Introduction

Trading and investing are two distinct approaches to the financial markets, each with its strategies, goals, and timeframes. Understanding the differences between trading and investing is essential for making informed decisions about how to grow and manage your wealth.

Distinguishing between trading and investing is akin to recognizing the varied tools in a financial toolkit, each serving a unique purpose. These approaches to the financial markets are not just dissimilar; they are fundamentally different methodologies, each with its own set of strategies, objectives, and timeframes. Let’s delve deeper into the disparities between trading and investing and why comprehending these distinctions is pivotal for prudent financial decision-making:

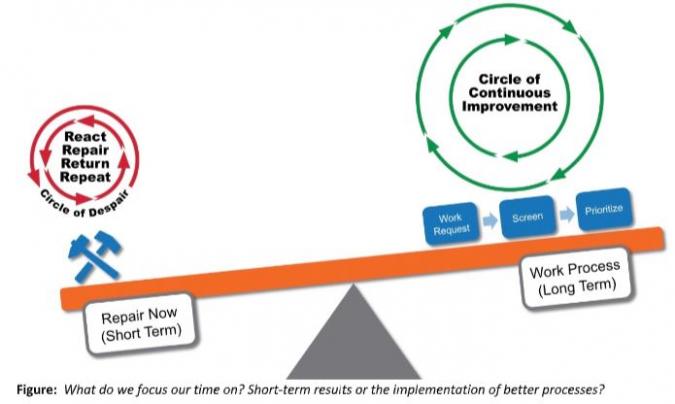

Time Horizon – Short-Term vs. Long-Term: The most fundamental disparity lies in the time horizon. Trading is typically characterized by short-term endeavors, often involving buying and selling assets within days, hours, or even minutes. Investors, on the other hand, are in it for the long haul, aiming to accumulate wealth over years, if not decades. Recognizing your preferred time horizon is essential, as it determines your tolerance for market volatility and your ability to ride out fluctuations.

Goals – Profits vs. Wealth Accumulation: Trading is primarily profit-oriented, with traders seeking to capitalize on short-term price movements. They aim to generate income or capital gains by exploiting market inefficiencies. Investors, conversely, prioritize wealth accumulation and aim to build a portfolio of assets that appreciate over time, potentially providing income and financial security in the future.

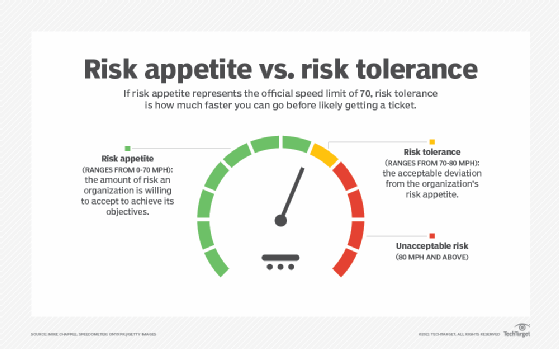

Risk Tolerance – Aggressive vs. Conservative: Trading inherently carries higher risk due to its focus on short-term price fluctuations. Traders often employ leverage and engage in riskier strategies to amplify gains. Investors, however, typically adopt a more conservative approach, diversifying their portfolios and holding assets through market ups and downs, with the goal of preserving capital.

Market Analysis – Technical vs. Fundamental: Traders predominantly rely on technical analysis, studying charts, patterns, and market indicators to make decisions. They aim to forecast short-term price movements based on historical data. Investors, on the other hand, favor fundamental analysis, evaluating the intrinsic value of assets based on factors like financial statements, industry trends, and economic conditions.

Frequency of Activity – Active vs. Passive: Trading is characterized by frequent and active decision-making, with traders monitoring markets closely and executing trades regularly. Investors often adopt a passive approach, making fewer adjustments to their portfolios and allowing long-term strategies to unfold.

Costs and Taxes – Considerations: Trading can incur higher costs, including commissions and taxes on short-term gains, which can erode profits. Investors may benefit from reduced costs and potentially lower tax rates on long-term capital gains.

Emotional Resilience – Handling Stress: Trading can be emotionally taxing due to the rapid pace, constant decision-making, and the potential for significant gains or losses in a short time. Investors often experience less stress as they take a longer view and are less perturbed by short-term market fluctuations.

In conclusion, understanding the nuances between trading and investing is akin to having a compass in the vast landscape of financial markets. Your choice between these approaches should align with your financial goals, risk tolerance, time availability, and market expertise. Whether you opt for the precision of trading or the patience of investing, grasping these distinctions empowers you to make informed decisions that best suit your wealth-building aspirations.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Investment Basics Explained With Types to Invest in

Traders aim to profit from short-term price fluctuations, often holding assets for minutes, hours, or days.

The world of trading is a fast-paced arena where participants aim to capitalize on short-term price movements with precision and strategy. Here, we delve deeper into the dynamics of short-term trading, exploring the strategies, tools, and mindset that traders employ to navigate the markets effectively:

Time Sensitivity: Short-term trading, also known as day trading or swing trading, operates on a compressed time scale. Traders are acutely attuned to market developments, making swift decisions to buy or sell assets. This time sensitivity demands a high level of focus and responsiveness.

Intraday and Swing Trading: Short-term traders employ various strategies. Intraday traders focus on making multiple trades within a single trading day, capitalizing on intraday price fluctuations. Swing traders, on the other hand, may hold positions for a few days to catch price swings within larger trends.

Technical Analysis: Technical analysis is a cornerstone of short-term trading. Traders scrutinize price charts, patterns, and technical indicators to identify entry and exit points. Chart patterns, moving averages, and oscillators are among the tools they use to make informed decisions.

Risk Management: Effective risk management is paramount. Short-term traders set stop-loss orders to limit potential losses and employ position sizing strategies to manage risk. Capital preservation is a fundamental principle.

Volatility as an Opportunity: Short-term traders often embrace market volatility as an opportunity. Volatility can lead to rapid price movements, creating potential profit avenues. However, it also heightens risk, necessitating vigilance.

Leverage and Margin: Some short-term traders utilize leverage and margin, amplifying their trading power. While this can magnify gains, it also escalates risk. Prudent use of leverage is essential to avoid significant losses.

News and Events: News releases and economic events can trigger rapid market movements. Short-term traders closely monitor news calendars and events that may impact the assets they trade, adjusting their strategies accordingly.

Psychological Resilience: Short-term trading can be mentally taxing. Traders must maintain emotional discipline, as impulsive decisions can lead to losses. Developing psychological resilience is as crucial as mastering technical analysis.

Continuous Learning: Markets are dynamic, and short-term traders must adapt to evolving conditions. Continuous learning, staying updated with market news, and refining strategies are ongoing processes.

Tax Implications: Tax considerations play a role in short-term trading. Depending on your jurisdiction, short-term capital gains may be subject to higher tax rates than long-term gains. Traders should be aware of the tax implications of their trading activities.

Technology and Tools: Short-term traders rely on advanced trading platforms and tools. These platforms provide real-time data, order execution capabilities, and charting features to facilitate rapid decision-making.

Trading Styles: Within short-term trading, various styles emerge, such as scalping (very short-term trades for small profits), day trading (buying and selling within a single day), and momentum trading (capitalizing on strong price trends).

In the realm of short-term trading, success hinges on a combination of skill, discipline, and adaptability. Traders seek to harness the power of short-term price fluctuations while carefully managing risk. It’s a demanding endeavor that requires continuous learning and the ability to stay cool under pressure. Whether you’re a seasoned trader or just starting, understanding the nuances of short-term trading is essential to navigate the markets effectively and pursue your financial objectives.

Should you desire more in-depth information, it’s available for your perusal on this page: Warren Buffett’s Investment Strategy and Rules – Investing.com

Trading requires constant monitoring of market conditions, news, and technical indicators.

Trading in the dynamic world of financial markets demands an unwavering commitment to vigilance and a relentless pursuit of information. Here’s a deeper exploration of why constant monitoring of market conditions, news, and technical indicators is not just a choice but a necessity for traders:

Timely Decision-Making: Financial markets operate at the speed of information. Prices can change within seconds due to breaking news, economic data releases, or geopolitical events. Constant monitoring allows traders to make timely decisions, seize opportunities, and mitigate risks before market conditions evolve further.

Risk Management: Monitoring is integral to risk management. Traders need to assess the risk associated with their positions continuously. A sudden adverse move in the market can erode profits or lead to significant losses. By staying vigilant, traders can implement risk-reduction strategies, including stop-loss orders and position adjustments, in real-time.

Adaptability: Markets are not static; they adapt and respond to various factors. Staying informed about market conditions, sentiment, and emerging trends enables traders to adapt their strategies accordingly. Flexibility in trading approaches is often the key to success.

News and Events: Global events, earnings reports, central bank decisions, and economic data releases can have a profound impact on financial markets. Traders must monitor news sources to anticipate how these events might affect asset prices. This proactive approach helps traders position themselves advantageously or protect their portfolios.

Technical Analysis: Technical indicators and chart patterns provide valuable insights into market dynamics. Traders rely on these tools to identify potential entry and exit points. Continuous monitoring of technical indicators helps traders spot trends, reversals, or overbought/oversold conditions.

Psychology and Sentiment: The collective psychology of market participants can drive price movements. Monitoring market sentiment, such as bullish or bearish sentiment indicators, can offer clues about market direction. Traders who are attuned to sentiment trends can make informed contrarian or trend-following decisions.

Earnings Season: For traders involved in stocks, earnings season is a critical period. Companies’ quarterly reports can lead to substantial price swings. Staying updated on earnings releases, guidance, and analyst expectations is vital for stock traders.

Global Markets: In today’s interconnected world, global markets influence one another. What happens in one market can spill over into others. Traders who track global developments and correlations between asset classes are better equipped to make informed decisions.

Preventing Overtrading: Overtrading, fueled by impulsive decisions, can lead to losses. Constant monitoring helps traders maintain discipline and avoid making hasty or excessive trades. It promotes a more calculated and strategic approach.

Continuous Learning: The financial markets are a vast and ever-evolving domain. Traders who continuously monitor and analyze market conditions are engaged in a perpetual learning process. They refine their skills, adapt to changing dynamics, and gain valuable experience over time.

In essence, trading is an information-intensive endeavor, and constant monitoring is the key to staying ahead of the curve. It’s a commitment to being well-informed, adaptable, and disciplined in the pursuit of trading success. Whether you’re a day trader, swing trader, or long-term investor, the ability to keep a watchful eye on market conditions, news, and technical indicators is your competitive edge in the world of trading.

Additionally, you can find further information on this topic by visiting this page: Portfolio Management: Definition, Types, and Strategies

Traders often rely on technical and fundamental analysis to predict short-term price movements and make quick buy and sell decisions.

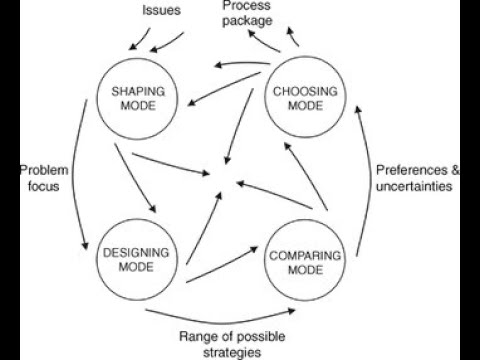

In the ever-evolving landscape of financial markets, the marriage of technical and fundamental analysis serves as a dynamic compass for traders navigating short-term price fluctuations. This holistic approach empowers traders to not only predict price movements but also make nimble and well-informed decisions that align with their trading goals. Here’s a deeper exploration of why these analytical methods are the cornerstones of successful trading:

Technical Analysis: The art of technical analysis goes beyond mere price chart examination; it’s about deciphering the language of the markets. Traders who wield this tool decode patterns, candlestick formations, and oscillators to discern market sentiment and potential turning points. Technical analysis is the trader’s way of tapping into the collective psychology of market participants, helping them pinpoint ideal entry and exit levels. Whether it’s identifying head-and-shoulders patterns or using Fibonacci retracement levels, technical analysis equips traders with the ability to respond swiftly to short-term market dynamics.

Fundamental Analysis: While technical analysis keeps an eye on the immediate horizon, fundamental analysis extends the trader’s view into the broader landscape of an asset’s value. Traders leveraging fundamental analysis dissect financial reports, economic indicators, and geopolitical events to unearth the intrinsic worth of an asset. This deep dive enables them to assess an asset’s potential for growth or decline, understand its competitive positioning, and anticipate the impact of external factors like interest rates or government policies. Armed with fundamental insights, traders are better equipped to make judicious choices that align with their overall trading strategy.

Risk Mitigation: The combination of technical and fundamental analysis is not just about profits; it’s also about prudent risk management. Technical analysis aids traders in setting stop-loss orders based on critical support and resistance levels, ensuring that potential losses are controlled. On the other hand, fundamental analysis enables traders to assess the overall risk associated with an asset, helping them avoid investments that may expose them to unwarranted risks. Together, these analyses act as a shield, safeguarding traders from excessive losses and unforeseen market events.

Market Adaptability: In the ever-shifting landscape of financial markets, adaptability is a trader’s most valuable asset. Traders who blend technical and fundamental analysis can switch gears seamlessly. In volatile markets, technical analysis shines, offering insights into short-term price movements and profit opportunities. During major economic events or corporate earnings releases, fundamental analysis takes center stage, providing traders with a broader understanding of an asset’s health and potential impact.

Continuous Learning: Both technical and fundamental analyses require a commitment to ongoing learning. The nuances of chart patterns, indicators, and economic indicators are constantly evolving. Traders who embrace this dynamic nature and stay updated on the latest developments are better equipped to make informed decisions and adapt their strategies to changing market conditions.

In summary, the convergence of technical and fundamental analysis equips traders with a versatile toolkit to decipher the intricate language of financial markets. This approach not only empowers traders to predict short-term price movements but also instills the discipline and agility needed to make swift and well-informed buy and sell decisions. It’s a dynamic synergy that elevates trading from a speculative endeavor to a strategic art form, where profit opportunities are seized and risks are managed with precision.

To expand your knowledge on this subject, make sure to read on at this location: Investment Basics Explained With Types to Invest in

Trading can involve higher risks due to the potential for rapid price changes. Traders use stop-loss orders to limit losses.

Engaging in active trading is akin to navigating a high-speed highway in the financial markets. The potential for rapid price changes and heightened volatility can be both exhilarating and treacherous. To safeguard their capital and navigate this fast-paced terrain, traders deploy a critical tool known as the “stop-loss order.” Let’s delve deeper into why stop-loss orders are a crucial component of any trader’s risk management arsenal:

Loss Mitigation: At the heart of every stop-loss order is the fundamental principle of loss mitigation. Trading carries inherent risks, and prices can move against a trader’s position unexpectedly. A stop-loss order acts as an insurance policy, automatically triggering a sale when a predetermined price level is reached. This preemptive action limits potential losses and protects the trader’s capital.

Emotion Control: Emotions run high in trading, especially when profits or losses are at stake. The fear of losing can lead to impulsive decisions, such as holding onto a losing position in the hope that it will recover. A stop-loss order eliminates the need for emotional decision-making. It enforces discipline by executing a sale based on a predetermined strategy, sparing the trader from potentially detrimental emotional responses.

Risk-Reward Management: Trading is about finding a delicate balance between risk and reward. Stop-loss orders are instrumental in managing this balance. Traders set their stop-loss levels based on their risk tolerance and overall trading strategy. By doing so, they establish clear risk parameters for each trade, ensuring that potential losses are controlled and aligned with their risk appetite.

Adaptive Strategy: Markets are dynamic and ever-changing, making it challenging to predict price movements with absolute certainty. Stop-loss orders are adaptable tools that can be adjusted as market conditions evolve. Traders can move their stop-loss levels to lock in profits or reduce potential losses in response to market developments, thus fine-tuning their strategy to align with market dynamics.

Capital Preservation: Preserving capital is a paramount goal for traders. A well-placed stop-loss order safeguards a trader’s initial investment. By preventing substantial losses, it ensures that a trader has the capital necessary to participate in future trading opportunities. This preservation of capital is essential for long-term trading success.

Risk Control Across Assets: Traders often have diverse portfolios that include various financial instruments, such as stocks, currencies, or commodities. Stop-loss orders offer a consistent risk control mechanism across these assets. Whether trading equities or currencies, the principles of loss limitation remain the same, providing traders with a universal risk management tool.

Time Efficiency: Monitoring markets 24/7 can be exhausting and impractical. Stop-loss orders offer time efficiency by automating the exit process. Traders can set their stop-loss levels and then step away from their screens, knowing that their positions will be managed according to their predefined parameters.

Statistical Advantage: Many successful trading strategies are built on the principle of having an edge over the long term. Stop-loss orders are an integral part of such strategies. By consistently adhering to risk management practices, traders increase their statistical advantage and position themselves for sustainable profitability.

In essence, stop-loss orders are the safety nets that traders deploy in the challenging arena of financial markets. They not only limit potential losses but also provide traders with peace of mind and a structured approach to risk management. While trading will always involve risks, the strategic use of stop-loss orders empowers traders to navigate these risks with confidence, discipline, and a clear risk-reward framework, ultimately enhancing their potential for success in the dynamic world of trading.

Explore this link for a more extensive examination of the topic: How to Determine Your Risk Tolerance Level | Charles Schwab

Traders may need substantial capital to engage in active trading, as they aim to generate income through frequent trades.

Active trading, often associated with day trading or high-frequency trading, demands more than just a basic understanding of financial markets; it requires substantial capital to navigate the complexities of this fast-paced endeavor. Here’s an in-depth exploration of why traders need significant capital for active trading and how it plays a pivotal role in their pursuit of generating income:

1. Margin Requirements:

a. Leverage Potential: Active traders often use margin accounts to amplify their trading power. While leverage can enhance profits, it also increases risk. Substantial capital is needed to meet margin requirements and avoid margin calls, which can result in forced liquidation of positions.

2. Risk Management:

a. Diversification: To mitigate risk, active traders may engage in multiple trades simultaneously. This diversification strategy requires sufficient capital to spread across various assets, reducing the impact of a single adverse trade.

b. Stop Losses: Implementing stop-loss orders is a common risk management technique. Traders need enough capital to cover potential losses while adhering to their risk tolerance.

3. Trading Costs:

a. Commissions and Fees: Active traders frequently execute numerous trades, incurring brokerage commissions and fees. A substantial capital base is necessary to cover these costs while still achieving a net profit.

b. Market Impact: Large trades can influence market prices. Traders with substantial capital can execute orders without significantly impacting market dynamics, allowing them to enter and exit positions more favorably.

4. Liquidity and Flexibility:

a. Seizing Opportunities: In active trading, opportunities arise quickly and may require immediate action. Having ample capital at your disposal allows you to seize opportunities as they unfold without waiting for additional funds.

b. Adaptation: Financial markets are dynamic, and traders must adapt to changing conditions. Substantial capital provides the flexibility to adjust strategies, explore new markets, or switch between asset classes as market dynamics evolve.

5. Psychological Resilience:

a. Emotional Stability: Active trading can be emotionally demanding. Adequate capital cushions against emotional stress that may arise from sizable market fluctuations.

b. Tolerance for Drawdowns: Traders with substantial capital can better withstand temporary drawdowns, maintaining confidence in their trading strategies during challenging periods.

6. Regulatory Requirements:

a. Minimum Account Balances: Some regulatory authorities and brokerage firms impose minimum capital requirements for active trading accounts, ensuring that traders have sufficient resources to cover their positions.

In summary, active trading is a high-stakes game that necessitates a robust financial foundation. Traders require substantial capital to manage risk, cover trading costs, capitalize on opportunities, and maintain emotional and psychological stability. It’s not merely about the quantity of capital but also about the prudent allocation and risk management strategies that allow active traders to navigate the complexities of financial markets and strive for income generation through their frequent trades.

Should you desire more in-depth information, it’s available for your perusal on this page: Working Capital Management Explained: How It Works

Investors typically hold assets for years or even decades, focusing on long-term growth and wealth accumulation.

Investors, often characterized by their forward-thinking perspective, are inclined toward a horizon that spans years, if not decades. Their primary objective is to harness the power of time and patience in pursuit of enduring financial growth and wealth accumulation.

The Long View: Investors understand that the financial journey is not a sprint but a marathon. They acknowledge that short-term market fluctuations are inevitable, even expected, and can be overshadowed by long-term trends. This perspective allows them to ride out the inevitable ups and downs with unwavering commitment to their ultimate financial goals.

Compound Growth: The magic ingredient in the investor’s recipe for wealth accumulation is compound growth. By allowing their investments to flourish over extended periods, they benefit from the compounding effect. Their earnings generate additional earnings, creating a snowball effect that exponentially increases their wealth over time. This financial alchemy is most potent when the investment horizon extends to years or decades.

Strategic Asset Allocation: Investors understand that a well-balanced portfolio is essential for long-term success. They strategically allocate their assets across various classes, such as stocks, bonds, real estate, and cash equivalents, to achieve a blend of growth potential and risk mitigation. This diversification provides a robust foundation for their long-term investment strategy.

Weathering Market Storms: Long-term investors are resilient in the face of market storms. They recognize that market downturns are part of the investment landscape and are often followed by periods of growth. Instead of panicking during turbulent times, they stay the course, occasionally even seizing opportunities to buy undervalued assets when markets are in turmoil.

Financial Goals and Milestones: Investors don’t merely invest for the sake of it; they have clear financial goals and milestones in mind. These objectives may include retirement planning, funding a child’s education, or achieving financial independence. Each investment decision is made with these long-term aspirations in sight.

Embracing Volatility: Long-term investors have a unique relationship with market volatility. They don’t fear it; they embrace it. They recognize that volatility can create buying opportunities and that it’s an inherent part of the market’s growth trajectory. Instead of shying away from it, they navigate it with prudence and confidence.

Adaptability: While the long-term is their compass, investors remain adaptable. They periodically review and adjust their investment strategies to accommodate changing financial goals, risk tolerance, and market conditions. This adaptability ensures that their long-term journey remains on course even as circumstances evolve.

In conclusion, investors are the architects of their financial futures, constructing wealth over the years and decades. They recognize the intrinsic value of time, patience, and strategic planning in the pursuit of long-term growth and wealth accumulation. Their journey is marked by steady progress, financial milestones, and an unwavering commitment to their financial aspirations. Whether you’re a seasoned investor or just beginning your journey, the path to long-term financial success lies in embracing the investor’s mindset and harnessing the power of long-term vision.

Don’t stop here; you can continue your exploration by following this link for more details: The Administration’s Approach to the People’s Republic of China …

Investing often involves a “buy and hold” strategy, requiring less active involvement and monitoring compared to trading.

Investing and trading represent two distinct approaches to participating in financial markets, each with its own set of principles and practices. While both can be profitable, they require varying levels of involvement and commitment.

1. Investment Horizon: Investing typically embraces a longer time horizon. It revolves around the “buy and hold” philosophy, where investors purchase assets with the intention of holding them for an extended period, often years or even decades. This approach aligns with long-term financial goals, such as retirement planning or wealth accumulation for future generations.

2. Minimal Active Trading: Investors usually engage in minimal active trading. They focus on selecting assets that align with their investment objectives and exhibit the potential for long-term growth. After acquiring these assets, investors often adopt a patient and hands-off approach, allowing their investments to appreciate over time.

3. Risk Tolerance: The “buy and hold” strategy is often favored by those with a more conservative risk tolerance. By holding assets for the long term, investors may experience less exposure to short-term market volatility, as they aim to weather market fluctuations with the expectation of long-term gains.

4. Monitoring and Adjustments: While investors may not engage in frequent trading, they still need to monitor their portfolio periodically. This involves reviewing the performance of their investments, assessing whether they remain aligned with their financial goals, and making adjustments if necessary. These adjustments may include rebalancing the portfolio to maintain diversification or reallocating assets based on changing circumstances.

5. Emphasis on Fundamentals: Fundamental analysis plays a pivotal role in the investment approach. Investors often assess the intrinsic value of assets by examining factors such as company financials, industry trends, and economic conditions. This analysis guides their decision-making when selecting investments.

6. Income and Dividends: Many investors in the “buy and hold” camp prioritize income generation and dividends. They may seek assets that provide regular income, such as dividend-paying stocks or interest-bearing bonds. This income can supplement their financial needs during retirement or other life milestones.

7. Psychological Discipline: Successful investing often demands psychological discipline. Investors must resist the temptation to react to short-term market fluctuations and adhere to their long-term investment strategy. This discipline can be challenging during periods of market volatility but is crucial for achieving long-term financial goals.

In summary, investing embraces a patient and long-term approach to wealth accumulation, with an emphasis on fundamental analysis, risk tolerance, and the benefits of compounding over time. It’s a strategy that aligns with individuals seeking financial security and growth while requiring less active monitoring and trading compared to shorter-term trading strategies. Ultimately, the choice between investing and trading hinges on your financial objectives, risk tolerance, and the level of involvement you are comfortable with in managing your assets in the financial markets.

To expand your knowledge on this subject, make sure to read on at this location: Active Investing Vs. Passive Investing: What’s The Difference …

Investors assess the fundamentals of an asset, such as a company’s financial health, competitive advantages, and growth potential.

Traders, on the other hand, prioritize technical analysis, which involves studying historical price charts, patterns, and market indicators to make short-term predictions. This approach aims to capitalize on short-term price fluctuations and may involve frequent buying and selling within a single trading day. It’s a strategy that requires a sharp focus on market trends and rapid decision-making, quite different from the patient, long-term perspective of investors. While both trading and investing have their merits, understanding the differences between the two is crucial for individuals to choose the approach that aligns best with their financial goals, risk tolerance, and time horizon.

To delve further into this matter, we encourage you to check out the additional resources provided here: Investment Basics Explained With Types to Invest in

Investors seek to manage risks through diversification and may have a lower risk tolerance, aiming for stable, long-term returns.

Investors are constantly in pursuit of effective risk management strategies to safeguard their hard-earned capital. Diversification, a cornerstone of prudent investing, plays a pivotal role in this endeavor. However, risk management extends beyond diversification, encompassing a range of approaches and practices to align with investors’ unique risk tolerance and financial objectives.

1. Risk Tolerance Assessment: One of the initial steps in crafting a robust risk management plan is evaluating individual risk tolerance. Each investor has a distinct comfort level when it comes to taking on risk. This tolerance is influenced by factors such as age, financial goals, time horizon, and personal circumstances. Investors with a lower risk tolerance typically prioritize capital preservation and seek stable, long-term returns over aggressive, high-risk strategies.

2. Asset Allocation: Asset allocation is the foundation upon which a well-rounded investment portfolio is built. It involves strategically distributing investments across different asset classes, including stocks, bonds, real estate, and cash equivalents. A lower-risk tolerance often leads to a more conservative asset allocation with a higher proportion of fixed-income assets, such as bonds, to provide stability and income.

3. Diversification: Diversification is the art of spreading investments across a variety of securities within each asset class. It reduces the impact of a single underperforming asset on the overall portfolio. Investors with a lower risk tolerance may emphasize diversification even more, ensuring that their portfolio is well-diversified not only across asset classes but also within them. This approach helps cushion against market volatility and minimizes potential losses.

4. High-Quality Investments: Lower-risk investors tend to favor high-quality, well-established companies and investment-grade bonds. These assets are perceived as more stable and less susceptible to drastic price fluctuations. The focus is on preserving capital and generating consistent income.

5. Regular Portfolio Monitoring: Effective risk management doesn’t end with portfolio construction. Investors with lower risk tolerance often engage in more frequent portfolio monitoring to ensure that their investments remain aligned with their objectives. Periodic reviews and adjustments help maintain the desired risk profile.

6. Risk-Averse Strategies: Investors with lower risk tolerance may explore risk-averse strategies, such as dollar-cost averaging (DCA) or value investing. DCA involves investing a fixed amount of money at regular intervals, which can help mitigate the impact of market volatility. Value investing focuses on identifying undervalued assets with strong fundamentals, reducing the risk of overpaying for investments.

7. Emergency Fund: Building and maintaining an emergency fund is a prudent risk management practice for all investors, particularly those with a lower risk tolerance. This financial safety net provides peace of mind, ensuring that unexpected expenses or income disruptions won’t force premature liquidation of investments.

In summary, investors with a lower risk tolerance adopt a conservative approach to risk management, prioritizing capital preservation and stable, long-term returns. They carefully assess their individual risk tolerance, construct diversified portfolios, favor high-quality investments, and regularly monitor their holdings. By tailoring their strategies to their risk comfort zones, these investors aim to navigate the investment landscape with confidence and achieve their financial goals while minimizing undue risk.

You can also read more about this here: What Is Risk Management in Finance, and Why Is It Important?

Investing aims for capital appreciation over time, including income from dividends and interest.

Investing is a multifaceted financial journey that goes beyond merely growing your capital. Here’s an extended perspective:

1. Capital Appreciation:

- Indeed, a primary objective of investing is capital appreciation. By putting your money to work in various assets, you aim to see it grow over time.

2. Dividends as Income:

- Beyond capital gains, investments like stocks often yield dividends. These periodic payouts can serve as a steady income stream, especially in retirement.

3. Interest Earnings:

- Fixed-income investments, such as bonds and certificates of deposit (CDs), provide regular interest payments. This interest income can be a stable source of financial security.

4. Wealth Preservation:

- Investing can also serve the purpose of wealth preservation. Inflation erodes the purchasing power of money over time. Well-considered investments can help safeguard your wealth from this erosion.

5. Risk and Return:

- Investors understand the risk-return trade-off. Higher-risk investments may offer the potential for greater returns, while lower-risk options tend to provide more stability.

6. Long-Term Goals:

- Successful investing often aligns with long-term financial goals. Whether it’s saving for retirement, funding a child’s education, or buying a home, investing paves the way for achieving these milestones.

7. Diversification Benefits:

- Diversifying your investments across various asset classes can optimize your returns and manage risk. A well-diversified portfolio aims to balance growth and stability.

8. Informed Decision-Making:

- Successful investors make informed decisions based on research and analysis. They stay updated on market trends, economic indicators, and company fundamentals.

9. Time Horizon Matters:

- The time horizon for your investments plays a crucial role. Long-term investors can weather market fluctuations and harness the power of compounding.

10. Risk Management: – Smart investors assess and manage risk. They diversify their portfolios, consider asset allocation, and may use strategies like dollar-cost averaging to mitigate risk.

11. Asset Allocation: – Asset allocation involves dividing your investments among different asset classes like stocks, bonds, and cash. The right mix depends on your goals, risk tolerance, and time horizon.

12. Flexibility and Adaptability: – The investment landscape evolves. Successful investors are flexible and adapt their strategies as needed to seize opportunities and manage risks.

In conclusion, investing is a multifaceted journey with the potential for capital appreciation, income from dividends and interest, wealth preservation, and risk management. Success in investing hinges on aligning your strategy with your goals, staying informed, and making informed decisions to secure your financial future.

To expand your knowledge on this subject, make sure to read on at this location: Everything You Need to Know About Bonds | PIMCO

The decision between trading and investing depends on your financial goals, risk tolerance, and time commitment. Here are some considerations:

The choice between trading and investing hinges on several crucial factors that should align with your financial aspirations, risk tolerance, and the amount of time you can dedicate to your financial endeavors. Let’s delve deeper into these considerations:

1. Financial Goals:

- Investing: If your primary aim is to build wealth over the long term and achieve specific financial goals like retirement or buying a home, investing is often the preferred route. Investing focuses on accumulating assets that appreciate in value over time, potentially providing substantial returns in the future.

- Trading: Trading, on the other hand, is often pursued by those seeking shorter-term gains. Traders aim to profit from price fluctuations in the financial markets, which can be more suitable for individuals looking for quicker, albeit potentially riskier, returns.

2. Risk Tolerance:

- Investing: Investing is generally considered a lower-risk strategy, especially when adopting a diversified portfolio approach. It allows for the potential to weather market downturns and benefit from long-term market growth.

- Trading: Trading, particularly short-term and speculative trading, involves higher risks. Markets can be volatile, and traders may experience significant losses if they are not well-prepared or have a low risk tolerance.

3. Time Commitment:

- Investing: Investing is often viewed as a more passive approach that requires less daily monitoring. It suits individuals with busy lifestyles or those who do not wish to spend significant time managing their investments.

- Trading: Trading demands active involvement in financial markets. Traders need to regularly analyze market conditions, execute orders, and adapt to changing circumstances. It can be time-consuming and may not be suitable for those with limited availability.

4. Knowledge and Skills:

- Investing: While investing still requires knowledge and research, it generally involves a more straightforward strategy of selecting diversified assets and holding them for the long term. It is accessible to individuals with varying levels of financial expertise.

- Trading: Trading necessitates a deeper understanding of market dynamics, technical and fundamental analysis, and risk management. Success in trading often relies on honed skills and a comprehensive understanding of the markets.

5. Emotional Resilience:

- Investing: Investing encourages a long-term perspective, which can help reduce emotional reactions to short-term market fluctuations. It aligns well with individuals who can withstand market volatility without making impulsive decisions.

- Trading: Trading can be emotionally challenging, especially during periods of high market volatility. It requires discipline to stick to a trading plan and avoid emotional responses to market movements.

6. Diversification:

- Investing: Diversification is a fundamental principle of investing, spreading risk across different asset classes. A diversified portfolio can help mitigate the impact of poor-performing investments.

- Trading: Trading strategies can vary widely, and some traders focus on a single asset or sector. While specialization can lead to expertise, it also concentrates risk.

7. Transaction Costs:

- Investing: Investing typically incurs lower transaction costs, making it more cost-effective for long-term strategies.

- Trading: Frequent trading can accumulate higher transaction costs, particularly if you engage in short-term trading.

In summary, the decision between trading and investing should align with your financial goals, risk tolerance, time commitment, knowledge, emotional resilience, and transaction cost considerations. Understanding these factors will help you determine which approach is better suited to your unique financial situation and objectives.

Looking for more insights? You’ll find them right here in our extended coverage: The Complete Guide to Choosing an Online Stock Broker

Determine whether you aim to generate short-term income through trading or seek long-term wealth growth through investing.

The choice between seeking short-term income through trading or aiming for long-term wealth growth through investing is akin to deciding the course of your financial journey. It’s a decision that hinges on your financial goals, risk tolerance, and time horizon. Let’s explore this pivotal choice in more detail:

Short-Term Income through Trading: If your primary goal is to generate short-term income, trading may be the path for you. This approach involves actively buying and selling financial instruments, such as stocks, currencies, or commodities, within relatively brief timeframes. Traders often leverage technical analysis, market trends, and short-term price fluctuations to make swift and precise decisions.

Income Generation: Trading can provide a source of immediate income, as traders aim to profit from short-term market movements. This can be particularly appealing for those seeking supplemental income or capitalizing on opportunities in dynamic markets.

Active Involvement: Trading requires hands-on involvement, with traders monitoring markets closely and executing transactions frequently. It demands a keen understanding of market dynamics and technical analysis.

Higher Risk: Short-term trading can be riskier due to the emphasis on short timeframes. Markets can be highly volatile, and traders may employ leverage, which amplifies both gains and losses.

Emotional Resilience: Trading can be emotionally demanding, as it involves rapid decision-making and the potential for substantial gains or losses. Emotional discipline and a well-defined trading plan are essential.

Long-Term Wealth Growth through Investing: Investing, on the other hand, focuses on accumulating wealth over the long haul. It typically involves buying assets with the expectation that they will appreciate in value over years, if not decades. Investors often utilize fundamental analysis, considering factors like company financials, industry trends, and economic conditions.

Wealth Accumulation: Investing is a strategy aimed at building wealth over time. It’s well-suited for individuals looking to secure their financial future, plan for retirement, or achieve long-term financial goals.

Passive Approach: Investors generally adopt a more passive approach, making fewer adjustments to their portfolios. They rely on the power of compounding and the potential for assets to appreciate over the years.

Lower Risk: Long-term investing typically carries lower risk compared to short-term trading, as it allows for a more extended timeframe to ride out market fluctuations. Diversification and a focus on quality assets are common strategies.

Less Frequent Decision-Making: Investors don’t need to make frequent decisions or closely monitor markets. This can be ideal for those with busy schedules or those who prefer a less intensive approach to managing their finances.

Emotional Stability: Investing tends to be less emotionally taxing than trading, as the focus is on long-term trends rather than short-term volatility. It often requires a more patient and disciplined mindset.

Ultimately, the choice between trading for short-term income and investing for long-term wealth growth should align with your financial aspirations, risk tolerance, and time commitment. Some individuals may even choose to incorporate both approaches within their financial strategy, combining active trading for income generation with long-term investing for wealth preservation and growth. Regardless of your choice, it’s crucial to have a well-defined financial plan and to continuously educate yourself about the approach you select.

Explore this link for a more extensive examination of the topic: Saving vs. Investing: Understanding the Key Differences

Assess your comfort level with risk. Trading can be riskier due to frequent price fluctuations, while investing tends to be more stable over the long term.

Evaluating your comfort level with risk is a pivotal step in your financial journey, whether you’re considering trading or investing. Let’s delve deeper into this crucial aspect of financial decision-making and explore how your risk tolerance influences your choice between trading and investing:

Risk Assessment: Assessing your risk tolerance involves a comprehensive evaluation of your financial goals, time horizon, and emotional resilience. It’s a personalized journey that requires honest self-reflection.

Trading vs. Investing: Trading and investing exist on opposite ends of the risk spectrum. Trading entails frequent buying and selling of assets, often capitalizing on short-term price movements. It can be lucrative but comes with heightened risk due to rapid price fluctuations. In contrast, investing is typically associated with a longer time horizon, aiming for stable, long-term growth with lower risk.

Emotional Resilience: Your emotional resilience plays a pivotal role in determining your risk tolerance. Trading can be emotionally demanding, as it requires making quick decisions in response to market volatility. Investing, with its longer time frame, generally involves less emotional turbulence.

Financial Goals: Consider your financial objectives. Are you seeking to grow your wealth steadily over time, or are you aiming for more aggressive returns in the short term? Your goals will influence your risk tolerance and, subsequently, your choice between trading and investing.

Time Horizon: Your investment horizon is a critical factor. If you have a longer time horizon, such as saving for retirement or a child’s education, investing aligns well with your objectives. Trading, on the other hand, may be more suitable for those seeking shorter-term gains.

Risk Management: Both trading and investing require effective risk management strategies. For traders, this includes setting stop-loss orders and position sizing. Investors focus on diversification and asset allocation to manage risk over time.

Market Knowledge: Your level of market knowledge and expertise also influences your risk tolerance. Seasoned traders may have a higher tolerance for risk, as they have developed skills and strategies to navigate volatile markets. Novice investors may opt for a more conservative, long-term approach.

Stress Tolerance: Assess how well you handle stress and uncertainty. Trading can be intense and stressful due to the constant monitoring of markets. Investing typically involves less day-to-day stress but may require patience during market downturns.

Diversification: Diversification is a risk management strategy employed in both trading and investing. Diversifying your portfolio by holding various assets can help spread risk and reduce the impact of poor-performing investments or trades.

Financial Advisor Guidance: Consulting with a financial advisor can provide valuable insights into your risk tolerance. Advisors can assess your financial situation, goals, and risk tolerance to offer tailored guidance on whether trading, investing, or a combination of both aligns with your objectives.

In the end, there is no one-size-fits-all answer to the trading vs. investing dilemma. It’s a decision influenced by your unique financial circumstances, goals, and emotional temperament. Some individuals may find a balance by incorporating both trading and investing strategies within their portfolio. Ultimately, the key is to align your financial approach with your risk tolerance and long-term objectives, ensuring that your chosen path reflects your comfort level while working toward your financial aspirations.

Looking for more insights? You’ll find them right here in our extended coverage: What Is Risk Tolerance, and Why Does It Matter?

Consider how much time you can dedicate to monitoring the markets. Trading requires more active involvement than investing.

When embarking on the journey of trading, one of the fundamental considerations that often goes underestimated is the commitment of time and attention required. Trading, by its very nature, is a hands-on endeavor that demands constant vigilance and active involvement. Here’s a closer look at why understanding and managing your time commitment is pivotal in the world of trading:

Trading Frequency: The level of time commitment in trading is closely tied to your chosen trading style. Day traders, for instance, are at the extreme end of the spectrum, executing multiple trades within a single day and closely monitoring intraday price movements. Swing traders, on the other hand, typically hold positions for days or weeks, requiring less frequent monitoring. Investors, in contrast, take a longer-term perspective, making fewer trades and needing minimal daily attention.

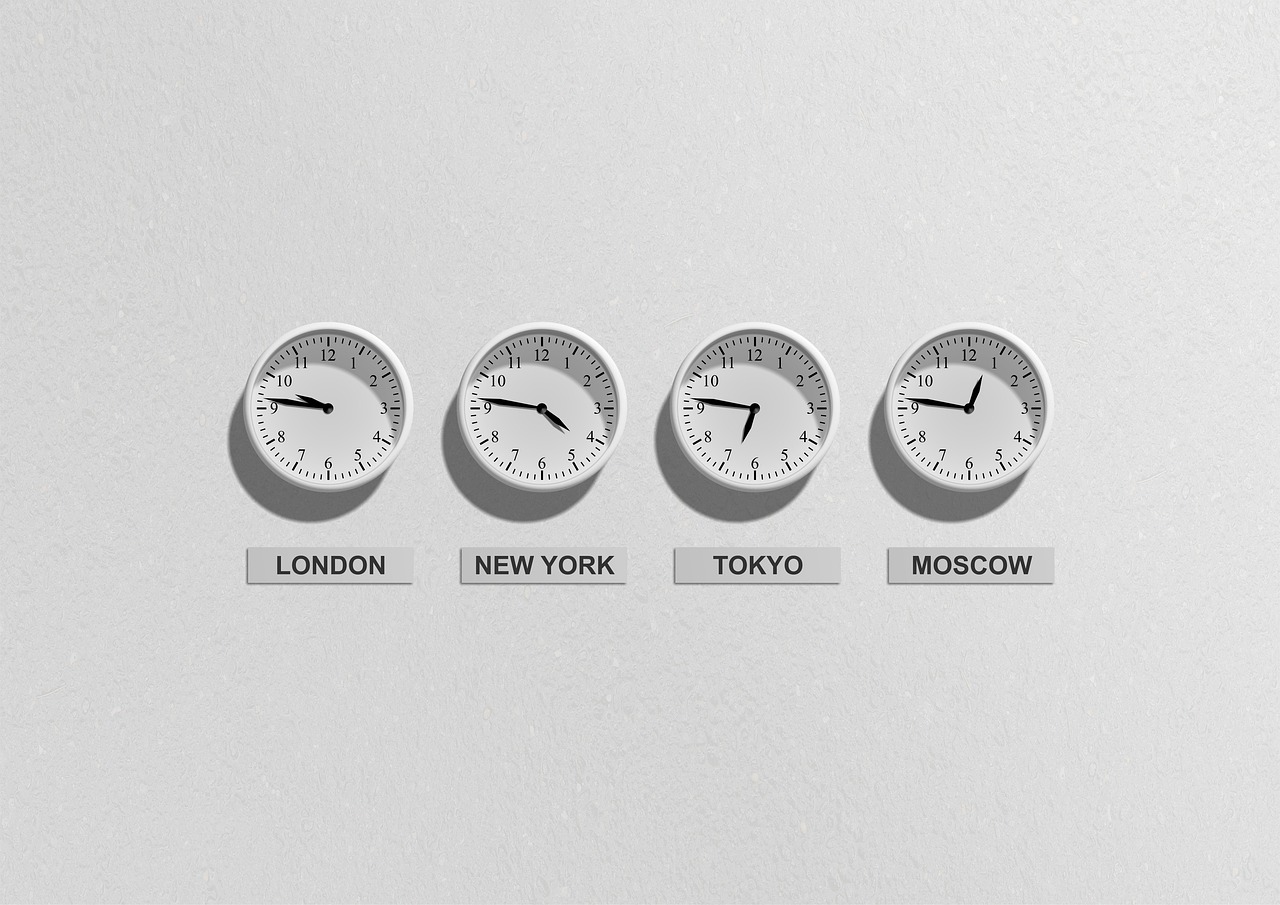

Market Hours: Financial markets operate within specific hours, depending on the asset class and exchange. Understanding the market hours relevant to your trading preferences is crucial. For example, if you’re trading international markets, you may need to accommodate different time zones and market hours.

Time Zones: Trading often involves global markets, and traders need to be aware of time zone differences. If you’re trading assets in a different time zone from your location, it may necessitate unusual hours to monitor and manage your positions effectively.

News and Events: Market-moving events can occur at any time, including outside regular trading hours. Being prepared to react to unexpected news, economic releases, or geopolitical developments may require immediate attention. Traders should consider how they’ll stay informed during non-trading hours.

Technology and Automation: Technology has provided traders with tools for automation, including setting stop-loss orders, take-profit levels, and even automated trading algorithms. Utilizing these technologies can reduce the time required for manual monitoring, but it also requires initial setup and ongoing management.

Lifestyle Considerations: Your personal lifestyle and daily commitments play a significant role in your ability to dedicate time to trading. Consider your work schedule, family responsibilities, and other obligations. Striking a balance between trading and personal life is essential for long-term success.

Psychological Well-Being: Trading can be emotionally taxing, especially during periods of market volatility. Constantly monitoring the markets can lead to stress and burnout. Understanding your psychological limits and implementing strategies for stress management is crucial.

Continuous Learning: The financial markets are ever-evolving, and traders must stay informed about new developments, trading strategies, and market dynamics. Allocating time for continuous learning is essential to remain competitive.

Risk Management: Effective risk management requires careful monitoring of open positions and adherence to trading plans. Neglecting risk management due to a lack of time can lead to significant losses.

Simulated Trading: If you’re new to trading or testing new strategies, simulated or paper trading allows you to gain experience without risking real capital. It’s a valuable tool for honing your skills and strategies before committing significant time and resources to live trading.

In conclusion, trading is a time-intensive pursuit that demands a clear understanding of your time constraints, trading style, and lifestyle. Careful planning and time management are essential to navigate the challenges and opportunities of the financial markets successfully. Finding the right balance between active involvement and other life commitments is key to achieving your trading goals while maintaining overall well-being.

Should you desire more in-depth information, it’s available for your perusal on this page: Investment Basics Explained With Types to Invest in

Both trading and investing require knowledge and skill. Educate yourself about each approach before making decisions.

Trading and investing, though distinct in their strategies and time horizons, share a common foundation: the need for knowledge and skill. Whether you’re inclined towards active trading or long-term investing, here’s an expanded perspective on why educating yourself is paramount before venturing into the world of financial markets:

Trading Expertise: Trading is akin to navigating the high seas of financial markets with the aim of capturing short-term price fluctuations. It demands a deep understanding of technical analysis, chart patterns, candlestick formations, and various indicators. Traders need to master order types, risk management strategies, and market psychology. Continuous learning is essential to stay abreast of evolving trading techniques and market dynamics.

Investment Acumen: Investing, on the other hand, requires a broader and more patient perspective. Investors are concerned with long-term wealth accumulation, and this necessitates a solid grasp of fundamental analysis, portfolio diversification, and risk tolerance assessment. Educated investors are well-versed in analyzing financial statements, evaluating economic indicators, and recognizing the potential impact of geopolitical events on their investments.

Risk Management: Both trading and investing entail risk, but the nature of risk differs. Trading involves short-term price risk, while investing involves long-term market and economic risk. Educated practitioners understand these distinctions and employ risk management strategies tailored to their chosen approach. Whether it’s setting stop-loss orders for traders or constructing a well-balanced portfolio for investors, risk mitigation is a key component of financial success.

Psychological Preparedness: Trading and investing also test one’s emotional fortitude. Traders face the pressure of making quick decisions and managing the emotional rollercoaster of gains and losses. Investors, on the other hand, must navigate the temptation to make impulsive decisions during market fluctuations. Education equips individuals with the psychological preparedness needed to maintain discipline and emotional stability in the face of market turbulence.

Continuous Learning: Financial markets are dynamic, influenced by a multitude of factors including economic data, corporate earnings, geopolitical events, and technological advancements. Staying educated is not a one-time endeavor; it’s an ongoing commitment. Successful traders and investors dedicate themselves to lifelong learning, staying informed about market trends, regulatory changes, and emerging investment opportunities.

Risk of Overconfidence: Overestimating one’s knowledge can be detrimental. Traders and investors who believe they have mastered the markets without continuous education may fall victim to overconfidence bias, leading to costly mistakes. A commitment to ongoing education keeps individuals humble and open to new perspectives and strategies.

In conclusion, whether you aspire to be a trader or an investor, the journey begins with education. It’s the foundation upon which you build your financial acumen and skill set. By immersing yourself in the intricacies of your chosen approach, you empower yourself to make informed decisions, manage risk effectively, and navigate the ever-changing landscape of financial markets. The path to success in trading and investing is not a sprint; it’s a marathon, and education is your enduring companion on this journey to financial proficiency.

Don’t stop here; you can continue your exploration by following this link for more details: Experts on the Future of Work, Jobs Training and Skills | Pew …

Even if you choose one approach, consider diversifying your portfolio to spread risk. For example, you can allocate a portion of your portfolio to trading and the rest to long-term investing.

Striking the right balance between trading and long-term investing is a pivotal decision in wealth management. While some investors may lean heavily towards one approach, a thoughtful strategy often involves a diversified portfolio that incorporates both trading and long-term investing. Here’s why diversifying your portfolio in this manner can be a wise move:

Risk Mitigation: Diversification is a bedrock principle of risk management in investing. By allocating a portion of your portfolio to trading and another to long-term investments, you spread risk across different asset classes and strategies. This diversity acts as a cushion against potential losses in any single approach. When one segment of your portfolio faces headwinds, the other may remain stable or even thrive, reducing overall portfolio volatility.

Capital Utilization: Different investment horizons call for varying levels of capital commitment. Trading often requires more active involvement and shorter holding periods, necessitating the allocation of a portion of your capital. Long-term investing, on the other hand, benefits from a more patient approach with capital tied up for extended periods. By diversifying, you efficiently allocate your available capital to match the requirements of both strategies.

Income Generation: Diversifying your portfolio can enable you to harness the benefits of both short-term and long-term income generation. Trading can yield quick profits, while long-term investments, such as dividend stocks or bonds, provide consistent income over time. This income diversification helps you meet immediate financial needs while simultaneously building wealth for the future.

Opportunity Capture: Financial markets are dynamic, offering various opportunities across different timeframes. Trading capitalizes on short-term market fluctuations, while long-term investments leverage the power of compounding over extended periods. By adopting both strategies, you position yourself to seize a broader spectrum of market opportunities, regardless of whether they are immediate or long-term in nature.

Psychological Balance: Trading and long-term investing often require distinct mindsets. Trading demands vigilance, quick decision-making, and the ability to handle short-term losses. Long-term investing, on the other hand, necessitates patience and a focus on the bigger picture. By incorporating both approaches, you strike a psychological balance that aligns with your risk tolerance and temperament, enhancing your overall emotional resilience in the face of market fluctuations.

Adaptive Strategy: Market conditions evolve, and what works well in one period may not be as effective in another. Diversifying your portfolio allows you to adapt to changing market dynamics. If market conditions favor trading, you can allocate more resources to it. Conversely, during more stable or bearish phases, you can shift your focus towards long-term investments. This adaptability ensures that your investment strategy remains relevant and effective.

Financial Goals: Your financial goals often span various timeframes. Some goals, such as retirement planning, require a long-term investment horizon. Simultaneously, you may have shorter-term objectives, like funding a vacation or purchasing a home. Diversifying your portfolio accommodates these diverse financial goals, providing you with the flexibility to tailor your investment approach to specific objectives.

Performance Smoothing: Trading and long-term investing can exhibit different performance characteristics. While trading may yield intermittent gains and losses, long-term investments tend to offer more stable, albeit gradual, growth. Combining both approaches can smooth out the performance of your portfolio, resulting in a more consistent and predictable overall return.

In summary, diversifying your portfolio to include both trading and long-term investing is a strategic move that harmonizes risk, capital utilization, income generation, and psychological factors. This balanced approach not only enhances your resilience in the face of market fluctuations but also positions you to capitalize on a broader spectrum of market opportunities and achieve a well-rounded investment strategy that aligns with your multifaceted financial goals.

For additional details, consider exploring the related content available here The Importance of Diversification

Conclusion

In conclusion, trading and investing serve different financial objectives and risk profiles. Understanding the distinctions between the two can help you make informed decisions and build a balanced financial strategy that aligns with your goals and preferences. Whether you choose to be a trader, an investor, or a combination of both, it’s crucial to continuously educate yourself and adapt to the ever-evolving financial markets.

Indeed, comprehending the disparities between trading and investing is a vital step toward crafting a financial strategy that suits your unique objectives and risk tolerance. To conclude, let’s delve further into why this understanding is crucial and how you can navigate the dynamic world of finance:

1. Tailored Approach:

a. Customized Strategy: Recognizing the distinctions between trading and investing empowers you to tailor your approach to match your financial goals. Whether you seek short-term gains, long-term wealth accumulation, or a blend of both, your strategy can be designed to align precisely with your aspirations.

2. Risk and Reward:

a. Risk Management: Understanding the risk profiles of trading and investing allows you to make informed choices that align with your risk tolerance. Traders may embrace higher short-term risks for the potential of quick gains, while investors often adopt a more patient approach with a focus on long-term rewards.

3. Time and Effort:

a. Time Commitment: Trading typically demands more time and attention due to frequent market monitoring and decision-making. Investors, on the other hand, may have a less time-intensive approach, making it suitable for those with busy lifestyles.

4. Education and Adaptation:

a. Continuous Learning: Both trading and investing require ongoing education and adaptation to changing market conditions. Staying informed about financial instruments, economic trends, and market dynamics is essential for success in either endeavor.

b. Market Evolution: Financial markets are dynamic, influenced by factors such as technology, geopolitics, and global events. Being aware of these changes and adapting your strategies accordingly is key to staying ahead.

5. Diversification:

a. Portfolio Diversification: The choice between trading and investing can also impact your portfolio diversification. Investors may have a more diversified portfolio, spreading risk across various assets, while traders might focus on specific instruments or sectors.

6. Risk-Reward Balance:

a. Balancing Act: Some individuals opt for a balanced approach, combining elements of both trading and investing. This approach allows them to benefit from both short-term opportunities and long-term wealth growth while managing risk.

In essence, the choice between trading and investing is a deeply personal one, influenced by your financial goals, risk tolerance, time commitment, and preferences. What remains constant, however, is the importance of continuous learning and adaptability in the ever-evolving financial landscape.

Whether you embark on the path of a trader, investor, or a hybrid of the two, the key lies in staying informed, understanding your objectives, and crafting a strategy that serves your unique financial journey. By doing so, you position yourself to navigate the complexities of financial markets with confidence and purpose, making informed decisions that lead you toward your financial aspirations.

Additionally, you can find further information on this topic by visiting this page: Investment Basics Explained With Types to Invest in

More links

Should you desire more in-depth information, it’s available for your perusal on this page: Investing vs. Trading: What’s the Difference?