Introduction

When it comes to securing a mortgage for your dream home, the world of home financing can seem complex and overwhelming. Among the various options available, two common choices are FHA (Federal Housing Administration) loans and conventional mortgages. Each has its unique characteristics and benefits, making it crucial to understand the differences to determine which one aligns better with your financial situation and homeownership goals.

“Navigating the path to homeownership often starts with a fundamental decision: FHA loans or conventional mortgages. These two stalwarts of home financing offer distinct avenues to achieve your dream of owning a home. Let’s explore further the nuances that set them apart, helping you chart the course that best suits your financial circumstances and aspirations:

FHA Loans – Accessibility and Low Down Payments:

- Low Down Payment: FHA loans are renowned for their low down payment requirements, typically as low as 3.5% of the home’s purchase price. This accessibility is a boon for first-time buyers and those with limited upfront funds.

- Credit Flexibility: FHA loans often accommodate borrowers with credit scores that might not meet the stringent requirements of conventional mortgages. This flexibility extends homeownership opportunities to a broader audience.

- Government Backing: FHA loans are backed by the Federal Housing Administration, providing an added layer of security for lenders. This backing can lead to more favorable loan terms for borrowers.

Conventional Mortgages – Versatility and Equity Building:

- Higher Down Payment Options: While conventional mortgages do require higher down payments, they provide greater flexibility. Borrowers can choose down payments ranging from 3% to 20% or more, tailoring the loan to their financial capacity.

- Credit Score Impact: Conventional mortgages often favor borrowers with strong credit histories. This can translate into lower interest rates and reduced long-term borrowing costs.

- Private Mortgage Insurance (PMI) Control: Conventional borrowers can potentially eliminate PMI once they reach a certain level of home equity (usually 20%). This can lead to significant cost savings over time.

- Property Types: Conventional mortgages may be more suitable for certain property types, such as investment properties and second homes.

Consideration Factors:

- Financial Situation: Assess your current financial standing, including your credit score and available down payment. This evaluation will help determine which loan aligns better with your resources.

- Long-Term Goals: Consider your long-term homeownership goals. FHA loans can provide an accessible entry point, while conventional mortgages offer more extensive financial control.

- Interest Rates: Compare interest rates and loan terms for both options. This evaluation can significantly impact your monthly payments and the total cost of homeownership.

- Property Type: The type of property you intend to purchase may influence your loan choice. FHA loans have specific requirements for property condition.

In summary, the choice between FHA loans and conventional mortgages is a pivotal one in your homeownership journey. FHA loans excel in accessibility and low down payments, while conventional mortgages offer versatility and equity-building opportunities. Your decision should align with your financial situation, long-term objectives, and the type of property you plan to purchase. It’s a decision that can significantly impact your path to homeownership and your financial well-being in the years to come.”

You can also read more about this here: FHA Loans: What Are They And How Do They Work? | Bankrate

FHA loans are backed by the Federal Housing Administration, a government agency under the U.S. Department of Housing and Urban Development (HUD). These loans are designed to make homeownership more accessible, particularly for first-time homebuyers and those with lower credit scores or smaller down payments. Here are some key features of FHA loans:

Low down payment requirements: FHA loans typically require a lower down payment, making it easier for individuals with limited savings to purchase a home.

Lenient credit score requirements: While traditional mortgages may have strict credit score criteria, FHA loans are more forgiving and allow borrowers with lower credit scores to qualify.

Competitive interest rates: FHA loans often offer competitive interest rates, helping borrowers secure affordable monthly payments.

Flexible eligibility criteria: FHA loans have flexible eligibility criteria, making them a suitable option for a wide range of borrowers.

Mortgage insurance: Borrowers are required to pay mortgage insurance premiums, which protect the lender in case of default. This insurance is typically included in the monthly mortgage payment.

Streamlined refinancing options: FHA loans also offer streamlined refinancing programs, allowing borrowers to potentially lower their interest rates or monthly payments.

Overall, FHA loans provide a valuable avenue to homeownership for individuals who may face challenges with traditional mortgage requirements.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: FHA Loans: What to Know in 2023 – NerdWallet

FHA loans typically require a down payment as low as 3.5% of the home’s purchase price. This lower upfront cost can be advantageous for buyers with limited savings.

FHA loans are well-known for their accessibility, allowing homebuyers with limited savings to enter the real estate market. With a down payment requirement as low as 3.5% of the home’s purchase price, these loans can make homeownership a reality for many who might not have the means for a substantial down payment. This lower upfront cost can free up funds for other essential aspects of homeownership, such as moving expenses or initial home improvements, providing greater flexibility and opportunity for aspiring homeowners. However, it’s crucial to understand that while a lower down payment is an advantage, it also comes with considerations like mortgage insurance and potentially higher monthly payments. Therefore, prospective buyers should carefully weigh the benefits and costs of FHA loans to determine if they align with their financial goals and circumstances. In summary, FHA loans are a valuable option for those looking to buy a home with a smaller down payment, but they should be approached with a comprehensive understanding of their implications and costs.

Explore this link for a more extensive examination of the topic: FHA vs. Conventional Mortgage: Pros and Cons – Capital Bank

FHA loans are more lenient when it comes to credit score requirements. Borrowers with lower credit scores may still qualify for an FHA loan, making homeownership accessible to a broader range of individuals.

“FHA loans, backed by the Federal Housing Administration, have earned a reputation for their flexibility, particularly in the realm of credit score requirements. This leniency plays a pivotal role in expanding the horizons of homeownership, ensuring that a more diverse spectrum of individuals can achieve the dream of owning a home. Let’s delve deeper into the advantages of FHA loans for borrowers with lower credit scores:

Credit Score Flexibility: One of the standout features of FHA loans is their relatively relaxed stance on credit scores. While traditional mortgages may demand higher credit scores for approval, FHA loans open the door to borrowers with lower scores. This means that individuals who may have faced hurdles in securing conventional financing due to credit challenges now have a viable path to homeownership.

Access to Affordable Financing: FHA loans provide access to competitive interest rates and down payment options, even for borrowers with less-than-perfect credit histories. This affordability factor can be a game-changer, allowing aspiring homeowners to enter the market with lower upfront costs and monthly mortgage payments.

Credit Repair Opportunities: For those with less-than-ideal credit scores, an FHA loan can serve as a stepping stone towards improving their financial standing. By successfully managing their FHA loan and making on-time payments, borrowers can work toward rebuilding their credit profiles, potentially positioning themselves for more favorable terms in the future.

Diverse Buyer Pool: The inclusivity of FHA loans has enriched the diversity of homebuyers. It has empowered individuals who may have faced financial setbacks or challenges to pursue homeownership. This diversity not only enriches communities but also contributes to the stability and vibrancy of the housing market.

Comprehensive Financial Assessment: It’s important to note that while FHA loans offer flexibility, lenders still assess a borrower’s overall financial health. This includes factors beyond credit scores, such as income, debt-to-income ratio, and employment stability. A holistic approach to underwriting ensures that borrowers can comfortably manage their mortgage obligations.

Financial Counseling: FHA borrowers may have access to financial counseling programs that help them manage their finances, budget effectively, and make informed homeownership decisions. These resources are designed to support borrowers in their journey toward responsible homeownership.

In conclusion, FHA loans have played a pivotal role in democratizing homeownership by offering flexibility in credit score requirements. This inclusivity has made it possible for a broader range of individuals, including those with lower credit scores, to embark on their homeownership journey. While FHA loans provide valuable opportunities, it’s essential for borrowers to approach the process with financial responsibility and a commitment to long-term success. By leveraging the benefits of FHA loans, borrowers can achieve the goal of homeownership and work toward a brighter financial future.”

For a comprehensive look at this subject, we invite you to read more on this dedicated page: What Are The Pros And Cons Of FHA Loans? | Rocket Mortgage

FHA loans require borrowers to pay for mortgage insurance premiums (MIP). This insurance protects the lender in case the borrower defaults on the loan. While this increases the overall cost of the loan, it can be a trade-off for those who may not qualify for a conventional mortgage.

“Borrowers should carefully consider the pros and cons of FHA loans, weighing the benefits of lower down payments and more lenient credit requirements against the added cost of mortgage insurance premiums. For some, FHA loans provide an accessible path to homeownership, but it’s essential to understand the long-term financial implications.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: How to decide how much to spend on your down payment …

FHA loans offer both fixed-rate and adjustable-rate mortgage (ARM) options, providing borrowers with flexibility in choosing their preferred interest rate structure.

The ability to choose between fixed-rate and adjustable-rate mortgage (ARM) options provides borrowers with the flexibility to align their loan structure with their specific financial goals and circumstances. Fixed-rate mortgages offer the stability of a consistent interest rate throughout the loan term, which can be advantageous when long-term predictability is desired. On the other hand, adjustable-rate mortgages (ARMs) typically start with lower initial interest rates that may adjust periodically based on market conditions. This can be appealing to borrowers who anticipate changes in their financial situation or plan to stay in their homes for a shorter duration.

When deciding between these options, borrowers should carefully assess their financial situation, including their short-term and long-term goals, income stability, and risk tolerance. Fixed-rate mortgages provide peace of mind with a set interest rate, making budgeting predictable over the life of the loan. ARMs, on the other hand, may offer lower initial payments but come with the potential for rate adjustments that can impact monthly payments in the future.

It’s crucial for borrowers to consider their comfort level with potential payment fluctuations when choosing between fixed-rate and ARM FHA loans. Additionally, working closely with a knowledgeable lender can help borrowers make informed decisions tailored to their unique circumstances and financial objectives. Ultimately, whether you opt for a fixed-rate or ARM FHA loan, FHA loans are designed to provide access to homeownership and financing options that suit a wide range of borrowers.

For additional details, consider exploring the related content available here Types of Mortgage Loans – Understanding Your Options

Conventional mortgages, on the other hand, are not insured or guaranteed by any government agency. They are offered by private lenders, such as banks and credit unions, and are subject to the guidelines set by the lender and the secondary mortgage market. Here’s what you need to know about conventional mortgages:

Conventional mortgages represent a distinct category within the world of home financing, setting them apart from government-backed alternatives. These mortgages, backed solely by private entities like banks and credit unions, offer unique characteristics and considerations that can significantly impact your homebuying journey. Here’s a comprehensive look at what you need to know about conventional mortgages:

Creditworthiness Emphasis: With conventional mortgages, your creditworthiness takes center stage. Lenders place a substantial emphasis on your credit score and credit history when evaluating your eligibility and interest rate. A strong credit profile can translate into more favorable terms and lower interest rates, making it imperative to maintain good credit.

Down Payment Flexibility: While conventional mortgages typically require a down payment, the amount can vary. Down payment options range from as low as 3% to the traditional 20% or more. The ability to choose a down payment that aligns with your financial situation can be an advantage, especially for first-time homebuyers.

Private Mortgage Insurance (PMI): When making a down payment below 20%, you may be required to pay for private mortgage insurance (PMI). PMI protects the lender in case of borrower default. It’s an additional cost to consider, but it enables borrowers with lower down payments to enter the housing market.

Loan Limits: Conventional mortgages have loan limits that can vary by location. These limits determine the maximum loan amount eligible for conventional financing. In areas with higher housing costs, loan limits are often higher to accommodate expensive properties.

Interest Rate Variability: Interest rates on conventional mortgages can vary based on market conditions, your credit profile, and the lender’s terms. This variability means you have the opportunity to shop for competitive rates and terms, potentially saving money over the life of your loan.

Less Stringent Property Requirements: Conventional mortgages may have more lenient property condition requirements compared to government-backed loans. This can provide greater flexibility when choosing a home, as properties in various conditions may still qualify.

Fixed and Adjustable Rate Options: Conventional mortgages offer both fixed-rate and adjustable-rate options. Fixed-rate mortgages provide rate stability over the life of the loan, while adjustable-rate mortgages (ARMs) typically start with lower interest rates that may adjust periodically. Choosing the right type of mortgage depends on your financial goals and risk tolerance.

Secondary Mortgage Market: Many conventional mortgages are sold in the secondary mortgage market, which can impact your lender relationship. Your mortgage may be serviced by a different entity than your original lender.

Prepayment Privileges: Conventional mortgages may offer more flexibility in terms of prepayment privileges. This allows you to pay down your mortgage faster without incurring penalties, potentially saving on interest costs.

Overall Borrower Responsibility: With conventional mortgages, borrowers bear a higher level of responsibility for their financial profile, down payment, and overall mortgage terms. Being well-prepared and informed is essential for securing favorable lending terms.

In summary, conventional mortgages provide a versatile pathway to homeownership, but they also place a premium on creditworthiness and down payment flexibility. Understanding the nuances of conventional mortgages empowers you to make informed decisions that align with your financial goals and aspirations of homeownership. It’s a dynamic and competitive realm within the mortgage market, and careful consideration of your financial situation is paramount when choosing this path to home ownership.

To delve further into this matter, we encourage you to check out the additional resources provided here: Conventional vs. FHA for Washington Home Buyers in 2023

Conventional loans often require a higher down payment, typically ranging from 5% to 20% or more. The specific amount depends on the lender, the borrower’s creditworthiness, and the type of conventional loan.

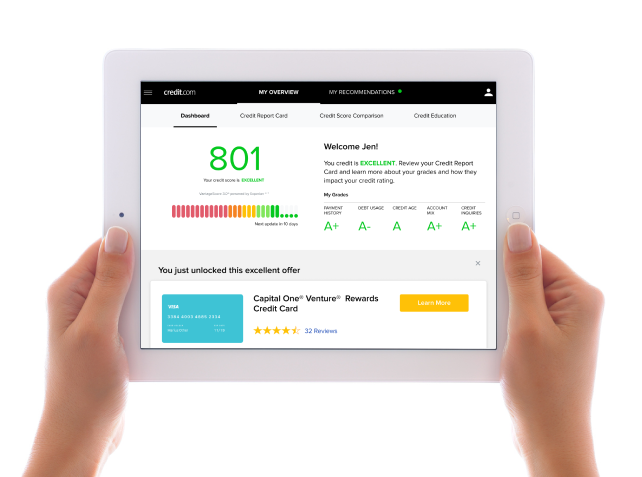

FHA loans have more lenient credit score requirements, making them accessible to borrowers with lower credit scores. Typically, a credit score of 580 or higher is required to qualify for the minimum down payment of 3.5%. This flexibility can be especially beneficial for first-time homebuyers or those who have faced credit challenges in the past. However, borrowers with credit scores below 580 may still be eligible but might need to provide a larger down payment, usually 10% of the home’s purchase price. It’s essential to understand your credit profile and how it aligns with the requirements of both FHA and conventional loans when making your financing decision.

Explore this link for a more extensive examination of the topic: FHA vs. Conventional Mortgage: Pros and Cons – Capital Bank

Conventional mortgages usually have stricter credit score requirements than FHA loans. Lenders typically look for higher credit scores and a strong credit history.

Conventional mortgages often have more stringent credit score prerequisites compared to FHA loans. Lenders generally seek elevated credit scores and a robust credit history from borrowers applying for conventional loans. These stricter credit requirements are a key distinction between the two types of mortgages and can impact eligibility for potential homebuyers. It’s essential for borrowers to assess their credit standing and choose the mortgage type that aligns best with their financial profile and homeownership goals.

Should you desire more in-depth information, it’s available for your perusal on this page: FHA Vs. Conventional Loan: What Are They? | Quicken Loans

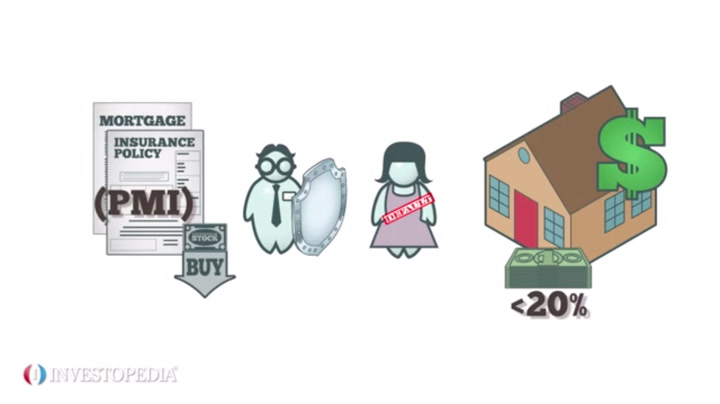

If a borrower makes a down payment of less than 20% on a conventional loan, they will typically be required to pay for private mortgage insurance (PMI). PMI protects the lender in case of default, similar to MIP for FHA loans.

The requirement for private mortgage insurance (PMI) when a borrower makes a down payment of less than 20% on a conventional loan is an important aspect of the mortgage process. Let’s explore this further and understand the nuances of PMI, its purpose, and its impact on borrowers:

Risk Mitigation: PMI serves as a risk mitigation tool for lenders. When a borrower provides a smaller down payment, the lender faces a higher level of risk in case the borrower defaults on the loan. PMI steps in to mitigate this risk by providing financial protection to the lender, ensuring they are reimbursed for a portion of the outstanding loan balance in the event of default.

Lowering the Down Payment Barrier: The existence of PMI makes homeownership more attainable for a broader spectrum of buyers. Not everyone can afford a 20% down payment, especially in regions with high housing costs. PMI allows borrowers to enter the housing market with a more manageable down payment, which is often in the range of 3% to 5%.

Affordability: PMI enhances the affordability of homeownership. By enabling borrowers to make a smaller upfront payment, it frees up funds for other essential expenses or investments. This can be particularly beneficial for first-time homebuyers and those who are diligently saving but haven’t reached the 20% threshold.

Balancing Risk and Reward: For lenders, PMI helps strike a balance between risk and reward. It encourages lending to borrowers with smaller down payments, expanding the pool of potential homeowners. At the same time, it provides a level of financial protection that makes such lending more palatable to lenders.

Monthly Premiums: PMI is typically paid as a monthly premium, which is added to the borrower’s mortgage payment. The exact cost of PMI can vary based on factors such as the loan amount, down payment percentage, and the borrower’s credit score. Borrowers should be aware of the additional monthly expense and factor it into their budget.

Cancellation Options: Borrowers should also be aware that PMI is not necessarily a permanent expense. Many lenders allow borrowers to request PMI cancellation once they have built sufficient equity in the home, often when the loan balance reaches 78% to 80% of the property’s original value. This can result from a combination of regular monthly payments and property appreciation.

Alternative Loan Types: Some borrowers may explore alternative loan types, such as FHA loans, that have their own form of mortgage insurance known as Mortgage Insurance Premium (MIP). While similar in concept to PMI, MIP has its own rules and costs. Borrowers should compare the advantages and disadvantages of different loan options to determine the best fit for their financial situation.

In summary, PMI is a financial tool that enables borrowers to enter the housing market with a smaller down payment, making homeownership more accessible. While it does come with additional monthly costs, it can be a stepping stone toward achieving the dream of owning a home. Borrowers should carefully consider their options, evaluate PMI cancellation opportunities, and work with lenders to navigate the complexities of mortgage insurance to make informed decisions about their home financing.

Additionally, you can find further information on this topic by visiting this page: How to decide how much to spend on your down payment …

Conventional loans offer both fixed and adjustable-rate options. Borrowers can choose the structure that best suits their financial goals and risk tolerance.

“Conventional loans provide borrowers with flexibility by offering both fixed and adjustable-rate options. This choice allows borrowers to align their mortgage with their financial goals and risk tolerance, whether they prioritize stable payments or lower initial rates.”

For additional details, consider exploring the related content available here Types of Mortgage Loans – Understanding Your Options

The decision between an FHA loan and a conventional mortgage depends on your unique financial situation, including your credit score, down payment ability, and long-term homeownership goals. Here are some factors to consider:

When choosing between an FHA loan and a conventional mortgage, it’s essential to evaluate your individual financial circumstances and homeownership objectives. Several factors should influence your decision, including:

Credit Score: FHA loans are more lenient with lower credit scores, making them accessible to borrowers with less-than-perfect credit. Conventional loans often require higher credit scores for favorable terms.

Down Payment: FHA loans typically have lower down payment requirements, as low as 3.5%, while conventional loans may require 5% or more. Your down payment ability is a significant consideration.

Mortgage Insurance: FHA loans mandate upfront and ongoing mortgage insurance premiums, adding to the overall cost. Conventional loans may require private mortgage insurance (PMI), but it can be canceled once you have sufficient equity.

Loan Limits: FHA loans have specific limits depending on your location, while conventional loans often have higher limits. Ensure the loan you choose aligns with your desired property value.

Long-Term Plans: Consider your homeownership goals. If you plan to stay in your home for the long haul, a conventional loan might offer more flexibility and potentially lower costs over time.

Interest Rates: Interest rates can vary between FHA and conventional loans. Obtain rate quotes from lenders to compare and determine which is more advantageous in your situation.

Property Type: Some property types may be more suitable for one loan type over the other. FHA loans are commonly used for first-time homebuyers and primary residences.

Ultimately, consulting with a mortgage professional can provide personalized guidance based on your specific circumstances and preferences. They can help you make an informed decision that aligns with your homeownership objectives.

Explore this link for a more extensive examination of the topic: How to Choose the Best Mortgage for You

If you have a lower credit score, an FHA loan may be more accessible, as they tend to be more forgiving in this regard. However, if you have a strong credit history, you may qualify for more favorable terms with a conventional mortgage.

“Credit scores are like keys that can unlock different doors in the world of home financing. Let’s delve deeper into the significance of your credit score and how it can influence your choice between an FHA loan or a conventional mortgage:

FHA Loans – A Path to Accessibility:

- Credit Forgiveness: FHA loans are celebrated for their flexibility when it comes to credit scores. If you have a lower credit score, perhaps due to past financial challenges or limited credit history, FHA loans can be a welcoming option. They often accommodate borrowers with credit scores that might not meet the more stringent requirements of conventional mortgages.

- Lower Credit Score Threshold: FHA loans typically have a lower minimum credit score requirement, making them more accessible to a broader range of homebuyers. This inclusivity is particularly beneficial for first-time buyers or individuals looking to reenter the housing market after credit setbacks.

Conventional Mortgages – Favorable Terms for Strong Credit:

- Credit Score Impact: Conventional mortgages tend to reward borrowers with strong credit histories. If you have a solid credit score, you may qualify for more favorable terms, including lower interest rates. This can result in significant savings over the life of your loan.

- Interest Rate Advantage: A high credit score can translate into a lower interest rate on your conventional mortgage. This not only reduces your monthly mortgage payments but also decreases the overall cost of homeownership.

Your Credit Score and the Lender’s Perspective:

- Risk Assessment: Lenders use credit scores to assess the risk associated with lending to a borrower. A higher credit score signals a lower level of risk, while a lower score may raise concerns.

- Interest Rate Determination: Your credit score often plays a pivotal role in determining the interest rate you’ll receive on your mortgage. Lenders use risk-based pricing, adjusting rates based on your creditworthiness.

- Down Payment Requirement: Credit scores can also influence the down payment required. While FHA loans offer low down payment options, borrowers with excellent credit may have access to low down payment conventional loans as well.

Improving Your Credit Score:

- Long-Term Benefits: If your credit score currently falls below your desired range for conventional mortgage terms, don’t despair. Working to improve your credit score can open doors to more favorable financing options and lower borrowing costs in the future.

- Credit Management: Managing your credit responsibly by paying bills on time, reducing outstanding debts, and monitoring your credit report can contribute to credit score improvement over time.

In conclusion, your credit score is a powerful determinant in the choice between an FHA loan and a conventional mortgage. If you have a lower credit score, FHA loans provide accessibility. However, if you have a strong credit history, conventional mortgages offer the potential for more favorable terms. Regardless of your current credit situation, understanding the role of credit scores and actively managing your credit can lead to improved financing opportunities in your homeownership journey.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: FHA vs. Conventional Loans – What is the Difference? | Guardian …

If you have a limited down payment, an FHA loan’s lower down payment requirement can be advantageous. Conversely, if you can afford a larger down payment, a conventional loan may offer better terms.

Choosing between an FHA loan and a conventional loan often comes down to your financial situation and long-term goals. Here are some considerations to help you decide:

Down Payment:

- If you have a limited down payment, an FHA loan’s lower down payment requirement (typically around 3.5%) can be advantageous.

- If you can afford a larger down payment (usually 20% or more), a conventional loan may offer better terms, including lower interest rates and no private mortgage insurance (PMI) requirements.

Credit Score:

- FHA loans are more lenient when it comes to credit score requirements, making them accessible to borrowers with lower credit scores.

- Conventional loans may have stricter credit score criteria, and a higher credit score can lead to better interest rates.

Mortgage Insurance:

- FHA loans require both an upfront mortgage insurance premium (MIP) and ongoing monthly MIP payments.

- Conventional loans may require private mortgage insurance (PMI) if your down payment is less than 20%, but PMI can be canceled once you reach sufficient equity in your home.

Interest Rates:

- FHA loans often have competitive interest rates, but they can vary depending on your credit score and other factors.

- Conventional loans may offer slightly lower interest rates if you have a strong credit profile.

Long-Term Plans:

- Consider your long-term homeownership goals. If you plan to stay in your home for many years and can afford a larger down payment, a conventional loan may offer cost savings over time.

- If you’re looking for a more affordable way to enter the housing market or plan to move within a few years, an FHA loan with its lower down payment might be a better fit.

Ultimately, the choice between an FHA loan and a conventional loan depends on your individual financial situation and goals. It’s advisable to consult with a mortgage lender or financial advisor to determine which type of loan aligns best with your needs and circumstances.

Explore this link for a more extensive examination of the topic: How to decide how much to spend on your down payment …

Consider the cost of mortgage insurance. While FHA loans have MIP, conventional loans have PMI if your down payment is less than 20%. Compare the overall loan costs, including insurance premiums, to determine which is more cost-effective.

Comparing the cost of mortgage insurance between FHA and conventional loans is a crucial step in the homebuying process. Both types of loans require insurance premiums, but they operate differently. FHA loans mandate Mortgage Insurance Premiums (MIP), while conventional loans require Private Mortgage Insurance (PMI) if your down payment is less than 20%.

To make an informed decision, it’s essential to weigh the overall loan costs, including insurance premiums, associated with each option. Here’s how you can approach this comparison:

Calculate Total Loan Costs: Consider the total costs over the life of the loan, including the principal, interest, and insurance premiums. Remember that FHA loans often have higher upfront and ongoing MIP costs than conventional loans with PMI.

Determine the Break-Even Point: Calculate when you would reach a point where the cumulative cost of MIP on an FHA loan equals the cumulative cost of PMI on a conventional loan. This break-even point can help you understand which option is more cost-effective in the long run.

Consider Your Financial Situation: Evaluate your financial stability and how long you plan to stay in the home. If you anticipate refinancing or selling the property within a few years, a higher upfront MIP on an FHA loan might be less of a concern. However, if you plan to stay in the home for an extended period, the lower PMI costs of a conventional loan may become more attractive.

Consult with a Mortgage Professional: Discuss your specific financial situation and homeownership goals with a mortgage lender or broker. They can provide personalized insights and help you compare loan options, ensuring you choose the one that aligns best with your needs.

In summary, understanding the differences in mortgage insurance and comparing the overall loan costs, including insurance premiums, is a prudent approach to selecting the most cost-effective financing option for your home purchase. Keep in mind that the right choice depends on your unique circumstances and long-term homeownership plans.

Additionally, you can find further information on this topic by visiting this page: How to decide how much to spend on your down payment …

Compare the interest rates offered by lenders for both FHA and conventional loans. Your interest rate can significantly impact your monthly mortgage payments and the overall cost of homeownership.

“Comparing interest rates is a critical step in the mortgage decision-making process, as it can have a substantial impact on your financial journey as a homeowner. Here’s a deeper exploration of the significance of comparing interest rates for FHA and conventional loans:

Monthly Mortgage Payments: The interest rate on your mortgage directly influences your monthly mortgage payment. Even a slight difference in interest rates can result in significantly higher or lower monthly payments. When comparing FHA and conventional loans, carefully assess how variations in interest rates will affect your budget. A lower interest rate can translate into more manageable monthly payments, potentially reducing financial stress.

Long-Term Cost Savings: Beyond the monthly impact, the interest rate you secure can have a profound effect on the total cost of your mortgage over its term. A lower interest rate on a conventional loan, for instance, can lead to substantial savings over the life of the loan compared to an FHA loan with a higher rate. By carefully evaluating these long-term cost differences, you can make an informed decision that aligns with your financial goals.

Loan Type Considerations: Different loan types may come with varying interest rate structures. FHA loans, for example, often have competitive interest rates, especially for borrowers with lower credit scores. Conventional loans, on the other hand, may offer favorable rates to borrowers with strong credit histories. It’s essential to consider how your financial profile aligns with each loan type and the interest rate implications.

Private Mortgage Insurance (PMI): For conventional loans, the interest rate can be influenced by factors such as credit score and down payment. Borrowers with lower credit scores or smaller down payments may secure a conventional loan with a higher interest rate. Additionally, if your down payment is less than 20% on a conventional loan, you may be required to pay for private mortgage insurance (PMI), which can affect the overall cost of your loan. Carefully evaluate how these factors intersect with your interest rate options.

Credit Score Impact: Credit scores play a crucial role in determining the interest rate you qualify for. A higher credit score typically translates to a lower interest rate, regardless of whether you choose an FHA or conventional loan. Taking steps to improve your credit score can result in more favorable interest rate offers, ultimately benefiting your homeownership journey.

Rate Lock Considerations: When comparing interest rates, inquire about rate lock options with your lender. A rate lock allows you to secure a specific interest rate for a predetermined period, protecting you from potential rate increases before closing. This can provide peace of mind and financial predictability during the homebuying process.

In summary, the interest rate you secure for your mortgage is a pivotal factor in your homeownership experience. By comparing interest rates for FHA and conventional loans, you gain insights into how your choice will affect your monthly budget, long-term cost savings, and overall financial well-being. Thoroughly assess your financial situation, credit profile, and homeownership goals to make an informed decision that aligns with your unique circumstances.”

You can also read more about this here: FHA vs. Conventional Mortgage: Pros and Cons – Capital Bank

Consider your homeownership goals. If you plan to stay in your home for the long term and can meet the down payment and credit score requirements, a conventional mortgage may offer more flexibility and potentially lower costs over time.

“When deciding between mortgage options, it’s crucial to align your choice with your homeownership goals. If your plan involves long-term residence and you meet the down payment and credit score criteria, a conventional mortgage often provides greater flexibility and the potential for lower overall costs as you build equity. However, each individual’s financial situation is unique, so it’s wise to consult with a mortgage professional to make the most informed decision.”

Additionally, you can find further information on this topic by visiting this page: Understand loan options | Consumer Financial Protection Bureau

Conclusion

In conclusion, the choice between an FHA loan and a conventional mortgage should align with your unique financial situation and long-term homeownership goals. It’s essential to consult with mortgage professionals, compare loan offers, and carefully evaluate the terms and costs associated with each option. By doing so, you can make an informed decision that paves the way for successful homeownership.

In summary, the decision between an FHA loan and a conventional mortgage should be a well-informed one, tailored to your individual financial circumstances and homeownership aspirations. It’s imperative to engage with mortgage experts, thoroughly assess loan proposals, and meticulously examine the terms and expenses linked to each alternative.

To make a wise choice, consider the following:

Credit Profile: FHA loans may be an attractive option if you have a lower credit score or limited credit history, as they often have more lenient credit requirements. Conversely, if you possess a strong credit profile, a conventional mortgage might provide access to better interest rates and terms.

Down Payment: FHA loans generally require a lower down payment, making them accessible to borrowers with limited savings. If you can afford a higher down payment, conventional mortgages might offer lower monthly payments and potentially eliminate the need for mortgage insurance.

Loan Limits: Assess your region’s conforming loan limits, as they can impact your loan choice. FHA loans have set limits, while conventional loans can exceed these limits in high-cost areas.

Interest Rates: Compare the interest rates offered for both FHA and conventional loans. Your credit score and the current market conditions will influence these rates.

Loan Duration: Consider the length of time you intend to stay in the home. Conventional loans often shine for long-term homeownership, while FHA loans can be suitable for those planning shorter stays.

Mortgage Insurance: Understand the implications of mortgage insurance, whether it’s FHA’s Mortgage Insurance Premium (MIP) or private mortgage insurance (PMI). Factor in how these costs align with your financial plan.

Property Type: If you are interested in purchasing a condominium, townhouse, or a home in a planned unit development (PUD), check whether the property meets FHA eligibility requirements, as they differ from those of conventional loans.

Ultimately, consulting with mortgage professionals and performing a comprehensive analysis of your financial situation and objectives will empower you to make a prudent decision. Whether you choose an FHA loan or a conventional mortgage, the key is to select the option that best supports your path to successful homeownership.

Don’t stop here; you can continue your exploration by following this link for more details: Conventional Mortgage vs. FHA | Is FHA a Conventional Loan …

More links

Should you desire more in-depth information, it’s available for your perusal on this page: Should I Get an FHA or Conventional Loan? | Credit.com