Introduction

The stock market is a fascinating world, but it can be intimidating for newcomers. With its own jargon and a plethora of acronyms, understanding the language of the stock market can feel like learning a new language. In this article, we’ll take you on a journey through the often complex but always intriguing landscape of stock market terminology. Whether you’re a seasoned investor or just getting started, this guide will help demystify the key terms and concepts that drive the world of finance.

The stock market is a fascinating world, but it can be intimidating for newcomers. With its own jargon and a plethora of acronyms, understanding the language of the stock market can feel like learning a new language. In this article, we’ll take you on a journey through the often complex but always intriguing landscape of stock market terminology.

For those just getting started, it’s essential to build a solid foundation of knowledge. Terms like “bull market” and “bear market” may sound like they belong in a zoo, but they hold critical meanings in the financial world. We’ll demystify these terms and help you understand how they shape market sentiment.

Seasoned investors, too, can benefit from revisiting the fundamentals. This guide will serve as a valuable reference, offering insights into less common but equally important concepts such as “options,” “dividends,” and “market volatility.” Whether you’re a casual trader or a day-to-day investor, staying well-versed in the ever-evolving landscape of stock market terminology is crucial.

We’ll also delve into the role of financial instruments such as “stocks,” “bonds,” and “mutual funds,” explaining their unique characteristics and how they fit into diversified investment portfolios. Understanding these instruments can empower you to make informed decisions about your financial future.

In the dynamic world of finance, keeping pace with market trends and news is vital. We’ll introduce you to terms like “market indices” and “market cap,” helping you decode the language used by financial news outlets and analysts. This knowledge will enable you to follow the market’s performance and make strategic investment choices.

Whether you’re a seasoned investor or just getting started, this guide will help demystify the key terms and concepts that drive the world of finance. By the end of your journey through stock market terminology, you’ll have the confidence to navigate this complex terrain and make informed decisions about your financial goals. So, let’s embark on this enlightening exploration of the stock market’s language together.

Explore this link for a more extensive examination of the topic: Bulls, Bears, and Long-Term Benefits of Stock Investing – Petersen …

“Bull Market” and “Bear Market.” A bull market is characterized by optimism, rising stock prices, and a generally positive outlook on the economy. In a bull market, investors believe that the market will continue to rise, so they buy stocks. On the other hand, a bear market is marked by pessimism, falling stock prices, and a gloomy economic outlook. In a bear market, investors anticipate further losses, leading them to sell stocks.

“Bull Market” and “Bear Market” are not just terms used in the world of finance; they are windows into the ebb and flow of economic sentiment and investment behavior. These two iconic phrases encapsulate the emotional rollercoaster that is the stock market, serving as critical indicators of market health and overall economic sentiment.

In a “Bull Market,” the sun seems to shine brightly on investors’ portfolios. It’s a time of economic optimism and hope. Rising stock prices are like a rising tide that lifts all boats, and investors eagerly join the voyage. Confidence is contagious, leading to an ever-increasing demand for stocks. People believe that the good times will keep rolling, so they buy stocks with the expectation of future gains. Companies may find it easier to secure financing, which can spur innovation and economic growth. A bull market is a time when dreams of financial success seem attainable for many.

Conversely, a “Bear Market” is akin to enduring a long, dark night. It’s a period characterized by pessimism, uncertainty, and the gnawing fear of financial loss. Falling stock prices are like ominous storm clouds that cast a shadow over investors’ portfolios. A gloomy economic outlook prevails, and fear grips the market. Investors anticipate further losses, leading them to sell stocks in an attempt to protect their wealth. The consequences of a bear market can ripple throughout the economy, potentially impacting job security, consumer spending, and even government policies aimed at economic stability.

These two market phases represent the yin and yang of financial markets, a perpetual cycle of optimism and pessimism, confidence and fear. They underscore the importance of understanding market dynamics and the psychology of investors. Recognizing the signs of a changing market environment can be crucial for investors, guiding their decisions about when to buy, sell, or hold.

In essence, “Bull Markets” and “Bear Markets” are not just about financial statistics and stock prices; they reflect the collective emotions and perceptions of millions of individuals. They remind us that financial markets are as much about human psychology as they are about economic fundamentals. So, whether you find yourself in the midst of a bull market or navigating the challenges of a bear market, understanding these terms can help you make more informed financial decisions and weather the ever-shifting tides of the investment landscape.

To delve further into this matter, we encourage you to check out the additional resources provided here: IN THE LOOP, A Reference Guide to American English Idioms

An IPO is the first sale of a company’s stock to the public. It marks the transition from a privately held company to a publicly traded one. Investors can purchase shares of the company for the first time during an IPO.

The Initial Public Offering (IPO) is a pivotal moment in the life of a company, a financial milestone that signifies a transformation from a closely-held entity to one that opens its doors to the investing public. It’s akin to a company’s debut on the financial stage, where it takes center spotlight and invites investors to become stakeholders in its journey.

For the company, an IPO represents a strategic move, often driven by the need for capital to fund expansion, innovation, or to pay down debt. It’s a decision made after careful consideration, as going public carries a multitude of responsibilities, including increased regulatory scrutiny and the need for transparency.

One of the most significant aspects of an IPO is that it allows investors, both individual and institutional, to buy shares of the company for the first time. Prior to the IPO, these shares were typically restricted to company insiders, employees, and early investors. Now, they become accessible to anyone interested in becoming a part-owner of the company.

This newfound accessibility is what makes IPOs particularly exciting for investors. It’s a chance to invest in a company during its early stages of public trading, potentially reaping the rewards if the company’s stock price appreciates over time. However, it’s important to note that investing in IPOs can also carry risks, as the stock’s initial trading behavior can be volatile and unpredictable.

For investors, an IPO offers the opportunity to become part of a company’s growth story from the very beginning. It’s a way to support and potentially benefit from a company’s success, all while contributing to its journey as a publicly traded entity.

In essence, an IPO is a financial rite of passage, a moment of transition for a company that opens up new avenues for growth and investment. It’s a reflection of the dynamism of the financial markets, where companies, investors, and the broader economy intersect in a complex dance of opportunity and risk.

Don’t stop here; you can continue your exploration by following this link for more details: 71 Stock Market Terms Every Beginner Trader Should Know – Stash …

The P/E ratio is a valuation metric that compares a company’s stock price to its earnings per share (EPS). It helps investors assess whether a stock is overvalued or undervalued. A high P/E ratio may indicate that investors have high expectations for future earnings growth.

The P/E ratio, or Price-to-Earnings ratio, is a fundamental financial metric that plays a crucial role in helping investors make informed decisions about stocks. This ratio is a straightforward yet powerful tool for assessing the relative value of a company’s stock by comparing its market price to its earnings per share (EPS).

In essence, the P/E ratio provides a snapshot of how much investors are willing to pay for each dollar of a company’s earnings. A higher P/E ratio generally suggests that investors have more confidence in the company’s future earnings potential, as they are willing to pay a premium for a share of those anticipated profits. Conversely, a lower P/E ratio may imply that investors have more conservative expectations or concerns about the company’s future earnings growth.

However, it’s essential to remember that while a high P/E ratio can indicate optimism about a company’s prospects, it doesn’t necessarily guarantee success or future profitability. A stock with a soaring P/E ratio can be overvalued if those high expectations aren’t met or if market sentiment changes suddenly.

Investors often use P/E ratios to compare companies within the same industry or sector, as this can provide insights into how a stock is valued relative to its peers. For example, a technology company with a P/E ratio of 30 might appear expensive compared to a manufacturing company with a P/E ratio of 15, suggesting that investors have higher expectations for the technology company’s future earnings growth.

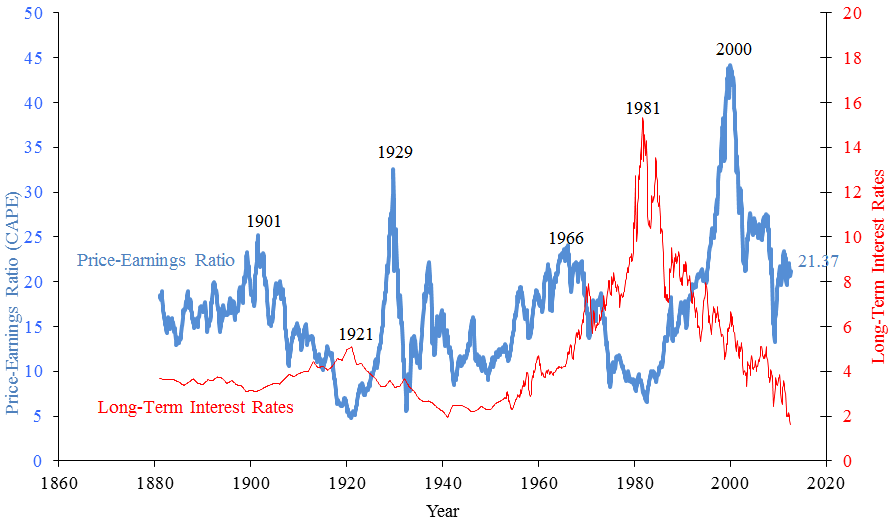

In addition to comparing P/E ratios across companies, investors also consider historical P/E ratios for a specific stock to assess whether it is currently trading above or below its historical valuation levels. This historical context can offer valuable insights into whether the stock is overvalued, undervalued, or trading in line with its typical valuation.

It’s important to note that while the P/E ratio is a useful tool, it should not be used in isolation when making investment decisions. Other factors, such as a company’s financial health, growth prospects, competitive position, and industry trends, should also be considered to form a comprehensive view of an investment opportunity. Nonetheless, the P/E ratio remains a foundational metric in the world of stock analysis, providing investors with a valuable starting point for their assessments of stock value and growth potential.

For additional details, consider exploring the related content available here Bear Market Guide: Definition, Phases, Examples & How to Invest …

Conclusion

Navigating the stock market is a journey that requires not only financial knowledge but also a grasp of its unique terminology. Understanding terms like bull and bear markets, market capitalization, and P/E ratio can empower you to make informed investment decisions and manage your financial future. Whether you’re aiming for long-term growth or seeking income through dividends, a solid grasp of stock market terminology is a valuable asset on your financial journey. So, embrace the language of finance, and let it guide you toward your investment goals.

Embarking on the stock market journey is akin to setting sail on a vast and dynamic sea. While financial knowledge serves as your compass, mastering the unique terminology of this realm is like learning the language of the waves and winds. Among the most fundamental terms to grasp are bull and bear markets, which symbolize the ebb and flow of market sentiment. Recognizing when to ride the bullish waves of optimism or navigate the bearish currents of pessimism can be the key to steering your portfolio to safety.

Market capitalization, another vital term, offers insight into a company’s size and scale within the market. Whether you’re considering the stability of large-cap stocks or the growth potential of small-cap gems, understanding market capitalization empowers you to align your investments with your financial goals.

And then there’s the ever-critical P/E ratio, a metric that sheds light on a stock’s valuation. Armed with this knowledge, you can discern whether a company’s stock is trading at an attractive price relative to its earnings or if it’s overvalued, helping you make informed choices on when to buy or sell.

Ultimately, this fluency in stock market terminology isn’t just about deciphering numbers and charts; it’s about securing your financial future. Whether you’re pursuing long-term growth or seeking a steady income stream through dividends, a solid understanding of these terms acts as your sturdy vessel on the investment journey. Embrace the language of finance, and let it guide you toward your financial goals, helping you navigate the unpredictable seas of the stock market with confidence and clarity.

Should you desire more in-depth information, it’s available for your perusal on this page: Guide to the Markets | J.P. Morgan Asset Management

More links

You can also read more about this here: What Is a Bear Market? Definition and How to Invest During One …