Table of Contents

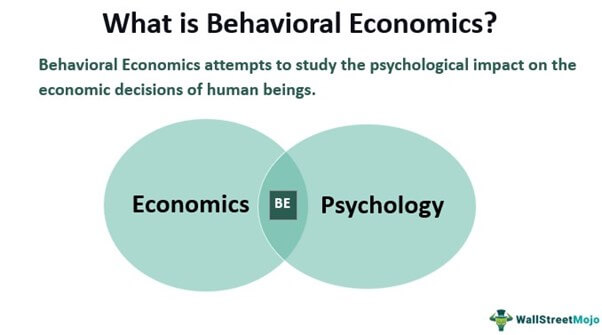

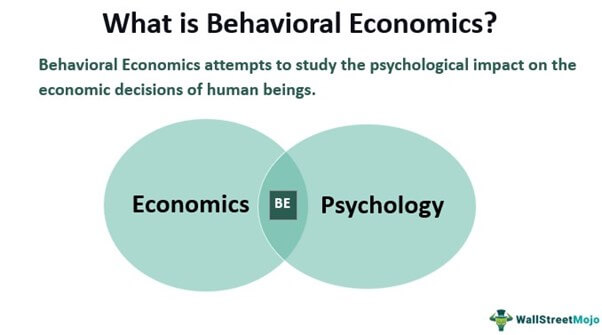

In the world of marketing, understanding consumer behavior is akin to holding the key to a treasure trove. Behavioral economics, a multidisciplinary field that combines insights from psychology and economics, has emerged as a powerful tool for deciphering the decision-making processes of consumers. This article delves into the role of behavioral economics in marketing, exploring how it shapes consumer choices, influences purchasing decisions, and empowers businesses to craft more effective marketing strategies.

In the ever-evolving landscape of marketing, unlocking the mysteries of consumer behavior is akin to discovering a treasure map that leads to unparalleled success. Behavioral economics, a dynamic field that harmoniously blends principles from psychology and economics, has emerged as a pivotal compass guiding marketers through the intricate realm of consumer decision-making. Let’s embark on a deeper exploration of the transformative role that behavioral economics plays in the world of marketing, illuminating its profound impact on consumer choices, purchasing decisions, and the crafting of highly effective marketing strategies.

1. Understanding the Psychology of Decision-Making: Behavioral economics delves into the intricacies of how consumers make decisions. It ventures beyond traditional economic models, recognizing that human behavior is not always rational or predictable. By embracing insights from psychology, it sheds light on the emotional, cognitive, and social factors that influence choices, offering marketers a more nuanced understanding of their target audience.

2. Nudging Consumer Choices: One of the central tenets of behavioral economics is the concept of “nudging.” Marketers leverage behavioral insights to design interventions that gently guide consumers toward desired behaviors. Whether it’s encouraging healthier eating habits, promoting sustainable choices, or increasing savings, nudges have proven to be potent tools in the marketer’s arsenal.

3. Anchoring and Pricing Strategies: Behavioral economics uncovers the anchoring effect, where consumers rely heavily on the first piece of information they encounter when making decisions. Marketers strategically use this insight by anchoring prices or values to influence how consumers perceive offers. This can lead to more favorable perceptions of pricing and increased willingness to make purchases.

4. Embracing Loss Aversion: Behavioral economics recognizes the innate human tendency of loss aversion—the preference to avoid losses over acquiring equivalent gains. Savvy marketers craft messaging that taps into this psychology, emphasizing what consumers might lose by not choosing their product or service. This can be a compelling motivator in driving conversions.

5. Social Proof and Influencer Marketing: Consumers often look to others for guidance when making decisions. Behavioral economics underscores the power of social proof, whereby people are more likely to adopt behaviors endorsed or practiced by their peers. This insight fuels influencer marketing, where brands leverage individuals with significant followings to sway consumer choices.

6. Default Options and Decision Architecture: Behavioral economics emphasizes the significance of default options and the design of choice architecture. Marketers leverage these principles to influence consumer choices by strategically positioning certain options as defaults, simplifying decision-making processes, and enhancing user experiences.

7. Overcoming Cognitive Biases: Cognitive biases, such as confirmation bias and availability heuristic, significantly impact decision-making. Behavioral economics equips marketers with tools to counter these biases, fostering more objective and informed consumer choices.

8. Ethical Considerations: While behavioral economics provides valuable tools for marketers, ethical considerations are paramount. It’s essential to use these insights responsibly and transparently, ensuring that consumers are not manipulated but empowered to make choices that genuinely align with their preferences and values.

In conclusion, the fusion of psychology and economics within the realm of behavioral economics has revolutionized marketing. It offers a profound understanding of consumer behavior, empowering marketers to create impactful strategies that resonate with their audience. By leveraging behavioral insights, businesses can forge more authentic connections with consumers, enhance the effectiveness of their campaigns, and ultimately navigate the dynamic landscape of marketing with unprecedented success. As behavioral economics continues to evolve, its role in shaping the future of marketing remains pivotal, promising a deeper level of consumer engagement and more meaningful brand-consumer relationships.

To expand your knowledge on this subject, make sure to read on at this location: Choice Architecture – The Decision Lab

What is Behavioral Economics?

Behavioral economics is the study of how psychological and emotional factors influence economic decision-making. Unlike traditional economics, which assumes that individuals always make rational choices, behavioral economics recognizes that human behavior is often driven by emotions, biases, and cognitive shortcuts. This field seeks to uncover the hidden forces that shape our decisions.

Behavioral economics, as a dynamic and evolving discipline, unveils the intricate interplay between human psychology, emotions, and economic decision-making. While traditional economics predominantly relies on the rational actor model, which posits that individuals consistently make logical choices based on self-interest, behavioral economics acknowledges the undeniable presence of cognitive biases and emotional influences in our decisions. Expanding on this idea, let’s delve deeper into the fascinating realm of behavioral economics:

Understanding Irrationality: One of the central tenets of behavioral economics is the exploration of human irrationality. By recognizing that individuals often deviate from purely rational decision-making, this field delves into the underlying reasons for these deviations, shedding light on the cognitive biases that affect our choices.

Biases and Heuristics: Behavioral economics investigates a multitude of biases and heuristics that lead to systematic errors in judgment and decision-making. Examples include confirmation bias, anchoring bias, and availability heuristic. Understanding these biases enables us to recognize when they might be at play in various economic contexts.

Prospect Theory: Prospect theory, developed by Daniel Kahneman and Amos Tversky, is a cornerstone of behavioral economics. It posits that individuals do not evaluate potential outcomes in isolation but rather relative to a reference point. This theory helps explain phenomena like loss aversion and the endowment effect, where people place a higher value on what they own.

Emotional Economics: Emotions play a significant role in our economic choices. Behavioral economics investigates how emotions like fear, greed, and regret influence decisions related to investments, spending, and risk-taking. Understanding emotional economics helps individuals and businesses manage their financial decisions more effectively.

Nudge Theory: Behavioral economics has practical applications in policy and public choice. Nudge theory, popularized by Richard Thaler and Cass Sunstein, explores how subtle changes in choice architecture can influence behavior for the better. Governments and organizations use nudges to encourage desirable behaviors like saving for retirement or conserving energy.

Behavioral Interventions: In the realm of marketing and consumer behavior, behavioral economics provides insights into designing effective marketing strategies. Businesses leverage knowledge about consumer biases to create persuasive messaging and pricing structures that drive purchasing decisions.

Financial Well-Being: Behavioral economics has profound implications for personal finance and financial well-being. It encourages individuals to recognize their own behavioral biases and implement strategies to counteract them. Concepts like automatic savings plans and choice architecture aim to help people make better financial choices.

Healthcare Decision-Making: Behavioral economics extends its reach to healthcare, exploring how patients make decisions about medical treatments and health-related behaviors. Insights from this field inform strategies to improve patient adherence to treatment plans and promote healthier lifestyles.

Environmental Economics: In the context of environmental conservation, behavioral economics studies how individuals make choices that impact the environment. It guides the development of policies and incentives that encourage sustainable behaviors such as recycling and energy conservation.

Ethical Considerations: Behavioral economics prompts ethical discussions about the responsibility of businesses, policymakers, and individuals in recognizing and mitigating biases that can lead to harmful decisions. It raises questions about informed consent, transparency, and the role of paternalism in choice architecture.

In essence, behavioral economics is a compelling lens through which we can better understand the intricate factors shaping economic decisions. By acknowledging the complexities of human behavior and decision-making, this field empowers individuals, businesses, and policymakers to navigate economic choices with greater awareness and effectiveness, ultimately leading to more informed and advantageous outcomes in a wide array of contexts.

Additionally, you can find further information on this topic by visiting this page: Choice Architecture – The Decision Lab

Understanding the Power of Nudging

At the heart of behavioral economics lies the concept of “nudging.” A nudge is a subtle change in the presentation of choices or information that guides individuals toward making a specific decision without restricting their freedom of choice. It’s about making the preferred choice the default option or framing choices in a way that encourages a desired outcome.

“At the heart of behavioral economics lies the concept of “nudging,” a nuanced approach that wields significant influence over decision-making. Nudging is more than just gently steering choices; it’s a strategic art that capitalizes on human psychology to achieve desired outcomes while respecting individual autonomy.

Choice Architecture: Nudging relies heavily on the art of choice architecture. This involves carefully crafting the way choices are presented to individuals. For instance, in a cafeteria, placing healthier food options at eye level and less healthy options out of immediate view can encourage healthier eating without forcing anyone’s hand.

Default Choices: Default choices are a powerful form of nudging. By making the preferred choice the default, individuals are more likely to go along with it, often out of convenience or inertia. This approach is seen in settings like retirement savings plans, where employees are automatically enrolled and must actively opt out if they don’t want to participate.

Framing and Language: The way choices are framed and the language used to describe them can nudge decisions in a particular direction. For example, describing a product as “90% fat-free” instead of “10% fat” highlights the positive aspect, nudging consumers toward perceiving it as a healthier option.

Social Norms: Nudging often leverages social norms and the desire for conformity. Messages like “Most people recycle in this neighborhood” or “Join thousands of satisfied customers” tap into the inclination to align with what’s considered typical or socially desirable.

Salience of Information: Nudging can involve making critical information more salient. Highlighting the potential drawbacks of a choice can make individuals think twice, while emphasizing the benefits can nudge them toward a particular decision.

Feedback Loops: Continual feedback loops are essential for effective nudging. By analyzing how individuals respond to nudges, businesses and policymakers can fine-tune their strategies to achieve better results over time.

Ethical Considerations: While nudging can be a force for good, it raises ethical questions. Businesses and policymakers must use nudging responsibly, ensuring that it aligns with individuals’ well-being and respects their freedom of choice. Transparency and informed consent are key principles.

Consumer Empowerment: Nudging also extends to consumer empowerment. Providing individuals with clear information and tools, such as energy usage dashboards or personalized health data, can empower them to make informed choices that align with their goals and values.

Application in Various Fields: Nudging is versatile and applicable in various fields, from public policy to marketing. Governments use nudging to promote healthy behaviors, and businesses employ it to improve customer experiences and drive desired actions.

Continuous Improvement: Successful nudging strategies are not set in stone. They require ongoing evaluation and refinement to adapt to changing behaviors, preferences, and societal norms.

In summary, nudging is a subtle yet influential force that gently guides decisions toward desired outcomes. It respects individuals’ autonomy while harnessing the intricate interplay of human psychology and choice architecture. When wielded responsibly, nudging can be a potent tool for shaping behaviors, fostering positive change, and achieving collective goals in an increasingly complex world.”

Looking for more insights? You’ll find them right here in our extended coverage: Nudging Consumers to Make Sustainable Choices | BCG

Applications in Marketing

Behavioral economics has profound implications for marketing strategies. Here’s how it plays a pivotal role:

nullYou can also read more about this here: Nudging Consumers toward Better Food Choices: Policy …

Choice Architecture

Behavioral economics emphasizes the importance of choice architecture, or how choices are presented to consumers. Marketers can use this insight to design product displays, website layouts, and menu options that nudge consumers toward preferred choices.

Behavioral economics, a fascinating branch of economic theory, goes beyond traditional models by recognizing that human decision-making is often driven by cognitive biases and emotions. At the heart of behavioral economics lies the concept of choice architecture, a powerful tool that marketers can wield to influence consumer decisions and preferences. Let’s explore how choice architecture can be harnessed to shape product displays, website layouts, and menu options in ways that not only nudge consumers toward preferred choices but also create a seamless and satisfying experience:

1. Default Options: One of the foundational principles of choice architecture is the power of defaults. Marketers can strategically set default options to guide consumer choices. For example, in an online subscription service, the default choice might be the most popular plan. By making it the default, a significant proportion of consumers may opt for it without actively considering other options.

2. Framing and Presentation: How information is framed and presented can significantly impact choices. Marketers can employ techniques like framing a discount as “Save $10” versus “10% Off.” Different phrasing can lead consumers to perceive the same offer in distinct ways, influencing their decisions.

3. Limited Choice Sets: Choice overload can overwhelm consumers. Marketers can curate product displays or menu options by presenting a limited but well-chosen set of choices. This simplification can make decision-making more manageable and lead consumers toward preferred options.

4. Highlighting Anchors: Anchoring is a cognitive bias where people rely heavily on the first piece of information they encounter. Marketers can strategically place high-margin or featured products at the beginning of a menu or product display, creating an anchor that influences subsequent choices.

5. Visual Cues and Prominence: The layout and design of websites and product displays matter. Marketers can use visual cues such as bold fonts, contrasting colors, or images to draw attention to preferred choices. Prominently featuring specific products or options can make them more appealing.

6. Social Proof: People often look to others for guidance in decision-making. Marketers can incorporate social proof elements like user reviews, ratings, or testimonials to nudge consumers toward choices validated by their peers.

7. Scarcity and Urgency: Creating a sense of scarcity or urgency can influence decisions. Marketers can use phrases like “Limited Time Offer” or “Only 3 Left in Stock” to encourage consumers to take action promptly.

8. Default Sorting: Websites and menus can use default sorting options that prioritize preferred choices. For instance, on an e-commerce website, products can be sorted by “Best Sellers” by default, nudging consumers toward popular items.

9. Feedback and Suggestions: Marketers can provide real-time feedback and suggestions during the decision-making process. For example, an e-commerce platform might offer “Frequently Bought Together” or “You Might Also Like” recommendations to guide consumers toward complementary or preferred products.

10. Testing and Iteration: Effective choice architecture is often a result of testing and iteration. Marketers can A/B test different layouts, presentations, and default options to determine which strategies yield the desired consumer behavior and preferences.

In conclusion, behavioral economics and the concept of choice architecture offer a treasure trove of insights for marketers. By understanding how consumers make decisions and leveraging choice architecture principles, businesses can create experiences that not only nudge consumers toward preferred choices but also enhance user satisfaction and engagement. It’s a delicate dance between influencing choices and respecting consumer autonomy, ultimately crafting a win-win scenario where consumers find value in their decisions while businesses achieve their goals.

To delve further into this matter, we encourage you to check out the additional resources provided here: What Is Behavioral Economics? Theories, Goals, and Applications

Anchoring

The anchoring effect demonstrates that people rely heavily on the first piece of information they receive when making decisions. Marketers can strategically place higher-priced items first or showcase premium features to anchor consumer perceptions and influence purchasing decisions.

The anchoring effect, a cognitive bias deeply rooted in human decision-making, underscores the significance of initial information in shaping our choices. For marketers, understanding and harnessing this psychological phenomenon can be a potent tool for influencing consumer behavior and optimizing sales strategies. Here’s an extended exploration of how the anchoring effect can be strategically applied:

Pricing Strategies: Marketers can strategically employ the anchoring effect in pricing strategies. By presenting a higher-priced item as the initial point of reference, consumers tend to perceive subsequent options as more reasonably priced. This makes the higher-priced option, often a premium or luxury offering, more appealing and likely to be chosen. It’s a tactic that not only boosts sales of the premium product but also positively influences sales of mid-range or lower-priced alternatives.

Value Perception: Anchoring isn’t limited to price alone; it extends to the perception of value. Marketers can anchor consumer perceptions by highlighting premium features or benefits right at the outset. When consumers encounter these standout features first, they tend to attribute greater value to the product as a whole. This can justify higher price points and encourage consumers to opt for the product with the showcased premium attributes.

Bundling and Upselling: The anchoring effect can be applied to bundled products or upselling strategies. By leading with a premium or high-value item in a bundle or suggesting it as an upsell, marketers can anchor consumers to that product’s value. This encourages customers to consider the entire bundle or upgrade, ultimately driving higher sales and revenue.

Discounting Strategies: Anchoring can also be applied to discounting strategies. For instance, showcasing an original higher price (even if it’s rarely charged) before revealing a discounted price can make the discount appear more substantial. Consumers perceive a greater deal when they anchor to the higher price, which can stimulate purchases and create a sense of urgency.

Comparison Shopping: In e-commerce and retail environments, where consumers often engage in comparison shopping, the anchoring effect is particularly relevant. Marketers can use it by strategically positioning products with desired profit margins as the first items in search results or on shelves. Consumers are more likely to consider these products and make purchases based on the initial anchor.

Consumer Decision Funnel: Recognizing that consumers move through a decision-making funnel, marketers can strategically employ the anchoring effect at various stages. For instance, during the awareness stage, premium features can anchor initial interest. In the consideration stage, pricing anchoring can help narrow down choices. Finally, during the decision stage, anchoring can be used to reinforce the perceived value of the chosen option.

Ethical Considerations: While the anchoring effect can be a powerful marketing tool, it should be employed ethically and transparently. Misleading anchoring tactics that manipulate consumers into making decisions they later regret can harm brand reputation. Maintaining trust and transparency is essential in anchoring strategies.

A/B Testing: Marketers can fine-tune their anchoring strategies through A/B testing. By testing different anchoring points, such as price, features, or product placement, businesses can determine which approach resonates most effectively with their target audience and fine-tune their marketing efforts accordingly.

In summary, the anchoring effect offers a compelling insight into the psychology of decision-making. Marketers can leverage this bias to influence consumer perceptions, encourage higher-value purchases, and optimize pricing, bundling, and upselling strategies. However, it’s important to use anchoring ethically and transparently, prioritizing consumer trust and long-term brand relationships. When harnessed effectively, the anchoring effect becomes a valuable tool for marketers seeking to drive sales and enhance the perceived value of their products and services.

Don’t stop here; you can continue your exploration by following this link for more details: How to Influence Consumer Decisions with Nudging

Social Proof

Humans are social creatures, and behavioral economics shows that people tend to follow the crowd. Marketers leverage social proof by showcasing product reviews, ratings, and endorsements to nudge consumers into believing that others have made and enjoyed similar choices.

Absolutely, human behavior is profoundly influenced by social dynamics, and the principles of behavioral economics shed light on how marketers leverage these tendencies. Here’s an extended exploration of the idea:

Psychological Anchoring: Behavioral economics reveals that humans often rely on cognitive shortcuts or “anchors” when making decisions. Marketers strategically use social proof as an anchor by presenting product reviews, ratings, and endorsements prominently. By doing so, they provide consumers with a reference point that suggests a product’s quality and popularity.

Building Trust: Trust is a critical factor in consumer behavior. When consumers see that others have positively reviewed or endorsed a product, it instills trust in the brand and its offerings. This trust can significantly reduce the perceived risk associated with a purchase, making consumers more likely to buy.

Reducing Decision Fatigue: The abundance of choices in today’s marketplace can overwhelm consumers. Social proof simplifies decision-making by offering a quick and easy way to evaluate a product’s desirability. Instead of meticulously researching every option, consumers can rely on the collective wisdom of others.

Creating a Sense of Belonging: Humans have an innate desire to belong and conform to social norms. Marketers tap into this by showcasing that others have made similar choices. Consumers are nudged to align themselves with the group, feeling that they are making a socially accepted decision.

Fostering FOMO (Fear of Missing Out): Social proof can trigger the “fear of missing out” (FOMO). When consumers see others enjoying a product or benefiting from a service, they fear missing out on a positive experience. This fear can be a powerful motivator to make a purchase.

Visual and Emotional Impact: Visual elements like star ratings, customer photos, or video testimonials have a strong emotional impact. They make social proof more relatable and compelling, as consumers can see real people sharing their experiences.

User-Generated Content: Marketers encourage user-generated content, such as customer reviews, photos, and videos, to further enhance social proof. This authentic content resonates with potential buyers and reinforces the credibility of the product or service.

Creating Viral Effects: Positive social proof can lead to viral marketing effects. When a product gains a reputation for being popular and well-liked, it can organically spread through word of mouth and social media, amplifying its reach and impact.

Tailoring Social Proof: Effective marketers understand that different consumer segments may be influenced by varying forms of social proof. Some may prefer expert endorsements, while others rely on peer reviews. Tailoring social proof to match the preferences of target audiences maximizes its impact.

Continuous Feedback Loop: Social proof is not a one-time effort. Marketers actively monitor and respond to consumer feedback and reviews, addressing concerns, and maintaining a positive online presence. This ongoing feedback loop reinforces social proof over time.

Ethical Considerations: Marketers must use social proof ethically, ensuring that reviews and endorsements are genuine and not manipulated. Misleading or fabricated social proof can damage brand trust and reputation.

In summary, behavioral economics and social proof are potent tools that marketers use to tap into the innate social tendencies of consumers. By showcasing the positive experiences of others, marketers can reduce decision-making friction, build trust, and create a sense of belonging, ultimately nudging consumers towards making confident purchase decisions. It’s a strategy deeply rooted in understanding human psychology and social dynamics.

Additionally, you can find further information on this topic by visiting this page: How to Influence Consumer Decisions with Nudging

Scarcity and Urgency

The fear of missing out is a powerful motivator. Marketers use tactics like limited-time offers, low-stock notifications, and exclusive access to create a sense of scarcity and urgency, compelling consumers to act quickly.

nullTo delve further into this matter, we encourage you to check out the additional resources provided here: Digital nudging with recommender systems: Survey and future …

Loss Aversion

Behavioral economics reveals that people are more motivated to avoid losses than to acquire gains. Marketers frame messages to emphasize potential losses if consumers don’t take action, encouraging them to make choices that minimize perceived losses.

“Behavioral economics, with its profound insights into human decision-making, uncovers a fundamental truth: people are inherently wired to be more motivated by the fear of losses than the promise of gains. This psychological phenomenon has profound implications for marketers who seek to influence consumer behavior.

The Power of Loss Aversion: Loss aversion, a cornerstone of behavioral economics, underscores that individuals feel the sting of a loss more acutely than the pleasure of an equivalent gain. This cognitive bias is deeply ingrained in our psyche and profoundly influences our choices.

Framing Messages for Impact: Armed with the knowledge of loss aversion, marketers strategically frame their messages to capitalize on this psychological quirk. They emphasize the potential losses that consumers might incur if they don’t take action. Whether it’s a limited-time offer, a product in high demand, or a missed opportunity, the focus is on what consumers stand to lose.

Urgency and Scarcity: Scarcity tactics, such as limited inventory or a looming deadline, are potent tools in marketing. They trigger a sense of urgency by highlighting the imminent loss consumers face if they delay their decision. This urgency compels action, as individuals strive to avert the perceived loss.

Risk Mitigation: Marketers also leverage loss aversion to position their products or services as solutions that mitigate potential losses. Whether it’s insurance, security systems, or preventive healthcare, the message centers on protecting consumers from adverse outcomes.

Decision-Making Psychology: Understanding loss aversion goes beyond messaging—it delves into the psychology of decision-making. Marketers use this knowledge to design customer experiences that minimize the perception of loss during the decision-making process. This can involve clear return policies, satisfaction guarantees, or free trials, all aimed at reducing the perceived risk of a purchase.

Behavioral Triggers: Behavioral economics identifies specific triggers that activate loss aversion. These include the fear of missing out (FOMO), the endowment effect (attaching higher value to what one owns), and status quo bias (resistance to change due to the perceived risk of loss). Marketers strategically employ these triggers to nudge consumers towards the desired action.

In summary, loss aversion is a powerful force that shapes consumer behavior. Behavioral economics has unveiled this inherent human bias, offering marketers a profound understanding of how to influence choices. By framing messages, creating urgency, and mitigating perceived risks, marketers tap into the psychology of loss aversion, guiding consumers towards decisions that align with their objectives and the marketer’s goals.”

Explore this link for a more extensive examination of the topic: What is behavioral economics? | University of Chicago News

The Impact on Decision-Making

Behavioral economics doesn’t manipulate choices; instead, it aligns marketing strategies with how consumers naturally make decisions. By recognizing that individuals are not purely rational actors, businesses can create more persuasive marketing campaigns that resonate with consumers’ cognitive biases and emotional triggers.

Indeed, the essence of behavioral economics lies in alignment rather than manipulation. Let’s delve deeper into this concept to understand how it benefits both businesses and consumers:

Empowering Informed Choices: Behavioral economics respects the autonomy of consumers by empowering them to make informed choices that align with their preferences. Instead of coercing or tricking individuals into decisions, it provides them with a well-structured choice architecture that facilitates decision-making. This approach fosters a sense of empowerment among consumers, leading to more satisfying and confident choices.

Enhancing Consumer Satisfaction: When marketing strategies align with consumers’ natural decision-making processes, the result is a more satisfying and fulfilling consumer experience. By acknowledging cognitive biases like loss aversion, confirmation bias, or social proof, businesses can design marketing messages and product offerings that cater to consumers’ underlying psychological needs and preferences. This leads to greater customer satisfaction and loyalty.

Reducing Decision Fatigue: In today’s information-rich world, consumers face decision fatigue as they navigate countless choices. Behavioral economics helps businesses simplify choices for consumers. By offering clear defaults, well-framed options, and streamlined decision pathways, companies reduce the cognitive load on consumers, making their lives easier and more enjoyable.

Promoting Ethical Marketing Practices: One of the cornerstones of behavioral economics is ethical nudging. This means that businesses can leverage behavioral insights to encourage choices that are genuinely in the best interest of consumers. By adhering to ethical guidelines, companies can build trust and goodwill, which are essential for long-term success in the marketplace.

Improved Product Design: Understanding how consumers naturally make decisions allows businesses to design products and services that better cater to user needs and preferences. This goes beyond marketing and extends into the core of product development. Products that align with consumer behavior and psychology are more likely to succeed in the market.

Long-Term Value: Behavioral economics shifts the focus from short-term gains to long-term value creation. Instead of relying on one-off sales or impulsive purchases, businesses can build enduring customer relationships by consistently delivering value and understanding the evolving needs and behaviors of their customers.

Market Adaptation: Markets are dynamic, and consumer behavior evolves over time. Behavioral economics equips businesses with the tools to adapt to changing market conditions effectively. By staying attuned to shifting consumer preferences and cognitive biases, companies can remain relevant and competitive.

In essence, behavioral economics empowers businesses to create marketing strategies and products that genuinely resonate with consumers. It acknowledges the complexity of human decision-making and leverages this understanding to enhance consumer well-being while achieving business goals. By aligning with the natural tendencies of consumers, businesses can create win-win scenarios where customers make choices that fulfill their needs, and companies prosper through enhanced customer loyalty and satisfaction.

To delve further into this matter, we encourage you to check out the additional resources provided here: Nudging Consumers to Make Sustainable Choices | BCG

Ethical Considerations

While nudging can be a powerful tool, it raises ethical questions. Marketers must use behavioral economics responsibly, ensuring that nudges are transparent, do not deceive consumers, and ultimately benefit them. Ethical marketing practices build trust and long-term customer relationships.

While nudging can be a powerful tool for influencing consumer behavior, it does indeed raise significant ethical questions that marketers must navigate with care and responsibility. Behavioral economics provides a nuanced understanding of how individuals make decisions, and marketers wield this knowledge to create nudges that drive desired outcomes. However, ethical considerations should always be at the forefront of these strategies.

Transparency: Ethical nudging demands transparency. Marketers should clearly communicate the intent and impact of nudges to consumers. This means being upfront about the behavioral techniques being employed, whether it’s scarcity tactics, social proof, or personalized recommendations. Transparency ensures that consumers are aware of the influences at play and can make informed decisions.

Avoiding Deception: Nudges should never deceive consumers or manipulate them into making choices against their best interests. Marketers must steer clear of practices that exploit cognitive biases or create a false sense of urgency. Instead, nudges should align with consumers’ genuine preferences and needs.

Consumer Well-Being: The primary goal of ethical nudging should be to enhance consumer well-being. Marketers should assess whether a nudge ultimately benefits the individual, rather than solely focusing on short-term gains for the business. Nudges should help consumers make choices that align with their goals and values.

Respect for Autonomy: Ethical nudging respects individual autonomy. It acknowledges that consumers have the right to make their own choices, even if those choices differ from what marketers might consider ideal. Marketers should avoid overly paternalistic approaches and recognize the importance of individual agency.

Long-Term Relationships: Building trust and fostering long-term customer relationships should be a core objective. Ethical marketing practices that prioritize consumer well-being over quick wins contribute to a positive brand image and customer loyalty. Customers are more likely to engage with businesses they trust.

Self-Regulation: Marketers should embrace self-regulation when employing behavioral economics techniques. Developing and adhering to ethical guidelines within the industry helps maintain consumer trust and ensures that practices remain responsible and respectful.

Ethical Oversight: Independent ethical oversight, such as ethical review boards or consumer advocacy groups, can provide an external perspective on marketing practices. These entities can help assess the ethical implications of nudges and provide guidance on responsible implementation.

Continuous Evaluation: Marketers should continuously evaluate the impact and ethics of their nudging strategies. Regularly assessing the outcomes and soliciting consumer feedback can help identify and rectify any unintended negative consequences.

In conclusion, ethical marketing practices in the realm of behavioral economics require a delicate balance between influence and responsibility. While nudging can be a valuable tool for businesses, it must always be wielded with transparency, respect for consumer autonomy, and a genuine commitment to enhancing consumer well-being. By prioritizing ethics in marketing strategies, businesses can build trust, foster enduring customer relationships, and contribute to a more responsible and ethical marketplace.

You can also read more about this here: Reducing the Consumer Attitude–Behaviour Gap in Animal Welfare …

Behavioral economics offers a profound shift in the way businesses approach marketing. By understanding the hidden forces that shape consumer choices, marketers can create more effective campaigns, improve product design, and ultimately enhance the customer experience. As consumers continue to face a multitude of choices in today’s information-rich world, behavioral economics serves as a guiding light, nudging them toward choices that align with their preferences while fostering mutual trust between businesses and consumers. It’s a dynamic field that empowers marketers to not only understand but also influence the decision-making processes of their target audience, ultimately driving success in the marketplace.

Should you desire more in-depth information, it’s available for your perusal on this page: Choice Architecture – The Decision Lab

More links

Should you desire more in-depth information, it’s available for your perusal on this page: Nudging Consumers to Make Sustainable Choices | BCG