Introduction

Cryptocurrency, once a niche interest, has grown into a global phenomenon with the potential to revolutionize the financial landscape. Born out of the desire for decentralized, secure, and borderless transactions, cryptocurrencies have transcended their initial purpose and are now poised to disrupt traditional finance. In this article, we will explore the disruptive potential of cryptocurrency in finance, examining the key innovations, challenges, and opportunities it presents.

Cryptocurrency, a concept once relegated to the fringes of the financial world, has emerged as a global force that could reshape the very foundations of our economic systems. Its origins trace back to a desire for a financial realm that is decentralized, secure, and unrestricted by geographical boundaries. However, its evolution has been nothing short of remarkable, extending far beyond its initial intent.

At its core, cryptocurrency represents a radical departure from traditional finance. It’s built on the principle of decentralization, removing the need for intermediaries such as banks and payment processors. This revolutionary approach empowers individuals with direct control over their finances, offering a level of financial autonomy that was previously unimaginable. Moreover, the inherent security features of blockchain technology make transactions tamper-proof, enhancing trust and transparency in financial interactions.

As cryptocurrencies continue to gain momentum, they are poised to disrupt various aspects of traditional finance. For instance, cross-border transactions that were once time-consuming and costly can now occur in seconds with minimal fees, bypassing the complexities of the traditional banking system. This has the potential to democratize access to financial services, particularly in regions with limited banking infrastructure.

However, the disruptive potential of cryptocurrencies is not without its challenges. Regulatory concerns, price volatility, and the need for widespread adoption all pose significant hurdles. Governments and financial institutions are grappling with how to regulate and integrate these digital assets into the existing financial framework while ensuring consumer protection and preventing illicit activities.

Nonetheless, the opportunities presented by cryptocurrencies are undeniable. They extend far beyond just digital cash, with applications in smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs), among others. These innovations are reshaping how we think about ownership, transactions, and contracts.

In this ever-evolving landscape, understanding the potential and challenges of cryptocurrency in finance is crucial. As we delve deeper into this article, we will explore the intricacies of this disruptive force, examining the key innovations that have brought us to this point, the challenges that must be overcome, and the immense opportunities that lie ahead. In doing so, we aim to provide insights into a financial future that is undergoing a profound transformation, driven by the power of cryptocurrency.

To delve further into this matter, we encourage you to check out the additional resources provided here: FACT SHEET: White House Releases First-Ever Comprehensive …

Decentralization and Trustless Transactions

Cryptocurrency’s disruptive potential begins with its foundation: blockchain technology. Unlike traditional financial systems that rely on centralized authorities like banks and governments, cryptocurrencies operate on decentralized networks. This means transactions occur directly between users without the need for intermediaries. The blockchain, a public ledger, records all transactions transparently, creating trust through technology rather than centralized institutions.

Cryptocurrency’s disruptive potential is anchored in its innovative foundation: blockchain technology. This technology represents a paradigm shift in the world of finance and trust-based transactions.

1. Decentralization and Trust: Traditional financial systems have long relied on centralized intermediaries like banks and governments to facilitate and validate transactions. Cryptocurrencies, on the other hand, operate on decentralized networks. This means that transactions take place directly between users, peer to peer, without the need for intermediaries. This decentralization removes the reliance on a single authority, distributing trust across a network of nodes (computers) that collectively validate and record transactions.

2. Transparency and Security: The blockchain, often referred to as a public ledger, is at the core of cryptocurrency technology. It records all transactions in a transparent, tamper-proof manner. Every participant in the network can view the entire transaction history, ensuring accountability and security. Once a transaction is added to the blockchain, it becomes immutable, making it extremely difficult for bad actors to alter or manipulate transaction records. This inherent transparency and security offer a level of trust that transcends centralized institutions.

3. Inclusion and Accessibility: Cryptocurrencies empower individuals by granting them direct control over their finances. This inclusivity extends to the unbanked and underbanked populations who lack access to traditional banking services. With an internet connection and a digital wallet, anyone can participate in the global economy. This disruptive potential is particularly significant in regions with limited financial infrastructure, where cryptocurrency can provide a lifeline to essential financial services.

4. Borderless Transactions: Traditional cross-border transactions often come with significant fees and delays due to intermediary banks and currency conversions. Cryptocurrencies, being borderless by nature, allow for near-instant, low-cost global transactions. This has the potential to transform international trade, remittances, and financial access on a global scale.

5. Empowering Financial Innovation: The elimination of intermediaries and the programmable nature of cryptocurrencies have given rise to a wave of financial innovation. Smart contracts, decentralized applications, and decentralized finance (DeFi) platforms are just a few examples of how blockchain technology is reshaping traditional financial services. These innovations offer users greater control, transparency, and efficiency in managing their financial affairs.

6. Challenges and Evolving Landscape: While the disruptive potential of cryptocurrencies is clear, it is not without its challenges. Regulatory uncertainties, scalability issues, and concerns about security and fraud are areas that require continued attention and development. Achieving the right balance between fostering innovation and ensuring consumer protection remains an ongoing challenge for governments and the cryptocurrency industry.

In conclusion, cryptocurrency’s disruptive potential is rooted in its blockchain technology, which fundamentally changes the way we perceive trust and conduct financial transactions. This technology enables decentralization, transparency, and inclusivity, offering a new path forward for the financial world. While challenges persist, the ongoing evolution of the cryptocurrency landscape promises to shape the future of finance in ways that are more inclusive, efficient, and accessible to people around the globe.

To expand your knowledge on this subject, make sure to read on at this location: Decentralized finance research and developments around the world …

Financial Inclusion

One of the most profound impacts of cryptocurrencies is their potential to bring financial services to the unbanked and underbanked populations worldwide. Millions of people lack access to traditional banking systems, but with a smartphone and an internet connection, they can participate in the global economy through cryptocurrencies. This democratization of financial access has the power to reduce poverty and drive economic growth in underserved regions.

One of the most profound impacts of cryptocurrencies is their potential to bring financial services to the unbanked and underbanked populations worldwide. Millions of people lack access to traditional banking systems, but with a smartphone and an internet connection, they can participate in the global economy through cryptocurrencies. This democratization of financial access has the power to reduce poverty and drive economic growth in underserved regions.

Cryptocurrencies offer several advantages in addressing financial inclusion challenges. First and foremost, they provide a secure and accessible means for individuals to store and transfer value without the need for a traditional bank account. This is particularly beneficial in regions with limited access to physical banking infrastructure.

Additionally, cryptocurrencies can significantly lower the cost of financial transactions. Traditional banking systems often impose high fees for remittances and international money transfers, making it expensive for migrants to send money home to their families. Cryptocurrencies offer a more cost-effective alternative, potentially saving billions of dollars in fees each year and putting more money in the pockets of those who need it most.

Furthermore, cryptocurrencies are resistant to inflation and currency devaluation, which can be a significant issue in some countries. People in nations with unstable currencies can use cryptocurrencies as a store of value and a means of preserving their wealth. This stability can protect individuals and businesses from the adverse effects of hyperinflation and economic crises.

The use of cryptocurrencies also opens doors to financial services like loans and microfinance for those who were previously excluded from the formal financial system. Decentralized finance (DeFi) platforms, built on blockchain technology, enable individuals to borrow and lend funds without the need for traditional intermediaries, making credit more accessible to a broader range of people.

However, it’s essential to recognize that the adoption of cryptocurrencies for financial inclusion is not without challenges. Education and digital literacy are necessary to ensure that people can use cryptocurrencies safely and effectively. Regulatory frameworks must also evolve to protect consumers while fostering innovation.

In conclusion, cryptocurrencies have the potential to revolutionize financial inclusion by providing a secure, affordable, and accessible means of participating in the global economy. This democratization of financial access can empower individuals and communities, reduce poverty, and drive economic growth in underserved regions, ultimately contributing to a more equitable and prosperous world. As cryptocurrencies continue to evolve, their role in financial inclusion efforts will become increasingly significant.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Potential of Web3 | McKinsey

Reduced Transaction Costs

Traditional financial transactions often come with hefty fees, especially for international transfers. Cryptocurrencies eliminate many of these costs by bypassing intermediaries like banks and payment processors. This not only saves money for individuals and businesses but also streamlines cross-border trade and commerce.

Traditional financial transactions often come with hefty fees, especially for international transfers. Cryptocurrencies eliminate many of these costs by bypassing intermediaries like banks and payment processors. This not only saves money for individuals and businesses but also streamlines cross-border trade and commerce.

Financial Inclusion: Cryptocurrencies have the potential to bring financial services to the unbanked and underbanked populations around the world. This inclusion can help lift people out of poverty by providing them with access to a global financial system.

Speed and Efficiency: Cryptocurrency transactions can be processed much faster than traditional banking systems, which may take days for international transfers. This speed is especially beneficial in emergency situations or for time-sensitive transactions.

Reduced Fraud and Security Risks: Blockchain technology, which underlies most cryptocurrencies, offers enhanced security through its decentralized and transparent nature. This can reduce the risk of fraud and cyberattacks that plague traditional financial systems.

Global Trade Simplification: Cryptocurrencies can simplify global trade by providing a common, digital medium of exchange. This can reduce the complexities and costs associated with currency conversion and fluctuating exchange rates.

Micropayments and New Business Models: Cryptocurrencies enable microtransactions, allowing users to pay for small services or content economically. This has given rise to new business models, such as pay-per-article journalism and micro-donations for content creators.

Financial Innovation: The adoption of cryptocurrencies has spurred financial innovation, including decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and smart contracts. These innovations have the potential to reshape traditional financial systems and industries.

Global Workforce: Cryptocurrencies facilitate the payment of remote workers and freelancers around the world, eliminating the need for expensive international wire transfers or currency conversion fees. This supports the growth of the global gig economy.

Cross-Border Investment: Investors can use cryptocurrencies to easily access international markets and diversify their portfolios. This can democratize investment opportunities and reduce barriers for smaller investors.

Economic Sovereignty: Cryptocurrencies provide individuals and nations with greater control over their financial sovereignty. They can transact independently of centralized financial institutions, which can be particularly important in regions with economic instability.

Environmental Considerations: While cryptocurrencies offer many advantages, there are environmental concerns related to energy-intensive mining processes. Innovations in more energy-efficient consensus mechanisms and a shift toward sustainable mining practices are actively being explored.

In conclusion, cryptocurrencies are disrupting the traditional financial landscape by reducing costs, increasing financial inclusion, and fostering innovation. As their adoption continues to grow, their impact on the global economy and financial systems will likely become even more significant, transforming the way we conduct financial transactions and interact with money in the digital age.

For additional details, consider exploring the related content available here No 117 – Fintech and the digital transformation of financial services …

Smart Contracts and Programmable Money

Cryptocurrencies like Ethereum introduced the concept of smart contracts, self-executing agreements with the terms of the contract directly written into code. These contracts automate processes, reducing the need for legal intermediaries and administrative overhead. Programmable money opens the door to innovative applications in finance, including decentralized finance (DeFi), lending, and insurance, further disrupting traditional financial services.

Cryptocurrencies, spearheaded by pioneering platforms like Ethereum, have ushered in a new era of financial innovation through the concept of smart contracts. These ingenious self-executing agreements are much more than mere buzzwords; they represent a fundamental shift in how we envision and engage with contracts.

At their core, smart contracts embody efficiency and trust. The terms and conditions of these contracts are not buried within pages of legal jargon but are instead directly encoded into immutable code on a blockchain. This remarkable feature ensures that once a condition is met, the contract executes automatically without the need for intermediaries, paperwork, or administrative oversight. Imagine a world where contractual agreements are not reliant on the interpretation and enforcement of legal documents but are governed by transparent, tamper-proof code.

The implications of smart contracts are far-reaching. They have the potential to revolutionize a multitude of industries, starting with finance. Decentralized finance (DeFi), one of the most prominent sectors in the cryptocurrency space, leverages smart contracts to create an open and accessible financial ecosystem. Through DeFi platforms, individuals can engage in lending, borrowing, trading, and earning interest on their assets without relying on traditional banks or intermediaries. This not only provides greater financial inclusivity but also reduces the barriers to entry for those who may not have had access to conventional financial services.

Smart contracts also extend their transformative reach into the domains of lending and insurance. In the realm of lending, decentralized platforms facilitate peer-to-peer lending and borrowing, eliminating the need for traditional financial institutions as intermediaries. This can lead to more competitive interest rates and expanded access to credit for a global audience. In insurance, smart contracts can automate claims processing, ensuring that payouts occur automatically when predefined conditions are met, streamlining the often-complex and lengthy claims settlement process.

Furthermore, the concept of programmable money, which underpins smart contracts, is not confined to the financial sector alone. It extends into areas like supply chain management, healthcare, and even voting systems, where transparent and automated processes can lead to increased efficiency, trust, and security.

However, as with any groundbreaking innovation, challenges lie on the path to widespread adoption. Issues of scalability, security, and regulatory compliance must be addressed to unlock the full potential of smart contracts. Additionally, the complexity of coding and the potential for bugs or vulnerabilities necessitate a heightened level of scrutiny and expertise.

In conclusion, the introduction of smart contracts through cryptocurrencies like Ethereum has opened a world of possibilities in finance and beyond. These self-executing agreements represent a paradigm shift in how we conduct business and contractual interactions. As smart contract technology matures and evolves, we can anticipate further disruptions in traditional financial services and the emergence of novel, blockchain-powered applications that redefine the way we engage with the world.

Challenges and Regulatory Uncertainty

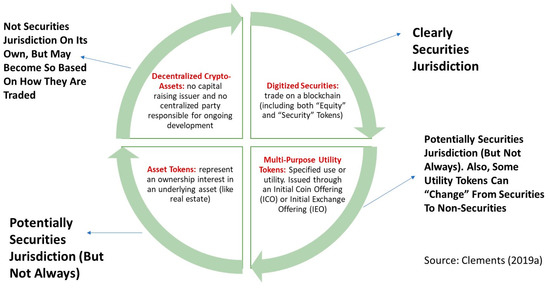

The disruptive potential of cryptocurrencies also faces significant challenges. Regulatory bodies worldwide are grappling with how to classify and regulate these digital assets. The lack of uniformity in regulations has created uncertainty for businesses and investors. Striking a balance between innovation and consumer protection remains a complex and ongoing endeavor.

Indeed, as cryptocurrencies continue to gain traction and disrupt traditional financial systems, they find themselves at the center of a regulatory crossroads. The clash between innovation and consumer protection, while complex, represents a critical juncture in the evolution of this transformative technology.

1. Regulatory Divergence: One of the primary challenges facing cryptocurrencies is the lack of uniformity in regulatory approaches across different countries and regions. While some nations have embraced cryptocurrencies and enacted clear regulations, others have taken a more cautious or restrictive stance. This regulatory divergence creates a patchwork of rules and standards, making it challenging for businesses and investors to navigate the global crypto landscape. It also raises questions about jurisdiction and regulatory arbitrage, where entities may choose jurisdictions with more favorable regulations.

2. Innovation vs. Consumer Protection: Striking the right balance between fostering innovation and ensuring consumer protection is a delicate dance for regulatory bodies. On one hand, they want to encourage the development of blockchain technology and its various applications, recognizing its potential to streamline financial processes and expand access to financial services. On the other hand, they must protect consumers from fraud, scams, and market manipulation, which are more prevalent in the nascent and largely unregulated crypto space.

3. AML and KYC Compliance: Cryptocurrencies are often associated with anonymity, which can make them attractive to individuals seeking to engage in illicit activities such as money laundering and terrorism financing. Regulatory efforts are directed toward implementing Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures to mitigate these risks. Stricter AML and KYC regulations may help law enforcement combat illicit activities but may also challenge the privacy and anonymity features that some cryptocurrencies offer.

4. Taxation and Reporting: The taxation of cryptocurrency transactions is a complex issue. Different jurisdictions have different tax treatments for cryptocurrencies, which can lead to confusion for users and potential non-compliance. Regulatory bodies are working to provide clearer guidance on taxation and reporting requirements to ensure that cryptocurrency users are fulfilling their tax obligations.

5. Consumer Education: A critical aspect of cryptocurrency regulation is ensuring that consumers are well-informed about the risks and benefits of using cryptocurrencies. Regulatory bodies are increasingly focusing on education initiatives to raise awareness about cryptocurrency-related scams, investment risks, and the importance of secure storage practices. An informed user is less likely to fall victim to fraudulent schemes and more likely to make sound investment decisions.

6. Evolving Regulation: As the cryptocurrency space evolves, regulatory bodies must adapt their approaches accordingly. This means staying updated on technological advancements, market trends, and emerging risks. Flexibility in regulation is essential to address new challenges and opportunities that arise in the dynamic cryptocurrency ecosystem.

In conclusion, the disruptive potential of cryptocurrencies is inextricably linked to the regulatory environment in which they operate. Achieving a balance between innovation and consumer protection is a daunting task but a necessary one to ensure the responsible growth of this transformative technology. As regulatory bodies continue to refine their approaches and work toward greater harmonization, the cryptocurrency industry will evolve, and its impact on the broader financial landscape will become increasingly significant and integrated.

Don’t stop here; you can continue your exploration by following this link for more details: Potential of Web3 | McKinsey

Market Volatility

Cryptocurrency markets are known for their volatility, with prices experiencing rapid fluctuations. While this volatility can be a hurdle for mainstream adoption, it also presents opportunities for traders and investors. Stablecoins, cryptocurrencies pegged to stable assets like the US dollar, aim to mitigate this issue, providing a reliable store of value and a bridge between traditional finance and the crypto world.

Cryptocurrency markets are known for their volatility, with prices experiencing rapid fluctuations. While this volatility can be a hurdle for mainstream adoption, it also presents opportunities for traders and investors. Stablecoins, cryptocurrencies pegged to stable assets like the US dollar, aim to mitigate this issue, providing a reliable store of value and a bridge between traditional finance and the crypto world.

Stablecoins have gained significant traction in recent years as a solution to the crypto market’s wild price swings. These digital assets offer a degree of stability by maintaining a fixed value or staying within a narrow price range, making them more suitable for everyday transactions, savings, and smart contract applications. This stability is particularly important for merchants and businesses that want to accept cryptocurrency payments without exposing themselves to exchange rate risk.

One of the most significant advantages of stablecoins is their potential to enable financial services in regions with hyperinflation or unstable local currencies. People in such areas can use stablecoins as a reliable store of value, helping them protect their wealth from devaluation. This use case can lead to increased financial stability and greater economic resilience for individuals and businesses in these regions.

Moreover, stablecoins provide a bridge between the traditional financial system and the world of cryptocurrencies. Users can easily move funds between their bank accounts and crypto wallets through stablecoins, facilitating smoother onboarding for newcomers to the crypto space. This bridging function has caught the attention of financial institutions and central banks, who are exploring the potential of stablecoins for cross-border payments, remittances, and digital versions of national currencies (Central Bank Digital Currencies or CBDCs).

The rise of decentralized finance (DeFi) has further propelled the adoption of stablecoins. DeFi platforms leverage stablecoins to offer lending, borrowing, yield farming, and other financial services without traditional intermediaries. This ecosystem has grown exponentially, attracting billions of dollars in locked assets and providing users with new ways to earn interest and access credit, all while enjoying the stability of stablecoin denominations.

However, stablecoins are not without challenges. Their stability relies on the backing assets or mechanisms, which must be transparent and trustworthy. Regulatory scrutiny has intensified in response to the growing popularity of stablecoins, with concerns about potential systemic risks and the need for consumer protection. Striking the right balance between innovation and regulation will be crucial for the continued development of stablecoins.

In summary, stablecoins are a pivotal innovation within the cryptocurrency ecosystem, addressing the issue of price volatility and offering a reliable gateway between traditional finance and the digital asset space. As they evolve, stablecoins have the potential to revolutionize cross-border transactions, financial inclusion, and the way we interact with digital assets, ultimately bridging the gap between the old and the new financial world.

Explore this link for a more extensive examination of the topic: Global Financial Stability Report

Institutional Adoption

In recent years, institutional investors, including hedge funds and major corporations, have shown growing interest in cryptocurrencies. The entry of institutional capital into the crypto market is a significant step toward mainstream acceptance. However, it also raises questions about the potential centralization of a space built on decentralization principles.

In recent years, institutional investors, including hedge funds and major corporations, have shown growing interest in cryptocurrencies. The entry of institutional capital into the crypto market is a significant step toward mainstream acceptance. However, it also raises questions about the potential centralization of a space built on decentralization principles.

Market Maturation: The involvement of institutional investors signals the maturation of the cryptocurrency market. Their participation brings stability and liquidity, making cryptocurrencies more attractive for a broader range of investors.

Regulatory Scrutiny: The influx of institutional capital has drawn the attention of regulators worldwide. Governments are now actively working on establishing comprehensive regulatory frameworks for cryptocurrencies to ensure investor protection and market integrity.

Increased Credibility: Institutional involvement lends credibility to the crypto space, making it more palatable to conservative investors and mainstream financial institutions. This can encourage broader adoption and integration of cryptocurrencies into traditional finance.

Risk Management: Institutional investors often employ sophisticated risk management strategies, which can help mitigate some of the volatility associated with cryptocurrencies. This can lead to more stable markets and a reduced perception of risk.

Potential for Centralization: As institutions amass significant holdings of cryptocurrencies, there’s a concern that they could wield substantial influence over the market. This potential centralization contradicts the decentralized ethos on which many cryptocurrencies were founded.

Market Manipulation: With large sums of institutional money at play, there’s a risk of market manipulation. The actions of big players can impact prices and potentially harm retail investors, underscoring the need for regulatory oversight.

Conflict of Values: Institutional investors may have different motivations and values compared to the early adopters of cryptocurrencies. Striking a balance between profit-seeking and the original principles of decentralization may become a challenge.

Innovation and Development: Institutional interest can drive innovation in the crypto space, leading to new financial products, services, and investment vehicles. However, it’s important to ensure that innovation aligns with the principles of decentralization and inclusivity.

Diversification Opportunities: For institutional portfolios, cryptocurrencies offer diversification opportunities that can help spread risk. As part of a balanced investment strategy, exposure to cryptocurrencies can provide an additional layer of protection.

Education and Awareness: The involvement of institutions also calls for increased education and awareness among both investors and the broader public. Understanding the risks and benefits of cryptocurrencies becomes essential as they become more intertwined with traditional finance.

In summary, the entry of institutional investors into the cryptocurrency market is a double-edged sword. It brings credibility, liquidity, and the potential for market maturation. However, it also raises concerns about centralization, regulation, and the preservation of the core values of decentralization. Striking the right balance between these factors will likely be a key challenge as cryptocurrencies continue to evolve and find their place in the broader financial landscape.

Explore this link for a more extensive examination of the topic: Cryptocurrencies, Digital Dollars, and the Future of Money | Council …

Conclusion

Cryptocurrency’s disruptive potential in finance is undeniable. It challenges traditional financial systems by offering decentralized, efficient, and inclusive alternatives. Yet, its path forward is not without obstacles. Regulatory clarity, market stability, and addressing the concerns of institutional players are essential for its continued growth and mainstream adoption.

As cryptocurrencies continue to evolve, their impact on finance will become increasingly pronounced. Whether cryptocurrencies become the foundation of a new financial order or coexist with traditional systems, they have already reshaped the way we think about money, value, and trust in the digital age. The future of finance is likely to be a hybrid one, with cryptocurrencies playing a vital role in shaping its contours.

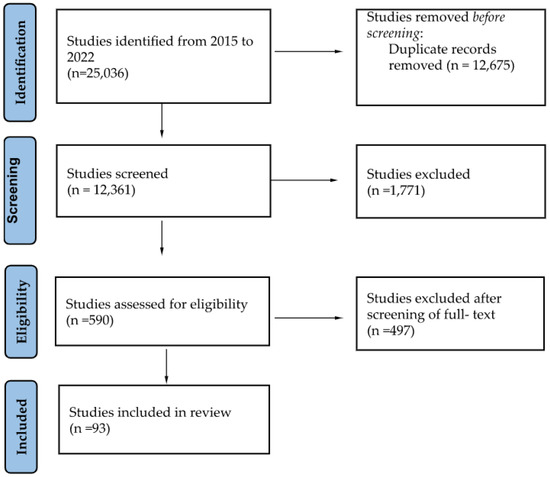

More links

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Cryptocurrencies: Are Disruptive Financial Innovations Here?