Introduction

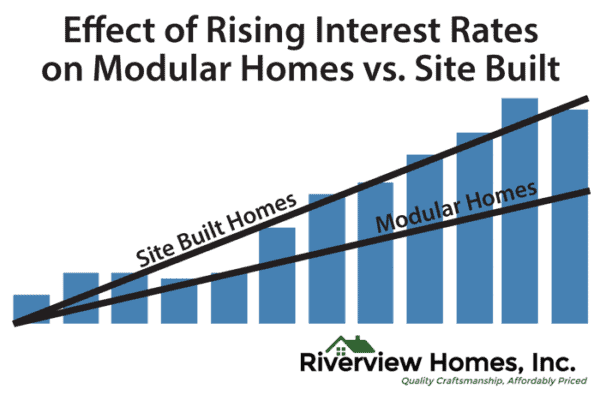

Modular homes have gained popularity as a cost-effective and efficient housing solution. These homes offer customizable designs, environmental sustainability, and faster construction timelines. However, understanding the financial aspects of modular home ownership is crucial for a smooth and successful home buying process. In this article, we’ll take a closer look at modular home financing and appraisal considerations to help prospective homeowners navigate this exciting journey.

“Financing a modular home involves a unique set of considerations compared to traditional homes. From selecting the right loan type to understanding the appraisal process, making informed financial decisions is key. By delving into modular home financing and appraisal intricacies, you can confidently embark on your path to owning a stylish, sustainable, and efficiently constructed home.”

To expand your knowledge on this subject, make sure to read on at this location: CHAPTER 5: PROPERTY REQUIREMENTS

Financing a modular home is similar to traditional home financing. Homebuyers can obtain mortgage loans from various sources, including banks, credit unions, and mortgage lenders. Some essential aspects to consider include:

Creditworthiness: Like traditional home financing, your credit score and financial history play a crucial role in securing a favorable mortgage rate for your modular home. Maintain a good credit score to access better loan terms.

Down Payment: Be prepared to make a down payment, usually a percentage of the home’s purchase price. The exact amount varies but typically ranges from 3% to 20%. Save accordingly to meet this requirement.

Loan Options: Explore different mortgage loan options, such as fixed-rate and adjustable-rate mortgages. Choose the one that best suits your financial situation and long-term plans.

Lender Selection: Research and compare lenders to find the one that offers competitive rates and terms for modular home financing. Don’t hesitate to shop around for the best deal.

Modular Home Appraisal: Your lender will require an appraisal of the modular home to determine its value. Ensure the appraisal is thorough and accurately reflects the property’s worth.

Insurance: Obtain homeowners insurance for your modular home to protect your investment. Shop for insurance providers and policies that align with your needs.

Closing Costs: Factor in closing costs, which include fees for loan origination, appraisal, title search, and more. Be prepared to cover these expenses when finalizing your home purchase.

By considering these aspects and working closely with your chosen lender, you can navigate the financing process for your modular home with confidence, just as you would with a traditional home purchase.

Looking for more insights? You’ll find them right here in our extended coverage: Chapter 12 Minimum Property Requirement Overview

A good credit score is essential to secure favorable loan terms.

“A good credit score serves as a financial passport to opportunities and stability in the world of personal finance. It is not just a number but a key that unlocks several significant advantages, and securing favorable loan terms is one of the most compelling benefits.

Lower Interest Rates: Lenders use your credit score to assess your creditworthiness. A high credit score demonstrates your ability to manage debt responsibly. As a result, lenders are more willing to offer you loans at lower interest rates. With reduced interest expenses, you not only save money in the short term but also enjoy more affordable monthly payments over the life of the loan.

Higher Loan Approvals: A strong credit score not only leads to lower interest rates but also increases your chances of loan approval. Lenders are more likely to trust borrowers with solid credit histories, making it easier to secure the financing you need for major life milestones, such as buying a home, starting a business, or pursuing higher education.

Credit Limit Increases: Maintaining a good credit score often results in credit limit increases on your credit cards. This not only provides greater financial flexibility but also boosts your credit utilization ratio, which can further improve your credit score.

Negotiating Power: A high credit score gives you negotiating power. When you apply for a loan, you are in a better position to negotiate terms that are more favorable to you. Whether it’s a lower interest rate, reduced fees, or more flexible repayment terms, a strong credit score can tilt the negotiations in your favor.

Access to Prime Credit Cards: Credit card companies reserve their best rewards and benefits for individuals with excellent credit scores. With a good credit score, you can qualify for premium credit cards that offer cashback rewards, travel perks, and exclusive privileges, enhancing your overall financial experience.

Rental Housing Opportunities: Landlords and property managers often review credit scores when considering rental applications. A good credit score can make it easier to secure your desired rental property and may even result in lower security deposits.

Insurance Premiums: Some insurance companies use credit scores to determine insurance premiums. With a good credit score, you may qualify for lower insurance rates, reducing the cost of protecting your assets and loved ones.

Employment Opportunities: In some industries and positions, employers may review credit reports as part of the hiring process. A strong credit score can enhance your employability and open doors to career opportunities that require financial responsibility and trustworthiness.

In summary, a good credit score is a powerful financial tool that extends far beyond securing favorable loan terms. It enables you to save money, access better financial products, and enjoy a more comfortable and secure financial future. Cultivating and maintaining a solid credit history is an essential aspect of personal finance that pays dividends in various aspects of your life.”

Looking for more insights? You’ll find them right here in our extended coverage: B2-3-02, Special Property Eligibility and Underwriting …

Determine the down payment required by your lender; it typically ranges from 3% to 20% of the home’s purchase price.

Understanding the down payment required by your lender is a crucial step in the homebuying process. Here’s an extended idea:

“Before embarking on your journey to homeownership, it’s vital to determine the down payment required by your lender. Down payments typically range from 3% to 20% of the home’s purchase price, although they can vary based on your specific circumstances and the type of mortgage you’re seeking.

A larger down payment can offer several advantages. Firstly, it often leads to lower monthly mortgage payments, which can make your homeownership experience more affordable in the long run. Secondly, a substantial down payment can improve your chances of securing a mortgage loan with favorable terms and interest rates. Additionally, a larger down payment may help you avoid private mortgage insurance (PMI) if you can put down 20% or more.

However, it’s essential to strike a balance between your down payment and other financial goals. While a bigger down payment can be advantageous, it shouldn’t deplete your savings or hinder your ability to cover other important expenses. Therefore, it’s wise to assess your financial situation carefully and work with a financial advisor or mortgage specialist to determine the right down payment amount that aligns with your financial goals and budget.

Remember that saving for a down payment is a significant step towards achieving homeownership, and the effort you put into this aspect of the process can have a lasting impact on your overall financial well-being as a homeowner.”

Additionally, you can find further information on this topic by visiting this page: A Closer Look at the USDA Rural Development Home Loan …

Explore different mortgage options, such as fixed-rate, adjustable-rate, or FHA loans.

“When considering a mortgage, it’s essential to explore various options to find the one that best suits your financial situation and long-term goals. Some common mortgage types include fixed-rate mortgages, adjustable-rate mortgages (ARMs), and FHA loans. Each has its advantages and drawbacks, so it’s crucial to evaluate them carefully and seek expert advice if needed. Your choice of mortgage can significantly impact your homeownership experience and financial stability, so take the time to make an informed decision.”

Should you desire more in-depth information, it’s available for your perusal on this page: Chapter 12 Minimum Property Requirement Overview

Get pre-approved for a loan to understand your budget and expedite the buying process.

Getting pre-approved for a loan is a smart and strategic move for anyone looking to purchase a home, and it offers several advantages that can streamline the entire buying process while providing valuable insights into your financial situation.

Clarity on Budget: One of the most significant benefits of getting pre-approved is gaining a clear understanding of your budget. With a pre-approval, you’ll know precisely how much a lender is willing to lend you. This information not only prevents you from wasting time looking at homes that are beyond your budget but also ensures that you’re focusing on properties you can afford comfortably.

Competitive Advantage: In a competitive real estate market, where multiple buyers may be interested in the same property, having a pre-approval letter can give you a significant advantage. Sellers are more likely to take your offer seriously because they see you as a qualified and serious buyer who can secure financing.

Faster Closing: The pre-approval process involves a thorough review of your financial situation, which includes verifying your income, credit history, and debts. By completing these steps ahead of time, you expedite the mortgage approval process when you find your dream home. This can lead to a faster closing, allowing you to move in sooner.

Negotiation Power: Armed with a pre-approval, you have more confidence when negotiating the purchase price. Sellers may be more willing to work with you on price or terms when they know you’re financially capable and ready to proceed.

Focused Home Search: Knowing your budget narrows down your home search and helps your real estate agent identify properties that match your criteria. This saves time and effort and ensures that you’re looking at homes that align with your financial capabilities.

Peace of Mind: A pre-approval not only benefits sellers but also provides peace of mind to you as the buyer. It confirms that you’re on the right track financially and that you’re taking a realistic approach to homeownership.

Interest Rate Lock: When you get pre-approved, you may have the option to lock in an interest rate for a specific period. This can protect you from potential rate increases while you shop for a home, potentially saving you money in the long run.

In summary, getting pre-approved for a home loan is a crucial step in the home buying process. It helps you determine your budget, provides a competitive edge, accelerates the closing process, and gives you more negotiation power. Overall, it’s a wise financial move that simplifies the journey to homeownership and ensures you make well-informed decisions along the way.

To delve further into this matter, we encourage you to check out the additional resources provided here: Questions and Answers

For modular homes, construction loans are common. These loans provide funds for the construction phase and later convert into a permanent mortgage. Factors to consider include:

Down Payment: Depending on your lender and creditworthiness, you may need to provide a down payment. Typical down payments range from 5% to 20% of the total project cost.

Interest Rates: The interest rates for construction loans can vary. It’s important to compare rates from different lenders and choose the one that offers the most favorable terms.

Loan Term: Construction loans have a shorter term compared to traditional mortgages, typically ranging from six months to one year. Ensure that your construction timeline aligns with the loan term.

Credit Score: Lenders will assess your creditworthiness before approving a construction loan. A higher credit score can lead to more favorable loan terms.

Builder’s Reputation: The reputation and experience of the modular home builder can influence your ability to secure financing. Lenders may prefer working with reputable builders with a track record of successful projects.

Appraisal Process: Modular homes are appraised similarly to traditional homes. The appraiser will assess the home’s value based on factors like location, size, features, and comparable sales in the area.

Insurance: Ensure that your modular home is adequately insured during construction. Construction insurance protects against unforeseen events that could damage or delay the project.

Navigating these considerations is essential to secure the financing needed to turn your modular home dream into a reality. Consulting with financial experts and lenders experienced in modular construction can provide valuable guidance throughout the process.

Should you desire more in-depth information, it’s available for your perusal on this page: B2-3-02, Special Property Eligibility and Underwriting …

Construction loans often have short terms, typically 6 to 12 months.

The short terms of construction loans can sometimes lead to challenges for borrowers, as the construction process itself may take longer than the loan term. This can result in the need for loan extensions or the conversion of the construction loan into a traditional mortgage once the project is completed. Therefore, it’s important for borrowers to carefully plan their construction timeline and finances to ensure a smooth transition from the construction phase to long-term financing.

To expand your knowledge on this subject, make sure to read on at this location: Pros and Cons of the VA Loan in 2023

Understand how the interest rates will transition from the construction phase to the permanent mortgage.

Understanding how interest rates will transition from the construction phase to the permanent mortgage is a critical aspect of managing your home building project and long-term financial stability. Here’s why this transition is significant and what you should consider:

Construction Phase Interest: During the construction phase of your home, you typically have a construction loan. This loan usually has a variable interest rate, often tied to a benchmark such as the prime rate. It’s essential to understand how the interest on this loan will be calculated, as it directly impacts your monthly payments and overall project cost.

Interest-Only Payments: In many cases, during the construction phase, you’ll only be required to make interest payments on the loan. This means you won’t be paying down the principal balance of the loan. Understanding this can help you budget effectively, as your initial monthly payments may be lower than they will be once you transition to the permanent mortgage.

Transition to Permanent Mortgage: The transition from the construction loan to the permanent mortgage occurs once your home is completed. At this point, you’ll need to secure a mortgage with a fixed or variable interest rate for the long term. It’s essential to shop around and find a mortgage that suits your financial goals and offers favorable terms.

Fixed vs. Variable Rates: You’ll need to decide whether to opt for a fixed or variable interest rate on your permanent mortgage. A fixed-rate mortgage offers stable, predictable payments, while a variable-rate mortgage may initially have lower rates but can fluctuate with market conditions. Understanding the pros and cons of each type is crucial in making an informed decision.

Rate Lock: Some lenders offer rate-lock options, allowing you to secure a specific interest rate for your permanent mortgage before construction begins. This can provide peace of mind by protecting you from potential interest rate increases during construction.

Financial Planning: Knowing how the interest rate will transition allows you to plan your finances effectively. You can anticipate changes in your monthly payments and budget accordingly, ensuring that you’re prepared for the financial responsibilities associated with homeownership.

Creditworthiness: As you transition to the permanent mortgage, your creditworthiness and financial situation will play a crucial role in securing favorable interest rates. Maintaining a strong credit score and managing your debt responsibly can help you qualify for better mortgage terms.

Future Rate Changes: Keep in mind that even with a fixed-rate mortgage, interest rates can change over time due to economic factors. Understanding how potential rate changes may impact your finances can help you make informed decisions about your mortgage.

Refinancing Options: Down the road, you may consider refinancing your mortgage to take advantage of lower interest rates or adjust your financial strategy. Understanding the terms of your permanent mortgage will enable you to explore refinancing opportunities when they arise.

In conclusion, comprehending how interest rates transition from the construction phase to the permanent mortgage is essential for managing your homebuilding project and ensuring your long-term financial stability as a homeowner. It empowers you to make informed decisions about the type of mortgage that best suits your needs and allows you to plan your finances effectively throughout the construction and homeownership journey.

For additional details, consider exploring the related content available here What to know about mobile home financing

Secure loan approval before starting the modular home construction.

Securing loan approval before commencing modular home construction is a crucial step in ensuring a smooth and successful building process. This early financial preparation offers several benefits:

Budget Clarity: Obtaining loan approval helps you establish a clear budget for your modular home project. You’ll have a better understanding of the funds available for construction, allowing you to make informed decisions about design, materials, and finishes.

Reduced Delays: With financing in place, you can avoid potential delays caused by unexpected financial obstacles during construction. This ensures that your project stays on track and progresses according to the planned timeline.

Improved Negotiation: Having loan approval enhances your negotiating power when dealing with modular home builders and suppliers. You can confidently negotiate contracts, pricing, and payment schedules, potentially securing better terms and deals.

Project Confidence: Knowing that your financing is secured instills confidence in your modular home project. It provides peace of mind, reduces stress, and allows you to focus on the creative and logistical aspects of your new home.

Streamlined Construction: Approved financing streamlines the construction process. Builders and contractors can proceed with confidence, knowing that the necessary financial resources are available, which can result in a more efficient and productive construction phase.

Risk Mitigation: Loan approval helps mitigate financial risks associated with unforeseen expenses or construction challenges. You’ll be better prepared to handle unexpected costs without compromising the quality or progress of your project.

In summary, securing loan approval upfront is a proactive and strategic approach to launching your modular home construction. It provides financial clarity, minimizes potential setbacks, and allows you to embark on your project with confidence and efficiency.

To delve further into this matter, we encourage you to check out the additional resources provided here: VA Loan Closing Time – How Long Does It Take?

A critical step in financing a modular home is the appraisal. Appraisers evaluate the home’s value to ensure it aligns with the loan amount. Some appraisal considerations include:

“Appraisers consider various factors when assessing the value of a modular home to determine its suitability for the loan amount. Key appraisal considerations include:”

For additional details, consider exploring the related content available here How Tough is the VA Appraisal? 3 Factors to Consider

Work with appraisers experienced in assessing modular homes, as they may have unique features compared to site-built homes.

“When it comes to the appraisal of modular homes, it’s essential to collaborate with professionals who possess specialized expertise in this field. Modular homes do indeed present unique features and considerations that set them apart from traditional site-built homes. Here’s an extended insight into the significance of working with experienced appraisers for modular homes:

Understanding Modular Home Construction: Appraisers experienced in assessing modular homes have a deep understanding of the intricacies of modular construction. They comprehend the modular building process, which involves constructing various sections or modules in a factory before assembling them on-site. This knowledge allows them to accurately evaluate the quality, craftsmanship, and structural integrity of modular homes.

Recognizing Quality and Standards: Experienced appraisers are well-versed in recognizing the quality standards specific to modular construction. They can assess whether the modular home adheres to industry regulations, including building codes and safety standards, ensuring that the property meets all necessary requirements.

Valuing Customization: Modular homes often offer a high degree of customization. Appraisers with expertise in modular homes are skilled at assessing the value of these custom features accurately. Whether it’s unique floor plans, specialized finishes, or customized layouts, they can determine how these factors contribute to the overall appraisal value.

Appraising Energy Efficiency: Modular homes are known for their energy-efficient features. Experienced appraisers can accurately assess the impact of these energy-saving elements on the property’s value. This includes evaluating insulation, energy-efficient appliances, and renewable energy systems like solar panels, all of which can influence the appraisal value.

Accounting for Local Regulations: Appraisers familiar with modular homes are well-acquainted with local zoning and permitting regulations. They can navigate these requirements effectively, ensuring that the modular home complies with all relevant laws, further contributing to an accurate appraisal.

Comparing to Local Market: Seasoned appraisers have a deep knowledge of the local real estate market, including the presence and demand for modular homes in the area. They can compare the modular home to similar properties and assess its value within the context of the local market dynamics.

Evaluating Resale Value: Appraisers experienced in modular homes can provide insights into the property’s long-term value. They consider factors such as the durability of modular construction, the potential for future modifications or additions, and the property’s overall resilience in various market conditions.

Staying Updated: The field of modular home construction is continually evolving with advancements in technology and design. Appraisers with expertise in this area stay updated on the latest trends and innovations, ensuring that their assessments accurately reflect the value of modern modular homes.

Liaising with Lenders: Experienced appraisers can effectively communicate the unique features and value propositions of modular homes to lenders. This facilitates the mortgage approval process, ensuring that financing is readily available to potential buyers.

In conclusion, partnering with appraisers experienced in assessing modular homes is essential to ensure an accurate and fair valuation of these unique properties. Their specialized knowledge and attention to modular construction nuances help both buyers and sellers make informed decisions and navigate the real estate market confidently.”

Should you desire more in-depth information, it’s available for your perusal on this page: CHAPTER 12: PROPERTY AND APPRAISAL REQUIREMENTS

Appraisers often use comparable sales of modular or manufactured homes in the area to determine value.

“In the world of real estate appraisal, finding the right comparables is an art. When it comes to modular homes, appraisers aim to select properties that closely resemble the subject property in terms of size, style, age, and location. By using these relevant comparables, appraisers can provide an accurate and fair valuation, ensuring that homeowners receive the true worth of their modular homes.”

For a comprehensive look at this subject, we invite you to read more on this dedicated page: B2-3-02, Special Property Eligibility and Underwriting …

A thorough home inspection ensures the modular home meets construction standards and local codes.

During a comprehensive home inspection for a modular home, several critical factors should be examined to ensure that the home meets construction standards and local building codes:

Foundation and Structural Integrity: Inspectors will examine the foundation for stability and any signs of settling or shifting. They will also check the structural components of the modular home, including load-bearing walls and roof support systems.

Plumbing and Electrical Systems: The inspection should cover all plumbing and electrical systems, from pipes and wiring to fixtures and outlets. This ensures that everything is correctly installed, safe, and compliant with local regulations.

Heating, Ventilation, and Air Conditioning (HVAC): The HVAC system’s efficiency and safety are vital. The inspection should include an assessment of the heating and cooling units, ductwork, and ventilation to ensure they meet energy efficiency standards.

Insulation and Energy Efficiency: Proper insulation is essential for maintaining energy efficiency. The inspector will check insulation levels and the condition of doors and windows to verify that the home is adequately insulated.

Roof and Exterior: Inspectors will assess the roof for any damage or wear and tear. They will also examine the exterior, siding, and drainage systems to ensure they are in good condition.

Interior: Interior inspections focus on the overall quality of the finishes, including flooring, walls, ceilings, and fixtures. Any issues related to the fit and finish of the modular home will be noted.

Fire Safety: The inspection should include checks for smoke detectors, carbon monoxide detectors, and fire extinguishers, as well as the presence of fire-safe materials and construction practices.

Local Code Compliance: The inspector will verify that the modular home complies with local building codes, zoning regulations, and permit requirements. This step is crucial to ensure that the home is legally habitable.

Environmental Considerations: Depending on the location, inspectors may also assess environmental factors such as flood zones, soil conditions, and the presence of hazardous materials.

Documentation Review: Review of all relevant documentation, including construction plans, permits, and certifications, is essential to ensure that the modular home has been built according to the approved specifications.

Once the inspection is complete, the inspector will provide a detailed report outlining any issues or areas of concern. Addressing these findings promptly can help ensure that the modular home is safe, functional, and compliant with all regulations, providing peace of mind for the homeowners.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Should I Waive the Home Inspection? – My Home by Freddie Mac

The location of your modular home can impact its appraisal value. Factors like the neighborhood, proximity to amenities, and the value of the land play a role. Ensure the land is appropriately zoned for modular home construction.

“The location of your modular home is a crucial factor that influences its appraisal value and overall desirability. Here’s a deeper exploration of how location can impact your modular home’s value:

Neighborhood Appeal: The neighborhood in which your modular home is situated can significantly affect its appraisal value. Desirable neighborhoods with well-maintained properties, low crime rates, good schools, and community amenities often lead to higher property values. When selecting a location for your modular home, consider factors such as the quality of nearby schools, safety, and the overall ambiance of the neighborhood.

Proximity to Amenities: The convenience of nearby amenities can add value to your modular home. Proximity to grocery stores, shopping centers, healthcare facilities, public transportation, parks, and recreational areas can make your property more attractive to potential buyers and appraisers. Easy access to essential services and recreational opportunities can enhance the overall quality of life for residents.

Land Value: The underlying value of the land on which your modular home is placed plays a critical role in its appraisal. Factors like the size of the lot, its topography, and any unique features can influence property value. Additionally, the land’s potential for future development or expansion can affect its worth.

Zoning Regulations: It’s essential to ensure that the land you choose is appropriately zoned for modular home construction. Zoning regulations dictate how properties can be used and developed in specific areas. Compliance with zoning laws not only ensures that your modular home can be legally placed on the land but also impacts its future resale value.

Local Real Estate Trends: Real estate markets are dynamic, and property values can fluctuate over time. Stay informed about local real estate trends and market conditions in the area where you plan to locate your modular home. Understanding market dynamics can help you make informed decisions about the timing of your purchase or sale.

Natural Features: Consider the natural features surrounding your modular home, such as views, waterfront access, or proximity to natural parks and reserves. These features can contribute to the property’s value, especially if they offer unique and sought-after attributes.

Future Development Plans: Research any planned developments or infrastructure projects in the area. Proximity to upcoming transportation improvements, commercial developments, or public services can impact property values positively. However, potential downsides like increased traffic or noise should also be considered.

Historical and Cultural Significance: In some cases, the historical or cultural significance of an area can impact property values. Homes located in historically preserved districts or culturally vibrant neighborhoods may carry added value due to their unique character and heritage.

In conclusion, the location of your modular home is a multifaceted factor that can significantly affect its appraisal value. By carefully considering neighborhood appeal, proximity to amenities, land value, zoning regulations, and local real estate trends, you can make informed decisions to maximize the value of your modular home. A well-chosen location not only enhances the enjoyment of your property but also contributes to its long-term financial worth.”

Looking for more insights? You’ll find them right here in our extended coverage: CHAPTER 5: PROPERTY REQUIREMENTS

Modular homes are known for their energy-efficient features. Highlight any upgrades or energy-efficient elements, as they can positively influence the appraisal value.

When it comes to appraising the value of your modular home, emphasizing its energy-efficient features can be a smart strategy. Here’s an extended idea:

“Modular homes are renowned for their energy-efficient design and construction, which not only contribute to a greener environment but also enhance the overall value of your property. When you’re preparing for an appraisal, it’s essential to highlight these energy-efficient elements, as they can significantly impact the appraisal value in a positive way.

Start by showcasing any upgrades or features that make your modular home more energy-efficient. This might include superior insulation, high-quality energy-efficient windows, energy-efficient heating and cooling systems, programmable thermostats, or even renewable energy sources like solar panels. These elements not only reduce your energy consumption and utility bills but also make your home more attractive to potential buyers or appraisers.

Furthermore, consider providing documentation and data regarding your home’s energy performance. This can include records of energy-efficient appliances, utility bills demonstrating energy savings, or certifications like ENERGY STAR or LEED (Leadership in Energy and Environmental Design), if applicable. These documents can serve as tangible evidence of your home’s energy efficiency and contribute to a higher appraisal value.

Incorporate the concept of ‘green living’ into your home’s narrative during the appraisal process. Explain how energy-efficient features not only benefit the environment but also offer long-term cost savings for homeowners. By underlining the practical advantages of these elements, you can help appraisers recognize the added value of your modular home in a sustainable and energy-conscious world.

Ultimately, showcasing your modular home’s energy-efficient features during the appraisal can not only improve its valuation but also attract eco-conscious buyers who appreciate the long-term benefits of a green and energy-efficient home.”

To delve further into this matter, we encourage you to check out the additional resources provided here: CHAPTER 12: PROPERTY AND APPRAISAL REQUIREMENTS

Conclusion

Financing and appraising a modular home require careful consideration of various factors. Securing the right mortgage, understanding construction loans, and ensuring a thorough appraisal process are essential steps in achieving a successful modular home purchase. By addressing these considerations, you can confidently embark on your journey to homeownership and enjoy the benefits of a customized, efficient, and elegant modular home.

“When it comes to financing and appraising a modular home, there are several crucial factors to keep in mind. Securing the right mortgage tailored to your needs is paramount, as it can impact your long-term financial stability. Additionally, understanding construction loans, which differ from traditional mortgages, is essential if you plan to build your modular home. Finally, a thorough appraisal process ensures that your home’s value aligns with your investment. By carefully navigating these considerations, you can embark on your journey to modular homeownership with confidence, knowing you’ve made a smart and informed decision.”

To delve further into this matter, we encourage you to check out the additional resources provided here: VA Loan Closing Time – How Long Does It Take?

More links

Should you desire more in-depth information, it’s available for your perusal on this page: CHAPTER 12: PROPERTY AND APPRAISAL REQUIREMENTS