Introduction

In the world of finance, the rise of cryptocurrencies has been nothing short of revolutionary. As these digital assets continue to gain popularity, platforms like Robinhood have made it easier than ever for retail investors to participate in crypto trading. This article explores the dynamics of crypto trading on Robinhood, offering insights and tips for those venturing into this exciting but complex realm.

The financial landscape has witnessed a seismic shift with the meteoric rise of cryptocurrencies. These digital assets have not only disrupted traditional finance but have also democratized access to a new realm of investment possibilities. Among the platforms facilitating this transformation, Robinhood stands out, making crypto trading more accessible to retail investors. Let’s delve deeper into the dynamics of crypto trading on Robinhood and unveil essential insights for those embarking on this thrilling but intricate journey:

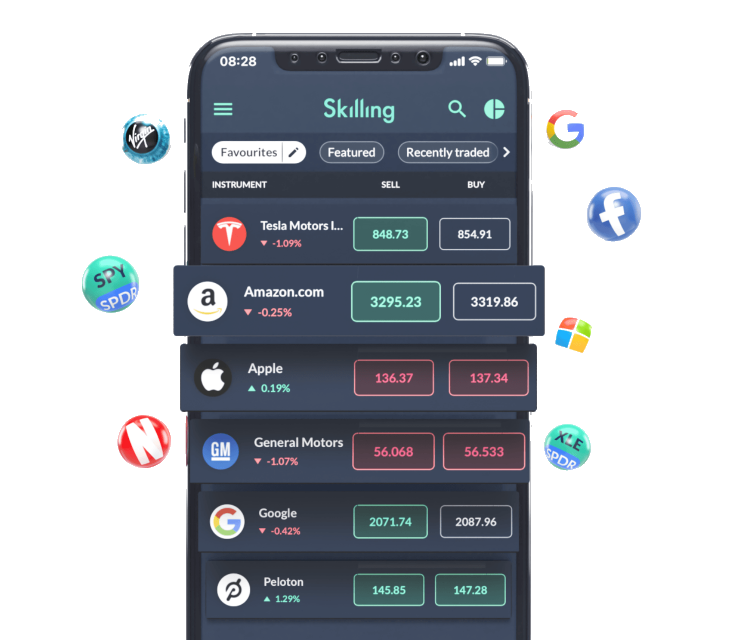

Unprecedented Access: Robinhood’s user-friendly interface has broken down the barriers to entry for crypto trading. Retail investors, regardless of their experience level, can now easily buy, sell, and hold cryptocurrencies with just a few taps on their smartphones. This unprecedented access has opened the doors to a global marketplace that operates 24/7, unlike traditional stock markets.

Diverse Crypto Offerings: Robinhood offers a variety of cryptocurrencies beyond the well-known Bitcoin and Ethereum. Retail investors can explore a diverse array of digital assets, each with its unique features and potential for growth. This diversity enables investors to tailor their portfolios to their risk tolerance and investment goals.

Fractional Crypto Trading: Similar to fractional share trading in the stock market, Robinhood allows users to buy fractional amounts of cryptocurrencies. This feature enables investors to allocate their capital precisely and build a diversified crypto portfolio, even with limited funds.

Educational Resources: Robinhood provides educational resources to help users navigate the complexities of crypto trading. These resources include articles, tutorials, and market insights, empowering investors to make informed decisions and understand the unique aspects of the crypto market.

Volatility Management: Cryptocurrencies are renowned for their price volatility. Robinhood equips users with tools to manage this volatility effectively. Investors can set stop-loss orders to limit potential losses and employ dollar-cost averaging (DCA) strategies to reduce the impact of price fluctuations over time.

Security and Custody: Security is paramount in the world of crypto trading, and Robinhood takes measures to safeguard user assets. The platform utilizes state-of-the-art encryption and offers secure custody solutions to protect digital holdings from cyber threats.

Regulatory Considerations: Cryptocurrencies operate in a rapidly evolving regulatory environment. Robinhood complies with regulatory requirements and keeps users informed about changes that may impact their trading activities. Staying informed about tax implications and reporting requirements is essential for responsible crypto trading.

Risk Management: As with any investment, risk management is crucial. Robinhood encourages users to diversify their portfolios, invest only what they can afford to lose, and resist the urge to chase speculative assets. Responsible risk management is essential for long-term success in the crypto market.

Continuous Learning: The crypto market is dynamic, and learning is an ongoing process. Staying updated on market trends, blockchain technology developments, and emerging cryptocurrencies can enhance your ability to make informed decisions and adapt to changing market conditions.

In conclusion, the rise of cryptocurrencies has reshaped finance, offering new opportunities for investors. Robinhood has played a pivotal role in democratizing crypto trading, making it accessible to a broad audience. However, navigating the crypto market requires careful consideration, education, and responsible risk management. As you embark on your crypto trading journey, remember that success is not guaranteed, but with the right knowledge and strategies, you can harness the potential of this revolutionary asset class.

Looking for more insights? You’ll find them right here in our extended coverage: Introducing Robinhood Connect, Simplifying Access to Web 3 …

Cryptocurrencies have captured the imagination of investors worldwide. Bitcoin, Ethereum, and a multitude of altcoins have seen dramatic price increases, creating both hype and skepticism. Robinhood, known for its commission-free stock trading, expanded its offerings to include cryptocurrencies in response to the growing demand for these digital assets. Here are some key reasons why traders are flocking to Robinhood for crypto trading:

Cryptocurrencies have indeed become a global phenomenon, attracting investors with their potential for substantial gains and technological innovation. Robinhood’s foray into the world of crypto trading has been a significant development, driven by several compelling reasons that draw traders to this platform:

Accessibility and Convenience: Robinhood’s user-friendly interface and mobile app make it exceptionally easy for both novice and experienced traders to access and manage their cryptocurrency portfolios. The platform simplifies the process of buying, selling, and tracking digital assets.

Commission-Free Trading: Building on its reputation for commission-free stock trading, Robinhood extends this benefit to crypto trading. This eliminates the barrier of high trading fees that can eat into profits, making it an attractive choice for cost-conscious traders.

Diverse Cryptocurrency Selection: Robinhood offers a wide range of cryptocurrencies beyond just Bitcoin and Ethereum. Traders can explore and invest in various altcoins, gaining exposure to a diverse set of digital assets.

Fractional Ownership: Robinhood enables users to buy fractional shares of cryptocurrencies, which is particularly beneficial for those who want to invest in high-priced assets like Bitcoin but may not have the capital to purchase whole coins.

Seamless Integration: For users already trading stocks or other assets on Robinhood, the platform’s integration of crypto trading simplifies portfolio management by providing a consolidated view of all investments in one place.

Educational Resources: Robinhood offers educational resources and tools to help traders understand cryptocurrencies better. This includes informative articles, market data, and real-time price tracking to assist traders in making informed decisions.

Instant Deposits: Robinhood provides the option for instant deposits, allowing users to quickly fund their accounts and seize trading opportunities without waiting for traditional bank transfers to clear.

Security Measures: Robinhood employs robust security measures to protect users’ crypto holdings. This includes two-factor authentication (2FA) and insurance coverage for digital assets held on the platform.

Simplified Tax Reporting: Robinhood offers features to help users track their cryptocurrency transactions, making tax reporting more manageable. This simplification can be especially valuable given the complex tax implications of crypto trading.

Market Insights: The platform provides market data, charts, and analysis tools to assist traders in making data-driven decisions. This empowers users to stay informed about cryptocurrency trends and potential opportunities.

Continuous Innovation: Robinhood is continually evolving its crypto offerings, introducing features like recurring investments and staking to cater to the evolving needs of crypto traders.

Community and Social Trading: Robinhood’s user base, which includes a vibrant community of traders, can be an invaluable source of insights and ideas. Traders can interact, share strategies, and learn from one another.

In conclusion, Robinhood’s expansion into cryptocurrency trading is driven by the platform’s commitment to providing accessible, low-cost, and user-friendly financial services. Traders are flocking to Robinhood not only for its commission-free approach but also for the diverse range of cryptocurrencies, educational resources, and integration with their existing investment portfolios. As the cryptocurrency market continues to evolve, Robinhood remains a significant player in democratizing access to these digital assets.

To expand your knowledge on this subject, make sure to read on at this location: How to Invest in NFT on Robinhood: Navigating Opportunities

Robinhood’s user-friendly interface makes it accessible to both novice and experienced traders. Its mobile app provides a convenient platform for buying, selling, and managing cryptocurrencies.

Robinhood, with its user-friendly interface, has emerged as a groundbreaking platform that bridges the gap between novice and experienced traders in the dynamic world of finance. Its intuitive design and accessibility have transformed the landscape of investing, making it a favored choice for those looking to navigate the markets, whether they’re newcomers or seasoned professionals.

What truly sets Robinhood apart is its mobile app, which has redefined the way people engage with financial markets. The app serves as a comprehensive toolkit, offering a seamless experience for buying, selling, and managing cryptocurrencies, as well as traditional assets like stocks and ETFs. The convenience it provides is unparalleled, giving users the freedom to execute trades and monitor their investments with a few taps on their smartphones.

For novice traders, Robinhood’s easy-to-navigate interface acts as an ideal starting point. It demystifies the complexities of trading, allowing individuals with limited experience to embark on their investment journey confidently. The platform’s educational resources, such as informative articles and tutorials, further empower beginners to grasp essential concepts and strategies.

Experienced traders, on the other hand, appreciate Robinhood’s efficiency and accessibility. The app’s real-time data, customizable watchlists, and advanced charting tools cater to the needs of those who seek to fine-tune their trading strategies. Whether it’s conducting technical analysis or executing rapid trades, Robinhood provides the necessary tools at traders’ fingertips.

Moreover, Robinhood’s commission-free model has revolutionized the industry, eliminating the barriers that traditionally deterred many from investing. This fee structure allows traders to retain a more significant portion of their gains, contributing to its widespread appeal.

However, it’s essential to acknowledge that the ease of use and commission-free trading also come with considerations. For example, the allure of quick, frequent trading can sometimes lead to impulsive decisions, potentially impacting overall investment strategies. It’s crucial for all users, regardless of experience, to approach trading on Robinhood with a well-defined plan and a disciplined mindset.

In summary, Robinhood’s user-friendly interface and mobile app have reshaped the financial landscape. They have made trading accessible to a broad spectrum of users, from beginners taking their first steps into the world of finance to seasoned traders optimizing their strategies. While the convenience and commission-free model are undeniably attractive, they also underscore the importance of informed decision-making and disciplined trading practices to ensure a successful and balanced investment journey in the Robinhood-like environment.

Explore this link for a more extensive examination of the topic: Introducing Robinhood Connect, Simplifying Access to Web 3 …

Robinhood’s zero-commission model extends to cryptocurrencies, which means users can trade digital assets without incurring fees, making it cost-effective.

Robinhood’s pioneering zero-commission model isn’t limited to traditional investments; it also embraces the world of cryptocurrencies, creating a revolutionary approach to trading digital assets. This extension of commission-free trading to cryptocurrencies has ushered in a new era of accessibility and cost-effectiveness in the world of digital finance.

Democratizing Cryptocurrencies: Traditionally, cryptocurrency trading was encumbered by fees associated with each transaction, which could significantly eat into profits, especially for frequent traders. However, Robinhood’s zero-commission model has democratized the world of cryptocurrencies, allowing individuals of all financial backgrounds to access and trade these digital assets without the financial burden of transaction fees.

Reduced Barriers to Entry: The elimination of trading fees lowers the barriers to entry for cryptocurrency enthusiasts and curious investors alike. It encourages newcomers to dip their toes into the world of digital currencies, learn about blockchain technology, and explore a new asset class without being deterred by the fear of hidden costs.

Cost-Effective Strategies: The absence of trading fees enables traders to adopt cost-effective strategies. For instance, dollar-cost averaging, a strategy where investors regularly buy a fixed amount of a cryptocurrency regardless of its price, becomes more practical without transaction fees eating into each purchase. This approach can help mitigate the impact of market volatility over time.

Increased Liquidity: Zero-commission cryptocurrency trading can lead to increased liquidity in the market. Traders are more likely to engage in frequent buying and selling, which can contribute to healthier price discovery and a more efficient market.

Educational Opportunities: With the financial burden of fees removed, traders have the freedom to experiment, learn, and refine their cryptocurrency trading strategies. This educational aspect is vital in a space as dynamic and evolving as the cryptocurrency market.

However, it’s important to note that while the zero-commission model offers significant advantages, it doesn’t eliminate other risks associated with cryptocurrency trading. The cryptocurrency market is known for its volatility, regulatory uncertainties, and security challenges. Traders should still exercise caution, conduct thorough research, and employ risk management strategies to navigate this complex landscape effectively.

In conclusion, Robinhood’s extension of the zero-commission model to cryptocurrencies has disrupted the way individuals engage with digital assets. It fosters accessibility, cost-effectiveness, and educational opportunities, empowering a broader range of people to participate in the exciting world of cryptocurrencies. While it presents numerous benefits, it’s essential for users to approach cryptocurrency trading with care, understanding the risks and complexities involved, and making informed decisions in this evolving and dynamic market.

You can also read more about this here: Robinhood Wallet | Robinhood

Robinhood allows investors to buy fractional shares of cryptocurrencies, enabling them to invest in high-value assets like Bitcoin with as little as $1.

Robinhood’s introduction of fractional shares for cryptocurrencies has brought a wave of inclusivity to the world of digital assets. It has fundamentally altered the landscape of cryptocurrency investing, making it accessible to a broader range of investors, regardless of their financial resources. Here’s a closer look at the significance and implications of this innovative feature:

Democratizing Crypto: Historically, cryptocurrencies like Bitcoin were often associated with high price tags, making them seem out of reach for many. With fractional shares on Robinhood, the barrier to entry has crumbled. Now, even with just a single dollar, investors can own a fraction of Bitcoin or other cryptocurrencies, giving them a stake in the world of digital finance.

Risk Mitigation: The ability to buy fractional shares of cryptocurrencies can be a powerful risk management tool. Crypto markets are known for their price volatility, and owning a whole Bitcoin can be financially daunting. Fractional ownership allows investors to diversify their cryptocurrency holdings, potentially reducing risk by spreading their investment across multiple assets.

Accessibility to Diverse Assets: Beyond Bitcoin, Robinhood’s fractional share feature extends to a range of other cryptocurrencies, each with its unique value proposition and potential for growth. Investors can create a diversified cryptocurrency portfolio that aligns with their risk tolerance and investment goals.

Educational Opportunity: Investing in cryptocurrencies, especially for newcomers, can be intimidating due to the complexity of blockchain technology and the market’s speculative nature. Robinhood’s user-friendly platform and fractional shares feature provide an excellent avenue for investors to learn and experiment with cryptocurrency investments in a controlled environment.

Liquidity and Flexibility: Fractional ownership of cryptocurrencies enhances liquidity. Investors can easily buy or sell fractional shares at any time, allowing them to react to market developments or adjust their portfolio to meet changing financial goals. This flexibility empowers investors to tailor their cryptocurrency holdings according to their evolving strategies.

Long-Term Potential: Fractional ownership can be particularly appealing for those who see the long-term potential of cryptocurrencies. They can accumulate these digital assets gradually over time, harnessing the power of compounding and potentially benefiting from the asset’s appreciation over the years.

Responsibility and Caution: While fractional shares make cryptocurrency investments more accessible, they also come with the responsibility of informed decision-making. Investors must understand the unique risks associated with the cryptocurrency market, conduct thorough research, and consider their overall financial situation before participating.

In conclusion, Robinhood’s introduction of fractional shares for cryptocurrencies is a game-changer in the world of digital assets. It embodies the platform’s commitment to financial inclusivity, empowering investors with the tools to engage with cryptocurrencies and diversify their portfolios. This innovation underscores the evolving landscape of finance, where technology continues to bridge gaps and provide opportunities for a more inclusive and informed investing experience.

Additionally, you can find further information on this topic by visiting this page: Best Investing Apps Of September 2023

Robinhood simplifies the crypto trading process, making it easy for those new to the space to buy and sell digital assets without the complexities of managing private keys or wallets.

Robinhood’s user-friendly platform has significantly contributed to the accessibility and adoption of cryptocurrency trading, particularly among newcomers to the digital asset space. Expanding on this idea underscores the impact of Robinhood’s approach:

Streamlined Access: Robinhood has played a pivotal role in breaking down the barriers to entry for cryptocurrency markets. Its user interface is intuitive, and the onboarding process is straightforward, allowing individuals with little to no prior experience in cryptocurrencies to participate confidently.

No Private Key Hassles: One of the most intimidating aspects of cryptocurrency ownership for beginners is managing private keys and digital wallets. Robinhood eliminates this complexity by offering a custodial service. Users can trade cryptocurrencies without worrying about the security and technical nuances of private keys, simplifying the experience.

Fractional Ownership: Robinhood’s fractional trading feature extends beyond equities to cryptocurrencies. This means that users can invest in popular cryptocurrencies like Bitcoin and Ethereum with small amounts of capital, further reducing the financial barrier to entry.

Educational Resources: Robinhood doesn’t just facilitate trading; it also provides educational materials and resources about cryptocurrencies. This empowers users to understand the basics, risks, and potential rewards of the crypto market, enabling more informed decision-making.

Market Access: The platform offers a range of cryptocurrencies, allowing users to diversify their crypto holdings easily. Beyond Bitcoin and Ethereum, Robinhood provides access to a variety of altcoins, giving users exposure to different segments of the crypto market.

Real-Time Information: Staying updated with cryptocurrency markets is crucial for traders. Robinhood provides real-time data, charts, and news, enabling users to make informed decisions based on the latest market developments.

Reduced Trading Fees: Robinhood’s commission-free model extends to cryptocurrency trading, which can lead to cost savings for users. This feature allows users to trade cryptocurrencies more actively without the concern of incurring fees.

Integration with Traditional Investments: Robinhood’s seamless integration of cryptocurrency trading with traditional stock and ETF investments provides users with a comprehensive financial management platform. This approach enables investors to diversify their portfolios across various asset classes.

Market Exposure: Robinhood’s crypto offerings expose users to the potential growth and volatility of the crypto market, broadening their investment horizons beyond traditional assets. It caters to a new generation of investors seeking alternative investment opportunities.

Regulatory Compliance: Robinhood ensures that its crypto offerings comply with relevant regulations, providing users with a sense of security and legitimacy when trading digital assets.

In conclusion, Robinhood’s user-friendly approach to cryptocurrency trading has played a pivotal role in attracting new participants to the crypto market. By simplifying the process, providing educational resources, and offering fractional ownership, the platform has made cryptocurrencies more accessible to a broader audience. This has not only contributed to the growth of the crypto industry but also empowered individuals to explore and invest in the evolving world of digital assets.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: The Future of Crypto and Blockchain: Why Financial Services …

While crypto trading on Robinhood offers undeniable advantages, it’s essential to approach it with a clear understanding of the market’s unique characteristics and risks:

Engaging in crypto trading on platforms like Robinhood can indeed offer several advantages, but to navigate this market effectively, it’s crucial to approach it with a comprehensive understanding of its distinctive features and associated risks. Here’s an extended perspective on what you should keep in mind:

Volatility Awareness: Cryptocurrencies are renowned for their extreme price volatility. Prices can skyrocket one moment and plummet the next. While this volatility presents opportunities for profit, it also entails substantial risk. Ensure you’re mentally prepared for the price swings and have risk management strategies in place.

Educate Yourself: Before diving into crypto trading, invest time in educating yourself about blockchain technology, different cryptocurrencies, and their underlying principles. Understanding the fundamentals can help you make informed decisions and distinguish between genuine projects and scams.

Security and Wallets: Cryptocurrency security is paramount. Be diligent in protecting your holdings by using reputable cryptocurrency wallets and enabling two-factor authentication (2FA) wherever possible. Understand the differences between hot wallets (online) and cold wallets (offline) for storing your assets securely.

Regulatory Considerations: Keep abreast of the regulatory landscape for cryptocurrencies in your jurisdiction. Regulations can vary significantly from one region to another and may impact your ability to trade or withdraw funds. Comply with any reporting requirements and tax obligations related to cryptocurrency transactions.

Risk Management: Develop a clear risk management strategy that includes setting stop-loss orders, diversifying your holdings, and establishing position sizes that align with your risk tolerance. Avoid overexposing yourself to a single cryptocurrency or trading strategy.

Market Research: Conduct thorough research before investing in any cryptocurrency. Analyze market trends, project fundamentals, and potential use cases. Be cautious of hype-driven investments and take a long-term perspective rather than chasing short-term gains.

Emotional Control: Emotional discipline is essential in crypto trading. Avoid making impulsive decisions based on fear or greed. Stick to your trading plan, even when faced with sudden market fluctuations or news events.

Use Trusted Platforms: Ensure you’re trading cryptocurrencies on reputable and secure platforms like Robinhood. Verify the platform’s regulatory compliance, security measures, and track record. Beware of phishing scams and fraudulent websites.

Stay Informed: Cryptocurrency markets are highly influenced by news and social media sentiment. Stay informed about developments in the crypto space, including technological upgrades, regulatory changes, and market trends. Be cautious of misinformation and rumors.

Long-Term Perspective: While day trading and short-term speculation are common in crypto, consider adopting a long-term investment perspective as well. Some investors find success in “HODLing” (holding onto assets for an extended period) and believing in the long-term potential of certain cryptocurrencies.

Tax Implications: Understand the tax implications of crypto trading in your jurisdiction. Many countries require individuals to report cryptocurrency gains for tax purposes. Keep accurate records of your transactions and consult with a tax professional if needed.

Continuous Learning: The cryptocurrency space is continually evolving. Stay engaged with the community, attend conferences, and follow industry experts to stay up-to-date with the latest trends and advancements.

In conclusion, while crypto trading on platforms like Robinhood offers exciting opportunities, it comes with its own set of unique challenges and risks. By approaching the market with a well-rounded understanding of its intricacies and following prudent strategies, you can navigate the crypto space more confidently and potentially benefit from its transformative potential.

You can also read more about this here: Fidelity vs. Robinhood: 13 Differences to Choose the Best

Conclusion

Crypto trading on Robinhood opens the door to a world of digital assets for retail investors. However, this opportunity comes with unique challenges and considerations. Understanding the volatile nature of cryptocurrencies, conducting thorough research, practicing risk management, and staying informed are all vital aspects of navigating the crypto landscape on Robinhood successfully.

Remember that crypto trading carries inherent risks, and it’s possible to incur losses. Therefore, it’s essential to approach it with caution, start with a well-thought-out plan, and only invest what you can afford to lose. With the right knowledge and strategy, crypto trading on Robinhood can be a valuable addition to your investment portfolio in this rapidly evolving financial landscape.

If you’d like to dive deeper into this subject, there’s more to discover on this page: 2022-National-Money-Laundering-Risk-Assessment.pdf

More links

To delve further into this matter, we encourage you to check out the additional resources provided here: The Best Global Crypto Exchanges