Table of Contents

- Understanding the Basics

- Create a Detailed Budget

- Explore Affordable Housing Options

- Use Public Transportation

- Shop Wisely

- Dine Strategically

- Save on Entertainment

- Prioritize Health Insurance

- Explore Banking Options

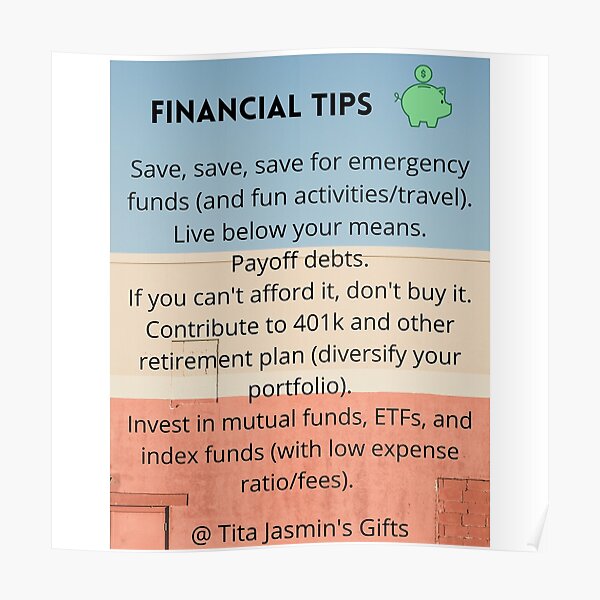

- Save for the Future

- Learn the Local Currency

- Emergency Fund

- Stay Informed

- Embracing Moscow’s Diversity on a Budget

Moscow, the vibrant capital of Russia, is a city of contrasts where rich history meets modern innovation. It’s also known for its diverse and sometimes unpredictable cost of living. Whether you’re a local resident or an expatriate, navigating the financial landscape of Moscow requires a bit of savvy and careful budgeting. In this article, we’ll explore the cost of living in Moscow and provide valuable financial tips to help you make the most of your life in this bustling metropolis.

Moscow, the vibrant capital of Russia, is a city that thrives on the interplay of contrasts. It’s where the opulent history of czars and empires converges with the cutting-edge innovations of a modern metropolis. This dynamic blend of past and present lends a unique character to the city, but it also extends to the realm of finances, creating a diverse and at times unpredictable cost of living.

For both local residents and expatriates, navigating Moscow’s financial landscape can be akin to embarking on an exciting but challenging adventure. Understanding the nuances of the city’s cost of living is essential for making the most of your experience in this bustling urban center.

One of the most striking aspects of living in Moscow is its diverse range of living expenses. On one hand, you can find high-end luxury establishments and exclusive neighborhoods where the cost of living rivals some of the world’s most expensive cities. On the other hand, there are budget-friendly options, especially if you’re willing to explore local markets, dine at traditional eateries and use public transportation.

Accommodation is often the most substantial expense for residents. The city offers a wide spectrum of housing choices, from luxurious apartments with stunning views of the Moscow River to more affordable options in the outskirts. Understanding your priorities and budget is crucial when it comes to selecting the right place to live.

Transportation in Moscow is a well-developed system and while it can be efficient and convenient, costs can add up. Knowing the best transportation options for your daily commute and leisure activities can help you manage this aspect of your budget effectively.

The dining scene in Moscow is a reflection of the city’s diversity. You can indulge in high-end international cuisine at upscale restaurants or savor traditional Russian dishes at local eateries. Balancing your culinary experiences with your budget is an art and exploring local markets and street food can be a delicious and cost-effective way to enjoy Moscow’s food culture.

Understanding currency exchange rates and banking practices is essential for expatriates and it’s wise to explore financial services that cater to international residents to minimize fees and inconveniences.

Finally, embracing the cultural richness of Moscow doesn’t have to break the bank. Many museums, galleries and cultural events offer discounts or free admission on certain days, making it more accessible for residents to enjoy the city’s rich artistic heritage.

In this article, we’ll delve deeper into the specifics of the cost of living in Moscow and provide valuable financial tips for navigating the city’s financial terrain. From budgeting techniques to insider insights on saving money while savoring the city’s offerings, our goal is to empower you to make informed financial decisions that allow you to fully immerse yourself in the vibrant tapestry of Moscow’s life and culture. After all, in this city of contrasts, financial savvy can open the door to a world of opportunities and unforgettable experiences.

Additionally, you can find further information on this topic by visiting this page: Differentiation Factors of the Debt Situation in Russian Urban …

Understanding the Basics

Before diving into budgeting tips, it’s essential to grasp the fundamental elements that contribute to the cost of living in Moscow:

“Before diving into budgeting tips, it’s essential to grasp the fundamental elements that contribute to the cost of living in Moscow. Understanding the dynamics of this vibrant and culturally rich city will not only help you manage your finances effectively but also enhance your overall experience of living in Moscow.

1. Housing Costs: Moscow’s real estate market is diverse, ranging from luxurious apartments in the city center to more affordable options in outlying districts. Rental prices can vary significantly based on location, size and amenities. It’s crucial to research the housing market thoroughly, considering factors like proximity to work, public transportation and neighborhood safety when choosing a place to live.

2. Transportation Expenses: Moscow boasts an extensive and efficient public transportation system, including the metro, buses, trams and commuter trains. The cost of commuting can be a significant part of your monthly expenses. Understanding the various ticket options, such as single rides, monthly passes or contactless cards, will help you manage transportation costs effectively.

3. Food and Dining: Moscow offers a wide range of dining experiences, from budget-friendly street food to upscale restaurants. The cost of groceries can also vary based on where you shop and your dietary preferences. Exploring local markets and preparing meals at home can help you save on food expenses, while occasional dining out can be a delightful way to savor Russian cuisine.

4. Utilities and Services: Monthly utility bills, including electricity, water, heating and internet, are an integral part of your budget. Understanding the billing cycles and comparing service providers can help you find cost-effective options.

5. Healthcare and Insurance: Health insurance is essential when living in Moscow. While the city has excellent medical facilities, having comprehensive health coverage is crucial for your peace of mind. Research the available insurance plans and choose one that suits your needs.

6. Entertainment and Recreation: Moscow offers a vibrant cultural scene, with theaters, museums and cultural events. Managing your entertainment expenses is key to budgeting effectively. Look for discounted tickets, free exhibitions and cultural events to enjoy the city’s offerings without breaking the bank.

7. Education Expenses: If you have children attending international or private schools, factor in their tuition fees and related expenses. Moscow has several excellent educational institutions, but the cost can vary considerably.

8. Savings and Emergency Funds: Beyond covering your regular expenses, it’s crucial to allocate a portion of your income to savings and emergency funds. This financial cushion provides security and ensures you’re prepared for unexpected expenses or future investments.

9. Currency Exchange and Banking: Understanding the local currency, exchange rates and banking services is essential for managing your finances effectively. Familiarize yourself with the banking options available and consider opening a local bank account for convenience.

10. Cultural Adjustments: Finally, be prepared for cultural adjustments that may affect your spending habits. Embrace the local lifestyle while staying mindful of your financial goals and priorities.

By gaining a comprehensive understanding of these fundamental elements, you’ll be better equipped to create a budget that suits your lifestyle and financial goals in Moscow. Effective budgeting ensures that you can make the most of your experience in this dynamic and culturally rich city while maintaining financial stability and peace of mind.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: A Basic Guide to Exporting

Create a Detailed Budget

Begin by outlining your monthly income and expenses. Track your spending to identify areas where you can cut back or save.

Begin by outlining your monthly income and expenses as a crucial step toward financial control and stability. This process serves as the foundation for managing your finances effectively. It’s akin to creating a roadmap for your financial journey, helping you navigate your way toward financial goals and security.

Understanding Your Income: Start by clearly identifying and documenting all sources of income. This includes your salary, any freelance or side gig income, rental income, dividends or any other money that regularly comes your way. Knowing your total income provides a realistic picture of what you have to work with each month.

Expense Categories: Categorize your expenses into fixed and variable categories. Fixed expenses are those that remain relatively constant each month, such as rent or mortgage, utilities, insurance premiums and loan payments. Variable expenses encompass items like groceries, dining out, entertainment and shopping, which may fluctuate from month to month.

Tracking Spending: Implement a robust tracking system to monitor your spending. This can be done manually through spreadsheets or by using budgeting apps that automatically categorize your expenses. Tracking allows you to see exactly where your money is going, which is essential for identifying areas where you can cut back or save.

Budgeting: Create a budget that allocates specific amounts to each expense category based on your income and financial goals. Be realistic and considerate of your needs and priorities. Budgeting is not about depriving yourself but rather about making conscious choices that align with your financial objectives.

Identify Saving Opportunities: As you track your spending, you’ll likely discover areas where you can make adjustments to save more. It could be as simple as reducing impulse purchases, cooking at home more often or canceling unused subscriptions. These small changes can add up significantly over time.

Emergency Fund and Savings Goals: Prioritize building an emergency fund to cover unexpected expenses. Having this financial safety net can prevent you from going into debt when the unexpected occurs. Additionally, set specific savings goals, whether it’s for a vacation, a down payment on a home or retirement. Having clear objectives will motivate you to stick to your budget and save diligently.

Regular Review: Your financial situation can change over time, so it’s essential to review your budget regularly. Reevaluate your income and expenses periodically and adjust your budget as needed. Life events, such as job changes or family additions, may require modifications to your financial plan.

Seek Professional Guidance: If you find it challenging to manage your finances independently, consider seeking help from a financial advisor. They can provide expert guidance, help you create a comprehensive financial plan and offer strategies to reach your long-term financial goals.

In summary, the process of outlining your income and expenses, tracking spending and creating a budget is a fundamental practice for financial well-being. It empowers you to take control of your finances, make informed decisions and work toward a more secure and prosperous future. Remember that financial management is an ongoing process and with diligence and discipline, you can achieve your financial aspirations.

Explore this link for a more extensive examination of the topic: Budget of the United States Government, Fiscal Year 2023

Explore Affordable Housing Options

While central districts are appealing, consider living in less expensive neighborhoods and commuting to work. Sharing an apartment with roommates can also reduce housing costs.

While central districts in cities often hold a strong allure, there’s a whole world of living possibilities beyond the urban core that can offer both financial benefits and unique lifestyle advantages. Here’s why considering less expensive neighborhoods and exploring shared housing arrangements can be a savvy choice:

Cost-Effective Living: Less expensive neighborhoods typically offer more affordable housing options, whether it’s renting an apartment, a house or even purchasing a property. This can result in significant savings on rent or mortgage payments, leaving you with more disposable income for other aspects of your life.

Community and Diversity: Many less expensive neighborhoods are known for their vibrant communities and diverse populations. Living in these areas can provide a more authentic cultural experience and opportunities to connect with a wide range of people from different backgrounds.

Reduced Commute Stress: While living in the city center may seem convenient for work, it often comes with the stress of rush-hour traffic, crowded public transportation and long commutes. Opting for a neighborhood outside the central business district can mean a shorter, more relaxed commute, allowing you to start and end your workday on a less frenetic note.

Discovering Hidden Gems: Less expensive neighborhoods often hide gems like local markets, authentic restaurants and unique shops. Exploring these hidden treasures can become a delightful part of your daily routine, offering a rich tapestry of experiences.

Quiet and Green Spaces: Suburban and less expensive neighborhoods tend to have more green spaces, parks and recreational areas. If you value peace and access to nature, living in these areas can provide a more tranquil and relaxing environment.

Roommate Savings: Sharing an apartment or house with roommates can significantly reduce housing costs, making it an attractive option for those looking to maximize savings. It can also lead to enriching social experiences and lasting friendships.

Financial Flexibility: Lower housing costs can free up your budget for other financial goals, such as saving for travel, investing or pursuing hobbies and interests that enrich your life.

Affordable Entertainment: Less expensive neighborhoods often have budget-friendly entertainment options, including local theaters, cultural events and community activities. This means you can enjoy a fulfilling social life without breaking the bank.

Investment Potential: In some cases, less expensive neighborhoods may be undergoing revitalization, which can lead to property value appreciation over time. This presents the opportunity for long-term financial growth if you choose to buy property in such areas.

Personalized Space: Living in a neighborhood outside the city center often means you can afford more living space for yourself or your family. This can lead to a more comfortable and personalized living environment.

Reduced Cost of Living: Beyond housing, the cost of living in less expensive neighborhoods, including groceries, dining and everyday expenses, can be lower, allowing you to stretch your budget further.

Supporting Local Businesses: Choosing to live in a less expensive neighborhood often means supporting local businesses and contributing to the growth and vibrancy of the community.

While central districts certainly have their allure, exploring the benefits of less expensive neighborhoods and shared housing arrangements can open up a world of possibilities for those seeking financial stability, unique cultural experiences and a more relaxed pace of life. Ultimately, the choice of where to live should align with your personal preferences, financial goals and lifestyle priorities.

Explore this link for a more extensive examination of the topic: The territorial impact of COVID-19: Managing the crisis across levels …

Use Public Transportation

The Moscow Metro and buses are cost-effective and efficient ways to get around the city. Consider purchasing a monthly travel pass to save on transportation expenses.

The Moscow Metro and bus system not only offer efficient transportation within the city but also present an opportunity for both residents and visitors to optimize their travel expenses. For those looking to make the most of their time in Moscow or for locals seeking economical commuting options, purchasing a monthly travel pass can be a savvy decision with several advantages.

Cost Savings: One of the most significant benefits of opting for a monthly travel pass is the substantial cost savings it offers. For frequent commuters or travelers exploring Moscow extensively, the pass often proves to be more budget-friendly than purchasing individual tickets for every journey. With a fixed monthly fee, you can enjoy unlimited rides on the metro and buses, which can add up to significant savings over time.

Convenience: Monthly travel passes enhance the convenience of using public transportation. There’s no need to queue up for tickets or worry about having exact change for bus fares. Simply flash your pass and you’re good to go. This convenience factor not only saves time but also reduces the hassle associated with daily commuting.

Freedom to Explore: For tourists and newcomers to Moscow, a monthly pass provides the freedom to explore the city at their own pace. You can hop on and off public transportation without worrying about the cost of each ride, making it easier to discover the many historical, cultural and culinary delights that Moscow has to offer.

Reduced Environmental Impact: Opting for public transportation, especially when using a monthly pass, can contribute to reducing your environmental footprint. By choosing buses and the metro over private vehicles, you’re helping to decrease traffic congestion and lower carbon emissions, making Moscow a more sustainable and eco-friendly city.

Predictable Budgeting: With a monthly travel pass, you can budget your transportation expenses more predictably. Knowing the exact cost of commuting or traveling within Moscow for a month allows for better financial planning and fewer surprises in your monthly budget.

Access to Outlying Areas: Moscow’s extensive public transportation network, including the metro and buses, provides access to not only the city center but also its outlying suburbs and neighborhoods. With a monthly pass, you can conveniently explore areas beyond the city center without incurring extra costs, offering a broader perspective of Moscow’s diversity.

In conclusion, whether you’re a resident or a visitor in Moscow, a monthly travel pass for the metro and buses is a practical and cost-effective solution. It simplifies your transportation experience, saves you money in the long run and allows you to fully immerse yourself in all that Moscow has to offer, making it a win-win for both your wallet and your travel experience.

Additionally, you can find further information on this topic by visiting this page: The cost of living in Russia: a comprehensive guide | Expatica

Shop Wisely

Take advantage of local markets and discount stores for groceries. Planning meals and buying in bulk can also help save money.

Taking advantage of local markets and discount stores for groceries is a savvy way to manage your budget while still enjoying delicious and nutritious meals. Here are some additional tips and strategies to make the most of your grocery shopping and save money:

1. Plan Your Meals: Before heading to the store, plan your meals for the week. Create a list of the ingredients you’ll need, considering recipes that use similar ingredients to minimize waste. Meal planning not only helps you save money but also reduces food spoilage.

2. Buy in Bulk: Consider purchasing non-perishable items and pantry staples in bulk. Items like rice, pasta, canned goods and dry beans are often more affordable when bought in larger quantities. Be sure to store them properly to maintain freshness.

3. Explore Local Farmers’ Markets: Farmers’ markets are a great way to access fresh, locally sourced produce at competitive prices. You can often find seasonal fruits and vegetables that are both affordable and bursting with flavor. Plus, you’ll be supporting local farmers.

4. Embrace Store Brands: Many supermarkets offer their own store brands, which are typically more budget-friendly than name brands. These store-brand products are often of high quality and provide excellent value for your money.

5. Shop During Sales and Promotions: Keep an eye on sales, promotions and discounts offered by your local grocery stores. This includes weekly circulars, special offers and loyalty programs. Timing your shopping to coincide with these promotions can lead to significant savings.

6. Use Coupons and Cashback Apps: Digital coupons and cashback apps like Ibotta and Rakuten can help you save on a wide range of grocery items. These apps offer rebates and discounts that you can redeem after your purchase, putting money back in your pocket.

7. Opt for Frozen and Canned Foods: Frozen fruits and vegetables, as well as canned goods, can be cost-effective alternatives to fresh produce, especially when certain items are out of season. They have a longer shelf life and can be just as nutritious.

8. Limit Convenience and Pre-Packaged Foods: Convenience foods and pre-packaged meals often come with a higher price tag. Preparing meals from scratch not only saves money but also allows you to have greater control over the ingredients and portions.

9. Compare Prices: Take the time to compare prices across different brands and stores. Sometimes, a quick check can reveal significant price variations, allowing you to make the most budget-friendly choices.

10. Minimize Impulse Purchases: Stick to your shopping list and avoid impulse purchases. Retailers often strategically place tempting items near the checkout counters, so staying disciplined can help you stay within your budget.

By implementing these strategies and being mindful of your grocery spending habits, you can make the most of local markets and discount stores to save money without compromising on the quality and variety of your meals. Smart grocery shopping is not only economical but also a rewarding way to manage your finances effectively.

Don’t stop here; you can continue your exploration by following this link for more details: Untitled

Dine Strategically

Enjoy the city’s dining scene without breaking the bank by opting for lunch specials, exploring local eateries and reserving fine dining experiences for special occasions.

“Enjoy the city’s dining scene without breaking the bank by opting for lunch specials, exploring local eateries and reserving fine dining experiences for special occasions.

Lunch Specials: Many restaurants offer enticing lunch specials that provide a taste of their culinary excellence at a fraction of the dinner price. It’s the perfect opportunity to savor gourmet dishes without the premium cost. Plus, lunch hours often come with a more relaxed atmosphere, allowing you to enjoy your meal at your own pace.

Local Eateries: Don’t underestimate the charm of local eateries and hole-in-the-wall restaurants. These hidden gems often serve up authentic, flavorful cuisine that won’t dent your wallet. By dining where the locals do, you not only save money but also get a genuine taste of the city’s culinary soul.

Special Occasions: While exploring budget-friendly options, don’t forget to set aside moments for special occasions. Fine dining experiences in the city can be unforgettable and they’re worth indulging in for celebrations, anniversaries or milestones. By reserving these experiences for select moments, you’ll appreciate them all the more.

In a city known for its diverse culinary offerings, there’s no shortage of ways to enjoy exquisite flavors without overspending. Whether you’re sipping on a cappuccino at a quaint café, savoring street food at a bustling market or sipping champagne at a Michelin-starred restaurant, New York City’s dining scene is as varied as it is accessible. So, relish every bite and every moment, knowing that you can navigate the city’s culinary delights with both savvy and splendor.”

Should you desire more in-depth information, it’s available for your perusal on this page: GlobalTrends_2040.pdf

Save on Entertainment

Look for free or low-cost cultural events, museums with discounted admission days and explore Moscow’s numerous parks and green spaces for inexpensive leisure activities.

When exploring Moscow on a budget, there’s a wealth of affordable and often free experiences waiting to be discovered. Here are some savvy tips for making the most of your visit without breaking the bank:

1. Free Cultural Events: Moscow boasts a vibrant cultural scene and many events are free to attend. Keep an eye out for open-air concerts, street performances and public art installations. During the summer months, you’ll find a plethora of outdoor events, from music festivals to dance performances, that won’t cost you a dime.

2. Discounted Museum Days: Moscow’s museums offer discounted or even free admission on certain days of the week or month. Plan your visits accordingly to take advantage of these deals. For example, the Pushkin State Museum of Fine Arts offers free admission on the third Sunday of each month.

3. Explore Red Square and St. Basil’s: While some attractions within Red Square may require an entrance fee, simply strolling around this iconic location won’t cost you a thing. You can admire the stunning architecture of St. Basil’s Cathedral and take in the grandeur of the Kremlin from the outside.

4. Gorky Park: Gorky Park, one of Moscow’s most beloved green spaces, offers plenty of free activities. You can stroll along its scenic pathways, relax by the ponds or watch skateboarders and rollerbladers at the skate park. In the winter, the park turns into a winter wonderland with ice skating and other seasonal activities.

5. Visit Patriarch’s Ponds: Made famous by Mikhail Bulgakov’s novel “The Master and Margarita,” Patriarch’s Ponds is a charming area to explore on foot. It’s a serene escape from the city’s hustle and bustle and provides a glimpse into Moscow’s literary history.

6. People-Watch at Arbat Street: Arbat Street is a lively pedestrian thoroughfare where you can indulge in some prime people-watching. It’s lined with street performers, souvenir shops and outdoor cafes. You can soak in the atmosphere without spending much.

7. Explore Local Markets: Moscow’s markets are a great way to experience local life and enjoy inexpensive street food. Visit places like Danilovsky Market to savor Russian cuisine at a fraction of the cost of a restaurant meal.

8. Take Advantage of Metro Art: Moscow’s metro system is not just a means of transportation; it’s an underground art gallery. Many metro stations are adorned with intricate mosaics, sculptures and ornate architecture. You can explore this subterranean art for the price of a metro ticket.

9. Attend Free Lectures and Workshops: Look for universities and cultural centers that host free lectures, workshops and cultural events. These gatherings often provide insights into Russian culture, history and contemporary issues.

By being resourceful and seeking out these budget-friendly experiences, you can savor the best of Moscow without straining your wallet. Moscow’s cultural richness and vibrant atmosphere are accessible to all, making it a welcoming destination for travelers on any budget.

You can also read more about this here: Cost of Living in Idaho (2023) | SoFi

Prioritize Health Insurance

Ensure you have comprehensive health insurance coverage, as healthcare costs can be high without it.

Securing comprehensive health insurance coverage is not just a financial safeguard; it’s a vital necessity in today’s world. In an era where healthcare costs can escalate rapidly, having robust insurance coverage is your shield against unexpected medical expenses that could otherwise prove overwhelming. Let’s explore why comprehensive health insurance is a paramount consideration and how it can provide you with peace of mind and financial security.

1. Protection Against Unforeseen Medical Expenses: Comprehensive health insurance serves as a safety net, catching you in the event of unforeseen medical emergencies. Whether it’s a sudden illness, a debilitating injury or the need for a major surgery, your insurance coverage ensures that you receive the necessary medical care without having to bear the full brunt of the expenses. This protection is especially critical in times of crisis when your focus should be on recovery, not financial worry.

2. Access to Quality Healthcare: With health insurance, you gain access to a network of healthcare providers and facilities. This means you can receive medical attention from qualified professionals, access specialized treatments and benefit from the latest advancements in healthcare. Insurance enhances your ability to make informed healthcare choices and receive the best possible care.

3. Preventive Care and Wellness Programs: Many comprehensive insurance plans include coverage for preventive care and wellness programs. This not only encourages you to prioritize your health but also identifies potential health issues early, when they are more manageable and less costly to treat. Regular check-ups, vaccinations and screenings become part of your healthcare routine, contributing to long-term well-being.

4. Financial Security and Peace of Mind: Healthcare expenses can be exorbitant, particularly for major medical procedures or ongoing treatments. Without insurance, these costs can quickly deplete your savings, disrupt your financial stability and lead to long-term debt. Comprehensive health insurance offers financial security by limiting your out-of-pocket expenses and ensuring that you are not burdened by the high cost of medical care.

5. Coverage Beyond Medical Expenses: Comprehensive health insurance often extends coverage beyond medical expenses. It may include provisions for prescription medications, mental health services, maternity care and more, depending on the plan. This holistic approach to healthcare ensures that you receive comprehensive care tailored to your specific needs.

6. Compliance with Legal Requirements: In some regions or countries, having health insurance is a legal requirement. Failing to maintain insurance coverage can result in fines or legal penalties. Ensuring you have the necessary insurance not only keeps you financially protected but also helps you stay compliant with the law.

7. Flexibility and Choice: Comprehensive health insurance plans often offer a degree of flexibility in choosing healthcare providers and specialists. This allows you to make informed decisions about your care and select providers that align with your healthcare preferences.

In conclusion, comprehensive health insurance is your key to navigating the complexities of the modern healthcare landscape with confidence and financial security. It ensures that you receive the care you need when you need it, without the looming specter of unmanageable medical bills. Prioritizing your health through insurance is an investment not only in your well-being but also in your peace of mind, offering you the assurance that you can face any medical challenge that comes your way.

To delve further into this matter, we encourage you to check out the additional resources provided here: Budget of the United States Government, Fiscal Year 2023

Explore Banking Options

Choose a bank that offers competitive fees and services that align with your financial needs. Online banking can also provide convenience and cost savings.

When selecting a bank, it’s essential to make a choice that not only suits your financial requirements but also ensures you get the most value from your banking experience. Opt for a financial institution that offers competitive fees and services tailored to your specific needs. By doing so, you can efficiently manage your money while minimizing unnecessary expenses.

In today’s digital age, online banking has become an increasingly attractive option for many. The convenience it offers is unparalleled – you can access your accounts and conduct transactions from the comfort of your home or on the go. This not only saves valuable time but also reduces the need for in-person visits to a physical bank branch.

Moreover, online banking often comes with cost-saving advantages. Many online banks boast lower fees and higher interest rates on savings accounts compared to traditional brick-and-mortar institutions. By choosing online banking, you can potentially maximize your savings and earnings.

Additionally, the digital nature of online banking promotes eco-friendliness by reducing paper usage. Statements, bills and documents can be accessed electronically, contributing to a more sustainable and environmentally conscious banking experience.

In conclusion, the choice of your bank and the decision to embrace online banking can significantly impact your financial well-being. Prioritize a bank that aligns with your financial goals and consider the convenience and cost-saving benefits that online banking can bring to your financial life. Ultimately, a well-informed choice can make managing your finances easier, more efficient and more economical.

Explore this link for a more extensive examination of the topic: G20 Bali Leaders’ Declaration | The White House

Save for the Future

Consider opening a savings account or investment account to build a financial safety net and plan for your future goals.

“Consider opening a savings account or investment account to build a financial safety net and plan for your future goals. Regularly setting aside a portion of your income not only helps you accumulate funds but also cultivates a habit of financial discipline. Assess your financial situation and choose an account that aligns with your goals, whether it’s buying a house, starting a business or traveling the world. Over time, your savings or investments can grow and provide you with the means to achieve your aspirations, ensuring a more secure and fulfilling future.”

Don’t stop here; you can continue your exploration by following this link for more details: 4 Free Personal Finance Courses That Can be Done in Three Hours

Learn the Local Currency

Familiarize yourself with the Russian ruble and exchange rates to avoid overpaying when making currency conversions.

To ensure a smooth and cost-effective financial experience during your visit to Russia, it’s essential to take the time to familiarize yourself with the Russian ruble and exchange rates. Understanding the currency and its nuances will not only prevent you from overpaying but also enhance your overall travel experience.

The Russian ruble, often symbolized as ₽ and abbreviated as RUB, is the official currency of Russia. While it’s relatively easy to acquire rubles within the country, it’s still wise to have a basic understanding of the exchange rates before you arrive. This knowledge allows you to make informed decisions about when and where to exchange your money.

Exchange rates fluctuate and they can vary slightly between different exchange providers, such as banks, exchange offices and ATMs. It’s a good practice to check the current rates with reliable sources like financial websites or smartphone apps. This helps you identify favorable rates and avoid less favorable ones, ultimately maximizing your currency conversion.

When exchanging your currency, be mindful of any fees or commissions charged by the service provider. Some outlets may offer better rates but charge higher fees, while others may have lower fees but less competitive rates. By comparing the overall cost of currency conversion, you can make informed choices that save you money in the long run.

Additionally, it’s beneficial to carry a small amount of Russian rubles with you upon arrival in Russia. This provides immediate access to local currency for essentials like transportation, meals and incidentals. It’s also wise to keep some U.S. dollars or euros as backup in case you encounter difficulties with currency exchange at your destination.

While card payments are widely accepted in many urban areas of Russia, cash remains the preferred method of payment in some places, especially in more remote or smaller towns. Being prepared with local currency ensures you can navigate all aspects of your trip comfortably.

By taking the time to familiarize yourself with the Russian ruble and exchange rates, you not only avoid overpaying but also gain a sense of confidence and financial control during your visit. This practical knowledge empowers you to make the most of your travel experience, whether you’re exploring Moscow’s vibrant cultural heritage or venturing into the beautiful Russian countryside.

Don’t stop here; you can continue your exploration by following this link for more details: Budget of the United States Government, Fiscal Year 2023

Emergency Fund

Build an emergency fund to cover unexpected expenses, such as medical emergencies or repairs.

Building an emergency fund is not just a financial safeguard; it’s a strategic move that can provide peace of mind and financial stability in times of uncertainty. Here’s why having such a fund is crucial:

Financial Resilience: Life is full of surprises and not all of them are pleasant. From unexpected medical bills to car breakdowns or home repairs, unforeseen expenses can disrupt your financial equilibrium. Having an emergency fund means you’re prepared to tackle these challenges without resorting to high-interest loans or credit card debt.

Stress Reduction: Financial stress can take a toll on your well-being and relationships. Knowing that you have a safety net in the form of an emergency fund can alleviate anxiety and allow you to focus on solutions rather than worrying about how to cover unexpected costs.

Protection Against Debt: Relying on credit cards or loans to cover emergencies can lead to a cycle of debt that’s hard to break. An emergency fund prevents you from falling into this trap, as you have cash readily available to handle unforeseen expenses. This not only saves you money on interest but also preserves your credit score.

Swift Response: Emergencies often require quick action. Whether it’s a medical procedure, a necessary home repair or a sudden job loss, having cash on hand allows you to respond promptly and decisively, minimizing the impact of the crisis.

Peace of Mind: Knowing that you have a financial cushion gives you a sense of control and confidence. It’s like having a safety net that allows you to navigate life’s uncertainties with resilience and composure. You’ll sleep better at night, knowing that you’re prepared for whatever comes your way.

Goal Achievement: An emergency fund is not just for dealing with unexpected expenses. It also helps you stay on track with your financial goals. Without the burden of unexpected costs, you can continue saving for retirement, a dream vacation or a down payment on a house, uninterrupted.

Financial Freedom: Ultimately, an emergency fund is a cornerstone of financial freedom. It liberates you from the paycheck-to-paycheck cycle and empowers you to make choices based on your aspirations, not just your immediate needs.

So, start building your emergency fund today. Set a monthly savings goal, even if it’s a modest amount and watch it grow over time. Remember, emergencies are a part of life, but with a well-funded safety net, you can face them with confidence and financial resilience.

Looking for more insights? You’ll find them right here in our extended coverage: The territorial impact of COVID-19: Managing the crisis across levels …

Stay Informed

Keep up with changes in local regulations, tax laws and economic trends that may impact your financial situation.

Staying informed about changes in local regulations, tax laws and economic trends is not just a wise financial move; it’s essential for making informed decisions that can significantly impact your financial well-being. Here’s why it’s crucial to keep up with these evolving factors:

1. Regulatory Compliance: Local regulations and laws are subject to change and failure to stay compliant can result in fines or legal complications. By staying informed, you can ensure that your financial practices, whether in business or personal finance, align with the current legal requirements.

2. Tax Efficiency: Tax laws can have a profound effect on your financial situation. Being aware of changes in tax codes, deductions and credits can help you optimize your tax strategy. This might mean reducing your tax liability, taking advantage of new opportunities or adjusting your financial plans accordingly.

3. Economic Resilience: Economic trends, including inflation, interest rates and market fluctuations, can impact your investments, savings and purchasing power. Keeping an eye on these trends allows you to adapt your financial strategy to minimize risks and seize opportunities for growth.

4. Financial Planning: Changes in local regulations and economic conditions can necessitate adjustments to your financial plan. Whether you’re saving for retirement, planning for a major purchase or managing debt, staying informed helps you make decisions that align with your goals and circumstances.

5. Business Success: For entrepreneurs and business owners, understanding local regulations is crucial for maintaining a thriving enterprise. Changes in tax laws, labor regulations and industry-specific rules can all have a profound impact on your business’s profitability and sustainability.

6. Risk Management: In an ever-changing financial landscape, risk management is paramount. By keeping up with economic trends and regulatory changes, you can identify potential risks early and take proactive measures to mitigate them.

7. Investment Strategies: If you’re an investor, staying informed about market trends and shifts can help you make informed decisions about asset allocation, diversification and when to buy or sell investments.

8. Financial Security: Ultimately, staying informed about these factors contributes to your overall financial security. Being aware of changes allows you to make adjustments in real time, reducing the likelihood of financial setbacks or unexpected challenges.

In a world where change is constant, staying financially savvy means staying informed. It empowers you to make strategic decisions that protect and enhance your financial well-being, adapt to new circumstances and achieve your long-term financial goals. Whether you’re an individual managing your personal finances or a business owner navigating complex financial landscapes, being proactive and well-informed is key to financial success and resilience.

To delve further into this matter, we encourage you to check out the additional resources provided here: Budget of the United States Government, Fiscal Year 2023

Embracing Moscow’s Diversity on a Budget

Moscow’s cost of living can be manageable with careful planning and budgeting. By prioritizing your spending, making informed financial decisions and exploring cost-effective options for housing, transportation and entertainment, you can enjoy all that this dynamic city has to offer while maintaining financial stability. Remember that Moscow’s diversity extends beyond its culture and people; it’s also reflected in the financial opportunities and challenges it presents to its residents.

Moscow’s cost of living can be manageable with careful planning and budgeting. By prioritizing your spending, making informed financial decisions and exploring cost-effective options for housing, transportation and entertainment, you can enjoy all that this dynamic city has to offer while maintaining financial stability. Remember that Moscow’s diversity extends beyond its culture and people; it’s also reflected in the financial opportunities and challenges it presents to its residents.

1. Affordable Housing Options: Moscow offers a range of housing options, from centrally located apartments to more budget-friendly areas on the outskirts. Consider sharing an apartment with roommates to split the rent and reduce living expenses. Additionally, explore government-subsidized housing programs and rental assistance options that may be available.

2. Public Transportation: Moscow has an extensive and efficient public transportation system, including buses, trams and the metro. Invest in a transportation card or pass to save on daily commuting costs. It’s often more cost-effective than owning and maintaining a private vehicle in the city.

3. Entertainment on a Budget: While Moscow has a thriving cultural scene, you can enjoy entertainment without breaking the bank. Look for free or low-cost cultural events, museums with discounted admission days and explore the city’s parks and outdoor activities, which are often budget-friendly or free of charge.

4. Meal Planning and Cooking: Dining out in Moscow can be expensive, so consider cooking at home more often. Explore local markets for fresh, affordable ingredients and embrace the rich culinary traditions by preparing your own Russian dishes. This can be a cost-effective way to savor local flavors.

5. Financial Literacy: Familiarize yourself with the local financial landscape, including banking options and currency exchange rates. Understand the costs associated with international money transfers to make informed decisions about managing your finances efficiently.

6. Healthcare Planning: Healthcare costs can vary, so it’s essential to have proper health insurance coverage. Explore different health insurance plans and providers to ensure you have access to quality medical care without unexpected expenses.

7. Building Savings: While enjoying life in Moscow, don’t forget to prioritize saving. Set financial goals and create a budget that includes saving for emergencies, retirement and future financial aspirations. Building financial stability is a long-term investment in your well-being.

8. Financial Assistance Programs: Investigate whether you qualify for any government or community assistance programs. Moscow may offer support in areas such as housing subsidies, educational grants and social welfare programs that can alleviate financial burdens.

9. Networking and Community: Connect with local residents and expat communities to gain insights into cost-saving strategies and local resources. Building a support network can be valuable in navigating the financial aspects of living in Moscow.

10. Language Proficiency: Improving your Russian language skills can open up opportunities for finding cost-effective solutions and better understanding financial transactions, contracts and negotiations.

Living in Moscow can be a fulfilling experience that combines rich cultural heritage with unique financial dynamics. By approaching your finances strategically, you can thrive in this diverse and vibrant city while maintaining financial stability and making the most of the opportunities it has to offer. Moscow’s cultural and financial diversity can be your source of inspiration and growth, both personally and financially.

For additional details, consider exploring the related content available here Four Contending U.S. Approaches to Multilateralism – Carnegie …

More links

To expand your knowledge on this subject, make sure to read on at this location: Residence Hall Cost of Living | U of I Housing & Residence Life