Introduction

Buying a home is a significant milestone in life, but it often involves a complex financial process. One crucial step in securing your dream home is obtaining a mortgage pre-approval. This process not only streamlines your home buying journey but also offers several advantages. In this article, we’ll delve into what mortgage pre-approval means, why it’s essential, and how it can benefit prospective homebuyers.

“Embarking on the journey to homeownership is a momentous and often exhilarating endeavor. Yet, this path is intertwined with a multifaceted financial process that can seem daunting at times. At the heart of this process lies a pivotal step that can make all the difference in realizing your dream of owning a home: obtaining a mortgage pre-approval.

In this comprehensive guide, we’ll navigate the intricate terrain of mortgage pre-approval, shedding light on its significance and the array of advantages it bestows upon prospective homebuyers. Let’s embark on this journey together to understand not only what mortgage pre-approval entails but also why it stands as an essential milestone and how it can empower you in your quest for homeownership.

The Quest for Homeownership: Owning a home is a cherished aspiration, representing stability, personal space, and a sense of accomplishment. However, the path to homeownership often appears labyrinthine, brimming with financial intricacies and important decisions. Among these decisions, securing a mortgage pre-approval stands as a beacon of clarity and opportunity.

Unraveling Mortgage Pre-Approval: At its core, mortgage pre-approval is a financial evaluation conducted by a lender to determine your creditworthiness and establish the maximum loan amount you’re eligible for. It goes beyond a cursory glance at your financial standing; it’s a comprehensive assessment that factors in your income, credit history, employment stability, debts, and assets. This meticulous review sets the stage for your homebuying journey.

The Streamlined Path: One of the primary advantages of mortgage pre-approval is the streamlined path it paves toward homeownership. It equips you with a clear budget, allowing you to focus your search on homes within your financial reach. This not only saves time but also ensures that you invest your efforts in exploring properties that align with your aspirations.

The Power of Confidence: Armed with a pre-approval letter, you enter the real estate market with confidence. Sellers and real estate agents take pre-approved buyers more seriously, knowing that they have already secured financing up to a specific amount. This can be a game-changer in competitive markets, potentially leading to more favorable terms and a smoother negotiation process.

Budget Clarity: Mortgage pre-approval provides you with budget clarity. You know precisely how much you can borrow, which helps you set realistic expectations and avoid the disappointment of falling in love with a home that’s beyond your financial reach.

Negotiation Leverage: Pre-approval can grant you negotiation leverage. Sellers may be more inclined to work with pre-approved buyers, as it signifies a higher probability of a successful transaction. This advantage can translate into better terms, potentially saving you money in the long run.

An Efficient Process: Pre-approval expedites the mortgage application process once you’ve found your dream home. Much of the groundwork, including credit assessment and documentation verification, is already complete. This accelerates the final loan approval process and brings you closer to the keys to your new home.

Financial Responsibility: It’s important to maintain financial responsibility after pre-approval. Avoid significant financial changes or taking on new debt, as these can affect your final loan approval. Your financial stability should align with the information presented during pre-approval.

A Limited Timeframe: Keep in mind that mortgage pre-approval typically has a limited timeframe, often ranging from 60 to 90 days. If you don’t find a suitable home within this period, you may need to undergo the pre-approval process again, as financial circumstances can change.

In this journey toward homeownership, mortgage pre-approval shines as a beacon of clarity, empowerment, and opportunity. It’s more than a financial milestone; it’s a strategic advantage that guides you toward the home of your dreams. Let’s embark on this enlightening exploration of what mortgage pre-approval truly means, why it’s pivotal, and how it can be your key to unlocking the door to your new home.”

To delve further into this matter, we encourage you to check out the additional resources provided here: Comment for 1003.2 – Definitions | Consumer Financial Protection …

What Is Mortgage Pre-Approval? Mortgage pre-approval is a pivotal early step in the home buying process. It involves a comprehensive assessment by a lender to determine if you are eligible for a home loan and, if so, the maximum amount you can borrow. Unlike pre-qualification, which is a more informal estimate, pre-approval is a thorough evaluation of your financial situation.

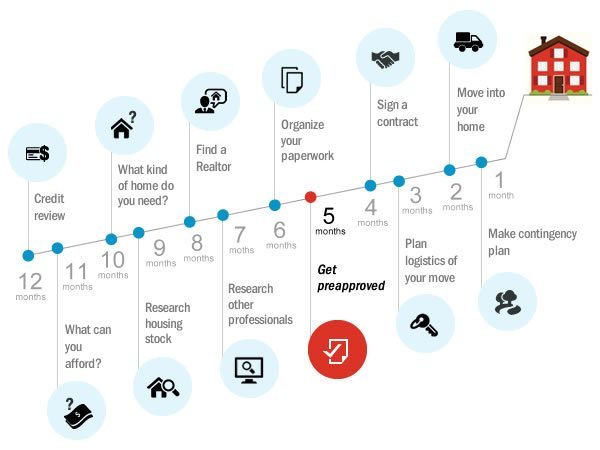

“Mortgage pre-approval sets the stage for a successful homebuying journey. It provides you with a clear understanding of your budget, allowing you to focus your search on homes within your price range. Additionally, pre-approval demonstrates your seriousness to sellers, making your offers more appealing in competitive real estate markets. To secure a mortgage pre-approval, follow these essential steps:”

Don’t stop here; you can continue your exploration by following this link for more details: How To Get A Mortgage Preapproval | Rocket Mortgage

Knowing how much you can borrow provides clarity when searching for homes. It ensures you focus on properties within your budget, saving time and effort.

“Understanding your borrowing capacity streamlines the home search process. By concentrating on homes within your financial reach, you maximize your chances of finding the right property while avoiding wasted time and resources.”

Don’t stop here; you can continue your exploration by following this link for more details: How To Get A Mortgage Preapproval | Rocket Mortgage

Sellers are more likely to entertain offers from pre-approved buyers since they present a lower risk of a deal falling through due to financing issues.

“Sellers place immense value on the reliability of a buyer’s offer, and pre-approval provides a tangible assurance that you are a serious and financially capable purchaser. Here’s a closer look at why pre-approved buyers are favored by sellers and why they represent a lower risk in real estate transactions:

Certainty of Financing: A pre-approval indicates that you have undergone a thorough financial evaluation and have received preliminary approval for a mortgage loan. This means that a lender has assessed your creditworthiness, income, and debt obligations, and is willing to finance your home purchase up to a certain amount. Sellers appreciate the certainty this brings to the transaction, knowing that you have the means to secure financing.

Faster Closing Process: Pre-approved buyers can often expedite the closing process. Since much of the financing groundwork has already been laid, there is a reduced likelihood of financing-related delays. Sellers who want a smooth and efficient transaction are more inclined to work with pre-approved buyers to achieve this.

Reduced Risk of Deal Breakdown: A deal falling through due to financing issues can be a nightmare for sellers. Pre-approved buyers mitigate this risk significantly. By presenting a pre-approval letter, you demonstrate your financial capability, reassuring sellers that they won’t encounter unexpected hurdles later in the process.

Competitive Advantage: In competitive real estate markets, where multiple offers may be on the table, pre-approval gives you a competitive edge. Sellers are more likely to consider your offer favorably, knowing that it comes with a higher level of financial security. This advantage can be particularly important when bidding on properties with multiple interested buyers.

Negotiating Leverage: Sellers may be more open to negotiations with pre-approved buyers. This can translate into opportunities for price concessions, favorable terms, or quicker response times to counteroffers. Sellers appreciate buyers who are well-prepared and financially qualified.

Confidence in Buyer’s Intentions: Pre-approval is often seen as a strong indicator of a buyer’s seriousness and commitment. Sellers are more likely to invest time and effort in negotiations with pre-approved buyers, believing that they are genuinely interested in completing the transaction.

Streamlined Process: Since you’ve already taken the steps to secure pre-approval, the homebuying process tends to be more streamlined. This can be particularly attractive to sellers who are looking for a straightforward and hassle-free experience.

Eases Seller Concerns: Selling a home can be an emotional process for homeowners. Knowing that the buyer is pre-approved can alleviate some of the seller’s concerns about the fate of their property. It provides peace of mind and a sense of security.

In summary, pre-approval is not just a formality; it’s a powerful tool that instills confidence in sellers and reduces the risks associated with financing-related delays or deal cancellations. It strengthens your offer, enhances your position in negotiations, and increases the likelihood of your offer being accepted. In a competitive and dynamic real estate market, being a pre-approved buyer can be the key to securing the home of your dreams.”

You can also read more about this here: Get Preapproved For A Car Loan In 3 Steps | Bankrate

In a competitive market, pre-approval distinguishes you as a serious buyer. It can make your offer more appealing than others without pre-approval.

“In a competitive market, pre-approval distinguishes you as a serious buyer. It can make your offer more appealing than others without pre-approval, increasing your chances of securing your dream home.”

For additional details, consider exploring the related content available here Mortgage Pre-Qualification vs. Pre-Approval – Understanding the …

Mortgage pre-approval often comes with a rate lock option. This means that if interest rates rise during your pre-approval period, you’re still eligible for the lower rate that was in effect when you were pre-approved.

Rate locks give homebuyers peace of mind and protection against rising interest rates during the pre-approval period. This safeguard ensures you can secure a mortgage at a favorable rate, even if market conditions change. It’s a valuable tool for budget-conscious homebuyers, allowing you to plan your purchase with greater financial stability. So, when considering a mortgage pre-approval, explore rate lock options with your lender to take full advantage of this benefit.

Looking for more insights? You’ll find them right here in our extended coverage: Pre-Qualified vs. Pre-Approved: What’s the Difference?

Since much of the paperwork is completed during pre-approval, the closing process tends to be faster, allowing you to move into your new home sooner.

The efficiency gained during the mortgage pre-approval process extends its benefits well into the closing phase, facilitating a smoother and faster transition to homeownership. Here’s how the groundwork laid during pre-approval expedites the closing process and gets you into your new home sooner:

Reduced Document Redundancy: During pre-approval, you’ve already submitted essential financial documents for review. This means that many of the necessary paperwork, such as income verification, bank statements, and credit checks, have been thoroughly examined and are readily available. There’s no need to duplicate these efforts during the closing process, which eliminates redundancy and speeds things up.

Faster Lender Review: The pre-approval process involves a comprehensive review of your financial situation by the lender. This review often uncovers any potential issues or discrepancies early on. Addressing and resolving these matters in advance means fewer surprises during the closing process, resulting in a quicker lender review.

Clearer Financial Picture: Pre-approval provides a clearer financial picture to both you and the lender. With your budget and loan amount determined, you can confidently select a home within your means. This clarity minimizes delays caused by last-minute changes or adjustments during the closing process.

Shorter Mortgage Contingency Period: In many real estate transactions, a mortgage contingency period is stipulated, allowing you time to secure financing. With pre-approval, you’re already ahead of the game. This often shortens the contingency period, instilling confidence in sellers and streamlining the process.

Focused Negotiations: Knowing your budget through pre-approval allows you to negotiate with precision. There’s less back-and-forth on pricing and terms, as you can make informed decisions quickly. This efficiency in negotiations expedites the contract-to-close timeline.

Quicker Appraisal and Underwriting: The appraisal and underwriting processes are typically more efficient with pre-approval in place. With key financial documents already reviewed, the underwriting process becomes smoother, and the appraisal is more likely to align with the contract price. This reduces potential bottlenecks that could slow down the closing.

Confidence for All Parties: Pre-approval provides confidence not only to you but also to sellers and real estate professionals involved in the transaction. This confidence fosters cooperation and timely communication among all parties, further expediting the process.

Faster Closing Date: All these factors culminate in a faster closing date. You can often move into your new home sooner than if you were navigating the process without pre-approval, saving you time, stress, and potential costs associated with delays.

In essence, mortgage pre-approval serves as the foundation for an efficient and expedited closing process. It minimizes paperwork redundancies, streamlines financial reviews, and instills confidence in all stakeholders. As a result, you’re well-positioned to transition into your new home with minimal delays, allowing you to enjoy the benefits of homeownership sooner than you might have expected.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Mortgage Pre-Qualification vs. Pre-Approval – Understanding the …

Lenders require various documents, including pay stubs, tax returns, bank statements, and employment history. Ensure you have these ready.

Certainly, here’s an extended idea:

“Preparing the necessary documentation for your mortgage pre-approval is a crucial step in the process. Lenders typically require a thorough financial history, which includes pay stubs, tax returns, bank statements, and a detailed employment history. Gathering and organizing these documents in advance not only expedites the pre-approval process but also demonstrates your commitment and readiness as a homebuyer. Being well-prepared with your financial records can set you on the path to a smooth and successful homebuying journey.”

For additional details, consider exploring the related content available here 6 Requirements to Buy a House – Mortgage

Research and select a reputable lender. Mortgage brokers, banks, and credit unions are common options.

When it comes to choosing a lender for your mortgage, it’s essential to do your research and select a reputable financial institution. You have several options to consider, including mortgage brokers, banks, and credit unions. Each has its advantages and disadvantages, so let’s explore these options in more detail:

Mortgage Brokers: Mortgage brokers act as intermediaries between borrowers and multiple lenders. They have access to a range of loan products from various financial institutions. Here are some key points to consider when working with a mortgage broker:

- Choice: Brokers can provide you with a variety of loan options from different lenders, potentially increasing your chances of finding a mortgage that suits your needs.

- Convenience: Mortgage brokers can save you time by doing the legwork for you. They’ll gather your financial information, shop around for the best rates, and help you with the application process.

- Expertise: Experienced mortgage brokers can offer valuable insights and advice, especially if you have a complex financial situation.

However, keep in mind that mortgage brokers earn commissions from lenders, which may influence the loan options they present to you. It’s essential to work with a reputable and transparent broker.

Banks: Many people turn to their regular banks when seeking a mortgage. Here are some considerations when dealing with banks:

- Familiarity: If you already have a banking relationship, your bank may offer you competitive rates and terms.

- In-House Services: Banks often have in-house underwriters and processors, potentially streamlining the approval and closing processes.

- Limited Options: Banks typically offer a narrower range of loan products compared to mortgage brokers.

Credit Unions: Credit unions are member-owned financial cooperatives that can be excellent options for obtaining a mortgage. Here’s what you should know:

- Community Focus: Credit unions often emphasize community involvement and may offer personalized service.

- Membership Required: To access their services, you typically need to become a member of the credit union.

When choosing a lender, it’s crucial to consider factors like interest rates, fees, customer service, and the lender’s reputation. Take the time to compare offers from multiple lenders, and don’t hesitate to ask questions to ensure you fully understand the terms and conditions of your mortgage. A well-informed decision can save you money and make your homeownership journey more successful.

Should you desire more in-depth information, it’s available for your perusal on this page: Competing on customer experience in US mortgage

Complete a mortgage pre-approval application. You may do this in person, over the phone, or online.

Completing a mortgage pre-approval application is a pivotal step on your path to homeownership, and the process offers multiple avenues for your convenience. Here’s a closer look at these application methods:

In-Person Application: Many individuals prefer the traditional approach of meeting with a loan officer or mortgage broker in person to complete their pre-approval application. This method provides a personal touch, allowing you to ask questions and receive guidance on the spot. It’s an excellent choice if you value face-to-face interactions and want to build a rapport with your mortgage professional.

Over-the-Phone Application: Applying for pre-approval over the phone is a convenient option for those who prefer verbal communication. You can speak directly with a loan officer or mortgage specialist who will guide you through the application process, answer any queries you may have, and assist you in gathering the necessary documentation. This method is particularly helpful if you have a busy schedule or prefer discussing financial matters in real-time.

Online Application: With the digital age in full swing, online mortgage pre-approval applications have become increasingly popular. This method offers the utmost convenience, allowing you to complete the application at your own pace from the comfort of your home. Online applications are often user-friendly, with clear instructions and prompts to help you provide all the necessary information. They also offer the advantage of immediate submission, expediting the pre-approval process.

Paper Application: While less common today, some lenders still offer paper-based pre-approval applications. This method involves filling out a physical application form, which you can either pick up from a lender’s office or request by mail. You’ll need to complete the form, gather the required documentation, and send it back to the lender. While it may be less convenient than digital methods, it can be suitable for individuals who prefer tangible paperwork or face challenges with online access.

Regardless of the application method you choose, the key is to provide accurate and complete information. The lender will review your application, assess your creditworthiness, and determine the mortgage amount you may be pre-approved for. Keep in mind that the documentation required, such as income statements, bank statements, and tax returns, will be similar across application methods.

Ultimately, the choice of how to complete your mortgage pre-approval application depends on your personal preferences, schedule, and comfort level with technology. Whichever method you select, rest assured that the goal is to obtain a pre-approval letter that empowers you to confidently explore the housing market and make informed decisions as you embark on your journey to homeownership.

Explore this link for a more extensive examination of the topic: Pre-Qualified vs. Pre-Approved: What’s the Difference?

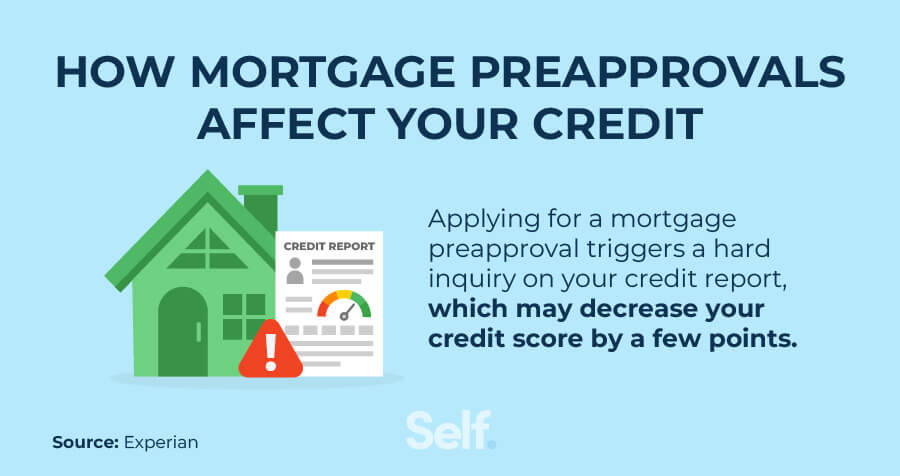

The lender will run a credit check to assess your creditworthiness.

A credit check is a critical step in the mortgage application process. Lenders use it to evaluate your credit history, which includes your credit score, payment history, outstanding debts, and any derogatory marks. This assessment helps them determine your creditworthiness and the level of risk associated with lending to you.

Here are some key aspects to understand about the credit check during the mortgage application:

Credit Score: Your credit score is a numerical representation of your creditworthiness. Lenders typically use FICO scores, which range from 300 to 850. A higher score indicates better creditworthiness and may lead to more favorable mortgage terms.

Payment History: Lenders want to see a consistent history of on-time payments for your debts, such as credit cards, loans, and previous mortgages. Late payments or delinquencies can negatively impact your credit report.

Outstanding Debts: Your current outstanding debts, including credit card balances and loans, are considered in the assessment. High levels of debt relative to your income can affect your ability to qualify for a mortgage.

Derogatory Marks: Negative marks on your credit report, such as bankruptcies or foreclosures, can significantly impact your creditworthiness. It’s important to address and resolve any derogatory marks before applying for a mortgage.

Credit Utilization: Lenders also examine your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. Keeping this ratio low can positively influence your credit score.

Credit Inquiries: Each time a lender or creditor checks your credit, it results in a credit inquiry. Multiple inquiries within a short period can lower your credit score, so it’s advisable to limit credit inquiries during the mortgage application process.

Minimum Credit Score Requirements: Different loan programs and lenders may have specific minimum credit score requirements. It’s essential to know these requirements and work on improving your credit score if necessary.

Credit Report Accuracy: Review your credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) for accuracy. Dispute any errors or discrepancies to ensure your credit history is correctly represented.

Credit Improvement: If your credit score is lower than desired, take steps to improve it before applying for a mortgage. This may include paying down debts, avoiding late payments, and maintaining a positive credit history.

A strong credit profile can lead to better mortgage terms, including a lower interest rate and a higher chance of mortgage approval. Therefore, it’s crucial to manage your credit responsibly and address any issues that may negatively impact your creditworthiness. By doing so, you’ll be better positioned to secure a mortgage that aligns with your homeownership goals.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Pre-Qualified vs. Pre-Approved: What’s the Difference?

The lender will evaluate your financial information and provide you with a pre-approval letter if you qualify.

A pre-approval letter serves as a valuable tool in the homebuying process. It not only shows sellers that you’re a serious and qualified buyer but also gives you a clear understanding of your budget and what you can afford. This puts you in a stronger position to negotiate and make well-informed decisions when searching for your dream home. So, before you embark on your homebuying journey, obtaining a mortgage pre-approval is a crucial step that can save you time, money, and stress in the long run.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Guardianship Basics

Once you receive your pre-approval letter, you can confidently house hunt within your budget.

“Armed with your pre-approval letter, your house-hunting journey transforms into a purposeful and confident expedition, guided by the clarity of your budget. Here’s why this document holds the power to make your home search not only efficient but also exceptionally rewarding:

Focused Search: Your pre-approval letter is your financial compass in the vast landscape of the real estate market. It sets a clear boundary on your budget, ensuring that you dedicate your time and energy to exploring homes that fall within your financial reach. This focus prevents you from wandering into the territory of homes that might be too expensive or, conversely, well below your budget.

Realistic Expectations: Armed with the knowledge of your pre-approved loan amount, you enter showings and open houses with realistic expectations. You’re less likely to be swayed by properties that stretch your budget beyond its limits or those that fall short of your desired features. Your home criteria align with the financial parameters set by your pre-approval, streamlining your decision-making process.

Confident Offers: When you find the perfect home, you can confidently submit an offer. Sellers often give preference to pre-approved buyers because they know that these individuals have already secured financing. This confidence can strengthen your position during negotiations and increase the likelihood of your offer being accepted.

Competitive Advantage: In competitive real estate markets, where multiple buyers may be vying for the same property, having a pre-approval letter can be a game-changer. It distinguishes you as a serious and prepared buyer, potentially placing you ahead of those who are still in the early stages of securing financing.

Time Efficiency: With a pre-approval letter, you optimize your use of time. You won’t waste precious weekends touring homes that ultimately prove to be outside your budget. Instead, you invest your efforts in exploring properties that align with your financial capacity, which can expedite the overall home-buying process.

Peace of Mind: Knowing that you have secured financing up to a specific amount offers peace of mind. You can navigate the home-buying process with reduced stress and anxiety, as the uncertainty surrounding financing is minimized. This assurance allows you to focus on other important aspects of your home search.

Financial Discipline: Pre-approval encourages financial discipline throughout the house-hunting journey. Since you are aware of your budget constraints, you are less likely to be tempted by properties that would stretch your finances to the limit. This discipline contributes to a healthier long-term financial outlook as a homeowner.

Customized Offers: Your pre-approval letter can be tailored to specific offers. If you find a property that falls below your pre-approved amount, you can submit an offer for that precise figure. Conversely, if you decide to make an offer on a property at the upper limit of your pre-approval, your letter signals to the seller that you have the financial means to support the purchase.

In summary, a pre-approval letter is your ticket to a focused, efficient, and confident house-hunting experience. It empowers you to explore homes within your budget, make informed decisions, and compete effectively in the real estate market. With this financial compass in hand, you’re well on your way to discovering the home that perfectly aligns with your aspirations and financial goals.”

Don’t stop here; you can continue your exploration by following this link for more details: What Is a Preapproval Letter? – Experian

Conclusion

Mortgage pre-approval is not just a paperwork formality; it’s a valuable tool for homebuyers. It streamlines the buying process, gives you a competitive edge, and provides clarity on your budget. So, before you embark on your home buying journey, consider getting pre-approved—it’s a significant step toward securing your dream home.

“Securing a mortgage pre-approval is more than just a formality; it’s a strategic move that can greatly benefit homebuyers. This important step streamlines the buying process, enhances your competitiveness in the real estate market, and offers you a clear understanding of your financial boundaries. So, don’t overlook the value of pre-approval as you embark on your homebuying journey—it’s a significant milestone on the path to realizing your dream home.”

For a comprehensive look at this subject, we invite you to read more on this dedicated page: What is mortgage insurance and how does it work? | Consumer …

More links

Should you desire more in-depth information, it’s available for your perusal on this page: Get a prequalification or preapproval letter | Consumer Financial …