Introduction

The Eurozone, a monetary union comprising 19 of the 27 European Union (EU) member states, has been a crucial element of European economic integration since its inception in 1999. Among these member states, Germany stands out as the largest and most influential economy. Its role in shaping European economic policies within the Eurozone has been pivotal, with both admirers and critics highlighting its significant impact. In this article, we will explore Germany’s role in shaping economic policies within the Eurozone and its implications for the broader European economy.

The Eurozone, a monetary union comprising 19 of the 27 European Union (EU) member states, has been a crucial element of European economic integration since its inception in 1999. Among these member states, Germany stands out as the largest and most influential economy. Its role in shaping European economic policies within the Eurozone has been pivotal, with both admirers and critics highlighting its significant impact.

Germany’s economic prowess has allowed it to play a central role in steering the Eurozone’s fiscal and monetary policies. This influence has been a double-edged sword, as it has contributed to stability and growth but also generated debates about fairness and the concentration of power.

In this article, we will delve deeper into Germany’s role in shaping economic policies within the Eurozone. We’ll examine how its commitment to fiscal responsibility and export-driven growth has influenced the union’s economic strategy. We’ll also discuss the implications of Germany’s dominance for smaller member states, considering the challenges and opportunities it presents. By understanding the dynamics of Germany’s role within the Eurozone, we can gain valuable insights into the broader European economy and the ongoing debates about the future of the European project.

Additionally, you can find further information on this topic by visiting this page: The Great Depression and U.S. Foreign Policy

Germany is often referred to as the “economic powerhouse” of the Eurozone, and for good reason. Its economy is the largest in the EU, and it boasts a robust industrial base, a strong export sector, and a high level of fiscal discipline. The economic stability and success of Germany have earned it a dominant position in Eurozone policymaking.

Germany’s reputation as the “economic powerhouse” of the Eurozone is deeply rooted in its remarkable economic achievements. Beyond its size, there are several key factors that contribute to Germany’s prominent role in the European Union and global economics.

First and foremost, Germany’s industrial prowess is a cornerstone of its economic strength. Renowned for its engineering excellence and innovation, German companies consistently produce high-quality goods that are in demand worldwide. This not only fuels domestic economic growth but also enhances the nation’s competitiveness on the global stage.

The robustness of Germany’s export sector is another vital component of its economic success story. German exports, ranging from automobiles to machinery, are highly sought after across the globe. This export-oriented approach has not only expanded Germany’s economic reach but also created millions of jobs within the country, contributing significantly to its overall prosperity.

A crucial aspect often associated with Germany’s economic might is its unwavering commitment to fiscal discipline. Germany’s prudent fiscal policies, characterized by low deficits and balanced budgets, have not only ensured economic stability but also served as a model for other European nations. This financial responsibility has allowed Germany to weather economic crises more effectively and maintain investor confidence in the Eurozone.

Furthermore, Germany’s economic stability and success have positioned it as a key player in Eurozone policymaking. Its influential role extends to shaping policies related to monetary affairs, trade, and fiscal governance. As a result, Germany plays a pivotal role in steering the direction of the European Union’s economic agenda, and its decisions often have far-reaching implications for the entire Eurozone.

In conclusion, Germany’s status as the “economic powerhouse” of the Eurozone goes beyond its impressive economic size. It is a testament to the nation’s industrial strength, export prowess, fiscal discipline, and influential policymaking role. As the economic landscape continues to evolve, Germany’s stability and success are likely to remain central to the region’s economic prosperity and resilience.

Additionally, you can find further information on this topic by visiting this page: How a Russian Natural Gas Cutoff Could Weigh on Europe’s …

Germany has consistently championed fiscal responsibility within the Eurozone. This commitment to prudent fiscal policies, such as the “debt brake” enshrined in its constitution, has led to calls for other Eurozone members to emulate its approach. While fiscal discipline is undoubtedly important for economic stability, critics argue that Germany’s insistence on austerity measures during the Eurozone debt crisis may have exacerbated the economic hardships faced by some member states.

Germany’s steadfast commitment to fiscal responsibility has not only shaped its own economic landscape but has also cast a spotlight on the role it plays within the broader Eurozone. The German model of fiscal prudence, exemplified by its constitutional “debt brake,” has garnered both admiration and criticism, sparking important debates about the future of economic governance within the Eurozone.

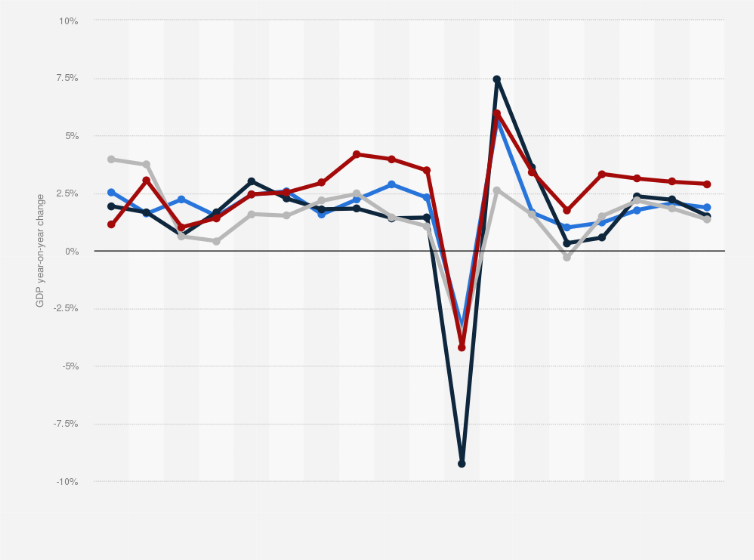

On one hand, Germany’s fiscal discipline has served as a beacon of stability within the Eurozone. Its rigorous adherence to balanced budgets and debt reduction has been a source of confidence for investors and creditors alike. This has allowed Germany to weather economic storms with resilience, such as the global financial crisis of 2008, which had ripple effects throughout the Eurozone. As a result, Germany’s approach has been hailed by proponents of fiscal conservatism as a template for other member states to emulate, with the hope of achieving similar economic resilience.

However, the German model has not been without its critics, especially in the context of the Eurozone debt crisis that unfolded in the early 2010s. Some argue that Germany’s insistence on austerity measures for heavily indebted member states exacerbated their economic hardships. Austerity measures, which often involved significant cuts in public spending and increased taxation, were seen by critics as exacerbating unemployment, social inequality, and stifling economic growth in countries such as Greece, Spain, and Portugal. The call for belt-tightening in the face of economic turmoil was met with social unrest and political turmoil in some of these nations.

Furthermore, critics contend that Germany’s trade surplus, which is one of the largest in the world, benefited from the Eurozone’s economic imbalances. The argument goes that Germany’s surplus was, in part, a result of weaker economies in other Eurozone countries, as their reduced purchasing power limited imports and contributed to Germany’s export-driven growth.

The debate over Germany’s approach to fiscal responsibility within the Eurozone remains complex and multifaceted. While there is broad recognition of the importance of fiscal discipline in maintaining economic stability, questions persist about the extent to which austerity measures should be employed and whether a one-size-fits-all approach is suitable for a diverse group of member states. As the Eurozone continues to evolve, the role of Germany’s fiscal policies and their implications for the broader European economy will remain a topic of intense discussion and scrutiny. Striking the right balance between fiscal responsibility and economic support for struggling member states will be a key challenge in shaping the Eurozone’s future.

You can also read more about this here: A European approach to artificial intelligence | Shaping Europe’s …

Germany’s export-oriented economic model has been both a source of strength and contention. Its emphasis on manufacturing and exporting goods has resulted in trade surpluses, making it the world’s third-largest exporter. However, this approach has also led to imbalances within the Eurozone, as some countries struggle with trade deficits and lower competitiveness.

Germany’s export-oriented economic model stands as a multifaceted phenomenon, with far-reaching implications that continue to shape not only its own economic landscape but also the broader global economy. This model, built on the pillars of manufacturing excellence and relentless export prowess, has indeed yielded substantial strengths but has also sparked contentious debates and international tensions.

On the one hand, Germany’s commitment to manufacturing and exporting has undeniably solidified its position as the world’s third-largest exporter. This achievement speaks volumes about the nation’s precision engineering, quality control, and relentless pursuit of excellence in producing a wide range of products, from automobiles and machinery to chemicals and industrial equipment. These exports have not only created jobs and wealth domestically but have also significantly bolstered Germany’s international influence and economic stability.

The resulting trade surpluses have contributed to Germany’s fiscal resilience and financial strength. These surpluses have allowed the country to weather economic storms with relative ease and maintain a robust social safety net. Furthermore, Germany’s strong export performance has attracted foreign investment and fostered innovation, positioning the nation as a global leader in technological advancements.

However, the flip side of this economic model reveals a complex web of challenges and contentions. Within the Eurozone, this approach has been a source of controversy. Germany’s persistent trade surpluses have translated into trade deficits for some of its European partners. This discrepancy has led to tensions and concerns over the Eurozone’s economic stability and balance.

Countries with trade deficits find themselves grappling with issues of lower competitiveness and reduced economic resilience. This, in turn, has prompted debates over the need for a more balanced approach within the Eurozone, where all member states can thrive economically without accumulating unsustainable levels of debt. Critics argue that Germany’s export-driven strategy might exacerbate inequalities and hinder the shared prosperity that the Eurozone was designed to promote.

To address these challenges, there have been calls for Germany to recalibrate its economic model, focusing more on domestic consumption and investment, which could potentially help reduce global trade imbalances. However, such shifts are complex and require careful planning to ensure a smooth transition without disrupting the German economy.

In conclusion, Germany’s export-oriented economic model is a double-edged sword, characterized by both strength and contention. While it has propelled Germany to the status of a global economic powerhouse, it has also ignited debates over trade imbalances and competitiveness within the Eurozone. As Germany continues to navigate these complexities, it remains a focal point in discussions about the future of the European and global economies. Balancing its export prowess with efforts to foster economic stability among its European partners will be crucial in defining the path forward.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: GlobalTrends_2040.pdf

During the Eurozone crisis that began in 2010, Germany played a central role in shaping the response to the economic turmoil that engulfed several member states, including Greece, Ireland, Portugal, and Spain. Germany, led by Chancellor Angela Merkel, was a staunch advocate for austerity measures and structural reforms as a condition for financial assistance.

During the Eurozone crisis that began in 2010, Germany played a central role in shaping the response to the economic turmoil that engulfed several member states, including Greece, Ireland, Portugal, and Spain. Germany, led by Chancellor Angela Merkel, was a staunch advocate for austerity measures and structural reforms as a condition for financial assistance. This approach was rooted in Germany’s strong belief in fiscal discipline and economic stability, honed through its own post-war economic miracle.

Germany’s insistence on austerity and reform was driven by a desire to ensure the long-term sustainability of the Eurozone and protect the credibility of the euro currency. Merkel’s leadership, often described as “Merkelism,” emphasized the importance of fiscal responsibility and balanced budgets as a means of preventing future crises.

However, it’s important to note that Germany’s stance during the Eurozone crisis was met with both praise and criticism. Supporters argued that it was a necessary step to restore confidence in the Eurozone’s financial stability, while critics contended that the strict austerity measures imposed had severe social consequences, including high unemployment rates and social unrest in some of the crisis-affected countries.

Nonetheless, the Eurozone crisis and Germany’s response to it remain a defining chapter in the country’s modern history, shaping not only its economic policies but also its role within the European Union and its influence on the global stage.

If you’d like to dive deeper into this subject, there’s more to discover on this page: History of the EU, EU pioneers | European Union

Germany’s insistence on austerity was based on its belief in the importance of fiscal discipline. While this approach aimed to address budget deficits and restore market confidence, it was met with significant opposition from some Eurozone countries and economists who argued that it exacerbated economic downturns and social hardships.

Germany’s insistence on austerity was based on its belief in the importance of fiscal discipline. While this approach aimed to address budget deficits and restore market confidence, it was met with significant opposition from some Eurozone countries and economists who argued that it exacerbated economic downturns and social hardships.

Proponents of Germany’s austerity measures argued that disciplined fiscal policies were crucial for long-term economic stability and sustainable growth. They believed that by reducing public spending, controlling deficits, and promoting fiscal responsibility, governments could create a solid foundation for economic prosperity. Moreover, they contended that these measures could prevent future financial crises and the accumulation of unsustainable levels of public debt.

However, critics of austerity policies pointed out that during times of economic crisis, such as the global financial downturn of 2008 and the Eurozone debt crisis, severe budget cuts and reduced public investment could have a detrimental impact. They argued that austerity measures often led to higher unemployment rates, reduced social services, and decreased economic activity, which, in turn, hindered economic recovery. Moreover, they emphasized that the human cost of austerity, in terms of increased poverty and social inequality, was a significant concern.

The debate over austerity policies highlighted the complex nature of economic governance within the Eurozone and the diversity of economic conditions among its member states. It also underscored the importance of finding a balance between fiscal discipline and addressing the immediate needs of citizens during challenging economic times. Over the years, this debate has led to discussions about alternative approaches to economic policy, including greater flexibility within the Eurozone’s fiscal rules and increased emphasis on growth-oriented strategies.

In conclusion, Germany’s insistence on austerity reflected its commitment to fiscal responsibility, but it was met with substantial opposition due to its perceived negative impact on economic recovery and social well-being. This ongoing debate continues to shape economic policy discussions within the Eurozone and beyond, highlighting the need for adaptable and nuanced approaches to economic governance.

Don’t stop here; you can continue your exploration by following this link for more details: Climate change: what the EU is doing – Consilium

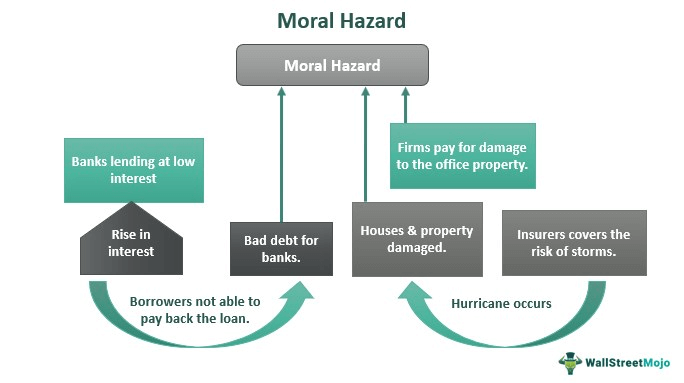

Germany argued for strict conditionality in bailout programs to prevent moral hazard, the idea that countries might take excessive risks if they believe they will be bailed out. This approach sought to ensure that recipient countries undertook necessary reforms in exchange for financial assistance.

Germany’s stance on strict conditionality in bailout programs, aimed at preventing moral hazard, reflects a prudent and forward-thinking approach to managing financial crises on both domestic and international fronts. Moral hazard is a real concern in the world of finance, and Germany’s insistence on attaching conditions to financial assistance programs serves as a valuable lesson for global economic governance.

Moral hazard, in essence, is the notion that individuals, institutions, or countries may engage in riskier behavior when they believe that a safety net exists to rescue them from the consequences of their actions. This concept is particularly pertinent in the context of financial crises, where the anticipation of a bailout can encourage irresponsible financial practices. Germany’s commitment to combating moral hazard through conditional bailout programs sends a clear message that accountability and responsibility are paramount in the international financial system.

By requiring recipient countries to undertake specific reforms and commitments in exchange for financial assistance, Germany and other proponents of strict conditionality are fostering a culture of accountability. These conditions often involve implementing fiscal austerity measures, structural reforms, and improved financial governance. While these conditions can be challenging and unpopular, they are necessary to address the root causes of economic instability and promote long-term sustainability.

Moreover, Germany’s insistence on strict conditionality can be seen as a proactive measure to protect the stability of the Eurozone and the global financial system as a whole. When countries undertake necessary reforms, it not only helps them recover from the immediate crisis but also strengthens their resilience against future economic shocks. This, in turn, reduces the burden on other countries and institutions that may be called upon to provide financial assistance in the event of another crisis.

Germany’s approach also encourages responsible lending practices among international financial institutions. If countries believe that bailouts come with stringent conditions, lenders are more likely to conduct due diligence and exercise prudence when extending credit. This can help prevent the excessive accumulation of unsustainable debt and reduce the likelihood of future crises.

Furthermore, Germany’s insistence on conditionality underscores the importance of multilateralism and cooperation in addressing global economic challenges. It highlights that financial assistance should not be a one-sided transaction but a collaborative effort to stabilize economies and promote sustainable growth. In doing so, it contributes to the broader discourse on international economic governance and reinforces the idea that collective action is crucial in managing global financial risks.

In conclusion, Germany’s advocacy for strict conditionality in bailout programs to prevent moral hazard is a principled and pragmatic approach to managing financial crises. It emphasizes the need for accountability, responsible lending and borrowing, and long-term economic stability. By setting an example and promoting these principles, Germany is not only protecting its own interests but also contributing to the resilience and stability of the international financial system.

You can also read more about this here: Divergence and Diversity in the Euro Area – Stiftung Wissenschaft …

Germany’s dominant role in shaping economic policies within the Eurozone has not been without criticism. Critics argue that its focus on austerity and export-led growth has contributed to economic disparities within the Eurozone. They contend that a more expansionary fiscal policy and greater willingness to share financial risks would have been more beneficial during the Eurozone crisis.

Furthermore, Germany’s influence has raised concerns about democratic legitimacy within the EU. Some argue that the decision-making process is heavily skewed in favor of larger economies like Germany, potentially undermining the sovereignty of smaller member states.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Germany, the Eurozone crisis and the Covid-19 pandemic: Failing …

Conclusion

Germany’s role in shaping economic policies within the Eurozone is undeniable, reflecting its economic strength and commitment to fiscal discipline. While it has contributed to stability and recovery in the wake of the Eurozone crisis, its approach of emphasizing austerity and export-led growth has also faced criticism for exacerbating economic disparities.

As the Eurozone continues to evolve, the debate over Germany’s leadership in economic policymaking will persist. Finding a balance between fiscal discipline and addressing economic disparities remains a significant challenge for the EU, one that will shape the future of the Eurozone and European economic integration. The role of Germany in this ongoing process will undoubtedly be a subject of intense scrutiny and debate.

You can also read more about this here: The Impact of the First World War and Its Implications for Europe

More links

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Germany, the Eurozone crisis and the Covid-19 pandemic: Failing …