Table of Contents

- Understanding Customer Lifetime Value (CLV)

- Average Purchase Value

- Purchase Frequency

- Customer Lifespan

- Customer Acquisition Cost (CAC)

- The formula for CLV is as follows

- Targeted Marketing

- Personalized Customer Experiences

- Customer Retention Strategies

- Pricing Optimization

- Product Development

- Resource Allocation

- Predictive Analytics

- Challenges and Considerations

In the ever-competitive landscape of business, companies are constantly seeking ways to not only acquire customers but also retain them over the long haul. Customer Lifetime Value (CLV) has emerged as a powerful economic metric that not only measures the worth of a customer over time but also provides valuable insights into how businesses can maximize long-term profitability. In this article, we delve into the significance of CLV and how it serves as a guiding light for companies looking to secure lasting success.

“In the ever-competitive landscape of business, where customer acquisition costs continue to rise, the quest to not only acquire customers but also retain them over the long haul has never been more critical. Customer Lifetime Value (CLV) has emerged as a powerful economic metric that not only measures the worth of a customer over time but also provides invaluable insights into how businesses can maximize long-term profitability and secure lasting success.

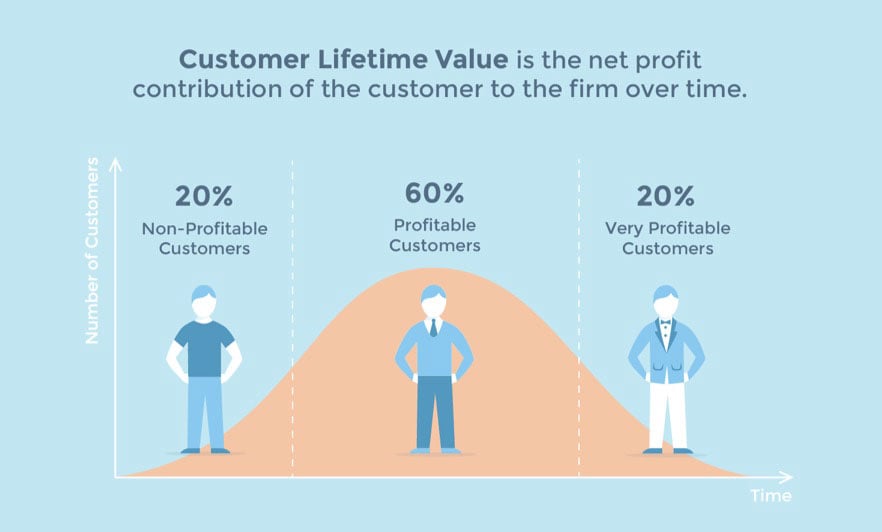

Understanding the True Value: At its core, CLV goes beyond the immediate transaction value of a customer; it assesses the holistic value that a customer brings to a business throughout their entire relationship. It accounts for repeat purchases, upsells, referrals, and the potential for customer loyalty over the years. Understanding this comprehensive value is essential for making informed decisions about resource allocation, marketing strategies, and customer relationship management.

Segmentation and Personalization: CLV isn’t a one-size-fits-all metric. It enables businesses to segment their customer base based on their value potential. High-CLV customers may receive personalized offers, exclusive perks, and targeted marketing, fostering loyalty and encouraging them to become brand advocates. Low-CLV customers can be engaged in ways that maximize their potential value or help them evolve into higher-value segments.

Resource Allocation: CLV helps businesses allocate their resources more efficiently. By identifying high-CLV customers, companies can prioritize their marketing efforts and customer service initiatives accordingly. This optimization ensures that the most valuable customers receive the attention and incentives they deserve, ultimately driving long-term profitability.

Product and Service Innovation: CLV also influences product and service innovation. By analyzing the preferences and behaviors of high-CLV customers, businesses can tailor their offerings to meet specific needs and preferences. This not only enhances customer satisfaction but also opens up opportunities for premium pricing and increased customer retention.

Churn Prediction and Prevention: Understanding CLV enables businesses to predict and prevent customer churn. By identifying the factors that lead to customer attrition, companies can implement retention strategies targeted at preserving the value of their most valuable customers.

Maximizing ROI: Ultimately, CLV is a critical tool for maximizing return on investment (ROI). It guides businesses in making strategic decisions that lead to long-term profitability. Whether it’s refining marketing strategies, improving customer service, or launching loyalty programs, CLV ensures that every initiative is aligned with the goal of nurturing and retaining valuable customers.

In conclusion, Customer Lifetime Value isn’t just a metric; it’s a strategic imperative in the world of business. It illuminates the path to securing lasting success by providing a deep understanding of customer worth and guiding businesses in their efforts to foster loyalty, drive profitability, and thrive in the competitive marketplace.”

For a comprehensive look at this subject, we invite you to read more on this dedicated page: What Customer Lifetime Value (CLV) Is & How to Calculate It …

Understanding Customer Lifetime Value (CLV)

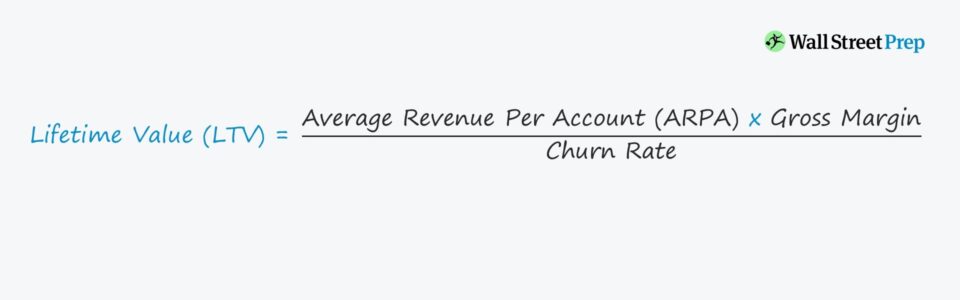

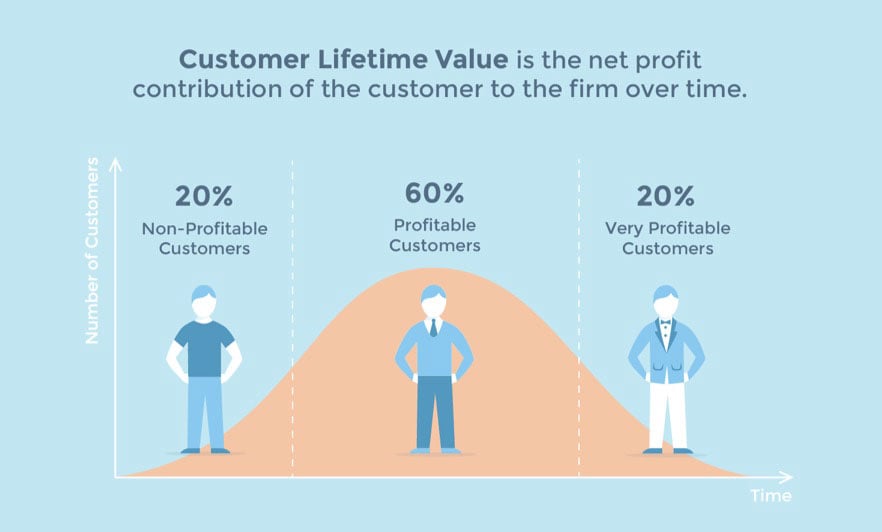

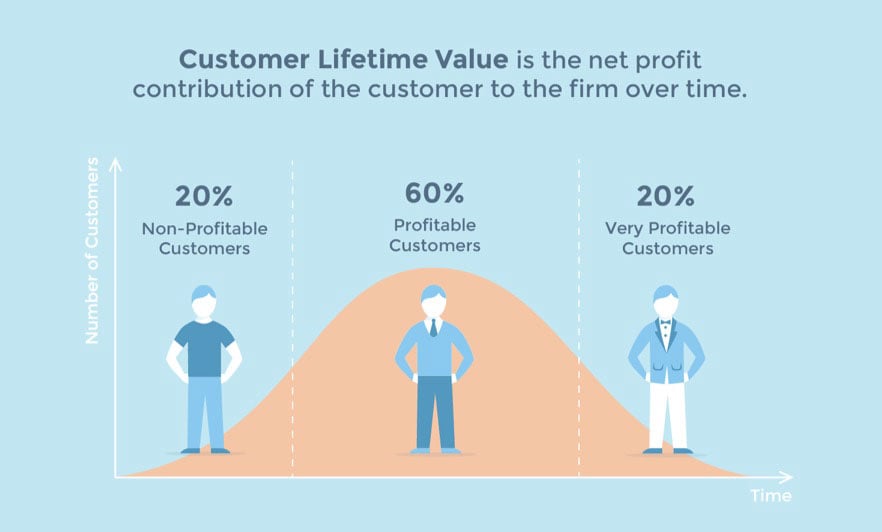

Customer Lifetime Value is a financial metric that quantifies the total expected value a customer will bring to a business throughout their entire relationship. It goes beyond immediate transactions and focuses on the long-term impact of customer interactions. Calculating CLV involves several key components:

Customer Lifetime Value (CLV) is a vital financial metric that transcends the here and now, offering businesses profound insights into their customer relationships and long-term profitability. Beyond merely tracking immediate transactions, CLV delves deep into the enduring significance of each customer interaction. To calculate CLV effectively, several key components need careful consideration:

Purchase History: An essential aspect of CLV calculation is a comprehensive analysis of a customer’s purchase history. By examining the frequency, size, and consistency of their transactions, businesses can gauge the immediate value a customer brings.

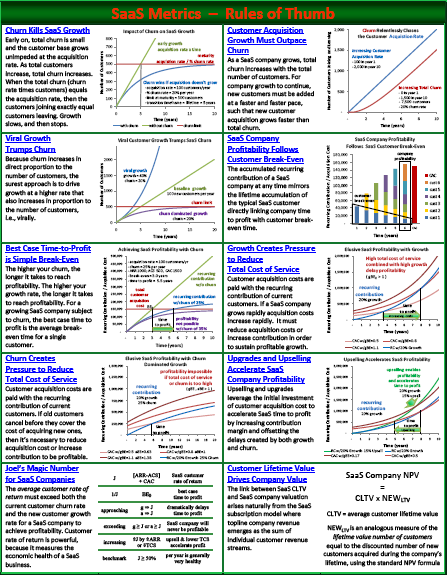

Retention Rate: A high CLV often hinges on customer loyalty. Calculating CLV involves determining the percentage of customers who continue to engage with your business over time. A strong retention rate indicates the potential for higher CLV.

Average Order Value (AOV): The average amount a customer spends per transaction plays a pivotal role in CLV computation. Understanding this metric helps in estimating the revenue generated from each customer.

Churn Rate: To obtain a more accurate CLV, it’s crucial to factor in customer attrition. Knowing how many customers you lose over a given period is essential for predicting the longevity of customer relationships.

Customer Segmentation: Customers are not uniform, and CLV can vary widely across different segments. By segmenting your customer base, you can gain deeper insights into which types of customers tend to have higher CLV.

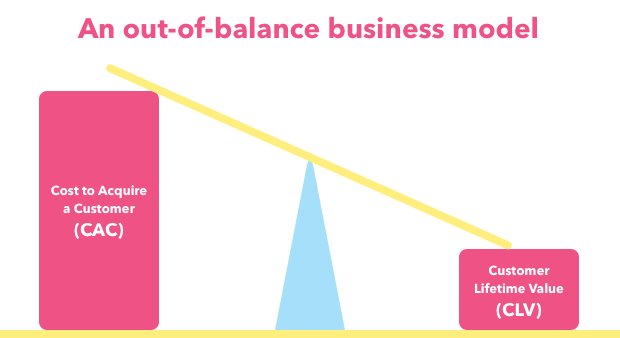

Cost of Acquisition: Balancing CLV with the cost of acquiring customers (CAC) is crucial for assessing the overall health of your business. A high CAC relative to CLV can indicate potential profitability challenges.

Referrals and Advocacy: CLV extends beyond individual transactions. Satisfied customers often become advocates and bring in new business through referrals. Incorporating the potential for viral growth through word-of-mouth marketing is essential.

Upselling and Cross-selling Opportunities: Identifying opportunities to upsell or cross-sell to existing customers can significantly impact CLV. By encouraging customers to explore additional products or services, you can increase their long-term value.

Customer Feedback and Satisfaction: The emotional connection customers have with your brand matters. High levels of satisfaction and positive feedback can lead to longer-lasting relationships and higher CLV.

Predictive Analytics: Leveraging advanced analytics and predictive models can refine CLV calculations. These models can help anticipate future customer behavior based on historical data.

In summary, Customer Lifetime Value is more than a simple financial metric; it’s a strategic tool that empowers businesses to make informed decisions about marketing, customer service, and product development. By considering these key components, you can harness the full potential of CLV to drive sustainable growth and build lasting customer relationships.

For additional details, consider exploring the related content available here The Ultimate Guide to Customer Lifetime Value | Bloomreach

Average Purchase Value

This represents the average amount a customer spends during each transaction.

This represents the average amount a customer spends during each transaction, and it holds significant implications for businesses aiming to maximize their revenue and profitability. Known as the average transaction value (ATV) or average order value (AOV), this metric serves as a key indicator of a company’s financial health and the effectiveness of its sales and marketing strategies.

A higher ATV signifies that, on average, customers are spending more with each purchase. For businesses, this translates into increased revenue without necessarily acquiring more customers, making it a powerful lever for growth. There are several strategies companies can employ to boost ATV:

Upselling and Cross-Selling: Encouraging customers to add complementary products or upgrade their purchases can elevate the transaction value. For example, a fast-food restaurant might suggest adding fries or a drink to a burger order.

Bundling: Offering bundled packages or discounts for multiple items can incentivize customers to buy more. Software companies, for instance, often provide software suites at a lower price than purchasing individual applications.

Loyalty Programs: Rewarding repeat customers with discounts or incentives for larger purchases can encourage them to spend more each time they buy.

Minimum Purchase Thresholds: Offering free shipping or other perks for orders above a certain value can motivate customers to add items to their cart to meet the threshold.

Product Recommendations: Implementing recommendation engines based on customer preferences and past purchases can entice shoppers to explore and purchase additional items.

Monitoring and optimizing ATV is essential for businesses aiming to increase their revenue and profitability. By understanding customer behavior and strategically implementing techniques to enhance the average transaction value, companies can boost their bottom line and improve their financial performance. Additionally, this metric provides valuable insights into consumer preferences and helps tailor marketing and sales strategies to maximize customer spending during each transaction.

Don’t stop here; you can continue your exploration by following this link for more details: What is CLV? Why Customer Lifetime Value Matters | Mailchimp

Purchase Frequency

It indicates how often a customer makes a purchase or interacts with the business.

nullTo delve further into this matter, we encourage you to check out the additional resources provided here: Customer lifetime value: The customer compass | McKinsey

Customer Lifespan

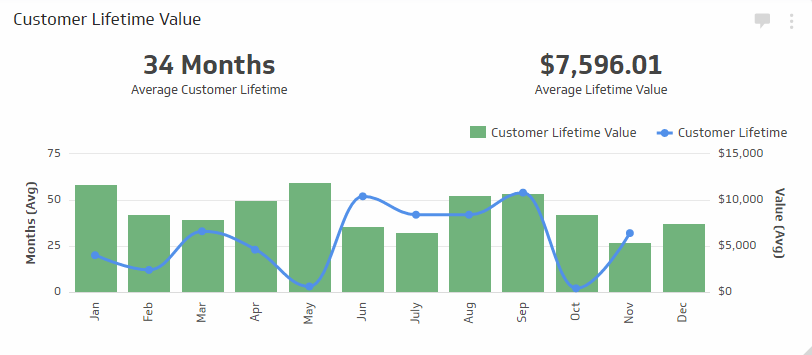

This is the expected duration of the customer’s relationship with the company.

Certainly, let’s expand on the concept of the expected duration of a customer’s relationship with a company and why it’s a crucial metric in business:

“The expected duration of a customer’s relationship with a company, often referred to as ‘customer lifetime’ or ‘customer lifetime value,’ is a pivotal metric in the realm of business and marketing. It encapsulates the estimated length of time a customer is likely to engage with a company, from their initial purchase or interaction to the point where they cease to be an active customer. This metric holds profound significance for several reasons:

1. Strategic Planning: Understanding the expected duration of customer relationships informs strategic planning. It guides businesses in shaping their long-term goals, customer acquisition strategies, and overall business strategies. By having a clear vision of how long customers are expected to stay engaged, companies can make informed decisions about resource allocation and investment in customer retention efforts.

2. Customer Retention: Customer lifetime value underscores the importance of customer retention. It’s more cost-effective to retain existing customers than to acquire new ones. Companies can implement tailored retention strategies, such as loyalty programs, exceptional customer service, and personalized marketing, to extend the duration of customer relationships and maximize their value over time.

3. Revenue Projection: Customer lifetime value is a critical factor in revenue projection. It provides a basis for estimating the future revenue generated from a single customer or a cohort of customers. Businesses can use this information to set revenue targets and make financial forecasts, aiding in budgeting and financial planning.

4. Marketing Investment: Companies can optimize their marketing investments by considering customer lifetime value. They can calculate the allowable acquisition cost per customer based on the expected revenue that customer will generate over their lifetime. This insight ensures that marketing spend remains within profitable bounds.

5. Product and Service Improvement: A longer expected duration of customer relationships often correlates with higher satisfaction and loyalty. By analyzing the factors that contribute to extended customer lifetimes, businesses can identify areas for product or service improvement. Enhancing the customer experience can lead to longer-lasting relationships.

6. Competitive Edge: Companies that excel in maximizing customer lifetime value gain a competitive edge. They build strong, enduring relationships with their customer base, making it challenging for competitors to lure customers away with short-term incentives. This long-term focus bolsters brand reputation and stability.

7. Customer Segmentation: Customer lifetime value can also inform customer segmentation strategies. Companies can categorize customers based on their expected duration of engagement and tailor their marketing and service efforts accordingly. High-value, long-term customers may receive distinct treatment from lower-value, short-term customers.

8. Innovation: Insights derived from customer lifetime value can drive innovation. Companies can develop new products or services that align with the needs and preferences of their long-term customers, ensuring continued relevance and value delivery.

In conclusion, the expected duration of a customer’s relationship with a company serves as a linchpin in business strategy. It shapes everything from marketing tactics to customer retention efforts and informs long-term planning. By focusing on extending customer lifetimes, companies can secure sustainable growth and build enduring customer relationships that stand as a cornerstone of success in the competitive business landscape.”

Don’t stop here; you can continue your exploration by following this link for more details: Customer lifetime value: The customer compass | McKinsey

Customer Acquisition Cost (CAC)

The expenses associated with acquiring a new customer, which may include marketing, sales, and onboarding costs.

Delving into the concept of customer acquisition cost (CAC) sheds light on its multifaceted nature and its significance in shaping business strategies:

Marketing Investments: A substantial portion of CAC typically comprises marketing expenditures. Businesses allocate resources to various marketing channels, such as digital advertising, content marketing, social media campaigns, and SEO efforts, all aimed at attracting and engaging potential customers.

Sales Efforts: Beyond marketing, CAC encompasses the cost of sales efforts. This includes salaries and commissions for sales teams, the cost of sales tools and technologies, and expenses related to lead generation and customer relationship management (CRM) systems.

Onboarding and Conversion: The journey from prospect to paying customer often involves onboarding and conversion costs. These expenses may include resources allocated to product demonstrations, trial periods, or customer support teams dedicated to helping new customers integrate and utilize the product or service effectively.

Measurement and Analytics: Accurate measurement and analysis of CAC require investments in data analytics tools and expertise. Businesses need to track and assess the effectiveness of their customer acquisition strategies to optimize their spending over time.

Customer Retention: While CAC primarily focuses on acquiring new customers, it’s essential to consider the long-term relationship. Retaining existing customers can be more cost-effective than continually acquiring new ones. Therefore, CAC analysis often extends to include strategies for customer retention and loyalty programs.

Segmentation and Targeting: Understanding the various customer segments and their acquisition costs is vital. Businesses may discover that certain segments are more cost-effective to acquire than others, prompting them to refine their targeting strategies accordingly.

Lifetime Value: Evaluating CAC in isolation is incomplete without considering customer lifetime value (CLV). CLV represents the total revenue a customer is expected to generate over their entire relationship with the company. Comparing CAC to CLV helps businesses gauge the overall return on investment from their customer acquisition efforts.

Scaling and Growth: As businesses expand and grow, they may adjust their CAC strategies. Scaling often requires additional investments to reach a broader audience or enter new markets. Careful planning and cost management are essential to ensure sustainable growth.

Competitive Analysis: CAC analysis extends to competitive intelligence. Understanding how competitors acquire customers and at what cost provides insights into the market landscape. It can help businesses benchmark their own CAC and identify areas for improvement.

Efficiency Optimization: Continual optimization of CAC is crucial for maximizing profitability. Businesses can experiment with different acquisition channels, refine targeting, and automate processes to reduce costs while maintaining or even improving acquisition effectiveness.

In conclusion, the concept of customer acquisition cost (CAC) encapsulates the comprehensive expenses associated with acquiring new customers. It goes beyond marketing alone, encompassing sales efforts, onboarding, measurement, and customer retention. By carefully managing and optimizing CAC, businesses can make informed decisions, allocate resources effectively, and achieve sustainable growth in a competitive marketplace.

Looking for more insights? You’ll find them right here in our extended coverage: What Is Customer Lifetime Value And Why Is It Very Important …

The formula for CLV is as follows

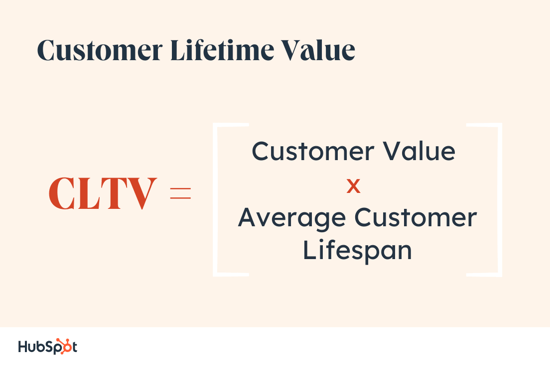

CLV = (Average Purchase Value * Purchase Frequency * Customer Lifespan) – CAC

The concept of Customer Lifetime Value (CLV) encapsulates a profound understanding of a customer’s financial worth to a business throughout their entire relationship. While the formula CLV = (Average Purchase Value * Purchase Frequency * Customer Lifespan) – CAC calculates this value, let’s explore further why CLV is a vital metric and how businesses can leverage it:

Strategic Decision-Making: CLV informs strategic decisions about customer acquisition, retention, and engagement. By quantifying the long-term value of a customer, businesses can allocate resources more efficiently, determining how much they can afford to spend on acquiring and retaining customers.

Customer Segmentation: CLV aids in segmenting customers based on their potential value. High CLV customers may receive preferential treatment or targeted marketing, while strategies for low CLV customers might focus on retention and upselling.

Product and Service Development: Understanding CLV can influence product and service development. Businesses can tailor offerings to meet the needs and preferences of high-value customers, enhancing the customer experience and driving long-term loyalty.

Pricing Strategies: CLV plays a pivotal role in pricing strategies. Businesses can justify premium pricing for products or services that cater to high CLV segments, while offering competitive pricing or discounts to attract and retain valuable customers.

Customer Loyalty Programs: CLV guides the design of customer loyalty programs. Rewarding customers based on their long-term potential can foster loyalty and increase CLV over time.

Churn Prediction and Prevention: By tracking changes in CLV over time, businesses can identify early signs of customer churn. Proactive measures can then be taken to prevent attrition, such as offering targeted incentives or addressing customer pain points.

Cross-Selling and Upselling: CLV insights can guide cross-selling and upselling efforts. Knowing a customer’s potential value enables businesses to suggest relevant products or services, increasing average purchase value and frequency.

Customer Support and Engagement: High CLV customers often expect a higher level of service. Businesses can invest in personalized support and engagement strategies to enhance the customer experience and retain these valuable relationships.

Market Expansion: CLV can inform decisions about entering new markets or expanding product lines. It helps assess the potential return on investment in these endeavors by considering the long-term value of acquired customers.

Investor and Stakeholder Confidence: A strong CLV demonstrates the financial health and growth potential of a business. This can boost investor and stakeholder confidence, attracting capital and support for expansion.

Competitive Advantage: Leveraging CLV effectively can confer a competitive advantage. Businesses that prioritize and optimize customer relationships tend to outperform rivals in terms of customer satisfaction, loyalty, and profitability.

Data-Driven Marketing: CLV relies on data analysis, fostering a culture of data-driven marketing and decision-making. This data-centric approach allows businesses to continuously refine strategies based on performance metrics.

In essence, Customer Lifetime Value is not just a formula but a strategic cornerstone that drives business decisions across various facets. It underpins customer-centric strategies that not only enhance profitability but also cultivate lasting and mutually beneficial relationships between businesses and their customers.

If you’d like to dive deeper into this subject, there’s more to discover on this page: What Is Customer Lifetime Value (CLV)? – Qualtrics

Targeted Marketing

CLV helps businesses understand the value of different customer segments. By identifying high CLV segments, companies can allocate marketing resources more effectively. These segments are often willing to spend more and are more likely to become loyal, repeat customers.

nullIf you’d like to dive deeper into this subject, there’s more to discover on this page: The Ultimate Guide to Customer Lifetime Value | Bloomreach

Personalized Customer Experiences

Armed with CLV data, businesses can tailor their interactions with customers. They can offer personalized recommendations, loyalty rewards, and exclusive offers, all of which enhance the customer experience and increase the likelihood of repeat business.

Leveraging Customer Lifetime Value (CLV) data is akin to wielding a powerful tool in the arsenal of customer-centric strategies. This invaluable data not only allows businesses to understand the long-term value of each customer but also empowers them to craft personalized and meaningful interactions that can significantly impact customer relationships and the bottom line. Here’s an extended look at how CLV data enhances customer interactions and fosters loyalty:

1. Personalized Recommendations: Armed with CLV insights, businesses can create personalized product or service recommendations tailored to each customer’s preferences, purchase history, and anticipated needs. These recommendations go beyond generic suggestions, making customers feel understood and valued. This personalization not only increases the likelihood of additional purchases but also deepens the customer’s connection with the brand.

2. Loyalty Rewards Programs: CLV data helps identify high-value customers who are likely to provide long-term revenue streams. Recognizing and rewarding these customers through loyalty programs can be particularly effective. By offering exclusive benefits, discounts, or early access to new products, businesses incentivize repeat business and strengthen customer loyalty.

3. Tailored Communication: Communication with customers can be refined based on their CLV. High-value customers may receive more personalized and frequent communications, whereas lower CLV customers might receive targeted efforts aimed at increasing their engagement. This tailored approach ensures that resources are allocated where they can have the most significant impact.

4. Predictive Analytics: CLV data isn’t just about understanding past behavior; it’s also about predicting future actions. By analyzing CLV trends, businesses can anticipate customer needs and preferences, allowing them to proactively address customer concerns or offer relevant products or services at the right time.

5. Enhanced Customer Support: High CLV customers often expect a higher level of service and support. Armed with CLV data, businesses can prioritize support for these valuable customers, ensuring they have a positive experience whenever they interact with the company. This can include expedited issue resolution, dedicated account managers, or 24/7 support for premium customers.

6. Product and Service Innovation: Understanding the lifetime value of customers helps businesses make informed decisions about product or service development. By focusing on offerings that resonate with high CLV segments, companies can allocate resources more efficiently, ensuring that their investments align with customer preferences and market demand.

7. Churn Prediction and Prevention: CLV data can also assist in identifying customers at risk of churning or discontinuing their relationship with the brand. Early detection allows businesses to take proactive measures, such as offering incentives, addressing concerns, or providing additional support, to retain these valuable customers.

8. Maximizing ROI: Ultimately, the goal of using CLV data is to maximize the return on investment (ROI) of customer interactions. By tailoring these interactions to the specific needs and behaviors of different customer segments, businesses can optimize their marketing and engagement strategies, ensuring that resources are allocated where they can generate the highest ROI.

In summary, CLV data isn’t just about calculating a customer’s worth; it’s about leveraging that knowledge to enhance every facet of the customer journey. From personalized recommendations to loyalty rewards and predictive analytics, CLV-driven strategies enable businesses to create deeper, more meaningful connections with customers. This, in turn, cultivates loyalty, boosts customer retention, and fuels long-term business success in today’s competitive marketplace.

Explore this link for a more extensive examination of the topic: The Ultimate Guide to Customer Lifetime Value | Bloomreach

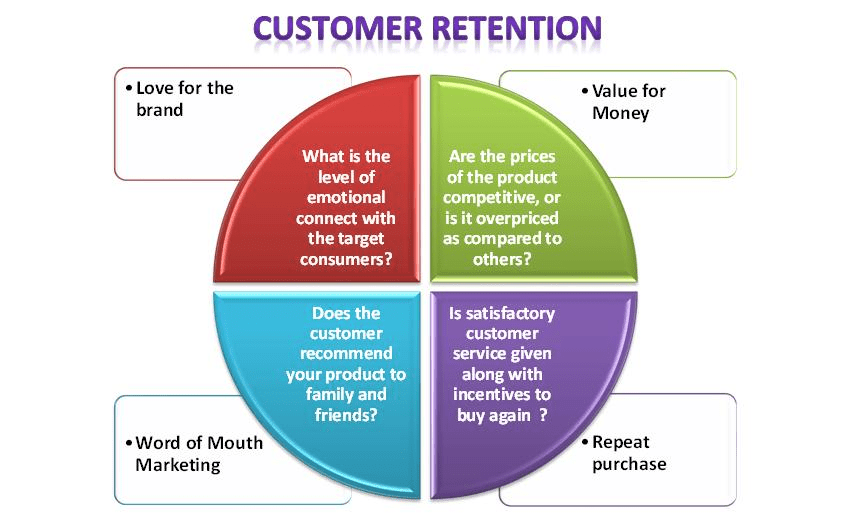

Customer Retention Strategies

Retaining existing customers is often more cost-effective than acquiring new ones. CLV reveals the potential return on investment for various customer retention strategies, such as loyalty programs, excellent customer service, and proactive issue resolution.

Retaining existing customers is a strategic imperative for businesses looking to build sustainable success and maximize profitability. While acquiring new customers is essential for growth, it’s important to recognize that the cost of retaining and nurturing existing customers is often significantly lower than the cost of acquiring new ones. Customer Lifetime Value (CLV) plays a central role in this endeavor, shedding light on the potential return on investment (ROI) for various customer retention strategies. Let’s explore how businesses can leverage CLV to inform and implement effective retention initiatives:

Loyalty Programs: CLV provides a clear financial perspective on the benefits of loyalty programs. By quantifying the potential revenue generated from loyal customers over their lifetime, businesses can gauge the ROI of loyalty incentives. This insight helps in tailoring loyalty programs to align with customer preferences and behaviors, ultimately enhancing customer retention.

Excellent Customer Service: Exceptional customer service is a cornerstone of customer retention. CLV allows businesses to assess the long-term impact of investing in service excellence. By measuring the increased customer retention, repeat purchases, and word-of-mouth referrals that result from outstanding service, companies can justify and prioritize resources for training, support, and relationship-building initiatives.

Proactive Issue Resolution: Resolving customer issues proactively can prevent churn and strengthen customer loyalty. CLV quantifies the potential loss of revenue associated with unresolved problems or dissatisfaction. Armed with this information, businesses can invest in systems, processes, and training to address issues promptly and efficiently, preserving long-term customer relationships.

Personalization and Targeted Marketing: CLV-driven segmentation enables businesses to tailor marketing efforts to individual customer preferences and behaviors. By understanding the value of different customer segments, companies can allocate marketing resources more effectively, crafting personalized offers and recommendations that enhance customer loyalty and boost CLV.

Subscription and Membership Models: For businesses employing subscription or membership models, CLV is an essential metric. It helps in forecasting the lifetime revenue generated from subscribers and members, guiding pricing strategies, feature enhancements, and customer engagement initiatives to ensure long-term commitment and loyalty.

Feedback and Product Improvement: Listening to customer feedback and using it for product or service improvements can have a direct impact on retention. CLV considers the potential loss of revenue due to product-related issues or dissatisfaction. Armed with this information, businesses can invest in research and development to enhance their offerings and meet customer expectations more effectively.

Cross-Selling and Upselling: Cross-selling and upselling are potent retention strategies when executed judiciously. CLV analysis helps businesses identify opportunities for cross-selling and upselling by assessing the potential revenue gains from expanding the customer’s relationship with the brand.

Community Building: Building a sense of community among customers fosters loyalty and strengthens brand affinity. CLV measures the long-term benefits of community engagement and advocacy. Businesses can invest in online forums, social media engagement, and events to cultivate a sense of belonging among customers.

Competitive Differentiation: CLV-driven strategies enable businesses to differentiate themselves in competitive markets. By delivering exceptional value and experiences that resonate with their most valuable customers, companies can carve out a niche and create a unique selling proposition that enhances retention.

In essence, CLV serves as a compass that guides businesses in their quest to retain customers effectively. It quantifies the long-term value of customer relationships and informs the allocation of resources and strategies that nurture and strengthen these bonds. By leveraging CLV insights, businesses can develop a holistic approach to customer retention that not only enhances loyalty but also drives sustained revenue growth and long-term success in an increasingly competitive business landscape.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Customer Lifetime Value: How To Track & Increase It

Pricing Optimization

CLV analysis informs pricing decisions. By considering the long-term value of a customer, businesses can adjust pricing strategies to maximize overall profitability. They may offer lower initial prices to attract customers, knowing that CLV will make the relationship profitable over time.

Customer Lifetime Value (CLV) analysis is akin to a compass guiding businesses toward optimal pricing strategies. It represents a profound shift from short-term gains to long-term sustainability, emphasizing the importance of fostering lasting customer relationships and maximizing overall profitability.

Holistic Pricing Strategies: CLV analysis encourages businesses to look beyond immediate revenue and consider the entire customer journey. This broader perspective allows for the development of holistic pricing strategies that balance short-term and long-term gains. For instance, companies may offer competitive or even lower initial prices to entice customers, recognizing that over time, the cumulative CLV will significantly outweigh the initial discount.

Customer Retention: CLV analysis underscores the value of customer retention. It’s often more cost-effective to retain existing customers than to acquire new ones. By offering competitive pricing to retain loyal customers, businesses ensure a consistent revenue stream and reduce the need for expensive customer acquisition efforts.

Cross-Selling and Upselling: CLV analysis highlights opportunities for cross-selling and upselling. By understanding the potential value of a customer over time, companies can introduce additional products or services at appropriate price points. These complementary offerings not only increase CLV but also enhance the overall customer experience.

Personalization: Pricing strategies become more dynamic and personalized with CLV insights. Businesses can tailor discounts, loyalty rewards, and pricing structures based on individual customer behaviors and preferences. This personalization fosters a deeper connection with customers and can lead to higher CLV.

Profit Maximization: CLV analysis seeks to maximize overall profitability, not just individual transaction profits. This means that pricing decisions are evaluated in the context of their impact on the entire customer base. Businesses may strategically offer discounts or promotions to specific segments to boost CLV while ensuring that the overall profitability of the customer base remains high.

Competitive Advantage: A deep understanding of CLV can also provide a competitive advantage. Businesses that can offer competitive prices while maintaining a focus on long-term customer value can gain an edge in the market. This combination of pricing savvy and customer-centricity can be a powerful differentiator.

Feedback Loop: CLV analysis is not a one-time endeavor but an ongoing process. It creates a feedback loop where pricing strategies are continually refined based on real customer data and performance metrics. This iterative approach allows businesses to adapt to changing market conditions and customer behaviors effectively.

In conclusion, CLV analysis is a strategic imperative for modern businesses. It transforms pricing decisions from short-sighted, transactional choices into thoughtful, customer-centric strategies that aim to maximize the lifetime value of each customer. By offering competitive prices that align with CLV, companies can build strong, profitable relationships that endure over time and drive sustained success in today’s competitive marketplace.

Should you desire more in-depth information, it’s available for your perusal on this page: Customer lifetime value: The customer compass | McKinsey

Product Development

CLV provides insights into what products or services are most valuable to customers. Businesses can use this information to prioritize product development efforts and refine their offerings to align with customer preferences.

nullTo delve further into this matter, we encourage you to check out the additional resources provided here: 4 Ways to Maximize Customer Lifetime Value and Boost Profits in …

Resource Allocation

In a world of limited resources, CLV guides resource allocation decisions. Companies can invest more heavily in acquiring and retaining high CLV customers while optimizing spending on low CLV segments.

In an era where companies are continually striving to make the most of their limited resources, Customer Lifetime Value (CLV) emerges as a beacon of strategic wisdom. This metric not only illuminates the path to sustainable growth but also informs resource allocation decisions that can shape a company’s future. Here’s an expanded perspective on how CLV plays a pivotal role in guiding resource allocation:

1. Maximizing High-Value Customer Relationships: High CLV customers are the lifeblood of any business. They contribute significantly to revenue and profitability over an extended period. CLV-driven resource allocation encourages companies to prioritize nurturing and expanding relationships with these valuable customers. This may involve personalized marketing efforts, loyalty programs, or exclusive offers that solidify the bond between the customer and the brand.

2. Allocating Marketing Budgets Effectively: Marketing budgets are often one of the most substantial resource allocations for businesses. CLV insights allow for the optimization of marketing spend. Companies can focus their marketing efforts on customer segments with the highest CLV potential, ensuring that every marketing dollar is invested where it’s most likely to yield significant returns.

3. Tailored Customer Experiences: CLV-driven resource allocation extends beyond marketing. It influences product development, customer service, and user experience enhancements. Companies can tailor their offerings to meet the specific needs and preferences of high CLV customers, delivering exceptional value that strengthens customer loyalty.

4. Reducing Churn and Attrition: CLV is not only about acquiring high-value customers but also retaining them. By understanding the factors that contribute to customer attrition, companies can allocate resources to implement retention strategies. This might involve proactive customer support, personalized recommendations, or targeted promotions designed to reduce churn and extend customer relationships.

5. Efficient Product Development: New product or feature development can be resource-intensive. CLV insights guide product teams in prioritizing initiatives that are likely to resonate most with high CLV segments. This ensures that development efforts align with the preferences and needs of the most valuable customers.

6. Pricing Strategies: Pricing decisions have a profound impact on CLV. Companies can allocate resources to pricing optimization strategies that strike a balance between maximizing revenue and providing value to high CLV customers. This might include tiered pricing models, subscription offerings, or loyalty discounts.

7. Enhanced Customer Insights: CLV analysis delves into customer behavior and preferences. By allocating resources to advanced analytics and data mining, companies can gain deeper insights into what drives CLV. This knowledge informs decision-making across various departments, from marketing to product development, leading to more informed resource allocation.

8. Predictive Modeling: CLV is not just about current value; it’s about forecasting future value. Companies can allocate resources to predictive modeling techniques that anticipate the CLV trajectory of individual customers. This enables proactive resource allocation strategies that cater to evolving customer needs and expectations.

9. Customer Segmentation: CLV can guide the segmentation of customer bases into distinct groups based on their lifetime value potential. Resource allocation can then be tailored to the unique characteristics and behaviors of each segment, optimizing the effectiveness of strategies and campaigns.

In conclusion, CLV is more than a metric; it’s a strategic compass that guides resource allocation decisions. By focusing on high CLV customers, optimizing marketing efforts, enhancing customer experiences, and making data-driven decisions, companies can achieve sustainable growth and profitability. In a world of limited resources, CLV empowers businesses to invest where it matters most, ensuring that every resource allocation decision contributes to long-term success.

Don’t stop here; you can continue your exploration by following this link for more details: What Customer Lifetime Value (CLV) Is & How to Calculate It …

Predictive Analytics

CLV serves as the foundation for predictive analytics. Companies can use historical CLV data to develop predictive models that forecast future customer behavior and identify potential high-value customers.

Customer Lifetime Value (CLV) not only serves as a foundational metric but also acts as the springboard for the exciting world of predictive analytics. This powerful combination of historical data and forward-looking models empowers companies to anticipate customer behavior, nurture valuable relationships, and fuel business growth. Let’s explore how CLV fuels predictive analytics and its manifold applications:

Data-Driven Insights: Historical CLV data is a goldmine of information about past customer interactions, purchase patterns, and loyalty trends. By harnessing this data, businesses gain valuable insights into what has worked in the past and can identify which customer segments have proven most profitable. These insights form the basis for predictive models.

Customer Segmentation: Predictive analytics, fueled by CLV, enables businesses to segment their customer base more effectively. By analyzing historical CLV alongside other customer attributes, companies can identify high-value customer segments that exhibit similar behaviors and preferences. This segmentation allows for tailored marketing strategies that cater to the specific needs of each group.

Churn Prediction: One of the key applications of predictive analytics is churn prediction. By analyzing CLV data, businesses can develop models that identify signs of customer attrition before it occurs. This proactive approach allows companies to implement retention strategies for at-risk customers, such as targeted offers, loyalty programs, or personalized communication.

Cross-Selling and Upselling: Predictive models that incorporate CLV data can forecast opportunities for cross-selling and upselling. By understanding which products or services are likely to resonate with individual customers based on their CLV profiles, businesses can craft enticing offers and recommendations that drive additional revenue.

Customer Acquisition: CLV-driven predictive analytics doesn’t stop at existing customers. It can also guide customer acquisition strategies. By identifying the characteristics and behaviors of high-value customers, businesses can target their marketing efforts toward prospects who are more likely to become valuable, long-term clients.

Personalization: Predictive models can power personalized marketing efforts. By analyzing CLV alongside other data points like browsing history and demographic information, companies can deliver highly personalized content and offers that align with each customer’s preferences and value potential.

Lifetime Value Maximization: Predictive analytics doesn’t just focus on acquiring new customers; it’s also about maximizing the value of existing ones. By predicting future CLV based on historical data, businesses can develop strategies for nurturing and expanding customer relationships over time. This might involve loyalty programs, special promotions, or tailored customer service.

Resource Allocation: Predictive analytics helps businesses allocate resources more efficiently. By forecasting which customer segments are likely to yield the highest CLV, companies can direct their marketing budgets and efforts where they are most likely to generate a significant return on investment.

Continuous Improvement: Predictive analytics powered by CLV is an iterative process. Companies regularly refine their models as new data becomes available, enabling continuous improvement in customer relationship management, marketing strategies, and overall business performance.

In summary, CLV serves as the bedrock upon which predictive analytics is built, offering a comprehensive view of customer value and behavior. Armed with historical CLV data and predictive models, companies can make informed decisions across the entire customer lifecycle, from acquisition to retention and growth. This data-driven approach not only enhances the customer experience but also fosters long-term profitability and competitiveness in today’s dynamic business landscape.

You can also read more about this here: What Is Customer Lifetime Value And Why Is It Very Important …

Challenges and Considerations

While CLV is a powerful metric, it’s essential to recognize that it’s not without its challenges. Accurate CLV calculations require access to comprehensive customer data and sophisticated analytics tools. Additionally, CLV models are based on assumptions that may evolve over time, necessitating periodic reevaluation and adjustments.

While Customer Lifetime Value (CLV) is undoubtedly a powerful metric for understanding the long-term value of customers, it’s crucial to acknowledge the challenges that come with its application. Here are some important considerations:

Data Accessibility: Accurate CLV calculations depend on access to comprehensive and high-quality customer data. This can be a significant challenge for businesses, especially smaller ones, as collecting and maintaining such data can be resource-intensive.

Data Privacy: With increasing concerns about data privacy and regulations like GDPR, businesses must handle customer data with care and compliance. Striking a balance between data collection for CLV analysis and respecting customer privacy is a delicate challenge.

Analytics Expertise: Calculating CLV often requires the use of sophisticated analytics tools and modeling techniques. Businesses may need to invest in data science expertise or engage third-party analytics providers to ensure accurate calculations.

Model Assumptions: CLV models are built on assumptions about customer behavior, such as retention rates, purchase patterns, and discounting. These assumptions may evolve over time due to changing market dynamics, customer preferences, or external factors. Regular reevaluation and adjustment of CLV models are essential to maintain their accuracy.

Customer Segmentation: CLV can vary significantly among different customer segments. It’s essential to segment the customer base to gain a more nuanced understanding of value. However, accurately defining and managing these segments can be challenging.

Market Volatility: External factors like economic downturns, industry disruptions, or competitive pressures can impact customer behavior and, consequently, CLV. Businesses need to account for such volatility when using CLV for strategic decision-making.

Multi-Channel Complexity: In today’s multi-channel environment, tracking customer interactions across various touchpoints can be challenging. Businesses must have the capability to attribute value accurately to each channel to calculate CLV effectively.

Cohort Analysis: Effective CLV analysis often involves cohort analysis, which tracks the behavior of groups of customers who joined at the same time. Managing and analyzing these cohorts can be complex but provides valuable insights into customer behavior.

Dynamic Pricing: CLV can be influenced by dynamic pricing strategies, discounts, and promotions. Businesses must factor in the impact of pricing decisions on CLV calculations.

Long-Term Strategy: CLV is most valuable when used as part of a long-term strategic approach. Businesses need to be committed to using CLV insights to drive decisions related to customer acquisition, retention, and engagement over time.

In summary, while CLV is a powerful metric for understanding the long-term value of customers, it’s not without its complexities and challenges. Businesses should be prepared to invest in data, analytics, and ongoing model refinement to harness the full potential of CLV for strategic decision-making. By recognizing these challenges and addressing them proactively, organizations can make CLV a valuable asset in their customer-centric strategies.

To expand your knowledge on this subject, make sure to read on at this location: What Customer Lifetime Value (CLV) Is & How to Calculate It …

In conclusion, Customer Lifetime Value (CLV) is a vital economic metric that transcends transactional data to provide businesses with a long-term perspective on customer value. It serves as a compass for optimizing marketing strategies, enhancing customer experiences, and ultimately maximizing long-term profits. In a business world where sustainability and profitability are paramount, CLV stands as a guiding principle for companies committed to securing lasting success in their respective industries.

nullShould you desire more in-depth information, it’s available for your perusal on this page: Moving from customer lifetime value to customer equity | Quantitative …

More links

Looking for more insights? You’ll find them right here in our extended coverage: What is CLV? Why Customer Lifetime Value Matters | Mailchimp