Introduction

When it comes to choosing a mortgage, one of the most significant decisions you’ll face is whether to opt for a fixed-rate mortgage or an adjustable-rate mortgage (ARM). Each option has its own set of advantages and drawbacks, making it essential to understand the key differences between them. In this article, we’ll delve into the intricacies of fixed-rate and adjustable-rate mortgages to help you make an informed decision that aligns with your financial goals and preferences.

Selecting the right mortgage is a pivotal choice in your homebuying journey, and it often boils down to whether you prefer the stability of a fixed-rate mortgage or the flexibility of an adjustable-rate mortgage (ARM). Each of these options presents a unique set of benefits and considerations, so let’s explore the fundamental distinctions between them to equip you with the knowledge needed to make a well-informed decision that best suits your financial aspirations.

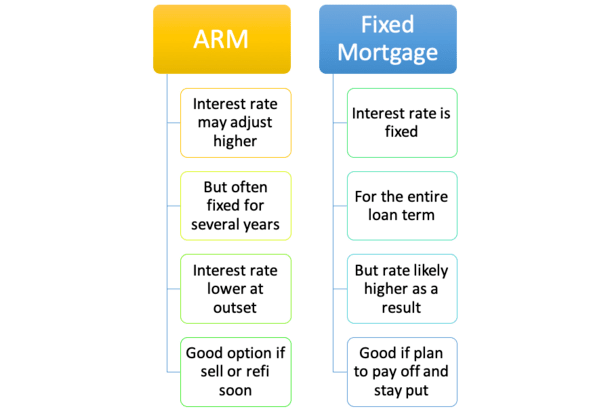

Fixed-Rate Mortgage (FRM):

Predictable Payments: With a fixed-rate mortgage, your interest rate remains constant throughout the life of the loan. This predictability makes it easier to budget and plan for your monthly housing expenses, as your principal and interest payments won’t change.

Long-Term Stability: Fixed-rate mortgages are ideal for those who value long-term financial stability and want to lock in a rate when interest rates are low. You won’t have to worry about fluctuations in market interest rates affecting your monthly payments.

Peace of Mind: Knowing that your mortgage payment will stay the same for the duration of the loan provides peace of mind. This can be especially reassuring in times of economic uncertainty.

Potentially Higher Initial Rates: One drawback is that fixed-rate mortgages often come with slightly higher initial interest rates compared to the initial rates of ARMs. However, this is balanced by the assurance that your rate won’t increase over time.

Adjustable-Rate Mortgage (ARM):

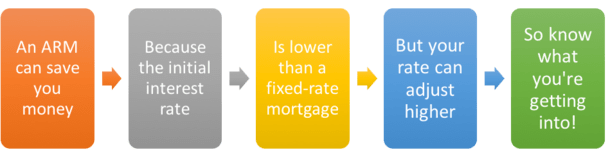

Lower Initial Rates: ARMs typically start with lower initial interest rates compared to fixed-rate mortgages. This can translate into lower initial monthly payments, making homeownership more accessible, especially for first-time buyers.

Rate Adjustments: ARMs have adjustable interest rates that can fluctuate based on market conditions. These adjustments usually occur after an initial fixed-rate period, which can range from a few months to several years. The frequency and extent of rate adjustments depend on the terms of the ARM.

Risk and Uncertainty: The main drawback of ARMs is the uncertainty surrounding future rate adjustments. While initial rates may be attractive, there is the potential for significant rate increases, leading to higher monthly payments.

Short-Term Planning: ARMs may be suitable for those who plan to sell or refinance their homes before the initial fixed-rate period ends. This way, you can take advantage of the lower initial rates without worrying about future adjustments.

Ultimately, the choice between a fixed-rate mortgage and an ARM hinges on your financial circumstances, risk tolerance, and future plans. If you prioritize stable and predictable payments, a fixed-rate mortgage is likely the better option. On the other hand, if you’re comfortable with some level of uncertainty and want to benefit from lower initial rates, an ARM might be the right choice. Evaluating your long-term financial goals and consulting with a mortgage professional can help you make a mortgage decision that aligns perfectly with your unique needs.

Should you desire more in-depth information, it’s available for your perusal on this page: Adjustable-Rate Mortgage (ARM): What It Is and Different Types

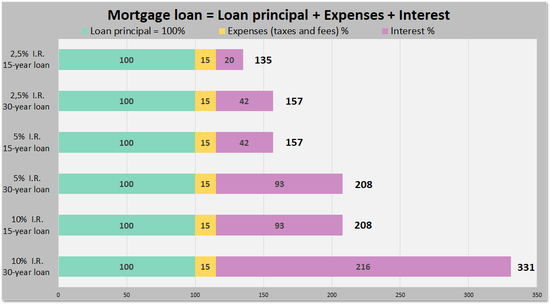

A fixed-rate mortgage is a loan where the interest rate remains constant throughout the entire term of the loan, typically 15, 20, or 30 years. Here are some key advantages of opting for a fixed-rate mortgage:

Predictable Payments: With a fixed-rate mortgage, your monthly payments remain stable, making it easier to budget and plan for your financial future.

Long-Term Stability: Fixed-rate mortgages provide a sense of security, as you won’t be affected by interest rate fluctuations in the market. Your rate is “locked in.”

Peace of Mind: Homeowners can enjoy peace of mind knowing that their mortgage payments won’t unexpectedly increase, even if interest rates rise significantly.

Easier to Budget: Knowing your exact monthly payment simplifies financial planning and helps avoid unexpected financial strain.

Protection Against Market Volatility: In times of economic uncertainty, fixed-rate mortgages offer stability and protection against rising interest rates, which can be especially valuable during a recession or economic downturn.

You can also read more about this here: Fixed-Rate Mortgages: A Guide | Bankrate

With a fixed-rate mortgage, your monthly principal and interest payments remain steady, providing financial predictability and making it easier to budget for your housing costs.

Fixed-rate mortgages offer stability in an ever-changing financial landscape. Knowing that your monthly payments won’t fluctuate allows for better financial planning and peace of mind. Whether interest rates rise or fall, your principal and interest payments remain constant throughout the life of your loan. This predictability simplifies budgeting, making it an attractive option for many homeowners. Plus, it provides protection against rising interest rates, ensuring that your housing costs won’t unexpectedly soar. So, if you value financial security and want to avoid surprises in your mortgage payments, a fixed-rate mortgage could be the right choice for you.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Fixed- Vs. Adjustable-Rate Mortgage | Rocket Mortgage

If interest rates in the broader market rise, your fixed-rate mortgage won’t be affected. This insulation from interest rate fluctuations ensures that your housing costs remain consistent over the life of the loan.

The stability of a fixed-rate mortgage in the face of rising interest rates is a significant advantage for homeowners. Here’s why:

Predictable Monthly Payments: With a fixed-rate mortgage, your monthly payments remain consistent throughout the life of the loan. This predictability is invaluable for budgeting because you know exactly how much you need to allocate for your mortgage each month. Regardless of fluctuations in the broader market, your housing costs remain steady, providing financial peace of mind.

Protection Against Inflation: Inflation can erode the purchasing power of your money over time. However, a fixed-rate mortgage effectively shields you from the impact of inflation on your housing expenses. While rents and adjustable-rate mortgages may increase with inflation, your fixed-rate mortgage remains unaffected, making homeownership a reliable long-term financial strategy.

Long-Term Financial Planning: Fixed-rate mortgages are ideal for long-term financial planning. Homebuyers who intend to stay in their homes for an extended period benefit from the stability of fixed payments. This enables them to plan for other financial goals, such as saving for retirement, investing, or funding their children’s education, with greater confidence.

Protection from Interest Rate Volatility: In a volatile interest rate environment, homeowners with fixed-rate mortgages are insulated from the anxiety of rising rates. Adjustable-rate mortgages (ARMs) can leave borrowers vulnerable to sudden interest rate spikes, resulting in higher monthly payments. A fixed-rate mortgage provides a buffer against such fluctuations.

Build Equity with Certainty: When you make fixed monthly payments on your mortgage, you gradually build equity in your home. Knowing that your payments won’t change allows you to track your progress accurately. This equity can be tapped into through home equity loans or lines of credit, providing you with financial flexibility when needed.

Peace of Mind: Financial stability is essential for peace of mind. Knowing that your housing costs won’t unexpectedly rise due to interest rate increases allows you to focus on other aspects of your life without the worry of a fluctuating mortgage payment.

Refinancing Opportunities: If interest rates decline significantly after you secure your fixed-rate mortgage, you have the option to refinance to a lower rate. This can lead to potential savings on your mortgage over the long term, further enhancing your financial well-being.

Legacy Planning: Fixed-rate mortgages can be a valuable component of legacy planning. Knowing that your mortgage will remain consistent can make it easier to plan for the transfer of assets to heirs or charitable organizations.

In summary, the stability and insulation from interest rate fluctuations that come with a fixed-rate mortgage offer homeowners a range of benefits. They provide peace of mind, enable effective long-term financial planning, protect against inflation, and ensure that housing costs remain predictable and manageable over the life of the loan. These advantages make fixed-rate mortgages a popular and prudent choice for many homebuyers.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Understand loan options | Consumer Financial Protection Bureau

Fixed-rate mortgages are ideal for those who plan to stay in their homes for an extended period. Knowing your interest rate won’t change allows for long-term financial planning.

Fixed-rate mortgages are often favored by homeowners seeking stability and predictability in their monthly payments. With a fixed interest rate, your mortgage payments remain consistent throughout the life of the loan, providing peace of mind and making budgeting easier. This stability is especially valuable for those planning to stay in their homes for an extended period or who want to lock in a low-interest rate when rates are favorable.

Furthermore, fixed-rate mortgages protect you from potential interest rate hikes in the future. If interest rates rise, you won’t be affected because your rate is locked in. This security can help you avoid financial stress and maintain your home’s affordability, even in a changing economic climate.

Additionally, fixed-rate mortgages are an excellent choice for individuals who prioritize long-term financial planning. Knowing that your monthly mortgage payment will remain steady allows you to create a comprehensive financial strategy that includes savings, investments, and other financial goals. You can confidently map out your financial future without worrying about the unpredictable fluctuations that can come with adjustable-rate mortgages.

In summary, fixed-rate mortgages offer stability, predictability, and protection against rising interest rates. They are a smart choice for homeowners who value financial security and want to plan for the long term, making them a valuable tool for achieving your homeownership and financial goals.

Looking for more insights? You’ll find them right here in our extended coverage: Fixed vs. Adjustable-Rate Mortgage: What’s the Difference?

An adjustable-rate mortgage (ARM), on the other hand, offers a variable interest rate that can change periodically, typically after an initial fixed-rate period, which can range from a few months to several years. Here are some advantages of choosing an ARM:

“An adjustable-rate mortgage (ARM), on the other hand, offers a variable interest rate that can change periodically, typically after an initial fixed-rate period, which can range from a few months to several years. Here are some advantages of choosing an ARM:

Lower Initial Interest Rate: ARMs often start with a lower interest rate compared to fixed-rate mortgages, which can lead to lower initial monthly payments.

Potential for Lower Payments: If interest rates remain stable or decrease, your monthly payments may stay lower than with a fixed-rate mortgage.

Short-Term Savings: ARMs can be advantageous for short-term homeownership plans, such as selling the home before the interest rate adjusts.

Opportunity for Future Savings: If interest rates decrease after the initial fixed period, you may benefit from lower interest rates and reduced payments.”

Remember, while ARMs offer these advantages, they also come with the risk of interest rate increases in the future, which could lead to higher monthly payments. It’s essential to carefully consider your financial situation and future plans when choosing a mortgage type.

Looking for more insights? You’ll find them right here in our extended coverage: Fixed Vs. Adjustable-Rate Mortgages | Bankrate

ARMs often feature lower initial interest rates than fixed-rate mortgages. This can result in lower initial monthly payments and potentially more affordable homeownership during the initial fixed-rate period.

“Adjustable-Rate Mortgages (ARMs) offer a unique proposition for prospective homebuyers, particularly during the initial stages of homeownership. Here’s an in-depth exploration of the benefits and considerations associated with ARMs, especially the allure of lower initial interest rates and its implications for homeowners:

Lower Initial Interest Rates: ARMs typically start with lower initial interest rates compared to fixed-rate mortgages. These lower rates can translate into more affordable homeownership for borrowers, especially during the initial fixed-rate period, which can extend from one to several years. This financial relief can be particularly appealing for first-time homebuyers looking to manage their initial monthly expenses.

Initial Monthly Savings: Lower initial interest rates directly impact the monthly mortgage payments during the fixed-rate period. As a result, borrowers may enjoy lower monthly mortgage payments compared to what they would have with a fixed-rate mortgage of the same size. This extra financial breathing room can be directed towards other household expenses, savings, or even investments.

Financial Flexibility: ARMs can provide borrowers with a degree of financial flexibility during the initial phase of homeownership. Lower monthly payments may allow homeowners to allocate funds to other priorities, such as home improvements, debt reduction, or building an emergency fund. This flexibility can help homeowners better manage their finances and adapt to changing circumstances.

Short-Term Homeownership Plans: ARMs can be a suitable choice for individuals or families with short-term homeownership plans. If you anticipate relocating or refinancing your mortgage within the initial fixed-rate period, the lower initial interest rates of an ARM can be a cost-effective strategy. It allows you to enjoy the benefits of homeownership without committing to the long-term interest rates of a fixed-rate mortgage.

Market-Dependent Adjustments: It’s important to recognize that ARMs are subject to interest rate adjustments after the initial fixed-rate period. These adjustments are typically tied to specific market indexes. Borrowers should carefully assess their ability to handle potential future increases in monthly payments. It’s advisable to have a financial contingency plan in place to mitigate the impact of rate adjustments.

Rate Caps and Limits: ARMs often come with rate caps and limits, which provide some level of protection against extreme interest rate fluctuations. Understanding the terms of these caps, including initial adjustment caps and lifetime caps, is essential to assess the level of risk associated with your ARM.

Consideration of Future Rates: When choosing an ARM, it’s crucial to evaluate your confidence in future interest rate trends. Factors such as the state of the economy, inflation expectations, and Federal Reserve policies can influence future interest rates. If you anticipate favorable rate conditions in the near term, an ARM may be a strategic choice.

Financial Planning and Education: First-time homebuyers, in particular, should invest time in financial planning and education when considering ARMs. Understanding the nuances of interest rate adjustments, as well as conducting thorough financial assessments, can help borrowers make informed decisions about their mortgage choices.

In summary, ARMs offer an attractive option for homebuyers, thanks to their lower initial interest rates and potential for reduced initial monthly payments. However, it’s essential to approach ARMs with a clear understanding of their features, potential rate adjustments, and your own financial goals. For those who carefully manage their finances and have short-term homeownership plans, ARMs can provide an affordable and flexible path to homeownership.”

Should you desire more in-depth information, it’s available for your perusal on this page: Fixed Vs. Adjustable-Rate Mortgages | Bankrate

If you plan to live in your home for only a few years, an ARM can be an attractive option. You can take advantage of the lower initial rates without worrying about potential rate adjustments in the distant future.

When considering an Adjustable Rate Mortgage (ARM), it’s crucial to assess your future plans and financial stability. ARMs can offer lower initial rates, making them appealing for short-term homeownership. However, if you plan to stay in your home for an extended period, you should carefully evaluate the potential risks associated with future interest rate adjustments. It’s essential to strike a balance between immediate cost savings and long-term financial security.

You can also read more about this here: Fixed Vs. Adjustable-Rate Mortgages | Bankrate

Most ARMs come with rate caps that limit how much the interest rate can increase during adjustment periods. These caps provide some protection against drastic rate hikes.

“Rate caps act as safety buffers for homeowners, shielding them from sudden and steep interest rate spikes, making ARMs more predictable and manageable.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: Consumer Handbook on Adjustable-Rate Mortgages

Deciding between a fixed-rate mortgage and an ARM ultimately depends on your unique financial situation, goals, and risk tolerance. Here are some factors to consider:

“Choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) is a pivotal decision in your homeownership journey, one that should align with your specific financial circumstances, objectives, and comfort with risk. To make an informed choice, it’s essential to carefully evaluate the following factors:

Financial Stability: Consider the stability of your income and overall financial situation. A fixed-rate mortgage offers predictability with consistent monthly payments throughout the loan term, making it a prudent choice for those who prefer budgeting certainty. On the other hand, if you expect your income to increase or have confidence in your ability to manage fluctuating payments, an ARM might be appealing, especially in the short term.

Interest Rate Outlook: Assess the prevailing interest rate environment and interest rate forecasts. Fixed-rate mortgages shield you from interest rate fluctuations, which can be valuable during periods of rising rates. Conversely, ARMs typically start with lower initial interest rates but can adjust upward over time, potentially leading to higher payments. Evaluate your tolerance for potential rate hikes and your ability to absorb increased costs.

Initial Interest Rate: ARMs typically feature an initial fixed-rate period, often at a lower interest rate than the equivalent fixed-rate mortgage. Consider how long you plan to stay in the home during this initial period. If you intend to sell or refinance before the ARM’s rate adjustment, you can take advantage of the lower rate without exposing yourself to future increases.

Rate Adjustment Caps: Review the terms of the ARM, specifically the rate adjustment caps. Rate caps limit how much the interest rate can change during each adjustment period and over the life of the loan. Understanding these caps is vital to assess the potential impact on your future payments.

Financial Goals: Align your mortgage choice with your broader financial goals. If your aim is to pay off the mortgage as quickly as possible and you can afford higher monthly payments, a shorter-term fixed-rate mortgage might be ideal. Conversely, if your objective is to minimize initial costs or invest the savings elsewhere, an ARM with a lower initial rate can free up funds for other purposes.

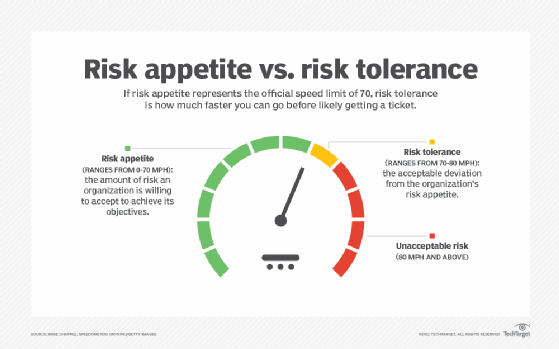

Risk Tolerance: Evaluate your risk tolerance and capacity. A fixed-rate mortgage provides stability and protection against interest rate increases, making it suitable for risk-averse borrowers. In contrast, an ARM carries some level of interest rate risk, which may be manageable for those comfortable with potential fluctuations.

Long-Term Plans: Consider your long-term plans for the home. If you anticipate staying in the property for the entirety of the mortgage term, a fixed-rate mortgage provides peace of mind. However, if you plan to sell or refinance within a few years, an ARM’s lower initial rate may offer cost savings during your ownership period.

Financial Flexibility: Assess your ability to manage changing mortgage payments. Fixed-rate mortgages provide consistent payments, simplifying budgeting. ARMs offer lower initial payments but require readiness to adapt to potential rate adjustments.

Ultimately, the decision between a fixed-rate mortgage and an ARM hinges on your specific circumstances, priorities, and risk tolerance. Taking the time to evaluate these factors carefully can lead to a mortgage choice that aligns with your financial goals and provides a stable foundation for homeownership.”

Additionally, you can find further information on this topic by visiting this page: Fixed Vs. Adjustable-Rate Mortgages | Bankrate

If you plan to stay in your home for the long haul and value stability, a fixed-rate mortgage is likely the better choice. If you expect to move within a few years, an ARM may offer lower initial costs.

Choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) depends on your long-term plans. A fixed-rate mortgage provides stability and is ideal for long-term homeowners. On the other hand, an ARM might be more suitable if you plan to relocate within a few years, as it offers lower initial costs but carries the potential for rate adjustments. Consider your future goals and financial situation when deciding which option aligns best with your needs.

You can also read more about this here: Variable vs. Fixed Rate

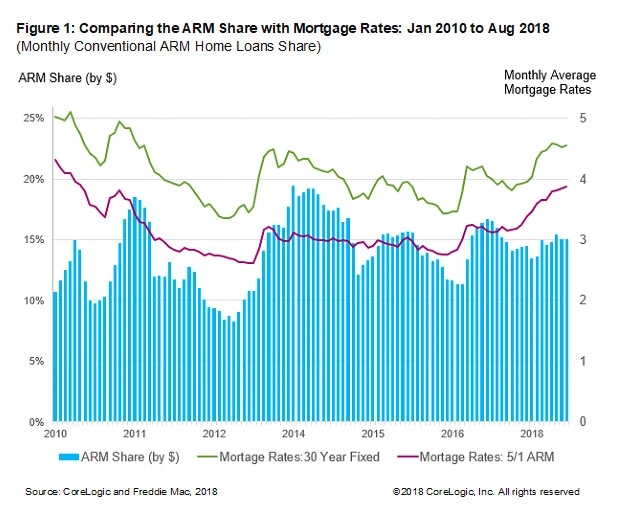

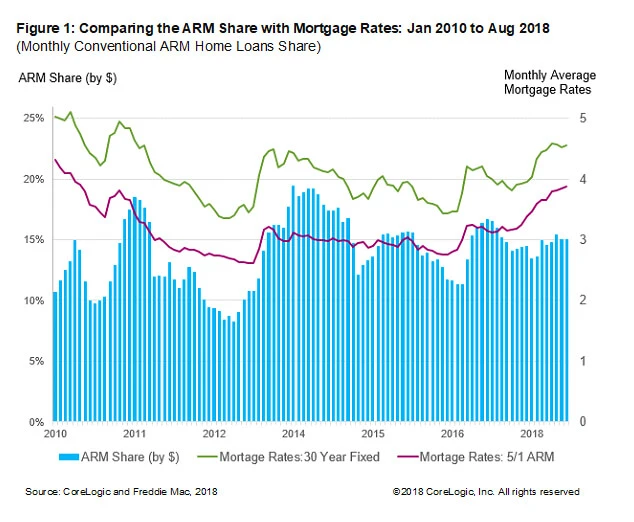

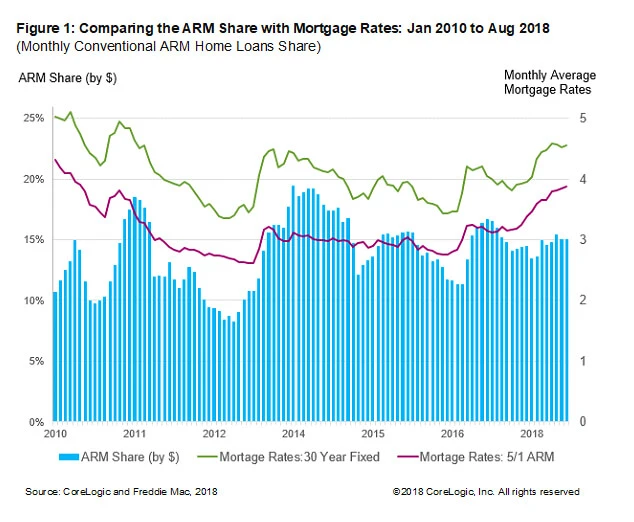

Monitor current interest rates to assess whether they are relatively low or high. When market rates are low, fixed-rate mortgages can be particularly appealing.

Keeping an eye on the ebb and flow of interest rates is crucial for making informed mortgage decisions. In a climate of low rates, fixed-rate mortgages offer stability and can be a wise choice for homebuyers.

Should you desire more in-depth information, it’s available for your perusal on this page: Fixed- Vs. Adjustable-Rate Mortgage | Rocket Mortgage

Consider your comfort level with potential interest rate fluctuations. ARMs come with some level of uncertainty, so evaluate whether you can handle potential payment increases.

When contemplating the choice between a fixed-rate mortgage and an adjustable-rate mortgage (ARM), it’s crucial to assess your comfort level with the potential for interest rate fluctuations. ARMs offer enticing lower initial rates, but they do come with a degree of uncertainty. Take the time to carefully evaluate whether you’re financially equipped to manage potential payment increases, especially in the event of rising interest rates. This assessment involves considering various aspects of your financial situation:

Income Stability: Assess the stability and predictability of your income. If your income is reliable and expected to remain consistent, you may be better equipped to handle any potential increases in your mortgage payments.

To expand your knowledge on this subject, make sure to read on at this location: Should I choose a fixed-rate or variable-rate mortgage? | National …

If you opt for an ARM, pay close attention to the rate caps, which limit how much your interest rate can change. Understanding these caps is crucial for assessing your risk exposure.

Here are some additional points to consider when evaluating adjustable-rate mortgages (ARMs):

Initial Low Rates: ARMs often start with lower initial interest rates than fixed-rate mortgages. This can result in lower initial monthly payments, making homeownership more affordable in the short term.

Rate Adjustment Periods: ARMs typically have an initial fixed-rate period, such as 5, 7, or 10 years, during which your interest rate remains stable. After this period, your rate may adjust annually or at specified intervals, based on market conditions.

Index and Margin: ARMs are tied to an index, such as the U.S. Prime Rate or the London Interbank Offered Rate (LIBOR), plus a margin set by the lender. Changes in the index can impact your interest rate adjustments.

Potential for Lower Lifetime Costs: If interest rates remain stable or decrease over time, an ARM may result in lower lifetime interest costs compared to a fixed-rate mortgage.

Risk of Rising Rates: One of the main risks with ARMs is the potential for rising interest rates. When rates increase, your monthly payments can rise significantly, impacting your budget.

Rate Caps: ARMs often have rate caps that limit how much your interest rate can increase during each adjustment period and over the life of the loan. There are usually initial adjustment caps, periodic caps, and lifetime caps to protect borrowers from extreme rate hikes.

Assessing Your Risk Tolerance: Before choosing an ARM, assess your comfort level with the possibility of rising interest rates. Consider your long-term financial stability and whether you can handle higher payments if rates go up.

Future Plans: Your choice between fixed and adjustable-rate mortgages should align with your future plans. If you plan to stay in your home for a short period, an ARM with a lower initial rate may be suitable. For long-term homeownership, a fixed-rate mortgage can provide stability.

Consult with a Mortgage Professional: It’s advisable to consult with a mortgage professional who can help you understand the nuances of different mortgage products, evaluate your financial situation, and determine which option aligns best with your goals and risk tolerance.

To expand your knowledge on this subject, make sure to read on at this location: FHA Adjustable Rate Mortgage – HUD | HUD.gov / U.S. Department …

Conclusion

The choice between a fixed-rate mortgage and an adjustable-rate mortgage hinges on your financial situation, future plans, and risk tolerance. Fixed-rate mortgages offer stability and predictability, while ARMs provide initial cost savings and flexibility. Weigh the pros and cons carefully, consult with a mortgage professional, and make an informed decision that aligns with your homeownership goals. Remember that your mortgage choice can significantly impact your long-term financial well-being, so choose wisely.

Selecting the right mortgage type is a pivotal decision in your homeownership journey. It’s not just about numbers; it’s about aligning your mortgage choice with your unique financial situation and goals. Fixed-rate mortgages offer stability and peace of mind, making them an excellent fit for those who value predictability. With steady monthly payments, you can budget with confidence, knowing that market fluctuations won’t disrupt your financial plans.

On the other hand, adjustable-rate mortgages (ARMs) can be advantageous if you’re comfortable with some level of risk and desire initial cost savings. The lower initial interest rates of ARMs can translate into more affordable early payments. However, it’s crucial to understand that these rates can adjust in the future, potentially increasing your payments.

To make the right decision, consult with a mortgage professional who can provide personalized guidance based on your financial situation and future plans. Consider your risk tolerance and how long you plan to stay in your home. Your mortgage choice will significantly impact your financial well-being, so take the time to weigh the pros and cons carefully. Ultimately, by making an informed decision, you can pave the way for a more secure and successful homeownership experience.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: CFPB Consumer Laws and Regulations HPA – Homeowners …

More links

Looking for more insights? You’ll find them right here in our extended coverage: Fixed- Vs. Adjustable-Rate Mortgage | Rocket Mortgage