climate change. The urgency to reduce greenhouse gas emissions, transition to clean energy, and adapt to a changing climate has never been greater. Climate finance and green investments have emerged as powerful tools in the fight against climate change, offering a pathway to a more sustainable and resilient future. In this article, we will delve into the world of climate finance, exploring its significance, challenges, and the transformative potential of green investments.

The urgency to address climate change has reached a critical juncture. The scientific consensus is clear: we must take immediate and bold actions to curb greenhouse gas emissions, mitigate the impacts of climate change, and transition to a more sustainable future. Climate finance and green investments stand at the forefront of this global effort, representing not just tools but beacons of hope in our battle against environmental crisis.

A Race Against Time: The acceleration of climate change is evident in the increasing frequency of extreme weather events, rising sea levels, and shifting weather patterns. Our window of opportunity to avert the worst impacts of climate change is narrowing rapidly. Every day we delay action exacerbates the challenges we face.

Transitioning to Clean Energy: One of the central pillars of climate action is the transition to clean energy sources. This shift is not just an environmental necessity but an economic opportunity. Green investments in renewable energy technologies not only reduce carbon emissions but also create jobs, stimulate innovation, and enhance energy security.

Adaptation and Resilience: While mitigation efforts are crucial, we must also adapt to the changes that are already underway. Climate finance supports adaptation measures, helping communities build resilience against climate impacts. Investments in infrastructure, agriculture, and disaster preparedness save lives and protect livelihoods.

Global Solidarity: Climate change is a global challenge that requires a global response. Climate finance embodies the principles of global solidarity and shared responsibility. Developed countries, historically responsible for the bulk of emissions, contribute to financing climate solutions in developing nations. This support fosters international cooperation in addressing climate change.

Transforming Our World: Climate finance and green investments are not just about mitigating harm; they are about transformation. They offer us the chance to reimagine our economies and societies in ways that are more sustainable, equitable, and prosperous. It’s a unique opportunity to shift our trajectory toward a brighter future.

In the pages that follow, we will delve deeper into the mechanics of climate finance, examining where the funds come from, how they are allocated, and the challenges that must be overcome. We will also explore the diverse range of green investments, from renewable energy projects to sustainable agriculture initiatives, showcasing their potential to drive positive change.

The journey to a sustainable and resilient future is a daunting one, but it is a journey we must embark upon with unwavering determination. Climate finance and green investments are not just tools; they are the compass guiding us toward a world where future generations can thrive in harmony with nature.

To expand your knowledge on this subject, make sure to read on at this location: Paving the Way: An Inclusive Roadmap to Sustainability – Building a …

Climate finance refers to the flow of funds from various sources, including governments, private sectors, and international organizations, directed towards projects and initiatives that mitigate climate change and build climate resilience. Its significance can be understood through several key aspects:

Climate finance, a critical component in the global fight against climate change, encompasses a wide range of financial mechanisms and strategies aimed at addressing one of the most pressing challenges of our time. Expanding on the idea, let’s delve deeper into the key aspects that highlight the significance of climate finance:

Scaling Up Climate Action: Climate finance is the lifeblood of climate action. It enables the scaling up of projects and initiatives that might otherwise remain underfunded or unrealized. By channeling resources towards climate-related endeavors, it empowers nations, organizations, and communities to take meaningful steps in reducing greenhouse gas emissions and adapting to the impacts of climate change.

Global Cooperation: Climate finance operates on a global scale, involving collaboration among countries, international organizations, and private sector entities. It fosters cooperation and encourages developed countries to provide financial support to developing nations that are disproportionately affected by climate change but often lack the resources to combat it effectively.

Adaptation and Mitigation: Climate finance addresses both adaptation and mitigation efforts. Mitigation projects focus on reducing emissions, such as renewable energy deployment, afforestation, and carbon capture technologies. Adaptation projects, on the other hand, help communities and ecosystems adapt to the changing climate, such as building resilient infrastructure or implementing drought-resistant agricultural practices.

Risk Mitigation: Climate-related projects often carry significant risks due to their long-term nature and uncertainty associated with climate impacts. Climate finance mechanisms, such as climate insurance and risk-sharing agreements, help mitigate these risks, making investments in climate action more attractive to both public and private funders.

Private Sector Engagement: The private sector plays a pivotal role in climate finance. Businesses and investors are increasingly recognizing the financial risks associated with climate change and the opportunities presented by sustainable practices. Climate finance encourages private sector engagement by providing incentives, reducing investment risks, and facilitating the transition to a low-carbon economy.

Innovation and Technology Transfer: Climate finance fosters innovation by supporting research and development of clean technologies. It also facilitates the transfer of sustainable technologies from developed to developing regions, accelerating the global transition to cleaner and more efficient systems.

Environmental and Social Co-Benefits: Many climate projects deliver not only environmental benefits but also positive social and economic outcomes. Investments in renewable energy, for example, create jobs, reduce air pollution, and enhance energy security, demonstrating that climate finance can drive sustainable development.

Transparency and Accountability: Climate finance mechanisms often come with transparency and accountability requirements to ensure that funds are used effectively and reach their intended recipients. This helps build trust among donors and stakeholders, ensuring that resources are used efficiently.

Long-Term Commitment: Climate change is a long-term challenge, and climate finance reflects this reality. Committing to sustained financial support for climate action is essential to meet global climate goals and address the evolving nature of climate impacts.

Global Equity: Climate finance recognizes the principle of “common but differentiated responsibilities,” acknowledging that developed countries historically contributed more to climate change and therefore have a greater responsibility to assist developing nations in their climate efforts. This equity principle underscores the importance of climate finance in achieving global climate justice.

In sum, climate finance is a linchpin in the collective effort to combat climate change and build a more sustainable future. Its significance lies not only in the substantial financial resources it provides but also in its capacity to drive international collaboration, foster innovation, and address the multifaceted challenges posed by climate change. As the world continues to grapple with the impacts of a changing climate, climate finance remains a vital tool in the toolbox of climate action.

Don’t stop here; you can continue your exploration by following this link for more details: Building bridges for climate action: Comparative Study paves the …

Climate finance plays a pivotal role in reducing greenhouse gas emissions. It supports the development and deployment of renewable energy projects, energy-efficient technologies, and initiatives that promote carbon capture and storage, all of which are essential for achieving global emissions reduction targets.

Climate finance stands as a linchpin in the global fight against climate change, serving as a catalytic force for the reduction of greenhouse gas emissions. Its multifaceted role extends far beyond mere financial support, driving transformative change across industries and economies. Here, we delve into the expanded idea, emphasizing the critical role of climate finance in advancing emissions reduction objectives:

Scaling Renewable Energy: Climate finance is a driving force behind the rapid expansion of renewable energy projects worldwide. By providing funding and incentives, it accelerates the deployment of solar, wind, hydro, and geothermal energy infrastructure. These clean energy sources replace fossil fuels, reducing emissions while bolstering energy security and resilience.

Promoting Energy Efficiency: Climate finance champions the adoption of energy-efficient technologies and practices. Businesses, industries, and households receive support to enhance their energy efficiency, reducing energy consumption and emissions. This includes initiatives like retrofitting buildings, upgrading industrial processes, and deploying efficient appliances.

Research and Development: Climate finance channels resources into research and development efforts focused on breakthrough technologies. Innovations in carbon capture and storage (CCS), sustainable agriculture, and emission-reducing solutions benefit from this funding, contributing to the development of scalable and cost-effective climate solutions.

Enabling Sustainable Transport: Transportation is a major source of emissions. Climate finance supports the transition to low-emission and electrified transportation systems. Investment in electric vehicles, public transit, and infrastructure for cycling and walking reduces emissions from the transportation sector.

Forestry and Land Use: Climate finance recognizes the pivotal role of forests and land in sequestering carbon. Projects related to afforestation, reforestation, and sustainable land management receive funding. These initiatives not only capture carbon but also enhance biodiversity and protect ecosystems.

Empowering Vulnerable Communities: Climate finance prioritizes the resilience and adaptation needs of vulnerable communities. Funding is directed towards climate-resilient infrastructure, disaster preparedness, and sustainable agriculture practices that help communities adapt to the impacts of climate change.

Mobilizing Private Investment: Climate finance serves as a catalyst for private sector involvement. Public funds often leverage private capital, amplifying the impact of climate investments. Mechanisms like green bonds, carbon markets, and blended finance models attract private investment into climate-friendly projects.

International Climate Agreements: Climate finance is a cornerstone of international climate agreements like the Paris Agreement. Developed countries commit to providing financial support to developing nations to aid their transition to low-carbon economies and build resilience to climate impacts.

Accountability and Transparency: Climate finance institutions prioritize transparency and accountability. They ensure that funds are directed to projects with measurable emissions reductions, fostering trust and confidence in climate finance mechanisms.

Long-Term Sustainability: Climate finance is not a short-term endeavor. It envisions long-term sustainability by funding projects that yield lasting emissions reductions and drive systemic changes in how societies produce and consume energy.

In essence, climate finance represents the financial commitment required to align our global trajectory with emissions reduction targets. Its role transcends monetary investments; it encompasses a collective commitment to fostering innovation, resilience, and sustainability in the face of climate change. As we move forward, climate finance will continue to be an essential instrument in the toolbox of climate action, catalyzing the transformational changes needed to secure a more sustainable and climate-resilient future for all.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Colombia: Leading the Path to Sustainability in Latin America

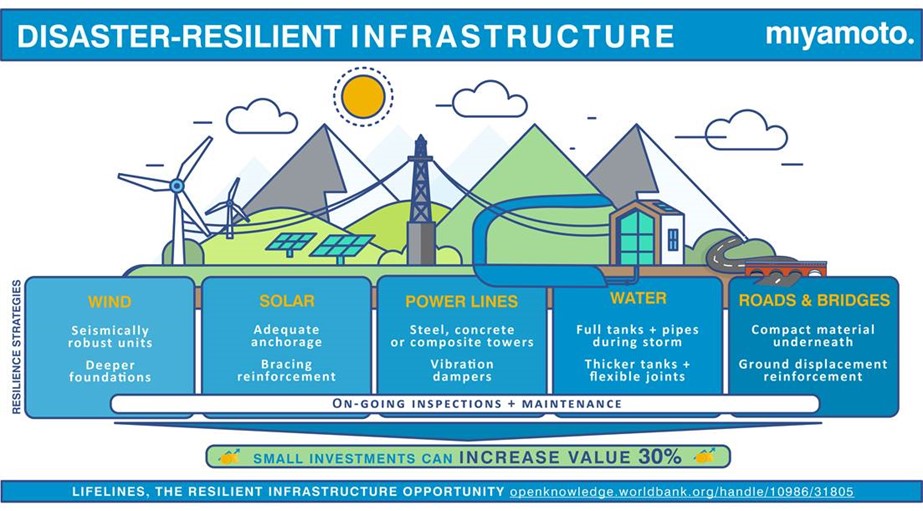

As climate change impacts intensify, investments in adaptation and resilience are crucial. Climate finance supports projects that enhance climate resilience in vulnerable communities, such as building resilient infrastructure, safeguarding water resources, and improving disaster preparedness.

As the impacts of climate change continue to escalate, the imperative for investments in adaptation and resilience becomes even more pronounced. Expanding on this idea, let’s delve deeper into the significance of climate finance in supporting projects that bolster climate resilience in vulnerable communities:

Building Resilient Infrastructure: Climate finance is instrumental in funding the construction of resilient infrastructure. This includes roads, bridges, buildings, and utilities designed to withstand extreme weather events such as hurricanes, floods, and wildfires. Resilient infrastructure not only reduces the risk of damage and disruption but also ensures the continuity of essential services during and after disasters.

Safeguarding Water Resources: Water scarcity and the increased frequency of droughts are significant challenges exacerbated by climate change. Climate finance can be directed toward projects that secure and manage water resources more effectively. This includes the development of sustainable water supply systems, water recycling and conservation initiatives, and strategies for improved irrigation and agriculture practices.

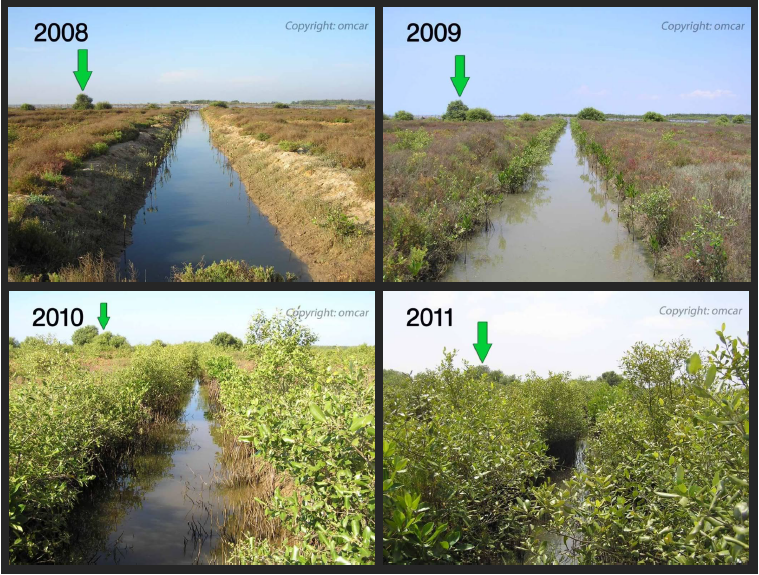

Enhancing Ecosystem Resilience: Ecosystems play a crucial role in climate resilience. Climate finance can support initiatives that protect and restore natural habitats, such as wetlands, mangroves, and forests, which act as natural buffers against climate-related hazards. Ecosystem-based adaptation projects contribute to flood control, carbon sequestration, and biodiversity preservation.

Improving Disaster Preparedness: Climate finance enables communities to enhance their disaster preparedness and response capacities. This includes early warning systems, evacuation plans, and the stockpiling of emergency supplies. Investments in disaster risk reduction can save lives and minimize the economic impact of climate-related disasters.

Supporting Vulnerable Populations: Vulnerable communities, including those in low-income regions and marginalized groups, are disproportionately affected by climate change. Climate finance prioritizes projects that address the unique needs of these populations, such as providing access to resilient housing, healthcare, and social safety nets.

Promoting Climate-Resilient Agriculture: Agriculture is highly susceptible to climate variability. Climate finance can be channeled into agricultural practices and technologies that enhance resilience, including drought-resistant crop varieties, sustainable land management, and access to climate-smart farming techniques.

Innovation and Technology Transfer: Climate finance fosters innovation and technology transfer, enabling the adoption of climate-resilient solutions. This includes the development and dissemination of climate-adaptive technologies, such as weather-resistant crop strains or affordable clean energy solutions for off-grid communities.

Community Engagement and Education: Effective climate resilience projects often involve community engagement and education. Climate finance supports awareness campaigns, capacity-building initiatives, and community-driven adaptation strategies that empower individuals to take action in safeguarding their communities.

Research and Data Collection: Climate finance also plays a role in advancing climate science and data collection. Robust climate data informs decision-making and helps identify areas that are most vulnerable to climate impacts, guiding the allocation of resources for resilience projects.

Private Sector Engagement: Climate finance can mobilize private sector investments in climate-resilient technologies and practices. Public-private partnerships can drive innovation and scale up climate adaptation efforts.

Measuring and Monitoring Impact: Effective climate finance projects include mechanisms for measuring and monitoring their impact. This allows for continuous improvement and ensures that investments are achieving their intended resilience outcomes.

International Cooperation: Global challenges require global solutions. Climate finance involves international cooperation and agreements to mobilize financial resources for climate resilience projects in developing countries, acknowledging that climate change is a shared global concern.

In conclusion, climate finance is a linchpin for enhancing climate resilience in vulnerable communities. By channeling resources into projects that strengthen infrastructure, protect natural ecosystems, improve water resource management, and empower communities, climate finance not only mitigates the impact of climate change but also fosters sustainable and resilient societies. It represents a collective commitment to safeguarding our planet and ensuring that communities are better prepared to face the challenges of a changing climate.

Don’t stop here; you can continue your exploration by following this link for more details: Building back better: A sustainable, resilient recovery after COVID-19

Climate finance aligns with broader sustainable development goals. It promotes economic growth, job creation, and poverty reduction while addressing climate challenges. Investments in clean energy, sustainable agriculture, and ecosystem restoration contribute to a more sustainable and equitable world.

Indeed, the nexus between climate finance and sustainable development goals (SDGs) is a compelling testament to their intertwined destinies. Climate finance serves as a catalyst, propelling us toward a more prosperous and equitable world while simultaneously mitigating the profound challenges posed by climate change. Here’s an extended look at this symbiotic relationship:

Economic Growth: Climate finance isn’t merely an expense; it’s an investment in a green economy. As funds flow into clean energy, energy-efficient technologies, and sustainable infrastructure, they stimulate economic growth. These investments create jobs across a spectrum of industries, from solar panel manufacturing to green construction, bolstering local economies and fostering innovation.

Job Creation: One of the most tangible and immediate impacts of climate finance is job creation. The renewable energy sector, in particular, is a powerhouse of employment opportunities. Wind turbine technicians, solar installers, and researchers in clean energy technologies are just a few examples. Climate investments, therefore, contribute not only to economic growth but also to addressing unemployment and underemployment.

Poverty Reduction: Climate finance isn’t blind to the plight of vulnerable communities. In fact, it is precisely these communities that often bear the brunt of climate change. Investments in climate resilience, such as climate-smart agriculture, sustainable forestry, and disaster risk reduction, uplift the livelihoods of those living in poverty. By enhancing the resilience of these communities, we take significant strides toward reducing poverty and inequality.

Clean Energy Revolution: At the heart of climate finance lies the clean energy revolution. Investments in renewable energy sources, such as solar, wind, and hydropower, not only reduce carbon emissions but also democratize access to clean energy. This democratization empowers communities and regions with previously limited energy access, reducing energy poverty and enhancing the quality of life.

Sustainable Agriculture: Sustainable agriculture practices supported by climate finance not only bolster food security but also help reduce rural poverty. Techniques like precision farming, agroforestry, and organic farming increase agricultural productivity, improve soil health, and reduce the environmental impact of food production.

Ecosystem Restoration: The restoration of ecosystems, including reforestation and wetland restoration projects, goes hand in hand with climate finance. These initiatives not only sequester carbon dioxide but also enhance biodiversity, protect water resources, and provide valuable ecosystem services. These benefits cascade through communities and regions, improving overall well-being.

Equity and Inclusion: Climate finance underscores the importance of equity and inclusion. By directing resources toward marginalized communities and empowering them with the tools to adapt to climate change, we work toward more equitable societies. This focus on equity is not just a moral imperative but a strategic one, as resilient societies are more stable and prosperous.

In essence, climate finance isn’t a solitary endeavor. It’s a bridge that connects climate action with broader sustainable development objectives. It’s a vehicle for progress, carrying us toward a world where economic prosperity, social equity, and environmental sustainability coexist harmoniously. Through strategic investments and collective efforts, we can simultaneously tackle climate challenges and build a brighter, more equitable future for all.

Looking for more insights? You’ll find them right here in our extended coverage: Building bridges for climate action: Comparative Study paves the …

Climate finance fosters international cooperation in addressing a shared global challenge. Developed countries provide financial assistance to developing nations to help them transition to low-carbon, climate-resilient economies, promoting a sense of solidarity and shared responsibility.

Climate finance serves as a powerful catalyst for international cooperation in addressing the urgent and shared global challenge of climate change. It represents a tangible expression of the commitment to collective action and the recognition that the consequences of climate change transcend borders and affect us all. Extending the idea, let’s explore how climate finance fosters international cooperation and solidarity:

Shared Responsibility: Climate finance embodies the principle of “common but differentiated responsibilities.” Developed countries, historically major contributors to greenhouse gas emissions, acknowledge their historical role in climate change. By providing financial assistance to developing nations, they take responsibility for their past actions and support global efforts to address the climate crisis. This acknowledgment fosters a sense of shared responsibility among nations.

Equitable Access: Climate finance promotes equitable access to resources and opportunities. Developing nations often lack the financial means to invest in climate mitigation and adaptation measures. Climate finance bridges this gap by ensuring that these countries have access to funding and technologies necessary for their sustainable development. This equitable approach enhances international cooperation and reduces disparities.

Technology Transfer: Alongside financial support, climate finance encourages the transfer of clean and sustainable technologies from developed to developing countries. This technology transfer not only helps developing nations reduce emissions but also strengthens their capacity to adapt to climate impacts. It exemplifies cooperation for mutual benefit.

Capacity Building: Climate finance often includes provisions for capacity building and knowledge sharing. Developed countries assist developing nations in building their institutional and technical capabilities to plan, implement, and monitor climate projects effectively. This knowledge exchange enhances cooperation and promotes self-reliance.

Global Partnerships: Climate finance fosters the establishment of global partnerships and collaborations. International organizations, development banks, philanthropic foundations, and private sector entities work together to mobilize and allocate funds efficiently. These partnerships facilitate knowledge sharing and best practices, amplifying the impact of climate finance.

Economic Opportunities: Investments in climate projects can generate economic opportunities in both developed and developing countries. For instance, renewable energy projects create jobs and stimulate economic growth. This economic interdependence encourages cooperation as nations see the potential for mutual benefits.

Political Diplomacy: Climate finance plays a crucial role in climate negotiations and diplomacy. Financial commitments and actions signal a nation’s dedication to global climate goals. The negotiations themselves provide a platform for nations to engage in constructive dialogue, build trust, and make collective decisions.

Resilience Building: Climate finance promotes resilience-building efforts in vulnerable regions. Developing nations are often disproportionately affected by climate-related disasters. By providing funding for resilience measures, developed countries contribute to global stability and security.

Humanitarian Concerns: Climate change’s impacts, such as extreme weather events and sea-level rise, can lead to displacement and humanitarian crises. Climate finance recognizes the human dimension of climate change and seeks to address these pressing concerns, fostering international cooperation in humanitarian efforts.

Global Climate Goals: Ultimately, climate finance is essential for achieving global climate goals, including those outlined in the Paris Agreement. Nations understand that meaningful progress can only be made through cooperation, and climate finance serves as a linchpin in this collective endeavor.

In conclusion, climate finance transcends financial transactions; it represents a commitment to a shared future where nations work together to combat climate change. By fostering international cooperation, promoting equity, and addressing both mitigation and adaptation needs, climate finance reinforces the interconnectedness of our world and underscores the importance of solidarity in tackling the climate crisis.

Additionally, you can find further information on this topic by visiting this page: Paving the way for sustainable finance in Latin America and the …

While the significance of climate finance is clear, several challenges must be addressed to maximize its impact:

Indeed, the significance of climate finance is undeniable in the battle against climate change. However, to fully harness its potential and maximize its impact on emissions reduction, we must address several substantial challenges:

Access to Funding: Many developing countries and vulnerable communities lack easy access to climate finance. Simplifying and streamlining the application and disbursement processes can ensure that those who need it most can access funding for adaptation and mitigation projects.

Resource Allocation: Balancing investments between mitigation and adaptation projects is crucial. While reducing emissions is vital, adaptation measures are equally essential to protect communities from the current and future impacts of climate change. Ensuring equitable distribution between these two priorities is a challenge that requires careful consideration.

Scaling Up Investments: The magnitude of investments required to meet global climate goals is immense. Climate finance must continually seek ways to scale up investments, whether through innovative financial mechanisms, leveraging private sector involvement, or increasing contributions from developed nations.

Risk Management: Climate projects often involve considerable risks, including political, financial, and environmental uncertainties. Addressing these risks and providing risk mitigation mechanisms can make climate investments more attractive to private sector partners.

Transparency and Accountability: Maintaining transparency in the allocation and use of climate finance is paramount. Establishing clear accountability mechanisms ensures that funds are used effectively and that emissions reductions and resilience-building objectives are met.

Local Ownership and Empowerment: Effective climate finance should prioritize the participation and empowerment of local communities. Ensuring that projects are tailored to local needs and that communities have a say in project design and implementation leads to more sustainable and impactful outcomes.

Measuring Impact: Quantifying the actual emissions reductions and adaptation benefits of climate finance projects can be challenging. Developing standardized methodologies for impact measurement and reporting can enhance accountability and help refine climate finance strategies.

Long-Term Commitment: Climate finance must be viewed as a long-term commitment rather than a one-off investment. Providing predictability and sustained support over the years is essential to fostering the stability needed for successful climate action.

Alignment with National Priorities: Climate finance should align with national and local development priorities. It’s essential to avoid imposing external agendas and instead ensure that investments contribute to broader sustainable development goals.

Innovation and Technology Transfer: Encouraging the transfer of clean and sustainable technologies to developing countries is vital. This facilitates the adoption of low-carbon solutions and accelerates emissions reductions.

Building Capacity: Strengthening the capacity of recipient countries to manage climate finance effectively is a continuous challenge. Providing training and technical assistance can enhance their ability to access and manage funds efficiently.

Ethical Considerations: Climate finance should consider ethical aspects, including the historical responsibility of developed countries for greenhouse gas emissions and the disproportionate impacts on vulnerable communities. Addressing these ethical dimensions is essential for fair and equitable climate finance.

Global Cooperation: Climate change is a global challenge that requires international collaboration. Ensuring that climate finance commitments are met and that developed nations fulfill their financial obligations to support developing countries is crucial for achieving collective climate goals.

In conclusion, climate finance is a cornerstone of our response to climate change, but its effectiveness relies on overcoming these challenges. By addressing these issues systematically and collaboratively, we can optimize the impact of climate finance, accelerate emissions reductions, and build a more climate-resilient and sustainable future for all.

For additional details, consider exploring the related content available here Private Sector Climate Finance After the Crisis | Center For Global …

The scale of climate finance required to meet global climate goals far exceeds current commitments. Bridging the funding gap remains a critical challenge, necessitating increased contributions from both public and private sectors.

The magnitude of climate finance needed to achieve global climate objectives is indeed monumental, and addressing the funding gap is a formidable challenge. Expanding on this idea, let’s explore the complexities and potential solutions associated with bridging this financial divide:

Magnitude of the Funding Gap: The funding gap to meet climate goals, as outlined in international agreements like the Paris Agreement, is substantial. Estimates vary, but the need for trillions of dollars annually for mitigation and adaptation efforts is widely acknowledged. The current commitments from governments and international institutions fall short of this requirement.

Public Sector Commitments: Governments play a crucial role in climate finance through public sector commitments. Many countries have pledged contributions to climate funds such as the Green Climate Fund (GCF) and Adaptation Fund. However, these commitments often fall short of the funds required to implement comprehensive climate action plans.

Private Sector Mobilization: Engaging the private sector is essential to bridge the funding gap. Private investments in renewable energy, sustainable infrastructure, and climate-resilient technologies can significantly augment available resources. Public-private partnerships are instrumental in mobilizing these investments.

Innovative Financing Mechanisms: Innovative financing mechanisms are emerging to attract private capital for climate projects. Green bonds, climate risk insurance, and impact investments are examples of financial instruments designed to channel funds toward climate-resilient projects.

Carbon Pricing: Implementing carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, can generate revenue that can be reinvested in climate initiatives. These pricing mechanisms not only reduce emissions but also create a financial incentive for transitioning to low-carbon technologies.

Climate Finance Transparency: Ensuring transparency and accountability in climate finance is critical. Transparent reporting on the allocation and utilization of climate funds enhances trust and encourages contributions from both public and private sectors.

Development Finance: International development finance institutions, such as the World Bank and regional development banks, play a significant role in climate finance. These institutions provide concessional loans and grants to support climate projects in developing countries.

Multilateral Cooperation: Climate finance often involves multilateral cooperation. Developed countries pledge to provide financial assistance to developing nations to support their climate efforts. Encouraging stronger commitments from developed nations is essential.

Climate-Compatible Investments: Investors are increasingly considering climate risk when making investment decisions. Encouraging investments in climate-compatible projects that align with sustainability goals can bridge the funding gap.

Climate Resilience Bonds: Climate resilience bonds are financial instruments designed explicitly for projects that enhance resilience to climate change. These bonds can attract investors looking for opportunities to support climate adaptation efforts.

Fostering Innovation: Encouraging innovation in climate finance can lead to more efficient and cost-effective solutions. This includes exploring blockchain technology for transparent financial transactions and exploring new ways to securitize climate-related assets.

Capacity Building: Building the capacity of developing countries to access and manage climate finance is essential. This includes providing technical assistance and support for project development and implementation.

Climate Diplomacy: Diplomacy and negotiations among nations are crucial for securing increased climate finance commitments. International agreements and negotiations, such as the annual United Nations Climate Change Conferences, aim to encourage countries to enhance their financial contributions.

Bridging the funding gap for climate finance is not just a matter of economic necessity; it’s a moral imperative. Failure to adequately finance climate action threatens the well-being of current and future generations, exacerbates climate-related challenges, and undermines global efforts to combat climate change. By forging partnerships, promoting innovative financing mechanisms, and fostering international cooperation, it is possible to mobilize the resources needed to address this monumental challenge and transition to a sustainable and climate-resilient future.

For additional details, consider exploring the related content available here Rwanda, Team Europe and partners pioneer an additional EUR 300 …

Ensuring equitable access to climate finance, particularly for the most vulnerable countries and communities, is essential. Addressing historical imbalances and providing support for capacity building and project development is crucial.

Equity in climate finance is not just a matter of moral obligation; it’s a cornerstone of effective climate action. Addressing historical imbalances and ensuring equitable access to climate finance are paramount for achieving meaningful and lasting results. Here’s a more in-depth exploration of this critical aspect:

Historical Injustices: Historical emissions of greenhouse gases have disproportionately originated from developed countries, while the impacts of climate change are often most acutely felt by the least developed and vulnerable nations. Recognizing this historical injustice, climate finance aims to rectify this imbalance by providing financial resources to countries that are least responsible for climate change but most affected by it.

Vulnerable Communities: Within countries, climate change doesn’t affect everyone equally. Vulnerable communities, including indigenous peoples, low-income populations, and marginalized groups, often bear the brunt of climate impacts. Equitable climate finance ensures that these communities receive the support they need to adapt to and mitigate climate change effectively.

Capacity Building: Many developing countries lack the institutional and technical capacity to access and effectively utilize climate finance. Capacity-building initiatives are crucial to bridge this gap. They involve training, knowledge sharing, and the development of local expertise to enable countries and communities to develop and implement climate projects successfully.

Local Empowerment: Equity in climate finance extends beyond just distributing funds. It involves empowering local stakeholders, including indigenous communities and civil society organizations, to actively participate in decision-making processes. These stakeholders often possess valuable traditional knowledge and insights that can enhance the effectiveness of climate projects.

Women’s Empowerment: Gender equity is an integral part of climate finance. Women in many parts of the world are disproportionately affected by climate change and play a crucial role in climate adaptation and resilience efforts. Ensuring that women have equitable access to climate finance and are actively involved in decision-making processes is vital.

Transparent Allocation: Transparent and accountable allocation mechanisms are essential to ensure that climate finance reaches the most vulnerable countries and communities. These mechanisms must be based on clear criteria that prioritize those in greatest need and are free from political biases.

Long-Term Commitment: Climate finance should not be a one-time gesture but a sustained commitment. Addressing the ongoing and evolving challenges of climate change requires predictable and consistent support. Long-term partnerships between developed and developing nations are vital to build trust and ensure effective climate finance delivery.

Innovative Financing: Exploring innovative financing mechanisms, such as climate bonds, green funds, and public-private partnerships, can expand the pool of available resources for climate finance. These mechanisms can mobilize private sector investments while maintaining a focus on equity and sustainability.

Measuring Impact: Monitoring and evaluating the impact of climate finance is crucial to ensure that it effectively reaches vulnerable communities and achieves its intended objectives. Robust tracking and reporting systems help measure progress and hold stakeholders accountable.

In conclusion, equitable access to climate finance is a linchpin of global climate action. It acknowledges historical imbalances, recognizes the disproportionate impacts of climate change on the most vulnerable, and empowers local communities to be active participants in their own resilience-building efforts. By fostering equity in climate finance, we not only address climate change more effectively but also promote a fairer and more just world for all.

For additional details, consider exploring the related content available here Rwanda, Team Europe and partners pioneer an additional EUR 300 …

Climate projects often face higher risks, including regulatory, technological, and financial uncertainties. Innovative financial instruments and risk mitigation strategies are needed to attract private sector investments and reduce perceived risks.

Climate projects are pivotal in the global effort to combat climate change and transition to a sustainable future. However, they often encounter a multitude of challenges and uncertainties that can deter private sector investments. To make these projects more appealing and feasible, innovative financial instruments and risk mitigation strategies are essential. Expanding on this idea, let’s explore why such tools are crucial and how they can be leveraged:

Enhanced Financial Viability: Innovative financial instruments can bridge the gap between the high upfront costs of climate projects and their long-term benefits. For instance, green bonds and climate finance mechanisms can provide the necessary upfront capital, making these projects financially viable for both public and private investors.

Risk Reduction: Climate projects face various risks, such as regulatory changes, technological obsolescence, and market uncertainties. Risk mitigation strategies, such as insurance products tailored to climate risks, can significantly reduce the perceived risks associated with these projects. This, in turn, attracts more private sector investments.

Cost-Effective Capital: Innovative financial instruments often enable access to more cost-effective capital. For example, blended finance structures combine public and private funds, reducing the overall cost of financing for climate projects. This affordability encourages more investors to participate.

Long-Term Investment Incentives: Climate projects often have extended payback periods, making them less attractive to investors looking for quick returns. Innovative financial tools, like green bonds with extended maturities, align investment timelines with the project’s life cycle, making long-term investments more appealing.

Credit Enhancement: Credit enhancements, such as guarantees or risk-sharing mechanisms, can improve the creditworthiness of climate projects. By reducing the perceived credit risk, these instruments make it easier for projects to secure financing at lower interest rates.

Leveraging Public Funds: Public funds, such as climate finance from governments or international organizations, can be leveraged to attract private sector capital. These funds can serve as a catalyst, enticing private investors who are more willing to participate when they see public support and alignment with global climate goals.

Regulatory Support: Governments can incentivize private sector investments in climate projects by implementing supportive regulatory frameworks. Policies such as tax incentives, emissions reduction targets, and renewable energy mandates can create a conducive environment for private investment.

Public-Private Partnerships (PPPs): Collaboration between the public and private sectors through PPPs can help share risks and responsibilities in climate projects. These partnerships bring together the resources, expertise, and risk-sharing mechanisms needed to tackle large-scale initiatives.

Market Signals: Government commitments to climate action and clear signals about the transition to a low-carbon economy provide assurance to investors. Such signals reduce the uncertainty surrounding climate projects, making them more attractive investment opportunities.

Knowledge Sharing and Capacity Building: Innovative financial instruments often come with technical assistance and capacity-building components. These resources can help project developers and investors better understand the intricacies of climate projects and navigate potential challenges.

Track Record and Best Practices: As more climate projects are successfully implemented, they establish a track record of profitability and sustainability. This track record builds confidence among investors and demonstrates that climate projects can be both environmentally and financially rewarding.

In conclusion, addressing climate change requires substantial investments in climate projects, many of which face complex challenges. Innovative financial instruments and risk mitigation strategies are indispensable tools for unlocking the vast potential of private sector investments in these projects. By reducing perceived risks, enhancing financial viability, and aligning investments with global climate goals, these instruments pave the way for a sustainable and resilient future.

Should you desire more in-depth information, it’s available for your perusal on this page: Colombia: Leading the Path to Sustainability in Latin America

Robust data on climate finance flows and their impact is essential for accountability and informed decision-making. Improving transparency and reporting standards is an ongoing challenge.

The transparency and accountability of climate finance flows represent critical elements in the global effort to combat climate change effectively. Robust data on where climate finance is directed, how it is utilized, and the outcomes it achieves are indispensable for informed decision-making, building trust among stakeholders, and ensuring that financial resources are allocated efficiently. However, this pursuit of transparency and reporting standards is not without its complexities and ongoing challenges:

Data Fragmentation: Climate finance often comes from diverse sources, including governments, international organizations, private sector entities, and non-governmental organizations. Coordinating and aggregating data from these various sources to create a comprehensive and cohesive picture of climate finance flows can be a formidable challenge.

Consistency and Compatibility: Achieving consistent and compatible reporting standards across countries and organizations is essential. Currently, variations in reporting methodologies, metrics, and data quality can hinder efforts to compare and analyze climate finance information accurately.

Complex Financial Instruments: Climate finance involves various financial instruments, such as grants, loans, guarantees, and equity investments. Each of these instruments has unique reporting requirements and challenges, making it necessary to standardize reporting frameworks for diverse financial mechanisms.

Attribution and Additionality: Determining the direct impact of climate finance on emissions reduction or adaptation outcomes can be intricate. Establishing clear attribution and additionality criteria is vital to assess whether climate finance projects are achieving their intended objectives and making a meaningful contribution to global climate goals.

Monitoring Impact Over Time: Climate projects often have long timelines, and measuring their impact over several years or even decades is challenging. Developing methodologies for tracking the long-term effects of climate finance and adjusting strategies accordingly is an ongoing endeavor.

Data Accessibility: Ensuring that climate finance data is accessible to all stakeholders, including the public, can be a struggle. While transparency is essential, balancing the need for accessibility with data privacy and security concerns is a delicate task.

Capacity Building: Enhancing the capacity of recipient countries and organizations to collect, manage, and report climate finance data is essential. Providing training and resources to improve data management capabilities can enhance the quality and reliability of reporting.

Alignment with National Reporting Systems: Coordinating climate finance reporting with national reporting systems and priorities is crucial. Aligning climate finance reporting with broader development goals fosters ownership and ensures that climate projects are integrated into national development strategies.

Global Aggregation and Tracking: Developing mechanisms for global aggregation and tracking of climate finance flows is essential for assessing progress toward international climate commitments, such as the Paris Agreement. These mechanisms should facilitate comparisons across countries and regions while respecting individual circumstances.

Independent Verification: To enhance trust and accountability, some climate finance initiatives may benefit from independent verification or auditing of their reporting. This can provide assurance that reported data accurately reflects the utilization and impact of climate finance resources.

In summary, improving the transparency and reporting standards of climate finance is an ongoing and collaborative effort that involves multiple stakeholders, including governments, financial institutions, civil society, and international organizations. As climate finance continues to grow in importance, addressing these challenges and establishing robust data collection and reporting mechanisms is essential for ensuring that financial resources are directed effectively toward addressing the urgent global challenge of climate change.

You can also read more about this here: Abbas Mashaollah – Shaping the Future of Climate Investing

Coherent and supportive policy frameworks at the national and international levels are critical to attracting investments. Regulatory barriers and policy inconsistencies can hinder climate finance mobilization.

Establishing coherent and supportive policy frameworks, both nationally and internationally, is pivotal in not only attracting climate investments but also ensuring their effectiveness and scalability. Elaborating on this idea, let’s delve deeper into the significance of well-crafted climate policies:

Policy Clarity and Consistency: Clear and consistent climate policies provide a stable and predictable environment for investors. Investors are more likely to commit capital to climate projects when they can rely on consistent regulations and policy signals. Frequent changes or inconsistencies can deter investments.

Long-Term Commitment: Climate investments often require long-term commitments. Coherent policy frameworks that emphasize long-term climate goals, such as emissions reductions or renewable energy targets, provide investors with the confidence that their investments align with broader climate objectives.

Regulatory Streamlining: Streamlining regulatory processes and reducing bureaucratic barriers can accelerate project development and financing. Policies that simplify permitting, licensing, and compliance procedures make it easier for investors to navigate the regulatory landscape.

Incentive Mechanisms: Policies that offer incentives for climate investments, such as tax credits, subsidies, or feed-in tariffs, can attract private sector funding. These mechanisms help level the playing field and make clean energy and sustainable practices more financially appealing.

Carbon Pricing: Implementing carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, can create a financial incentive for emissions reductions and low-carbon investments. Revenue generated from carbon pricing can be reinvested in climate initiatives.

Risk Mitigation Instruments: Governments can provide risk mitigation instruments, such as guarantees or insurance, to reduce the perceived risk associated with climate investments. These instruments can make projects more attractive to private investors.

Fostering Innovation: Policy frameworks can encourage innovation in clean technologies and sustainable practices. Support for research and development, as well as incentives for adopting new technologies, can drive investments in climate solutions.

Energy Market Reforms: Reforms in energy markets, including measures to promote competition and market transparency, can create a more favorable environment for renewable energy investments. Well-functioning energy markets can attract private sector capital.

Emission Reduction Targets: Establishing clear emission reduction targets and carbon neutrality goals sends a strong signal to investors. These targets provide a roadmap for investments that align with a low-carbon future.

Stakeholder Engagement: Involving various stakeholders, including businesses, local communities, and civil society, in the policy-making process ensures that climate policies are well-informed and reflect the needs and aspirations of diverse constituencies. This builds trust and support for climate investments.

International Cooperation: At the international level, cooperation and alignment of climate policies among nations are critical. Agreements like the Paris Agreement aim to create a global framework for climate action, encouraging countries to set ambitious climate goals and mobilize climate finance.

Data and Reporting Requirements: Policies can require companies to disclose climate-related information and risks. Enhanced transparency and reporting enable investors to assess climate risks and opportunities more effectively.

Fiscal Policy Alignment: Fiscal policies can be aligned with climate goals by reducing fossil fuel subsidies and reallocating funds to support clean energy and sustainable practices.

Adaptation Planning: Climate policies should include adaptation planning to address the impacts of climate change. This ensures that investments in resilience, infrastructure, and disaster preparedness are integrated into the policy framework.

In summary, coherent and supportive climate policy frameworks are the linchpin for attracting and mobilizing climate investments. They provide the necessary regulatory certainty, incentives, and risk mitigation measures that make climate projects financially viable and aligned with climate goals. Effective policies not only attract investments but also catalyze the transformative changes needed to transition to a sustainable, low-carbon, and climate-resilient future.

Don’t stop here; you can continue your exploration by following this link for more details: Building bridges for climate action: Comparative Study paves the …

Green investments encompass a wide range of financial activities that support environmentally sustainable and climate-resilient projects. These investments are a central component of climate finance, and their transformative potential is evident in several key areas:

The transformative potential of green investments extends far and wide, encompassing a diverse array of sectors and initiatives that collectively shape a more sustainable and climate-resilient future. Let’s delve deeper into the multifaceted impact of these investments:

1. Renewable Energy Revolution: At the forefront of green investments lies the renewable energy revolution. Funding and support for solar, wind, hydro, and geothermal energy projects are driving a seismic shift away from fossil fuels. This transition not only reduces greenhouse gas emissions but also enhances energy security and creates a burgeoning market for clean energy technologies.

2. Energy Efficiency Advancements: Green investments promote energy efficiency in buildings, industries, and transportation. Initiatives such as retrofitting buildings with energy-efficient systems, developing smart grids, and incentivizing fuel-efficient vehicles contribute to significant energy savings and lower carbon footprints.

3. Sustainable Transportation: Transforming the way we move people and goods is a key facet of green investments. Electric vehicles (EVs), efficient public transit systems, and investments in bike lanes and pedestrian-friendly infrastructure reduce emissions from the transportation sector. Green investments support the transition to cleaner, more sustainable modes of mobility.

4. Climate-Resilient Infrastructure: Climate-resilient infrastructure projects, backed by green investments, strengthen communities’ ability to withstand the impacts of climate change. These projects include flood defenses, drought-resistant water supply systems, and resilient urban planning that considers rising sea levels and extreme weather events.

5. Sustainable Agriculture: Agriculture is both a contributor to and a victim of climate change. Green investments in sustainable agriculture practices, such as precision farming, organic farming, and regenerative agriculture, improve crop yields, soil health, and water conservation while reducing the carbon footprint of food production.

6. Ecosystem Restoration: Investments in the restoration of ecosystems, including reforestation, wetland rehabilitation, and coral reef conservation, not only sequester carbon but also enhance biodiversity, protect watersheds, and provide essential ecosystem services. These projects are fundamental to building climate resilience.

7. Circular Economy Initiatives: Green investments are driving the transition to a circular economy, where waste is minimized, and resources are conserved. This shift involves recycling, reusing, and repurposing materials, reducing waste generation, and promoting sustainable product design.

8. Green Finance Instruments: Innovative financial instruments such as green bonds, sustainability-linked loans, and impact investing channels capital toward environmentally sustainable projects. These instruments align financial incentives with ecological goals, creating a win-win scenario for investors and the planet.

9. Nature-Based Solutions: Green investments increasingly recognize the power of nature-based solutions. These approaches leverage natural ecosystems, such as forests, wetlands, and mangroves, to provide climate resilience, carbon sequestration, and protection against natural disasters.

10. Empowering Communities: Green investments extend beyond infrastructure to empower local communities and stakeholders. They foster participation in decision-making processes and often include social and environmental safeguards to ensure that projects benefit communities while minimizing harm.

In summary, green investments are a force of transformation, touching every facet of our lives and the planet. They represent a collective commitment to build a sustainable, equitable, and climate-resilient future. By channeling financial resources into environmentally conscious and climate-smart initiatives, we take bold strides toward a world where prosperity harmonizes with planetary well-being.

Should you desire more in-depth information, it’s available for your perusal on this page: Blockchain’s Impact on the Energy Sector: Paving the Way for Green …

Green investments drive the expansion of renewable energy sources, such as wind, solar, and hydropower. These technologies reduce emissions, promote energy security, and create jobs in the clean energy sector.

Green investments play a pivotal role in reshaping our energy landscape and addressing the pressing challenges of climate change, energy security, and economic growth. Expanding on this idea, let’s explore the multifaceted impact of green investments in the renewable energy sector:

Diverse Renewable Energy Sources: Green investments fuel the growth of diverse renewable energy sources beyond wind, solar, and hydropower. This includes emerging technologies like geothermal energy, tidal energy, and advanced biofuels. Diversification enhances energy resilience by reducing dependence on a single energy source.

Emissions Reduction: The expansion of renewable energy sources through green investments directly contributes to significant reductions in greenhouse gas emissions. This transition to cleaner energy plays a pivotal role in mitigating climate change and achieving carbon neutrality goals.

Energy Security: By harnessing domestic renewable energy resources, countries reduce their reliance on imported fossil fuels, enhancing energy security. This reduces exposure to energy price fluctuations and geopolitical tensions associated with fossil fuel dependencies.

Job Creation: The clean energy sector is a robust source of job creation. Green investments lead to employment opportunities in manufacturing, installation, maintenance, and research and development of renewable energy technologies. This sector’s growth strengthens local economies and contributes to a skilled workforce.

Technological Advancements: Increased investments drive innovation and technological advancements in renewable energy. Research and development efforts result in more efficient solar panels, wind turbines, energy storage solutions, and grid integration technologies. These innovations continually lower the cost of renewable energy production.

Decentralization of Energy: Renewable energy projects, such as rooftop solar installations and community wind farms, empower individuals and communities to generate their own energy. This decentralization reduces dependence on centralized energy grids and enhances energy access and resilience, particularly in remote or underserved areas.

Resilience to Climate Impacts: Green investments contribute to climate resilience by reducing vulnerability to extreme weather events. Renewable energy systems are less susceptible to disruption from climate-related disasters, ensuring a more reliable energy supply during crises.

Attracting Private Investment: Government incentives and policies that encourage green investments often attract private sector funding. Initiatives such as tax incentives, renewable energy credits, and power purchase agreements make renewable energy projects financially attractive to investors.

Electrification of Transportation: Green investments extend beyond power generation to the electrification of transportation. Electric vehicles (EVs) and charging infrastructure benefit from green investments, reducing emissions from the transportation sector and promoting sustainable mobility.

Environmental Benefits: In addition to reducing carbon emissions, green investments in renewable energy help preserve ecosystems, protect air and water quality, and reduce habitat disruption associated with fossil fuel extraction and transportation.

Public Health: The shift to cleaner energy sources reduces air pollution, leading to improved public health outcomes. Fewer pollutants in the air translate to reduced respiratory illnesses and related healthcare costs.

Global Leadership: Green investments position countries as global leaders in sustainability and climate action. Such leadership fosters international cooperation and encourages other nations to follow suit in adopting clean energy technologies and practices.

In summary, green investments in renewable energy sources extend far beyond the reduction of greenhouse gas emissions. They promote energy security, stimulate economic growth, enhance technological innovation, and improve overall quality of life. As the world continues its transition toward a more sustainable and resilient energy future, green investments remain a linchpin in achieving these vital goals.

Explore this link for a more extensive examination of the topic: Paving the Way for Greener Central Banks. Current Trends and …

Investments in energy-efficient technologies and practices reduce energy consumption and lower operating costs for businesses and households. This leads to significant carbon savings and economic benefits.

Investments in energy-efficient technologies and practices represent a win-win scenario for both the environment and the economy. The adoption of these measures not only reduces energy consumption but also has a profound impact on lowering operating costs for businesses and households. Let’s delve deeper into the multifaceted benefits that emanate from such investments:

Cost Savings: Energy efficiency measures, such as upgrading lighting systems, improving insulation, and installing energy-efficient appliances, result in immediate and sustained cost savings. For businesses, this translates into reduced operational expenses, enhanced profitability, and increased competitiveness. Households enjoy lower energy bills, freeing up disposable income for other needs and investments.

Enhanced Competitiveness: Energy-efficient businesses often gain a competitive advantage. They can offer products and services at a lower cost, which can attract more customers and increase market share. Additionally, environmentally conscious consumers increasingly favor businesses that demonstrate a commitment to sustainability.

Job Creation: Investments in energy efficiency generate jobs across various sectors. The installation, maintenance, and manufacturing of energy-efficient technologies create employment opportunities, contributing to economic growth and stability.

Environmental Benefits: Reduced energy consumption directly translates into lower greenhouse gas emissions and a smaller carbon footprint. Energy-efficient practices are a crucial component of climate action, helping to mitigate the impacts of climate change and reduce dependence on fossil fuels.

Resilience to Energy Price Volatility: Energy-efficient technologies insulate businesses and households from energy price fluctuations. When energy costs rise, those who have invested in efficiency measures are less vulnerable to these price hikes, ensuring stability in their budgets and operations.

Long-Term Savings: Energy-efficient investments often have a rapid payback period, with initial costs recouped through energy savings relatively quickly. Over the long term, businesses and households can enjoy substantial cumulative savings, making these investments financially prudent.

Infrastructure Improvement: Retrofitting buildings and industrial facilities with energy-efficient technologies often results in infrastructure improvements. This enhances the quality, safety, and functionality of these structures, increasing their value and longevity.

Reduced Strain on Grids: Energy-efficient practices reduce the overall demand on energy grids, particularly during peak hours. This lowers the risk of blackouts or brownouts and reduces the need for costly infrastructure upgrades.

Innovation and Technological Advancement: Investing in energy efficiency fosters innovation in technology and manufacturing. It drives the development of new, more efficient technologies and the refinement of existing ones, benefiting multiple industries.

Government Incentives: Many governments offer incentives, tax credits, and rebates to encourage energy-efficient investments. These financial incentives can significantly offset the initial costs and accelerate the adoption of energy-efficient technologies.

Improved Indoor Comfort: For households, energy-efficient improvements often result in improved indoor comfort, including better temperature control, reduced drafts, and enhanced air quality. These benefits contribute to a higher quality of life.

Health Benefits: Energy-efficient technologies can lead to reduced emissions of air pollutants, which can improve air quality and public health outcomes, ultimately reducing healthcare costs.

In conclusion, investments in energy-efficient technologies and practices have far-reaching positive effects on the environment, the economy, and individual well-being. By reducing energy consumption, lowering costs, creating jobs, and mitigating climate change, these investments represent a powerful tool for achieving sustainable, resilient, and prosperous communities and businesses. They not only make economic sense but also pave the way for a greener and more sustainable future for all.

Looking for more insights? You’ll find them right here in our extended coverage: Colombia: Leading the Path to Sustainability in Latin America

Green investments support the development of climate-resilient infrastructure, including flood defenses, drought-resistant agriculture, and sustainable urban planning. These projects enhance communities’ ability to withstand climate impacts.

Green investments, which prioritize sustainability and climate resilience, are instrumental in shaping a more climate-resilient future. Expanding on this idea, let’s explore the various ways in which green investments bolster the development of climate-resilient infrastructure and improve communities’ capacity to withstand the impacts of climate change:

Flood Defenses and Coastal Protection: Green investments support the construction of nature-based infrastructure like wetlands, mangroves, and dunes that act as natural buffers against flooding and storm surges. These resilient coastal ecosystems absorb water and reduce the risk of coastal erosion, safeguarding communities and critical infrastructure.

Drought-Resistant Agriculture: Sustainable agriculture practices and investments in drought-resistant crop varieties enable farmers to adapt to changing precipitation patterns. These investments enhance food security by ensuring a stable food supply even in drought-prone regions.

Sustainable Urban Planning: Green investments in urban planning prioritize climate-resilient cities. This includes designing green spaces, implementing low-impact development techniques, and constructing resilient infrastructure like permeable pavements and green roofs that manage stormwater and reduce the risk of urban flooding.

Renewable Energy Infrastructure: Investments in renewable energy sources like solar, wind, and hydropower contribute to climate resilience by diversifying energy sources and reducing dependence on fossil fuels. These sources are less vulnerable to climate-related disruptions, ensuring a reliable energy supply during extreme weather events.

Green Building and Infrastructure: Green building practices, such as constructing energy-efficient buildings and resilient infrastructure, make communities more adaptable to climate change. These investments reduce energy consumption, lower greenhouse gas emissions, and enhance the durability of structures.

Biodiversity Conservation: Green investments in biodiversity conservation protect ecosystems and species that play a vital role in climate resilience. Diverse ecosystems are more resilient to environmental changes and provide essential services like pollination and pest control for agriculture.

Rural Resilience: Investments in rural areas include climate-resilient infrastructure like irrigation systems, flood protection, and sustainable forestry practices. These projects strengthen rural communities’ ability to cope with climate variability and maintain vital ecosystems.

Transportation Resilience: Green transportation investments prioritize climate-resilient transport systems. This includes constructing roads and bridges to withstand extreme weather events, promoting public transportation to reduce emissions, and integrating non-motorized transportation options like cycling and walking.

Waste Management and Recycling: Sustainable waste management practices and investments in recycling infrastructure reduce environmental pollution and contribute to climate resilience. Effective waste management prevents contamination of water sources during extreme weather events.

Climate Information Systems: Investments in climate information systems provide communities with timely and accurate weather forecasts and early warnings. This empowers them to take proactive measures and evacuate or prepare for weather-related disasters.

Ecosystem-Based Adaptation: Green investments support ecosystem-based adaptation strategies that use nature as a solution to climate challenges. Examples include reforestation, creating urban green spaces, and restoring degraded lands.

Community Capacity Building: Green investments often involve community capacity building, educating local residents on climate-resilient practices, disaster preparedness, and sustainable land use. Empowered communities are better equipped to respond to climate impacts.

Technological Innovation: Investments in climate-resilient technologies, such as weather-resistant building materials or drought-tolerant crop varieties, drive innovation and make communities more adaptable to climate change.

Education and Awareness: Green investments can include educational programs and awareness campaigns to inform communities about climate resilience and sustainable practices.

In conclusion, green investments represent a strategic approach to building climate-resilient infrastructure and fostering resilient communities. These investments not only reduce vulnerability to climate impacts but also promote sustainability and environmental stewardship. By prioritizing green investments, societies can better withstand the challenges posed by climate change while moving toward a more sustainable and equitable future.

To delve further into this matter, we encourage you to check out the additional resources provided here: Building bridges for climate action: Comparative Study paves the …

Funds directed toward ecosystem restoration and conservation contribute to carbon sequestration, biodiversity protection, and sustainable land management. These investments have far-reaching ecological and climate benefits.

Ecosystem restoration and conservation are not only smart investments in the environment; they are also powerful engines of positive change that ripple through our planet’s ecological and climatic systems. Let’s delve deeper into the extensive and far-reaching benefits of these investments:

1. Carbon Sequestration: Ecosystems such as forests, wetlands, and mangroves are remarkable carbon storehouses. When funds are directed toward their restoration and conservation, they become even more effective at capturing and storing carbon dioxide from the atmosphere. This not only helps mitigate climate change by reducing greenhouse gas concentrations but also contributes to carbon sequestration goals, playing a pivotal role in our fight against global warming.

2. Biodiversity Protection: Ecosystem restoration and conservation efforts safeguard biodiversity, preserving the intricate web of life on Earth. By protecting habitats and restoring degraded ecosystems, we provide refuge for countless plant and animal species. This biodiversity is not just a source of wonder and inspiration; it’s also essential for ecological balance, resilience, and the provision of ecosystem services upon which humans depend.

3. Sustainable Land Management: Ecosystem restoration often involves practices that promote sustainable land management. Whether through reforestation, agroforestry, or regenerative agriculture, these investments improve soil health, enhance water retention, and reduce erosion. This, in turn, bolsters agricultural productivity, food security, and the livelihoods of local communities.

4. Flood Mitigation and Water Quality: Wetland restoration, in particular, offers critical benefits for flood mitigation and water quality improvement. Healthy wetlands act as natural sponges, absorbing excess water during storms and preventing downstream flooding. They also filter pollutants and improve water quality, benefiting both people and ecosystems.

5. Resilience to Extreme Events: Ecosystems, when intact and healthy, provide natural defenses against extreme weather events. Coastal mangroves, for example, serve as buffers against storm surges and tsunamis, protecting coastal communities from disaster. Ecosystem restoration enhances these natural defenses and boosts resilience in the face of climate-related disasters.

6. Ecosystem Services: Ecosystems deliver a wide range of services to humanity, including pollination, water purification, and air quality regulation. Investments in restoration and conservation help maintain and enhance these services, directly benefiting human well-being and reducing the need for costly human-made alternatives.

7. Enhanced Ecotourism: Restored and conserved ecosystems often become hubs for sustainable ecotourism. This not only generates economic opportunities for local communities but also fosters greater appreciation for nature, encouraging conservation efforts.

8. Educational and Research Opportunities: Preserved and restored ecosystems serve as living laboratories for scientific research and environmental education. They provide invaluable insights into ecological processes, climate change impacts, and conservation strategies.

9. Cultural and Indigenous Values: Many ecosystems hold deep cultural and spiritual significance for indigenous and local communities. By investing in ecosystem restoration and conservation, we respect and preserve these cultural connections, promoting cultural diversity and heritage.

10. Long-Term Sustainability: Ecosystem restoration and conservation investments are not quick fixes; they offer enduring benefits. As ecosystems recover and thrive, their positive impacts compound over time, creating lasting legacies of sustainability for future generations.

In conclusion, ecosystem restoration and conservation investments are much more than just ecological initiatives; they are investments in a healthier, more resilient, and more harmonious planet. They showcase the incredible potential for positive change when we prioritize the protection and restoration of our natural world. These investments have far-reaching benefits that extend beyond ecological well-being, touching every facet of our interconnected world.

You can also read more about this here: Ecosystem restoration for the future we want in the Mediterranean …

Investments in sustainable transportation systems, such as electric vehicles and public transit, reduce emissions from the transportation sector and promote cleaner and more efficient mobility.