Introduction

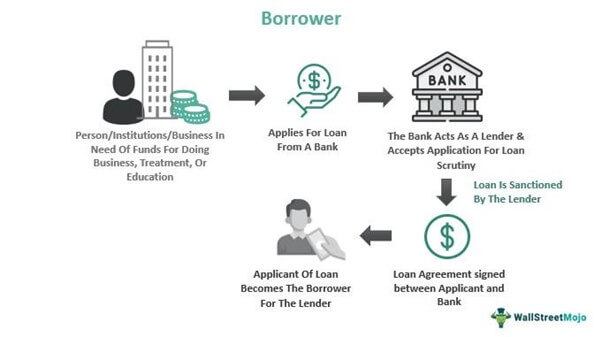

When diving into the world of homeownership and mortgages, you’re likely to encounter a slew of acronyms, with PMI and MIP being among the most common. These acronyms stand for Private Mortgage Insurance and Mortgage Insurance Premium, respectively. But what exactly do they mean, and why are they important? In this article, we’ll decode the world of mortgage insurance, demystifying these acronyms and shedding light on their significance for both lenders and borrowers.

Private Mortgage Insurance (PMI) and Mortgage Insurance Premium (MIP) are acronyms you’ll often come across in the realm of homeownership and mortgages. PMI is short for Private Mortgage Insurance, while MIP stands for Mortgage Insurance Premium. But what do these terms really entail, and why should you care? In this article, we’ll unravel the mystery of mortgage insurance, providing clarity on these acronyms and explaining their relevance to both lenders and borrowers.

Should you desire more in-depth information, it’s available for your perusal on this page: Publication 936 (2022), Home Mortgage Interest Deduction | Internal …

Mortgage insurance, in its various forms, serves as a safeguard for lenders in case borrowers default on their loans. It’s typically required when the down payment on a home is less than 20% of the purchase price. Let’s explore the different types of mortgage insurance and their roles in the homebuying process.

“Mortgage insurance, a financial safety net for lenders, plays a pivotal role in the homebuying process, especially when down payments fall below the 20% threshold. Understanding the various types of mortgage insurance and their functions is essential for borrowers. Here’s a comprehensive exploration of these insurance options and their significance:

Private Mortgage Insurance (PMI): PMI is a common type of insurance that lenders often require when a borrower makes a down payment of less than 20%. PMI protects the lender in the event of borrower default, reducing the risk associated with lower down payments. Borrowers pay a monthly PMI premium as part of their mortgage payment until they achieve a loan-to-value (LTV) ratio of 80% or less. At this point, they can request the removal of PMI.

- Advantage: PMI allows borrowers to secure a mortgage with a smaller down payment, making homeownership more accessible.

FHA Mortgage Insurance Premium (MIP): The Federal Housing Administration (FHA) offers loans with low down payment requirements. Borrowers who choose FHA loans are required to pay MIP, which serves a similar purpose to PMI. MIP consists of an upfront premium paid at closing and an ongoing annual premium.

- Advantage: FHA loans are accessible to borrowers with lower credit scores and limited down payment funds, thanks in part to MIP.

USDA Mortgage Insurance: The U.S. Department of Agriculture (USDA) offers loans for rural and suburban homebuyers with low to moderate incomes. USDA loans require mortgage insurance, both an upfront guarantee fee and an annual fee. This insurance ensures that the USDA program remains financially sustainable.

- Advantage: USDA loans provide an affordable path to homeownership for individuals and families in eligible rural areas.

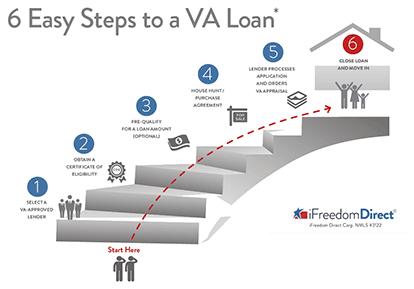

VA Funding Fee: The Department of Veterans Affairs (VA) guarantees loans for eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. Instead of mortgage insurance, VA loans require a one-time funding fee, which can be financed into the loan amount.

- Advantage: VA loans are a valuable benefit for those who have served in the military, offering competitive terms without monthly mortgage insurance premiums.

Lender-Paid Mortgage Insurance (LPMI): In LPMI arrangements, the lender pays for the mortgage insurance, typically by charging a slightly higher interest rate. Borrowers benefit from not having a separate monthly insurance premium, but they may pay a slightly higher interest rate over the life of the loan.

- Advantage: LPMI can be an attractive option for borrowers who want to avoid a visible monthly insurance payment.

Understanding these types of mortgage insurance and their roles empowers borrowers to make informed decisions about their home financing. While these insurance premiums add to the cost of homeownership, they can provide access to mortgage options and lower down payment requirements that make buying a home a reality for many individuals and families. It’s important to weigh the costs and benefits of mortgage insurance within the context of your financial situation and homeownership goals.”

Should you desire more in-depth information, it’s available for your perusal on this page: Loan estimate explainer | Consumer Financial Protection Bureau

PMI is associated with conventional loans, which are not insured or guaranteed by the government (such as FHA or VA loans).Borrowers who make a down payment of less than 20% on a conventional mortgage often need PMI.PMI premiums can vary based on factors like loan-to-value ratio, credit score, and the size of the down payment.

PMI, or Private Mortgage Insurance, is a common requirement for borrowers who opt for conventional loans and make a down payment of less than 20% of the home’s purchase price. The cost of PMI can fluctuate depending on various factors, including your credit score, loan-to-value ratio, and the size of your down payment. Understanding PMI and how it impacts your mortgage is crucial for informed financial planning when buying a home.

To delve further into this matter, we encourage you to check out the additional resources provided here: How to Avoid Paying Private Mortgage Insurance (PMI)

MIP is primarily tied to Federal Housing Administration (FHA) loans, which are government-backed mortgages designed to assist low-to-moderate-income borrowers.Unlike PMI, which can be canceled once the homeowner’s equity reaches a certain threshold, MIP is typically required for the entire life of the loan.MIP rates are set by the FHA and may vary depending on the loan amount and the term.

MIP, or Mortgage Insurance Premium, plays a crucial role in FHA loans, making homeownership more accessible to many. However, it’s essential to understand that MIP differs from PMI (Private Mortgage Insurance) in some significant ways. While both types of insurance protect lenders in case of borrower default, they have distinct features:

Government Backing: MIP is closely associated with Federal Housing Administration (FHA) loans. These government-backed mortgages are designed to assist low-to-moderate-income borrowers in achieving homeownership. PMI, on the other hand, is generally linked to conventional loans.

Cancellation Rules: A key difference lies in the ability to cancel these insurance premiums. With PMI, borrowers can request its removal once they reach a certain level of equity in their homes, typically when their loan-to-value ratio falls below 80%. In contrast, MIP is usually required for the entire life of the FHA loan. This means that even if you build significant equity in your home, you may still be obligated to pay MIP.

Rate Variability: MIP rates for FHA loans are set by the Federal Housing Administration and can vary depending on factors such as the loan amount and the loan term. These rates may change periodically, impacting the overall cost of homeownership.

Understanding the distinctions between MIP and PMI is crucial when considering your mortgage options. While FHA loans can be an excellent choice for some borrowers, the ongoing MIP requirement is an important factor to consider when evaluating the long-term costs of homeownership. Consulting with a mortgage professional can help you make an informed decision based on your financial situation and homeownership goals.

You can also read more about this here: What Is Private Mortgage Insurance (PMI)? | Bankrate

UFMIP is a one-time fee associated with FHA loans, paid at the time of closing.It’s calculated as a percentage of the loan amount and is typically financed into the mortgage.UFMIP serves to protect the FHA against losses due to borrower default.

Understanding the Upfront Mortgage Insurance Premium (UFMIP) is essential when considering an FHA loan, as it plays a pivotal role in the overall cost structure and financial protection for both borrowers and the FHA itself.

Calculation and Financing: UFMIP is determined as a percentage of the loan amount. This upfront fee can vary but is typically around 1.75% of the base loan amount. While it’s called an “upfront” premium, borrowers often have the option to finance it into their mortgage rather than paying it out of pocket at closing. This financing option can be beneficial for those seeking to preserve their available cash for other homeownership expenses.

Risk Mitigation: One of the primary purposes of UFMIP is to mitigate risk for the FHA. By collecting this fee at the outset, the FHA creates a financial buffer that helps cover potential losses resulting from borrower default. This mechanism helps sustain the FHA’s ability to continue providing mortgage insurance to borrowers with lower down payments and credit scores.

Long-Term Cost Considerations: While financing the UFMIP into the mortgage can provide short-term affordability, it’s essential to consider the long-term cost implications. Borrowers effectively “spread out” the UFMIP over the life of the loan, which can result in slightly higher monthly mortgage payments. It’s advisable to assess whether this approach aligns with your financial objectives and budget.

FHA Loan Benefits: Despite the UFMIP, FHA loans offer several advantages, including lower down payment requirements and more flexible credit criteria. These benefits can make homeownership accessible to a broader range of individuals and families, especially those who may not qualify for conventional loans.

MIP and Annual Premium: In addition to the UFMIP, FHA loans require borrowers to pay a monthly Mortgage Insurance Premium (MIP). This ongoing premium serves a similar purpose by protecting the FHA and is typically higher for loans with higher loan-to-value ratios.

Loan Limits: FHA loan limits may vary by location, and it’s essential to be aware of the specific limits in your area, as they can affect the UFMIP and overall loan structure.

In summary, UFMIP is a critical component of FHA loans, ensuring the financial stability of the FHA while enabling borrowers to access homeownership with more lenient requirements. It’s a one-time fee that can be financed into the mortgage, but borrowers should weigh the long-term cost implications when considering this option. Understanding how UFMIP functions and its role in the FHA loan process empowers borrowers to make informed decisions and navigate the homebuying journey with confidence.

Should you desire more in-depth information, it’s available for your perusal on this page: What Is Mortgage Insurance? | Rocket Mortgage

VA loans, available to eligible veterans, active-duty service members, and certain members of the National Guard and Reserves, do not require PMI or MIP.Instead, VA loans may have a different form of protection called the VA Funding Fee, which helps offset the cost of VA loans to taxpayers.

VA loans, designed to support our nation’s veterans and service members, come with a unique advantage – the absence of PMI or MIP requirements. This is a testament to the government’s commitment to providing affordable homeownership options to those who have served our country. Instead of private mortgage insurance, VA loans may include a VA Funding Fee, which serves a similar purpose by contributing to the sustainability of the VA loan program without burdening borrowers with monthly insurance premiums. It’s a valuable benefit that recognizes the sacrifices made by those in uniform and their right to secure the American dream of homeownership with minimal financial barriers.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: What Is Private Mortgage Insurance (PMI)? | Bankrate

While mortgage insurance primarily benefits lenders by reducing their risk, it also plays a crucial role for borrowers, especially those who might not have a 20% down payment saved. Here’s why mortgage insurance matters for homebuyers:

Lower Down Payments: Mortgage insurance allows homebuyers to purchase a home with a lower down payment, often as low as 3% to 5%, making homeownership more accessible.

Expanded Borrowing Opportunities: For borrowers with good credit but limited funds for a down payment, mortgage insurance can open doors to a wider range of loan options and lenders.

Accelerated Homeownership: Without the need to save a substantial down payment, borrowers can become homeowners more quickly, potentially taking advantage of favorable market conditions or locking in a lower interest rate.

Competitive Interest Rates: With mortgage insurance, lenders may offer borrowers more competitive interest rates, as the added coverage reduces their risk.

Flexible Loan Programs: Various loan programs, such as FHA loans, VA loans, and conventional loans with private mortgage insurance (PMI), provide flexibility to suit different financial situations.

Ability to Build Equity: Instead of waiting years to save a substantial down payment, borrowers can start building equity in their homes sooner, potentially benefiting from property appreciation.

Tax Deductibility: In some cases, mortgage insurance premiums may be tax-deductible, providing potential tax benefits for homeowners.

In summary, mortgage insurance offers a pathway to homeownership for those who might not have substantial savings for a down payment, making it an important consideration for many homebuyers.

Don’t stop here; you can continue your exploration by following this link for more details: What Is Mortgage Insurance? | Rocket Mortgage

Mortgage insurance makes homeownership more accessible by allowing borrowers to purchase a home with a smaller down payment.

Mortgage insurance plays a pivotal role in expanding homeownership opportunities by mitigating the risks associated with smaller down payments. Here’s a deeper exploration of how mortgage insurance facilitates greater accessibility to homeownership:

Reduced Down Payment Requirement: One of the primary ways mortgage insurance increases accessibility is by permitting borrowers to secure a mortgage with a smaller down payment. Conventional loans typically require a down payment of 20% to avoid mortgage insurance. However, many prospective homebuyers, especially first-time buyers, may not have the financial means to provide such a substantial upfront payment. Mortgage insurance allows them to enter the housing market with down payments as low as 3% or 5%, making homeownership more achievable.

Lowering Entry Barriers: By lowering the entry barriers associated with down payments, mortgage insurance opens doors for a broader range of individuals and families. This is particularly advantageous for those who are diligently saving and building their credit but haven’t reached the 20% threshold. Mortgage insurance enables them to transition from renting to owning a home sooner.

Affordability: Home prices can be prohibitively high in certain areas, making it challenging for buyers to accumulate a substantial down payment. Mortgage insurance helps bridge the affordability gap by allowing borrowers to access homes that might otherwise be out of reach. It provides a pathway to homeownership in regions with high housing costs.

Financial Flexibility: Mortgage insurance provides financial flexibility, empowering borrowers to allocate their savings strategically. Rather than channeling all available funds into a down payment, borrowers can use some of their savings for home maintenance, emergencies, or other financial goals, enhancing overall financial stability.

Opportunity for Investment: Homeownership is often viewed as a valuable long-term investment. Mortgage insurance facilitates this by enabling borrowers to enter the market sooner and begin building equity. Over time, as homeowners make mortgage payments and property values appreciate, their investment grows.

Boosting the Housing Market: Mortgage insurance contributes to the health of the housing market by increasing demand. A broader pool of potential buyers means a more active real estate market, benefiting sellers and sustaining property values. This vitality can have positive ripple effects on local economies.

Supporting Diverse Homebuyers: Mortgage insurance is especially supportive of diverse homebuyers, including those from minority communities. It addresses the historical homeownership gap by providing opportunities for a more inclusive and representative range of individuals and families to become homeowners.

First-Time Buyers: Mortgage insurance often serves as a crucial resource for first-time homebuyers, who may not have accumulated substantial savings or equity. It empowers them to embark on their homeownership journey, which can have long-term financial benefits.

In summary, mortgage insurance is a financial tool that enhances homeownership accessibility by permitting borrowers to purchase a home with smaller down payments. It’s instrumental in breaking down barriers to entry, supporting diverse homebuyers, and stimulating the housing market. By making homeownership more achievable, mortgage insurance contributes to the realization of the American dream for countless individuals and families.

To expand your knowledge on this subject, make sure to read on at this location: What Is Private Mortgage Insurance (PMI)? | Bankrate

With mortgage insurance, lenders are often willing to offer more favorable interest rates, which can save borrowers money over the life of their loans.

Certainly! Here’s an extension of the idea:

“Mortgage insurance not only provides financial protection for lenders but also benefits borrowers by opening doors to lower interest rates. This means that opting for mortgage insurance can lead to significant long-term savings on your mortgage payments.”

For additional details, consider exploring the related content available here Purchase Loan | Veterans Affairs

For borrowers with PMI, once they’ve built up enough equity in their homes (typically when they reach a loan-to-value ratio of 80% or less), they can request to have the PMI premiums canceled, reducing their monthly payments.

“Cancellation of PMI (Private Mortgage Insurance) can significantly lower your monthly mortgage payments once you’ve accumulated sufficient home equity, usually reaching a loan-to-value ratio of 80% or less. Here’s how it works:”

For additional details, consider exploring the related content available here How Much is Mortgage Insurance? | PMI Cost vs. Benefit

Conclusion

In the world of mortgages, acronyms like PMI and MIP might seem confusing, but they serve a crucial purpose in the homebuying process. By understanding these forms of mortgage insurance, borrowers can make informed decisions about their financing options and work towards their homeownership goals with confidence. Whether it’s a conventional loan with PMI or an FHA loan with MIP, mortgage insurance opens doors to homeownership for many individuals and families.

“Demystifying mortgage insurance, represented by acronyms like PMI (Private Mortgage Insurance) and MIP (Mortgage Insurance Premium), is a vital step towards achieving your homeownership dreams. These insurance forms, although initially daunting, play a pivotal role in the homebuying journey. Here’s a deeper dive into their significance and how they empower borrowers:

Risk Mitigation: Both PMI and MIP are insurance mechanisms that aim to mitigate the risk for lenders when borrowers provide a down payment below the conventional 20%. PMI applies to conventional loans, while MIP is specific to FHA loans. These safeguards enable lenders to extend financing to a more extensive pool of aspiring homeowners.

Down Payment Flexibility: Mortgage insurance allows borrowers to enter the real estate market with a smaller down payment, making homeownership more accessible. With PMI, conventional loans can be obtained with down payments as low as 3%, while FHA loans, backed by MIP, often require as little as 3.5% down. This flexibility is particularly valuable for first-time buyers and those with limited upfront funds.

Affordability Enhancement: By facilitating lower down payments, mortgage insurance enhances affordability. It enables borrowers to allocate their finances more effectively and, in some cases, reserve cash for home improvements, furnishings, or other financial goals that enhance their quality of life as homeowners.

Borrower Protection: While PMI and MIP serve primarily to protect lenders, they also offer a layer of protection for borrowers. In the event of unforeseen financial challenges, such as job loss or medical expenses, homeowners can continue making manageable mortgage payments, reducing the risk of foreclosure.

Accelerated Homeownership: Mortgage insurance can expedite the path to homeownership. Rather than waiting years to accumulate a larger down payment, borrowers can seize opportunities in a competitive real estate market, secure their dream homes, and gradually build home equity.

Loan Options: Understanding PMI and MIP opens doors to a wider array of loan options. Borrowers can choose between conventional loans with PMI or FHA loans with MIP, aligning their financing with their unique circumstances and financial goals.

Cancellation Options: PMI and MIP are not perpetual expenses. Borrowers can often request the cancellation of these insurance premiums once specific equity thresholds are reached. This allows homeowners to reduce their monthly expenses over time, enhancing long-term affordability.

Education and Empowerment: Knowledge of mortgage insurance demystifies the homebuying process, empowering borrowers to make informed decisions. They can compare loan types, weigh the pros and cons of different down payment amounts, and create financial strategies tailored to their homeownership objectives.

In summary, PMI and MIP, while initially perplexing, serve as enablers of homeownership aspirations. These insurance mechanisms break down financial barriers, offering flexibility, affordability, and protection for both lenders and borrowers. Armed with this knowledge, individuals and families can confidently navigate the complex landscape of mortgage options, ultimately transforming homeownership dreams into reality.”

Should you desire more in-depth information, it’s available for your perusal on this page: What is mortgage insurance and how does it work? | Consumer …

More links

For a comprehensive look at this subject, we invite you to read more on this dedicated page: What Is Private Mortgage Insurance (PMI)? | Bankrate