Introduction

Investing is a journey, and like any journey, it comes with its share of risks and uncertainties. However, there are strategic ways to navigate these challenges and maximize your chances of success. One of the most effective strategies is diversification, coupled with vigilant risk management.

In this article, we will explore the crucial concepts of diversification and risk management and their significance in building a balanced and resilient investment portfolio. Whether you’re a seasoned investor or just starting to dip your toes into the world of finance, understanding these principles can make a significant difference in your financial journey.

To delve further into this matter, we encourage you to check out the additional resources provided here: Portfolio Management: Definition, Types, and Strategies

Diversification is a fundamental principle of investment. It involves spreading your investments across various asset classes, industries, and geographical regions. The goal is to reduce the impact of poor-performing investments on your overall portfolio. Here’s how it works:

Diversification stands as a cornerstone of prudent investing, serving as a shield against the storms of market volatility. To truly appreciate the significance of diversification and its mechanics, let’s delve deeper into this fundamental investment principle:

1. Mitigating Risk:

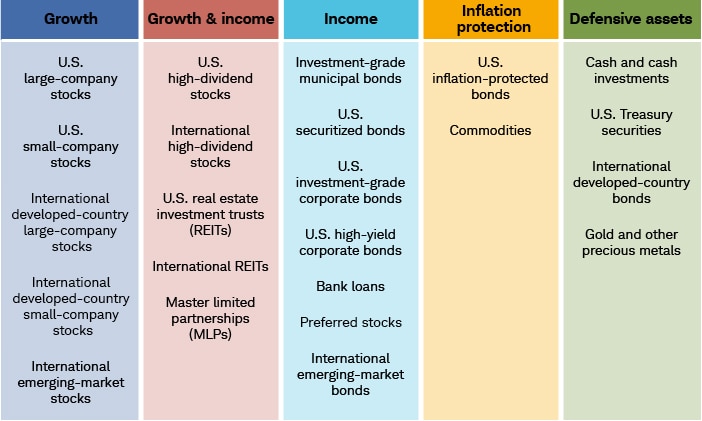

a. Risk Reduction: Diversification is akin to not putting all your eggs in one basket. By allocating your investments across different asset classes, such as stocks, bonds, real estate, and more, you spread risk. Poor performance in one asset class is offset by potential gains in others.

b. Industry Resilience: Within each asset class, diversification extends to various industries. Investing in a range of industries ensures that your portfolio isn’t overly exposed to the fortunes or downturns of any single sector.

c. Geographic Exposure: Geographical diversification takes your investments beyond borders. Investing in different regions or countries can help mitigate the risk associated with economic or geopolitical events specific to one area.

2. Smoothing Out Returns:

a. Steady Growth: Diversification can contribute to more stable and consistent returns over time. While some assets may perform exceptionally well during certain periods, others may provide stability during market downturns. The result is a more balanced and predictable portfolio.

b. Reduced Volatility: By spreading your investments, you reduce the overall volatility of your portfolio. This can help you stay the course during turbulent market conditions without making impulsive decisions.

3. Aligning with Objectives:

a. Tailoring Risk Tolerance: Diversification allows you to align your portfolio with your risk tolerance and investment goals. A more aggressive investor might allocate a larger portion to stocks, while a conservative investor may favor bonds and less volatile assets.

b. Achieving Financial Goals: Whether your aim is wealth preservation, retirement planning, or funding major life events, diversification enables you to construct a portfolio that reflects your financial aspirations.

4. Simplifying Management:

a. Streamlined Oversight: Managing a diversified portfolio can be more straightforward than overseeing a concentrated one. It reduces the need for constant monitoring and adjustment.

5. Investment Vehicles:

a. Mutual Funds and ETFs: These investment vehicles often provide built-in diversification. When you invest in a mutual fund or exchange-traded fund (ETF), you gain exposure to a portfolio of assets, offering instant diversification without the need for individual stock selection.

b. Professional Management: Managed funds, such as mutual funds and hedge funds, are typically managed by professionals who make allocation decisions based on diversification principles.

In essence, diversification is your financial shield, offering protection against the inherent unpredictability of financial markets. By spreading your investments strategically, you reduce the vulnerability of your portfolio to the ebb and flow of individual assets or sectors. Diversification provides not only risk management but also the potential for more consistent, long-term growth, ultimately helping you to achieve your financial goals with greater confidence and resilience.

Additionally, you can find further information on this topic by visiting this page: Investing Basics: Why Diversification Is Important

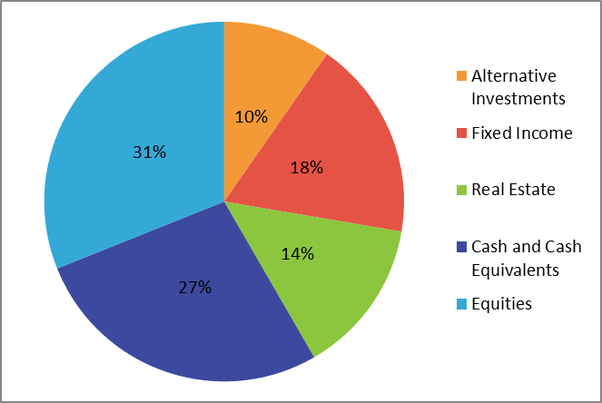

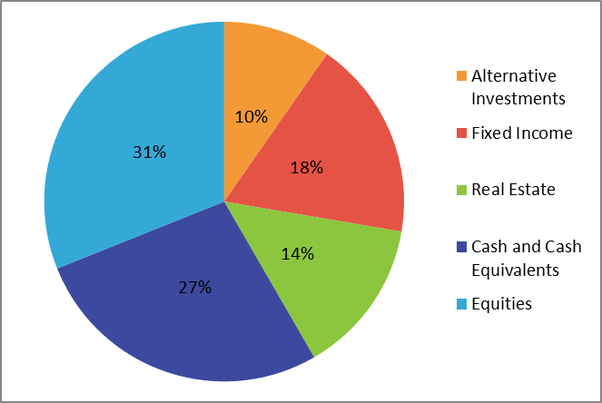

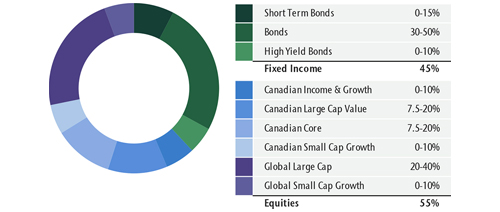

Diversification begins with allocating your investments across different asset classes, such as stocks, bonds, real estate, and cash equivalents. Each asset class has its own risk and return profile, and they don’t always move in the same direction. When one performs poorly, another might perform well, balancing out your overall returns.

Diversification, often heralded as the bedrock of sound investment strategy, is a multi-faceted approach that extends beyond simply spreading investments across different asset classes. It’s a nuanced art that involves careful consideration and a keen understanding of how various assets interact in your portfolio.

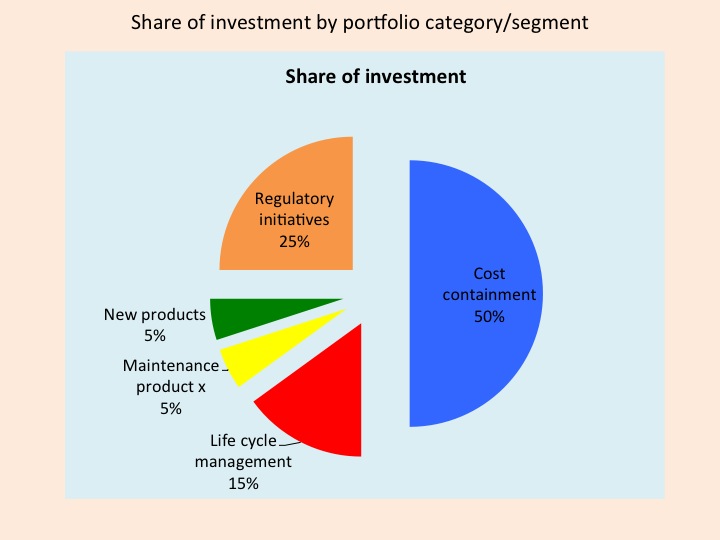

Asset Allocation: At its core, diversification commences with astute asset allocation. You’ll strategically distribute your investments across a spectrum of asset classes, each with its distinct risk and return characteristics. This allocation is akin to constructing a well-balanced orchestra, where each instrument plays a unique role to create harmonious music.

The Risk-Return Spectrum: Within your diversified portfolio, you’ll encounter a spectrum of risk and return profiles. Stocks, often associated with higher risk and potentially greater returns, might share the stage with bonds, known for their relative stability and income generation. Meanwhile, real estate investments could offer a unique blend of appreciation and cash flow.

Market Dynamics: One of the fascinating aspects of diversification is its ability to harness market dynamics. Different asset classes don’t always march in lockstep; they often move in response to varying market conditions. When one asset class experiences a downturn, another may shine, acting as a buffer against significant losses. This natural balance helps mitigate the impact of market volatility on your overall portfolio.

Risk Management: Diversification is a risk management strategy at heart. By judiciously combining assets that don’t exhibit perfectly correlated movements, you reduce the overall risk of your portfolio. This reduction in risk doesn’t mean you eliminate it entirely, but rather, you strive to achieve a level of risk that aligns with your investment goals and risk tolerance.

Long-Term Performance: While diversification can provide short-term benefits by smoothing out the peaks and valleys of your portfolio’s returns, its true power shines over the long term. By consistently applying diversification principles and periodically rebalancing your portfolio to maintain your desired asset allocation, you position yourself for sustained, stable growth that aligns with your financial objectives.

Customized to Your Goals: Effective diversification is not a one-size-fits-all approach. It’s a strategy that should be tailored to your unique financial goals, risk tolerance, and time horizon. Your portfolio’s composition should reflect your specific objectives, whether they involve wealth accumulation, income generation, or preservation of capital.

In conclusion, diversification is not merely a matter of spreading investments across asset classes; it’s a dynamic and nuanced strategy that requires ongoing attention and adaptation. When executed thoughtfully, it becomes a powerful tool for managing risk, achieving your financial aspirations, and navigating the ever-evolving landscape of the investment world. Whether you’re just beginning your investment journey or are a seasoned investor, diversification remains a timeless and indispensable element of your financial toolkit.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: What Is Diversification? Definition as Investing Strategy

Within each asset class, diversify further by investing in different industry sectors. For example, if you have stocks in your portfolio, consider having exposure to technology, healthcare, finance, and other sectors. This reduces the impact of sector-specific downturns.

Diversification within asset classes is a fundamental strategy for managing risk in your investment portfolio, and it doesn’t stop at simply holding different types of assets. Going a step further by diversifying across various industry sectors can add an extra layer of protection and enhance your portfolio’s resilience.

1. Risk Mitigation: Each industry sector is subject to its own set of economic and market forces. By holding investments across multiple sectors, you reduce the risk associated with sector-specific downturns. If one sector experiences a decline, investments in other sectors may continue to perform well, helping to balance out your portfolio’s overall performance.

2. Economic Cycle Sensitivity: Different sectors tend to perform better or worse during different phases of the economic cycle. For instance, technology companies often excel during periods of innovation and growth, while healthcare companies tend to remain relatively stable throughout economic fluctuations. By diversifying across sectors, you position your portfolio to adapt to changing economic conditions.

3. Enhancing Long-Term Growth: Diversification across sectors can also help capture growth opportunities. While some sectors may experience temporary setbacks, others may be on the verge of significant growth. Having exposure to a variety of sectors increases the likelihood of benefiting from emerging trends and opportunities.

4. Smoother Ride: Sector diversification can lead to a smoother investment experience. A portfolio concentrated in a single sector can experience high volatility and wide swings in value. Diversifying across sectors can help cushion these fluctuations, making your investment journey less bumpy and more predictable.

5. Improved Risk-Return Profile: A well-diversified portfolio across different asset classes and sectors can potentially provide a better risk-return profile. It allows you to pursue a balance between risk and potential returns that aligns with your investment goals and risk tolerance.

6. Flexibility for Tactical Moves: Sector diversification provides flexibility. It allows you to make tactical adjustments to your portfolio when you anticipate changes in market conditions or sector performance. For example, if you believe that a specific sector is poised for growth, you can allocate more capital to it.

7. Ongoing Monitoring: Keep in mind that sector performance can change over time. Regularly monitor your portfolio’s sector allocation and rebalance when necessary to maintain your desired level of diversification. This ensures that your portfolio continues to align with your investment objectives.

In conclusion, diversifying your investment portfolio across various industry sectors is a strategic move that helps manage risk, capture growth opportunities, and create a smoother investment experience. By doing so, you can reduce the impact of sector-specific challenges and build a well-rounded portfolio that’s better equipped to weather the dynamic nature of financial markets. Remember that diversification is a key principle of prudent investing and plays a vital role in achieving your long-term financial goals.

Looking for more insights? You’ll find them right here in our extended coverage: What Is Portfolio Diversification? – Fidelity

Global diversification involves investing in assets from various countries and regions. International markets don’t always move in sync with each other or with the U.S. market, making global diversification a valuable risk management tool.

Global diversification is like having multiple safety nets in your investment strategy. When you spread your investments across different countries and regions, you’re not relying solely on the performance of one market. Each region has its economic cycles, political situations, and market dynamics.

For instance, when the U.S. market experiences a downturn, it doesn’t necessarily mean that markets in Asia or Europe will follow suit. They may remain stable or even thrive. This means that even when some parts of your portfolio face challenges, others can offset potential losses, helping to maintain the overall health of your investments.

Moreover, global diversification provides exposure to industries and sectors that might not be prevalent in your home market. For example, investing in emerging markets can give you access to booming industries that are in their infancy stages in more developed economies.

In essence, global diversification isn’t just about spreading your investments thinly across the globe; it’s about intelligently positioning your assets in regions and industries with growth potential. It’s a strategic approach that adds resilience to your portfolio, ensuring that you’re prepared for a variety of economic scenarios.

To expand your knowledge on this subject, make sure to read on at this location: Our Investment Strategy | How We Invest | CPP Investments

While diversification is a proactive way to mitigate risk, risk management involves a set of strategies and practices aimed at preserving your capital and minimizing potential losses. Here are some key elements of effective risk management:

Diversification is indeed a crucial step in reducing investment risk, but it’s only one piece of the puzzle. Effective risk management encompasses a broader spectrum of strategies and practices that work in tandem to safeguard your capital and minimize potential losses. Let’s delve deeper into some key elements that constitute a robust risk management approach:

1. Asset Allocation: At the core of risk management is the strategic allocation of your assets across different asset classes, such as stocks, bonds, real estate, and cash equivalents. A well-balanced allocation helps distribute risk effectively. Depending on your risk tolerance and financial goals, you can adjust the allocation to achieve the right mix.

2. Stop-Loss Orders: Stop-loss orders are a valuable tool in your risk management arsenal. By setting predefined price levels at which you’ll sell an investment, you establish a safety net. If an asset’s price falls to the specified level, the order is triggered, limiting your losses and preventing emotional decisions during market volatility.

3. Position Sizing: How much you invest in a single asset or position matters. Risk management involves sizing your positions appropriately, ensuring that no single investment can significantly impact your portfolio if it doesn’t perform as expected. Smaller positions in high-risk assets and larger positions in more stable ones contribute to a well-structured portfolio.

4. Risk-Reward Analysis: Before making any investment, conduct a thorough risk-reward analysis. Assess the potential risks and rewards associated with the asset. Evaluate factors like historical performance, volatility, industry trends, and economic indicators to make informed decisions.

5. Diversification Across Sectors and Geographies: While diversifying within asset classes is important, diversification across sectors and geographic regions adds an extra layer of protection. A well-diversified portfolio may include assets from various industries and countries, reducing vulnerability to sector-specific or geopolitical risks.

6. Regular Portfolio Review: Effective risk management isn’t a one-time endeavor; it’s an ongoing process. Regularly review your portfolio’s performance and reallocate assets as needed. Market conditions and your financial goals may change over time, necessitating adjustments to maintain optimal risk management.

7. Risk Tolerance Assessment: Understanding your risk tolerance is a foundational aspect of risk management. It defines the level of risk you are comfortable with and guides your asset allocation decisions. A risk tolerance assessment ensures that your investments align with your psychological and financial comfort zones.

8. Emergency Fund: An emergency fund is a crucial component of risk management in personal finance. It serves as a financial cushion, covering unexpected expenses or providing a safety net during income disruptions. An adequately funded emergency fund reduces the need to liquidate investments prematurely.

9. Continuous Learning: Staying informed and continuously learning about financial markets and investment strategies is a vital aspect of risk management. The more you understand the dynamics of the investment landscape, the better equipped you are to make informed decisions.

Effective risk management isn’t about avoiding risk altogether; it’s about navigating it wisely. By incorporating these key elements into your financial strategy, you can safeguard your capital, make informed investment choices, and confidently pursue your financial goals, even in the face of market volatility and uncertainty.

Additionally, you can find further information on this topic by visiting this page: 60/40 Balanced Portfolio: Rethinking Strategies | Morgan Stanley

Determine an appropriate asset allocation strategy that aligns with your financial goals, risk tolerance, and investment horizon. Adjust your allocation as needed over time.

Crafting a sound asset allocation strategy lies at the heart of successful investing. Here’s an expanded perspective on this crucial concept:

1. Goal-Centric Strategy:

- Your investment goals serve as the guiding light for your asset allocation strategy. Are you saving for retirement, a home purchase, or your child’s education? Define your objectives clearly.

2. Risk Management:

- Assess your risk tolerance objectively. How comfortable are you with the ups and downs of the market? A balanced asset allocation should align with your risk tolerance.

3. Time Horizon:

- Consider your investment horizon. Are your goals short-term, like a vacation, or long-term, like retirement? Your time horizon influences your asset mix.

4. Diversification:

- Diversify your investments across asset classes (stocks, bonds, real estate, etc.) to spread risk. A well-diversified portfolio can enhance stability.

5. Monitoring and Rebalancing:

- Regularly review your portfolio to ensure it stays in line with your asset allocation plan.

- Rebalancing may be necessary to maintain your desired allocation. For example, if stocks have outperformed, you may need to sell some to buy other assets.

6. Flexibility and Adjustments:

- Life is dynamic, and so should be your asset allocation. Life events, market conditions, or changes in your financial situation may necessitate adjustments.

7. Professional Guidance:

- If navigating asset allocation seems daunting, consider consulting a financial advisor. They can provide expertise and insights tailored to your specific circumstances.

8. Long-Term Perspective:

- Remember that asset allocation is a long-term strategy. Don’t let short-term market fluctuations derail your overall plan.

9. Tax Considerations:

- Be mindful of tax implications when making allocation decisions. Certain investments may have tax advantages or disadvantages.

10. Continuous Learning: – Stay informed about investment options and market trends. A well-informed investor is better equipped to make asset allocation decisions.

In summary, your asset allocation strategy is a dynamic roadmap that must align with your financial goals, risk tolerance, and investment horizon. Regular monitoring and adjustments, as well as the ability to adapt to life’s changes, are key to achieving long-term financial success.

To expand your knowledge on this subject, make sure to read on at this location: What Is Asset Allocation and Why Is It Important? With Example

Consider using stop loss orders for individual investments. These automatically sell a security when it reaches a predetermined price, limiting potential losses.

Using stop loss orders for individual investments is a prudent strategy that can help safeguard your portfolio and limit potential losses. Here’s a more comprehensive look at the benefits and considerations of employing stop loss orders:

**1. Risk Management: Stop loss orders are a fundamental tool for risk management. By setting a predetermined price at which a security will be sold, you establish a safety net to protect your investment capital. This proactive approach minimizes the risk of substantial losses in volatile markets.

**2. Emotional Discipline: Investing can evoke strong emotions, such as fear and greed. Stop loss orders can serve as a buffer against emotional decision-making. They provide a systematic and unemotional way to exit a position when it’s not performing as expected, reducing the likelihood of impulsive actions driven by emotions.

**3. Tailored Protection: Stop loss orders allow you to customize your level of protection. Depending on your risk tolerance and investment goals, you can set stop loss levels at varying distances from the current market price. This flexibility ensures that the protection aligns with your specific needs.

**4. Predefined Exit Strategy: Having a predefined exit strategy is crucial for successful investing. Stop loss orders establish clear exit points, helping you adhere to your investment plan. This prevents the “hope and hold” mentality, where investors cling to declining investments in the vain hope of a recovery.

**5. Automatic Execution: Stop loss orders are executed automatically when the predetermined price is reached. This eliminates the need for constant monitoring of your investments. Whether you’re actively following the market or not, your stop loss orders work tirelessly to protect your portfolio.

**6. Limit Downside Risk: While stop loss orders primarily aim to limit losses, they also provide the opportunity to capture gains if a security appreciates in value. If the price of a stock or asset rises after your stop loss order is triggered, you can still exit with a profit.

**7. Volatility Mitigation: In volatile markets or during unforeseen events, stop loss orders can be invaluable. They can prevent a minor setback from turning into a significant loss when market conditions take an unexpected turn.

**8. Considerations: While stop loss orders offer substantial benefits, they are not foolproof. In highly volatile markets, prices can gap down or “slip” below your stop loss level, resulting in an execution at a lower price than anticipated. Additionally, using overly tight stop loss levels can lead to premature exits on minor price fluctuations.

**9. Regular Review: It’s essential to regularly review and adjust your stop loss orders as market conditions change or as your investment objectives evolve. Avoid setting and forgetting them, as this may not align with your current financial goals.

**10. Diversification: Diversifying your investment portfolio across various asset classes and industries can further enhance your risk management strategy. A well-diversified portfolio can help mitigate the impact of individual losses on your overall financial health.

In conclusion, incorporating stop loss orders into your investment strategy can be a powerful means of risk management and discipline. It allows you to protect your capital, stick to your investment plan, and minimize emotional reactions to market fluctuations. However, it’s essential to strike a balance between setting protective stop loss levels and allowing your investments room to breathe. Tailoring your stop loss approach to your unique financial situation and goals is key to making this risk management tool work effectively for you.

Don’t stop here; you can continue your exploration by following this link for more details: Stock-based compensation: How to use your 10b5-1 plan to achieve …

Regularly assess the risk level of your portfolio and make adjustments as necessary. This includes monitoring the risk associated with individual investments and asset classes.

Risk management is a dynamic process that requires constant vigilance and adaptation. Your investment portfolio, akin to a ship navigating financial waters, should be guided by a skilled captain who regularly assesses the seascape for potential storms. Here’s why ongoing risk assessment and prudent adjustments are paramount for a successful financial journey:

Market Volatility – An Ever-Present Companion: Financial markets are inherently volatile, subject to a multitude of factors ranging from economic shifts to geopolitical events. Regular risk assessment acknowledges that market conditions evolve and that your portfolio’s risk profile must adjust accordingly. By monitoring market volatility, you can gauge the potential impact on your investments.

Asset Diversification – Balancing Act: Diversification is a cornerstone of risk management, and it entails spreading your investments across various asset classes. However, as market dynamics change, the risk associated with different assets can fluctuate. Regular assessments enable you to rebalance your portfolio to maintain an optimal mix, ensuring that your risk exposure aligns with your goals and risk tolerance.

Individual Investment Risk – Scrutinizing Holdings: Within your portfolio, individual investments carry their own risk profiles. Some may outperform, while others may underperform or become riskier due to internal or external factors. Ongoing evaluation of these holdings allows you to identify underperformers, potential red flags, or opportunities for optimization.

Life Stage and Goals – Shifting Priorities: As you progress through life and your financial goals evolve, your risk tolerance and investment horizon may change. Regular risk assessments account for these shifts. For example, as retirement approaches, you may opt for a more conservative portfolio to preserve wealth rather than seeking aggressive growth.

Economic and Global Events – External Influences: Economic conditions and global events can significantly impact your investments. Assessing how these external factors affect your portfolio is essential. For instance, a global recession may necessitate adjustments to reduce exposure to cyclical industries.

Aligning Risk and Return – Balancing Act: Risk and return are intertwined in the world of investments. Regular assessments ensure that the level of risk you’re undertaking aligns with the potential rewards you seek. If your goals prioritize capital preservation, you might opt for lower-risk investments; conversely, if you’re focused on growth, a higher-risk strategy may be more suitable.

Mitigating Losses – Preventing Downside: Identifying and addressing risks before they escalate can prevent significant losses. Regular risk assessments serve as an early warning system, allowing you to take corrective action or implement risk-mitigation strategies.

Staying Informed – Empowering Decision-Making: The financial landscape is ever-evolving. Staying informed through regular risk assessments ensures that you’re equipped to make informed decisions. It empowers you to take advantage of opportunities and navigate challenges effectively.

In essence, regular risk assessment is your compass in the unpredictable world of finance. It enables you to steer your portfolio through changing tides, maintaining alignment with your financial objectives and risk tolerance. By remaining vigilant and adaptable, you enhance your ability to navigate the seas of investment with confidence and prudence.

Don’t stop here; you can continue your exploration by following this link for more details: Managing Risks: A New Framework

Maintain an emergency fund to cover unexpected expenses or financial setbacks. This reduces the need to tap into your investment portfolio during challenging times.

Building and maintaining an emergency fund is akin to creating a financial safety net that shields your long-term investments from unexpected storms. Here’s why having this financial cushion is a wise strategy and how it bolsters your financial resilience:

Financial Preparedness: Life is replete with surprises, some pleasant and others less so. An emergency fund is your shield against the financial impact of unexpected events, such as medical emergencies, car repairs, or job loss. With a well-funded emergency fund, you’re prepared to face these challenges without depleting your investments.

Protecting Your Investments: Your investment portfolio is a valuable asset that grows over time. Dipping into it to cover sudden expenses can disrupt your long-term investment strategy and potentially lead to missed opportunities for growth. An emergency fund ensures your investments remain untouched, allowing them to continue their wealth-building journey undisturbed.

Peace of Mind: Knowing you have a financial safety net brings peace of mind. It reduces the stress and anxiety that can accompany unexpected financial setbacks. This peace of mind is invaluable, as it allows you to make more level-headed decisions during challenging times.

Avoiding Debt: When confronted with unforeseen expenses, individuals without an emergency fund may resort to credit cards or loans to bridge the gap. This can lead to the burden of debt and its associated interest payments. An emergency fund helps you avoid accruing unnecessary debt by covering these expenses with cash on hand.

Flexibility and Control: An emergency fund grants you the flexibility to address unexpected financial needs on your terms. You’re in control of your response to emergencies, allowing you to make decisions that align with your financial goals rather than being forced into hasty choices.

Preserving Investments in Market Downturns: In times of economic downturns or bear markets, having an emergency fund can be especially crucial. It prevents you from selling investments when their value is depressed, which can lock in losses. Instead, you can weather the storm with your cash reserves, allowing your investments to recover when market conditions improve.

Tailoring Your Fund Size: The size of your emergency fund should align with your lifestyle, financial obligations, and risk tolerance. It’s a flexible concept, and you have the freedom to determine the right fund size for your specific circumstances.

Building Financial Discipline: Maintaining an emergency fund instills financial discipline. It encourages you to save consistently, prioritize your financial goals, and resist impulsive spending. Over time, this discipline becomes a cornerstone of your financial well-being.

A Catalyst for Financial Growth: By protecting your investments and avoiding debt, your emergency fund acts as a catalyst for your overall financial growth. It allows you to stay the course with your long-term investment strategy, potentially leading to greater wealth accumulation over time.

Economic Uncertainty: Economic uncertainties are a part of life. Whether it’s a recession, market volatility, or unexpected economic shocks, an emergency fund offers a buffer against financial instability, ensuring that you can navigate through uncertain times with confidence.

In conclusion, an emergency fund is not just a financial asset; it’s your financial safeguard and a cornerstone of responsible financial planning. It provides you with the security and resilience needed to weather unexpected storms while allowing your investments to thrive and propel you toward your long-term wealth-building goals. It’s a strategy that brings peace of mind and financial empowerment, ensuring you’re well-prepared for whatever life may bring.

Don’t stop here; you can continue your exploration by following this link for more details: Risk: What It Means in Investing, How to Measure and Manage It

By combining diversification and effective risk management, you create a balanced portfolio that can weather market volatility and economic fluctuations. Such a portfolio allows you to achieve the following benefits:

The art of crafting a well-balanced portfolio, one that seamlessly integrates diversification and robust risk management, is akin to building a financial fortress. Within this fortress, you can safeguard and nurture your wealth even amidst the storms of market volatility and economic uncertainty. Let’s delve deeper into the multitude of benefits such a portfolio bestows upon you:

Stability in Turbulent Times: A balanced portfolio’s primary virtue lies in its ability to provide stability during market turbulence. When one asset class faces a downturn, others may remain resilient, mitigating potential losses and offering a protective shield for your investments.

Risk Mitigation: Effective risk management is the bedrock of a balanced portfolio. By carefully selecting assets with varying risk profiles and employing risk-reduction strategies, you minimize the impact of adverse market events, preserving your capital.

Consistent Income: Depending on your asset allocation, a balanced portfolio can generate a steady stream of income. This income may come from dividends, interest payments, or other yield-bearing investments. Such consistency is invaluable for covering living expenses or reinvesting for growth.

Capital Appreciation: Beyond stability, a balanced portfolio aims for growth. By including assets with growth potential, such as stocks or real estate, you position yourself to benefit from long-term capital appreciation, increasing your wealth over time.

Diversification’s Power: Diversification spreads your investments across different asset classes, industries, and geographical regions. This not only mitigates risk but also taps into diverse growth opportunities. Your portfolio becomes resilient to the idiosyncrasies of individual assets or sectors.

Alignment with Financial Goals: A well-structured portfolio is tailored to your financial objectives. Whether you’re saving for retirement, a major purchase, or generational wealth transfer, your asset allocation aligns with your goals, optimizing your chances of achieving them.

Peace of Mind: The combination of diversification and risk management provides peace of mind. You can confidently weather market fluctuations, knowing that your portfolio is built to withstand adversity and capitalize on opportunities.

Adaptability: A balanced portfolio isn’t static. It adapts to changing market conditions and your evolving financial situation. Regular rebalancing ensures that your asset allocation remains aligned with your objectives and risk tolerance.

Reduced Emotional Stress: Emotional decision-making can lead to impulsive actions during market volatility. A balanced portfolio, designed with a long-term perspective, reduces the emotional stress associated with investing, fostering discipline and rationality.

Tax Efficiency: Effective asset allocation considers tax implications. By strategically locating assets in tax-advantaged accounts and managing tax consequences, you can enhance your after-tax returns.

Legacy Planning: A balanced portfolio serves not only your current financial needs but also supports legacy planning. It allows for the creation of a lasting financial legacy for future generations.

Financial Independence: Ultimately, the goal of a balanced portfolio is to empower you to achieve financial independence. It provides you with the means to pursue your passions, dreams, and aspirations without being beholden to financial constraints.

In the world of finance, where uncertainty is a constant companion, a balanced portfolio stands as a beacon of stability and a path to financial prosperity. It’s a testament to the wisdom of diversification and the foresight of risk management. With such a portfolio as your financial ally, you’re well-equipped to navigate the ever-changing landscape of the markets and build a secure and prosperous future.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: What Is Portfolio Diversification? – Fidelity

Diversification helps smooth out the ups and downs of your portfolio, aiming for consistent, albeit moderate, returns.

Diversification acts as a financial safety net, strategically spreading your investments across various asset classes, sectors, and geographic regions. This approach not only seeks to mitigate the volatility of your portfolio but also strives for steadier, albeit more moderate, returns over time. Here’s a more in-depth look at the benefits and principles of diversification:

Risk Reduction: The primary objective of diversification is risk reduction. When your investments are concentrated in a single asset or sector, your portfolio is vulnerable to fluctuations and downturns specific to that area. By diversifying, you spread your risk, making your portfolio less susceptible to significant losses in any one investment.

Smoothing Volatility: Markets can be unpredictable, with periods of rapid growth and sudden declines. Diversification helps smooth out this volatility. When some assets underperform, others may thrive, balancing out the overall returns of your portfolio. This results in a more stable and predictable investment experience.

Asset Allocation: Diversification goes hand-in-hand with asset allocation, a strategic approach to dividing your investments among different asset classes like stocks, bonds, and cash equivalents. The right asset allocation aligns with your financial goals, risk tolerance, and investment horizon, ensuring that your portfolio is tailored to your unique circumstances.

Optimal Risk-Return Profile: Diversification aims to strike a balance between risk and return. While it may reduce the potential for high-risk, high-reward investments, it also provides a level of security that aligns with conservative and long-term investment strategies. This balance helps you achieve your financial goals without exposing yourself to excessive risk.

Sector and Geographic Diversification: Beyond asset classes, diversification extends to sectors and geographic regions. By investing in a variety of industries and markets, you’re less susceptible to downturns in any single sector or country’s economy. This broader approach adds another layer of risk management to your portfolio.

Time-Tested Strategy: Diversification is a time-tested strategy endorsed by financial experts and investors alike. It’s a fundamental principle of modern portfolio theory, which underpins many investment strategies. By adhering to this principle, you align your investments with a well-established framework for success.

Long-Term Consistency: While diversification may not result in dramatic short-term gains, it aims for long-term consistency. It’s a strategy that encourages patience and discipline. By staying invested and maintaining a diversified portfolio, you position yourself for gradual, sustainable wealth accumulation over time.

In conclusion, diversification is more than just a financial buzzword; it’s a fundamental strategy for building and preserving wealth. It’s a deliberate and intelligent approach to managing risk and achieving financial goals with prudence. By diversifying your investments across different asset classes, sectors, and regions, you not only aim for smoother and more predictable returns but also foster resilience in the face of market volatility. It’s a strategy that stands the test of time, empowering you to pursue your financial aspirations with confidence.

To delve further into this matter, we encourage you to check out the additional resources provided here: What Is Diversification? Definition as Investing Strategy

A balanced portfolio is less prone to extreme fluctuations, reducing the emotional stress associated with investing.

A well-balanced portfolio isn’t just a sound investment strategy; it’s also a powerful tool for managing the emotional roller coaster often associated with financial markets. Here’s an extended exploration of how a balanced portfolio can provide investors with a smoother and more emotionally stable ride:

Diversification’s Calming Effect: A balanced portfolio is, by its very nature, diversified across various asset classes such as stocks, bonds, and possibly alternative investments. Diversification helps spread risk, reducing the impact of a poor-performing asset on the overall portfolio. When one asset class experiences turbulence, others may remain stable or perform well. This diversification acts as a buffer against extreme fluctuations, helping investors stay composed during market ups and downs.

Risk Mitigation: Emotional stress often stems from the fear of losing money. A well-balanced portfolio includes assets with different risk profiles. While stocks offer growth potential, bonds provide stability and income. The presence of lower-risk assets can help mitigate losses during market downturns, providing investors with a sense of security and reducing anxiety.

Smoothing Volatility: Financial markets are notorious for their volatility, with prices often subject to rapid and unpredictable changes. A balanced portfolio is designed to smooth out these ups and downs. When stocks surge, bonds may remain steady or even rise slightly. Conversely, during stock market corrections, the stability of bonds can offset losses in equities. This balance tempers the emotional highs and lows that can lead to impulsive investment decisions.

Sleep-Well Factor: The emotional stress associated with investing can lead to sleepless nights and anxiety. A balanced portfolio promotes the “sleep-well” factor. Investors know that their assets are strategically allocated to manage risk and achieve their long-term goals. This peace of mind enables them to focus on their broader financial objectives without constantly worrying about daily market fluctuations.

Long-Term Perspective: A balanced portfolio encourages a long-term perspective. Investors recognize that their assets are allocated based on their financial goals and risk tolerance, not on short-term market movements. This shift in focus from day-to-day market noise to long-term objectives reduces emotional reactions to market volatility.

Disciplined Rebalancing: To maintain balance, a well-structured portfolio requires periodic rebalancing. This disciplined approach ensures that investors buy low and sell high, effectively enforcing the “buy low, sell high” adage. The act of rebalancing, rooted in a pre-determined strategy, reduces the impulsive emotional responses that can lead to poor investment decisions.

Steady Income Streams: Many balanced portfolios include income-generating assets like bonds or dividend-yielding stocks. These income streams provide a regular source of cash flow, which can be particularly comforting during market downturns or economic uncertainties. Steady income reduces the emotional stress associated with the fear of income disruption.

Advisor Guidance: Investors often rely on financial advisors to construct and manage balanced portfolios. Advisors provide valuable expertise and guidance, helping clients navigate volatile markets with a steady hand. This professional support can alleviate emotional stress and instill confidence in the chosen investment strategy.

In conclusion, a balanced portfolio isn’t just about optimizing returns; it’s a blueprint for emotional stability in the world of investing. By diversifying assets, managing risk, and encouraging a long-term perspective, it empowers investors to weather market storms with resilience and composure. The emotional stress often tied to investing can be significantly reduced when a well-balanced portfolio becomes the cornerstone of an individual’s financial strategy, allowing them to pursue their financial goals with confidence and peace of mind.

Explore this link for a more extensive examination of the topic: What Is Portfolio Diversification? – Fidelity

Risk management strategies protect your capital and limit losses during market downturns.

In the ever-fluctuating world of investing, the implementation of robust risk management strategies is akin to fortifying the foundations of your financial fortress. These strategies act as your shield against unforeseen market turmoil, safeguarding your capital and minimizing losses when market conditions take a downturn. Here’s a deeper exploration of the importance of risk management strategies and how they play a pivotal role in preserving your wealth:

1. Capital Protection:

a. Preserving Your Nest Egg: At the core of risk management is the protection of your hard-earned capital. By employing these strategies, you prioritize capital preservation, ensuring that your financial foundation remains intact even in turbulent market environments.

b. Mitigating Large Losses: Market downturns can be brutal, but effective risk management can prevent catastrophic losses. Through diversification, asset allocation, and stop-loss orders, you establish safeguards to limit the extent of potential financial setbacks.

2. Emotional Discipline:

a. Calm Amidst Chaos: Risk management strategies instill discipline in your investment approach. They help you maintain emotional composure during market volatility, preventing impulsive decisions driven by fear or greed.

b. Reduced Stress: Knowing that you have protective measures in place allows you to approach investing with less anxiety. This peace of mind can lead to more rational and calculated decisions.

3. Portfolio Resilience:

a. Diverse Asset Allocation: Diversification across different asset classes, industries, and geographical regions is a key risk management strategy. It ensures that your portfolio is not overly dependent on the performance of a single investment or sector.

b. Hedging Techniques: Certain risk management techniques, like using options or inverse exchange-traded funds (ETFs), can act as insurance policies for your portfolio. They provide a form of protection when markets move against your positions.

4. Long-Term Viability:

a. Sustainable Investing: Effective risk management extends the longevity of your investment portfolio. By mitigating losses during market downturns, you can maintain the financial health necessary to achieve your long-term goals, such as retirement planning or funding major life events.

b. Opportunity Utilization: Managing risk also involves seizing opportunities. Cash reserves, for instance, can be strategically deployed to capitalize on undervalued assets during market corrections.

5. Goal Alignment:

a. Customized Risk Tolerance: Risk management strategies allow you to align your investments with your risk tolerance and financial objectives. They empower you to tailor your portfolio to meet specific goals, whether they involve income generation, wealth preservation, or growth.

6. Ongoing Monitoring:

a. Adaptability: The financial landscape is dynamic, and risk management is an ongoing process. Regularly reviewing and adjusting your strategies in response to changing market conditions is crucial for maintaining effective protection.

In conclusion, risk management strategies are the guardian angels of your financial well-being. They shield your capital from the turbulence of financial markets, instill discipline in your investment decisions, and ensure that your portfolio remains resilient and adaptable. By incorporating these strategies into your investment approach, you not only protect your wealth but also enhance your capacity to seize opportunities and navigate the complex world of investing with confidence and poise.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: The Importance of Diversification

A well-structured portfolio can help you achieve your long-term financial goals by preserving and growing your capital over time.

A meticulously crafted portfolio stands as a formidable ally on your journey to achieving long-term financial aspirations. Its role extends far beyond the simple task of preserving and growing your capital; it acts as a well-tailored roadmap that guides you through the ever-changing landscape of the financial world.

Capital Preservation: At its foundation, a well-structured portfolio is a guardian of your capital. It’s designed to shield your investments from unnecessary risks and market gyrations. By carefully selecting assets with varying risk profiles and monitoring their performance, you reduce the likelihood of significant capital erosion during market downturns. This preservation of capital provides the stability needed to weather turbulent times.

Capital Growth: Beyond safeguarding your wealth, your portfolio serves as a fertile ground for capital growth. It’s a platform where your investments have the opportunity to multiply over time. By diversifying across asset classes and sectors, you harness the growth potential of various markets, amplifying your chances of achieving long-term financial prosperity.

Risk Management: A well-structured portfolio is not devoid of risk; rather, it’s a tool for managing risk effectively. Through diversification, you spread your investments across assets with different risk-return profiles. This strategic allocation helps mitigate the impact of adverse market movements, safeguarding your capital from significant losses. It’s a dynamic risk management strategy that evolves with your changing financial needs and objectives.

Income Generation: Depending on your financial goals, a portfolio can be tailored to provide a steady stream of income. Whether you’re planning for retirement or seeking to supplement your current earnings, income-focused assets, such as bonds or dividend-yielding stocks, can be strategically incorporated. This income generation component adds another dimension to your portfolio’s functionality, allowing it to align with your specific needs.

Adaptability: A well-structured portfolio is not static; it’s a dynamic entity that adapts to changing circumstances. As your financial goals evolve and market conditions shift, your portfolio can be adjusted to reflect these changes. Whether it involves rebalancing your asset allocation or reallocating investments to seize emerging opportunities, your portfolio remains a flexible tool that evolves in tandem with your objectives.

Long-Term Vision: Ultimately, a well-structured portfolio is a testament to your long-term vision. It’s a commitment to a financial journey that extends beyond the short-term fluctuations of the market. By aligning your investments with your aspirations, risk tolerance, and time horizon, your portfolio becomes a vehicle for long-term financial success.

In conclusion, a well-structured portfolio is not just a collection of investments; it’s a strategic masterpiece that empowers you to navigate the complex and dynamic world of finance. It’s a guardian of your capital, a catalyst for growth, a risk management tool, and a reflection of your long-term vision. Whether you’re building your portfolio from the ground up or fine-tuning an existing one, its role in helping you achieve your long-term financial goals cannot be overstated. It stands as your steadfast companion on the path to financial prosperity, preserving and growing your capital as you journey toward your aspirations.

Looking for more insights? You’ll find them right here in our extended coverage: Our Investment Strategy | How We Invest | CPP Investments

Conclusion

In conclusion, diversification and risk management are not just buzzwords in the world of finance; they are the bedrock principles of successful investing. Whether you’re planning for retirement, funding your child’s education, or simply growing your wealth, a balanced investment portfolio guided by these principles can pave the way for a more secure and prosperous financial future.

In the complex and ever-evolving world of finance, the principles of diversification and risk management stand as timeless pillars of prudent investing. As we conclude, it’s essential to underscore their enduring significance and their profound impact on your financial journey.

1. Wealth Preservation: Diversification safeguards your wealth by reducing the risk of significant losses. It’s a powerful tool for preserving your hard-earned capital, allowing you to weather the storms that inevitably arise in financial markets.

2. Investment Goals: No matter your financial aspirations—whether it’s securing a comfortable retirement, funding your child’s education, or achieving financial independence—diversification is a versatile strategy that can be tailored to align with your specific goals.

3. Peace of Mind: Beyond financial returns, diversification offers something equally valuable: peace of mind. Knowing that your investments are spread across various assets and sectors provides a sense of security, allowing you to sleep soundly even during turbulent times.

4. Adaptability: The financial landscape is ever-changing, with economic cycles, market trends, and geopolitical events shaping investment opportunities and risks. Diversification equips your portfolio with adaptability, enabling it to adjust to shifting dynamics and seize emerging prospects.

5. Risk Management: Effective risk management isn’t about avoiding all risks; it’s about understanding and managing them wisely. Diversification empowers you to balance risk and reward, enabling you to make informed choices that align with your risk tolerance.

6. Long-Term Prosperity: Diversified portfolios have historically demonstrated resilience and the ability to deliver consistent, long-term returns. By adhering to these principles, you lay the foundation for a prosperous financial future.

7. Financial Well-Being: Ultimately, diversification and risk management are not abstract concepts but tangible tools that contribute to your financial well-being. They empower you to take control of your financial destiny and work toward achieving your dreams and aspirations.

In your financial journey, remember that these principles are not mere guidelines; they are the essence of successful investing. Whether you’re just starting to build your wealth or you’re a seasoned investor, their application remains a fundamental and time-tested approach to achieving financial security and prosperity. By embracing diversification and risk management, you pave the way for a brighter and more secure financial future, where your aspirations have the potential to become reality.

Don’t stop here; you can continue your exploration by following this link for more details: Managing Risks: A New Framework

More links

For additional details, consider exploring the related content available here 5 Tips for Diversifying Your Portfolio