Introduction

Refinancing a mortgage is a financial strategy that can help homeowners save money, reduce monthly payments, or achieve other financial goals. However, understanding when and how to consider refinancing is essential to make informed decisions about your home loan. In this article, we’ll explore the ins and outs of refinancing, helping you navigate the process and make choices that align with your financial objectives.

Refinancing a mortgage is a valuable tool for managing your financial well-being and making the most of your homeownership. It allows you to adjust the terms of your existing mortgage, potentially leading to lower monthly payments, reduced interest costs, or even cashing out on your home’s equity. However, refinancing isn’t a one-size-fits-all solution, and there are several factors to consider before taking the plunge. In this comprehensive guide, we’ll delve into the intricacies of mortgage refinancing, helping you determine when it makes sense, how to get started, and what pitfalls to avoid along the way. Whether you’re a first-time homeowner or a seasoned real estate pro, you’ll find valuable insights to optimize your mortgage and secure your financial future.

Additionally, you can find further information on this topic by visiting this page: A Consumer’s Guide to Mortgage Refinancings

One of the primary reasons homeowners consider refinancing is to take advantage of lower interest rates. When market interest rates decrease significantly below your current mortgage rate, refinancing can lead to substantial savings over the life of your loan. Even a 1% reduction in interest rate can make a noticeable difference in your monthly mortgage payments.

In addition to lowering monthly payments, refinancing can also help you shorten your loan term. If you’re able to secure a lower interest rate, you may be able to refinance into a shorter-term loan, such as moving from a 30-year to a 15-year mortgage. This can save you significant interest costs over the life of the loan and allow you to build home equity more quickly.

Additionally, some homeowners choose to refinance to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. This can provide stability and predictability in your monthly payments, protecting you from potential interest rate hikes in the future.

Before refinancing, it’s important to carefully consider your financial goals, the current market conditions, and any associated costs, such as closing fees. Refinancing can be a powerful financial tool when used strategically, but it’s essential to ensure that the potential benefits outweigh the costs in your specific situation. Consulting with a mortgage professional can help you make an informed decision about whether refinancing is right for you.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Interest Rate Reduction Refinance Loan | Veterans Affairs

Refinancing allows you to extend your loan term, which can lower your monthly mortgage payments. While this can provide immediate relief to your budget, it’s essential to consider the long-term cost of interest and the overall financial impact of extending the loan.

Refinancing presents a tempting opportunity to ease the strain on your monthly budget by extending your loan term and reducing those often hefty mortgage payments. It can be a lifeline in times of financial stress, but like any financial decision, it comes with its own set of considerations and trade-offs. Let’s take a closer look at the nuances of extending your loan term through refinancing:

Immediate Monthly Relief: Extending your loan term typically leads to lower monthly mortgage payments. For homeowners facing temporary financial challenges or seeking to free up cash for other investments or expenses, this immediate relief can be a welcome change. It can provide the breathing room needed to regain financial stability or redirect funds toward other financial goals.

Long-Term Interest Costs: While lower monthly payments can provide short-term relief, it’s crucial to consider the long-term consequences. Extending your loan term means you’ll be paying interest for an extended period. Over time, this can result in higher overall interest costs compared to the original loan term.

Total Loan Cost: When evaluating the decision to extend your loan term, it’s essential to assess the total cost of the loan. This includes not only the lower monthly payments but also the cumulative interest payments over the life of the loan. You may find that the immediate relief in monthly payments is outweighed by the long-term financial impact.

Impact on Equity: Extending your loan term can slow down the rate at which you build equity in your home. This is because a larger portion of your monthly payment goes toward interest rather than principal. If building equity and owning your home outright are important long-term goals, extending the loan term may not align with these objectives.

Financial Goals: Consider your broader financial goals and how refinancing fits into your financial plan. If your primary objective is to reduce monthly expenses and increase cash flow, extending the loan term may align with your immediate needs. However, if long-term financial security and reducing debt are priorities, you may want to explore other refinancing options, such as lowering your interest rate without extending the term.

Future Plans: Think about your future plans. If you anticipate selling the home or paying off the mortgage early, extending the loan term may not be a significant concern. However, if you plan to stay in the home for the long haul, the decision to extend the loan term becomes more impactful.

In conclusion, extending your loan term through refinancing can provide immediate financial relief, but it’s essential to weigh this against the long-term financial implications. Consider your financial goals, your capacity to handle interest costs over time, and how the decision aligns with your homeownership journey. A thoughtful approach to refinancing ensures that you strike the right balance between short-term budget relief and long-term financial well-being.

To expand your knowledge on this subject, make sure to read on at this location: Mortgage refinancing options | Fannie Mae

Conversely, some homeowners aim to pay off their mortgages faster by refinancing into a shorter loan term, such as going from a 30-year to a 15-year mortgage. Although this can lead to higher monthly payments, it can significantly reduce the total interest paid over the life of the loan and allow you to build home equity more rapidly.

Refinancing is a financial strategy that offers homeowners the opportunity to optimize their mortgage terms, potentially saving money and achieving various financial goals. It’s essential to understand when and how to consider refinancing to make informed decisions about your home loan. Here are some key factors to consider:

Interest Rates: One of the primary reasons homeowners refinance is to secure a lower interest rate. When market interest rates drop significantly below your current mortgage rate, it may be an excellent time to refinance. Lower rates can result in reduced monthly payments and substantial long-term savings.

Monthly Payment Management: Refinancing can be a tool for adjusting your monthly mortgage payments. If your financial situation has changed, refinancing can help by extending the loan term for lower payments or shortening it for faster debt payoff. Evaluate your budget and long-term financial goals to determine the best approach.

Debt Consolidation: If you have high-interest debts such as credit card balances or personal loans, you can use a cash-out refinance to consolidate these debts into your mortgage. This approach may result in a lower overall interest rate and a single, more manageable monthly payment.

Shortening the Loan Term: Conversely, some homeowners aim to pay off their mortgages faster by refinancing into a shorter loan term, such as going from a 30-year to a 15-year mortgage. Although this can lead to higher monthly payments, it can significantly reduce the total interest paid over the life of the loan and allow you to build home equity more rapidly.

Building Equity: Home equity is the portion of your home’s value that you own outright. Refinancing can help you build equity faster, especially if you’ve made substantial payments towards your mortgage. By securing a lower interest rate or shortening your loan term, you’ll accumulate equity more rapidly.

Credit Score Consideration: When refinancing, your credit score plays a crucial role in the interest rate you can qualify for. Ensure your credit score is in good shape before applying for refinancing. Paying bills on time, reducing debt, and monitoring your credit report are effective ways to improve your credit score.

Closing Costs: It’s important to calculate the closing costs associated with refinancing and determine how long it will take to recoup these expenses through lower monthly payments or interest savings. Discuss closing costs with potential lenders to understand the financial implications of refinancing.

Consult a Mortgage Professional: The decision to refinance is significant, and it’s wise to consult with a mortgage professional or financial advisor. They can provide personalized guidance, help you explore loan options, and perform a cost-benefit analysis to ensure refinancing aligns with your financial objectives.

Market Conditions: Keep an eye on market conditions and interest rate trends. Timing your refinance when rates are favorable can result in substantial savings. However, avoid trying to time the market perfectly, as interest rates can be unpredictable.

In conclusion, refinancing is a financial tool that can help homeowners save money, achieve specific financial goals, and manage their mortgage effectively. Careful consideration of your current financial situation, long-term objectives, and market conditions is essential when deciding if and when to refinance your mortgage.

Additionally, you can find further information on this topic by visiting this page: What Is Refinancing And How Does It Work? | Bankrate

Homeowners who have built substantial equity in their homes may consider a cash-out refinance. This option allows you to borrow against your home’s equity and receive a lump sum of cash that can be used for various purposes, such as home improvements, debt consolidation, or education expenses.

A cash-out refinance can provide homeowners with a valuable financial tool to tap into their home’s equity. By converting this equity into cash, you can tackle important financial goals and investments that may not have been achievable otherwise. Whether you’re looking to renovate your home, pay off high-interest debt, or fund a major expense like education, a cash-out refinance can be a strategic move to unlock your home’s potential for your financial benefit.

Should you desire more in-depth information, it’s available for your perusal on this page: Cash-Out Refinance Guide | Rocket Mortgage

If you currently have an adjustable-rate mortgage (ARM) and are concerned about potential interest rate hikes, refinancing into a fixed-rate mortgage can provide stability and peace of mind. Fixed-rate mortgages offer predictable monthly payments throughout the loan term.

If you find yourself in a situation where you hold an adjustable-rate mortgage (ARM) and the prospect of rising interest rates is causing anxiety, refinancing into a fixed-rate mortgage can be a prudent financial move. Let’s delve deeper into why this transition can offer stability and peace of mind:

Rate Certainty: The primary advantage of a fixed-rate mortgage is the certainty it provides. With an ARM, your interest rate is subject to periodic adjustments based on market conditions. These fluctuations can lead to unpredictable changes in your monthly mortgage payments, potentially causing financial stress when rates rise. In contrast, a fixed-rate mortgage locks in your interest rate for the entire loan term, ensuring that your monthly payments remain constant.

Budgeting Confidence: Fixed-rate mortgages empower homeowners with the ability to budget confidently. Knowing that your mortgage payment will not change over the life of the loan allows you to plan your finances effectively. This stability is particularly beneficial for families and individuals who rely on a consistent budget to meet other financial goals, such as saving for retirement, education, or emergencies.

Protection Against Rate Spikes: Interest rate hikes in the broader market can have a significant impact on ARM holders. If rates increase substantially, your monthly mortgage payments could rise significantly, potentially straining your budget. By refinancing into a fixed-rate mortgage, you shield yourself from such spikes, providing a safety net against unpredictable market fluctuations.

Long-Term Financial Security: A fixed-rate mortgage contributes to long-term financial security. Over the years, as you make on-time payments, you build equity in your home. Knowing that your mortgage costs are stable enables you to focus on building wealth and achieving your financial goals without the added stress of interest rate uncertainties.

Protection from Economic Uncertainty: Economic conditions can change unexpectedly, affecting interest rates. Fixed-rate mortgages offer a hedge against such uncertainties. If economic downturns lead to lower rates, you can explore refinancing options to potentially reduce your monthly payment further. This flexibility allows you to adapt to changing financial circumstances while still benefiting from rate stability.

Planning for the Future: Fixed-rate mortgages are particularly suitable for homeowners who plan to stay in their homes for an extended period. They provide a consistent financial foundation, allowing you to focus on other aspects of your life and plan for the future with confidence.

Refinancing Opportunities: If you’re currently holding an ARM, you can explore the option to refinance into a fixed-rate mortgage when market conditions are favorable. Refinancing can provide an opportunity to secure a lower interest rate and potentially reduce your overall borrowing costs, enhancing your long-term financial well-being.

In summary, transitioning from an adjustable-rate mortgage to a fixed-rate mortgage offers stability, predictability, and peace of mind in the face of potential interest rate hikes. It empowers you to budget with confidence, protect your finances from market fluctuations, and build long-term financial security. Ultimately, it’s a strategic move that enhances your overall financial well-being and provides you with a sense of financial control and peace of mind.

To expand your knowledge on this subject, make sure to read on at this location: Should You Refinance Your ARM To A Fixed-Rate Mortgage …

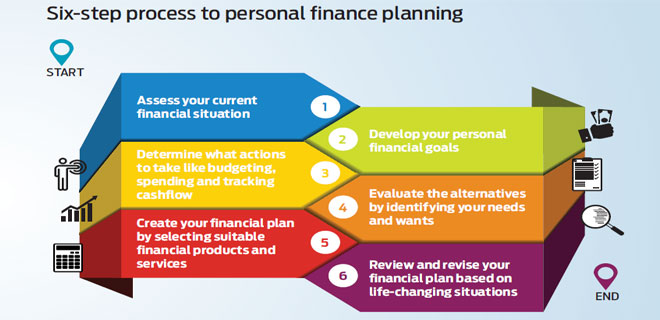

Start by defining your financial objectives. Are you looking to reduce monthly payments, pay off your mortgage faster, or access home equity? Your goals will help determine the type of refinance that best suits your needs.

Once you’ve defined your financial objectives, it’s essential to evaluate your current mortgage terms and compare them to potential refinancing options. Understand the interest rate, loan term, and monthly payments of your existing mortgage. Then, explore different refinance choices, such as a rate-and-term refinance, cash-out refinance, or streamline refinance, to determine which aligns best with your goals.

Consider factors like your credit score, current home equity, and the interest rate environment. If your credit score has improved since you initially took out your mortgage, you might qualify for a lower interest rate, potentially saving you thousands of dollars over the life of your loan.

Additionally, think about how long you plan to stay in your home. If you anticipate moving in a few years, a shorter-term refinance might not be the most cost-effective choice. On the other hand, if you intend to remain in your home for an extended period, a refinance with a shorter term can help you build equity faster and pay off your mortgage sooner.

Don’t forget to factor in closing costs and fees associated with the refinance process. While a refinance can lead to long-term savings, it’s essential to calculate your breakeven point to determine how many months it will take to recoup the costs of refinancing through lower monthly payments.

Ultimately, consulting with a mortgage professional can provide valuable insights and help you make an informed decision based on your unique financial situation and goals. Refinancing your mortgage can be a strategic move that improves your financial outlook and brings you closer to your homeownership objectives.

Additionally, you can find further information on this topic by visiting this page: Is It Time To Refinance? Understanding The Ins And Outs Of …

Your credit score plays a crucial role in your ability to secure a favorable refinance rate. Obtain a copy of your credit report, review it for accuracy, and take steps to improve your credit score if necessary.

Improving your credit score can include actions like paying bills on time, reducing credit card balances, and addressing any errors on your credit report. A higher credit score can help you qualify for lower refinance rates, saving you money in the long run. Additionally, consider working with a financial advisor or credit counselor to develop a plan for credit score improvement if needed.

If you’d like to dive deeper into this subject, there’s more to discover on this page: VA Funding Fee And Loan Closing Costs | Veterans Affairs

Shop around for lenders and compare their refinancing offers. Request quotes from multiple lenders to ensure you’re getting the most competitive rates and terms. Consider both traditional banks and online lenders.

“When it comes to refinancing your mortgage, the savvy move is to embark on a lender exploration journey. This journey involves shopping around, collecting quotes, and meticulously comparing refinancing offers from various sources. Here’s why this thorough approach is essential and some strategic steps to consider:

Lender Diversity: The mortgage landscape is diverse, with a wide array of lenders ranging from traditional banks to online mortgage providers. Each brings its own set of terms, rates, and conditions to the table. By considering multiple lenders, you open the door to a broader spectrum of refinancing opportunities.

Competitive Advantage: Requesting quotes from multiple lenders empowers you with a competitive advantage. Lenders understand that borrowers are actively seeking the best deals, which can prompt them to offer more favorable terms to win your business. This competition can work in your favor, potentially leading to better rates and reduced fees.

Rate and Term Comparison: Mortgage refinancing involves a delicate balance between interest rates and loan terms. By gathering quotes from various lenders, you can evaluate the interplay between these factors. You can choose between shorter-term loans for quicker debt payoff or longer-term loans for lower monthly payments, all while assessing the associated interest rates.

Cost Assessment: Beyond interest rates, refinancing may entail various costs, such as closing costs, origination fees, and appraisal fees. Obtaining multiple quotes allows you to assess the full financial picture. While one lender might offer a lower interest rate, another might have lower associated costs, making it essential to consider the overall cost-effectiveness of the refinancing offer.

Customized Solutions: Every borrower’s financial situation is unique. Requesting quotes from multiple lenders allows you to explore refinancing solutions that align with your specific needs and goals. Whether you seek to lower your monthly payments, reduce the overall interest paid, or access equity for other purposes, you can tailor your choice to match your objectives.

Online and Traditional Lenders: Don’t limit your search to a single category of lenders. Traditional brick-and-mortar banks often compete alongside online lenders, each with its own strengths. Online lenders may offer convenience and efficiency, while traditional banks might provide a deeper relationship and in-person support. Exploring both options ensures you don’t miss out on valuable refinancing opportunities.

Customer Service and Reputation: Alongside rates and terms, consider the reputation and customer service of each lender. Online reviews, recommendations from friends or family, and your own interactions with lenders can provide insights into their reliability and responsiveness. A lender’s commitment to providing excellent service can greatly impact your refinancing experience.

Rate Lock: Some lenders offer rate lock options, allowing you to secure a specific interest rate for a certain period, often until the closing of the loan. This can protect you from potential rate increases during the application process, providing stability and peace of mind.

Consultation and Questions: Don’t hesitate to consult with lenders and ask questions. Clarify any uncertainties regarding terms, fees, or processes. Open communication with potential lenders can help you make informed decisions and ensure there are no surprises down the road.

In summary, shopping around for lenders and diligently comparing refinancing offers is a strategic approach that can lead to substantial savings and a refinancing solution that aligns perfectly with your financial goals. By considering both traditional and online lenders, you can cast a wide net and confidently navigate the refinancing landscape, ultimately securing the best possible terms for your mortgage.”

Explore this link for a more extensive examination of the topic: What is mortgage refinancing and how does it work?

Refinancing typically involves closing costs, which can vary significantly depending on the lender and your location. Be sure to factor in these costs when assessing the financial feasibility of refinancing.

“Refinancing can be a smart financial move if it aligns with your goals and reduces your overall mortgage costs. However, it’s essential to carefully weigh the potential benefits against the associated closing costs to ensure it’s the right choice for your unique situation.”

Looking for more insights? You’ll find them right here in our extended coverage: Cash-Out Refinance: Rates And Guide For Homeowners

Prepare the required documents, including pay stubs, tax returns, bank statements, and proof of homeowners insurance. Having these documents ready will streamline the application process.

Preparing the necessary documents ahead of time not only expedites your mortgage application but also demonstrates your readiness to lenders, making a favorable impression and increasing your chances of approval. Organize pay stubs, tax returns, bank statements, and homeowners insurance proof to ensure a smooth application process.

You can also read more about this here: Tax Prep Checklist: Documents to Gather Before Filing – Forbes …

Once you’ve chosen a lender and received a favorable rate quote, consider locking in your interest rate to protect against potential rate increases while your loan application is processed.

“Locking in your interest rate is a savvy move that provides you with financial security and peace of mind throughout the mortgage application process. Here’s why taking this step is crucial and how it benefits you:

Rate Protection: Interest rates can fluctuate daily due to various economic factors. By locking in your rate, you shield yourself from these fluctuations. This means that even if market rates rise during the processing of your loan application, your rate remains fixed at the initially quoted, lower rate.

Budget Consistency: Rate locks ensure consistent monthly payments. Knowing exactly what your mortgage payment will be can help you budget more effectively and plan for your homeownership expenses with confidence. It eliminates the uncertainty of how rate changes might impact your financial obligations.

Financial Planning: If you’ve already received a favorable rate quote, it’s a prudent decision to secure that rate. This enables you to integrate your mortgage payments seamlessly into your overall financial plan, whether it involves saving for other goals, investing, or managing your household budget.

Competitive Advantage: When you make an offer on a home, having a locked-in rate can enhance your competitiveness as a buyer. It demonstrates to sellers that you’re well-prepared and committed to the purchase, potentially making your offer more appealing, especially in a competitive real estate market.

Rate Lock Period: Be aware of the rate lock period offered by your lender. It typically ranges from 30 to 60 days, although some lenders offer longer lock periods for a fee. Ensure that the lock duration aligns with the expected timeline for your loan approval and closing to avoid any potential rate extension fees.

Rate Lock Fees: Some lenders may charge a fee for locking in your rate. It’s essential to understand these costs and factor them into your overall closing expenses. In many cases, the financial benefits of a rate lock far outweigh the associated fees.

Rate Float Option: In some situations, you might choose to float your rate, which means you’re willing to take the rate that is available at the time of closing rather than locking it in advance. This can be a strategy if you believe rates may decrease further, but it carries the risk of rates rising.

Rate Lock Agreement: Before finalizing the rate lock, carefully review and sign the rate lock agreement provided by your lender. This document outlines the terms and conditions of the rate lock, including any potential penalties for breaking the lock.

In summary, when you’ve found a lender offering a favorable interest rate, securing that rate through a rate lock is a prudent and strategic move. It shields you from market rate fluctuations, ensures predictable monthly payments, and strengthens your position as a competitive buyer in the real estate market. By taking this step, you not only protect your financial interests but also gain confidence and stability throughout the homebuying process.”

To expand your knowledge on this subject, make sure to read on at this location: Mortgage Rate Lock Guide: When To Lock In | Rocket Mortgage

Conclusion

Refinancing can be a valuable financial tool when used strategically. By understanding when and how to consider it, homeowners can take advantage of lower interest rates, reduce monthly payments, and achieve their financial goals. However, it’s essential to carefully weigh the pros and cons of refinancing and consult with a financial advisor or mortgage professional to make informed decisions tailored to your unique circumstances.

Refinancing is a financial maneuver that can significantly impact your homeownership experience. When approached strategically, it can lead to reduced interest rates, lower monthly payments, and the achievement of various financial objectives. However, homeowners should exercise caution and engage in thorough research before deciding to refinance. Each situation is unique, and it’s crucial to consider factors such as current interest rates, the length of your remaining mortgage term, and your overall financial goals. Consulting with a financial advisor or mortgage professional can provide invaluable guidance in navigating the refinancing process, ensuring that your decisions align with your individual circumstances and long-term financial well-being.

To expand your knowledge on this subject, make sure to read on at this location: Dutch IT services provider Conclusion completes €410 million …

More links

To expand your knowledge on this subject, make sure to read on at this location: Cash-Out Refinance: How It Works and What to Know – NerdWallet