Introduction

When it comes to purchasing high-value homes or refinancing existing ones, traditional mortgage options may not always suffice. That’s where jumbo loans come into play. These specialized mortgage products are tailored to accommodate larger loan amounts, making homeownership a reality for those investing in upscale properties. In this article, we’ll decode jumbo loans, exploring what they are, how they work, and what potential homebuyers and current homeowners need to know.

In the realm of real estate finance, particularly for high-value properties, the standard mortgage options may not always fit the bill. It’s in these situations that jumbo loans step onto the stage, providing a tailored solution for individuals looking to purchase or refinance upscale homes. The world of jumbo loans can seem intricate, but understanding their essence is crucial for those aiming to invest in premium properties. In this comprehensive guide, we’ll demystify the realm of jumbo loans, delving deep into what they entail, how they operate, and the vital information that prospective homebuyers and current homeowners should have at their fingertips. By the end, you’ll possess the knowledge needed to navigate the unique landscape of jumbo loans and leverage them as a valuable tool for achieving your upscale homeownership goals.

If you’d like to dive deeper into this subject, there’s more to discover on this page: Home Mortgage Interest Deduction

What sets them apart from conventional mortgages.

Jumbo loans are a specialized type of mortgage that sets them apart from conventional mortgages in several key ways:

Loan Amount: The primary distinction is the loan amount. Jumbo loans exceed the conforming loan limits set by government-sponsored entities like Fannie Mae and Freddie Mac. These limits vary by location but typically start at around $548,250 (as of 2021). Any mortgage amount exceeding this limit is considered a jumbo loan.

Stringent Requirements: Jumbo loans often come with stricter qualification requirements. Lenders may require higher credit scores, lower debt-to-income ratios, and larger down payments compared to conventional loans. This is because they are taking on greater risk due to the larger loan amount.

Interest Rates: Interest rates for jumbo loans are typically higher than those for conventional loans. This is because lenders charge more to compensate for the increased risk associated with larger loan amounts.

Asset and Income Verification: Lenders may require more comprehensive documentation of a borrower’s assets and income when applying for a jumbo loan. This includes providing bank statements, tax returns, and other financial records.

Property Types: Jumbo loans are commonly used for luxury homes or properties in high-cost areas. They can be used to finance primary residences, second homes, and even investment properties.

Private Mortgage Insurance (PMI): While borrowers with conventional loans who make a down payment of less than 20% are typically required to pay PMI, jumbo loans often require a substantial down payment but do not require PMI.

Market Variation: Jumbo loan terms and conditions can vary between lenders, so it’s essential for borrowers to shop around and compare offers to find the best terms.

Economic Factors: The availability and terms of jumbo loans can be influenced by economic conditions, lender policies, and changes in the real estate market.

In summary, jumbo loans are tailored to meet the financing needs of high-value properties and affluent homebuyers. They come with distinct requirements and considerations that borrowers should thoroughly understand before pursuing this type of mortgage.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Jumbo Mortgage Loan Terms Decoded | Chase

How jumbo loan limits vary by location and property type.

Jumbo loan limits aren’t fixed nationwide; they depend on the location and the type of property you’re interested in. These limits are typically set by the Federal Housing Finance Agency (FHFA) and are influenced by regional housing market conditions. Additionally, jumbo loan limits can vary based on property type, such as single-family homes, multi-unit properties, or condominiums. It’s essential to research and understand the specific loan limits in your desired location and for the type of property you intend to purchase. This knowledge will help you determine if you qualify for a jumbo loan and how much you can borrow to finance your dream home.

Looking for more insights? You’ll find them right here in our extended coverage: Jumbo Mortgage Loan Terms Decoded | Chase

Recognizing scenarios where jumbo loans are necessary.

Recognizing scenarios where jumbo loans are necessary is a critical aspect of navigating the diverse landscape of mortgage financing. Jumbo loans, which exceed the conforming loan limits established by government-sponsored entities like Fannie Mae and Freddie Mac, serve specific purposes and cater to unique situations:

High-Value Home Purchases: One of the most common scenarios where jumbo loans are necessary is when purchasing a high-value home. Luxury properties in upscale neighborhoods often come with price tags that surpass conforming loan limits. Jumbo loans enable buyers to secure financing for these substantial investments.

Expensive Real Estate Markets: In metropolitan areas and regions with soaring real estate prices, standard conforming loan limits may not align with the cost of properties. In these markets, jumbo loans become essential for homebuyers to access the housing options they desire.

Custom Home Construction: Individuals looking to build custom homes often require significant financing. Jumbo construction loans allow them to fund the construction process and convert it into a permanent jumbo mortgage once the home is completed.

Investment Properties: Real estate investors who seek high-end rental properties or vacation homes may find jumbo loans necessary to finance these investments. Jumbo financing provides flexibility for investors targeting premium properties.

Debt Consolidation: Some homeowners with high-value properties use jumbo loans for debt consolidation purposes. They may leverage their property’s equity to pay off other debts, such as credit card balances or personal loans, with a single, more manageable jumbo mortgage.

Second Homes and Vacation Properties: Buyers looking to acquire second homes or vacation properties in sought-after destinations may encounter property values that necessitate jumbo loans. These loans enable them to fulfill their dreams of owning a vacation property.

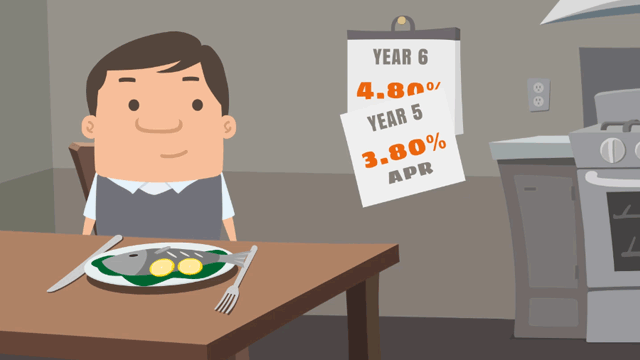

Adjustable-Rate Mortgages (ARMs): In some cases, homeowners with existing adjustable-rate mortgages may refinance into jumbo loans to secure fixed-rate stability, especially when they anticipate interest rate increases in the future.

Investment in Real Estate Markets: Savvy investors sometimes opt for jumbo loans when expanding their real estate portfolios. These loans provide the financial firepower needed to acquire multiple high-value investment properties.

Home Renovations: Substantial home renovations or remodeling projects can be costly. Homeowners who wish to undertake extensive upgrades may use jumbo loans to finance these improvements and increase their property’s value.

Unique Financial Scenarios: In certain financial situations where traditional conforming loans may not be feasible or sufficient, such as for self-employed individuals or those with complex income structures, jumbo loans can offer tailored solutions.

Recognizing when jumbo loans are necessary allows borrowers to explore appropriate financing options and make informed decisions based on their unique circumstances and property requirements. It’s essential to work closely with experienced lenders and mortgage professionals who can provide guidance and ensure that the chosen financing aligns with your goals and financial capabilities.

Additionally, you can find further information on this topic by visiting this page: Jumbo Mortgage Loan Terms Decoded | Chase

The importance of a strong credit profile.

A strong credit profile is the cornerstone of successful financial management. It not only impacts your ability to secure loans and favorable interest rates but also influences various aspects of your financial life. A robust credit profile enhances your financial stability, lowers borrowing costs, and opens doors to better opportunities. Additionally, it’s a valuable asset when planning for major life milestones such as buying a home, starting a business, or retiring comfortably. In this article, we’ll delve into the critical components of a strong credit profile, strategies to build and maintain it, and how it can shape your financial future.

You can also read more about this here: Jumbo Loans: What You Need to Know – NerdWallet

Ensuring you have sufficient funds for potential financial setbacks.

“Building an Emergency Fund”

If you’d like to dive deeper into this subject, there’s more to discover on this page: Jumbo Mortgage Loan Terms Decoded | Chase

Providing proof of a steady income source.

“Offering evidence of a consistent and reliable income source is a fundamental aspect of various financial transactions and endeavors, including mortgage applications, loan approvals, and rental agreements. This proof of steady income serves as a critical validation of your financial stability and capacity. Here’s a more detailed exploration of why it matters and how to provide it effectively:

Credibility and Trustworthiness: Lenders and financial institutions, when evaluating your financial profile, place a high premium on the predictability and stability of your income. A steady income source indicates that you have a reliable means of repaying debts and fulfilling financial obligations. It establishes your credibility and trustworthiness in the eyes of lenders.

Mortgage Approval: When applying for a mortgage to purchase a home or refinance an existing one, demonstrating a consistent income stream is a non-negotiable requirement. Lenders need assurance that you can meet your monthly mortgage payments without undue financial strain. This proof is often provided through pay stubs, W-2 forms, or tax returns.

Loan Eligibility: For various types of loans, such as personal loans, auto loans, or business loans, a steady income is a primary eligibility criterion. Lenders use your income as a primary factor in determining the loan amount you qualify for and the terms of the loan, including the interest rate.

Rental Applications: When seeking a rental property, landlords often request proof of income to assess your ability to pay rent consistently. This is crucial for both landlords and tenants, as it ensures a stable and harmonious leasing arrangement.

Credit Card Applications: While credit card applications typically focus on your credit history, income is still an essential consideration. Lenders want to know that you have the means to manage credit responsibly. Proof of income can influence your credit limit and the types of credit cards available to you.

Budgeting and Financial Planning: Steady income not only opens doors to financial opportunities but also forms the foundation for effective budgeting and financial planning. It provides you with a reliable source of funds to cover daily expenses, save for the future, and address unexpected financial challenges.

Multiple Income Sources: In today’s diverse employment landscape, individuals often have multiple sources of income, including full-time jobs, part-time work, freelance gigs, and investment income. Providing documentation for each income source can create a comprehensive picture of your financial stability.

Documentation: Proof of income can take various forms, depending on your income source. Common documents include pay stubs, tax returns, bank statements, and employment verification letters. It’s crucial to maintain accurate and up-to-date records to streamline the verification process when needed.

Transparency and Honesty: Building trust with financial institutions and potential landlords or creditors hinges on transparency and honesty. Accurate documentation of your income ensures that you present an honest representation of your financial situation.

Financial Goals: A steady income serves as a springboard for achieving your financial goals, whether they involve homeownership, retirement planning, or debt reduction. It provides the financial stability required to pursue these objectives with confidence.

In summary, providing proof of a steady income source is not just a bureaucratic requirement; it’s a cornerstone of financial stability and success. Whether you’re applying for a mortgage, securing a loan, renting a property, or pursuing various financial goals, your income documentation validates your ability to navigate these endeavors with reliability and confidence.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: Conforming Loan Limit Values | Federal Housing Finance Agency

Weighing the pros and cons.

When considering whether to refinance your mortgage, it’s essential to weigh the pros and cons carefully. On the positive side, refinancing can lower your interest rate, reduce your monthly payments, and potentially save you money over the life of your loan. It can also provide you with the opportunity to change the terms of your mortgage, such as switching from an adjustable-rate to a fixed-rate mortgage or adjusting the loan term.

However, there are also potential downsides to refinancing. These may include closing costs, which can add to the overall expense of the refinance. Additionally, if you’re planning to move or pay off your mortgage in the near future, the savings from refinancing may not outweigh the costs. It’s crucial to assess your financial goals and the specific terms of your current and potential new loan to determine if refinancing is the right choice for you.

Ultimately, the decision to refinance should align with your long-term financial plans and provide clear benefits that outweigh any associated costs. It’s advisable to consult with a financial advisor or mortgage professional to help you make an informed decision based on your unique circumstances.

To delve further into this matter, we encourage you to check out the additional resources provided here: Jumbo Loans for Larger Mortgage Amounts

Factors influencing jumbo loan rates.

Jumbo loan rates are influenced by various factors, including:

Economic Conditions: The overall state of the economy, such as inflation rates, employment levels, and economic growth, can impact jumbo loan rates. In a strong economy, rates may rise due to increased demand for borrowing, while rates may fall during economic downturns.

Credit Score: Borrowers with higher credit scores typically qualify for better jumbo loan rates. Lenders view borrowers with excellent credit as lower-risk, which translates to lower interest rates.

Loan-to-Value Ratio (LTV): The LTV ratio represents the percentage of the home’s value that you’re financing with the loan. A lower LTV ratio, indicating a larger down payment, often leads to more favorable rates.

Debt-to-Income Ratio (DTI): Lenders consider your DTI ratio, which measures your monthly debt payments relative to your income. A lower DTI ratio suggests a lower risk of default and may result in better rates.

Market Conditions: The broader financial markets, including the bond market and the Federal Reserve’s monetary policies, can impact jumbo loan rates. Changes in these markets can cause rates to fluctuate.

Loan Term: The length of your jumbo loan term also affects the rate. Typically, shorter loan terms, like 15 years, have lower rates than longer terms, such as 30 years.

Location: Jumbo loan rates can vary by region. Lenders may offer different rates based on the local real estate market and economic conditions.

Lender Policies: Different lenders may have varying rate structures and policies. Shopping around and comparing offers from multiple lenders can help you find the best jumbo loan rates for your specific circumstances.

Type of Interest Rate: You can choose between fixed-rate and adjustable-rate jumbo loans. Fixed-rate loans offer stability with a consistent interest rate throughout the loan term, while adjustable-rate loans may have lower initial rates but can change periodically, potentially leading to rate increases.

Market Competition: The level of competition among lenders can influence rates. When multiple lenders compete for your business, it may lead to more competitive jumbo loan offers.

Understanding these factors and how they apply to your financial situation can help you secure the most favorable jumbo loan rates when financing a high-value home purchase or refinance.

Should you desire more in-depth information, it’s available for your perusal on this page: What is a “higher-priced mortgage loan?” | Consumer Financial …

Exploring the typical repayment periods for jumbo loans.

“Delving into the world of jumbo loans involves understanding the nuances of repayment periods, a crucial aspect of these unique mortgage products. Here’s a closer look at what you should explore when it comes to the typical repayment periods for jumbo loans:

Flexible Term Options: Jumbo loans offer flexibility in terms of repayment periods. Unlike conventional mortgages with standard terms like 15 or 30 years, jumbo loans often provide a broader range of term options. Borrowers can choose repayment periods that align with their financial goals and circumstances. This flexibility means you can opt for a shorter term to pay off the loan faster or a longer term to reduce monthly payments.

Longer Terms for Affordability: Many borrowers gravitate toward jumbo loans because they allow for longer repayment terms, such as 40 years. This extended timeline can result in more manageable monthly payments, making homeownership in high-cost markets more attainable. It’s essential to consider the trade-off between lower monthly payments and the total interest paid over the life of the loan.

Shorter Terms for Equity Building: On the other hand, some jumbo loan borrowers prefer shorter repayment periods, typically 15 or 20 years. Shorter terms come with higher monthly payments but offer the advantage of building home equity rapidly. With a shorter-term jumbo loan, you can own your home outright sooner and reduce the overall interest costs.

Balloon Loans: In some cases, jumbo loans may feature balloon payments. These loans have a fixed interest rate for a specified term, often 5 to 7 years, followed by a lump-sum payment to pay off the remaining balance. Borrowers considering balloon loans should be prepared for this sizable final payment or plan to refinance before the balloon payment comes due.

Interest-Only Options: Certain jumbo loans offer interest-only repayment periods, usually for the first 5 to 10 years of the loan term. During this initial period, borrowers pay only the interest portion of the loan, which results in lower monthly payments. However, it’s essential to understand that once the interest-only period ends, monthly payments will increase significantly as you begin repaying both principal and interest.

Customizable Terms: Jumbo loans can often be customized to align with your unique financial situation. Some lenders offer the flexibility to choose specific repayment terms that fall outside the standard options, allowing borrowers to tailor the loan to their preferences and financial objectives.

Reviewing Total Costs: When exploring repayment periods for jumbo loans, it’s crucial to consider the total costs over the life of the loan. Longer terms may offer lower monthly payments but can result in higher overall interest expenses. Conversely, shorter terms may have higher monthly payments but lead to lower interest costs and faster equity accumulation.

In conclusion, understanding the typical repayment periods for jumbo loans empowers borrowers to make informed decisions that align with their financial goals. Whether you prioritize lower monthly payments, rapid equity building, or other financial objectives, exploring the various repayment options available in the jumbo loan market allows you to tailor your mortgage to your unique needs.”

To expand your knowledge on this subject, make sure to read on at this location: VA Home Loan Limits | Veterans Affairs

Strategies for increasing home equity in high-value properties.

Increasing home equity in high-value properties can be an advantageous financial move. Here are some strategic approaches to consider:

Home Renovations: Invest in home improvements that not only enhance your living space but also add value to your property. Kitchen remodels, bathroom upgrades, and energy-efficient enhancements can significantly boost your home’s worth.

Regular Maintenance: Consistent upkeep of your property prevents minor issues from becoming major expenses. It also preserves the overall condition of your home, which can positively affect its market value.

Market Timing: Keep an eye on real estate market trends. If you notice a favorable market for selling, you might consider capitalizing on your property’s high value by selling and reinvesting elsewhere.

Rental Income: If your high-value property allows for it, consider renting out a portion of your home or an accessory dwelling unit (ADU) to generate additional income.

Mortgage Payments: Make extra payments towards your mortgage principal when possible. This reduces the loan balance faster and increases your home equity.

Property Tax Appeals: Regularly review your property tax assessment. If you believe it’s overvalued, consider appealing to lower your tax burden, which can improve your overall financial situation.

Home Equity Loans or Lines of Credit: If you need access to funds, consider leveraging your home equity through a home equity loan or line of credit. Just be cautious and use these options wisely, as they involve borrowing against your property.

Property Appreciation: High-value properties often appreciate in the long term. Keep your property well-maintained and stay informed about neighborhood developments that could affect its value positively.

Professional Advice: Consult with a real estate expert or financial advisor who specializes in high-value properties. They can provide tailored strategies to maximize your home equity based on your unique circumstances and goals.

Remember that building home equity in high-value properties is a long-term endeavor. It requires a combination of smart financial decisions, property management, and market awareness.

You can also read more about this here: What Is A Jumbo Loan? | Bankrate

What you need to provide when applying for a jumbo loan.

When applying for a jumbo loan, be prepared to provide extensive documentation to demonstrate your financial stability and ability to repay the loan. This may include:

Income Verification: You’ll need to provide proof of your income through documents like tax returns, W-2s, or 1099 forms. Lenders typically require a history of stable income.

Credit Score: Expect lenders to scrutinize your credit score. A strong credit history is crucial for securing a jumbo loan with favorable terms.

Debt-to-Income Ratio: Lenders assess your ability to manage debt by looking at your debt-to-income (DTI) ratio. This ratio compares your monthly debt payments to your pre-tax income.

Asset Verification: Be ready to provide statements for all your financial assets, including savings, investments, and retirement accounts.

Appraisal: The lender will require an appraisal of the property to determine its value. This helps determine the loan-to-value (LTV) ratio, which can affect loan terms.

Down Payment: Jumbo loans often require a larger down payment compared to conventional loans. Be prepared to make a substantial upfront payment.

Reserve Requirements: Some lenders may require you to have a certain amount of money in reserves, typically several months’ worth of mortgage payments.

Employment History: A stable employment history can boost your chances of approval. Be prepared to provide information about your job history.

Additional Documentation: Depending on the lender and your specific circumstances, you may need to provide additional documents like gift letters (if you’re receiving down payment assistance), divorce decrees, or business income documentation.

It’s essential to work closely with your lender to understand their specific requirements, as these can vary among lenders. Being well-prepared with the necessary documentation can streamline the application process and increase your chances of approval for a jumbo loan.

You can also read more about this here: VA Home Loan Limits | Veterans Affairs

The steps involved in the application review.

The application review process for jumbo loans is a critical stage that demands thorough attention to detail and a clear understanding of the borrower’s financial profile. Here’s an overview of the steps involved in this meticulous review:

Documentation Collection: The process begins with the collection of comprehensive financial documentation from the borrower. This typically includes income verification, tax returns, bank statements, asset statements, and employment history. These documents offer a snapshot of the borrower’s financial health and ability to repay the loan.

Creditworthiness Assessment: Lenders scrutinize the borrower’s credit report and credit score. A strong credit history is crucial for jumbo loan approval, as it indicates a track record of responsible financial management. Lenders will evaluate factors such as payment history, outstanding debt, and credit utilization.

Debt-to-Income Ratio (DTI) Analysis: The borrower’s DTI ratio is a key metric in the review process. It compares the borrower’s monthly debt obligations to their gross monthly income. Lenders typically have maximum DTI limits, and exceeding these limits can impact loan approval. A lower DTI ratio is generally favorable.

Property Appraisal: A professional appraisal is conducted to determine the property’s current market value. The appraisal ensures that the loan amount aligns with the property’s worth. For jumbo loans, properties may undergo more extensive scrutiny due to their higher values.

Reserve Requirements: Lenders often require borrowers to have significant reserves or liquid assets on hand. These reserves act as a safety net and demonstrate the borrower’s ability to cover mortgage payments in case of unforeseen financial challenges.

Underwriting and Review: Highly trained underwriters meticulously assess all collected documentation, verifying its accuracy and completeness. They evaluate the borrower’s overall financial profile and assess risk factors. The underwriting process for jumbo loans is generally more stringent than for standard mortgages.

Credit Risk Assessment: Lenders assess the credit risk associated with the loan. This includes evaluating the property’s location, condition, and market conditions. Borrowers with strong credit profiles and lower loan-to-value ratios are often viewed more favorably.

Loan Approval: Based on the comprehensive review, the lender determines whether to approve or deny the jumbo loan application. If approved, the borrower receives a commitment letter outlining the terms and conditions of the loan.

Closing: Once the loan is approved, the closing process begins. This involves signing the necessary legal documents, paying closing costs, and finalizing the loan details. The property title is transferred to the borrower, and the funds are disbursed.

Ongoing Monitoring: After loan approval, lenders may continue to monitor the borrower’s financial situation. Borrowers are expected to meet their monthly obligations, and any substantial changes in their financial profile may trigger additional reviews.

In summary, the application review process for jumbo loans is a meticulous and comprehensive evaluation of the borrower’s financial health, creditworthiness, and the property’s value. Lenders exercise caution due to the larger loan amounts involved. Understanding and preparing for these steps is essential for a smooth and successful jumbo loan application process, allowing borrowers to secure financing for their high-value real estate investments.

To expand your knowledge on this subject, make sure to read on at this location: Loan Application Process at Assurance Financial

What to expect during the final stages of the loan process.

During the final stages of the jumbo loan process, borrowers can expect a series of steps that are similar to those involved in obtaining a conventional mortgage. However, due to the larger loan amount and stricter requirements associated with jumbo loans, the process can be more intensive. Here’s what to expect:

Underwriting Review: Your lender will conduct a thorough underwriting review, verifying all the information provided during the application process. This includes assessing your creditworthiness, income, employment history, and financial assets. Expect the underwriting process to be more rigorous than with conventional loans.

Home Appraisal: An appraisal of the property is critical in the jumbo loan process. Lenders want to ensure that the property’s value aligns with the loan amount. The appraiser will assess the property’s condition, features, and recent comparable sales in the area. If the appraisal falls short of the loan amount, you may need to make up the difference or renegotiate with the seller.

Title Search: A title search will be conducted to confirm that the property’s title is clear and free of any liens or legal issues. This step is crucial to protect both the lender and the borrower from any potential ownership disputes.

Documentation Verification: Lenders will meticulously verify your financial documents, including bank statements, tax returns, pay stubs, and any additional documentation they require. Be prepared to provide updated documents if needed.

Closing Disclosure: You will receive a Closing Disclosure (similar to the Loan Estimate) outlining the final loan terms, interest rate, closing costs, and monthly payment details. Review this document carefully and compare it to the initial loan estimate to ensure accuracy.

Closing Costs: Pay attention to the closing costs associated with your jumbo loan. These costs can be substantial due to the higher loan amount and may include origination fees, appraisal fees, title insurance, and other expenses. Be prepared to pay these costs at the closing table.

Final Walkthrough: Before closing, you may have the opportunity for a final walkthrough of the property to ensure it’s in the condition you expected and that any negotiated repairs have been completed.

Closing Meeting: The final step is the closing meeting, where you’ll sign the necessary paperwork to complete the loan transaction. This meeting typically takes place at a title company or attorney’s office. Ensure you have proper identification and any required funds for closing costs.

Funding and Recording: Once all documents are signed and funds are transferred, the loan will be funded, and the deed of trust or mortgage will be recorded with the appropriate government agency, officially transferring ownership.

Post-Closing: After closing, keep records of all your loan documents and continue to manage your finances responsibly. You’ll begin making regular mortgage payments according to the terms of your jumbo loan.

In summary, the final stages of obtaining a jumbo loan involve careful scrutiny of your financial documentation, property appraisal, and a thorough review of all loan terms and closing costs. Being prepared and informed throughout this process can help ensure a successful and smooth closing on your high-value property.

Additionally, you can find further information on this topic by visiting this page: Jumbo Mortgage Loan Terms Decoded | Chase

Discussing the benefits of jumbo loans, including access to high-end properties.

Jumbo loans offer distinct advantages, particularly when it comes to accessing high-end properties and unique real estate opportunities. These loans provide borrowers with the financial flexibility to purchase properties that exceed the conventional conforming loan limits, allowing them to explore luxury homes, upscale neighborhoods, or distinctive real estate investments that may not be accessible through traditional financing. With a jumbo loan, you can aim for that dream mansion, waterfront property, or custom-designed home that aligns with your lifestyle and preferences. However, it’s essential to consider the unique requirements and qualifications associated with jumbo loans to make an informed decision that suits your financial situation and homeownership goals.

Explore this link for a more extensive examination of the topic: What Is A Jumbo Loan? | Bankrate

Addressing potential downsides, such as stricter eligibility criteria and higher interest rates.

Addressing potential downsides is an integral part of making well-informed financial decisions, and this holds true when considering jumbo loans. While these loans offer the advantage of financing high-value properties and unique scenarios, it’s crucial to be aware of the potential downsides associated with them, including stricter eligibility criteria and higher interest rates:

Stricter Eligibility Criteria: Jumbo loans typically have more stringent eligibility requirements compared to conforming loans. Lenders may require higher credit scores, lower debt-to-income ratios, and a more substantial down payment. Additionally, they may scrutinize the borrower’s financial stability and employment history in greater detail. It’s essential for borrowers to be prepared to meet these stricter criteria to qualify for a jumbo loan.

Larger Down Payments: Jumbo loans often necessitate larger down payments. While conforming loans may offer low down payment options, such as 3% or 5%, jumbo loans might require down payments of 20% or more. This larger upfront investment can be a financial challenge for some homebuyers.

Higher Interest Rates: Jumbo loans typically come with higher interest rates compared to conforming loans. The increased risk associated with larger loan amounts prompts lenders to charge higher interest to compensate for potential defaults. Borrowers should be aware that these higher rates can result in greater long-term borrowing costs.

Potential for Limited Lender Options: Depending on your location and the specific jumbo loan amount you require, you may find that your options for jumbo lenders are more limited compared to those offering conforming loans. This reduced competition could affect the terms and rates available to you.

Economic Sensitivity: Jumbo loans can be more sensitive to economic conditions and market fluctuations. When the economy experiences uncertainty, lenders may become more conservative with jumbo lending, making it potentially more challenging to secure these loans during economic downturns.

Possible Additional Costs: Jumbo loans may entail additional costs, such as higher closing fees or private mortgage insurance (PMI) requirements if the down payment is below a certain threshold. These costs should be factored into your financial planning when considering a jumbo loan.

Limited Secondary Market Options: Unlike conforming loans, which can be sold to government-sponsored entities like Fannie Mae and Freddie Mac, jumbo loans often remain on the lender’s books. This can limit a lender’s ability to free up capital for additional lending, potentially impacting the availability of jumbo loans.

To address these potential downsides and make an informed decision, it’s essential to conduct thorough research, consult with experienced mortgage professionals, and assess your own financial situation and goals. This evaluation should include an understanding of your ability to meet stricter eligibility criteria, manage a larger down payment, and accommodate potentially higher interest rates. Ultimately, the decision to pursue a jumbo loan should align with your unique financial circumstances and the specific real estate investment or homeownership objectives you have in mind.

For additional details, consider exploring the related content available here What is a “higher-priced mortgage loan?” | Consumer Financial …

How economic conditions can impact jumbo loan availability.

The availability of jumbo loans is closely tied to economic conditions. During economic downturns or times of financial uncertainty, lenders may tighten their lending criteria, making it more challenging to obtain a jumbo loan. Conversely, in periods of economic stability and growth, lenders may be more willing to extend jumbo loan options to borrowers.

Economic factors such as interest rates, housing market trends, and lender confidence play pivotal roles in jumbo loan availability. For instance, when interest rates are low, borrowers may be more inclined to take out jumbo loans, increasing demand. Lenders may respond by offering more competitive jumbo loan products.

Understanding the dynamic relationship between economic conditions and jumbo loan availability is essential for borrowers seeking these larger loans. Staying informed about market trends and economic indicators can help borrowers make strategic decisions about when to pursue a jumbo loan and when to wait for more favorable conditions.

For additional details, consider exploring the related content available here What Is A Jumbo Loan? | Bankrate

Adapting to market fluctuations in the jumbo loan sector.

“Flexibility in the Jumbo Loan Market”

You can also read more about this here: VA Home Loan Limits | Veterans Affairs

Predictions for the jumbo loan market and its role in the real estate industry.

“Predicting the trajectory of the jumbo loan market and its impact on the real estate industry is a complex and dynamic exercise, influenced by a multitude of factors. As we look ahead, several key considerations come to the forefront, offering insights into what the future may hold for jumbo loans and their role within the real estate landscape:

Market Flexibility: The jumbo loan market is renowned for its adaptability. It tends to respond to shifts in the overall economy and the real estate sector with a degree of flexibility. Therefore, predictions for this market often hinge on broader economic trends, including interest rates, inflation, and housing market performance.

Interest Rate Dynamics: Jumbo loans have traditionally been associated with higher interest rates compared to conforming loans. Consequently, the market’s trajectory is closely linked to shifts in interest rates. As the Federal Reserve adjusts monetary policy to manage inflation and economic growth, it can influence jumbo loan rates, impacting both borrower demand and lender offerings.

Housing Market Trends: The health and direction of the housing market are pivotal for the jumbo loan sector. Rising home prices, changing demographics, and shifts in housing preferences can affect the demand for larger, more expensive homes, which often necessitate jumbo financing.

Economic Recovery: The aftermath of economic disruptions, such as the COVID-19 pandemic, plays a significant role in shaping the jumbo loan market. The pace of economic recovery, job market stability, and consumer confidence are all factors that influence whether borrowers opt for jumbo loans or explore alternative financing options.

Regulatory Environment: Regulatory changes, especially those related to lending practices and underwriting standards, can have a profound impact on the jumbo loan market. Adjustments to lending requirements can affect borrower eligibility and the risk appetite of lenders.

Lender Competition: The competitive landscape among financial institutions offering jumbo loans is ever-evolving. Lenders continually adjust their product offerings and terms to attract borrowers. Predictions for the jumbo loan market often involve assessing how lenders innovate to meet the demands of high-net-worth borrowers.

Regional Variations: Real estate markets and demand for jumbo loans can vary significantly by region. Predictions must consider these geographic nuances, as factors like population growth, job markets, and lifestyle preferences can influence the demand for large, luxury homes.

Housing Supply: The availability of high-end properties is a critical factor. Shortages in housing supply can drive up prices, potentially leading to an increased need for jumbo loans. Conversely, an oversupply of luxury homes can impact demand for jumbo financing.

Demographic Shifts: The preferences and financial capacity of different generations, particularly the growing number of affluent millennials, will impact the jumbo loan market. Understanding the homeownership aspirations and borrowing habits of these demographic groups is key to making accurate predictions.

Financial Innovation: The financial industry continually evolves, introducing new products and solutions. Predictions may involve assessing how financial innovation, such as digital lending platforms and alternative credit scoring models, impacts jumbo loan accessibility and terms.

In conclusion, predicting the future of the jumbo loan market and its role in the real estate industry is a multidimensional task. It requires a comprehensive analysis of economic, housing market, regulatory, and consumer trends. While the market may experience shifts and adjustments, the jumbo loan sector remains a vital component of the real estate ecosystem, providing opportunities for high-net-worth individuals to secure financing for their upscale housing aspirations.”

Should you desire more in-depth information, it’s available for your perusal on this page: Understand loan options | Consumer Financial Protection Bureau

Seeking guidance from financial advisors and real estate experts.

Seeking guidance from financial advisors and real estate experts is a prudent step when you’re navigating the complexities of mortgages and homeownership. These professionals bring a wealth of knowledge and experience to the table, helping you make well-informed decisions about your financial future.

Financial advisors can assess your overall financial situation, including your income, expenses, investments, and goals. They can provide personalized advice on whether refinancing makes sense for your specific circumstances. They can also help you understand the potential impact of refinancing on your long-term financial plan, ensuring that it aligns with your objectives, whether they involve debt reduction, retirement planning, or other financial goals.

Real estate experts, such as mortgage brokers or loan officers, are invaluable when it comes to navigating the intricacies of the mortgage market. They can help you find the most competitive refinancing options, negotiate terms on your behalf, and guide you through the application process. Their expertise can save you time and money, as they have a deep understanding of the mortgage industry’s ever-changing landscape.

Both financial advisors and real estate experts can provide you with a comprehensive view of your refinancing options, helping you make decisions that are not only financially sound but also tailored to your unique needs and aspirations. Whether you’re considering refinancing for a lower interest rate, debt consolidation, or other reasons, collaborating with these professionals ensures that you’re on the right path to achieving your financial objectives.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: What Is A Jumbo Loan? | Bankrate

Empowering borrowers to make informed decisions when it comes to high-value mortgages.

Empowering borrowers to make informed decisions regarding high-value mortgages is crucial for their financial well-being. Here are key components of this empowerment:

Education: Providing borrowers with access to educational resources on high-value mortgages is essential. This includes explaining the differences between conventional and jumbo loans, the pros and cons of fixed-rate and adjustable-rate mortgages, and the impact of credit scores on interest rates. Education should also cover the importance of budgeting and understanding the total cost of homeownership.

Financial Health Assessment: Empowerment begins with a comprehensive assessment of the borrower’s financial health. Lenders should encourage borrowers to evaluate their income, expenses, and long-term financial goals. This assessment helps borrowers determine how much they can comfortably afford and which type of mortgage aligns with their financial situation.

Transparency: Lenders should be transparent about all aspects of the mortgage process, including fees, closing costs, and the interest rate structure. Borrowers should have a clear understanding of how their mortgage works and the long-term financial implications.

Customized Solutions: Recognizing that each borrower’s financial situation is unique, lenders should offer customized solutions. This might involve tailoring loan terms, rates, and down payment options to fit the borrower’s specific needs and goals.

Rate Comparisons: Borrowers should be encouraged to shop around and compare rates and terms from multiple lenders. Having access to rate quotes from different sources allows borrowers to make more informed decisions and potentially secure more favorable loan terms.

Risk Assessment: High-value mortgages can carry unique risks, such as market fluctuations and the potential for higher interest rates. Empowered borrowers should understand these risks and how to mitigate them through financial planning and, if applicable, through appropriate financial products like fixed-rate mortgages.

Credit Management: Lenders should educate borrowers on the importance of maintaining good credit. A strong credit history can result in lower interest rates, potentially saving borrowers thousands of dollars over the life of their mortgage. Borrowers should be aware of credit reporting, monitoring, and improvement strategies.

Future Planning: An empowered borrower considers not only their current financial situation but also their long-term goals. Borrowers should evaluate how their mortgage fits into their overall financial plan, including retirement savings, investment strategies, and debt management.

Legal Rights: Borrowers should be informed of their legal rights throughout the mortgage process, including those related to fair lending practices, disclosure requirements, and consumer protection laws.

By empowering borrowers with knowledge, resources, and personalized guidance, the mortgage industry can help individuals and families make sound decisions when navigating the complexities of high-value mortgages. This not only benefits borrowers but also contributes to a more stable and responsible housing market.

Explore this link for a more extensive examination of the topic: What Is a Jumbo Loan? – Experian

Conclusion

In this guide to jumbo loans, we aim to provide a comprehensive overview of these unique mortgage products, helping prospective homebuyers and homeowners better understand the complexities and opportunities associated with high-value real estate investments. Whether you’re looking to purchase your dream luxury home or considering refinancing your existing jumbo loan, being well-informed is the first step towards success in the high-value mortgage market.

“Welcome to our comprehensive guide to jumbo loans, designed to be your go-to resource for navigating the world of high-value real estate financing. Jumbo loans represent a unique realm within the mortgage landscape, and our goal is to equip you with the knowledge and insights you need to make informed decisions, whether you’re embarking on the journey to purchase your dream luxury home or contemplating refinancing your existing jumbo loan.

Here’s what you can expect from this guide:

Understanding Jumbo Loans: We’ll start by demystifying the concept of jumbo loans, clarifying what sets them apart from conventional mortgages. You’ll gain a clear grasp of the loan limits, eligibility criteria, and the distinctive characteristics that define the world of jumbo financing.

Exploring Loan Types: Jumbo loans come in various forms, each catering to different financial goals and preferences. We’ll delve into the diverse range of jumbo loan types, including fixed-rate and adjustable-rate options, interest-only loans, and more. You’ll learn how to choose the right loan type that aligns with your unique circumstances.

Repayment Periods: Repayment periods play a pivotal role in jumbo loans, impacting your monthly obligations and the long-term financial implications of your mortgage. We’ll provide insights into the typical repayment periods, the pros and cons of longer versus shorter terms, and other customizable options to help you make an informed choice.

Interest Rates and Market Dynamics: Interest rates are a crucial component of any mortgage, and jumbo loans are no exception. You’ll gain a deeper understanding of how interest rates for jumbo loans are determined, how market dynamics can influence rates, and strategies to secure favorable terms.

Qualification and Application: We’ll walk you through the qualification process for jumbo loans, offering tips to enhance your eligibility. From gathering the necessary documentation to navigating the application process, you’ll be well-prepared to embark on your jumbo loan journey.

Refinancing Considerations: If you currently have a jumbo loan or are contemplating refinancing, we’ll explore the key factors to evaluate. You’ll learn how refinancing can help you optimize your financial situation, reduce interest costs, or access equity for other purposes.

Market Insights: Stay informed about the latest trends and insights in the high-value real estate market. We’ll provide updates on market conditions, potential challenges, and strategies for success in the ever-evolving world of luxury real estate.

Our aim is to empower you with the knowledge and confidence to navigate the complexities and opportunities of jumbo loans. Whether you’re taking your first steps into the realm of luxury homeownership or seeking to maximize the value of your existing investment, this guide is your trusted companion on your path to financial success in the high-value mortgage market. Let’s embark on this journey together, armed with the insights and expertise you need to achieve your homeownership and financial goals.”

You can also read more about this here: HELOC (Home Equity Line of Credit) and Home Equity Loan …

More links

To expand your knowledge on this subject, make sure to read on at this location: Jumbo Loans: What You Need to Know – NerdWallet