Introduction

Retirement is a significant life transition that most of us look forward to. It’s a time when you can finally enjoy the fruits of your labor and live life on your terms. However, achieving a comfortable retirement requires careful planning and financial foresight. In this article, we’ll explore the importance of retirement planning and the steps you can take to build a nest egg for your future.

Retirement is a significant life transition that most of us look forward to. It’s a time when you can finally enjoy the fruits of your labor and live life on your terms. However, achieving a comfortable retirement requires careful planning and financial foresight. In this article, we’ll explore the importance of retirement planning and the steps you can take to build a nest egg for your future.

Set Clear Retirement Goals: Start by defining your retirement goals. Consider when you want to retire and the lifestyle you envision during your retirement years. Setting clear objectives will help you determine how much money you’ll need to save.

Utilize Retirement Savings Accounts: Take full advantage of retirement savings accounts such as 401(k)s, IRAs, or Roth IRAs. These tax-advantaged accounts offer various benefits, including tax deductions and compound interest, which can help your savings grow faster.

Understand Social Security Benefits: Understanding how Social Security benefits work and when to claim them is essential. Delaying your Social Security benefits can result in higher monthly payments, providing more financial security during retirement.

Diversify Your Investments: Consider diversifying your investment portfolio to manage risk effectively. A mix of stocks, bonds, and other assets can help balance your investments and optimize returns over time.

Seek Professional Guidance: Seeking guidance from a certified financial advisor can provide you with personalized retirement planning strategies and expert advice tailored to your unique circumstances. Their expertise can help you make informed decisions and stay on track toward your retirement goals.

Remember that retirement planning is a journey, and it’s never too early to start. By taking proactive steps and making informed financial decisions, you can build a substantial nest egg that will support the retirement lifestyle you’ve always dreamed of.

To expand your knowledge on this subject, make sure to read on at this location: The Best Retirement Plans to Build Your Nest Egg

Assess Your Current Financial Situation

Before you can plan for retirement, you need to have a clear understanding of your current financial situation. Start by calculating your net worth, which is the total value of your assets minus your liabilities. This will give you a snapshot of your financial health. Take a close look at your income, expenses, savings, investments, and debts. Knowing where you stand financially is the first step towards setting realistic retirement goals.

Before you can plan for retirement, you need to have a clear understanding of your current financial situation. Start by calculating your net worth, which is the total value of your assets minus your liabilities. This will give you a snapshot of your financial health. But the process of preparing for retirement involves more than just a single calculation; it’s about creating a comprehensive financial roadmap for your future. Here’s how you can build on this foundation:

Evaluate Your Income Sources: Begin by taking a closer look at your income streams. This includes not only your salary but also any rental income, investment dividends, or other sources of money. Understanding the stability and potential growth of your income sources can help you project how much you’ll have available for retirement.

Examine Your Expenses: Scrutinize your current expenses, categorizing them as essential (e.g., housing, groceries, healthcare) and discretionary (e.g., dining out, entertainment, vacations). Identifying areas where you can reduce expenses can free up more funds for retirement savings. Creating a budget can be a valuable tool in this process.

Assess Your Savings: Take stock of your current savings and retirement accounts, such as 401(k)s, IRAs, and other investments. Consider how your savings align with your retirement goals and whether you need to adjust your contributions to meet those goals.

Review Your Investments: Examine your investment portfolio to ensure it aligns with your risk tolerance and retirement timeline. Diversify your investments to spread risk and potentially increase returns. Regularly rebalance your portfolio to maintain your desired asset allocation.

Manage Your Debts: Assess your outstanding debts, including mortgages, credit card balances, and loans. Develop a plan to reduce or eliminate high-interest debts before retirement. Lowering your debt burden can provide more financial security in your retirement years.

Consider Future Expenses: Think about potential major expenses in retirement, such as healthcare costs, home maintenance, and long-term care. These expenses should be factored into your retirement plan to ensure you’re financially prepared.

Set Realistic Retirement Goals: Based on your net worth, income, expenses, savings, investments, and debt management, set specific and realistic retirement goals. Determine the age at which you’d like to retire and the lifestyle you want to maintain. Adjust your goals as needed to ensure they are achievable.

Create a Retirement Savings Strategy: Develop a systematic plan for saving for retirement. Consider using retirement accounts with tax advantages, such as IRAs and 401(k)s, and take advantage of employer contributions if available. Regularly monitor and adjust your savings strategy as your financial situation evolves.

Seek Professional Guidance: If you find retirement planning overwhelming or have complex financial situations, consider consulting a financial advisor. They can provide personalized advice and help you make informed decisions to achieve your retirement goals.

In summary, while calculating your net worth is an essential starting point for retirement planning, the journey to a secure retirement involves a comprehensive assessment of your financial picture. By thoroughly examining your income, expenses, savings, investments, and debts, you can create a tailored retirement plan that sets you on the path to financial security and peace of mind during your golden years.

To expand your knowledge on this subject, make sure to read on at this location: How to Plan for Retirement

Define Your Retirement Goals

Retirement means different things to different people. Some dream of traveling the world, while others want to spend more time with family and friends. Begin by defining your retirement goals. Ask yourself questions like, “When do I want to retire?” and “What kind of lifestyle do I envision during retirement?” Setting clear objectives will help you determine how much money you’ll need to save.

Retirement means different things to different people. Some dream of traveling the world, while others want to spend more time with family and friends. It’s a time in life when you have the freedom to choose how you want to spend your days, unburdened by the routine of work.

To embark on this exciting journey, begin by defining your retirement goals. Ask yourself questions like, “When do I want to retire?” and “What kind of lifestyle do I envision during retirement?” These questions will serve as your compass, guiding you towards a fulfilling retirement.

Once you have a clearer picture of your retirement aspirations, you can start setting clear objectives. These objectives will help you determine how much money you’ll need to save to achieve your dreams. Whether it’s building a cozy nest egg for peaceful family gatherings or a substantial fund for globetrotting adventures, having well-defined goals will provide you with the motivation and direction needed to make your retirement dreams a reality. So, take the time to envision your ideal retirement, set your goals, and then plan accordingly to secure your financial future.

To expand your knowledge on this subject, make sure to read on at this location: How to Plan for Retirement

Maximize Retirement Savings Accounts

One of the most effective ways to build a nest egg for retirement is to take full advantage of retirement savings accounts. These include employer-sponsored plans like 401(k)s and individual retirement accounts (IRAs). These accounts offer significant tax advantages and often come with employer matching contributions. Contribute as much as you can to these accounts, especially if your employer offers a match. Over time, your contributions, along with compound interest, can grow substantially.

Additionally, consider diversifying your investments within your retirement accounts to spread risk and potentially increase returns. Consult with a financial advisor to create a well-balanced portfolio that aligns with your retirement goals and risk tolerance. Remember that the key to successful retirement planning is starting early and staying committed to your savings and investment strategy.

For additional details, consider exploring the related content available here SAVINGS FITNESS A Guide to Your Money and Your Financial Future

Understand Social Security Benefits

Social Security is a critical component of most retirees’ income. Understanding how Social Security benefits work and when to claim them is essential. You can start receiving Social Security benefits as early as age 62, but delaying your benefits can result in higher monthly payments. Consider factors like your health, financial needs, and life expectancy when deciding when to claim Social Security.

Social Security is a critical component of most retirees’ income. Understanding how Social Security benefits work and when to claim them is essential. You can start receiving Social Security benefits as early as age 62, but delaying your benefits can result in higher monthly payments.

When deciding when to claim Social Security, it’s important to consider several factors:

Health and Longevity: Assess your overall health and family history. If you expect to live a long and healthy life, delaying benefits may make sense as it can lead to significantly higher lifetime benefits.

Financial Needs: Examine your current financial situation and retirement savings. If you have other sources of income or sufficient retirement savings to cover your expenses, delaying Social Security can provide a financial buffer in later years when you may need it more.

Spousal Benefits: Consider how your decision will impact your spouse or surviving spouse. Delaying your benefits can result in larger survivor benefits, which can be crucial for your loved ones in the event of your passing.

Working Status: If you plan to continue working, be aware of the earnings limit imposed by Social Security. If you claim benefits before your full retirement age and earn above a certain threshold, your benefits may be reduced temporarily.

Life Expectancy: While predicting your exact lifespan is impossible, you can estimate your life expectancy based on factors like family history, lifestyle, and overall health. This estimation can help you make an informed decision about when to claim benefits.

It’s worth noting that the full retirement age for Social Security benefits varies depending on your birth year. Consult the Social Security Administration’s guidelines or speak with a financial advisor to determine your specific full retirement age.

Ultimately, the decision of when to claim Social Security benefits is highly individualized. Take the time to assess your unique circumstances, consider these factors, and make a choice that aligns with your financial goals and retirement plans. Planning ahead can help you maximize your Social Security benefits and secure a more comfortable retirement.

If you’d like to dive deeper into this subject, there’s more to discover on this page: SAVINGS FITNESS A Guide to Your Money and Your Financial Future

Diversify Your Investment Portfolio

Investing wisely is crucial for growing your retirement savings. Diversify your investment portfolio by allocating your assets across different types of investments, such as stocks, bonds, real estate, and even alternative investments like mutual funds or exchange-traded funds (ETFs). Diversification helps spread risk and can protect your savings from market volatility.

Investing wisely is indeed a critical component of building and growing your retirement savings. While diversification is a key principle, it’s important to delve deeper into the nuances of this strategy and explore additional aspects to consider as you navigate the world of retirement investments:

Asset Allocation Strategy: Beyond just diversifying your investments, you should establish a well-thought-out asset allocation strategy. This involves determining the percentage of your portfolio that should be allocated to each asset class based on your financial goals, risk tolerance, and investment timeline. For example, a younger investor with a longer time horizon might have a higher allocation to stocks, which historically offer higher returns but come with greater volatility.

Risk Tolerance: Assess your risk tolerance honestly. While diversification can spread risk, it’s essential to ensure that the level of risk in your portfolio aligns with your comfort level. If you’re uncomfortable with the potential for significant market fluctuations, you may need to adjust your asset allocation toward more conservative investments like bonds.

Regular Rebalancing: Your portfolio’s asset allocation can shift over time due to changes in market values. Regularly rebalancing your portfolio—selling assets that have appreciated significantly and reinvesting in underperforming assets—helps maintain your desired asset mix and risk level.

Long-Term Perspective: Retirement investments should primarily have a long-term perspective. Avoid making impulsive decisions based on short-term market fluctuations or news headlines. Staying invested through market ups and downs is often a key strategy for long-term success.

Cost Efficiency: Pay attention to the costs associated with your investments, including management fees and expenses. Lower-cost index funds and ETFs can be a cost-effective way to gain exposure to various asset classes while minimizing fees that can eat into your returns over time.

Tax Efficiency: Consider the tax implications of your investments. Certain retirement accounts, like Roth IRAs or 401(k)s, offer tax advantages that can boost your savings over time. Additionally, tax-efficient investing strategies, such as tax-loss harvesting, can help minimize your tax liability.

Diversify Within Asset Classes: Diversification should extend beyond just different types of investments. Within asset classes like stocks or bonds, diversify further by investing in different sectors, industries, and geographic regions. This reduces the risk associated with individual companies or regions experiencing poor performance.

Alternative Investments: While traditional investments like stocks and bonds are the backbone of many portfolios, consider incorporating alternative investments such as real estate, commodities, or private equity. These can provide additional diversification and potentially enhance returns.

Periodic Review and Adjustment: Your investment strategy should not be set in stone. Periodically review your portfolio, reassess your financial goals, and adjust your asset allocation as needed. Life circumstances change, and your investments should adapt accordingly.

Professional Guidance: If you’re uncertain about your investment strategy or want personalized advice, consider consulting a financial advisor or investment professional. They can provide expert guidance tailored to your unique financial situation and goals.

In conclusion, while diversification is a fundamental principle of investing for retirement, it’s just one element of a comprehensive strategy. A thoughtful approach that considers asset allocation, risk tolerance, cost efficiency, and tax implications, among other factors, is essential for building a retirement portfolio that can withstand market volatility and help you achieve your long-term financial objectives.

To delve further into this matter, we encourage you to check out the additional resources provided here: SAVINGS FITNESS A Guide to Your Money and Your Financial Future

Seek Professional Financial Advice

Retirement planning can be complex, and it’s often helpful to seek guidance from a certified financial advisor. A financial advisor can provide you with personalized retirement planning strategies, help you create a comprehensive retirement plan, and offer expert advice tailored to your unique circumstances. They can also assist you in managing your investments and making informed decisions along the way.

Retirement planning can indeed be a complex and daunting process, given the multitude of financial factors, investment options, and potential pitfalls to navigate. This is precisely why seeking guidance from a certified financial advisor can be a prudent and invaluable step in your retirement journey.

A certified financial advisor brings a wealth of knowledge and expertise to the table, making it easier for you to make informed decisions about your financial future. One of the key advantages of working with an advisor is their ability to create personalized retirement planning strategies that align with your specific goals and circumstances. They’ll take the time to understand your retirement aspirations, risk tolerance, and current financial situation to tailor a plan that suits you perfectly.

Moreover, a financial advisor can help you create a comprehensive retirement plan that encompasses not just your savings and investments but also factors in potential sources of retirement income, such as Social Security or pension benefits. This holistic approach ensures that your plan is well-rounded and robust, capable of weathering unforeseen financial storms.

As you progress towards retirement, your financial advisor can play a crucial role in managing your investments. They can help you build a diversified portfolio that balances risk and potential returns, adapting your strategy as market conditions change. This proactive management can help safeguard your retirement nest egg.

Furthermore, having an advisor by your side means you have a trusted source of expert advice to turn to whenever you face financial dilemmas or uncertainties. Whether it’s adjusting your investment strategy, assessing the tax implications of your retirement income sources, or addressing unexpected expenses, your advisor can provide guidance to keep you on track.

In summary, partnering with a certified financial advisor can be an essential step in achieving a secure and comfortable retirement. Their expertise, personalized strategies, and ongoing support can significantly enhance your ability to navigate the complexities of retirement planning and ensure you’re on the right path to realizing your retirement dreams.

To expand your knowledge on this subject, make sure to read on at this location: Blog: Cassandra Smalley Wealth Management

Continuously Monitor and Adjust

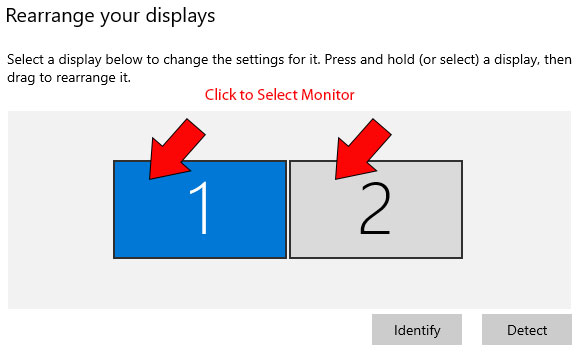

Retirement planning is not a one-and-done task. It’s essential to continuously monitor your progress and make adjustments when necessary. Life events, changes in financial goals, or shifts in the market can all impact your retirement plan. Regularly review and update your plan to ensure you’re staying on track to meet your retirement goals.

As part of your ongoing retirement planning, consider conducting annual or semi-annual check-ins with a financial advisor. They can help you assess your portfolio’s performance, make necessary adjustments, and ensure your retirement savings strategy remains aligned with your goals.

Another critical aspect of ongoing retirement planning is staying informed about changes in tax laws, Social Security, and other factors that could affect your retirement income. Staying proactive and adaptable will help you navigate any unexpected challenges and ensure a financially secure retirement. Remember, retirement planning is a lifelong journey, and staying vigilant will help you enjoy the retirement you’ve always envisioned.

To delve further into this matter, we encourage you to check out the additional resources provided here: What Is Personal Finance, and Why Is It Important?

Conclusion

Retirement planning is a journey that spans decades. It’s a journey filled with dreams, goals, and financial strategies. By assessing your current financial situation, defining your retirement goals, maximizing retirement savings accounts, understanding Social Security benefits, diversifying your investments, and seeking professional advice, you can build a robust nest egg for your future. Remember that a well-thought-out retirement plan is your roadmap to financial security and the retirement lifestyle you desire. Start planning today to ensure a comfortable and worry-free retirement tomorrow.

Retirement planning is a journey that spans decades. It’s a journey filled with dreams, goals, and financial strategies. By assessing your current financial situation, defining your retirement goals, maximizing retirement savings accounts, understanding Social Security benefits, diversifying your investments, and seeking professional advice, you can build a robust nest egg for your future. Remember that a well-thought-out retirement plan is your roadmap to financial security and the retirement lifestyle you desire. Start planning today to ensure a comfortable and worry-free retirement tomorrow.

Assess Your Current Financial Situation: Begin by taking a close look at your current financial status. Calculate your net worth, list your assets and liabilities, and analyze your spending habits. This will provide a clear picture of where you stand today and serve as a starting point for your retirement plan.

Define Your Retirement Goals: Ask yourself what you want your retirement to look like. Consider factors like when you want to retire, where you want to live, and what activities you’d like to pursue. Having specific goals will help you determine how much money you’ll need to save.

Maximize Retirement Savings Accounts: Take full advantage of retirement savings accounts such as 401(k)s, IRAs, and Roth IRAs. These accounts offer valuable tax advantages and can significantly boost your retirement savings over time. Contribute consistently and consider increasing your contributions as your income grows.

Understand Social Security Benefits: Social Security is a crucial part of many retirees’ income. Familiarize yourself with how it works and when it makes sense for you to start claiming benefits. Delaying benefits can result in higher monthly payments, so weigh the pros and cons carefully.

Diversify Your Investments: Diversification is a key strategy for managing risk in your retirement portfolio. Spread your investments across different asset classes to reduce the impact of market fluctuations. Consider working with a financial advisor to create an investment strategy that aligns with your goals and risk tolerance.

Seek Professional Advice: Don’t hesitate to seek the guidance of a certified financial advisor or retirement planner. These professionals can provide personalized strategies and help you make informed decisions. They can also assist with creating a comprehensive retirement plan tailored to your unique circumstances.

Remember that retirement planning is an ongoing process. Review and adjust your plan periodically as your circumstances change. By taking proactive steps today, you can build a nest egg that supports your retirement dreams and provides financial security for your future.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Retirement Planning Simplified: Our accounting experts can help …

More links

Don’t stop here; you can continue your exploration by following this link for more details: Will Your Retirement Income Be Enough?