have fewer items to manage, maintain, and store, leading to a more organized and streamlined living space.

In conclusion, the choice to invest in quality items is a testament to a more intentional and financially savvy lifestyle. It’s a decision that not only saves you money in the long run but also aligns with principles of sustainability and responsible consumption. So, the next time you’re faced with a purchase decision, consider the value of quality over quantity, and you may find that it’s a choice that pays off in multiple ways.”

Looking for more insights? You’ll find them right here in our extended coverage: Part 52 – Solicitation Provisions and Contract Clauses | Acquisition …

Impulse purchases are often regretted later. When you see something you want, take a moment to consider if it’s a necessity or a fleeting desire. If it’s the latter, give yourself time to think about it before making the purchase.

“Buyer’s remorse can be a common feeling after an impulsive purchase. To avoid this, practice the art of mindful shopping. Pause, reflect, and ask yourself if the item you’re considering aligns with your needs and long-term goals. This simple habit can lead to more intentional and satisfying purchases.”

You can also read more about this here: How to Stop Emotional Spending (aka Retail Therapy)

Using cash or a debit card for your shopping can help you stay within your budget. When you pay with cash, you can physically see the money leaving your wallet, making you more aware of your spending. If you prefer using cards, ensure you have enough funds in your account to cover your purchases.

Embracing cash or debit card payments is not only a practical budgeting strategy but also a mindful approach to your spending habits. The tactile nature of cash and the real-time deduction of funds from your account when using a debit card can significantly enhance your financial awareness. This heightened consciousness encourages you to make more intentional purchasing decisions, ultimately helping you stick to your budget and manage your finances more effectively. So, whether you prefer the tactile experience of cash or the convenience of debit cards, both methods can serve as valuable tools for responsible and budget-conscious shopping.

Explore this link for a more extensive examination of the topic: Impulsive Buying vs. Compulsive Shopping: What Are the Differences?

Thrifting and buying secondhand items can be a budget-conscious way to enjoy retail therapy. You can often find unique and gently used clothing, furniture, and decor at a fraction of the cost of new items. Explore thrift stores, consignment shops, and online resale platforms for hidden treasures.

“Thrifting and embracing the world of secondhand shopping offer not only budget-conscious retail therapy but also a treasure trove of benefits for both your wallet and the environment. Here’s why delving into thrifting can be a rewarding and sustainable choice:

Affordable Finds: Thrift stores, consignment shops, and online resale platforms are treasure troves of affordable items. From stylish clothing and vintage accessories to furniture and home decor, you can discover a wide range of products at a fraction of the cost of new ones. This budget-friendly aspect allows you to indulge in retail therapy without straining your finances.

Unique Discoveries: Thrifting often leads to unique discoveries that set you apart from the crowd. You’ll stumble upon one-of-a-kind clothing pieces, retro fashion gems, and eclectic home decor that add character and individuality to your style and living spaces. These unique finds can become conversation starters and cherished possessions.

Reduced Environmental Impact: Secondhand shopping aligns with eco-conscious living by extending the life cycle of products. Choosing pre-loved items reduces the demand for new manufacturing and minimizes the environmental impact associated with the production, transportation, and disposal of goods. It’s a sustainable choice that contributes to reducing waste and conserving resources.

Quality and Durability: Many secondhand items are of high quality and durability, built to withstand the test of time. By opting for pre-owned products, you often acquire goods with proven longevity, which can save you money in the long run compared to frequently replacing lower-quality, new items.

Thrill of the Hunt: Thrifting introduces an element of adventure and excitement to your shopping experience. The thrill of the hunt as you scour racks and shelves in search of hidden treasures can be immensely satisfying. It’s a hobby that combines the joy of discovery with the thrill of a good deal.

Supporting Local Businesses: Consignment shops and thrift stores are often local businesses that contribute to the community’s economy. By shopping at these establishments, you’re supporting small businesses and helping maintain vibrant and diverse shopping landscapes.

Minimalist Lifestyle: Thrifting aligns with minimalist and decluttering principles. It encourages thoughtful consumption and the practice of buying items with intention. As you shop secondhand, you may find that you’re more selective in your purchases, leading to a more curated and clutter-free living environment.

Conscious Consumption: Thrifting promotes conscious consumption by encouraging shoppers to consider the value and purpose of each item. It encourages you to buy what you truly need and love, rather than succumbing to impulse purchases driven by trends or marketing.

In essence, thrifting offers a multifaceted and enriching shopping experience that goes beyond the pursuit of bargains. It’s a sustainable, budget-friendly, and eco-conscious way to enjoy retail therapy while adding unique, durable, and character-rich items to your life. So, embark on your thrifting journey and uncover the hidden treasures waiting to be found in the world of secondhand shopping.”

To delve further into this matter, we encourage you to check out the additional resources provided here: What’s in your closet? | Recycle Smart

Do I need this? Will I use it frequently? Does it bring me joy or serve a practical purpose? Mindful shopping involves making deliberate and conscious choices, ensuring that your purchases align with your values and needs.

Mindful shopping empowers you to make thoughtful decisions about your purchases. Ask yourself if each item adds value, aligns with your values, or enhances your life in a meaningful way. This conscious approach leads to more intentional and satisfying shopping experiences.

You can also read more about this here: Shopping a “final sale” section? 5 tips before you buy. – Vox

Conclusion

Retail therapy doesn’t have to strain your finances. By following these smart shopping tips and tricks, you can enjoy the thrill of shopping while keeping your budget intact. Happy shopping!

“Happy shopping!” is a great way to conclude your shopping tips and tricks. Here’s an extension of the idea:

“Retail therapy doesn’t have to strain your finances. By following these smart shopping tips and tricks, you can enjoy the thrill of shopping while keeping your budget intact. Remember, a savvy shopper is a satisfied shopper. Happy shopping!”

To expand your knowledge on this subject, make sure to read on at this location: Is Retail Therapy an Effective Stress Reliever?

More links

Don’t stop here; you can continue your exploration by following this link for more details: Psychology behind Ikea’s huge success