Introduction

In the realm of global finance, Germany holds a position of significant influence and prominence. Its robust financial services sector, renowned banking institutions, and commitment to stability have shaped the international financial landscape for decades. In this article, we will explore Germany’s far-reaching impact on global finance, delving into its banking prowess, regulatory framework, and contributions to the worldwide financial ecosystem.

Within the intricate web of global finance, Germany occupies a position of remarkable influence and prominence. Its financial sector, with its solid reputation and unwavering commitment to stability, has been instrumental in shaping the international financial landscape over the course of many decades. In this article, we will embark on a journey to uncover the multifaceted ways in which Germany’s financial prowess, regulatory diligence, and contributions to the worldwide financial ecosystem have left an indelible mark.

Banking Titans: Germany is home to some of the world’s most venerable and robust banking institutions. Names like Deutsche Bank, Commerzbank, and KfW Group resonate globally as pillars of financial strength and reliability. These banks not only serve as economic powerhouses within Germany but also operate as crucial players on the international stage, facilitating global trade and investment.

Stability Amidst Turbulence: The hallmark of Germany’s financial sector is its unwavering commitment to stability. This dedication to sound fiscal practices has made the country a safe haven for investors during times of global financial turbulence. Germany’s ability to weather economic storms serves as a beacon of trust and resilience in the eyes of the

You can also read more about this here: McKinsey’s Global Banking Annual Review | McKinsey

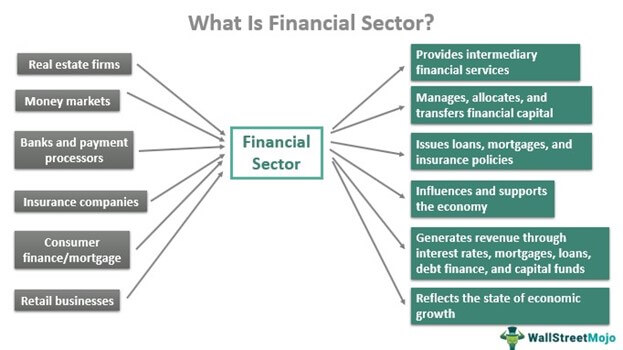

Germany’s financial services sector is a cornerstone of its economic strength. Several factors contribute to its prominence:

Germany’s financial services sector is indeed a cornerstone of its economic strength, underpinned by a confluence of factors that have collectively established it as a global financial powerhouse. Expanding upon this notion, let’s delve deeper into the key factors that have contributed to the prominence of Germany’s financial services sector:

Banking Expertise: Germany’s banking expertise, characterized by a strong focus on financial acumen and innovation, has propelled its financial services sector to international acclaim. German banks, both large and small, are recognized for their proficiency in providing a diverse range of financial products and services, including corporate and investment banking, retail banking, and asset management.

Stability and Trustworthiness: One of the hallmarks of Germany’s financial services sector is its unwavering commitment to stability and trustworthiness. The sector has been built on a foundation of prudential risk management, stringent regulatory oversight, and conservative lending practices. This stability and adherence to responsible banking have garnered trust among both domestic and international investors, making Germany a preferred destination for financial services.

Global Banking Giants: Germany is home to globally renowned banking giants like Deutsche Bank and Commerzbank, which have established a formidable presence on the world stage. These institutions offer a comprehensive suite of financial solutions and serve as key players in international finance, contributing to Germany’s prominence in the global financial arena.

Innovation and Investment Banking: Germany’s financial services sector is characterized by a robust culture of innovation, particularly in the field of investment banking. The nation’s investment banks excel in structuring complex financial products, mergers and acquisitions, and capital market transactions. This innovative prowess has attracted a diverse clientele from around the world.

Wealth Management Expertise: Germany’s wealth management industry is highly regarded for its proficiency in catering to high-net-worth individuals and families globally. German wealth managers are skilled at creating customized financial solutions that align with clients’ unique financial goals and risk profiles, contributing to the growth and preservation of wealth on a global scale.

Insurance Sector: Germany’s insurance sector, represented by industry leaders such as Allianz and Munich Re, commands global recognition. These companies provide critical risk management and insurance solutions to individuals, businesses, and governments worldwide. Their expertise in underwriting complex risks and addressing emerging challenges contributes to the stability of the global insurance industry.

Cross-Border Financial Services: Germany’s strategic location within Europe has facilitated cross-border financial services. German banks and financial institutions play a vital role in facilitating international trade, investments, and financial transactions within the European Union and beyond, contributing to the fluidity of global commerce.

In conclusion, Germany’s financial services sector has earned its reputation as a global financial stronghold through a combination of banking expertise, unwavering stability, innovation, and a commitment to responsible financial practices. Its ability to adapt to evolving market dynamics and meet the diverse needs of clients and investors worldwide underscores its enduring significance in the global financial landscape. As Germany continues to navigate the challenges and opportunities of the financial sector, its role as a global financial leader is likely to persist and evolve.

Don’t stop here; you can continue your exploration by following this link for more details: McKinsey’s Global Banking Annual Review | McKinsey

Germany is home to some of the world’s largest and most respected banking institutions. Deutsche Bank and Commerzbank, among others, have a global presence, offering a wide range of financial services, from corporate banking to asset management.

Germany’s position as a financial powerhouse extends beyond its renowned banking institutions. These institutions, like Deutsche Bank and Commerzbank, are at the forefront of global finance, offering an array of services that span the financial spectrum. From corporate banking, asset management, and investment banking to wealth management and retail banking, these institutions cater to diverse clientele with precision and expertise.

The significance of Germany’s banking sector goes beyond its domestic borders. Deutsche Bank, for example, operates on a global scale, with offices in key financial hubs worldwide. This international presence not only facilitates cross-border trade and investment but also underscores Germany’s role in the interconnected web of global finance.

Moreover, the stability and reputation of German banks have made them trusted partners for corporations, governments, and individuals alike. Their adherence to stringent regulatory standards and commitment to transparency have earned them a position of respect in the international financial community. This trust is pivotal in facilitating large-scale financial transactions, international investments, and the flow of capital across borders.

Germany’s financial institutions are also pivotal in supporting the country’s robust export-driven economy. They provide essential financial services such as trade finance and risk management, enabling German companies to navigate complex international markets with confidence.

In addition to their financial prowess, these institutions contribute significantly to the development and dissemination of financial knowledge and expertise. They often collaborate with educational institutions and think tanks, fostering a culture of financial literacy and innovation that benefits not only Germany but also the broader global financial ecosystem.

In summary, Germany’s large and reputable banking institutions, including Deutsche Bank and Commerzbank, are integral to its economic landscape and have a far-reaching impact on the global financial stage. Their comprehensive range of services, commitment to excellence, and international presence position them as key players in the complex and ever-evolving world of finance.

Should you desire more in-depth information, it’s available for your perusal on this page: Global Financial Stability Report

German investment banks are renowned for their expertise in various financial instruments, including mergers and acquisitions, capital markets, and structured finance. They play a crucial role in global financial markets, facilitating complex transactions for multinational corporations.

German investment banks have carved out a distinctive niche in the intricate world of global finance. Their reputation for expertise in a wide array of financial instruments, from mergers and acquisitions (M&A) to capital markets and structured finance, precedes them. These banks serve as pivotal players on the international financial stage, facilitating complex transactions that drive the growth and strategy of multinational corporations.

In the realm of M&A, German investment banks are trusted advisors renowned for their strategic acumen. They assist in identifying potential merger or acquisition targets, evaluating their financial health, and navigating the intricate negotiations that often accompany such transactions. Their role extends beyond mere transaction facilitation; they help companies unlock synergies, optimize capital structures, and ultimately enhance their competitiveness in the global market.

When it comes to capital markets, German investment banks are adept at structuring and executing various financial instruments, including initial public offerings (IPOs), bond issuances, and equity placements. Their deep knowledge of market dynamics and investor sentiment allows them to tailor financing solutions that align with their clients’ objectives. This expertise not only benefits German corporations but also attracts international companies seeking to tap into the global capital markets.

Structured finance is another arena where German investment banks excel. They are skilled in creating innovative financial products, such as collateralized debt obligations (CDOs) and asset-backed securities (ABS), which are used to optimize risk management and capital allocation. In an increasingly complex financial landscape, these institutions provide invaluable insights and solutions that help clients navigate the intricacies of structured finance.

Beyond their technical proficiency, German investment banks are known for their commitment to ethical and sustainable finance practices. They are active participants in the global movement towards responsible banking, incorporating environmental, social, and governance (ESG) criteria into their decision-making processes. This not only aligns with evolving market demands but also reinforces their reputation as trusted partners for corporations striving to integrate sustainability into their financial strategies.

In conclusion, German investment banks’ expertise in various financial instruments is not just about transactions; it’s about strategic collaboration. Their role extends beyond financial advisory to shaping the strategies and trajectories of multinational corporations. As they continue to adapt to evolving market dynamics and embrace responsible banking practices, German investment banks remain influential and indispensable players in the global financial landscape, fostering economic growth and innovation across continents.

For additional details, consider exploring the related content available here Structural changes in banking after the crisis

Germany boasts a thriving wealth management industry, providing tailored financial solutions to high-net-worth individuals and families worldwide. These services contribute to global asset management and wealth preservation.

Germany’s thriving wealth management industry is a testament to the country’s financial expertise and commitment to providing top-notch financial services. Catering to high-net-worth individuals and families worldwide, German wealth management firms offer a comprehensive array of solutions aimed at optimizing and preserving their clients’ wealth.

One key strength of Germany’s wealth management sector is its reputation for precision and reliability. Clients entrust their assets to German financial experts, drawn to the country’s strong tradition of fiscal discipline and risk management. This trust is further bolstered by stringent regulations and a culture of transparency that underpins the industry, ensuring that clients’ financial interests are protected.

The services offered by German wealth management firms extend beyond traditional investment management. They encompass estate planning, tax optimization, and customized financial strategies tailored to individual client goals. This holistic approach recognizes that wealth management is not just about accumulating assets but also about safeguarding them for future generations and optimizing their use to achieve broader financial objectives.

Germany’s influence in global asset management is substantial. The country is home to several leading asset management companies, managing portfolios that span asset classes and geographies. German financial institutions are trusted stewards of assets from clients around the world, contributing significantly to the global financial ecosystem.

Furthermore, the impact of Germany’s wealth management industry reverberates beyond its borders. As clients seek diversified investments and wealth preservation strategies, German wealth managers often engage with international markets, fostering cross-border investment and financial cooperation. This interconnectedness benefits not only clients but also the broader global financial landscape.

In an ever-evolving financial world, Germany’s wealth management industry remains at the forefront of innovation. It adapts to changing market conditions, embraces sustainable investing, and incorporates cutting-edge technologies to provide clients with state-of-the-art solutions.

In summary, Germany’s thriving wealth management industry is not just about managing wealth; it’s about building long-term financial security, preserving legacies, and contributing to the global financial marketplace. With its commitment to excellence, transparency, and financial stewardship, Germany continues to be a prominent player in the world of wealth management.

For additional details, consider exploring the related content available here J.P. Morgan | Official Website

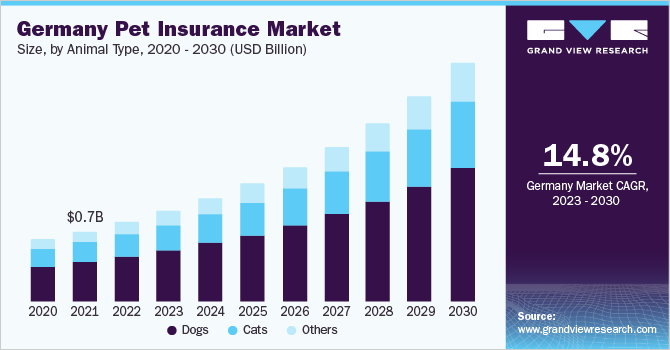

Germany’s insurance sector is among the largest in Europe, with companies like Allianz and Munich Re ranking as global leaders in the industry. They provide essential risk management solutions to individuals and businesses globally.

Germany’s insurance sector stands as a cornerstone of the nation’s financial stability and plays a crucial role not only within Europe but also on the global stage. The presence of insurance giants like Allianz and Munich Re underscores the sector’s importance and its far-reaching impact.

One of the key strengths of Germany’s insurance sector is its commitment to innovation and adaptability. These companies continually evolve their offerings to meet the changing needs of a dynamic global market. From traditional life and property insurance to cutting-edge products covering cyber risks and climate-related challenges, German insurers are at the forefront of developing innovative solutions that provide security and peace of mind to individuals and businesses worldwide.

In addition to their extensive range of insurance products, Allianz, Munich Re, and other German insurers are renowned for their financial stability and reliability. Their robust risk management strategies and substantial reserves enable them to weather economic downturns and unforeseen events, instilling confidence in their policyholders and investors alike. This stability is especially crucial during times of crisis, such as natural disasters or global economic shocks, when insurers play a pivotal role in helping communities and businesses recover.

Moreover, these insurance giants contribute significantly to the global economy. They not only protect individuals and businesses from financial risks but also invest substantial amounts of capital in various industries, spurring economic growth and job creation. This dual role as risk mitigators and economic catalysts positions German insurance companies as drivers of global financial stability and prosperity.

The expertise of German insurers also extends to risk assessment and management on a global scale. They engage in extensive research and analysis to understand emerging risks, including those related to climate change, cybersecurity, and public health crises. By sharing their insights and collaborating with international partners, these companies contribute to a more resilient global economy.

Furthermore, Germany’s commitment to ethical and sustainable business practices has a positive influence on the global insurance industry. German insurers often lead by example when it comes to responsible investing and environmental, social, and governance (ESG) considerations. Their adherence to high ethical standards sets benchmarks for the industry and encourages responsible corporate behavior worldwide.

In conclusion, Germany’s insurance sector, anchored by industry leaders like Allianz and Munich Re, is a global force that goes beyond merely offering financial protection. It provides innovative solutions, fosters economic stability, shares expertise, and promotes responsible business practices. As the world faces increasingly complex and interconnected risks, the contributions of German insurers continue to have a profound and positive impact on individuals, businesses, and economies worldwide.

Additionally, you can find further information on this topic by visiting this page: The territorial impact of COVID-19: Managing the crisis across levels …

Germany’s impact on global finance extends beyond its financial institutions. It encompasses various dimensions that influence the global financial landscape:

Germany’s influence on global finance is indeed profound and multifaceted, extending far beyond the confines of its financial institutions. This impact encompasses a wide array of dimensions, each of which leaves an indelible mark on the global financial landscape:

Economic Stability: Germany’s strong and stable economy plays a pivotal role in global financial stability. Its prudent fiscal policies, low inflation rates, and commitment to balanced budgets provide a benchmark for other nations to emulate. As a result, the stability of the Eurozone, in which Germany is a cornerstone, has a ripple effect on global markets and investor confidence.

Financial Powerhouses: Germany is home to some of the world’s largest and most influential financial institutions. Frankfurt, known as “Mainhattan,” houses the European Central Bank and several major banks. These institutions not only drive European financial policies but also exert influence on a global scale. Their role in facilitating international trade and investment is pivotal to the functioning of the global financial system.

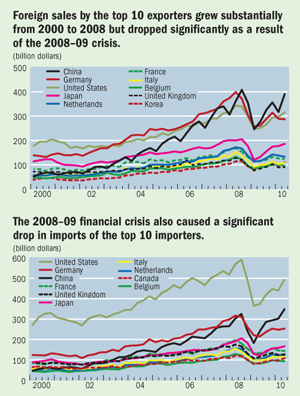

Export-Led Growth: Germany’s export-oriented economy has a significant impact on global trade and finance. Its high-quality products, from automobiles to machinery, are in demand worldwide. Germany’s trade surpluses and its position as one of the world’s top exporters contribute to global trade imbalances and shape international economic relations.

Investor Confidence: Germany’s reputation for economic stability and the reliability of its financial institutions make it an attractive destination for foreign investment. As a result, global investors often turn to German markets as a safe haven during times of uncertainty, influencing the flow of capital on a global scale.

Financial Regulation: Germany’s commitment to strong financial regulation and supervision has contributed to the resilience of its financial sector. This approach has been influential in shaping international discussions on financial stability and regulatory frameworks, particularly in the wake of the global financial crisis.

Green Finance and Sustainability: Germany’s dedication to environmental sustainability extends to the financial sector. It is a leader in promoting green finance and sustainable investment, influencing global efforts to align financial systems with environmental and social goals. This commitment has the potential to reshape the way financial markets approach environmental challenges.

Geopolitical Influence: Germany’s role as a leading European nation carries geopolitical weight in international financial negotiations and institutions. Its participation in forums like the G7, G20, and the International Monetary Fund (IMF) enables it to shape global financial policies and discussions.

In summary, Germany’s impact on global finance transcends its financial institutions; it’s woven into the very fabric of the global financial system. From economic stability to financial regulations, trade dynamics to sustainability efforts, Germany’s contributions resonate globally, shaping the contours of international finance in significant ways.

Explore this link for a more extensive examination of the topic: The territorial impact of COVID-19: Managing the crisis across levels …

Germany’s reputation for economic stability and fiscal discipline fosters trust among global investors. Its adherence to rigorous financial regulations and prudent fiscal policies bolsters confidence in the stability of international financial markets.

Germany’s reputation for economic stability and fiscal discipline stands as a bedrock of trust in the global financial landscape. This trust is not merely a perception but is rooted in tangible practices and policies that have consistently demonstrated Germany’s commitment to maintaining a sound and reliable economic environment.

One of the cornerstones of Germany’s economic stability is its adherence to rigorous financial regulations. The nation has implemented a robust regulatory framework that governs its financial institutions and markets. These regulations prioritize transparency, risk management, and accountability. They have been instrumental in safeguarding against financial crises and providing investors with a sense of security.

Prudent fiscal policies are another pillar of Germany’s economic reputation. The country’s commitment to balanced budgets and responsible debt management has resulted in a stable fiscal environment. By consistently avoiding excessive deficits and government debt, Germany has set an example of disciplined fiscal governance that inspires confidence in international financial markets.

Germany’s dedication to maintaining a strong and competitive economy further solidifies its position as a trusted destination for global investors. The nation’s focus on innovation, education, and research and development has created a thriving business environment that attracts foreign direct investment. This investment, in turn, fuels economic growth and job creation, reinforcing Germany’s image as a reliable and prosperous market.

Moreover, Germany’s role within the European Union as an economic powerhouse and a driving force behind the euro currency adds to its appeal for investors. Its stability and strong economic performance have a stabilizing effect on the eurozone, which, in turn, influences global financial markets. This interconnectedness underscores the importance of Germany’s fiscal responsibility not only for its own prosperity but also for the broader European and global financial ecosystems.

The trust in Germany’s economic stability and fiscal discipline has far-reaching implications. It encourages long-term investments, fosters economic growth, and provides a safe haven for capital during times of global uncertainty. This trust also extends beyond financial markets, impacting international trade and diplomatic relations. It positions Germany as a reliable partner in the global economic arena, allowing it to wield significant influence in shaping international economic policies and fostering cooperation.

In conclusion, Germany’s commitment to economic stability, reinforced by stringent financial regulations and prudent fiscal policies, is the foundation upon which global trust is built. This trust not only attracts investment but also enhances Germany’s role as a responsible global economic leader. As the world navigates the complexities of the global economy, Germany’s reputation for stability remains a beacon of confidence and a testament to the enduring value of fiscal discipline in the international financial landscape.

Don’t stop here; you can continue your exploration by following this link for more details: Global Financial Stability Report

Germany’s export-oriented economy and strong banking sector facilitate international trade and finance. Its trade finance services support the flow of goods and capital across borders, contributing to the global movement of goods and services.

Germany’s export-oriented economy and robust banking sector constitute a dynamic duo that significantly facilitates international trade and finance on a global scale. The synergistic relationship between these two pillars of the German economy not only propels the nation forward but also plays a pivotal role in the intricate web of global commerce.

Germany’s prowess as an export powerhouse is widely acknowledged. Its precision-engineered products, ranging from automobiles and machinery to electronics and chemicals, are sought after in markets around the world. This export-oriented mindset has made Germany a linchpin in the global supply chain, fostering interdependence among nations.

Central to Germany’s role as an international trade leader is its banking sector, which boasts a rich history of stability and innovation. German banks provide a wide array of financial services, from trade finance and foreign exchange to investment banking and asset management. They serve as trusted partners for businesses and investors worldwide, facilitating the flow of capital and mitigating financial risks associated with cross-border transactions.

In particular, Germany’s trade finance services are instrumental in supporting the seamless movement of goods and capital across borders. Trade financing instruments like letters of credit, export credit insurance, and export financing loans are essential tools that mitigate risks for both exporters and importers. These financial services grease the wheels of international trade, bolstering trust and confidence in global commerce.

Furthermore, Germany’s dedication to fostering economic relations extends beyond its own borders. The country actively engages in bilateral and multilateral trade agreements, promoting open markets and fair trade practices. Its commitment to multilateralism is evident through its active participation in organizations such as the World Trade Organization (WTO) and the European Union (EU), where it works to shape global trade rules and norms.

In conclusion, Germany’s export-oriented economy and robust banking sector constitute a formidable force that not only sustains the nation’s economic growth but also propels global trade and finance. The nation’s trade finance services serve as a linchpin in the global movement of goods and capital, fostering economic interdependence and facilitating the exchange of products and services across borders. As we delve into Germany’s multifaceted role, we gain valuable insights into how its economic strengths ripple through the global marketplace, promoting economic growth and cooperation on an international scale.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Belt and Road Economics: Opportunities and Risks of Transport …

Germany’s financial regulatory framework, in harmony with European and international standards, plays a crucial role in maintaining the integrity of global financial markets. It helps ensure transparency, fairness, and accountability in financial transactions.

Germany’s financial regulatory framework, in harmony with European and international standards, plays a crucial role in maintaining the integrity of global financial markets. It helps ensure transparency, fairness, and accountability in financial transactions, contributing to financial stability and fostering investor confidence.

Risk Mitigation: Germany’s regulatory framework includes measures to identify, assess, and mitigate financial risks. This proactive approach helps prevent systemic failures that can have cascading effects on global markets. By imposing prudential rules on financial institutions, Germany bolsters the resilience of its financial sector, which is interconnected with international markets.

Investor Protection: The regulatory framework prioritizes investor protection. Stringent regulations and oversight mechanisms ensure that financial products and services meet high standards of transparency and suitability. This instills trust in both domestic and international investors, attracting capital to Germany’s financial markets.

Market Surveillance: Germany’s financial regulatory authorities actively monitor market activities to detect irregularities and fraud. This oversight not only safeguards the interests of market participants but also contributes to global efforts to combat financial crimes such as money laundering and insider trading.

International Cooperation: Germany’s commitment to aligning its regulatory framework with international standards enhances global cooperation. It actively participates in forums such as the Financial Stability Board (FSB) and the Basel Committee on Banking Supervision, contributing to the development of harmonized global financial regulations.

Risk-Based Supervision: Germany employs a risk-based supervisory approach, focusing resources on institutions and activities posing the greatest systemic risks. This targeted oversight helps prevent crises and supports the stability of the broader financial system.

Cross-Border Transactions: As a hub for international trade and finance, Germany’s regulatory framework is particularly relevant for cross-border transactions. Its adherence to global standards facilitates seamless financial interactions between domestic and foreign entities, promoting international trade and investment.

Fostering Innovation: While ensuring stability and integrity, Germany’s regulatory framework also seeks to foster financial innovation. It creates an environment where fintech startups can thrive, promoting the development of new, more efficient financial services and technologies.

Sustainable Finance: Germany has also embraced the growing emphasis on sustainable finance. It is actively incorporating environmental, social, and governance (ESG) criteria into its regulatory framework, aligning with global efforts to promote responsible investing and sustainable economic development.

Crisis Management: Germany’s regulatory framework includes robust crisis management mechanisms. These mechanisms have been put to the test during financial crises, helping to restore stability and confidence in the financial sector, not only domestically but also internationally.

In conclusion, Germany’s commitment to a well-regulated financial sector, aligned with European and international standards, extends its influence far beyond its borders. By upholding transparency, fairness, and accountability in financial transactions, Germany contributes to the overall integrity of global financial markets. This, in turn, supports economic growth, encourages investment, and ensures that financial systems worldwide operate on a level playing field.

You can also read more about this here: Offshore Financial Centers — IMF Background Paper

German institutional investors, including pension funds and insurance companies, are major participants in global financial markets. Their investments in diverse asset classes, such as equities and bonds, impact global asset prices and capital flows.

German institutional investors, including pension funds and insurance companies, wield substantial influence in global financial markets. With vast pools of capital at their disposal, they actively participate in a wide range of asset classes, from equities and bonds to alternative investments like real estate and private equity. This active involvement has ripple effects throughout the global financial landscape, influencing asset prices, capital flows, and even shaping investment trends on a global scale.

Stability and Long-Term Focus: German institutional investors are known for their conservative and long-term investment strategies. This stability and commitment to secure, sustainable returns make them attractive partners and investors for businesses and projects worldwide.

Impact on Global Asset Prices: The scale of their investments means that German institutional investors can influence asset prices, particularly in markets where they are significant players. Their buying or selling decisions can sway the direction of stock markets and bond yields, creating waves felt far beyond Germany’s borders.

Diversification of Portfolios: In search of yield and risk mitigation, German institutions diversify their portfolios globally. This diversification strategy leads them to invest in various asset classes, including international equities, foreign government bonds, and emerging market assets. Consequently, their actions can impact the valuation of assets across different regions and economies.

Infrastructure Investment: German institutional investors often invest in infrastructure projects, both domestically and internationally. These investments can bolster the development of critical infrastructure, such as transportation and energy systems, in various countries.

Influence on Corporate Governance: As significant shareholders in many companies, German institutional investors often play an active role in corporate governance. They can advocate for responsible corporate practices, sustainability initiatives, and ethical considerations, setting global standards for responsible investing.

Capital Allocation Trends: The investment choices of German institutions reflect broader trends in capital allocation. Their decisions can signal market preferences, industry shifts, and emerging opportunities, guiding other investors and influencing economic sectors worldwide.

Risk Management: German investors’ cautious approach to risk management is mirrored by many other institutional investors globally. Their emphasis on due diligence and risk assessment sets a benchmark for international investment practices.

Global Economic Impact: The actions of German institutional investors can contribute to capital flows into or out of specific countries and regions. This movement of capital can affect currency exchange rates, balance of payments, and overall economic stability in various nations.

In summary, German institutional investors’ involvement in global financial markets extends beyond the mere allocation of funds. Their investment strategies, risk management practices, and ethical considerations have a profound impact on asset prices, capital flows, and investment trends on a global scale. As influential participants in the worldwide financial ecosystem, they play a pivotal role in shaping the future of international finance and investment.

Should you desire more in-depth information, it’s available for your perusal on this page: U.S. Treasury Announces Unprecedented & Expansive Sanctions …

Despite its substantial contributions to global finance, Germany also faces challenges and responsibilities:

Despite its substantial contributions to global finance, Germany also faces challenges and responsibilities that come with its economic prowess and influence. These challenges and responsibilities extend beyond the financial realm and encompass various facets of international relations and global governance.

Economic Stability: As a major player in the global economy, Germany must maintain its own economic stability. Economic downturns or financial crises in Germany can have ripple effects worldwide, affecting international trade, investment, and financial markets. Therefore, Germany must continue to implement sound economic policies and practices to ensure its resilience in a volatile global economic landscape.

Trade Balance: Germany’s persistent trade surplus has drawn both praise and criticism. While it signifies economic strength, it can also contribute to global trade imbalances. Germany has a responsibility to address these imbalances constructively, fostering a more equitable global trading system and promoting international cooperation.

Leadership in the European Union: As the largest economy in the European Union, Germany plays a central role in shaping EU policies and initiatives. It must provide leadership in addressing regional challenges, such as economic disparities among EU member states, migration issues, and environmental sustainability. Germany’s decisions and actions within the EU have far-reaching implications for the entire continent.

Climate Action: Germany’s commitment to sustainability and environmental responsibility is pivotal in the global fight against climate change. It must continue to invest in green technologies, reduce carbon emissions, and lead by example to meet international climate targets. Its role in transitioning to clean energy and promoting sustainable practices can inspire other nations to follow suit.

Global Diplomacy: Germany’s diplomatic efforts are essential in addressing global issues such as conflicts, humanitarian crises, and international security. Its commitment to multilateralism and diplomacy is critical in resolving conflicts peacefully and upholding human rights on the global stage.

Refugee and Migration Crisis: Germany has taken a prominent stance in responding to refugee and migration challenges. It faces the responsibility of managing and integrating diverse populations while working collaboratively with other nations to address the root causes of displacement and ensure the safety and well-being of those seeking refuge.

Promoting Global Health: Germany has an important role in promoting global health, especially in the wake of health crises like the COVID-19 pandemic. It can contribute to vaccine distribution, medical research, and supporting healthcare systems in less-developed regions, demonstrating solidarity with the international community.

In conclusion, while Germany enjoys a position of economic prominence, it must navigate its challenges and responsibilities on the global stage with wisdom and foresight. Its actions and policies have implications far beyond its borders, shaping the course of international relations, trade, environmental sustainability, and more. Germany’s commitment to collaboration, stability, and responsible leadership is essential in addressing global challenges and fostering a more prosperous and equitable world.

Should you desire more in-depth information, it’s available for your perusal on this page: COP27 Reaches Breakthrough Agreement on New “Loss and …

German financial institutions must adhere to stringent regulatory requirements and international standards. Ensuring compliance is vital to maintain trust and prevent systemic risks in the global financial system.

The rigorous regulatory environment that German financial institutions operate within is a critical component of the country’s financial stability and its role in the global financial system. Here, we explore the multifaceted aspects of this regulatory landscape and why adherence to stringent standards is paramount:

Banking Supervision: Germany’s regulatory framework places a strong emphasis on banking supervision. The Federal Financial Supervisory Authority (BaFin) oversees financial institutions, ensuring they comply with prudential standards, risk management practices, and capital adequacy requirements. This oversight not only protects the stability of the German financial system but also contributes to global financial stability.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF): Germany is vigilant in combating financial crime. Stringent AML and CTF regulations are enforced to prevent money laundering, the financing of terrorism, and illicit financial flows. Compliance with these measures is essential to maintain the integrity of the global financial system and prevent financial institutions from inadvertently facilitating illegal activities.

Basel III and International Standards: German financial institutions adhere to international standards such as the Basel III framework, established by the Basel Committee on Banking Supervision. These standards govern capital adequacy, liquidity risk, and leverage ratios, ensuring that financial institutions have a robust buffer against financial shocks. Compliance with Basel III fosters confidence in the stability of the global banking sector.

Data Protection and Privacy: Germany’s regulatory framework includes strict data protection and privacy regulations, notably the General Data Protection Regulation (GDPR). Compliance with these laws is crucial in safeguarding customer data and maintaining trust in financial institutions, both domestically and internationally.

Cross-Border Regulations: As financial institutions often engage in cross-border activities, compliance with international regulations becomes imperative. Germany’s commitment to aligning its regulatory framework with global standards ensures a seamless flow of capital and financial services while mitigating cross-border risks.

Systemic Risk Mitigation: Adherence to regulatory requirements is a critical tool for mitigating systemic risks. German financial institutions play a significant role in the global financial system, and their sound practices help prevent the contagion of financial crises to other countries.

Global Reputation: Germany’s reputation for financial stability is closely tied to the adherence of its financial institutions to stringent regulations. Maintaining this reputation is essential for attracting foreign investment, fostering international financial partnerships, and facilitating trade and capital flows.

Investor and Consumer Protection: Stringent regulations in Germany prioritize the protection of investors and consumers. This commitment extends to international clients and investors who engage with German financial institutions, fostering confidence in the fairness and transparency of the financial services sector.

Global Financial Integration: Germany’s adherence to international standards and regulations contributes to the seamless integration of its financial system into the global marketplace. This integration enhances the efficiency and accessibility of financial services on a global scale.

In conclusion, Germany’s financial institutions serve as integral components of the global financial system, and their adherence to stringent regulatory requirements and international standards is pivotal. By ensuring compliance, Germany not only upholds its own financial stability but also contributes to the trust, security, and resilience of the broader global financial ecosystem. This commitment to regulatory excellence underscores Germany’s enduring role as a responsible and trusted participant in the international financial arena.

Should you desire more in-depth information, it’s available for your perusal on this page: Powering the Digital Economy: Opportunities and Risks of Artificial …

As environmental, social, and governance (ESG) considerations gain importance, German financial institutions are increasingly focusing on sustainable finance and responsible investment practices, addressing global concerns about climate change and social responsibility.

As environmental, social, and governance (ESG) considerations gain importance, German financial institutions are increasingly focusing on sustainable finance and responsible investment practices, addressing global concerns about climate change and social responsibility. This evolution within Germany’s financial sector reflects a broader shift in the global financial landscape and carries profound implications for both the industry and society at large.

Green Finance Initiatives: German financial institutions have been actively engaged in promoting green finance initiatives. They play a pivotal role in financing renewable energy projects, energy-efficient infrastructure, and sustainable agriculture. By channeling capital toward environmentally friendly endeavors, they contribute to mitigating climate change and fostering a more sustainable future.

ESG Integration: German banks and asset managers are integrating ESG criteria into their investment decisions. This entails assessing the environmental, social, and governance impact of investments and incorporating these factors into risk assessments. As a result, investors are better informed about the sustainability and ethical implications of their portfolios.

Impact Investing: Impact investing, which seeks to generate measurable social and environmental benefits alongside financial returns, is gaining traction in Germany. Financial institutions are allocating capital to projects that address pressing societal challenges, such as affordable housing, clean water access, and education. This form of investing reflects a commitment to creating positive change while achieving financial goals.

Sustainable Products and Services: German financial institutions are expanding their offerings to include sustainable financial products and services. This includes green bonds, social impact funds, and ESG-themed investment portfolios. These offerings align with the growing demand for sustainable investment options among both retail and institutional investors.

Corporate Governance Enhancements: The “G” in ESG, which pertains to governance, is receiving increased attention in Germany. Financial institutions are scrutinizing the governance practices of the companies in which they invest. This heightened focus on governance aims to enhance transparency, accountability, and ethical conduct within corporations.

Sustainability Reporting: Many German companies, including financial institutions, are adopting sustainability reporting standards such as the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD). This practice enables them to communicate their ESG performance to stakeholders, reinforcing their commitment to responsible business practices.

Regulatory Framework: Germany’s financial regulatory authorities are actively involved in shaping the country’s sustainable finance landscape. They have introduced guidelines and disclosure requirements to promote ESG transparency and align financial activities with sustainability objectives. This regulatory support bolsters the credibility of sustainable finance initiatives.

Global Leadership: Germany’s commitment to sustainable finance extends beyond its borders. The nation actively participates in international forums and initiatives related to ESG and sustainable development. This global leadership role underscores its dedication to addressing global challenges collectively.

In conclusion, Germany’s financial institutions’ growing emphasis on sustainable finance and responsible investment practices reflects a broader societal awareness of the interconnectedness between finance, the environment, and social well-being. This shift is not only aligned with global trends but also positions Germany as a proactive participant in addressing pressing global challenges, such as climate change, social inequality, and ethical governance. As sustainability continues to gain prominence in finance, Germany’s financial sector is poised to play an increasingly pivotal role in advancing responsible and impactful investment practices on a global scale.

You can also read more about this here: Green and sustainable finance in Germany | Clean Energy Wire

Conclusion

Germany’s impact on global finance is undeniable, stemming from its robust financial services sector, trusted banking institutions, and adherence to stability. As the world grapples with economic challenges and opportunities, Germany’s role in shaping the international financial landscape remains central. Whether through its contributions to global trade, financial regulation, or sustainable finance, Germany’s influence on global finance is poised to continue shaping the future of the global financial ecosystem.

Germany’s impact on global finance is undeniable and multifaceted, reflecting its role as a financial stalwart. The resilience of its financial services sector, exemplified by a thriving stock exchange in Frankfurt and a vast network of financial institutions, has consistently weathered economic storms. This stability is a testament to Germany’s commitment to sound fiscal policies and effective regulatory frameworks.

In an increasingly interconnected world, Germany’s financial institutions stand as trusted guardians of wealth and assets for individuals and corporations alike. They not only manage investments but also provide vital support for international trade, facilitating the flow of capital across borders. This critical role makes them indispensable in a globalized economy, where economic transactions are conducted on a massive scale.

Furthermore, Germany’s unwavering commitment to financial stability is mirrored in its proactive stance on financial regulation. As a member of international organizations such as the G20 and the Financial Stability Board, Germany plays a key role in shaping global financial regulations and standards. Its emphasis on transparency, risk management, and ethical financial practices sets benchmarks for the rest of the world to follow.

Beyond traditional finance, Germany is also at the forefront of sustainable finance. With a strong focus on environmental, social, and governance (ESG) principles, German financial institutions are driving investments in renewable energy, green technology, and socially responsible initiatives. This commitment aligns with global efforts to address climate change and promote ethical investments, solidifying Germany’s position as a leader in responsible finance.

As the world grapples with economic challenges and opportunities, Germany’s role in shaping the international financial landscape remains central. Its influence extends not only to economic affairs but also to issues of global significance, such as climate change and sustainable development. Whether through its contributions to global trade, financial regulation, or sustainable finance, Germany’s profound impact on global finance is poised to continue shaping the future of the global financial ecosystem, guiding it toward stability, responsibility, and innovation.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Summit for a New Global Financing Pact: towards more …

More links

Should you desire more in-depth information, it’s available for your perusal on this page: Global Financing Facility |