Introduction

Securing a mortgage is a significant financial milestone for many people, but it can be a complex and intimidating process. Avoiding common mortgage mistakes is essential to ensure a smooth home buying experience. In this article, we’ll explore some of the most prevalent pitfalls that borrowers encounter and provide guidance on how to steer clear of them.

“Embarking on the journey of securing a mortgage is akin to setting sail on a significant financial voyage. While the destination is the cherished dream of homeownership, the path is often fraught with complexity and uncertainty. To navigate these waters successfully, it’s crucial to be vigilant and avoid the common mortgage mistakes that can turn your voyage into a turbulent one.

Inadequate Financial Preparation:

- Budget Assessment: One common misstep is not thoroughly assessing your financial readiness for homeownership. Failing to create a comprehensive budget that considers all homeownership costs, from the down payment to ongoing maintenance, can lead to financial strain.

Neglecting Credit Health:

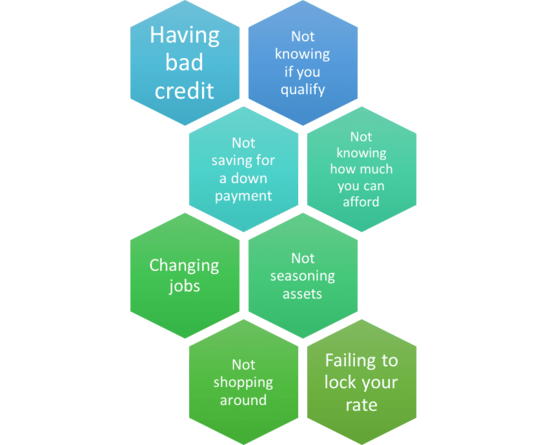

- Credit Check: Overlooking the importance of your credit health is a grave error. Mortgage lenders scrutinize credit reports and scores, so it’s essential to check and improve your credit if necessary before applying for a mortgage.

Skipping Pre-Approval:

- Pre-Approval: Bypassing the mortgage pre-approval process is a misstep. Pre-approval not only helps you understand your buying power but also makes you a more attractive buyer to sellers.

Neglecting Comparison Shopping:

- Lack of Comparison: Failing to shop around for lenders and mortgage terms is a mistake that can cost you thousands of dollars over the life of your loan. It’s essential to obtain quotes from multiple lenders to find the best deal.

Ignoring the Fine Print:

- Mortgage Terms: Glossing over the fine print of your mortgage terms can lead to surprises down the road. Understand all aspects of your loan, including interest rates, fees, and any potential penalties.

Overextending Financially:

- Stretching Finances: Many homebuyers make the error of purchasing a home that stretches their finances to the limit. This can lead to financial stress and limit your ability to save and invest in other financial goals.

Underestimating Ongoing Costs:

- Maintenance and Upkeep: Homeownership comes with ongoing costs, including maintenance, property taxes, and insurance. Underestimating these expenses can strain your budget.

Inadequate Research:

- Location and Neighborhood: Failing to research the location and neighborhood thoroughly can lead to dissatisfaction with your home’s surroundings. Investigate factors like schools, commute times, and local amenities.

Rushing the Process:

- Hasty Decisions: Rushing the homebuying process can result in poor decision-making. Take your time to find the right home that suits your needs and budget.

Lack of Professional Guidance:

- Expert Advice: Attempting to navigate the mortgage process without professional guidance is a mistake. Mortgage brokers and real estate agents can provide valuable insights and assistance.

In summary, securing a mortgage is a significant financial undertaking that demands diligence and foresight. Avoiding common mortgage mistakes, from financial preparation to the homebuying process, is paramount to ensuring a smooth and successful journey towards homeownership. By heeding this advice and seeking expert guidance when needed, you can navigate the complexities of mortgage financing with confidence.”

Don’t stop here; you can continue your exploration by following this link for more details: Avoid These 8 Common Investing Mistakes

One of the first steps in the mortgage application process is evaluating your creditworthiness. Failing to review your credit report for errors or discrepancies can lead to unfavorable loan terms or even mortgage rejection. Obtain a copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) and address any issues before applying for a mortgage.

“Regularly monitoring your credit report and addressing any errors or discrepancies is a proactive step in maintaining good credit health. A clean and accurate credit report can lead to better loan terms and greater financial opportunities.”

Looking for more insights? You’ll find them right here in our extended coverage: 17 Mistakes First-Time Homebuyers Should Avoid

Some homebuyers make the mistake of house hunting before obtaining a mortgage pre-approval. This misstep can lead to disappointment when you find your dream home but struggle to secure financing. Get pre-approved for a mortgage to determine your budget and improve your negotiating position with sellers.

Obtaining a mortgage pre-approval is a crucial initial step in the homebuying process. It not only helps you understand your budget but also demonstrates to sellers that you are a serious and qualified buyer. This can give you a competitive advantage in a competitive real estate market. So, before you start scouring listings and attending open houses, prioritize getting pre-approved for a mortgage to streamline your homebuying journey and increase your chances of securing your ideal home.

You can also read more about this here: Top 12 House-Hunting Mistakes

Even if you’re pre-approved for a certain loan amount, it doesn’t mean you should spend that much. Overstretching your budget can lead to financial strain and potentially jeopardize your ability to meet other financial goals. Consider your overall financial situation, including your monthly expenses, before committing to a mortgage.

“Pre-approval for a mortgage is a valuable step in the homebuying process, but it should serve as a starting point rather than a final destination. Here’s a more in-depth exploration of why it’s essential to exercise prudence when determining your budget:

The Pre-Approval Limit: When you receive a mortgage pre-approval, it represents the maximum amount a lender is willing to lend you based on your financial information at the time of the application. While this figure can be tempting, it’s crucial to remember that it’s a financial tool, not a mandate to spend the full amount.

Financial Realities: Your pre-approval amount may not align with your financial realities and goals. Overextending your budget by aiming for the highest pre-approved amount can lead to financial strain. Consider your current lifestyle, monthly expenses, and long-term financial objectives when deciding how much you’re comfortable spending on a mortgage.

Affordability and Peace of Mind: Affordability is a key factor in maintaining financial stability and peace of mind as a homeowner. It’s advisable to establish a housing budget that allows you to comfortably cover your mortgage payments while still having room in your budget for other essential expenses, savings, and unexpected financial challenges.

Future Financial Goals: Owning a home is just one aspect of your financial journey. You may have other goals, such as saving for education, retirement, or emergencies. Committing to a mortgage that consumes a significant portion of your income could hinder your ability to make progress toward these goals.

Interest Rates and Long-Term Costs: Keep in mind that interest rates play a crucial role in the overall cost of your mortgage. While low rates may make a larger loan amount seem affordable now, consider the long-term costs. A higher loan amount can result in significantly more interest paid over the life of the loan.

Homeownership Expenses: Beyond the mortgage payment, homeownership entails additional costs, such as property taxes, insurance, maintenance, and utilities. Ensure your budget accounts for these expenses to avoid financial stress down the road.

Flexibility and Future Financial Changes: Life is dynamic, and your financial situation may change. It’s essential to maintain flexibility in your budget to accommodate unexpected events or changes in income.

In conclusion, while a mortgage pre-approval is a helpful tool, responsible homeownership requires careful consideration of your overall financial situation and goals. Avoid the temptation to spend the maximum pre-approved amount and instead focus on finding a housing budget that aligns with your current and future financial well-being. By prioritizing affordability and financial security, you can embark on your homeownership journey with confidence and peace of mind.”

For a comprehensive look at this subject, we invite you to read more on this dedicated page: 15 Common First-Time Home Buyer Mistakes And How To Avoid …

Interest rates can vary significantly between lenders. Failing to shop around for the best mortgage rates could result in higher monthly payments over the life of your loan. Research and compare rates from multiple lenders to secure the most favorable terms.

“Interest rates can vary significantly between lenders. Failing to shop around for the best mortgage rates could result in higher monthly payments over the life of your loan. Research and compare rates from multiple lenders to secure the most favorable terms. Additionally, consider seeking pre-approval to strengthen your negotiating position when making an offer on a home.”

Additionally, you can find further information on this topic by visiting this page: Top 12 House-Hunting Mistakes

Mortgage agreements are laden with fine print, and some borrowers skim over these details without fully understanding the terms and conditions. Take the time to read and comprehend your mortgage contract, including any potential penalties or fees for early repayment or late payments.

Understanding your mortgage contract is crucial to avoid unexpected surprises. Review all terms, penalties, and fees carefully to make informed financial decisions and protect your interests throughout the life of your mortgage.

You can also read more about this here: Top 10 common credit card mistakes and how to avoid them

Beyond the down payment, homebuyers should budget for closing costs, which can include appraisal fees, title insurance, and attorney fees. Neglecting to save for these expenses can catch you off guard at the closing table. Be prepared and factor in closing costs when planning your home purchase.

Buying a home involves more than just saving for the down payment; it also requires careful consideration of the often-overlooked closing costs. These expenses, while not as prominent as the down payment, are a crucial part of the homebuying process and can catch you off guard if not adequately prepared. Here’s a closer look at what closing costs entail and why they deserve your attention:

- Appraisal Fees: An appraisal is essential to determine the fair market value of the property you intend to purchase. The cost of the appraisal typically falls on the buyer and can vary depending on the property’s size and location. It’s a necessary expense to ensure you’re not overpaying for your future home.

2

To delve further into this matter, we encourage you to check out the additional resources provided here: 16 First-Time Homebuyer Mistakes To Avoid | Bankrate

During the mortgage application process, it’s crucial to maintain financial stability. Changing jobs, accumulating new debts, or making large purchases can affect your eligibility and loan terms. Avoid significant financial changes until your mortgage is finalized.

One of the most crucial aspects of successfully securing a mortgage is maintaining financial stability throughout the application process. Any significant financial changes, such as switching jobs, taking on new debts, or making substantial purchases, can have a significant impact on your eligibility and the terms of your loan. It’s important to be cautious and avoid making such changes until your mortgage is finalized.

Lenders carefully assess your financial situation when determining your eligibility for a mortgage. They review your credit history, income stability, debt-to-income ratio, and overall financial health. Any abrupt alterations to these factors can create uncertainty and concern for lenders. Here are some common financial mistakes to avoid during the mortgage application process:

Changing Jobs: While changing jobs can sometimes be a positive career move, it can raise red flags for mortgage lenders. Lenders prefer borrowers with a stable employment history. If you must change jobs during the application process, try to stay within the same industry and maintain or increase your income.

Taking on New Debt: Accumulating new debts, such as personal loans, credit card balances, or auto loans, can negatively affect your credit score and debt-to-income ratio. This can make it harder to qualify for a mortgage or lead to less favorable terms.

Large Purchases: Making significant purchases, especially on credit, can also impact your debt-to-income ratio and credit utilization. Lenders may view this as increased risk, potentially resulting in higher interest rates or a denied application.

Missing Payments: Consistently paying bills late or missing payments can harm your credit score. Lenders closely examine your credit history, and a low credit score can lead to higher interest rates or loan denials.

Co-signing for Others: Co-signing on a loan for someone else can impact your debt-to-income ratio and financial stability. Even if you’re not the primary borrower, this commitment can affect your ability to qualify for a mortgage.

Changing Financial Priorities: Altering your financial goals or priorities during the mortgage application process can create confusion for both you and the lender. It’s best to maintain a consistent financial plan until your mortgage is finalized.

To maximize your chances of mortgage approval and secure favorable terms, it’s essential to communicate openly with your lender. If any significant financial changes are unavoidable, inform your lender immediately to explore potential solutions or adjustments to your application. Ultimately, maintaining financial stability and responsibility during the mortgage application process is key to achieving your homeownership goals.

Should you desire more in-depth information, it’s available for your perusal on this page: 17 Mistakes First-Time Homebuyers Should Avoid

Homeownership entails more than just mortgage payments. Don’t forget to budget for property taxes, homeowners’ insurance, maintenance, and potential renovations. Be realistic about the full cost of homeownership.

Certainly! Here’s an extension of the idea:

“Homeownership is a significant financial commitment that goes beyond mortgage payments. It’s crucial to factor in ongoing expenses such as property taxes, homeowners’ insurance, regular maintenance, and any planned renovations. A realistic budget ensures you’re well-prepared for the full cost of homeownership and helps you maintain financial stability.”

For additional details, consider exploring the related content available here 8 Mistakes That Real Estate Investors Should Avoid

Conclusion

Securing a mortgage is a significant financial commitment, and avoiding common mortgage mistakes is essential for a smooth home buying journey. By checking your credit, getting pre-approved, staying within your budget, and understanding your mortgage agreement, you can navigate the process confidently and achieve your homeownership goals while maintaining financial stability.

Securing a mortgage and embarking on the path to homeownership is a substantial financial undertaking, and it’s crucial to be well-prepared and informed to avoid common mortgage mistakes. Here’s an in-depth exploration of key steps and considerations that can help you navigate the process with confidence and financial stability:

Credit Check and Improvement: Begin by thoroughly checking your credit report and score. Your credit history plays a pivotal role in the mortgage approval process and the interest rate you’ll receive. Address any inaccuracies in your report and take steps to improve your credit score if needed. Paying down debts and managing your credit responsibly can have a positive impact on your mortgage terms.

Pre-Approval: Getting pre-approved for a mortgage should be a top priority. This step involves a lender assessing your financial situation and determining how much they are willing to lend you. It not only gives you a clear understanding of your budget but also demonstrates your seriousness as a buyer to sellers. Pre-approval strengthens your position in competitive real estate markets.

Budgetary Constraints: Establishing a budget is critical. Determine how much you can comfortably afford in monthly mortgage payments while still meeting your other financial obligations and savings goals. Keep in mind that homeownership comes with additional costs, such as property taxes, insurance, and maintenance. Staying within your budget safeguards your long-term financial stability.

Financial Planning: Consider your long-term financial goals. Owning a home is a significant investment, and it’s essential to ensure that this decision aligns with your broader financial objectives. Evaluate how homeownership fits into your retirement planning, education funding for children, and other financial aspirations.

Mortgage Agreement Understanding: Carefully review and understand all aspects of your mortgage agreement. Pay close attention to interest rates, loan terms, and any special features of the mortgage product. Clarify any doubts with your lender or a financial advisor. Knowing the details of your mortgage ensures that you make informed decisions throughout the homeownership journey.

Emergency Fund: Maintain an emergency fund. Homeownership can bring unexpected expenses, such as repairs or property-related emergencies. Having a financial cushion in place can prevent these unexpected costs from derailing your financial stability.

Future Planning: Think about the long-term implications of your mortgage. Are you considering refinancing in the future? Are you prepared for potential changes in interest rates? Having a financial strategy that accounts for potential adjustments in your mortgage can help you stay on track with your financial goals.

Professional Guidance: Seek guidance from professionals throughout the process. Mortgage brokers, real estate agents, and financial advisors can provide valuable insights and advice. Their expertise can help you avoid pitfalls and make sound financial decisions.

Market Research: Stay informed about the real estate market in your desired location. Understanding market trends and property values can help you make a wise investment decision. Don’t rush into a purchase; take your time to find the right property that aligns with your budget and long-term plans.

Flexibility and Adaptability: Finally, remain flexible and adaptable throughout the home buying process. Be open to negotiations, explore different mortgage options, and have a contingency plan in case your initial plans don’t work out. Flexibility can help you overcome unexpected challenges while maintaining your financial stability.

In conclusion, securing a mortgage and achieving homeownership goals require careful planning, financial diligence, and a comprehensive understanding of the process. Avoiding common mortgage mistakes involves a proactive approach that considers your credit, budget, long-term goals, and overall financial stability. By following these steps and seeking professional guidance when needed, you can embark on a smooth and financially sound journey towards homeownership.

To delve further into this matter, we encourage you to check out the additional resources provided here: Writing Resources – Writing a Good History Paper – Hamilton College

More links

For additional details, consider exploring the related content available here 8 Mistakes That Real Estate Investors Should Avoid