Introduction

The evolution of modern finance has been profoundly influenced by the pioneering efforts of American banking institutions. With a history dating back to the early days of the United States, American banks have played a pivotal role in shaping the global financial landscape. This article explores how American banking gave birth to modern finance and examines the far-reaching impacts it has had on the world.

The story of American banking institutions is one of innovation, resilience, and far-reaching influence that spans centuries. From their origins in the early days of the United States, these banks have not only played a pivotal role in shaping the nation’s financial system but have also significantly impacted the global financial landscape. This article delves into the profound influence of American banking on the evolution of modern finance and its enduring global implications.

Foundations of American Banking: The roots of American banking can be traced back to the late 18th century when the newly established United States faced the need for a stable financial system. Early institutions like the Bank of North America, chartered in 1781, and the First Bank of the United States, established in 1791, laid the foundation for centralized banking and issued a national currency. These institutions were instrumental in financing the young nation’s growth and development.

Pioneering Financial Innovations: American banks were at the forefront of financial innovation. They introduced concepts like fractional reserve banking, which allowed for the expansion of credit and capital formation. The development of a national banking system with the passage of the National Banking Acts in the mid-19th century provided stability and uniformity to the banking sector, setting the stage for further growth.

Global Impact: American banks ventured onto the international stage, extending their influence beyond U.S. borders. They facilitated trade finance, investment, and foreign exchange transactions, fostering global economic integration. American financial institutions played key roles in financing infrastructure projects worldwide, from the Panama Canal to transcontinental railroads.

Investment Banking and Capital Markets: American banks played a pivotal role in the development of investment banking and capital markets. Wall Street, centered in New York City, became synonymous with financial innovation and a global hub for trading stocks, bonds, and other securities. The establishment of the New York Stock Exchange in 1792 marked a significant milestone in the evolution of modern financial markets.

Technological Advancements: American banks embraced technological advancements. The introduction of telegraphy, followed by electronic trading platforms and digital banking, transformed the speed and efficiency of financial transactions. These innovations not only reshaped domestic finance but also extended the reach of American financial institutions across the globe.

Financial Crises and Regulation: American banks weathered numerous financial crises, from the Panic of 1837 to the Great Recession of 2008. These crises prompted regulatory reforms and the establishment of institutions like the Federal Reserve System to stabilize the financial system and protect consumers.

Global Banking Leadership: American banks, including J.P. Morgan Chase, Citibank, and Bank of America, emerged as global financial giants, providing a wide array of financial services to individuals, businesses, and governments worldwide. Their sheer size and influence made them integral to the global financial system.

Challenges and Opportunities: While American banking institutions have achieved remarkable success, they also face ongoing challenges, including cybersecurity threats, regulatory changes, and evolving customer expectations. Adapting to these challenges while continuing to innovate will be key to their continued global leadership.

In conclusion, the evolution of modern finance owes a considerable debt to the pioneering efforts of American banking institutions. From their early beginnings to their present-day global influence, American banks have left an indelible mark on the financial world. Their innovations, resilience, and contributions to global finance underscore their enduring significance and the integral role they continue to play in shaping the future of finance on a global scale.

You can also read more about this here: Causes and Consequences of Income Inequality: A Global …

The roots of American banking trace back to the late 18th century when the First Bank of the United States was established in 1791, followed by the Second Bank in 1816. These institutions provided the foundation for a sound and stable financial system, a critical requirement for the young nation’s growth and prosperity.

The establishment of the First Bank of the United States in 1791 and its successor, the Second Bank in 1816, marked a crucial turning point in the early financial history of the United States. These institutions were not mere banking enterprises; they laid the cornerstone for a robust and stable financial system, a prerequisite for the burgeoning nation’s economic growth and prosperity.

In the wake of the American Revolutionary War, the United States faced significant financial challenges. The country was saddled with war debt, and the economic landscape was characterized by uncertainty and instability. Recognizing the need for a dependable financial infrastructure, the First Bank of the United States was founded under the guidance of Alexander Hamilton, the nation’s first Secretary of the Treasury. The bank was conceived as a central institution that would manage the federal government’s finances, issue a national currency, and provide a platform for sound banking practices.

The impact of the First Bank was profound. It helped stabilize the nation’s currency by issuing a common medium of exchange, reducing the reliance on a patchwork of state-chartered banks’ notes. Additionally, the bank played a vital role in facilitating trade and commerce by providing a reliable financial foundation for businesses and entrepreneurs. By managing the federal government’s finances, it instilled confidence in the country’s fiscal stability, both domestically and internationally.

However, the First Bank’s charter was short-lived, as it expired in 1811, amid political opposition and concerns about centralized power. Yet, recognizing the importance of a national bank, the Second Bank of the United States was established in 1816. It inherited many of the responsibilities and functions of its predecessor, continuing to provide a stable currency, regulate state-chartered banks, and manage the federal government’s finances.

The Second Bank’s influence extended beyond financial stability. It contributed to the development of a national banking system, fostering a sense of unity and cohesion among the states. Its branches, strategically located across the country, facilitated economic interactions and promoted financial integration. Moreover, the bank played a pivotal role in supporting the expansion of infrastructure and industry during the early 19th century, further fueling the nation’s growth.

Despite their contributions to financial stability and economic growth, both banks faced political opposition. The debate over the role of central banking and the extent of federal power culminated in the Bank War of the 1830s, leading to the eventual demise of the Second Bank. Nonetheless, the legacy of these early institutions lived on, as their experiences informed the evolution of American banking and finance.

In conclusion, the establishment of the First and Second Banks of the United States was a testament to the nation’s commitment to financial stability and economic growth during its formative years. These institutions provided a solid foundation for a sound financial system, serving as catalysts for trade, commerce, and economic development. While their charters were short-lived, their impact endured, shaping the course of American banking and finance for generations to come.

To delve further into this matter, we encourage you to check out the additional resources provided here: History of Our Firm

American innovation in banking continued with the emergence of commercial banks in the early 19th century. These banks, initially regional in nature, played a fundamental role in financing trade, agriculture, and industrial development. They issued banknotes, provided credit, and facilitated monetary transactions, fueling economic expansion.

The emergence of commercial banks in the early 19th century marked a significant milestone in American financial history. These banks, initially regional in nature, not only continued the trajectory of American innovation in banking but also played a fundamental role in shaping the nation’s economic landscape.

One of the primary contributions of these early commercial banks was their pivotal role in financing various sectors of the economy. At a time when the United States was rapidly expanding its trade, agriculture, and industrial activities, access to capital was crucial for businesses to thrive. Commercial banks stepped in to meet this need by providing loans and credit to entrepreneurs and enterprises, enabling them to invest in expansion and innovation.

The issuance of banknotes by these commercial banks also played a critical role in facilitating economic growth. These banknotes served as a form of currency and a medium of exchange, making transactions more efficient and accessible. While the United States had a decentralized banking system during this period, the banknotes issued by commercial banks added liquidity to the economy, reducing the reliance on barter systems and improving overall economic stability.

Furthermore, commercial banks acted as intermediaries in the financial system, connecting depositors with borrowers. This financial intermediation function not only encouraged savings and investment but also helped channel funds to sectors with growth potential. It laid the groundwork for a more sophisticated and interconnected financial system, a precursor to the modern banking and lending practices we see today.

The growth of commercial banking was not without challenges. The absence of a central banking authority during this period led to a proliferation of state-chartered banks, each with varying degrees of financial stability and regulatory oversight. This environment gave rise to periods of financial instability and banking crises, highlighting the need for a more coordinated and regulated banking system.

The legacy of early American commercial banks extends beyond their contributions to economic expansion. It laid the foundation for the development of a national banking system, with the establishment of the First Bank of the United States and later, the Second Bank of the United States. While these central banks faced controversies and opposition, they represented early attempts to create a more uniform and stable financial system.

In conclusion, the emergence of commercial banks in the early 19th century was a pivotal chapter in American financial history. These banks played a fundamental role in financing trade, agriculture, and industrial development, issuing banknotes, providing credit, and facilitating monetary transactions that fueled economic expansion. While they faced challenges and controversies, their contributions helped shape the evolution of banking in the United States, setting the stage for the development of a more organized and interconnected financial system in the years to come.

Don’t stop here; you can continue your exploration by following this link for more details: Jamie Dimon’s Letter to Shareholders, Annual Report 2022 …

The 19th century also witnessed the rise of investment banking in the United States. Firms like J.P. Morgan and Goldman Sachs pioneered new financial instruments, such as bonds and stocks, and facilitated capital raising for corporations. This shift towards investment banking marked a significant departure from traditional commercial banking.

The emergence of investment banking in the 19th century reshaped the financial landscape of the United States and set the stage for the modern financial industry we know today. Firms like J.P. Morgan and Goldman Sachs played pivotal roles in this transformative journey, introducing innovative financial instruments and facilitating capital raising for corporations in ways that marked a profound departure from traditional commercial banking.

One of the key distinctions between investment banking and traditional commercial banking was the focus on capital markets. Investment banks specialized in connecting investors with corporations seeking to raise capital. They acted as intermediaries, facilitating the issuance of stocks and bonds. This innovation allowed companies to access a broader pool of capital beyond traditional bank loans, enabling them to fund expansion, research, and new ventures.

The introduction of bonds and stocks as financial instruments represented a significant departure from the more traditional lending practices of commercial banks. Bonds, in particular, provided a novel way for corporations to raise funds by essentially borrowing from investors with the promise of periodic interest payments and the return of principal upon maturity. Stocks, on the other hand, represented ownership stakes in a company, allowing investors to share in its fortunes and, through dividends and capital appreciation, potentially achieve substantial returns.

Investment banks were instrumental in underwriting and marketing these new financial instruments. They assumed the risk associated with selling bonds and stocks to investors, a practice that required both financial expertise and risk management skills. This risk-sharing arrangement encouraged investor confidence and facilitated the flow of capital into a wide array of industries, including railways, manufacturing, and emerging technologies.

J.P. Morgan, often regarded as one of the most influential figures in investment banking history, played a crucial role in stabilizing financial markets during times of crisis. His leadership during the Panic of 1907, where he personally intervened to prevent a catastrophic financial collapse, underscored the pivotal role of investment banks in maintaining financial stability and confidence.

Goldman Sachs, another prominent investment bank, also made significant contributions to the development of modern finance. The firm’s commitment to rigorous research and analysis, combined with its entrepreneurial spirit, helped it become a leading player in investment banking and financial services.

The shift toward investment banking had far-reaching implications for the broader economy. It allowed capital to flow more efficiently to enterprises with growth potential, fostering innovation and economic expansion. It also contributed to the development of a sophisticated financial ecosystem that facilitated the efficient allocation of capital, risk management, and wealth creation.

In conclusion, the rise of investment banking in the 19th century, led by firms like J.P. Morgan and Goldman Sachs, revolutionized the financial landscape by introducing new financial instruments and facilitating capital raising for corporations. This departure from traditional commercial banking practices played a pivotal role in shaping the modern financial industry and its impact on economic growth and prosperity.

If you’d like to dive deeper into this subject, there’s more to discover on this page: The Evolution of Banking Over Time

In 1913, the United States established the Federal Reserve System, often referred to as the “Fed.” This central banking system was a response to financial crises and aimed to provide stability and flexibility to the financial system. The Fed’s influence extended beyond America’s borders, as its monetary policies impacted global financial markets.

The establishment of the Federal Reserve System, colloquially known as the “Fed,” in 1913 marked a watershed moment in American financial history with reverberations across the global economic landscape. This central banking system emerged as a strategic response to the recurring financial crises that had plagued the United States in the 19th and early 20th centuries. Its primary objectives were to instill stability and flexibility into the financial system while exercising control over monetary policy. However, the Fed’s sphere of influence transcended national boundaries, wielding significant impact on global financial markets.

A Shield Against Financial Turmoil: The early 20th century was characterized by a series of financial panics and banking crises that roiled the American economy. The Fed was conceived as a solution to this instability, designed to serve as a lender of last resort to banks, inject liquidity during crises, and regulate the money supply. Its role in safeguarding the nation’s financial system was instrumental in preventing the devastating consequences of unchecked panics.

Flexibility in Monetary Policy: The Fed’s establishment also aimed to provide a degree of flexibility in monetary policy. Its ability to set interest rates, control the money supply, and influence credit conditions allowed it to respond to economic fluctuations and crises effectively. This capacity to adapt monetary policy in real-time became increasingly critical during times of war, economic downturns, and international financial disruptions.

Global Impact of Monetary Policies: The influence of the Federal Reserve extended far beyond the shores of the United States. The U.S. dollar, as the world’s primary reserve currency, meant that the Fed’s monetary policies had a profound impact on global financial markets. Changes in U.S. interest rates and monetary policy decisions could trigger international capital flows, currency exchange rate fluctuations, and investment decisions worldwide.

Global Financial Stability: During times of international financial turmoil or crises, the Federal Reserve often played a pivotal role in stabilizing global markets. Its willingness to provide liquidity and extend dollar swap lines to foreign central banks helped mitigate the severity of financial crises in various parts of the world. The Fed’s actions were instrumental in preventing contagion and promoting stability.

A Role in International Cooperation: The Federal Reserve has been an active participant in international forums and cooperative efforts aimed at promoting global financial stability. Its collaboration with other central banks and international organizations underscores its commitment to the interconnectedness of global financial systems.

The Modern Era: In recent decades, the role of the Federal Reserve in global finance has continued to evolve. Its response to the 2008 financial crisis, characterized by unconventional monetary policies like quantitative easing, had far-reaching implications for global financial markets. The Fed’s communication strategies and forward guidance now carry substantial weight in shaping expectations and influencing market behavior.

In conclusion, the establishment of the Federal Reserve System in 1913 was a response to the imperative of financial stability in the United States, but its influence extended well beyond American borders. Over the years, the Fed has played a crucial role in shaping global financial markets, responding to crises, and fostering international cooperation. Its position as a linchpin of the global financial system underscores the significance of central banking institutions in today’s interconnected world.

Should you desire more in-depth information, it’s available for your perusal on this page: Overview: The History of the Federal Reserve | Federal Reserve …

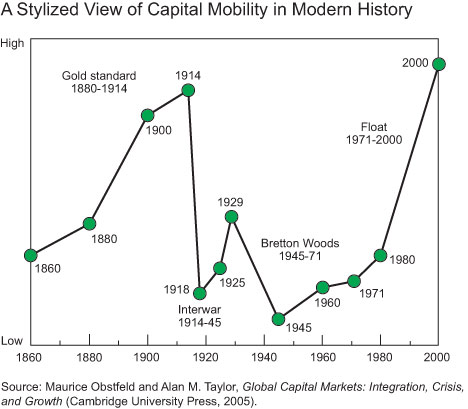

The aftermath of World War II saw the United States emerge as a dominant economic and financial superpower. The Bretton Woods Conference in 1944, held in New Hampshire, established the U.S. dollar as the world’s primary reserve currency. This decision, along with the creation of the International Monetary Fund (IMF) and the World Bank, set the stage for a post-war global financial order heavily influenced by American financial institutions.

The aftermath of World War II marked a pivotal moment in history, one where the United States ascended as a preeminent economic and financial superpower. This transformation was underscored by the landmark Bretton Woods Conference held in 1944 in picturesque New Hampshire. During this historic gathering, world leaders made consequential decisions that reverberate to this day. Central to these decisions was the establishment of the U.S. dollar as the world’s primary reserve currency, an epochal move that, along with the creation of the International Monetary Fund (IMF) and the World Bank, laid the cornerstone for a post-war global financial order heavily influenced by American financial institutions.

Dollar Hegemony: The decision to anoint the U.S. dollar as the world’s primary reserve currency, tethered to a fixed exchange rate, bestowed upon it a position of unparalleled importance in international trade and finance. This arrangement, known as the Bretton Woods system, bolstered the dollar’s value and solidified its dominance in global transactions.

Stability and Reconstruction: In the wake of the devastating war, the Bretton Woods institutions—the IMF and the World Bank—were conceived to promote global stability and facilitate post-war reconstruction efforts. The IMF offered financial assistance to nations facing balance of payments crises, while the World Bank supported long-term development projects.

Economic Assistance: America’s financial might, coupled with the establishment of these institutions, enabled the United States to provide crucial economic assistance to war-ravaged countries through initiatives like the Marshall Plan. These efforts played an instrumental role in rebuilding Europe and fostering global recovery.

Global Economic Architecture: The Bretton Woods Conference set the stage for a new global economic architecture. It promoted cooperation, exchange rate stability, and the free flow of capital—a stark departure from the economic isolationism that characterized the interwar period.

Promotion of American Values: The post-war financial order, underpinned by American institutions, allowed the United States to promote its democratic and capitalist values. By shaping the international financial landscape, the U.S. advanced its vision of an open, market-driven global economy.

Challenges and Transitions: The Bretton Woods system faced challenges, including the strain of financing the Vietnam War and inflation in the United States. By the early 1970s, the system’s rigidity gave way to the more flexible floating exchange rates, reshaping global finance.

Legacy of Influence: Despite the shift away from fixed exchange rates, the influence of American financial institutions remains significant. The dollar remains a dominant global reserve currency, and the IMF and World Bank continue to play pivotal roles in international financial stability and development.

Evolving Financial Landscape: In the 21st century, the global financial landscape is characterized by new challenges and emerging powers. As the world’s financial system evolves, the influence of Bretton Woods institutions, and by extension, the United States, adapts to these changes.

International Cooperation: The Bretton Woods legacy underscores the importance of international cooperation in addressing global economic challenges. It serves as a reminder that the stability of the global economy is intricately tied to the actions and decisions of nations working together.

Historical Significance: The Bretton Woods Conference remains a touchstone in the history of international finance and diplomacy. It reflects a moment when the United States, in the aftermath of war, played a leading role in shaping the financial and economic architecture of the post-war world.

In summary, the aftermath of World War II witnessed the United States ascend to unparalleled financial prominence, with the Bretton Woods Conference and its outcomes serving as a testament to American leadership in shaping the global financial order. This legacy endures, underscoring the profound impact that international financial institutions and monetary policy can have on the global economic landscape.

Don’t stop here; you can continue your exploration by following this link for more details: Bretton Woods Agreement and the Institutions It Created Explained

American banks have been at the forefront of financial innovation. The development of complex financial products, such as mortgage-backed securities and derivatives, transformed the financial landscape in the late 20th century. These innovations brought both opportunities and risks, as exemplified by the global financial crisis of 2008.

American banks have indeed been pioneers of financial innovation, pushing the boundaries of traditional banking practices and reshaping the financial landscape in profound ways. The late 20th century witnessed a surge in innovative financial products and practices, with American banks leading the charge:

Mortgage-Backed Securities (MBS): American banks were instrumental in the development and proliferation of mortgage-backed securities. These financial instruments allowed banks to package individual mortgages into securities that could be sold to investors. This innovation not only enabled banks to offload mortgage-related risks but also provided a new avenue for investors to participate in the housing market. The MBS market grew exponentially, attracting both domestic and international investors seeking higher yields.

Derivatives Markets: American banks played a central role in the expansion of derivatives markets. Financial derivatives, such as futures, options, and swaps, offered hedging mechanisms for managing various risks, from interest rate fluctuations to commodity price volatility. Derivatives provided businesses with valuable tools for risk mitigation, but their complexity and leverage potential also introduced systemic risks when not properly managed.

Securitization: Beyond mortgage-backed securities, American banks pioneered the securitization of various asset classes, including auto loans, credit card debt, and student loans. This process involved bundling these loans into tradable securities, diversifying risk, and increasing liquidity. However, the widespread use of securitization contributed to the opacity of financial markets, making it challenging to assess underlying risks.

Opportunities and Risks: The innovative financial products brought both opportunities and risks to the global financial system. On the one hand, they facilitated the efficient allocation of capital, improved access to credit for businesses and individuals, and fostered market liquidity. On the other hand, their complexity and interconnectedness amplified the potential for financial contagion.

Global Financial Crisis (2008): The culmination of these financial innovations and their associated risks became evident during the global financial crisis of 2008. The crisis was triggered by the collapse of the subprime mortgage market, which had been fueled by the widespread use of mortgage-backed securities and complex derivative products. American banks faced severe losses, leading to a cascade of financial institution failures and a global economic downturn.

Regulatory Responses: In the aftermath of the crisis, regulatory authorities both in the United States and internationally implemented sweeping reforms to address the vulnerabilities exposed by these innovations. The Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States aimed to enhance transparency, impose stricter capital requirements, and improve risk management practices within the financial industry.

Ongoing Innovation and Vigilance: American banks have continued to innovate, but the lessons from the financial crisis underscore the importance of responsible innovation and risk management. Banks are now more cautious about creating and trading complex financial products and are subject to increased regulatory scrutiny to ensure the stability of the financial system.

In conclusion, American banks’ role in financial innovation has been pivotal, introducing transformative products and practices to the global financial arena. While these innovations have brought notable benefits, they have also exposed the financial system to greater risks, as exemplified by the 2008 crisis. As the financial industry continues to evolve, a delicate balance must be struck between fostering innovation and safeguarding the stability and resilience of the global financial system.

Looking for more insights? You’ll find them right here in our extended coverage: Executive Order on Promoting Competition in the American …

American banks expanded their presence globally, establishing branches and subsidiaries in major financial centers around the world. This globalization facilitated international trade and investment, fostering economic growth and interconnectivity.

The global expansion of American banks was a pivotal development that not only reshaped the financial landscape but also played a fundamental role in shaping the global economy. As American banks established branches and subsidiaries in major financial centers worldwide, they became key players in facilitating international trade and investment, ushering in an era of unprecedented economic growth and interconnectedness.

Global Financial Network: American banks, with their extensive networks and resources, acted as the linchpin in the creation of a global financial network. They established a presence in financial hubs such as London, Hong Kong, and Singapore, allowing them to serve as conduits for capital flows and financial services across borders.

Facilitating International Trade: The presence of American banks in major global financial centers streamlined international trade. They provided trade financing, letters of credit, and foreign exchange services, reducing transaction costs and risks for businesses engaged in cross-border commerce. This support was pivotal in expanding the volume and reach of international trade.

Attracting Foreign Investment: American banks’ global presence also attracted foreign investment into the United States. Their reputation for stability and expertise made the U.S. an attractive destination for foreign capital. This influx of investment contributed to the growth of American businesses and the development of the U.S. economy.

Knowledge Transfer and Expertise: The expansion of American banks facilitated the transfer of financial expertise and best practices to emerging economies. As these banks established operations in various countries, they often trained local staff, helping to develop a pool of skilled financial professionals worldwide.

Risk Mitigation: American banks played a crucial role in risk mitigation through their global reach. They provided financial products and services that allowed businesses to hedge against currency fluctuations, interest rate risks, and other market uncertainties, increasing the predictability of global financial transactions.

Supporting Multinational Corporations: Multinational corporations relied on American banks for a range of services, including cash management, trade finance, and capital raising. These services enabled these corporations to operate seamlessly across borders, fostering their growth and global expansion.

Financial Innovation: American banks were often at the forefront of financial innovation. They introduced new financial products and technologies that improved efficiency in global financial markets. Innovations such as electronic trading platforms and derivatives markets had far-reaching effects on financial markets worldwide.

Challenges and Regulation: The global expansion of American banks also brought challenges, including the need for effective regulatory oversight. The 2008 financial crisis prompted increased scrutiny and regulation of global financial institutions to mitigate systemic risks.

In conclusion, the global expansion of American banks was a transformative force that reshaped the world of finance and economics. Their presence in major financial centers was instrumental in facilitating international trade, attracting foreign investment, and fostering global economic growth. While this expansion brought both opportunities and challenges, it remains a testament to the interconnectedness of the modern global economy and the role that financial institutions play in shaping it.

Don’t stop here; you can continue your exploration by following this link for more details: McKinsey’s Global Banking Annual Review | McKinsey

The global impact of American banking has not been without challenges. The 2008 financial crisis exposed vulnerabilities in the financial system, leading to increased regulatory oversight and reforms both domestically and internationally. American banks have adapted to these changes, further shaping the global financial industry.

The global impact of American banking has indeed been significant, but it has not been without its share of challenges. The 2008 financial crisis was a stark reminder of the vulnerabilities in the financial system, resulting in a wave of repercussions that resonated worldwide.

In the aftermath of the crisis, there was a pressing need for increased regulatory oversight and reforms, both domestically and on the international stage. American banks played a central role in this process, working closely with regulatory bodies to strengthen financial regulations and restore confidence in the global financial system. These reforms aimed to address issues like risk management, capital adequacy, and transparency, all of which were critical in preventing a similar crisis in the future.

Moreover, American banks recognized the importance of adapting to these changes proactively. They embraced new risk management practices, improved transparency in financial reporting, and bolstered their capital reserves to withstand economic shocks. These efforts not only helped restore trust in American banking institutions but also set a precedent for responsible banking practices globally.

The increased regulatory oversight and reforms that followed the crisis transformed the landscape of the global financial industry. They brought about a heightened awareness of the interconnectedness of financial markets and the need for prudent risk management. American banks, as key players in this industry, played a pivotal role in shaping these changes and influencing financial practices worldwide.

In essence, while the global impact of American banking has faced challenges, it has also demonstrated resilience and adaptability. American banks have not only weathered the storm of the financial crisis but have actively contributed to the development of a more secure and stable global financial system. Their ability to navigate these challenges and drive positive change underscores their enduring influence on the world of finance.

For additional details, consider exploring the related content available here Jamie Dimon’s Letter to Shareholders, Annual Report 2022 …

Conclusion

The birth of modern finance owes much to the pioneering spirit of American banking. From the early days of commercial banking to the rise of investment banking and the establishment of the Federal Reserve, American institutions have set the standard for financial innovation and stability. Their global impacts, from Bretton Woods to the globalization of banking, continue to shape the world’s financial landscape. As American banking institutions navigate the challenges and opportunities of the 21st century, their legacy as a driving force in modern finance remains undeniable, ensuring their enduring influence on the global economy.

The history of modern finance is intricately intertwined with the pioneering spirit and innovative prowess of American banking institutions. From their humble beginnings in the early days of commercial banking to the transformational rise of investment banking and the establishment of the Federal Reserve System, American financial institutions have consistently been at the forefront of shaping the world’s financial landscape.

Commercial Banking Foundations: American commercial banks played a fundamental role in facilitating trade and commerce during the nation’s early years. They provided essential financial services, including currency issuance, loans, and deposit services, that were vital for economic growth and development.

Investment Banking Pioneers: The late 19th and early 20th centuries witnessed the emergence of investment banking in the United States. These institutions provided capital and financial expertise to support the rapid industrialization and infrastructure development of the nation. Their innovative approach to raising capital and managing financial assets set the stage for the expansion of capital markets.

Federal Reserve System: The creation of the Federal Reserve in 1913 marked a watershed moment in central banking. The Federal Reserve’s role in regulating the money supply, influencing interest rates, and promoting financial stability has been pivotal not only for the American economy but also for the global financial system. Its policies have been instrumental in responding to economic crises and promoting monetary stability.

Global Influence: American banking institutions have had a profound global impact. The Bretton Woods Conference in 1944, which established the post-World War II international monetary system, featured a significant American presence. The conference laid the groundwork for the global financial order, with the U.S. dollar at its center. This legacy endures, as the dollar remains the world’s primary reserve currency.

Globalization of Banking: American banks have been at the forefront of international expansion and globalization in the financial sector. They have established a significant presence in major financial hubs around the world, providing a wide range of financial services to clients across borders. This globalization has facilitated international trade, investment, and capital flows.

Challenges and Opportunities: In the 21st century, American banking institutions continue to navigate a rapidly evolving financial landscape. They face challenges such as technological disruption, regulatory changes, and cybersecurity threats. However, they also seize opportunities presented by fintech innovation, digital banking, and sustainable finance, ensuring their continued relevance and adaptability.

The legacy of American banking as a driving force in modern finance remains undeniable. These institutions have not only contributed to the economic growth and stability of the United States but have also exerted a lasting influence on the global economy. As they navigate the complexities of the 21st century, their commitment to innovation, financial stewardship, and adaptability ensures that they will continue to shape the financial world and play a pivotal role in the global economic order. Their enduring legacy is a testament to the resilience and ingenuity of American finance.

Should you desire more in-depth information, it’s available for your perusal on this page: Causes and Consequences of Income Inequality: A Global …

More links

For additional details, consider exploring the related content available here The Evolution of Banking Over Time