Introduction

In the face of a rapidly changing climate and growing concerns about the environmental impact of human activities, governments and policymakers around the world are seeking effective strategies to mitigate greenhouse gas emissions. One of the most prominent and widely debated approaches is carbon pricing. This article delves into the concept of carbon pricing, its various mechanisms, and its role in climate policy.

In an era marked by the urgent need to address climate change and a growing recognition of the environmental consequences of human actions, governments and policymakers worldwide are fervently seeking effective strategies to combat the alarming rise in greenhouse gas emissions. At the forefront of these efforts is the concept of carbon pricing, a robust and multifaceted approach that has garnered widespread attention and sparked intense debates. In this comprehensive article, we embark on a deep exploration of carbon pricing, unraveling its complex mechanisms, and examining its pivotal role in shaping climate policy for a sustainable future.

Carbon pricing stands as a linchpin in the global fight against climate change, as it directly addresses one of the root causes of the problem: the release of carbon dioxide (CO2) and other greenhouse gases into the atmosphere. It operates on the fundamental principle that those who contribute to emissions should bear the costs associated with mitigating their impact on the climate and the environment.

The concept of carbon pricing encompasses a variety of mechanisms, each designed to achieve the overarching goal of reducing emissions while encouraging the adoption of cleaner and more sustainable practices. Some of the most prominent mechanisms include carbon taxes, cap-and-trade systems (also known as emissions trading systems), and offset programs.

Carbon Taxes: Carbon taxes impose a direct fee on the carbon content of fossil fuels, effectively internalizing the social cost of carbon emissions. This mechanism provides a clear price signal that incentivizes individuals, businesses, and industries to reduce their carbon footprint. Revenue generated from carbon taxes can be reinvested in initiatives that promote clean energy, research, and environmental conservation.

Cap-and-Trade Systems: Cap-and-trade systems establish a finite emissions cap for a specific jurisdiction or sector. Emission allowances are distributed among participants, and those who exceed their allocated limits must purchase additional allowances from others who have surplus allowances. This market-based approach encourages emissions reductions while allowing for flexibility and innovation in achieving targets.

Offset Programs: Offset programs enable entities to invest in emissions reduction projects outside their immediate operations. These projects can include reforestation efforts, renewable energy initiatives, and methane capture from landfills. Offsets can help bridge the gap between emissions reduction goals and practical feasibility.

The adoption and implementation of carbon pricing mechanisms are not without challenges and complexities. Debates often center around issues of fairness, the distribution of costs, and potential impacts on vulnerable communities and industries. Striking the right balance between incentivizing emissions reductions and supporting economic growth remains a delicate and ongoing endeavor.

Moreover, the success of carbon pricing relies on its integration into broader climate policies and international agreements. As governments collaborate to set emission reduction targets and implement strategies outlined in agreements like the Paris Agreement, carbon pricing can play a pivotal role in achieving these goals.

In conclusion, carbon pricing is a multifaceted and dynamic approach to addressing climate change that has gained prominence on the global stage. Its effectiveness in reducing greenhouse gas emissions and steering economies toward a sustainable future hinges on careful design, transparent implementation, and collaboration among governments, industries, and civil society. As the world grapples with the urgent need to combat climate change, the concept of carbon pricing will continue to be at the forefront of climate policy discussions, shaping the path toward a more environmentally responsible and resilient future.

You can also read more about this here: Summary for Policymakers — Global Warming of 1.5 ºC

As the world grapples with the consequences of climate change, it becomes increasingly evident that a comprehensive approach is needed to reduce carbon emissions. Carbon dioxide (CO2) and other greenhouse gases are major contributors to global warming, which leads to rising temperatures, extreme weather events, and other environmental challenges.

Carbon pricing is rooted in the idea that those responsible for emitting greenhouse gases should bear the cost of these emissions. It aims to internalize the external costs of carbon pollution, thereby incentivizing individuals, businesses, and industries to reduce their carbon footprint.

In the face of the escalating consequences of climate change, the urgency of adopting a comprehensive approach to combat carbon emissions becomes ever more apparent. Carbon dioxide (CO2) and other greenhouse gases are primary culprits driving global warming, a phenomenon that precipitates rising temperatures, intensifying extreme weather events, and a plethora of environmental challenges. Carbon pricing emerges as a pivotal strategy grounded in the principle that those accountable for greenhouse gas emissions must shoulder the financial burden of these emissions. It endeavors to internalize the external costs associated with carbon pollution, effectively compelling individuals, businesses, and industries to curtail their carbon footprint through economic incentives and disincentives.

Here are some key dimensions to consider in the context of carbon pricing:

Economic Signals for Emission Reduction: Carbon pricing sends clear economic signals by attaching a price to carbon emissions. This financial accountability encourages entities to explore innovative ways to reduce their emissions, whether through adopting cleaner technologies, enhancing energy efficiency, or transitioning to renewable energy sources. By factoring the cost of emissions into business decisions, companies are motivated to adopt sustainable practices that align with both environmental and economic interests.

Market-Based Mechanisms: Carbon pricing can take various forms, including carbon taxes and cap-and-trade systems. Carbon taxes impose a direct tax on the carbon content of fuels or emissions, while cap-and-trade systems allocate a limited number of emissions allowances that can be bought and sold in a regulated market. These market-based mechanisms provide flexibility for entities to choose the most cost-effective strategies for emissions reductions.

Revenue Allocation: The revenues generated from carbon pricing can be used in various ways. Some jurisdictions reinvest the proceeds into renewable energy projects, energy efficiency initiatives, or climate resilience programs. Others return the revenue to citizens through dividends or use it to offset taxes. The allocation of revenue can be a key political consideration when implementing carbon pricing policies.

Global Cooperation: Addressing climate change is a global challenge that requires international cooperation. Many countries have implemented carbon pricing policies, and efforts are underway to harmonize these approaches on a global scale. Initiatives like carbon border adjustments aim to ensure that carbon-intensive imports are subject to similar pricing mechanisms, preventing emissions leakage and maintaining a level playing field for domestic industries.

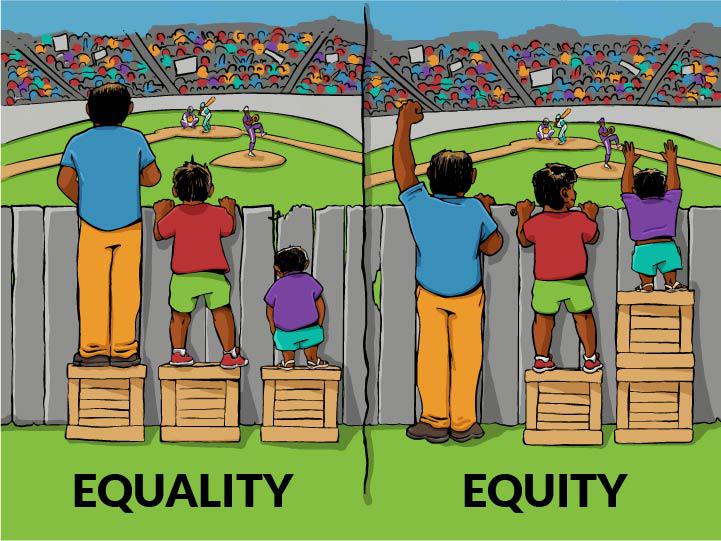

Equity and Social Considerations: Carbon pricing policies must be designed with equity in mind to avoid disproportionately burdening vulnerable populations. Measures such as targeted rebates or exemptions for low-income households can help mitigate the potential regressive impact of carbon pricing.

Innovation and Technological Advancements: Carbon pricing can stimulate innovation in clean energy technologies and sustainable practices. Industries are incentivized to develop and adopt greener solutions, fostering a transition toward a low-carbon economy.

Adaptation and Resilience: While carbon pricing primarily focuses on emissions reduction, it can also generate revenue that can be allocated to climate adaptation and resilience efforts. This can help communities prepare for and mitigate the impacts of climate change, particularly in vulnerable regions.

Public Support and Engagement: Public awareness and support are vital for the success of carbon pricing policies. Effective communication and engagement campaigns can help build public understanding and acceptance of these measures.

In conclusion, carbon pricing stands as a critical pillar in the global effort to combat climate change. By holding emitters accountable for their carbon emissions and creating economic incentives for reductions, it plays a pivotal role in catalyzing the transition to a sustainable, low-carbon future. As the world confronts the challenges of climate change, carbon pricing offers a powerful tool to align economic interests with environmental imperatives and drive meaningful emissions reductions.

Looking for more insights? You’ll find them right here in our extended coverage: G7 Hiroshima Leaders’ Communiqué | The White House

A carbon tax is a straightforward approach where a tax is imposed on each ton of CO2 or its equivalent emissions. The tax rate can vary, and it is typically set by the government. Businesses and individuals pay this tax based on their emissions, encouraging them to reduce their carbon output to minimize their tax liability.

A carbon tax, as a straightforward and transparent approach to carbon pricing, holds several key advantages and considerations:

Pricing Externalities: Carbon taxes directly address the economic concept of externalities, where the costs of carbon emissions, such as climate change impacts and health problems, are not reflected in the market price of fossil fuels. By placing a price on carbon emissions, a carbon tax internalizes these external costs, ensuring that those responsible for emissions pay for their environmental impact.

Economic Incentives: The core principle behind a carbon tax is the economic incentive it creates. When businesses and individuals face higher costs due to the tax, they are naturally motivated to reduce their emissions. This encourages the adoption of energy-efficient technologies, the transition to cleaner energy sources, and the implementation of carbon reduction strategies.

Revenue Generation: Carbon taxes can generate substantial revenue for governments. How this revenue is utilized can significantly impact its political acceptability. Some governments choose to reinvest it in renewable energy infrastructure, public transportation, or initiatives aimed at mitigating climate change impacts. Others use it to offset other taxes, potentially benefiting lower-income households.

Emissions Certainty: Unlike cap-and-trade systems, where emissions reductions are uncertain and depend on market dynamics, carbon taxes provide certainty in emissions pricing. Businesses and individuals know the cost of their emissions upfront, which makes it easier for them to plan and budget for emission reductions.

Ease of Administration: Carbon taxes are often simpler to administer compared to cap-and-trade systems, which require a complex framework for allocating, trading, and tracking emissions permits. This simplicity can reduce administrative costs and regulatory burdens.

Progressive Taxation: To address equity concerns, some governments design carbon taxes to be progressive, ensuring that the burden falls more heavily on higher-income individuals and carbon-intensive industries. This can help mitigate the potential regressive effects of carbon pricing on lower-income households.

Global Consistency: Carbon taxes can be implemented at various levels, from local to national and even international. This consistency across jurisdictions creates opportunities for harmonization and global collaboration in addressing climate change.

However, challenges and considerations also exist:

Elasticity of Demand: The effectiveness of a carbon tax depends on the elasticity of demand for carbon-intensive goods and services. If demand is highly inelastic (insensitive to price changes), a carbon tax may have limited impact on emissions reductions.

Border Adjustments: In a globalized economy, concerns about “carbon leakage” arise when businesses relocate to areas with lower carbon prices. To counter this, some jurisdictions implement border carbon adjustments, leveling the playing field for domestic businesses.

Political Will: The implementation of a carbon tax can face political opposition, particularly from industries with significant carbon emissions. Building broad public and political support is essential for its success.

Complexity in Rate Setting: Determining the appropriate tax rate can be challenging. It requires consideration of environmental goals, economic impacts, and potential social equity concerns. Striking the right balance is crucial.

In conclusion, a carbon tax is a pragmatic and market-oriented approach to carbon pricing. Its effectiveness depends on various factors, including the tax rate, the elasticity of demand, and the presence of complementary policies. While it offers a transparent way to incentivize emissions reductions, successful implementation requires careful consideration of both economic and environmental objectives.

To delve further into this matter, we encourage you to check out the additional resources provided here: Why carbon pricing is not sufficient to mitigate climate change—and …

Cap-and-trade systems establish a cap on total allowable emissions and allocate a certain number of emissions permits to entities within the jurisdiction. These permits can be bought, sold, or traded. Entities exceeding their emissions limit must purchase additional permits, while those below their cap can sell their surplus permits, creating a financial incentive to reduce emissions.

Cap-and-trade systems represent a market-based approach to addressing greenhouse gas emissions and have gained prominence as a tool for combatting climate change. The underlying principles of these systems, as described, offer several benefits and nuances worth exploring:

Market-Driven Emissions Reduction: Cap-and-trade systems harness the power of market forces to drive emissions reductions. By placing a cap on allowable emissions and allowing the trade of permits, they create a financial incentive for businesses and industries to find innovative ways to reduce their carbon footprint. This competition for emissions permits drives down emissions over time.

Flexibility and Innovation: One of the key advantages of cap-and-trade is its flexibility. Entities subject to the system can choose how to reduce their emissions most cost-effectively, whether through technological upgrades, operational changes, or investments in cleaner energy sources. This flexibility encourages innovation as companies seek out creative ways to meet their emissions targets.

Economic Efficiency: Cap-and-trade systems encourage emissions reductions where they are most economically efficient. Companies with lower mitigation costs can reduce emissions more and sell excess permits to those facing higher costs. This results in emissions reductions at the lowest possible cost to the economy as a whole.

Revenue Generation: The sale of emissions permits generates revenue for governments or regulatory authorities. These funds can be reinvested in climate-related projects, such as renewable energy development, energy efficiency programs, or climate adaptation efforts. Thus, cap-and-trade systems can contribute to broader sustainability and climate resilience initiatives.

Global and Regional Applications: Cap-and-trade systems can be tailored to operate at various scales, from regional to international. They can be implemented within a single country or across borders through agreements like the European Union Emissions Trading System (EU ETS) or the Kyoto Protocol’s Clean Development Mechanism. This scalability allows for a global approach to emissions reduction.

Environmental Certainty: The cap portion of cap-and-trade systems ensures a predetermined level of emissions reduction. This provides environmental certainty and helps countries and regions meet their greenhouse gas reduction targets, as outlined in international agreements like the Paris Agreement.

Transition to Low-Carbon Economy: By incentivizing emissions reductions, cap-and-trade systems support the transition to a low-carbon economy. Industries are encouraged to invest in cleaner technologies, reducing their reliance on fossil fuels and driving the growth of renewable energy sources.

Monitoring and Reporting: Cap-and-trade systems necessitate robust monitoring and reporting mechanisms to verify emissions and ensure compliance. This transparency builds trust among participants and the public, reinforcing the system’s effectiveness.

Challenges and Equity Concerns: Cap-and-trade systems are not without challenges. Critics argue that they can disproportionately affect low-income communities if emissions reductions lead to job losses or higher energy costs. Careful design and the allocation of emissions allowances to address equity concerns are essential considerations in system implementation.

Complementary Policies: Cap-and-trade systems often work best when complemented by other climate policies, such as renewable energy incentives, energy efficiency standards, and carbon taxes. These policies reinforce emissions reduction efforts and create a comprehensive approach to addressing climate change.

In summary, cap-and-trade systems offer a market-driven, flexible, and economically efficient approach to reducing greenhouse gas emissions. They encourage innovation, generate revenue for climate initiatives, and contribute to the global transition toward a low-carbon economy. However, successful implementation requires careful design, monitoring, and consideration of equity concerns to ensure that emissions reductions are achieved while minimizing adverse social and economic impacts.

Looking for more insights? You’ll find them right here in our extended coverage: What is Carbon Pricing? | Carbon Pricing Dashboard

Carbon pricing harnesses market forces to drive emissions reductions. It encourages innovation and the adoption of cleaner technologies by making carbon-intensive activities more expensive.

Carbon pricing represents a potent tool in the fight against climate change precisely because it leverages market dynamics to drive emissions reductions. At its core, this approach functions as a powerful economic signal that impels businesses, industries, and individuals to reevaluate their carbon-intensive practices and invest in cleaner, more sustainable alternatives. Here’s a deeper exploration of how carbon pricing achieves these transformative outcomes:

Economic Incentives for Emissions Reduction: By imposing a price on carbon emissions, whether through carbon taxes or cap-and-trade systems, carbon pricing creates a financial incentive for entities to reduce their emissions. When the cost of emitting carbon dioxide and other greenhouse gases becomes a tangible expense, it motivates decision-makers to seek ways to minimize those costs. This can encompass a range of strategies, from adopting energy-efficient technologies to transitioning to cleaner energy sources.

Promoting Technological Innovation: The prospect of higher costs associated with carbon-intensive activities drives innovation and the development of cleaner technologies. Businesses and industries are incentivized to invest in research and development efforts aimed at reducing their carbon footprint. This not only enhances their competitiveness but also contributes to the broader goal of transitioning to a low-carbon economy.

Market Signal for Sustainable Practices: Carbon pricing sends a clear and consistent market signal that favors sustainability. Companies that prioritize emissions reduction and sustainable practices gain a competitive edge in a carbon-priced market. Consumers, investors, and stakeholders increasingly favor businesses that align with environmental responsibility, further reinforcing this trend.

Revenue for Sustainable Initiatives: In cases where carbon pricing mechanisms generate revenue, such as carbon tax proceeds or auction revenues from emission allowances, these funds can be channeled into sustainability initiatives. This includes investments in renewable energy projects, energy efficiency programs, and climate adaptation measures. These investments not only offset the economic burden of carbon pricing but also stimulate job creation and economic growth.

Global Transition to Low-Carbon Technologies: As carbon pricing mechanisms become more widespread and stringent, they contribute to a global transition toward low-carbon technologies and practices. This collective effort is essential for meeting international climate targets and curbing the global temperature rise.

Behavioral Change: Carbon pricing also influences individual behavior by making carbon-intensive choices more expensive. It encourages individuals to reduce their carbon footprint through actions like using public transportation, adopting energy-efficient appliances, and reducing energy consumption.

Environmental and Health Benefits: As carbon pricing leads to reduced emissions, it has tangible environmental and health benefits. Fewer emissions translate to improved air quality, reduced smog, and decreased health problems associated with air pollution. These benefits extend to both urban and rural communities.

However, it’s crucial to acknowledge that the success of carbon pricing hinges on various factors, including the design of the pricing mechanism, the level of carbon pricing, and the availability of viable low-carbon alternatives. Furthermore, addressing concerns about potential regressive impacts on vulnerable populations and ensuring a just transition for affected industries are essential aspects of effective carbon pricing strategies.

In sum, carbon pricing is a dynamic and versatile approach that leverages economic incentives to foster emissions reductions, stimulate innovation, and steer societies toward a more sustainable and resilient future. As governments, industries, and communities continue to grapple with the challenges of climate change, carbon pricing remains a linchpin in the multifaceted strategy to mitigate its impacts and transition to a low-carbon economy.

For additional details, consider exploring the related content available here FACT SHEET: President Biden to Catalyze Global Climate Action …

Carbon pricing mechanisms can generate significant revenue for governments. This revenue can be reinvested in renewable energy projects, climate adaptation efforts, or used to offset other taxes.

The revenue generated by carbon pricing mechanisms represents a valuable resource that can be strategically deployed to address various environmental, economic, and social challenges. Expanding on this concept, let’s explore how governments can leverage carbon pricing revenue to advance sustainability and resilience:

Renewable Energy Investments: One of the most impactful uses of carbon pricing revenue is reinvesting it in renewable energy projects. By channeling these funds into solar, wind, hydro, and other clean energy initiatives, governments can accelerate the transition away from fossil fuels. This not only reduces carbon emissions but also fosters energy independence and job creation in the growing renewable energy sector.

Energy Efficiency Programs: Promoting energy efficiency is another prudent use of carbon pricing revenue. Governments can establish programs that incentivize homeowners, businesses, and industries to adopt energy-efficient technologies and practices. These initiatives reduce energy consumption, lower greenhouse gas emissions, and lower energy costs for consumers and businesses.

Climate Adaptation and Resilience: A significant portion of carbon pricing revenue can be directed toward climate adaptation and resilience efforts. This includes investments in infrastructure projects that protect communities from the impacts of climate change, such as sea-level rise, extreme weather events, and droughts. Funds can be allocated to the construction of resilient infrastructure, flood defenses, and disaster preparedness programs.

Support for Vulnerable Communities: To ensure that the benefits of carbon pricing reach all segments of society, governments can allocate revenue to support vulnerable communities disproportionately affected by climate change. This may involve providing financial assistance for low-income households to cope with higher energy costs or implementing targeted programs to enhance resilience in disadvantaged areas.

Tax Offsets and Rebates: Carbon pricing revenue can be used to offset other taxes or provide rebates to citizens. This approach ensures that the financial burden of carbon pricing policies does not disproportionately impact certain groups and can be a politically effective way to garner support for such policies.

Clean Transportation Initiatives: Investment in clean transportation infrastructure is critical for reducing emissions from the transportation sector. Carbon pricing revenue can be used to expand public transportation systems, develop electric vehicle charging networks, and incentivize the adoption of low-emission vehicles.

Green Job Creation: A portion of the revenue can be directed towards job training and workforce development in green industries. This fosters employment opportunities in renewable energy, energy efficiency, and other sustainable sectors, supporting economic growth while reducing carbon emissions.

Research and Innovation: Governments can allocate funds for research and innovation in clean energy technologies, carbon capture and storage, and sustainable agriculture practices. These investments drive technological advancements that further reduce emissions and enhance environmental sustainability.

International Climate Finance: Some countries use carbon pricing revenue to contribute to international climate finance mechanisms. This includes providing financial support to developing countries for mitigation and adaptation projects, helping to address global climate challenges.

Public Awareness and Education: A portion of the revenue can be dedicated to public awareness campaigns and education initiatives. These efforts aim to inform citizens about the importance of carbon pricing, climate change, and sustainable practices, fostering a culture of environmental responsibility.

In summary, carbon pricing revenue represents a potent tool for governments to advance their environmental and climate objectives. By reinvesting this revenue strategically in renewable energy, climate resilience, social equity, and innovation, governments can significantly reduce carbon emissions, build climate resilience, and foster a sustainable and prosperous future for their citizens. Effective allocation and transparent management of these funds are key to maximizing their positive impact on both the environment and society.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Net Zero by 2050 – Analysis – IEA

Businesses and industries can plan for and adapt to the carbon price, as it provides a clear financial incentive to reduce emissions. This predictability supports long-term investment in sustainable practices.

The predictability afforded by a carbon price is a valuable tool for businesses and industries as they navigate the transition to a low-carbon economy. Here are some further insights into why this predictability is essential and how it encourages long-term investment in sustainable practices:

Strategic Decision-Making: A stable and foreseeable carbon price enables businesses to make informed decisions about their long-term strategies. They can assess the financial implications of carbon emissions and factor this cost into their business models. This encourages strategic planning and risk management, allowing organizations to position themselves competitively in a carbon-constrained future.

Technology Adoption: Predictability in carbon pricing creates an environment conducive to the adoption of cleaner technologies and sustainable practices. Businesses are more inclined to invest in energy-efficient equipment, renewable energy sources, and carbon capture technologies when they have confidence in the financial benefits of emission reductions.

Market Competition: As carbon pricing becomes more prevalent, it may evolve into a competitive advantage. Companies that proactively reduce their emissions can gain an edge in markets where sustainability is valued by consumers and investors. This fosters innovation and drives the development of low-carbon products and services.

Investor Confidence: Long-term investors increasingly consider environmental risks and sustainability factors when assessing the companies in which they invest. A clear carbon price signal provides transparency and builds investor confidence, as they can better evaluate a company’s resilience and preparedness in a carbon-constrained world.

Regulatory Alignment: Predictable carbon pricing aligns with evolving regulatory frameworks and emissions reduction targets. It positions businesses to comply with current and future environmental regulations, reducing the risk of non-compliance penalties and reputational damage.

Cost Efficiency: Over time, businesses that invest in emissions reduction technologies often find that the cost of these technologies decreases. This makes it increasingly cost-effective to lower emissions, especially when compared to potential carbon tax liabilities.

Supply Chain Resilience: Businesses with clear carbon pricing signals can engage with suppliers and partners to implement sustainable practices throughout their supply chains. This resilience against future regulatory changes and market demands is increasingly important in a globalized economy.

Consumer Preferences: Consumers are becoming more environmentally conscious and are making choices based on the sustainability of products and services. Businesses that embrace sustainability in response to carbon pricing can align with changing consumer preferences, potentially expanding their market share.

However, it’s important to acknowledge that the effectiveness of carbon pricing in driving sustainable practices depends on several factors, including the stringency of the pricing mechanism, complementary policies, and the ability to address potential economic impacts and equity concerns.

In conclusion, predictability in carbon pricing is a cornerstone of effective climate policy. It empowers businesses and industries to make informed decisions, drive innovation, and invest in sustainable practices. With a clear financial incentive to reduce emissions, organizations can transition toward a more sustainable and resilient future while aligning with evolving market dynamics and regulatory requirements.

For additional details, consider exploring the related content available here G20 Bali Leaders’ Declaration | The White House

Carbon pricing can be implemented at various levels, from local to national and international. It provides a framework for global cooperation, as countries can engage in emissions trading and align their efforts to combat climate change.

Carbon pricing, as a policy mechanism, operates on multiple scales, from local to national and international, offering a versatile approach to addressing climate change. Its ability to foster collaboration and facilitate emissions reductions on a global scale makes it a pivotal tool in the fight against climate change. Here’s a more comprehensive exploration of carbon pricing at various levels:

Local Carbon Pricing: Some municipalities and local governments have initiated their own carbon pricing programs, often in alignment with broader regional or national efforts. Local carbon pricing schemes can target specific emissions sources, such as transportation or industry, and fund local sustainability projects or infrastructure improvements.

Regional and State-Level Carbon Markets: In regions and states, carbon pricing mechanisms can be implemented to cover a broader geographic area. These systems often involve cap-and-trade programs or carbon taxes that apply to all entities within the region. For example, the Regional Greenhouse Gas Initiative (RGGI) in the northeastern United States is a regional cap-and-trade system aimed at reducing power sector emissions.

National Carbon Pricing: Many countries have established national carbon pricing systems to regulate emissions across sectors. These systems often include emissions trading, carbon taxes, or a combination of both. National carbon pricing provides a consistent framework for addressing emissions and encouraging investment in cleaner technologies.

International Cooperation: On the global stage, carbon pricing plays a crucial role in fostering international cooperation to combat climate change. Under the Paris Agreement, countries have committed to reducing emissions and can use carbon pricing mechanisms as a tool to achieve their targets. International agreements, such as the Kyoto Protocol, have facilitated emissions trading and collaboration on a global scale.

Linking Carbon Markets: Countries and regions with carbon pricing systems can choose to link their markets, creating a larger and more liquid carbon market. Linking allows for the trading of emissions allowances or carbon credits across borders, increasing flexibility and potentially reducing compliance costs for participants.

Market Integration: The integration of carbon pricing into broader economic systems can create a more seamless transition to a low-carbon economy. It can incentivize industries to transition toward cleaner technologies and drive innovation in sectors where emissions reduction is challenging.

Revenue Allocation: Carbon pricing systems generate revenue through emissions allowances or taxes. Decisions regarding the allocation of this revenue are crucial and can vary widely. It can be reinvested in climate mitigation and adaptation efforts, used to support vulnerable communities, or returned to citizens through dividends.

Carbon Border Adjustments: Some regions are exploring the implementation of carbon border adjustments, where carbon pricing is applied to imported goods based on their carbon content. This approach encourages international trading partners to adopt similar emissions reduction measures and prevents carbon leakage.

Evolving Policy Landscape: Carbon pricing policies are continuously evolving to adapt to changing circumstances and scientific understanding. For instance, the inclusion of additional greenhouse gases, such as methane and nitrous oxide, and the consideration of carbon pricing for sectors like aviation and shipping are areas of ongoing policy development.

Public Support and Engagement: Effective implementation of carbon pricing relies on public support and engagement. Transparency and public awareness campaigns can help build understanding and acceptance of carbon pricing, ensuring its long-term effectiveness.

In summary, carbon pricing is a versatile tool that can be applied at various levels of governance, from local to international, and it provides a framework for global cooperation in addressing climate change. Its flexibility, when carefully designed and implemented, can drive emissions reductions, foster innovation, and mobilize resources for a sustainable and low-carbon future.

Looking for more insights? You’ll find them right here in our extended coverage: A Sustainable Future: Two Paths to 2050

Critics argue that carbon pricing can disproportionately burden lower-income households and certain industries. To address this, some governments implement mechanisms like carbon tax rebates or use revenue for social programs.

The debate surrounding carbon pricing is not without its critics, and their concerns revolve around potential negative impacts on lower-income households and specific industries. These concerns highlight the importance of implementing well-thought-out policies and measures to ensure that carbon pricing is equitable and doesn’t exacerbate existing inequalities. Here, we delve deeper into the criticisms and the strategies governments employ to address them:

Disproportionate Burden on Lower-Income Households: One of the primary criticisms of carbon pricing is that it can place a disproportionate financial burden on lower-income households. Critics argue that such households spend a larger proportion of their income on essential goods and services, including energy and transportation, which are often carbon-intensive. As carbon pricing raises the cost of these essentials, there’s a concern that it may lead to energy poverty or exacerbate income inequality.

Impact on Energy-Intensive Industries: Certain industries, particularly those with high energy consumption and emissions, may face challenges in transitioning to cleaner practices. Critics argue that carbon pricing could render these industries less competitive on the global stage, potentially resulting in job losses and economic decline in specific regions.

To address these valid concerns and ensure the fairness and effectiveness of carbon pricing, governments implement a range of strategies:

Carbon Tax Rebates: Some governments redistribute the revenue generated from carbon taxes directly back to citizens, particularly lower-income households. These carbon tax rebates aim to offset the increased costs of living associated with carbon pricing. By providing financial relief, they ensure that the burden of carbon pricing doesn’t fall disproportionately on those with fewer resources.

Progressive Tax Structures: Governments can design their carbon pricing mechanisms with progressive tax structures in mind. This means that the tax rates increase with the level of carbon emissions, effectively targeting the largest emitters. Such an approach places the onus on those with a greater carbon footprint while minimizing the impact on lower-income individuals and smaller businesses.

Investment in Clean Energy and Innovation: A portion of carbon pricing revenue can be earmarked for investments in clean energy projects, research, and innovation. This not only promotes the transition to a low-carbon economy but also creates jobs and economic opportunities in renewable energy sectors.

Social Programs and Climate Resilience: Governments can use carbon pricing revenue to fund social programs that directly benefit vulnerable communities. These programs may include energy efficiency upgrades for low-income housing, public transportation improvements, and initiatives that enhance climate resilience.

Just Transition Measures: Recognizing that certain industries may face challenges in adapting to carbon pricing, governments can implement just transition measures. These initiatives provide support to affected workers and communities through retraining programs, economic diversification efforts, and targeted investments.

Transparent Communication: Effective communication about the objectives and benefits of carbon pricing is essential. Governments and policymakers should engage in transparent dialogue with the public, explaining how carbon pricing works, its goals, and how the revenue will be used to benefit society and the environment.

Collaboration with Stakeholders: Engaging with businesses, industries, and civil society is crucial in designing equitable carbon pricing policies. Stakeholder collaboration ensures that policies consider the unique circumstances and challenges of different sectors and communities.

In conclusion, addressing the criticisms of carbon pricing and ensuring its fairness and effectiveness require a multifaceted approach. By implementing strategies such as carbon tax rebates, progressive tax structures, and targeted investments, governments can mitigate the potential adverse impacts on lower-income households and industries while advancing the goals of emissions reduction and a sustainable, low-carbon future. These measures demonstrate a commitment to not only combating climate change but also promoting social equity and economic resilience.

Don’t stop here; you can continue your exploration by following this link for more details: Executive Order on Tackling the Climate Crisis at Home and Abroad …

Carbon pricing in one jurisdiction may lead to “emission leakage” if businesses relocate to areas with laxer regulations. This underscores the need for coordinated international efforts to prevent this phenomenon.

The phenomenon of “emission leakage” is a critical consideration when implementing carbon pricing policies within a single jurisdiction. It highlights the interconnectedness of the global economy and the potential for unintended consequences when businesses respond to carbon pricing measures. To effectively address this issue, coordinated international efforts are not only beneficial but often essential. Here’s a more detailed exploration of the concept and the importance of global cooperation:

Emission Leakage Explained: Emission leakage occurs when businesses or industries subject to carbon pricing in one jurisdiction shift their operations to areas with less stringent emissions regulations. This relocation can result in emissions reductions in the regulated jurisdiction but lead to an increase in emissions elsewhere, essentially “leaking” carbon pollution across borders.

Global Economic Interdependence: In today’s highly interconnected global economy, businesses have the flexibility to move their operations to different regions or countries to optimize costs. When faced with carbon pricing that significantly raises their operating expenses, some companies may choose to relocate to areas with lower regulatory burdens to maintain their competitiveness.

Competitive Disadvantages: Jurisdictions that implement ambitious carbon pricing measures might encounter reluctance from businesses concerned about potential competitive disadvantages. To alleviate these concerns, governments may need to strike a balance between effective emissions reduction and maintaining a favorable business environment.

Leveling the Playing Field: Coordinated international efforts to combat climate change are essential for ensuring that carbon pricing is effective on a global scale. This includes agreements and mechanisms to level the playing field by harmonizing carbon pricing policies, preventing businesses from exploiting regulatory disparities, and encouraging emissions reductions worldwide.

Carbon Border Adjustments: One strategy to mitigate emission leakage is the implementation of carbon border adjustments. These mechanisms place tariffs or import taxes on products imported from jurisdictions with weaker carbon pricing or emissions regulations. By accounting for the embedded carbon emissions in imported goods, carbon border adjustments discourage businesses from relocating solely for regulatory arbitrage.

International Agreements: Multilateral climate agreements, such as the Paris Agreement, provide a framework for countries to collaborate on emissions reductions and carbon pricing strategies. These agreements promote transparency and encourage nations to enhance their climate ambitions while minimizing the risk of emission leakage.

Harmonization of Carbon Pricing: Countries can work together to harmonize their carbon pricing policies to create a more consistent global regulatory environment. This reduces the incentive for businesses to relocate and encourages a fair and equitable approach to emissions reduction across borders.

Data Sharing and Monitoring: Robust data sharing and monitoring mechanisms are crucial for tracking emissions and identifying potential leakage. International cooperation in data collection and reporting helps ensure that businesses cannot evade carbon pricing measures through relocation.

Technology Transfer: Coordinated international efforts can also facilitate the transfer of clean and efficient technologies to regions that are more carbon-intensive. This not only reduces emissions globally but also supports sustainable development in less developed areas.

Capacity Building: Developing countries often lack the capacity to implement and enforce robust carbon pricing policies. International cooperation can provide financial and technical assistance to help these nations establish effective emissions reduction measures.

In summary, emission leakage is a complex challenge that underscores the necessity of global cooperation in addressing climate change. Coordinated international efforts are essential for preventing businesses from relocating to evade carbon pricing measures and for ensuring that emissions reductions are achieved on a global scale. By working together, countries can create a more level playing field for businesses, drive emissions reductions, and advance the collective goal of combating climate change.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Why carbon pricing is not sufficient to mitigate climate change—and …

Carbon pricing can face resistance from industries and political groups with vested interests in maintaining the status quo. Overcoming this opposition often requires strong political will and public support.

Overcoming resistance to carbon pricing, which can come from industries and political groups vested in maintaining the status quo, is a complex and often politically charged endeavor. Here are some key insights into the challenges of addressing this opposition and the strategies required to build strong political will and public support:

Industry Concerns: Many industries, particularly those with high carbon emissions, may oppose carbon pricing due to concerns about increased operating costs and potential impacts on competitiveness. To address these concerns, it’s essential to engage in constructive dialogues with industry leaders. Policymakers can offer incentives, such as tax breaks for investments in emissions reduction technologies, to encourage businesses to transition toward cleaner practices.

Economic Transition: Resistance to carbon pricing often stems from fears of economic disruption, including potential job losses in carbon-intensive sectors. To alleviate these concerns, governments should implement a just transition strategy, which includes job retraining programs and targeted investments in regions and industries most affected by the transition to a low-carbon economy.

Political Lobbying: Industries with vested interests in the status quo may engage in extensive political lobbying to resist carbon pricing legislation. To counter this, policymakers must maintain transparency and resist undue influence. Campaign finance reform and strict lobbying regulations can help level the playing field.

Public Perception: Building public support for carbon pricing is crucial. Public education campaigns that highlight the environmental and economic benefits of pricing carbon can help change perceptions. Emphasizing that carbon pricing revenues can be reinvested in green technologies, infrastructure, and job creation can also gain public favor.

Carbon Dividends: One approach to garner public support is to implement a carbon dividend system, where a portion of carbon tax revenue is returned directly to citizens as dividends. This not only offsets any potential regressive effects of the tax but also provides tangible economic benefits to individuals, making carbon pricing more politically palatable.

Coalition Building: Forming alliances with environmental organizations, businesses that support carbon pricing, and influential community leaders can strengthen the political will behind carbon pricing initiatives. These coalitions can advocate for change at the local, state, and national levels.

Demonstrate Success: Pilot projects and successful case studies of carbon pricing can serve as examples to build support. Demonstrating that carbon pricing can effectively reduce emissions without detrimental economic impacts can be persuasive.

International Cooperation: Collaboration with other countries on carbon pricing can help prevent “carbon leakage” – where businesses relocate to jurisdictions with weaker emissions regulations. International agreements can create a level playing field and discourage this behavior.

Incremental Implementation: Sometimes, starting with a modest carbon price and gradually increasing it can be a politically viable strategy. This allows industries and the public to adjust gradually while gaining confidence in the effectiveness of carbon pricing.

Leadership and Communication: Strong political leadership is vital in championing carbon pricing. Leaders who prioritize climate action and communicate the urgency of addressing emissions can sway public opinion and build political will.

In conclusion, overcoming opposition to carbon pricing requires a multifaceted approach that addresses the concerns of industries, fosters public understanding and support, and maintains the integrity of the policymaking process. While it can be a challenging process, building strong political will and public support for carbon pricing is essential to effectively combat climate change and transition to a sustainable, low-carbon future.

Looking for more insights? You’ll find them right here in our extended coverage: Overcoming public resistance to carbon taxes – PMC

Conclusion

Carbon pricing is a powerful tool in the fight against climate change. It aligns economic incentives with environmental goals, driving emissions reductions while fostering innovation and sustainability. While challenges and criticisms exist, the urgency of addressing climate change necessitates comprehensive and effective policy measures like carbon pricing. As nations continue to refine and expand their carbon pricing strategies, it is increasingly becoming a central component of global climate policy, paving the way toward a more sustainable and resilient future.

Carbon pricing stands as a pivotal and powerful tool in the global effort to combat climate change, offering a multifaceted approach to reducing greenhouse gas emissions and advancing sustainability. Its impact goes beyond merely placing a price on carbon emissions; it fundamentally reshapes the economic landscape to align with environmental imperatives. Let’s delve deeper into why carbon pricing is indispensable in addressing the climate crisis:

Market-Driven Emissions Reduction: Carbon pricing capitalizes on market dynamics to drive emissions reductions. By assigning a cost to carbon emissions, it creates a financial incentive for businesses and industries to seek out cost-effective strategies for reducing their carbon footprint. This competitive environment fosters innovation, encouraging the development of cleaner technologies and practices.

Economic Efficiency: Carbon pricing promotes emissions reductions where they are most economically efficient. It allows industries with lower mitigation costs to lead in reducing emissions, while those facing higher costs can invest in offsets or cleaner technologies. This cost-effectiveness leads to emissions reductions at the least expense to the overall economy.

Revenue for Climate Action: Carbon pricing generates substantial revenue that can be channeled into climate-related initiatives. These funds can be used to accelerate the transition to renewable energy, improve energy efficiency, protect vulnerable communities from climate impacts, and finance climate adaptation and resilience measures.

Global Cooperation: Carbon pricing provides a common language for international cooperation. It facilitates emissions trading and harmonizes climate efforts among nations. Instruments like emissions trading systems and carbon markets create opportunities for countries to collaborate, exchange knowledge, and work collectively to meet global climate targets.

Technological Advancements: The economic incentive created by carbon pricing stimulates the development and adoption of cleaner technologies. Innovations in renewable energy, energy efficiency, carbon capture, and sustainable agriculture are driven by the imperative to reduce carbon costs.

Transparent Reporting and Accountability: Carbon pricing requires transparent monitoring and reporting of emissions, enhancing accountability among businesses and governments. This transparency builds trust and allows stakeholders to track progress toward emissions reduction goals.

Carbon Neutrality: Carbon pricing can be part of a broader strategy to achieve carbon neutrality or net-zero emissions. It encourages not only emissions reductions but also investments in carbon removal technologies and practices.

Adaptation Financing: Revenue generated from carbon pricing can be directed toward climate adaptation measures, supporting communities in coping with the unavoidable impacts of climate change, such as sea-level rise, extreme weather events, and shifting ecosystems.

Consumer Awareness: Carbon pricing can raise consumer awareness about the carbon footprint of products and services. Consumers can make informed choices to support companies and industries that are actively reducing their carbon emissions.

Long-Term Resilience: By incentivizing emissions reductions and climate-conscious investments, carbon pricing contributes to long-term resilience in the face of climate change. It promotes sustainable practices that are less vulnerable to climate-related disruptions.

Despite its evident advantages, carbon pricing also faces challenges and criticisms, including concerns about its impact on disadvantaged communities and industries. Addressing these challenges requires thoughtful policy design that incorporates measures to protect vulnerable populations and transition affected industries toward sustainable alternatives.

In a world confronted by the urgency of climate change, carbon pricing is increasingly central to global climate policy. As nations refine and expand their carbon pricing strategies, it becomes an indispensable tool for steering economies toward sustainability, resilience, and a future that is compatible with the planet’s ecological limits. It is a testament to the pivotal role that market-based mechanisms can play in addressing one of the most pressing challenges of our time.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Net Zero by 2050 – Analysis – IEA

More links

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Finance & Justice | United Nations