Table of Contents

- Cost-Plus Pricing: The Foundation of Profitability

- Value-Based Pricing: Aligning with Customer Perceptions

- Dynamic Pricing: Adapting to Market Conditions

- Price Discrimination: Tailoring to Customer Segments

- Psychological Pricing: Leveraging Perception

- Bundling and Pricing Strategies: Maximizing Customer Spend

- Competitive Pricing: Navigating the Marketplace

- The Economics of Profitable Pricing

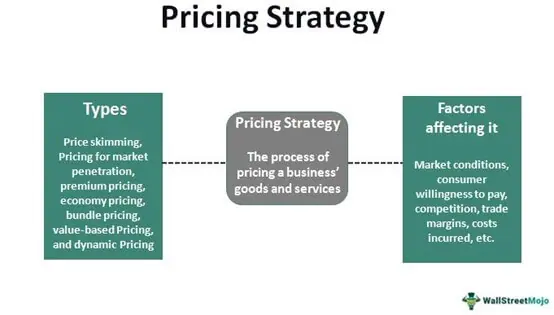

Pricing is a fundamental component of business strategy, and it plays a pivotal role in a company’s profitability. In the world of commerce, where competition is fierce and market dynamics are constantly evolving, setting the right price for a product or service is both an art and a science. Companies employ various economic approaches to pricing strategies to navigate this complex landscape and ultimately maximize their profits. In this article, we will delve into some of these approaches and explore how they contribute to a company’s bottom line.

Pricing is indeed a fundamental component of business strategy, and its significance cannot be overstated. It serves as a linchpin that connects a company’s financial health with its market positioning and customer value proposition. In today’s dynamic and competitive commercial landscape, mastering the art and science of pricing is essential for a company’s profitability and long-term success.

In the ever-evolving world of commerce, setting the right price for a product or service is akin to finding the delicate balance on a scale. On one side, businesses must ensure that their prices cover costs and generate a reasonable profit margin to sustain operations and investments. On the other side, they must consider the intricate interplay of market forces, consumer behavior, and competitive dynamics that influence pricing decisions.

Companies employ a spectrum of economic approaches to pricing strategies to navigate this multifaceted landscape effectively. These approaches draw from economic principles and data-driven analyses to formulate pricing strategies that align with both market realities and business objectives.

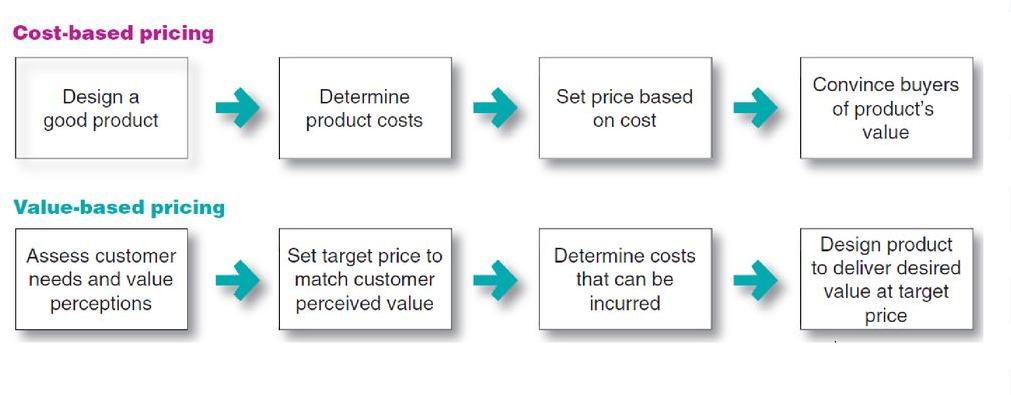

One such approach is cost-based pricing, where companies calculate prices based on production costs and desired profit margins. This method provides a solid financial foundation for pricing decisions but may overlook the influence of consumer demand and competitive factors.

Conversely, demand-based pricing, rooted in economic principles like price elasticity of demand, tailors prices to how consumers perceive value and respond to price changes. It recognizes that consumer willingness to pay can vary widely and can be influenced by factors such as brand image, product differentiation, and market conditions.

Dynamic pricing takes pricing strategies a step further by adjusting prices in real-time based on various variables, such as demand fluctuations, competitor pricing, and even individual customer behavior. This approach leverages advanced data analytics and algorithms to optimize prices for maximum revenue and profit under changing conditions.

Furthermore, value-based pricing considers the unique value a product or service offers to customers and assigns a price commensurate with that value. This approach requires a deep understanding of customer needs and preferences and aligns pricing with the perceived benefits customers receive.

In this article, we will delve into these pricing approaches and explore how they contribute to a company’s bottom line. We will discuss the nuances of each method, their applicability in different contexts, and how companies can blend them to create a well-rounded pricing strategy. By understanding these economic pricing approaches, businesses can navigate the intricate web of pricing decisions with confidence, ultimately driving profitability and ensuring their relevance in today’s highly competitive market landscape.

You can also read more about this here: 15 pricing strategies + how to set yours | Zapier

Cost-Plus Pricing: The Foundation of Profitability

Cost-plus pricing is one of the most basic and widely used economic approaches to pricing. It involves calculating the cost of producing a product or delivering a service and then adding a markup to determine the selling price. The markup represents the desired profit margin.

The advantage of cost-plus pricing is its simplicity and reliability. It ensures that a company covers its costs and generates a predictable profit. However, it may not take into account market demand or competitive pricing, potentially leaving money on the table.

nullDon’t stop here; you can continue your exploration by following this link for more details: Pricing Strategy Guide: Unlock Growth with These 3 Strategies

Value-Based Pricing: Aligning with Customer Perceptions

Value-based pricing is an economic approach that hinges on the perceived value of a product or service in the eyes of the customer. Instead of starting with costs, companies analyze what customers are willing to pay based on the benefits and value they receive.

This approach recognizes that customers make purchasing decisions based on the perceived value they derive from a product or service, rather than the cost of production. Value-based pricing allows companies to capture a portion of the additional value they provide, thus maximizing profits.

Certainly, let’s delve deeper into the concept of value-based pricing and its strategic advantages for companies:

“Value-based pricing is a sophisticated economic approach that places the perceived value of a product or service at the forefront of pricing strategies. Instead of beginning with production costs as a starting point, companies using this approach delve into a profound understanding of what customers are willing to pay, driven by the benefits and value they receive. This approach fundamentally acknowledges that consumers make purchasing decisions based on the perceived value they derive from a product or service, rather than the bare cost of production. By embracing value-based pricing, companies can unlock a myriad of strategic advantages that go beyond conventional cost-centric pricing models:

Precision in Pricing: Value-based pricing is inherently customer-centric. It delves into the intricacies of customer preferences, pain points, and aspirations. As a result, companies gain a precise understanding of how different customer segments perceive and value their offerings. This precision allows for the creation of tailored pricing structures that resonate with specific customer groups.

Maximizing Profits: Value-based pricing allows companies to capture a portion of the additional value they provide to customers. When customers perceive a product or service as delivering greater benefits than alternatives in the market, they are often willing to pay a premium price. This premium captures a share of the added value, resulting in higher profit margins.

Enhanced Customer Loyalty: By focusing on the perceived value and benefits delivered, value-based pricing fosters stronger customer loyalty. When customers consistently receive a product or service that meets or exceeds their expectations and provides excellent value for the price, they are more likely to become repeat buyers and brand advocates.

Competitive Advantage: Value-based pricing can be a source of competitive advantage. It enables companies to differentiate themselves in the market by emphasizing the unique value proposition of their offerings. This differentiation can insulate them from price wars and commoditization, making it difficult for competitors to replicate their value.

Innovation and Product Development: A value-based pricing strategy encourages innovation and product development. Companies strive to enhance their products and services to align more closely with customer needs and preferences. This drive for continuous improvement ensures that offerings remain competitive and relevant in the eyes of customers.

Flexibility in Pricing: Value-based pricing offers flexibility in adapting to market dynamics. Companies can adjust prices based on changes in customer perception and evolving market conditions. When additional features or improvements enhance the perceived value, prices can be adjusted to reflect this value accurately.

Ethical Pricing: Customers appreciate transparency and ethical pricing. Value-based pricing is often seen as more ethical because it aligns the price with the perceived value, rather than exploiting customer ignorance or desperation. This approach fosters trust and long-term customer relationships.

Market Expansion: As companies better understand the diverse value perceptions of various customer segments, they can identify new markets and opportunities. Value-based pricing allows them to tailor their offerings and pricing structures to cater to these untapped markets.

In conclusion, value-based pricing represents a paradigm shift in pricing strategy, placing the customer’s perception of value at the core. It is a strategic approach that recognizes that customers are willing to pay based on the benefits and value they receive. By embracing this approach, companies can unlock the potential for increased profits, enhanced customer loyalty, and a sustained competitive edge in today’s dynamic marketplace.”

To delve further into this matter, we encourage you to check out the additional resources provided here: Value-Based Pricing of Prescription Drugs Benefits Patients and …

Dynamic Pricing: Adapting to Market Conditions

Dynamic pricing, also known as demand-based pricing, leverages real-time data and algorithms to adjust prices based on changing market conditions. Companies monitor factors such as demand, competition, and even weather to optimize prices.

For example, an airline may increase ticket prices during peak travel times and lower them during off-peak periods. E-commerce platforms frequently adjust prices based on customer browsing behavior and competitor pricing.

Dynamic pricing enables companies to respond swiftly to market fluctuations, maximize revenue during high-demand periods, and attract price-sensitive customers during slower times.

Dynamic pricing, a sophisticated strategy rooted in real-time data and algorithms, holds the power to transform pricing dynamics across various industries. Expanding on this concept, let’s explore how dynamic pricing impacts businesses and the broader economy:

Personalized Customer Experience: Dynamic pricing isn’t just about maximizing revenue; it’s also about tailoring prices to individual customer preferences. By analyzing a customer’s historical purchasing behavior and preferences, businesses can offer personalized discounts and incentives, enhancing customer loyalty and satisfaction.

Seasonal and Event-Based Pricing: Beyond demand fluctuations, dynamic pricing can factor in external events and seasons. For instance, hotels might adjust prices for major holidays or local festivals, optimizing revenue during peak tourist seasons while offering attractive rates during quieter periods. This flexibility ensures that businesses can cater to different customer segments throughout the year.

Inventory Management: Dynamic pricing plays a crucial role in inventory management. Businesses can adjust prices to clear out excess inventory or capitalize on limited-time promotions. This practice prevents overstocking, reduces waste, and optimizes supply chain efficiency.

Competitive Strategy: Keeping a close eye on competitor pricing is essential in dynamic pricing. Businesses can strategically position their products or services by offering competitive rates. This approach helps in gaining market share and attracting price-sensitive customers without compromising profitability.

Consumer Behavior Insights: Dynamic pricing generates a wealth of consumer behavior data. By analyzing patterns and trends, businesses gain insights into how consumers respond to price changes. This information guides future pricing strategies and product offerings, fostering innovation and adaptability.

Ethical Considerations: While dynamic pricing is a powerful tool, it also raises ethical concerns. Overly aggressive pricing strategies can lead to customer dissatisfaction and damage a brand’s reputation. Businesses must use dynamic pricing ethically and transparently, ensuring that customers feel they are getting fair value.

Economic Efficiency: From a macroeconomic perspective, dynamic pricing contributes to economic efficiency. It allocates resources more effectively by matching supply with demand in real time. This prevents shortages and surpluses, ultimately benefiting both businesses and consumers.

Revenue Maximization: Dynamic pricing allows businesses to capture the full spectrum of consumer willingness to pay. During high-demand periods, they can charge higher prices, optimizing revenue. Conversely, during low-demand periods, they can attract budget-conscious customers by offering competitive rates.

Small Business Impact: While dynamic pricing is often associated with large corporations, small businesses can also benefit. It levels the playing field by enabling smaller players to compete effectively in the market. Cloud-based pricing software and platforms make dynamic pricing accessible to businesses of all sizes.

Regulatory Considerations: Dynamic pricing may face regulatory scrutiny in certain industries. Governments and consumer protection agencies monitor pricing practices to ensure fairness and prevent price discrimination. Businesses must stay informed about relevant regulations and compliance requirements.

In summary, dynamic pricing is a multifaceted strategy that transcends mere price adjustments. It has far-reaching implications for businesses, consumers, and the broader economy. When implemented judiciously and ethically, dynamic pricing can enhance customer experiences, optimize resource allocation, and contribute to economic efficiency, fostering a competitive and responsive marketplace.

You can also read more about this here: What Is Differential Pricing and How to Use It Effectively in Ecommerce

Price Discrimination: Tailoring to Customer Segments

Price discrimination is an economic strategy that involves charging different prices to different customer segments for the same product or service. Companies use this approach to capture additional consumer surplus—the difference between what a customer is willing to pay and the actual price.

Common examples of price discrimination include student discounts, senior citizen rates, and tiered pricing for software products. By tailoring prices to specific segments based on factors like willingness to pay, demographics, or usage patterns, companies can increase their overall revenue and profitability.

Price discrimination, a sophisticated economic strategy, reveals the dynamic interplay between consumer behavior, market segmentation, and revenue optimization. This practice isn’t solely about charging different prices to different customer segments; it’s a strategic maneuver with multifaceted benefits:

Consumer Equity: Price discrimination isn’t always about extracting the maximum possible price from each customer. It can also be a tool for promoting fairness and ensuring affordability. For instance, student discounts and senior citizen rates make products and services accessible to diverse demographics.

Dynamic Pricing: Beyond demographic factors, price discrimination takes into account the real-time dynamics of supply and demand. Companies can adjust prices based on factors like time of day, season, or even the customer’s location. This dynamic approach ensures that prices remain competitive and reflective of market conditions.

Competitive Advantage: Firms that master the art of price discrimination can gain a competitive edge. By aligning pricing with the perceived value of their products or services, they can attract a broader customer base while still optimizing revenue.

Maximizing Market Coverage: Price discrimination enables companies to capture a wider share of the market. While some customers may be willing to pay a premium for a product, others may have a lower willingness to pay. By catering to both segments, businesses expand their reach.

Revenue Stabilization: In industries with fluctuating demand, price discrimination can provide revenue stability. By attracting price-sensitive customers during slow periods and premium-paying customers during peak times, companies can mitigate revenue volatility.

Customer Retention: Loyalty programs and tiered pricing models, often forms of price discrimination, foster customer retention. Customers who receive special treatment or discounts are more likely to remain loyal to a brand, enhancing long-term profitability.

Data Utilization: Price discrimination relies on data analysis to segment markets effectively. This data can be a goldmine for understanding customer preferences, which can inform product development, marketing strategies, and future pricing decisions.

Elasticity Insights: The practice of price discrimination provides valuable insights into price elasticity—the responsiveness of demand to price changes. This knowledge helps companies fine-tune pricing strategies for maximum profitability.

Resource Allocation: By allocating resources more efficiently through price discrimination, companies can invest in product improvement, innovation, and customer service. This reinvestment can further enhance their competitive position in the market.

Sustainability: Price discrimination can contribute to the sustainability of businesses by optimizing revenue streams, allowing companies to weather economic downturns and invest in sustainable practices.

In essence, price discrimination is a dynamic and strategic tool that goes beyond revenue optimization. It touches on consumer equity, market competitiveness, and resource allocation while enhancing a company’s ability to adapt to ever-changing market conditions. When wielded thoughtfully, it can be a win-win strategy that benefits both businesses and their diverse customer base.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Dynamic Pricing: From Price Discrimination Theory to Modern …

Psychological Pricing: Leveraging Perception

Psychological pricing is a subtle yet powerful economic approach that leverages human psychology to influence buying behavior. It involves setting prices that create specific psychological perceptions, such as the perception of value or affordability.

Common psychological pricing tactics include setting prices just below a round number (e.g., $9.99 instead of $10), offering “buy one, get one free” promotions, or highlighting discounts with phrases like “50% off.”

By shaping the way customers perceive prices, companies can influence their decision-making and encourage purchases, ultimately driving profitability.

nullDon’t stop here; you can continue your exploration by following this link for more details: The Ultimate Guide to Pricing Strategies & Models

Bundling and Pricing Strategies: Maximizing Customer Spend

Bundling is a pricing strategy that involves offering multiple products or services together at a discounted price compared to purchasing them individually. This approach encourages customers to buy more, maximizing revenue per transaction.

Companies also use pricing tiers to encourage customers to upgrade to more expensive packages or purchase additional features. For example, streaming services offer multiple subscription tiers with varying levels of content and features.

By strategically bundling and tiering products or services, companies can increase the average transaction value and boost profitability.

Bundling and pricing tiers are two versatile strategies that have played a pivotal role in shaping consumer behavior and optimizing revenue streams for companies across various industries. Let’s explore these strategies in greater detail and understand how they contribute to maximizing revenue and profitability:

1. The Power of Bundling: Bundling is a pricing strategy that leverages the attractiveness of value packages. By offering multiple products or services together at a discounted price compared to purchasing them individually, companies tap into the psychological appeal of getting more for less. This approach not only encourages customers to make a purchase but also compels them to buy more than they originally intended, thereby increasing the revenue per transaction.

For example, fast-food chains often offer bundled meal deals that include a burger, fries, and a drink at a lower price than if each item were purchased separately. This bundling strategy not only simplifies decision-making for customers but also encourages them to add complementary items, boosting the overall transaction value.

2. Pricing Tiers and Upgrades: Pricing tiers are another strategic approach that companies use to cater to a diverse range of customer needs and budgets. By offering multiple product or service tiers with varying features, companies can effectively target different market segments and encourage customers to choose a tier that aligns with their preferences and willingness to pay.

For instance, software-as-a-service (SaaS) providers often offer pricing tiers with different levels of functionality, from basic to premium. Customers can start with a lower-priced tier and upgrade as their needs grow or when they see the value in additional features. This tiered approach not only increases the average transaction value over time but also promotes customer loyalty.

3. Subscription Services and Add-Ons: Subscription-based businesses have mastered the art of tiered pricing and upselling through add-ons. Streaming services, for instance, offer a range of subscription tiers, each providing access to different content libraries and features. Customers can choose the tier that best aligns with their viewing preferences and budget. Additionally, they have the option to purchase add-ons, such as premium channels or ad-free experiences, further increasing the revenue per customer.

4. Data-Driven Optimization: The success of bundling and pricing tiers relies on data-driven insights and continuous optimization. Companies use data analytics to understand customer preferences, track purchasing patterns, and identify opportunities for bundling complementary products or creating new pricing tiers. This iterative process ensures that pricing strategies remain effective and aligned with customer expectations.

5. Customer-Centric Approach: Both bundling and pricing tiers should be designed with the customer’s perspective in mind. They should offer genuine value, convenience, and flexibility. When customers perceive that they are getting more for their money and have options that cater to their needs, they are more likely to engage, make repeat purchases, and become loyal patrons.

In conclusion, bundling and pricing tiers are versatile strategies that not only drive revenue growth but also enhance customer satisfaction and retention. By strategically combining products or services, tailoring pricing options, and continuously refining their approach, companies can navigate the dynamic landscape of consumer preferences and purchasing behavior, ultimately boosting profitability and maintaining a competitive edge in the market.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Rule the Market: 14 Retail Pricing Strategies for 2023

Competitive Pricing: Navigating the Marketplace

Competitive pricing is an economic approach that involves setting prices based on what competitors charge for similar products or services. Companies use this approach to gain a competitive edge or maintain market share.

To execute competitive pricing effectively, companies continuously monitor competitor pricing and adjust their own prices accordingly. This approach ensures that a company’s prices remain competitive within the market.

Competitive pricing, as an economic strategy, is a dynamic and proactive approach that goes beyond simply mirroring what competitors charge for similar products or services. It’s a strategic tool that companies employ to gain a competitive edge or maintain their market share in a highly competitive business environment. Here, we delve deeper into the intricacies of competitive pricing and how it influences businesses:

Consumer-Centric Focus: Competitive pricing places consumers at the center of decision-making. By offering prices that are competitive with rivals, companies cater to the preferences and expectations of cost-conscious consumers, enhancing their attractiveness in the market.

Market Positioning: Competitive pricing allows companies to position themselves strategically within the market. They can choose to be price leaders, aiming for high sales volume, or price followers, seeking a niche market segment. The strategy selected influences how they set prices relative to competitors.

Price Discrimination: Companies can use competitive pricing to implement price discrimination strategies. This involves setting different prices for different customer segments based on their willingness to pay. By monitoring competitors, businesses can adjust prices for specific customer groups more effectively.

Real-Time Adjustments: In today’s fast-paced business landscape, competitive pricing necessitates real-time adjustments. Companies leverage data analytics and pricing software to monitor competitor pricing continuously. This allows them to respond swiftly to changes in the market and competitor pricing strategies.

Cost Considerations: While competitive pricing focuses on rival prices, it does not ignore the importance of cost analysis. Companies must consider their production costs, overhead, and desired profit margins when setting prices. This ensures that competitive prices are also financially sustainable.

Promotional Pricing: Competitive pricing is often integrated with promotional strategies. Businesses use periodic discounts, offers, and sales events to attract customers and drive sales while still aligning with the broader competitive pricing framework.

Long-Term Sustainability: Competitive pricing is not solely about short-term gains. It’s a long-term strategy that aims to create sustainable market positions. By remaining competitive, companies can retain customer loyalty, strengthen their brand, and withstand market fluctuations.

Market Research: Competitive pricing relies on comprehensive market research. Companies must have a deep understanding of their competitors, including their pricing strategies, product offerings, and customer segments. This knowledge informs pricing decisions.

Global Competition: In today’s globalized economy, competitive pricing extends beyond domestic markets. Companies must also consider global competitors and adapt their pricing strategies for international markets, factoring in currency exchange rates, cultural differences, and local regulations.

Ethical Considerations: While competitive pricing can be highly effective, companies must ensure it aligns with ethical standards. Price wars and predatory pricing tactics can harm both businesses and consumers. Maintaining ethical boundaries is essential.

In summary, competitive pricing is a multifaceted economic approach that goes beyond mere price matching. It’s a dynamic strategy that involves continuous monitoring of competitors, careful consideration of cost structures, and alignment with broader market positioning and consumer preferences. When executed effectively, competitive pricing can help companies thrive in competitive markets, build customer loyalty, and achieve long-term success. It’s a tool that empowers businesses to navigate the complexities of the modern business landscape while remaining agile and customer-focused.

Should you desire more in-depth information, it’s available for your perusal on this page: Navigating demand and pricing during COVID-19 | McKinsey

The Economics of Profitable Pricing

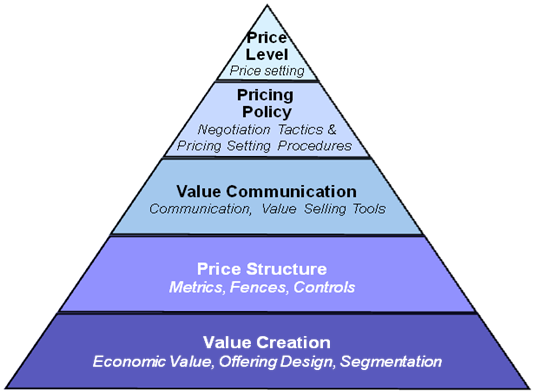

Effective pricing is not a one-size-fits-all endeavor. It requires a deep understanding of market dynamics, customer behavior, and economic principles. By employing these economic approaches to pricing strategies, companies can navigate the intricate pricing landscape, align their prices with customer perceptions, and ultimately maximize their profits. The art of pricing is an ongoing process that requires adaptability and data-driven decision-making, ensuring that businesses thrive in the ever-changing marketplace.

Effective pricing is a multifaceted discipline, far removed from the one-size-fits-all approach that some might envision. It’s an intricate dance where businesses must harmonize their prices with the shifting rhythms of market dynamics, consumer behavior, and economic principles. To master this art, companies need to embrace a variety of economic approaches that are tailored to their unique circumstances.

Market Segmentation: One of the fundamental principles of effective pricing is understanding that different customer segments have distinct preferences and price sensitivities. By segmenting the market and creating pricing strategies tailored to each segment, businesses can maximize revenue. For example, premium pricing might be suitable for one group, while value-based pricing may work better for another.

Price Discrimination: Price discrimination involves charging different prices to different customer groups for the same product or service. It’s a powerful strategy that relies on understanding consumer willingness to pay. Businesses can implement various forms of price discrimination, such as first-degree (individualized pricing), second-degree (tiered pricing), and third-degree (segmented pricing), to extract maximum value from their customer base.

Dynamic Pricing: In a dynamic market, where conditions change rapidly, static pricing may fall short. Dynamic pricing involves adjusting prices in real-time based on various factors like demand, competitor pricing, and inventory levels. Airlines and ride-sharing services are prime examples of industries that employ dynamic pricing to optimize revenue.

Value-Based Pricing: Understanding the perceived value of a product or service to the customer is essential. Value-based pricing sets prices based on what customers are willing to pay, rather than just the cost of production. This approach aligns prices with the benefits and satisfaction that customers derive from the product, often allowing for higher price points.

Psychological Pricing: Consumer psychology plays a significant role in pricing strategies. Techniques like charm pricing (ending prices with .99), bundling (offering related products together), and decoy pricing (introducing a less attractive option to make the main product seem like a better deal) can influence purchasing decisions.

Elasticity Analysis: Price elasticity measures how sensitive demand is to changes in price. By conducting elasticity analysis, companies can identify the price points that maximize revenue. For inelastic goods (where demand is relatively insensitive to price changes), higher prices may lead to higher profits, while for elastic goods, lower prices might be more effective in driving sales.

Competitor-Based Pricing: Monitoring competitor pricing is crucial in many industries. Understanding how competitors price their products and services can inform pricing decisions. Companies can choose to match or undercut competitors’ prices strategically.

Data-Driven Insights: Modern pricing strategies are increasingly reliant on data analytics and artificial intelligence. Advanced algorithms can analyze vast datasets, predict consumer behavior, and recommend optimal prices in real-time.

The art of pricing is not a static process; it’s an ongoing journey. Businesses must remain adaptable and vigilant, constantly reassessing their pricing strategies based on market shifts and customer feedback. The successful navigation of the pricing landscape hinges on data-driven decision-making, enabling companies to thrive in an ever-changing marketplace and maintain a competitive edge.

To delve further into this matter, we encourage you to check out the additional resources provided here: 9.2 How a Profit-Maximizing Monopoly Chooses Output and Price …

More links

Don’t stop here; you can continue your exploration by following this link for more details: How Starbucks Uses Pricing Strategy For Profit Maximization