Introduction

The S&P 500, often referred to simply as “the S&P,” is one of the most recognized and closely followed stock market indices in the world. It’s frequently mentioned in financial news and discussions, yet many individuals may not fully grasp what it represents and why it holds such significance. In this article, we’ll demystify the S&P 500, explaining what it is, how it works, and why it matters in the world of finance.

The S&P 500, often affectionately known as “the S&P,” is a financial giant that looms large in the world of investments and stock market analysis. Its pervasive presence in financial news and discussions may leave many wondering about its significance and why it garners so much attention. To unravel the mysteries surrounding the S&P 500, let’s embark on a journey to understand what it truly represents, how it functions, and why it holds such a hallowed place in the realm of finance.

Understanding the S&P 500: A Deeper Dive

1. The Definition: The S&P 500 is, at its core, a stock market index. But it’s not just any index; it’s a representation of the United States’ economic might distilled into a single number. Specifically, it tracks the performance of 500 of the largest publicly traded companies in the U.S. These companies collectively represent a significant portion of the American economy.

2. The Magic of Capitalization: The S&P 500 is unique in its methodology. Unlike other indices that weigh companies equally, the S&P 500 employs a market capitalization approach. This means that larger companies have a more substantial impact on the index’s movements. As a result, it offers a more realistic reflection of the broader stock market.

3. The All-Encompassing Benchmark: The S&P 500 isn’t just a passive observer of the market; it’s often used as a benchmark for investment performance. Asset managers, mutual funds, and even individual investors frequently measure their success against the S&P 500’s performance. Beating the index is a coveted achievement in the world of investment.

4. Economic Barometer: The S&P 500 isn’t merely an investment tool; it’s also a barometer of the U.S. economy. When the index rises, it’s often seen as a sign of economic health and investor confidence. Conversely, a declining S&P 500 can raise concerns about economic downturns.

5. Global Significance: The S&P 500 isn’t confined to the U.S. Its influence extends globally, with investors and analysts worldwide closely monitoring its movements. Its performance can impact international markets, making it a global economic indicator.

6. Investment Diversity: The S&P 500 is also a vehicle for diversified investing. Investors can gain exposure to a broad range of industries and sectors by investing in index-tracking funds or exchange-traded funds (ETFs) that mirror its composition.

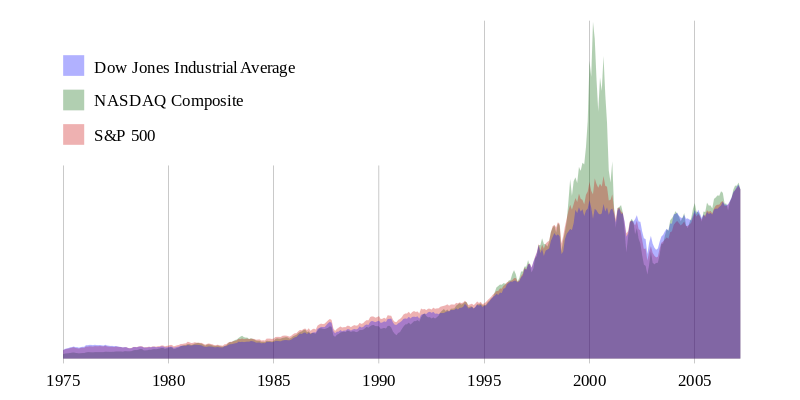

7. Historical Performance: Examining the historical performance of the S&P 500 reveals fascinating insights into market trends, economic cycles, and the resilience of American business. It’s a treasure trove for researchers and analysts.

8. Financial News Staple: Turn on any financial news network or read a financial publication, and you’ll likely encounter references to the S&P 500 throughout your exploration. Its daily movements and annual performance are among the most closely followed metrics in the financial world.

In essence, the S&P 500 isn’t just an index; it’s a mirror reflecting the ebb and flow of the U.S. economy and a compass guiding the investment journey of many. By demystifying its significance, we gain a deeper appreciation for the role it plays in the world of finance and its enduring impact on how we view and navigate the tumultuous seas of the stock market.

Should you desire more in-depth information, it’s available for your perusal on this page: Demystifying Responsible Investment Performance

The S&P 500, short for the Standard & Poor’s 500, is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the United States. These companies are carefully selected to represent various sectors of the U.S. economy, making the index a broad and diverse reflection of American business.

The S&P 500, often abbreviated as the Standard & Poor’s 500, stands as a pillar of the financial world, offering invaluable insights into the dynamics of the U.S. stock market. Delving deeper into this renowned index, we uncover its significance and the intricacies that shape it:

1. Iconic Market Barometer:

- The S&P 500 is not merely an index; it’s a barometer of the American economy.

- It provides investors, analysts, and economists with a snapshot of how the U.S. stock market is performing.

2. Selective Inclusion:

- The process of selecting the 500 companies that constitute the index is meticulous.

- Companies are chosen based on stringent criteria, ensuring they are among the largest and most influential in the nation.

3. Diverse Representation:

- The S&P 500 boasts diversity in its composition, representing various sectors of the U.S. economy.

- This diversity minimizes the impact of any single company’s performance on the overall index.

4. Reflecting Market Trends:

- As the U.S. economy evolves, so does the S&P 500. Companies are periodically added or removed to reflect market trends.

- This adaptability ensures that the index remains a relevant and accurate reflection of the economic landscape.

5. Widely Tracked Benchmark:

- Investors around the world use the S&P 500 as a benchmark to evaluate their portfolios’ performance.

- It serves as a yardstick against which fund managers and financial instruments are measured.

6. Investment Opportunities:

- Many investment products, such as exchange-traded funds (ETFs) and index funds, track the S&P 500.

- These products provide investors with opportunities to gain exposure to a broad spectrum of U.S. stocks.

7. Economic Insights:

- Analysts often analyze the S&P 500’s movements to glean insights into economic trends.

- It can serve as an early indicator of market sentiment and economic conditions.

8. Historical Significance:

- The S&P 500 has a rich history dating back to its inception in 1957.

- It has weathered market downturns, economic booms, and crises, offering a long-term perspective on U.S. financial markets.

9. Global Impact:

- Given its size and influence, the S&P 500’s performance can have a ripple effect on global financial markets.

- International investors closely monitor its movements when making investment decisions.

10. Symbol of American Business: – The S&P 500 is a symbol of the resilience, innovation, and dynamism of American businesses. – It embodies the spirit of entrepreneurship and corporate excellence in the United States.

In summary, the S&P 500 transcends its role as a stock market index; it is a reflection of the ever-evolving U.S. economy and a global financial benchmark. With its diverse composition, historical significance, and economic insights, the S&P 500 remains a cornerstone of the investment world, offering a panoramic view of American business and finance.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: S&P Dow Jones Indices (@SPDJIndices) / X

The S&P 500 is a market capitalization-weighted index, which means that companies with larger market capitalizations (the total value of their outstanding shares) have a more significant influence on the index’s movements. In simpler terms, the most substantial U.S. companies carry more weight in the index.

To calculate the S&P 500’s value, you sum up the market capitalizations of all 500 component companies and then adjust for various factors like stock splits and corporate actions. This figure is then divided by a divisor, which is used to ensure that changes in the index do not result solely from events such as stock splits.

The S&P 500, often referred to as a benchmark for the U.S. stock market, operates on a fascinating principle of market capitalization weighting. Let’s delve deeper into this concept:

**1. Market Capitalization Weighting: The essence of the S&P 500 lies in its market capitalization weighting method. In this approach, the significance of each constituent company is directly proportionate to its market capitalization. In simpler terms, bigger companies have a more substantial impact on the index’s movements, aligning it with the broader economy.

**2. Influence of the Giants: When you hear about the S&P 500’s performance, it’s the giants of Corporate America that you’re essentially monitoring. The largest U.S. companies, those with the highest market capitalizations, hold sway over the index. Their successes and setbacks have a more pronounced effect on the overall performance of the S&P 500.

**3. Complex Calculation: The calculation of the S&P 500’s value is an intricate process. To arrive at this figure, you first sum up the market capitalizations of all 500 component companies. This massive aggregation captures the collective worth of these influential businesses, painting a vivid picture of the U.S. stock market’s health.

**4. Adjustments and Fine-Tuning: The straightforward summation, however, is just the beginning. The index undergoes adjustments for various factors like stock splits, mergers, acquisitions, and other corporate actions. This meticulous fine-tuning ensures that the S&P 500 remains an accurate reflection of the market, unaffected by isolated events.

**5. The Divisor’s Role: To prevent significant disruptions caused by events like stock splits, the S&P 500 incorporates a special tool – the divisor. This divisor is a constant number that is used to adjust the index’s value. When necessary, it is altered to counterbalance changes in the index due to events that don’t reflect the broader market’s health.

**6. Continuity and Reliability: The divisor’s role is pivotal in maintaining the continuity and reliability of the S&P 500. It ensures that the index remains a consistent and trustworthy indicator of the U.S. stock market’s performance over time.

**7. Investor Insights: For investors and financial professionals, the S&P 500 is not just a number. It’s a window into the dynamics of the U.S. economy and the performance of its largest corporations. Understanding its market capitalization weighting helps investors make informed decisions based on the relative strength of these influential companies.

**8. Benchmark for Performance: The S&P 500 serves as a benchmark for evaluating the performance of investment portfolios and mutual funds. Investors often gauge their own investments against the index, aiming to outperform or at least match its returns.

In summary, the S&P 500’s market capitalization weighting method is at the heart of its role as a barometer for the U.S. stock market. It reflects the influence of the most substantial U.S. companies, combines complex calculations with fine-tuning mechanisms, and employs the divisor to ensure that it remains a reliable indicator of the nation’s economic health. Understanding the principles behind this iconic index is not only informative but also a valuable tool for investors and financial analysts navigating the dynamic world of finance.

Additionally, you can find further information on this topic by visiting this page: Demystifying commodity futures in China – CFA Institute

The S&P 500 is considered a benchmark for the performance of the U.S. stock market. It’s used by investors, financial professionals, and analysts to gauge the overall health of the U.S. economy and to assess how the stock market is performing. Here are a few key reasons why the S&P 500 is crucial:

The significance of the S&P 500 in the realm of finance cannot be overstated. This index, often referred to simply as “the S&P,” stands as an indispensable tool for investors, financial professionals, and analysts. It serves as a compass in the complex world of stocks and provides vital insights into the heartbeat of the U.S. economy. Here’s a deeper dive into why the S&P 500 holds such paramount importance:

Market Representation – A Microcosm of the Market: The S&P 500 represents a diverse array of 500 of the largest publicly traded companies in the United States. These companies span various sectors and industries, making the index a microcosm of the broader stock market. As a result, it offers a comprehensive snapshot of the U.S. corporate landscape.

Economic Health Barometer – Gauging Prosperity: One of the S&P 500’s primary roles is as a barometer for the overall health of the U.S. economy. As the index comprises major companies with substantial market capitalization, its performance reflects the collective financial well-being of these corporations. Consequently, when the S&P 500 rises, it often signals economic prosperity, while declines can indicate economic challenges.

Performance Evaluation – Assessing Returns: Investors and financial professionals use the S&P 500 as a yardstick to assess the performance of their investment portfolios. It serves as a benchmark against which the returns on stocks and other investments are measured. By comparing their own investments to the S&P 500, individuals and institutions can gauge how well their assets are performing relative to the broader market.

Risk Assessment – Measuring Market Volatility: Volatility in the stock market is a natural phenomenon, and the S&P 500 serves as a valuable tool for assessing it. By tracking the index’s fluctuations, investors can gain insights into the level of market volatility. A rapidly changing S&P 500 may indicate heightened market uncertainty, while a stable index suggests relative market calm.

Investment Strategy – Informed Decision-Making: Investors use the S&P 500 as a reference point for making informed investment decisions. For instance, they may choose to invest in index-tracking funds, such as exchange-traded funds (ETFs) or mutual funds that aim to replicate the performance of the S&P 500. This approach allows investors to gain exposure to a broad portfolio of stocks without the need to pick individual companies.

Portfolio Diversification – Risk Management: Diversifying a portfolio is a fundamental risk management strategy. Investors often use the S&P 500 as a core component of their diversified portfolios because of its broad representation of the U.S. market. By holding a mix of assets that includes the S&P 500, investors aim to spread risk and reduce the impact of poor performance in any single investment.

Economic Indicator – Tracking Trends: Analysts and policymakers closely monitor the S&P 500 to discern economic trends and sentiment. Sustained growth in the index can signal confidence in the economy, potentially influencing business and consumer behavior. Conversely, prolonged declines may raise concerns about economic stability.

In sum, the S&P 500 is not merely a collection of numbers; it’s a vital compass for navigating the intricate landscape of the stock market and assessing the pulse of the U.S. economy. It provides a comprehensive view of corporate America, aids in investment decision-making, and plays a pivotal role in risk management. As a reliable indicator and benchmark, the S&P 500 continues to be a cornerstone of financial analysis and investment strategy.

Explore this link for a more extensive examination of the topic: Demystifying ESG: Its History & Current Status

The index includes companies from various sectors, reducing the risk associated with investing in individual stocks. It provides diversification in a single investment.

Investing in an index, such as a stock market index or an exchange-traded fund (ETF), is akin to entering a realm of financial strategy that offers a multitude of advantages. Here, we delve deeper into why indices have become a favored choice for investors and how they empower individuals to navigate the complex world of financial markets with confidence:

Built-In Diversification: One of the most compelling features of investing in an index is the inherent diversification it offers. An index typically includes a broad spectrum of companies representing various sectors and industries. This diversification spreads the risk associated with investing across multiple stocks, significantly reducing the vulnerability to the poor performance of a single company.

Risk Mitigation: Diversification goes hand in hand with risk mitigation. By holding a diverse range of stocks within an index, investors can minimize the impact of adverse events or economic fluctuations affecting a particular industry or company. This risk reduction is particularly valuable during periods of market volatility.

Ease of Access: Investing in an index is an accessible and straightforward way for individuals to participate in the stock market. It provides an opportunity to indirectly invest in a basket of stocks without the need for extensive market research or the complexities associated with buying individual stocks.

Time Efficiency: Indices offer an efficient means of investing, saving investors valuable time. Rather than meticulously analyzing and selecting individual stocks, investors can rely on the collective expertise of the index’s creators, who have curated a representative selection of companies.

Lower Costs: Many index-based investments, such as ETFs, come with lower fees compared to actively managed mutual funds or individually managed portfolios. This cost efficiency allows investors to retain a more significant portion of their returns.

Market Representation: Indices are often designed to accurately represent the performance of a specific market or sector. Investors can use these indices as benchmarks to gauge the overall health and trends of the market, facilitating informed decision-making.

Long-Term Strategy: Investing in indices is well-suited for long-term investment strategies. As indices inherently hold a diversified portfolio of stocks, they are poised to capture the overall growth potential of the market over extended periods.

Flexibility and Choice: Investors have the flexibility to choose from a wide range of indices, each tailored to a specific market, sector, or investment style. This diversity empowers individuals to align their investments with their financial goals and risk tolerance.

Accessibility to Global Markets: Many indices offer exposure to global markets, enabling investors to diversify their portfolios across international borders. This diversification can reduce risk while tapping into the growth potential of economies worldwide.

Passive Investment: Index investing is often associated with passive investment strategies. Investors who prefer a more hands-off approach can benefit from this approach by simply holding index-based investments over the long term, potentially capturing market growth with minimal effort.

In essence, investing in an index isn’t merely a financial strategy; it’s a gateway to a world of opportunities, risk management, and simplified access to the ever-evolving landscape of financial markets. Whether you’re a seasoned investor or just beginning your financial journey, indices offer a practical and diversified path to potentially achieving your investment objectives while navigating the dynamic world of finance with confidence.

For additional details, consider exploring the related content available here Demystifying commodity futures in China – CFA Institute

As one of the most widely followed indices, the S&P 500 accurately reflects the sentiment and trends of the broader stock market. Movements in the S&P 500 are often seen as indicative of the overall market direction.

The S&P 500, often regarded as a barometer of the financial markets, plays a pivotal role in shaping investor sentiment and market perceptions. Its significance extends beyond its numerical value; it’s a symbol of the broader economic landscape. Here’s why the S&P 500 is not just an index but a reflection of the intricate dynamics of the stock market:

Diverse Representation: The S&P 500 encompasses a broad spectrum of industries, including technology, finance, healthcare, consumer goods, and more. With 500 of the largest publicly traded companies in the United States, it provides a comprehensive snapshot of the American economy. This diversity ensures that movements in the index are representative of the health and performance of various sectors.

Market Sentiment Gauge: Investors and analysts closely monitor the S&P 500 to gauge market sentiment. When the index experiences significant gains, it often indicates optimism and confidence in the economy. Conversely, declines may signal uncertainty or concern. These shifts in sentiment can influence investor behavior and trading decisions.

Investor Benchmark: The S&P 500 serves as a benchmark against which investment portfolios and fund performances are measured. Many mutual funds and exchange-traded funds (ETFs) aim to replicate or outperform the index. This benchmarking practice underscores the importance of the S&P 500 as a performance yardstick.

Economic Indicator: The S&P 500 can be viewed as an economic indicator in its own right. Historically, it has demonstrated a strong correlation with broader economic trends. When the index rises, it often aligns with economic growth and expansion, while declines may precede or coincide with economic downturns.

Global Impact: The influence of the S&P 500 extends far beyond U.S. borders. It’s a reference point for global investors, and its movements can impact international markets. For example, a sharp drop in the index can trigger sell-offs in markets around the world, highlighting its interconnectedness with the global financial system.

Risk Assessment: Investors use the S&P 500 as a tool for risk assessment. Volatility in the index can serve as an indicator of market turbulence. Traders and risk managers incorporate S&P 500 data into their risk models to evaluate exposure and potential market shocks.

Market Direction: Perhaps most notably, the S&P 500 is regarded as a directional indicator for the stock market as a whole. When the index trends upward, it’s often interpreted as a bullish sign for the broader market. Conversely, a declining S&P 500 can raise concerns about a potential market downturn.

Public Perception: Beyond its technical significance, the S&P 500 holds a prominent place in public perception. Media outlets report on its daily movements, making it a household name. It’s a symbol of the financial health of the nation and, by extension, the global economy.

In essence, the S&P 500 is more than just a compilation of stock prices; it’s a dynamic reflection of economic, financial, and investor sentiment. Its ability to encapsulate the complexity of the stock market and the broader economy underscores its role as a leading indicator and a cornerstone of financial analysis and decision-making. As a result, the S&P 500 continues to be a focal point for investors, analysts, and anyone with an interest in the financial world.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Demystifying the Alternative Investing Landscape

Many investment funds, including mutual funds and exchange-traded funds (ETFs), are designed to track or replicate the performance of the S&P 500. Investors use these funds to gain exposure to a broad range of U.S. companies.

Investment funds that aim to replicate the S&P 500’s performance offer investors a straightforward and efficient way to access a diverse portfolio of U.S. companies. Here’s an in-depth look at why these funds are a popular choice and how they can benefit investors:

Diversification Simplified: The S&P 500 is composed of 500 of the largest publicly traded companies in the United States, spanning various industries. By investing in a fund that tracks the S&P 500, investors instantly gain exposure to this broad spectrum of companies. This diversification spreads risk across different sectors and helps mitigate the impact of poor-performing individual stocks.

Risk Management: Diversification is a cornerstone of risk management in investing. When investors hold a single stock, they are exposed to company-specific risks. However, by investing in an S&P 500-tracking fund, the impact of poor performance by one company is diluted by the overall strength of the index. This can help protect an investor’s portfolio during market downturns.

Market Benchmark: The S&P 500 is often regarded as a benchmark for the performance of the U.S. stock market. It reflects the collective performance of a significant portion of the U.S. economy. Using an S&P 500-tracking fund as a core investment allows investors to measure their portfolio’s performance against this widely recognized benchmark.

Liquidity and Accessibility: S&P 500-tracking funds, whether they are mutual funds or ETFs, are highly liquid and easily tradable on stock exchanges. This liquidity provides investors with the flexibility to buy or sell shares at market prices throughout the trading day. It’s a convenient option for those who want to adjust their portfolio quickly in response to changing market conditions.

Lower Costs: Many S&P 500-tracking funds come with relatively low expense ratios compared to actively managed funds. These lower costs can translate into higher returns for investors over the long term. Additionally, the passive nature of these funds means they have fewer transaction costs associated with frequent buying and selling of stocks.

Historical Performance: Over the long term, the S&P 500 has demonstrated a historically strong performance, with average annual returns that have outpaced inflation. While past performance is not indicative of future results, the S&P 500’s track record has made it an attractive option for investors seeking growth potential in their portfolios.

Long-Term Investment: S&P 500-tracking funds are well-suited for long-term investors who prefer a “buy and hold” strategy. These funds align with a patient approach, allowing investors to benefit from the compounding of returns over time.

In conclusion, investment funds that mirror the S&P 500 index offer a convenient, diversified, and cost-effective way for investors to gain exposure to the U.S. stock market. By tracking the performance of 500 leading U.S. companies, these funds align with various investment objectives, from diversification and risk management to benchmarking and long-term growth. They serve as a valuable tool in the toolkit of both novice and experienced investors seeking to build a well-rounded and resilient investment portfolio.

To delve further into this matter, we encourage you to check out the additional resources provided here: Sitemap

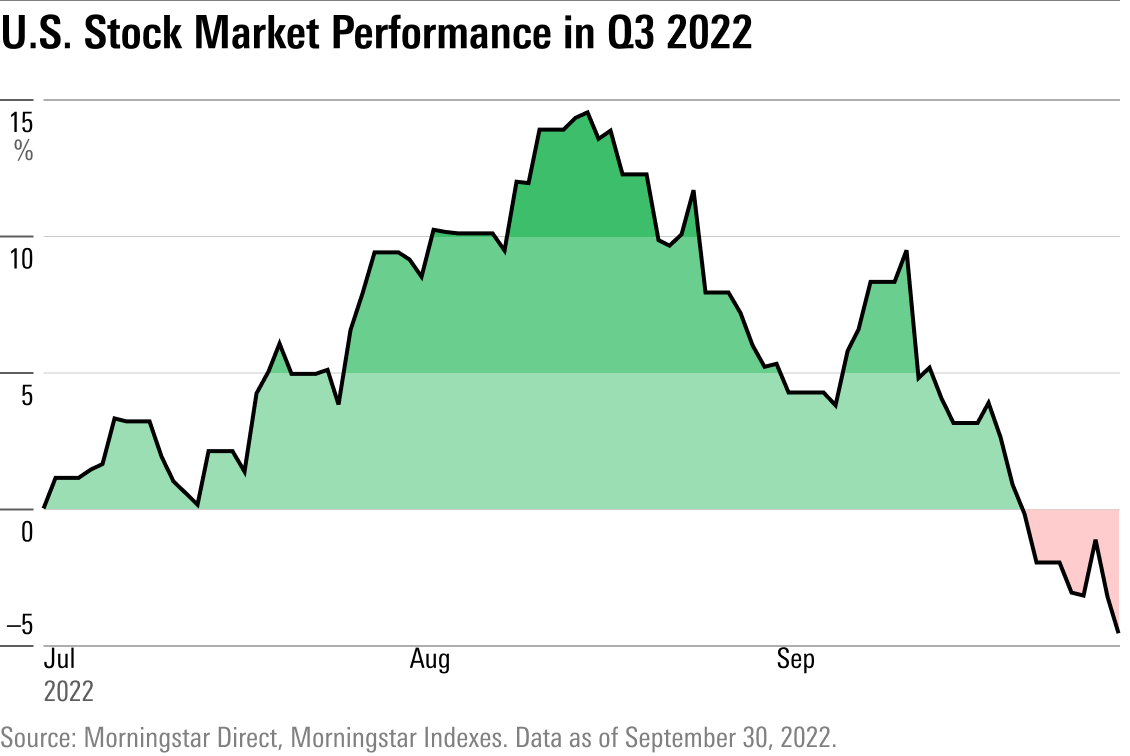

Changes in the S&P 500 can signal economic shifts and investor sentiment. A rising S&P 500 may indicate optimism about the economy, while a falling index might suggest concerns or uncertainty.

Monitoring the S&P 500, a prominent benchmark in the world of finance, is akin to reading the economic and investor sentiment tea leaves. Let’s explore how changes in this index serve as a powerful barometer for economic shifts and investor outlook:

Economic Bellwether: The S&P 500, comprising 500 of the largest publicly traded companies in the U.S., is often regarded as a reflection of the overall health of the American economy. When this index rises, it typically signals positive economic conditions. Investors’ optimism translates into higher stock prices, suggesting that businesses are thriving, consumer sentiment is positive, and economic growth is expected.

Market Confidence: A rising S&P 500 isn’t just about numbers on a screen; it’s a manifestation of investor confidence. It signifies that market participants believe in the potential for future returns and are willing to allocate capital to equities. This optimism can have a cascading effect on other financial markets and investment decisions, influencing asset allocation strategies and investment flows.

Bearish Signals: Conversely, a falling S&P 500 can be a harbinger of economic concerns or uncertainty. When this index experiences declines, it may indicate that investors are becoming cautious or risk-averse. Economic challenges, geopolitical tensions, or unexpected events can trigger sell-offs, causing stock prices to drop. This can ripple through the financial ecosystem, affecting not only stocks but also other asset classes like bonds and commodities.

Market Psychology: Investor sentiment plays a pivotal role in driving market movements. The S&P 500 is a reflection of the collective psychology of investors. Positive sentiment can create a self-fulfilling prophecy, with rising prices attracting more buyers, further boosting the index. Conversely, negative sentiment can trigger a domino effect of selling, leading to downward momentum.

Indicator for Policymakers: Policymakers and central banks closely monitor the S&P 500 as an indicator of economic stability. Large fluctuations or sustained declines can prompt policymakers to take action to stabilize markets and mitigate potential economic repercussions. This includes measures such as interest rate adjustments and economic stimulus programs.

Global Impact: The S&P 500’s influence extends beyond U.S. borders. It’s often used as a reference point for global investors and fund managers. Movements in the index can influence investment decisions in international markets. Moreover, multinational corporations included in the index have a global footprint, so changes in their stock prices can impact economies worldwide.

Risk Management: Investors use the S&P 500 as a risk management tool. When they perceive increased market risk, they may reallocate their portfolios, reducing exposure to equities and seeking safer assets. This dynamic can lead to fluctuations in the index as investors respond to changing risk-reward profiles.

Long-Term Trends: Tracking the S&P 500 over the long term can reveal trends and patterns in investor sentiment and economic cycles. Investors and analysts use historical data to gain insights into market behavior and make informed investment decisions.

In summary, the S&P 500 is far more than just a financial index; it’s a multifaceted indicator that encapsulates economic sentiment, investor confidence, and market dynamics. Changes in the S&P 500 serve as a valuable lens through which to interpret economic shifts, investor sentiment, and the broader financial landscape. Whether you’re an individual investor, a financial professional, or a policymaker, staying attuned to this index can provide invaluable insights into the ever-evolving world of finance and economics.

Don’t stop here; you can continue your exploration by following this link for more details: Chapter 3 | Guidance Notes on Evaluation Approaches and …

The S&P 500 includes a wide array of companies, spanning sectors such as technology, healthcare, finance, consumer goods, and more. Well-known companies like Apple, Microsoft, Amazon, and Alphabet (Google’s parent company) are among its components. The index is periodically reviewed and adjusted to ensure it reflects the evolving U.S. economy.

The composition of the S&P 500 reflects the diversity and dynamism of the U.S. economy, making it a barometer of economic health and a valuable asset for investors. Here’s a deeper look at why the inclusion of a wide range of companies, including tech giants like Apple and Microsoft, e-commerce leaders like Amazon, and Alphabet with its Google empire, is so significant:

1. Sectoral Representation:

a. Comprehensive Coverage: The S&P 500 encompasses companies from various sectors, providing investors with exposure to a broad spectrum of industries. This diversification helps mitigate risks associated with sector-specific fluctuations.

b. Market Insights: The performance of individual sectors within the index can offer insights into the overall health of the economy. For instance, technology companies’ success may indicate robust innovation and consumer demand.

2. Market Leaders:

a. Influential Players: Well-known companies like Apple, Microsoft, Amazon, and Alphabet often wield significant influence in their respective industries. Their performance can greatly impact the index and serve as a reflection of industry trends.

b. Investor Confidence: The presence of these household names can instill confidence in investors and attract capital to the market. It also provides opportunities for investors to align their portfolios with familiar and trusted brands.

3. Index Evolution:

a. Adaptation to Change: The periodic review and adjustment of the S&P 500’s components ensure that the index remains relevant and accurately represents the evolving U.S. economy. This adaptability is crucial for reflecting changes in market dynamics.

b. Reflecting Growth: As newer, disruptive companies emerge and gain prominence, they may be included in the index, reflecting shifts in the economic landscape.

4. Investment Benchmark:

a. Performance Benchmark: The S&P 500 is widely used as a benchmark for evaluating the performance of investment portfolios, mutual funds, and exchange-traded funds (ETFs). Investors often measure their returns against the index’s performance.

5. Economic Indicator:

a. Economic Health Indicator: The index’s movements can serve as an indicator of the broader economic health of the United States. Periods of sustained growth or decline in the S&P 500 may be seen as indicators of economic expansion or contraction.

In summary, the S&P 500’s diverse composition, including renowned companies across various sectors, makes it a valuable tool for investors and a reflection of the ever-changing U.S. economy. Its adaptability, sectoral representation, and the presence of market leaders like Apple, Microsoft, Amazon, and Alphabet underscore its importance in the world of finance and investment. As the index continues to evolve, it remains a key barometer of economic vitality and a vital component of the global financial landscape.

Explore this link for a more extensive examination of the topic: Demystifying commodity futures in China – CFA Institute

Conclusion

Understanding the S&P 500 is fundamental for anyone interested in the stock market and investing in the United States. It serves as a reliable indicator of market performance, offering insights into economic trends and investor sentiment. Whether you’re a seasoned investor or just starting your financial journey, the S&P 500 is a valuable tool for tracking the pulse of the U.S. stock market and making informed investment decisions.

The S&P 500, often referred to as the benchmark of the U.S. stock market, plays a pivotal role in the world of finance and investments. Regardless of your level of expertise, grasping the significance of this index is essential for informed decision-making.

Reliable Performance Indicator: At its core, the S&P 500 is a reliable barometer of how the U.S. stock market is performing. Comprising 500 of the nation’s largest publicly traded companies, it offers a broad snapshot of market dynamics. By tracking its movements, investors gain valuable insights into the overall health and direction of the market.

Economic Trend Insights: Beyond just reflecting market performance, the S&P 500 often serves as an early indicator of broader economic trends. Swings in the index can signal shifts in investor sentiment, economic conditions, and corporate earnings expectations. Savvy investors use these insights to anticipate market movements and adapt their strategies accordingly.

Accessible Investment Tool: One of the remarkable aspects of the S&P 500 is its accessibility to investors of all levels. It’s not limited to seasoned stock market veterans; even beginners can harness its power. Many investment products, such as exchange-traded funds (ETFs) and index funds, are designed to mimic the performance of the S&P 500. This accessibility allows investors to diversify their portfolios easily and gain exposure to a broad array of U.S. stocks.

Risk Management: For those seeking to manage risk in their investment portfolio, the S&P 500 can be an invaluable asset. By spreading investments across multiple sectors and industries represented in the index, investors can reduce the impact of individual stock volatility. This diversification is a time-tested strategy for mitigating risk while aiming for consistent, long-term returns.

Long-Term Perspective: The S&P 500 is not just a tool for day traders; it’s a compass for long-term investors. Tracking its historical performance reveals the resilience and growth potential of the U.S. stock market over time. Investors with a long-term horizon often use the S&P 500 as a guide for wealth-building and retirement planning.

Informed Decision-Making: Whether you’re actively managing your investments or working with a financial advisor, staying attuned to the S&P 500’s movements empowers you to make informed decisions. It allows you to gauge market sentiment, assess portfolio performance, and adjust your investment strategy based on prevailing market conditions.

In conclusion, the S&P 500 isn’t just a number on a financial ticker; it’s a valuable resource that provides deep insights into the U.S. stock market. Whether you’re an experienced investor or someone embarking on their financial journey, understanding and utilizing the S&P 500 can be a game-changer. It equips you with the knowledge and tools needed to navigate the complexities of the stock market, make informed investment choices, and work toward your financial goals with confidence.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Economics of Sovereign Wealth Funds

More links

Additionally, you can find further information on this topic by visiting this page: Sitemap