Moving Beyond the Basics

Algorithmic trading, often referred to as algo trading, has witnessed remarkable growth and transformation in recent years. As we step into 2023, the world of financial markets is poised for even more significant changes driven by advancements in technology, regulations, and evolving market dynamics. In this article, we will explore the key algo trading trends expected to shape the landscape in 2023.

Certainly, let’s dive deeper into the fascinating world of algorithmic trading and the trends that are set to shape it in 2023:

1. Artificial Intelligence (AI) Dominance:

- AI-driven algorithms are expected to continue their dominance in the world of algo trading. Machine learning models, neural networks, and natural language processing are being harnessed to analyze vast datasets and make real-time trading decisions. This trend will lead to more precise and adaptive trading strategies.

2. High-Frequency Trading Evolution:

- High-frequency trading (HFT) will evolve further, driven by the need for speed and efficiency. The adoption of low-latency technologies, such as 5G networks and advanced hardware, will enable HFT firms to execute trades with unprecedented speed and accuracy.

3. Quantum Computing Exploration:

- Quantum computing, with its immense computational power, is on the horizon for algo trading. While practical quantum applications are still in the experimental stage, 2023 could see breakthroughs that leverage quantum computing for complex financial modeling and risk assessment.

4. Decentralized Finance (DeFi) Integration:

- DeFi is blurring the lines between traditional finance and cryptocurrencies. Algo traders are likely to integrate DeFi protocols into their strategies, offering new avenues for arbitrage, yield farming, and decentralized exchanges.

5. Regulatory Developments:

- Regulators are keeping a close eye on algo trading. Increased scrutiny and potential regulations regarding transparency, fairness, and risk management are expected. Algo traders will need to adapt to evolving compliance requirements.

6. Ethical and Responsible Trading:

- The concept of ethical and responsible algo trading is gaining traction. Traders and institutions are increasingly considering the environmental, social, and governance (ESG) impact of their strategies. Ethical algorithms that align with sustainability goals are likely to emerge.

7. Sentiment Analysis Integration:

- Sentiment analysis, driven by natural language processing and social media data, will become a crucial component of algo trading strategies. Traders will leverage real-time sentiment data to gauge market sentiment and make informed decisions.

8. Personalization in Trading:

- Algorithms that adapt to individual investor preferences and risk profiles will gain prominence. Personalized algo trading will provide retail investors with tailored solutions that cater to their financial goals.

9. Risk Management Innovation:

- Advanced risk management algorithms will play a vital role in protecting trading portfolios. These algorithms will continuously assess market conditions and adjust trading strategies to minimize exposure to unforeseen risks.

10. Human-Machine Collaboration: – The future of algo trading is likely to involve a deeper collaboration between human traders and machines. While algorithms handle data analysis and execution, human traders will provide strategic oversight and decision-making based on their expertise.

11. Data Privacy and Security: – With the increasing reliance on data-driven strategies, data privacy and security will be paramount. Algo traders will invest in robust cybersecurity measures and data protection protocols to safeguard sensitive information.

In conclusion, algo trading in 2023 promises to be a dynamic and transformative field, driven by technological advancements, regulatory changes, and shifting market dynamics. The integration of AI, the evolution of high-frequency trading, and the exploration of quantum computing are just a few of the exciting trends that will shape the landscape. As algo trading continues to evolve, it will redefine how financial markets operate, presenting both opportunities and challenges for traders and investors alike.

You can also read more about this here: Financial markets: Exchange or Over the Counter

Exploration

AI and Machine Learning IntegrationArtificial intelligence (AI) and machine learning are becoming indispensable tools for algo traders. These technologies enable algorithms to adapt, learn from historical data, and make more informed decisions in real-time. In 2023, we can expect an even greater integration of AI and machine learning into algo trading strategies, enhancing predictive analytics and risk management.

AI and Machine Learning Integration: Shaping the Future of Algo Trading

As we step into 2023, the symbiotic relationship between artificial intelligence (AI) and machine learning with algo trading is poised to reach new heights, revolutionizing the way we perceive and execute trading strategies. Here’s why this integration is more crucial than ever:

1. Real-Time Adaptability: AI and machine learning algorithms possess the extraordinary ability to adapt to changing market conditions in real-time. They can identify patterns and anomalies, allowing your trading strategies to remain agile and effective even in volatile markets.

2. Data-Driven Insights: These technologies excel at sifting through vast datasets, extracting invaluable insights that were previously inaccessible. This means you can make trading decisions based on comprehensive and data-backed information, reducing the reliance on gut feelings and intuition.

3. Enhanced Predictive Analytics: In 2023, expect predictive analytics to reach unprecedented levels of sophistication. AI-driven algorithms can forecast market movements with a remarkable degree of accuracy, helping you stay ahead of the curve and capitalize on emerging trends.

4. Risk Management Reinvented: AI and machine learning are redefining risk management in algo trading. They can identify potential risks and vulnerabilities within your portfolio and provide recommendations to mitigate them, ultimately safeguarding your investments.

5. Customization and Optimization: These technologies allow you to fine-tune your trading strategies to an extraordinary degree. You can tailor algorithms to your risk tolerance, investment goals, and preferred trading style, ensuring that your strategies are as unique as your financial objectives.

6. Efficient Resource Allocation: AI-driven algorithms can optimize resource allocation, ensuring that your capital is deployed in the most efficient and profitable manner. This means you can make the most out of your investments while minimizing unnecessary risks.

7. Continuous Learning: AI and machine learning algorithms are constantly learning and evolving. They adapt and improve over time, becoming more adept at identifying profitable opportunities and avoiding pitfalls.

8. Reduced Emotional Bias: Emotions can cloud judgment in trading, leading to impulsive decisions that may not be in your best interest. AI-driven trading strategies are devoid of emotional bias, executing trades based on data and predefined parameters.

9. Competitive Edge: In the fast-paced world of algo trading, staying competitive is paramount. The integration of AI and machine learning technologies gives you an edge by allowing you to leverage the latest advancements in data analysis and decision-making.

10. Ethical Considerations: As AI and machine learning play a more prominent role in algo trading, ethical considerations become vital. Ensuring that algorithms adhere to ethical trading practices and responsible AI principles is essential for maintaining trust in the financial markets.

In conclusion, the integration of AI and machine learning into algo trading strategies represents a paradigm shift in the financial industry. In 2023 and beyond, these technologies will continue to enhance predictive analytics, risk management, and trading efficiency. They provide a competitive edge, reduce emotional bias, and offer a level of customization and optimization that was previously unimaginable. As we navigate the evolving landscape of financial markets, embracing AI and machine learning is not just an option; it’s a necessity for traders looking to thrive in the dynamic world of algo trading.

Should you desire more in-depth information, it’s available for your perusal on this page: Future Algorithmic Trading in Data science

Delving Deeper

Quantum Computing on the HorizonWhile still in its infancy, quantum computing holds the potential to revolutionize algo trading. Quantum computers can process vast amounts of data and solve complex problems at speeds unimaginable with classical computers. As quantum computing technology matures, it may become a game-changer for high-frequency trading strategies.

Quantum computing represents a paradigm shift in computational power that could redefine the very essence of algo trading. While it’s currently in its infancy, the promise it holds is nothing short of revolutionary.

The core advantage of quantum computing lies in its ability to process massive datasets and perform complex calculations at speeds that classical computers can only dream of. In the world of algo trading, this means the ability to analyze an unprecedented volume of market data in real-time, identify intricate patterns, and execute trades with split-second precision.

High-frequency trading (HFT) strategies, which rely on speed and efficiency, stand to benefit immensely from quantum computing. These strategies demand split-second decisions and lightning-fast execution, and quantum computers have the potential to deliver on this front in ways that were once inconceivable.

However, it’s essential to acknowledge that quantum computing in algo trading is not without its challenges. The technology is highly specialized and, at this stage, incredibly expensive to develop and maintain. Moreover, the expertise required to harness the power of quantum computers is limited, making it a niche area for the time being.

Additionally, the inherent unpredictability and volatility of financial markets pose unique challenges for quantum algorithms. While quantum computers excel at solving complex problems, the quantum states they rely on can be sensitive to external influences, potentially leading to unexpected outcomes in the trading process.

As quantum computing technology matures and becomes more accessible, we can anticipate a gradual integration of quantum algorithms into algo trading strategies. However, this transformation won’t happen overnight. It will require collaboration between quantum scientists, mathematicians, and financial experts to develop and fine-tune quantum algorithms that align with the intricacies of financial markets.

In conclusion, while quantum computing is on the horizon for algo trading, it’s still a technology in its nascent stages. The potential it holds is undeniably exciting, offering the prospect of unparalleled speed and efficiency in trading. As we move forward, the financial industry will keep a keen eye on quantum developments, exploring how this emerging technology can reshape the landscape of algorithmic trading.

To expand your knowledge on this subject, make sure to read on at this location: Systematic Trading: Introduction, Strategies, and More

Clarification

Ethical and ESG InvestingEnvironmental, Social, and Governance (ESG) considerations are gaining prominence in financial markets. Algo trading is adapting to this shift by incorporating ESG factors into trading algorithms. In 2023, we can anticipate a growing emphasis on ethical and sustainable investing in algo trading strategies.

The convergence of algorithmic trading and ethical investing represents a pivotal moment in the financial world. Here’s an extended perspective on how ethical and ESG (Environmental, Social, and Governance) considerations are becoming integral to algo trading and why they will continue to shape the landscape in 2023 and beyond:

Sustainability as a Core Value: Algo trading, known for its data-driven and rapid execution approach, is now embracing sustainability as a core value. ESG factors are no longer seen as peripheral but as critical components that contribute to long-term financial success. This shift signifies a fundamental change in the investment landscape, acknowledging that sustainable practices are not just ethical but also economically sound.

Risk Mitigation: Algo trading algorithms have traditionally focused on maximizing returns within predefined risk parameters. The inclusion of ESG factors adds a layer of risk mitigation. Companies with strong ESG performance tend to be more resilient in the face of environmental and social challenges, reducing the downside risk for investors. Algorithmic models are evolving to factor in these risk-reducing qualities.

Alpha Generation: Ethical and sustainable investing is not just about risk reduction; it also offers opportunities for alpha generation. Algo trading strategies are increasingly designed to identify companies that outperform due to their responsible and sustainable practices. These strategies leverage ESG data to uncover hidden value and capitalize on market inefficiencies.

Regulatory Influence: Regulatory bodies worldwide are recognizing the importance of ESG reporting and disclosure. As ESG regulations become more stringent, algo trading algorithms must adapt to ensure compliance. This adaptation involves not only staying within legal boundaries but also leveraging ESG data for strategic advantage.

Data Integration: ESG data is diverse and multifaceted, encompassing environmental impact, social responsibility, and governance practices. Integrating this data into algo trading models requires advanced data analytics and machine learning techniques. Algo traders are investing in data science capabilities to extract actionable insights from the wealth of ESG information available.

Market Transparency: Ethical and sustainable investing places a premium on transparency. Algo trading algorithms that incorporate ESG factors provide investors with greater visibility into the underlying assets and the reasoning behind trading decisions. This transparency fosters trust and empowers investors to make more informed choices.

Retail Investors: Ethical and sustainable investing is no longer the sole domain of institutional investors. Retail investors are increasingly seeking investment opportunities aligned with their values. Algo trading platforms are adapting to cater to this growing retail demand, democratizing access to ESG-focused strategies.

Global Impact: ESG considerations extend beyond borders. As algo trading algorithms become more sophisticated in evaluating global ESG trends, investors gain insights into companies’ worldwide impact. This global perspective is crucial for understanding systemic risks and opportunities.

Continuous Evolution: The field of algo trading is dynamic and constantly evolving. In 2023 and beyond, we can anticipate ongoing advancements in ESG integration. Algo traders will explore new data sources, refine their models, and adapt to changing market dynamics to ensure that ethical and sustainable investing remains at the forefront of their strategies.

In summary, ethical and ESG considerations are no longer a niche aspect of investing; they are becoming central to the world of algo trading. As these considerations continue to gain prominence, algo trading strategies will evolve to reflect the values and preferences of investors who seek not only financial returns but also positive social and environmental impact. The fusion of algorithmic precision with ethical imperatives marks a transformative moment in the financial industry, one that promises to reshape investment strategies and contribute to a more sustainable and responsible financial ecosystem.

Additionally, you can find further information on this topic by visiting this page: The ethics of artificial intelligence: Issues and initiatives

Further Insights

Regulatory ChangesRegulatory bodies worldwide are closely monitoring algo trading activities to ensure market integrity and fairness. In 2023, expect to see further regulatory changes aimed at increasing transparency and accountability in algo trading practices. Compliance and risk management will remain top priorities for algo trading firms.

Certainly, let’s explore the evolving regulatory landscape for algo trading and its implications for the industry in 2023:

1. Enhanced Transparency Measures:

- Regulatory bodies are actively working to enhance transparency in algo trading. In 2023, we can anticipate stricter reporting requirements, including more detailed disclosures of trading strategies and algorithms. This increased transparency aims to provide regulators with better insights into market activities.

2. Algorithm Testing and Certification:

- To ensure the reliability and safety of algorithms, regulatory changes may require algo trading firms to undergo rigorous testing and certification processes. This helps mitigate the risk of malfunctioning algorithms causing market disruptions.

3. Real-time Monitoring:

- Real-time monitoring of algo trading activities will become a standard practice. Regulators will have access to more comprehensive data feeds, allowing them to closely track trading behaviors and identify anomalies or manipulative practices promptly.

4. Pre-trade Risk Controls:

- The implementation of pre-trade risk controls will be emphasized. Algo trading firms will need to adopt mechanisms that prevent erroneous or excessive trading, minimizing the potential for disruptive events.

5. Fairness and Market Integrity:

- Regulatory changes will continue to prioritize fairness and market integrity. Rules and guidelines will be designed to prevent unfair advantages, market manipulation, and abusive trading practices.

6. Cross-border Regulations:

- Given the global nature of financial markets, cross-border regulations will gain importance. Regulators will work collaboratively to harmonize rules and standards to ensure consistent oversight of algo trading activities across jurisdictions.

7. Compliance Technology Investment:

- Algo trading firms will need to invest in advanced compliance technology to meet evolving regulatory requirements. This includes software and systems that facilitate reporting, risk management, and real-time monitoring.

8. Accountability Frameworks:

- Expect the establishment of accountability frameworks that hold individuals and organizations responsible for their algo trading activities. These frameworks may include clear lines of responsibility and consequences for non-compliance.

9. Ethical Considerations:

- Regulatory bodies may incorporate ethical considerations into their oversight of algo trading. This could involve guidelines related to ethical algorithm design, particularly in areas like ESG (Environmental, Social, and Governance) investing.

10. Collaboration and Education: – Regulatory bodies will likely collaborate with industry stakeholders to develop guidelines and best practices. Educational initiatives may also be launched to ensure that algo trading professionals are well-informed about regulatory changes.

11. Adaptation and Compliance: – For algo trading firms, adaptation and compliance will be essential. Staying informed about regulatory changes, investing in compliance measures, and maintaining open lines of communication with regulators will be crucial.

In summary, regulatory changes in algo trading for 2023 are driven by the need to ensure market integrity, fairness, and accountability. The industry is poised to navigate these changes by enhancing transparency, embracing advanced technology, and adopting a proactive approach to compliance and risk management. As regulations continue to evolve, algo trading firms will play a pivotal role in shaping the future of this dynamic and highly regulated sector of financial markets.

Additionally, you can find further information on this topic by visiting this page: Basics of Algorithmic Trading: Concepts and Examples

Significance

Decentralized Finance (DeFi)Decentralized finance, or DeFi, is a disruptive force in the financial industry. Algo trading is exploring opportunities within DeFi platforms, where smart contracts enable automated trading without intermediaries. In 2023, we may witness increased adoption of DeFi-based algo trading strategies.

Decentralized Finance (DeFi): Pioneering Algo Trading in 2023

Decentralized finance, or DeFi, stands at the forefront of financial innovation, reshaping the traditional financial landscape. As we venture into 2023, the synergy between DeFi and algo trading is poised to make significant waves, and here’s why:

1. Eliminating Intermediaries: DeFi platforms operate on the principle of trustless transactions, erasing the need for intermediaries like banks or brokers. Algo traders can now engage directly with these platforms, streamlining the trading process and reducing costs.

2. Smart Contracts Revolution: Smart contracts are the backbone of DeFi, and they bring automation to a whole new level. Algo trading strategies can be executed autonomously, triggered by predefined conditions encoded within smart contracts. This not only enhances efficiency but also minimizes the risk of human error.

3. Accessibility and Inclusivity: DeFi democratizes finance, making it accessible to a global audience. Algo trading strategies can be designed and deployed by traders from diverse backgrounds, leveling the playing field and fostering financial inclusivity.

4. Liquidity Pools: DeFi platforms offer liquidity pools that provide ample opportunities for algo traders. These pools allow traders to access a wide range of assets and execute trades with minimal slippage, enhancing the effectiveness of trading strategies.

5. Transparency and Security: DeFi’s blockchain-based nature ensures transparency and security. Every transaction and smart contract execution is recorded on the blockchain, providing a tamper-resistant and auditable history of activities—an attractive feature for algo traders seeking trust in their trades.

6. Yield Farming and Staking: DeFi introduces innovative opportunities like yield farming and staking, where traders can earn passive income on their assets. Algo trading strategies can be designed to take advantage of these opportunities, optimizing returns for traders.

7. Programmability: DeFi platforms are highly programmable, allowing algo traders to customize their strategies with a high degree of granularity. This flexibility empowers traders to adapt to changing market conditions and explore new trading avenues.

8. Regulatory Considerations: While DeFi offers exciting prospects, regulatory oversight is evolving. Algo traders operating in DeFi should stay attuned to regulatory changes and ensure compliance with relevant laws and regulations.

9. Risk Management: As with any emerging sector, DeFi carries its own set of risks. Algo traders must employ robust risk management strategies to mitigate potential vulnerabilities and protect their investments.

10. Community and Collaboration: DeFi thrives on community engagement and collaboration. Algo traders can tap into this ecosystem to exchange ideas, strategies, and insights, fostering a dynamic and innovative environment.

In the year 2023, the integration of DeFi into algo trading strategies represents a paradigm shift in the financial industry. It presents an opportunity for traders to harness the potential of blockchain technology, smart contracts, and decentralized networks to enhance their trading capabilities. As DeFi continues to evolve, algo traders who embrace this disruptive force stand to benefit from greater efficiency, accessibility, and innovation in their trading endeavors. The landscape of algo trading is expanding, and DeFi is at its forefront, driving the financial industry into an era of unprecedented possibilities.

Explore this link for a more extensive examination of the topic: The Role of ChatGPT in Algorithmic Trading

Interpretation

Crypto Algo TradingThe cryptocurrency market continues to expand rapidly, attracting both retail and institutional investors. Algo trading in the crypto space is expected to grow in sophistication, offering more advanced trading strategies and risk management tools tailored to the unique characteristics of digital assets.

Crypto algo trading has firmly established itself as a dynamic force within the financial world, and its evolution shows no signs of slowing down. With the cryptocurrency market experiencing exponential growth and garnering attention from both retail and institutional investors, algo trading in this space is poised for a significant transformation in 2023.

Institutional Participation: The influx of institutional capital into the crypto market has been a game-changer. As established financial institutions and hedge funds enter the fray, they bring with them a demand for more sophisticated algo trading strategies. Expect to see increased institutional participation in the crypto algo trading space, driving the development of advanced algorithms tailored to institutional needs.

Risk Management Solutions: Crypto markets are known for their volatility, and effective risk management is paramount. Algo trading strategies will continue to evolve to address this challenge. We can anticipate the emergence of more robust risk management tools and algorithms that provide real-time risk assessment and mitigation strategies for crypto assets.

Liquidity Provision: Liquidity provision algorithms will play a pivotal role in crypto algo trading. These algorithms facilitate market liquidity by providing buy and sell orders. As crypto markets mature, liquidity provision strategies will become more sophisticated, ensuring smoother market operations.

Arbitrage Opportunities: Crypto markets, being decentralized and fragmented, offer unique arbitrage opportunities. Algo trading will increasingly focus on capturing price discrepancies across different exchanges and assets. Algorithms that can execute arbitrage strategies swiftly and efficiently will be in high demand.

AI-Driven Predictive Analytics: Artificial intelligence (AI) and machine learning will continue to reshape crypto algo trading. These technologies enable algorithms to analyze vast amounts of data, identify patterns, and make predictive trades. In 2023, we can expect crypto algo trading to leverage AI-driven predictive analytics for more accurate trading decisions.

Algorithm Customization: With a growing array of cryptocurrencies and tokens, traders will seek more customized algo trading solutions. Algorithms tailored to specific digital assets and market conditions will gain popularity. Traders will look for flexibility in algorithm customization to adapt to the ever-changing crypto landscape.

Regulatory Compliance: As crypto markets face increasing regulatory scrutiny, algo trading strategies will need to incorporate compliance measures. Algorithms will be designed to adhere to evolving crypto regulations, ensuring transparency and adherence to legal frameworks.

Market Sentiment Analysis: Understanding market sentiment is crucial in crypto trading, where news and social media can significantly impact prices. Expect to see algo trading algorithms that incorporate sentiment analysis, providing traders with real-time insights into market sentiment and adjusting strategies accordingly.

In conclusion, crypto algo trading is set to become more sophisticated and versatile in 2023. The growing interest from institutional players, coupled with the unique characteristics of the cryptocurrency market, will drive innovation in algorithmic strategies and risk management tools. As crypto markets continue to evolve, algo trading will play an increasingly central role in navigating this dynamic and exciting financial landscape.

Explore this link for a more extensive examination of the topic: Basics of Algorithmic Trading: Concepts and Examples

Moving Beyond the Basics

Quantitative Analysts in DemandAs algo trading becomes increasingly complex, the demand for quantitative analysts (quants) is soaring. These experts in mathematics and data analysis play a crucial role in developing, testing, and fine-tuning trading algorithms. In 2023, we can anticipate a competitive job market for quants.

The growing intricacies of algo trading are paving the way for a surge in demand for quantitative analysts (quants) who are the backbone of this evolving landscape. Here’s a more comprehensive look at why quants are in high demand and how their role is set to shape the financial industry in 2023:

Algorithmic Complexity: Algo trading strategies are no longer simple buy and sell orders. They involve intricate algorithms, machine learning models, and data-driven decision-making. Quantitative analysts are at the forefront of designing and optimizing these complex algorithms, ensuring that they remain effective in dynamic markets.

Risk Management: Risk management is paramount in algo trading. Quants specialize in risk modeling and scenario analysis, helping firms identify potential pitfalls and develop strategies to mitigate them. In an era marked by market volatility and unexpected events, quants’ expertise is invaluable in safeguarding investments.

Data Deluge: The era of big data has transformed finance. Algo traders rely on vast amounts of data to make split-second decisions. Quantitative analysts possess the skills to extract meaningful insights from this data, enabling traders to make informed choices and adapt to changing market conditions.

Machine Learning and AI: Machine learning and artificial intelligence (AI) are becoming integral to trading algorithms. Quants are at the forefront of harnessing the power of these technologies. They develop predictive models, sentiment analysis tools, and pattern recognition algorithms that give algo trading strategies a competitive edge.

Regulatory Compliance: Financial markets are subject to increasing regulatory scrutiny, particularly in relation to algorithmic trading. Quantitative analysts are responsible for ensuring that trading algorithms comply with evolving regulations. Their expertise helps firms avoid legal pitfalls and fines.

Customization: Algo trading is not a one-size-fits-all approach. Firms require tailored strategies that align with their specific goals and risk tolerances. Quants develop customized algorithms that cater to a firm’s unique requirements, optimizing trading performance.

Market Insights: Quantitative analysts possess a deep understanding of market dynamics. Their ability to analyze historical market data, spot trends, and predict future movements is crucial for algo trading strategies. Their insights inform trading decisions and contribute to profit generation.

Competitive Job Market: As the demand for quants continues to surge, the job market in quantitative finance becomes increasingly competitive. Firms are vying for top talent, offering competitive compensation packages and incentives to attract and retain skilled quants.

Education and Skill Development: The demand for quants is reshaping educational programs. Universities and institutions are adapting by offering specialized courses and degrees in quantitative finance and data analysis. This trend is equipping the next generation of quants with the skills needed to excel in this dynamic field.

Global Impact: The influence of quants extends beyond financial markets. Their work affects the global economy, as algorithmic trading can significantly impact asset prices, liquidity, and market stability. Quants must consider the broader implications of their strategies on the financial ecosystem.

In conclusion, quantitative analysts are at the forefront of the finance industry’s technological revolution. Their expertise in mathematics, data analysis, and algorithm development is driving innovation in algo trading. In 2023, as the financial landscape becomes more complex and data-driven, quants will continue to play a pivotal role in shaping trading strategies, managing risk, and delivering competitive advantages to firms. As a result, the demand for these highly skilled professionals is expected to remain robust, making the job market for quants fiercely competitive.

To expand your knowledge on this subject, make sure to read on at this location: Basics of Algorithmic Trading: Concepts and Examples

Clarification

Cybersecurity and Data ProtectionWith the rise of algorithmic trading comes an increased need for robust cybersecurity measures. In 2023, the focus on protecting sensitive trading data and strategies from cyber threats will intensify. Algo trading firms will invest in cutting-edge cybersecurity solutions to safeguard their operations.

Certainly, let’s delve deeper into the critical importance of cybersecurity and data protection in the world of algorithmic trading in 2023:

1. Evolving Cyber Threats:

- As algo trading continues to grow, so do the cyber threats targeting this industry. Hackers and malicious actors are becoming more sophisticated, making it imperative for algo trading firms to stay one step ahead by continually evolving their cybersecurity defenses.

2. Protection of Proprietary Algorithms:

- Proprietary trading algorithms are the lifeblood of algo trading firms. Protecting these algorithms from theft or unauthorized access is paramount. In 2023, expect to see heightened security measures to safeguard these valuable assets.

3. Data Encryption and Secure Storage:

- Encryption of sensitive trading data and secure storage solutions will be a top priority. Advanced encryption techniques will be employed to ensure that data remains confidential and tamper-proof, both in transit and at rest.

4. Multi-factor Authentication (MFA):

- Algo trading firms will increasingly adopt multi-factor authentication (MFA) for access control. MFA adds an additional layer of security, requiring multiple forms of verification, such as a password and a biometric scan, to access sensitive systems.

5. Continuous Monitoring and Threat Detection:

- Real-time monitoring and threat detection systems will become standard practice. These systems can identify unusual patterns or anomalies in trading activities, helping to mitigate potential security breaches.

6. Employee Training and Awareness:

- Human error remains a significant cybersecurity risk. Algo trading firms will invest in employee training programs to raise awareness about security best practices and the importance of maintaining a security-conscious culture.

7. Regulatory Compliance:

- Regulatory bodies are increasingly focusing on cybersecurity requirements. Algo trading firms will need to align their security practices with regulatory standards and be prepared for audits to demonstrate compliance.

8. Incident Response Plans:

- Robust incident response plans will be in place to address potential security incidents promptly. These plans outline the steps to take in case of a breach, including containment, investigation, and reporting.

9. Third-party Risk Assessment:

- Algo trading firms will conduct thorough risk assessments of third-party vendors and service providers. This ensures that external partners meet cybersecurity standards and do not introduce vulnerabilities into the trading ecosystem.

10. Secure Development Practices: – Secure software development practices will be adopted to prevent vulnerabilities in trading algorithms and software. This includes regular code reviews and security testing.

11. Collaboration within the Industry: – Collaboration within the algo trading industry will play a crucial role in combating cyber threats. Information sharing about emerging threats and best practices will help the industry as a whole stay resilient.

In conclusion, cybersecurity and data protection will be paramount in 2023 as the algo trading industry continues to expand and evolve. Algo trading firms must remain vigilant, proactive, and adaptable in the face of evolving cyber threats. Investments in cutting-edge cybersecurity solutions and a strong commitment to data protection are not only essential for compliance but also for preserving the integrity and security of algorithmic trading operations in an increasingly digital and interconnected financial landscape.

To delve further into this matter, we encourage you to check out the additional resources provided here: MiFID II Review Report

Delving Deeper

Hybrid Trading ModelsHybrid trading models that combine human expertise with algorithmic strategies are gaining traction. Traders are recognizing the value of human intuition and decision-making alongside the speed and efficiency of algorithms. Hybrid models are likely to become more prevalent in 2023.

Hybrid Trading Models: The Evolution of Algo Trading in 2023

In the ever-evolving world of algo trading, the emergence of hybrid trading models represents a significant paradigm shift. These models, which seamlessly blend human expertise with algorithmic strategies, are poised to redefine the way we approach trading in 2023. Here’s why they are gaining traction and what the future holds:

1. The Best of Both Worlds: Hybrid trading models leverage the strengths of both humans and algorithms. Algorithms excel at processing vast datasets and executing high-frequency trades, while human traders bring intuition, adaptability, and complex decision-making skills to the table. Together, they form a powerful synergy.

2. Adapting to Dynamic Markets: Financial markets are inherently dynamic and subject to unexpected events. Human traders can interpret news, assess geopolitical factors, and make swift decisions that algorithms might struggle with. In 2023, expect hybrid models to excel in adapting to rapidly changing market conditions.

3. Risk Management: Managing risk is a cornerstone of successful trading. Human traders have an innate ability to assess and respond to risk factors that may not be fully captured by algorithms. By combining the two, hybrid models can implement risk mitigation strategies with greater precision.

4. Handling Unforeseen Events: The world is no stranger to unforeseen events, such as market crashes or geopolitical crises. Human traders can exercise judgment and deviate from preset algorithms when such events occur, helping to protect investments and adapt to market turbulence.

5. Behavioral Analysis: Human intuition is invaluable when it comes to understanding market sentiment and behavior. Hybrid models can incorporate sentiment analysis and behavioral insights into their strategies, enhancing their ability to predict market movements.

6. Learning and Evolution: These hybrid models are not static; they learn and evolve over time. Human traders can fine-tune algorithms based on their experiences and insights, resulting in algorithms that become more refined and effective with each iteration.

7. Regulatory Compliance: Financial markets are subject to complex regulatory frameworks. Human traders can ensure that trading activities remain compliant with evolving regulations, a critical consideration in today’s trading landscape.

8. Psychological Factors: Human traders understand the psychology of trading—how fear, greed, and emotions can influence decision-making. They can intervene when emotions run high and algorithms are ill-equipped to handle psychological factors.

9. Market Diversity: Different markets and asset classes require unique strategies. Human traders possess the adaptability to navigate various markets effectively, while algorithms can execute strategies with precision.

10. Enhanced Decision-Making: Hybrid models empower traders with augmented decision-making capabilities. They can leverage algorithmic insights to make more informed choices, combining data-driven strategies with human judgment.

In 2023, the prevalence of hybrid trading models will continue to grow, driven by the realization that combining human expertise with algorithmic efficiency offers a distinct competitive advantage. These models are adaptable, capable of handling unforeseen events, and proficient in managing risk—a dynamic fusion of human intuition and artificial intelligence. As the trading landscape evolves, the fusion of human and machine will shape the future of algo trading, offering a path to more agile, informed, and successful trading strategies.

Should you desire more in-depth information, it’s available for your perusal on this page: Algorithmic Trading Strategies: Basics to Advanced Algo Trading …

Taking It a Step Further

Algo trading in 2023 promises to be an exciting and dynamic field, driven by technological advancements, shifting market priorities, and regulatory developments. Traders and firms operating in this space will need to stay agile, adapt to emerging trends, and prioritize risk management and compliance to navigate the ever-evolving landscape successfully. As technology continues to reshape financial markets, algo trading remains at the forefront of innovation and efficiency, shaping the future of trading and investment strategies.

Algo trading in 2023 stands at the intersection of cutting-edge technology, evolving market dynamics, and increasingly stringent regulatory frameworks. As the year unfolds, here are some insights into what traders and firms can expect in this dynamic field:

Interplay of Technology and Data: Algo trading’s foundation lies in data analysis and technology. In 2023, we will witness a deeper integration of big data analytics, artificial intelligence, and machine learning into trading strategies. This fusion will empower algorithms to process vast datasets, detect intricate patterns, and make swift, data-driven decisions.

Risk Management Takes Center Stage: With the unpredictability of financial markets, risk management remains paramount. Algo traders will focus on enhancing risk assessment models, developing real-time monitoring systems, and incorporating dynamic risk mitigation strategies into their algorithms. The ability to adapt to changing risk profiles will be a key differentiator.

Regulatory Compliance and Transparency: Regulatory bodies across the globe are closely scrutinizing algo trading practices. Firms will invest in compliance solutions that ensure adherence to regulations while maintaining operational efficiency. Transparency in algorithmic operations will become the norm, offering regulators and market participants clearer insights into trading activities.

Hybrid Approaches: While algorithmic trading has gained prominence, human expertise remains invaluable. Hybrid trading models that blend human judgment with algorithmic execution will continue to thrive. Traders will leverage algorithms to identify opportunities and execute trades swiftly, while human traders provide the final decision-making touch.

Expanding Asset Classes: Algo trading, once confined to equities, has expanded into various asset classes, including cryptocurrencies, derivatives, and commodities. In 2023, expect a further diversification of algo trading strategies across these asset classes as traders seek new opportunities and manage risk more effectively.

Machine-to-Machine Communication: The rise of the Internet of Things (IoT) and machine-to-machine communication will have implications for algo trading. Algo trading systems will be interconnected with various data sources and financial instruments, enabling faster data feeds and more informed trading decisions.

Sustainability and ESG Considerations: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions. Algo trading will incorporate ESG data into strategies, allowing traders to align their portfolios with sustainable and ethical investment goals.

Education and Training: As algo trading becomes more complex, the demand for skilled professionals will grow. Education and training programs tailored to algo trading will be essential for traders, quants, and developers to stay competitive and adapt to changing market dynamics.

In essence, algo trading in 2023 embodies both innovation and responsibility. The fusion of advanced technologies, risk management strategies, and regulatory compliance will define success in this field. Staying ahead will require a commitment to continuous learning, adaptability, and a keen understanding of the evolving financial landscape. As algo trading continues to shape the future of trading and investment strategies, those who navigate this exciting and dynamic field adeptly will reap the rewards of innovation and efficiency in financial markets.

Explore this link for a more extensive examination of the topic: ChatGPT for Algorithmic Trading: Guidance, Benefits, Prompts …

More links

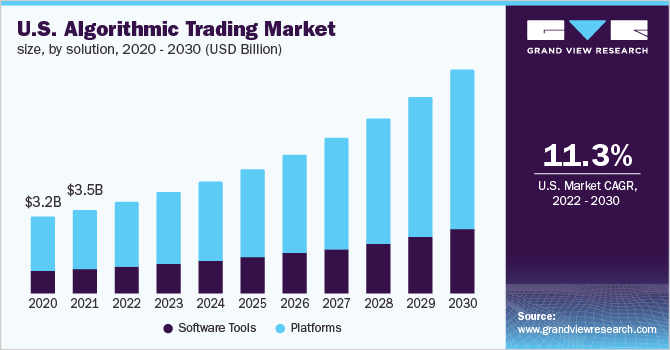

For additional details, consider exploring the related content available here Algorithmic Trading Market to Cross USD 84.60 Billion by