Table of Contents

- The Importance of Spreadsheet Programs in Finance

- Data Organization

- Calculations and Formulas

- Customization

- Data Visualization

- Collaboration

- Top Spreadsheet Programs for Finance

- Microsoft Excel

- Google Sheets

- LibreOffice Calc

- Apple Numbers

- Zoho Sheet

- Leveraging Spreadsheet Programs for Finance

- Use Templates

- Master Formulas

- Data Validation

- Charts and Graphs

- Regular Backups

In the world of office finance, precision, organization and efficiency are paramount. Whether you’re managing budgets, tracking expenses, analyzing financial data or creating financial reports, having the right tools at your disposal is crucial. Spreadsheet programs have long been the backbone of financial tasks in offices worldwide. In this article, we’ll explore how spreadsheet programs can transform your financial workflows and recommend some popular choices for your office finance needs.

“In the dynamic realm of office finance, where every digit counts, the trifecta of precision, organization and efficiency reigns supreme. Whether you’re orchestrating complex budgets, meticulously tracking expenses, crunching numbers for in-depth financial analysis or crafting comprehensive financial reports, having the right arsenal of tools at your disposal is nothing short of essential. Amid this financial symphony, spreadsheet programs have consistently emerged as the unsung heroes, the unassuming workhorses that power the financial tasks in offices across the globe. In this illuminating exploration, we’ll embark on a journey into the transformative capabilities of spreadsheet programs, unraveling how they can elevate your financial workflows to unprecedented heights. Additionally, we’ll introduce you to some esteemed choices that have graced the landscape of office finance.

The Financial Crucible: The realm of finance is a crucible where precision is the cornerstone. A minor error can have significant repercussions. Spreadsheet programs, with their grid-like structure and robust mathematical functions, have evolved into indispensable tools for maintaining the numerical integrity of financial data.

Budget Mastery: Crafting budgets that align with strategic objectives requires meticulous planning and precision. Spreadsheet programs provide the canvas to construct and fine-tune budgets of all complexities. They empower finance professionals to model various scenarios, anticipate outcomes and make informed decisions.

Expense Tracking Prowess: Tracking expenses can be a labyrinthine endeavor, especially in organizations with multiple cost centers and diverse spending categories. Spreadsheet programs serve as a central repository, enabling the systematic recording and categorization of expenses, thereby providing a clear financial snapshot.

Financial Analysis Hub: Spreadsheet programs are the sanctuaries where financial analysis comes to life. They facilitate the creation of dynamic financial models, enabling in-depth analysis of revenue, costs, profitability and trends. Functions like pivot tables and data visualization tools are invaluable assets for dissecting financial data.

Report Crafting Wizardry: The production of financial reports, whether for internal stakeholders or external auditors, demands finesse. Spreadsheet programs offer the canvas to construct detailed financial statements, balance sheets, income statements and cash flow reports, complete with embedded formulas for accuracy.

Data Validation and Integrity: Maintaining data accuracy is paramount in finance. Spreadsheet programs incorporate data validation rules and error-checking mechanisms to prevent inaccuracies. This safeguards against critical errors that could have far-reaching consequences.

Collaborative Excellence: Collaboration is central to financial workflows. Many spreadsheet programs offer cloud-based collaboration features, enabling real-time co-authoring and seamless document sharing. Multiple stakeholders can collaborate on a single financial model, fostering transparency and teamwork.

Audit Trail Transparency: Financial data changes are not made in a vacuum. Spreadsheet programs often include audit trail features that track modifications, providing transparency and accountability, which are critical in regulated financial environments.

Customization Prowess: The adaptability of spreadsheet programs is a remarkable asset. Finance professionals can customize spreadsheets to match the specific needs of their organization, whether it’s by adding macros for automation or embedding industry-specific calculations.

A Universe of Choices: The spreadsheet landscape is rich and diverse. While Microsoft Excel has been a perennial favorite, other options like Google Sheets and LibreOffice Calc offer compelling alternatives. Each has its strengths, catering to various user preferences and requirements.

In summary, spreadsheet programs are the financial virtuosos that empower finance professionals to navigate the intricacies of budgets, expenses, analysis and reporting with finesse. They bring order to the numerical chaos, provide a canvas for financial artistry and ensure precision in financial operations. The choices are abundant, but the outcome is the same: financial workflows elevated to a level of excellence that befits the world of office finance.”

To delve further into this matter, we encourage you to check out the additional resources provided here: Introduction to Excel Starter – Microsoft Support

The Importance of Spreadsheet Programs in Finance

Spreadsheet programs are the Swiss Army knives of financial management. They provide a structured grid of rows and columns that allow you to input, calculate and analyze data effortlessly. Here’s why they are indispensable in finance:

Spreadsheet programs are indeed the versatile Swiss Army knives of financial management and their indispensability in the world of finance cannot be overstated. These digital grids of rows and columns are powerful tools that empower financial professionals and businesses in numerous ways. Let’s explore in greater detail why spreadsheet programs are essential for financial tasks and how they revolutionize financial management:

Structured Data Management:

- Spreadsheet programs offer a structured and organized framework for managing financial data. Rows represent individual entries, while columns allow you to categorize and organize data by various parameters, such as dates, transactions, accounts or categories. This structured layout simplifies data entry and retrieval.

Effortless Data Input:

- The intuitive interface of spreadsheet software makes data input a breeze. You can quickly enter financial information, including income, expenses, investments and more, in a familiar tabular format. This ease of use encourages consistent data recording.

Real-Time Calculations:

- One of the standout features of spreadsheet programs is their ability to perform real-time calculations. Formulas and functions allow you to automatically calculate sums, averages, percentages and other mathematical operations, reducing the risk of calculation errors.

Budgeting and Financial Planning:

- Spreadsheets are invaluable for creating and maintaining budgets and financial plans. You can set up dynamic budget templates that automatically update as you input income and expenses. This capability helps you track your financial health and make informed decisions.

Data Analysis and Visualization:

- Beyond basic calculations, spreadsheet programs provide powerful tools for data analysis. You can generate charts, graphs and pivot tables to visualize financial trends, identify patterns and gain insights into your financial performance.

Scenario Planning:

- Spreadsheets enable you to perform scenario planning and what-if analyses. By changing input values, you can model various financial scenarios, allowing you to assess potential outcomes and make informed decisions based on different assumptions.

Customized Reporting:

- Financial professionals can create customized financial reports tailored to their specific needs. Whether it’s income statements, balance sheets, cash flow statements or financial forecasts, spreadsheets allow you to design reports that communicate financial information effectively.

Data Validation and Auditing:

- Spreadsheet programs offer data validation and auditing features that help ensure data accuracy. You can set validation rules to prevent incorrect data entry and use auditing tools to trace errors in complex financial models.

Collaboration and Sharing:

- Many spreadsheet programs support real-time collaboration, allowing multiple users to work on the same spreadsheet simultaneously. This collaborative capability fosters teamwork in financial analysis and reporting.

Integration with Financial Systems:

- Spreadsheets can integrate with financial systems, databases and other software tools. This facilitates data import/export, saving time and reducing manual data entry.

Historical Data Tracking:

- Spreadsheets are adept at tracking historical financial data. This historical perspective is crucial for understanding financial trends and making informed decisions about investments, expenditures and revenue growth.

Risk Management:

- Financial professionals use spreadsheets for risk management and scenario analysis. By simulating potential risks and their impacts, organizations can develop strategies to mitigate financial threats effectively.

In conclusion, spreadsheet programs are the bedrock of financial management. They provide an intuitive and flexible platform for data input, calculations, analysis and reporting. In a financial world driven by data-driven decision-making, spreadsheets are indispensable tools that empower individuals and organizations to navigate complex financial landscapes, make informed choices and achieve their financial goals with confidence.

Explore this link for a more extensive examination of the topic: What are spreadsheets and how do they work?

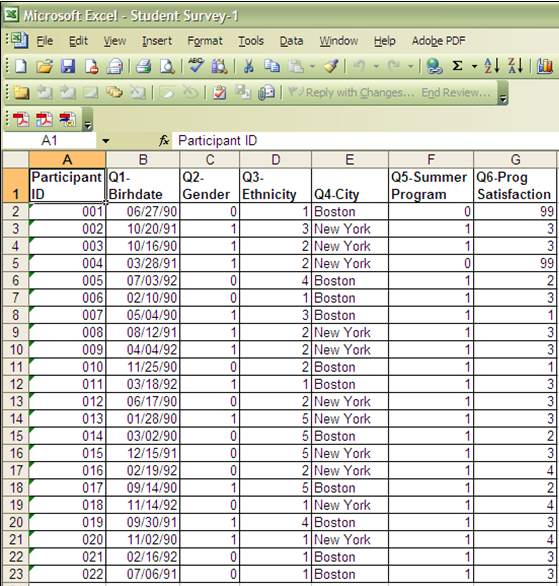

Data Organization

Spreadsheets help you keep your financial data organized, making it easy to access and reference when needed.

Spreadsheets serve as indispensable tools for financial management, offering a structured and efficient way to organize and maintain your financial data. Their versatility and capabilities go beyond simple data organization, enabling you to gain valuable insights, make informed decisions and ensure the financial health of your personal or professional endeavors.

One of the primary advantages of using spreadsheets for financial data management is their innate ability to impose order and structure on what can often be complex and extensive datasets. Instead of scattering financial information across multiple documents or folders, a spreadsheet consolidates it into a single, organized file. You can create separate sheets or tabs within the spreadsheet to categorize data, such as income, expenses, investments and assets, making it easy to locate and reference specific information at any time.

Moreover, spreadsheets facilitate data entry and manipulation, allowing you to input financial transactions and update balances with ease. With functions and formulas at your disposal, you can automate calculations, perform complex financial analyses and generate reports effortlessly. For example, you can calculate your monthly expenses, track the growth of your investments or project future financial scenarios with just a few clicks.

Spreadsheets also offer the advantage of flexibility. You can tailor the structure of your financial spreadsheet to match your specific needs and preferences. Customizable column headers, cell formatting and the ability to add comments or annotations allow you to create a financial record that is intuitive and user-friendly. This adaptability is particularly valuable as your financial situation evolves, accommodating changes in income sources, expenses or investment strategies.

Furthermore, spreadsheets provide a historical record of your financial transactions and activities. Over time, this history becomes a valuable resource for tracking trends, identifying patterns and evaluating your financial progress. For instance, you can compare your monthly expenses over the past year, assess the performance of your investment portfolio or measure your debt reduction efforts.

Perhaps one of the most significant benefits of using spreadsheets for financial management is the control and ownership they afford you. Unlike some financial software or applications that may require ongoing subscriptions or cloud-based access, a spreadsheet is a self-contained, offline solution. You have full control over your financial data and it remains accessible even without an internet connection, enhancing data security and privacy.

In conclusion, spreadsheets are indispensable tools for keeping your financial data organized, accessible and referenceable. Their flexibility, automation capabilities and historical tracking features empower you to maintain a clear and accurate picture of your financial situation. With spreadsheets at your disposal, you not only streamline financial management but also gain the insights and control needed to make informed financial decisions that align with your goals and aspirations.

Should you desire more in-depth information, it’s available for your perusal on this page: DoD Budget Request

Calculations and Formulas

Spreadsheet programs are equipped with powerful mathematical functions and formulas that can handle complex calculations, saving you time and reducing the risk of errors.

Spreadsheet programs are the unsung heroes of the digital age, armed with a formidable arsenal of mathematical functions and formulas that can be likened to a digital Swiss Army knife. These capabilities not only save you precious time but also act as a robust shield against the lurking specter of errors. Let’s delve deeper into how spreadsheet programs achieve this:

Complex Calculations Made Easy: Whether you’re dealing with financial data, scientific research, project management or inventory tracking, spreadsheet programs are well-versed in handling complex calculations effortlessly. From basic arithmetic operations to advanced statistical analyses, these tools can perform a wide range of mathematical tasks with precision and speed.

Automatic Updates: One of the remarkable features of spreadsheets is their ability to update calculations instantly as underlying data changes. This dynamic nature ensures that your results are always up-to-date, eliminating the need for manual recalculations.

Built-In Functions: Spreadsheet programs offer a treasure trove of built-in functions, from simple SUM and AVERAGE to more sophisticated ones like VLOOKUP, IF statements and pivot tables. These functions simplify the process of performing specific calculations and data manipulations, even for users with limited mathematical expertise.

Data Validation: To prevent errors at the source, spreadsheet programs can enforce data validation rules. This ensures that only valid data is entered, reducing the likelihood of incorrect calculations caused by data entry mistakes.

Error Checking: Modern spreadsheet software includes error-checking features that highlight potential errors in your formulas, such as circular references or inconsistent cell data. This proactive approach helps you catch and rectify mistakes before they cause serious issues.

Graphical Representations: Spreadsheets aren’t just about numbers; they can also create powerful visualizations like charts and graphs to help you better understand your data. These visual aids make it easier to spot trends, outliers and patterns.

Scenario Analysis: Spreadsheet programs excel at scenario analysis, allowing you to model various “what-if” scenarios by changing input variables and instantly seeing the impact on your calculations. This is invaluable for strategic planning and decision-making.

Data Integration: Spreadsheets can seamlessly import data from external sources, such as databases or web services, enabling you to consolidate and analyze information from multiple places in one central location.

Audit Trail: Many spreadsheet programs maintain an audit trail, showing the history of changes made to the spreadsheet. This feature is especially useful for tracking modifications and ensuring data integrity in collaborative environments.

Customization: Users can create custom functions and macros to extend the capabilities of spreadsheet programs further. This empowers individuals and organizations to tailor their spreadsheet software to specific needs.

Cross-Platform Compatibility: Most spreadsheet software works on multiple platforms and allows for easy sharing and collaboration, fostering efficient teamwork and data exchange.

In a world where data drives decisions and efficiency is paramount, spreadsheet programs stand as essential tools that transform raw numbers into valuable insights. They not only save time but also reduce the risk of costly errors, making them indispensable for professionals in various fields, from finance to science and from education to business management. So, the next time you open a spreadsheet, remember that you hold in your hands a digital wizard capable of mathematical feats and error-free calculations.

You can also read more about this here: Electronic Spreadsheet – an overview | ScienceDirect Topics

Customization

You can tailor spreadsheets to your specific financial needs, creating templates for budgeting, expense tracking, financial projections and more.

You can tailor spreadsheets to your specific financial needs, creating templates for budgeting, expense tracking, financial projections and more. This level of customization not only allows you to align your financial management tools with your unique goals but also streamlines your financial processes. By crafting tailored templates, you can ensure that your spreadsheets capture and analyze data in a way that makes sense to you, simplifying complex financial information into clear, actionable insights.

Furthermore, these customized spreadsheets can evolve with your changing financial circumstances. Whether you need to adapt to new income sources, investment strategies or expense categories, your personalized templates can easily incorporate these adjustments. This adaptability empowers you to stay in control of your finances and make informed decisions as your financial journey unfolds.

Moreover, sharing these customized templates with others, such as family members, colleagues or collaborators, can enhance collaboration and coordination in financial matters. With everyone using the same tailored tools, you can collectively work towards financial goals, track progress and make strategic adjustments as a team.

In essence, the ability to tailor spreadsheets for your financial needs not only simplifies day-to-day financial management but also empowers you to take charge of your financial future with precision and efficiency. It’s a versatile tool that can be as simple or as complex as your needs require, making it an indispensable asset for anyone seeking financial clarity and control.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: Memoranda | OMB | The White House

Data Visualization

Spreadsheets offer tools for creating charts and graphs, enabling you to visualize financial trends and patterns.

Spreadsheets offer tools for creating charts and graphs, enabling you to visualize financial trends and patterns. These visual representations are not just decorative additions but invaluable assets in the realm of financial management and analysis.

Identifying Trends: Charts and graphs help you quickly identify trends and patterns within your financial data. Whether it’s a line graph showing revenue growth over time or a pie chart breaking down expenses by category, visual cues make it easier to spot significant shifts or anomalies.

Enhancing Decision-Making: When making critical financial decisions, having a visual representation of data is immensely helpful. Graphs and charts provide a clear and concise overview, allowing you to make informed choices based on a deeper understanding of the numbers.

Communication and Reporting: Visualizations are powerful communication tools. When presenting financial information to colleagues, stakeholders or superiors, charts and graphs can convey complex data in a digestible format, making it easier for others to grasp the key takeaways.

Scenario Analysis: Creating multiple scenarios is a common practice in financial planning. Visual representations can help you compare different scenarios side by side, enabling you to assess potential outcomes and select the most advantageous course of action.

Forecasting and Goal Tracking: Whether you’re forecasting future revenue or tracking progress toward financial goals, charts and graphs provide a visual roadmap. You can set clear milestones and easily track your progress over time, adjusting strategies as needed.

Risk Assessment: Visualizations can also assist in risk assessment. By plotting financial data on a graph, you can visually pinpoint areas of vulnerability or potential exposure, allowing you to implement risk mitigation strategies more effectively.

Investor Relations: For businesses seeking investment, financial visualizations are essential in investor presentations. Well-crafted charts and graphs can instill confidence in potential investors, showcasing your financial health and growth potential.

Training and Education: Spreadsheets with visual elements are excellent tools for training or educating staff in financial matters. They provide a visual aid for explaining financial concepts, budgeting processes and financial analysis techniques.

Data-Driven Insights: Beyond just presenting data, visualizations help you derive insights from your financial data. Whether it’s identifying seasonality in sales, understanding cost drivers or uncovering customer behavior patterns, charts and graphs make data-driven insights more accessible.

Continuous Improvement: Regularly reviewing visualizations of financial data can promote a culture of continuous improvement within your organization. It encourages teams to proactively seek ways to optimize financial performance and achieve better results.

In essence, the ability to create charts and graphs within spreadsheets is a gateway to unlocking deeper understanding, informed decision-making and effective communication in the realm of finance. When used strategically, these visual tools can transform raw data into actionable insights, guiding your financial endeavors toward greater success.

For a comprehensive look at this subject, we invite you to read more on this dedicated page: 22 Advantages & Disadvantages of Using Spreadsheets for Business

Collaboration

Many spreadsheet programs support real-time collaboration, allowing multiple team members to work on financial documents simultaneously.

Many spreadsheet programs support real-time collaboration, allowing multiple team members to work on financial documents simultaneously.

1. Seamless Collaboration: Real-time collaboration eliminates the need for back-and-forth document sharing and ensures that all team members are on the same page. Whether you’re working with colleagues in the same office or distributed across the globe, everyone can contribute in real time.

2. Concurrent Editing: With real-time collaboration, users can edit different sections of a spreadsheet simultaneously. This means that while one team member is updating expense data, another can be revising revenue figures, increasing productivity and efficiency.

3. Instant Updates: Changes made by one collaborator are instantly visible to others. This transparency allows for quick feedback, reduces the risk of duplicate work and accelerates decision-making processes.

4. Version Control: Real-time collaboration tools often provide version history, which allows users to track changes and revert to previous versions if necessary. This ensures data integrity and provides an audit trail of document edits.

5. Access Control: Collaborative spreadsheet programs offer access control settings, allowing you to specify who can view, edit or comment on the document. This level of control ensures that sensitive financial data remains confidential.

6. Notifications: Many platforms provide notification features that alert users when changes are made or when they are mentioned in comments or discussions. This keeps everyone informed and engaged in the collaboration process.

7. Remote Work-Friendly: Real-time collaboration is particularly valuable for remote work scenarios. Team members can collaborate on financial documents as if they were in the same room, bridging geographical gaps and time zones.

8. Enhanced Communication: Integrated chat or comment features enable users to discuss specific parts of the document without the need for separate communication tools. This fosters clear communication and minimizes misunderstandings.

9. Greater Productivity: Collaborative spreadsheets reduce downtime associated with waiting for document updates or feedback. This allows team members to focus on analysis, decision-making and other value-added tasks.

10. Cross-Functional Collaboration: Financial documents often involve input from multiple departments, such as finance, sales and operations. Real-time collaboration facilitates cross-functional teamwork and ensures that all stakeholders can provide input.

11. Training and Onboarding: Collaborative spreadsheet platforms are user-friendly, making it easy for new team members to join ongoing projects without extensive training. This reduces the onboarding curve and accelerates their contribution to financial tasks.

12. Third-Party Integrations: Many collaborative spreadsheet tools offer integrations with other software, such as accounting systems, CRM software and data visualization tools, enhancing the overall financial workflow.

In today’s fast-paced business environment, real-time collaboration in spreadsheet programs is an invaluable asset for financial teams. It promotes efficiency, accuracy and transparency in financial document management, enabling organizations to make informed decisions and adapt swiftly to changing financial landscapes. Whether you’re working on budgeting, forecasting or financial analysis, real-time collaboration streamlines the process and empowers teams to excel in their financial endeavors.

To expand your knowledge on this subject, make sure to read on at this location: Office of Finance | HHS.gov

Top Spreadsheet Programs for Finance

Let’s delve into some of the top spreadsheet programs that can streamline your office financial tasks:

Exploring the landscape of spreadsheet programs opens up a world of possibilities for streamlining and enhancing your office’s financial tasks. These software tools are more than just grids of cells; they are versatile platforms that can revolutionize the way you manage, analyze and visualize financial data. Here, we’ll delve into some of the top spreadsheet programs that can empower your office to achieve financial efficiency and precision:

Microsoft Excel:

Industry Standard: Microsoft Excel is the quintessential spreadsheet software, widely recognized and used across industries. It offers an extensive array of features, including advanced formulas, pivot tables and data visualization tools.

Integration: Excel seamlessly integrates with other Microsoft Office applications, making it an indispensable part of the Microsoft ecosystem. It allows for efficient data sharing and collaboration within your office environment.

Google Sheets:

Cloud-Based Collaboration: Google Sheets excels in collaborative work. Multiple users can simultaneously edit and comment on spreadsheets in real time, promoting efficient teamwork even in remote settings.

Data Sharing: Google Sheets simplifies data sharing through easy-to-generate shareable links. This makes it an ideal choice for offices that prioritize cloud-based collaboration and accessibility.

LibreOffice Calc:

Open Source*: LibreOffice Calc is part of the open-source LibreOffice suite, offering a free and open alternative to proprietary spreadsheet software. It’s fully compatible with Microsoft Excel file formats.

Customization: Being open source, Calc is highly customizable. Users and developers can modify the software to suit their specific needs, making it versatile for various office scenarios.

Apple Numbers:

Sleek Design: Apple Numbers is known for its user-friendly and visually appealing interface. It’s particularly well-suited for Mac users who appreciate a seamless and aesthetic user experience.

Integration with Apple Ecosystem: If your office uses Apple devices and services, Numbers offers seamless integration with iCloud, macOS and other Apple apps for data synchronization and sharing.

Zoho Sheet:

Online Collaboration: Zoho Sheet is a cloud-based spreadsheet tool with robust collaboration features. It allows multiple users to work together, chat and comment within the application.

Automation: Zoho Sheet offers automation through macros and scripts, helping offices streamline repetitive financial tasks and improve efficiency.

Quip Spreadsheets:

- Real-Time Collaboration: Quip Spreadsheets is designed for modern collaboration. It combines spreadsheet functionality with real-time messaging and document editing, enhancing teamwork and communication.

Airtable:

Flexibility: Airtable combines spreadsheet functionality with database capabilities. It’s highly flexible, making it suitable for managing various types of financial data, from budgets to project tracking.

Visual Workspaces: Airtable uses a visual workspace format that’s intuitive and user-friendly, even for those without extensive spreadsheet experience.

Smartsheet:

- Project Management Integration: Smartsheet extends beyond traditional spreadsheet functionality by offering project management tools. It’s particularly useful for offices that need to track financial aspects of projects.

WPS Office Spreadsheets:

- Microsoft Compatibility: WPS Office Spreadsheets offers strong compatibility with Microsoft Excel file formats. This makes it easy to work with Excel files without the Microsoft Office subscription.

Incorporating one or more of these spreadsheet programs into your office workflow can significantly enhance financial tasks, from budgeting and expense tracking to data analysis and reporting. Each program has its unique strengths, so selecting the right one depends on your specific office needs, preferred platform and collaboration requirements. Whether you’re a small business, a large corporation or a non-profit organization, the right spreadsheet software can be a valuable asset in achieving financial excellence and efficiency.

Don’t stop here; you can continue your exploration by following this link for more details: The Importance of Excel in Business

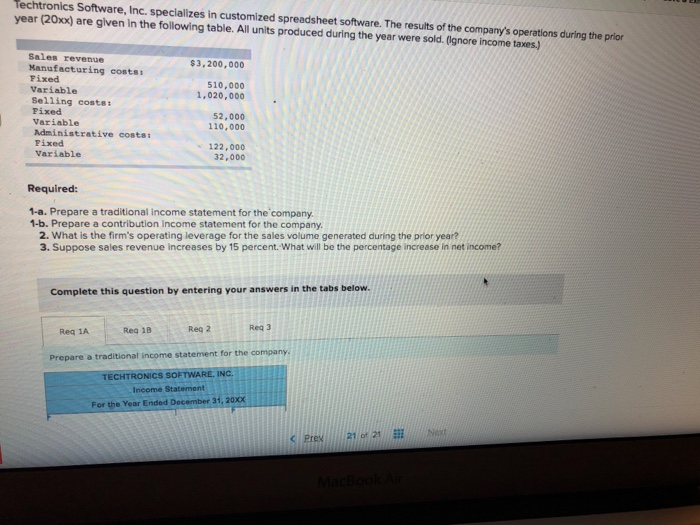

Microsoft Excel

Microsoft Excel is a stalwart in the world of spreadsheet programs. It offers a wide range of financial functions and tools that cater to various financial needs. With Excel, you can create complex financial models, perform in-depth data analysis and generate professional financial reports. Its user-friendly interface makes it accessible to users of all skill levels.

Microsoft Excel is undeniably a stalwart in the realm of spreadsheet programs and its prominence is well-earned. This venerable software is not just a tool; it’s a financial Swiss Army knife that empowers professionals and organizations across the globe. Here’s a deeper dive into how Excel’s financial prowess transcends the ordinary:

Diverse Financial Functions: Excel boasts an extensive library of financial functions that cater to a multitude of financial needs. Whether you’re calculating present values, analyzing loan amortizations or forecasting future cash flows, Excel’s repertoire of financial functions is a treasure trove for financial analysts, accountants and business planners.

Complex Financial Modeling: Excel excels in the creation of intricate financial models. Whether you’re projecting future revenues, estimating market growth or evaluating investment opportunities, its robust formula capabilities and flexible data structuring allow you to build complex models that aid in informed decision-making.

Data Analysis Prowess: With its data analysis tools, Excel is a data-driven decision-maker’s dream. Pivot tables, data validation and the Power Query tool enable you to slice and dice data effortlessly, uncovering insights and trends that inform your financial strategies.

Scenario Analysis: Excel’s “What-If” analysis tools let you explore various financial scenarios. You can tweak assumptions and instantly visualize their impact on your financial models, helping you make informed contingency plans and assess risk.

Charting and Visualization: Excel’s charting capabilities are second to none. You can transform raw data into meaningful visualizations like bar charts, pie charts and trendlines. These visual aids not only make data more digestible but also enhance presentations of financial information to stakeholders.

Professional Financial Reports: Excel is the go-to software for generating professional financial reports. Whether it’s income statements, balance sheets or cash flow statements, Excel templates and formatting options allow you to create polished reports that convey financial information with clarity and precision.

Easy-to-Use Interface: Despite its powerful features, Excel’s user-friendly interface ensures accessibility for users of all skill levels. Novices can perform basic calculations, while advanced users can harness the full spectrum of capabilities.

Integration with External Data: Excel’s ability to integrate with external data sources such as databases, cloud services and web APIs opens up new horizons for data enrichment and real-time financial analysis. This connectivity enables you to work with the most up-to-date information.

Add-Ins and Customization: Excel’s versatility extends further with the availability of add-ins and the ability to create custom functions and macros. These options allow you to tailor Excel to your specific financial needs and streamline repetitive tasks.

Collaboration and Sharing: Excel isn’t confined to individual use; it’s built for collaboration. Cloud-based versions and sharing options enable multiple stakeholders to work on financial documents simultaneously, fostering collaboration among financial teams and departments.

In summary, Microsoft Excel isn’t merely a spreadsheet program; it’s a financial wizard’s toolkit. Its rich assortment of financial functions, modeling capabilities and data analysis tools, combined with its user-friendly interface, make it an indispensable companion for financial professionals and organizations of all sizes. Excel’s legacy as a financial powerhouse continues to evolve, ensuring that it remains an integral part of the financial landscape for years to come.

You can also read more about this here: Using Access or Excel to manage your data – Microsoft Support

Google Sheets

Google Sheets is the cloud-based counterpart to Microsoft Excel. It’s highly collaborative, allowing teams to work on financial documents in real time, even if they are in different locations. Google Sheets offers robust financial templates and integrates seamlessly with other Google Workspace apps, making it an excellent choice for remote teams.

Google Sheets, as the cloud-based counterpart to Microsoft Excel, offers a plethora of advantages that cater to modern business needs and the dynamics of remote teams. Here’s an in-depth exploration of its features and benefits in the context of financial document management and collaboration:

1. Real-Time Collaboration Across Distances:

- Google Sheets takes collaboration to the next level. Multiple team members, regardless of their geographical locations, can simultaneously work on the same financial document. This real-time collaboration fosters efficient communication and teamwork.

2. Accessibility and Convenience:

- Being cloud-based, Google Sheets is accessible from anywhere with an internet connection. Team members can access financial documents on the go, which is particularly advantageous for remote or traveling professionals.

3. Robust Financial Templates:

- Google Sheets offers a wide range of pre-designed financial templates, including budget spreadsheets, financial reports and expense trackers. These templates save time and effort in creating financial documents from scratch.

4. Seamless Integration with Google Workspace:

- Integration with other Google Workspace apps, such as Google Drive, Google Docs and Google Slides, creates a unified ecosystem for document management, collaboration and presentation. Financial data can seamlessly flow between these apps, enhancing productivity.

5. Version Control and History:

- Google Sheets keeps a detailed version history, allowing users to track changes, revert to previous versions and view who made specific edits. This feature is invaluable for maintaining data accuracy and transparency.

6. Automated Functions and Formulas:

- Google Sheets offers a robust set of functions and formulas for financial calculations. Users can automate complex calculations, saving time and reducing the risk of errors.

7. Data Visualization and Charting:

- Transforming raw financial data into visual charts and graphs is effortless in Google Sheets. These visualizations provide insights and make it easier to communicate financial information effectively.

8. Data Security and Permissions:

- Google Sheets ensures data security through robust encryption and access control mechanisms. Owners can assign permissions to control who can view, edit or comment on financial documents, enhancing data privacy and compliance.

9. Notifications and Alerts:

- Users can set up notifications and alerts in Google Sheets to stay informed about changes or specific conditions in their financial data. This proactive feature helps teams address financial issues promptly.

10. Mobile Accessibility: – The Google Sheets mobile app allows users to access and edit financial documents on smartphones and tablets. This level of accessibility suits professionals who are frequently on the move.

11. Cost-Effective Solution: – Google Workspace, including Google Sheets, offers cost-effective subscription plans that include cloud storage, support and continuous updates. This pricing model is attractive to organizations seeking efficient financial tools without substantial upfront costs.

12. Third-Party Integrations: – Google Sheets integrates with a variety of third-party applications and add-ons, enabling users to extend its functionality for specific financial tasks or industry-specific requirements.

In conclusion, Google Sheets stands as a versatile and collaborative financial tool tailored to the demands of remote teams and modern business workflows. Its cloud-based nature, real-time collaboration, robust templates, integration capabilities and data security measures make it a valuable asset for managing and analyzing financial data efficiently and effectively, regardless of where team members are located. As remote work becomes increasingly prevalent, Google Sheets is poised to continue playing a pivotal role in enhancing financial document management and collaboration for organizations worldwide.

Looking for more insights? You’ll find them right here in our extended coverage: DoD Budget Request

LibreOffice Calc

LibreOffice Calc is a free and open-source spreadsheet program that rivals commercial alternatives. It provides a comprehensive suite of financial functions, supports complex macros and allows you to import and export data in various formats. LibreOffice Calc is a cost-effective choice for budget-conscious offices.

“LibreOffice Calc stands as a formidable contender in the realm of spreadsheet software, offering a robust set of features that squarely competes with its commercial counterparts. This open-source gem not only saves you from the financial burden of licensing fees but also excels in various aspects:

1. Comprehensive Financial Functions: LibreOffice Calc boasts a wealth of financial functions, making it an invaluable tool for tasks ranging from budgeting and expense tracking to complex financial analysis. Whether you need to calculate loan payments, assess investment returns or conduct statistical analysis, Calc has you covered.

2. Macro Magic: Automation is the cornerstone of efficiency and Calc doesn’t disappoint in this department. It supports the creation of complex macros using its built-in scripting language, allowing you to automate repetitive tasks, create custom functions and streamline your workflow.

3. Versatile Data Handling: LibreOffice Calc is a pro at data handling. It’s adept at importing data from various sources, including spreadsheets, databases and even web services. Likewise, it offers a plethora of export formats, ensuring compatibility with a wide range of systems and applications.

4. Cross-Platform Compatibility: Calc’s open-source nature means it’s available on multiple platforms, including Windows, macOS and Linux. This cross-platform compatibility ensures seamless collaboration and access across diverse office environments.

5. Familiar User Interface: Calc boasts a user-friendly interface that aligns with industry standards. If you’re transitioning from another spreadsheet software, the learning curve is minimal, allowing you to dive right into your tasks.

6. Continuous Development: The open-source community is dedicated to improving and enhancing LibreOffice Calc continually. Regular updates and contributions from developers around the world mean you’ll benefit from ongoing improvements and feature additions.

7. Cost-Effective Solution: One of the standout advantages of LibreOffice Calc is its cost-effectiveness. As a free and open-source software, it eliminates the need for costly licensing fees, making it an ideal choice for budget-conscious offices, small businesses, educational institutions and nonprofits.

8. Compatibility with Industry Standards: LibreOffice Calc prioritizes compatibility with industry-standard file formats, ensuring seamless interchangeability with commercial spreadsheet applications. You can confidently collaborate with colleagues and partners, knowing that your documents will retain their integrity.

In essence, LibreOffice Calc not only rivals commercial spreadsheet software but often surpasses them in terms of cost-efficiency and flexibility. Whether you’re an individual, a small business owner or part of a large organization, Calc empowers you to crunch numbers, automate tasks and make data-driven decisions without breaking the bank. It exemplifies the best of open-source software, offering a powerful and cost-effective solution for all your spreadsheet needs.”

Additionally, you can find further information on this topic by visiting this page: LibreOffice Calc 7.0 Guide

Apple Numbers

For Mac users, Apple Numbers is a versatile spreadsheet program that blends seamlessly with other Apple applications. It offers financial templates and features like interactive charts, which are particularly appealing for visualizing financial data. Its intuitive interface makes it an excellent choice for those in the Apple ecosystem.

For Mac users, Apple Numbers stands out as a versatile and integrated spreadsheet program that can significantly enhance your financial data management. Let’s delve deeper into why Apple Numbers is a compelling choice for users within the Apple ecosystem:

1. Seamless Integration: Apple Numbers is a native Apple application, which means it seamlessly integrates with other Apple software and services. This synergy facilitates effortless data sharing and collaboration with colleagues or team members who are also using Apple devices and applications. Whether you’re working with Numbers, Pages or Keynote, the compatibility is flawless.

2. User-Friendly Interface: Apple Numbers boasts an intuitive and user-friendly interface. If you’re accustomed to Apple’s design philosophy, you’ll find Numbers to be consistent with your expectations. Its clean layout and familiar design elements make it easy to start using, even for those new to spreadsheet software.

3. Financial Templates: Numbers includes a robust collection of financial templates tailored to various needs. Whether you’re managing personal finances, creating business budgets or analyzing investment portfolios, you can find pre-designed templates that expedite your work. These templates offer a head start and can be customized to suit your specific requirements.

4. Interactive Charts and Graphs: One standout feature of Apple Numbers is its ability to create interactive charts and graphs. Visualizing financial data is essential for gaining insights and Numbers excels in this regard. You can easily generate dynamic charts that allow you to explore data trends, compare figures and present your findings effectively.

5. Collaboration Made Easy: Collaboration is vital in today’s work environment and Apple Numbers facilitates it seamlessly. You can collaborate on spreadsheets in real-time, share documents with colleagues and even co-edit documents simultaneously. This collaborative approach enhances productivity and ensures that everyone is on the same page.

6. Accessibility Across Devices: The Apple ecosystem extends across various devices, including Mac computers, iPads and iPhones. With Numbers, your financial data is accessible from anywhere, allowing you to work on your spreadsheets across different devices while maintaining consistency and synchronization.

7. Data Security: Apple places a strong emphasis on data security and privacy. When you work with Numbers, you benefit from Apple’s commitment to protecting your data. This is particularly crucial when handling sensitive financial information.

8. Cross-Platform Compatibility: While Numbers is primarily designed for Mac, it also has web-based functionality. This means you can access and work on your spreadsheets using a web browser on Windows devices or other platforms, providing flexibility in your workflow.

9. Regular Updates: Apple continually updates its software, including Numbers, to improve performance and introduce new features. By staying within the Apple ecosystem, you can count on receiving updates and enhancements to your productivity tools over time.

In essence, Apple Numbers is not just a spreadsheet program; it’s a valuable tool tailored to the needs of Mac users. Its seamless integration, user-friendly interface and financial-focused features make it an excellent choice for managing and visualizing financial data within the Apple ecosystem. Whether you’re tracking personal expenses, creating business budgets or conducting financial analyses, Numbers provides a solid foundation for your financial endeavors.

You can also read more about this here: The Easy (and Free) Way to Make a Budget Spreadsheet – The New …

Zoho Sheet

Zoho Sheet is part of the Zoho Office Suite and is known for its ease of use and collaboration features. It offers financial templates, supports over 350 functions and allows for data import from various sources. Zoho Sheet is an excellent choice for small to medium-sized businesses.

Zoho Sheet, a component of the comprehensive Zoho Office Suite, stands out as an accessible and feature-rich spreadsheet software designed to streamline your work processes. Let’s explore why Zoho Sheet is a top choice, particularly for small to medium-sized businesses:

User-Friendly Interface: Zoho Sheet is celebrated for its intuitive and user-friendly interface. Whether you’re a seasoned spreadsheet pro or just getting started, the platform’s design ensures a smooth onboarding experience, allowing you to dive into your tasks without a steep learning curve.

Seamless Collaboration: Collaboration is at the heart of modern work and Zoho Sheet excels in this regard. Its real-time collaboration features enable multiple users to work on the same document simultaneously, whether you’re brainstorming ideas, creating financial reports or tracking project budgets. Collaborators can leave comments, chat and make edits, fostering efficient teamwork.

Diverse Financial Templates: Zoho Sheet caters to the financial needs of businesses with its extensive library of financial templates. From budgeting and expense tracking to income statements and balance sheets, these templates save you time and effort by providing pre-designed formats for various financial tasks.

Robust Formula Support: With over 350 functions at your disposal, Zoho Sheet empowers you to perform complex calculations and data analysis effortlessly. Whether you need to create intricate formulas for financial modeling or statistical analysis, the platform has you covered.

Data Import Versatility: Zoho Sheet offers the flexibility to import data from a wide range of sources, including spreadsheets, databases and cloud storage services. This versatility ensures that you can seamlessly integrate data from multiple platforms, streamlining your data management process.

Data Visualization: Visualizing data is crucial for decision-making and Zoho Sheet offers a suite of charting and graphing tools to help you transform raw data into meaningful insights. Customize your charts to present data exactly the way you want, making it easier to convey information to stakeholders.

Data Analysis Features: Beyond basic spreadsheet functions, Zoho Sheet provides data analysis features such as PivotTables and Data Validation. These tools empower you to explore data trends, identify outliers and maintain data accuracy, enhancing the quality of your reports.

Secure Cloud Storage: Zoho Sheet seamlessly integrates with cloud storage, allowing you to save and access your spreadsheets from anywhere with an internet connection. Your data is securely stored and you can control access permissions to protect sensitive information.

Mobile Accessibility: In today’s mobile work environment, Zoho Sheet offers mobile apps that ensure you can work on your spreadsheets from smartphones and tablets, keeping you productive even when you’re on the move.

Cost-Effective Solution: Zoho Sheet is cost-effective, making it an attractive choice for small to medium-sized businesses looking for powerful spreadsheet capabilities without breaking the bank. You can choose from various pricing plans to match your needs and budget.

In summary, Zoho Sheet is a versatile and accessible spreadsheet tool that simplifies your financial and data management tasks. With its collaboration features, extensive library of templates and support for a wide range of functions, it’s an excellent fit for businesses seeking efficiency and effectiveness in their spreadsheet work. Whether you’re crunching numbers, creating reports or collaborating with your team, Zoho Sheet equips you with the tools you need to excel in today’s competitive business landscape.

Additionally, you can find further information on this topic by visiting this page: Accounting & finance – Google Workspace Marketplace

Leveraging Spreadsheet Programs for Finance

To harness the full potential of spreadsheet programs for your office financial tasks:

To harness the full potential of spreadsheet programs for your office financial tasks, consider implementing these strategies that will not only enhance your efficiency but also help you make informed financial decisions with ease:

Master Formulas and Functions: Dive deep into the world of spreadsheet formulas and functions. Learn how to use SUM, AVERAGE, IF, VLOOKUP and other essential functions to perform calculations, analyze data and extract meaningful insights. Understanding these tools can save you countless hours of manual data manipulation.

Data Validation and Error Checking: Create data validation rules and error-checking mechanisms in your spreadsheets. This ensures that the data you input is accurate and reduces the chances of costly errors in your financial calculations. It’s an essential step to maintain the integrity of your financial records.

Pivot Tables for Data Analysis: Pivot tables are powerful tools for summarizing and analyzing large sets of financial data. Mastering pivot tables allows you to quickly generate reports, identify trends and gain a comprehensive overview of your financial performance.

Automate Data Entry: Reduce the time spent on repetitive data entry by automating it. Use features like data import, data connections and macros to streamline the process. This not only saves time but also minimizes the risk of manual input errors.

Custom Templates: Develop custom templates for your financial reports, invoices and budgets. Custom templates ensure consistency in your financial documents and make them look professional. Many spreadsheet programs offer templates you can customize to suit your specific needs.

Conditional Formatting: Use conditional formatting to visually highlight important data points. This feature can help you spot trends, anomalies and key performance indicators in your financial data more quickly.

Data Visualization: Leverage charts and graphs to visualize your financial data. Charts not only make it easier to interpret complex information but also help you communicate financial insights to stakeholders effectively.

Version Control: Maintain version control of your financial spreadsheets to track changes and ensure that you’re working with the most up-to-date information. This is especially crucial when collaborating with others on financial projects.

Data Security and Backup: Protect your financial data by implementing robust security measures. Use password protection, encryption and cloud backup solutions to safeguard sensitive financial information from loss or unauthorized access.

Regular Auditing: Establish a schedule for auditing your financial spreadsheets. Regularly review formulas, data sources and assumptions to verify the accuracy and reliability of your financial models.

Integration with Accounting Software: If your organization uses accounting software, ensure seamless integration with your spreadsheet programs. This allows for easy data exchange between your spreadsheets and accounting systems, reducing manual data transfer.

Continual Learning: Stay updated on the latest spreadsheet features and best practices. Many spreadsheet programs offer online courses, tutorials and communities where you can learn from experts and peers. Investing in ongoing learning can significantly boost your financial productivity.

By incorporating these strategies, you’ll not only unlock the full potential of spreadsheet programs but also transform them into indispensable tools for managing your office’s financial tasks. Whether you’re tracking expenses, creating budgets or analyzing financial reports, you’ll have the confidence and capability to excel in your financial responsibilities.

To delve further into this matter, we encourage you to check out the additional resources provided here: Chapter 3: Budgeting, Financial Accounting for Local and State …

Use Templates

Most spreadsheet programs offer pre-designed financial templates for common tasks like budgeting, expense tracking and financial reporting. Start with these templates to save time and effort.

Explore the array of pre-designed financial templates readily available in most spreadsheet programs, meticulously crafted for common financial tasks such as budgeting, expense tracking and financial reporting. Leveraging these templates as a starting point not only accelerates your workflow but also ensures a structured and organized approach to managing your finances. Customize and tailor these templates to align with your specific needs and watch as they efficiently assist you in achieving your financial objectives. By utilizing these readily available resources, you optimize your time and efforts, empowering yourself to focus on insightful analysis and strategic financial decisions.

Additionally, you can find further information on this topic by visiting this page: Chapter 3: Budgeting, Financial Accounting for Local and State …

Master Formulas

Invest time in learning essential formulas and functions related to finance, such as SUM, AVERAGE, IF and VLOOKUP. These will help you perform calculations efficiently.

“Investing your time in learning essential financial formulas and functions is a wise move that can significantly enhance your ability to handle financial data effectively. Whether you’re working on budgeting, financial analysis or any financial task, having a command of these foundational tools is invaluable. Here’s why dedicating time to learn and master these essential formulas and functions is a smart career move:

Accurate Financial Analysis: Financial formulas like SUM and AVERAGE are the building blocks of accurate financial analysis. They allow you to perform calculations with precision, ensuring that your financial reports and projections are error-free.

Data Summarization: SUM is a fundamental function for adding up values in a range, making it indispensable for summarizing data. Whether you’re calculating total revenues, expenses or profits, the SUM function simplifies the task.

Conditional Logic: The IF function adds a layer of conditional logic to your financial calculations. It allows you to perform different calculations based on specified conditions. This is particularly useful for scenarios like forecasting where outcomes depend on various factors.

Data Lookup: VLOOKUP is a powerful tool for retrieving specific data from large datasets. It’s a time-saver when you need to find and extract information, such as product prices, tax rates or customer details, from extensive tables or databases.

Efficiency and Productivity: Mastery of these formulas and functions significantly boosts your efficiency. Instead of manually crunching numbers, you can perform complex calculations in a fraction of the time, leaving you more time for strategic analysis and decision-making.

Error Reduction: Using formulas and functions reduces the risk of manual errors in financial calculations. Since these tools are formulaic and repeatable, they eliminate the potential for calculation mistakes and inconsistencies.

Versatility: The knowledge of these formulas and functions is transferable across various financial software and tools. Whether you’re using Microsoft Excel, Google Sheets or other financial applications, the concepts remain the same.

Enhanced Reporting: With these tools in your arsenal, you can create more informative and visually appealing financial reports. They enable you to present data in a structured, organized and easy-to-understand manner.

Competitive Advantage: Proficiency in financial formulas and functions is a sought-after skill in many industries, especially finance, accounting and business analysis. It enhances your resume and can be a deciding factor in job applications and promotions.

Continual Learning: Learning these essential formulas and functions is part of your ongoing professional development. It’s a journey that allows you to deepen your financial expertise and stay updated with industry best practices.

In conclusion, investing time in learning essential financial formulas and functions is an investment in your career growth and financial acumen. These tools are the foundation upon which you can build advanced financial modeling, analysis and reporting skills. They are your keys to unlocking accurate and efficient financial decision-making, setting you on a path to success in the world of finance and business.”

Don’t stop here; you can continue your exploration by following this link for more details: Master Nonprofit Accounting With (Free) Excel Templates

Data Validation

Implement data validation rules to ensure that the data entered into your spreadsheets is accurate and consistent.

Implementing data validation rules is akin to erecting strong safeguards for the integrity and reliability of your spreadsheet data. Here’s why it’s not just beneficial but crucial for maintaining accurate and consistent data:

Data Accuracy Assurance: Data validation rules act as gatekeepers, allowing only accurate and valid data to enter your spreadsheets. This significantly reduces the risk of errors caused by typos, incorrect values or inconsistent formatting, ensuring that your data remains dependable.

Consistency Across Entries: By enforcing consistency in data entry, validation rules create a standardized dataset. This consistency is particularly important when multiple users contribute to the same spreadsheet or when data needs to be compared or analyzed across different periods or projects.

Error Prevention: Prevention is often more efficient and cost-effective than error correction. Data validation rules help prevent errors at the point of entry, reducing the need for time-consuming data cleaning and reconciliation efforts later on.

Enhanced User Guidance: Validation rules can be designed to provide informative error messages or prompts when invalid data is entered. This guidance ensures that users are aware of any issues and can take corrective action immediately, improving data quality and user experience.

Protection Against Malicious Inputs: In some cases, data validation can serve as a defense against malicious or unauthorized data inputs. By restricting the types and values of data that can be entered, you can mitigate security risks associated with data manipulation.

Facilitation of Complex Calculations: For spreadsheets that perform complex calculations or rely on accurate data relationships, validation rules are indispensable. They ensure that input data meets the required criteria for calculations to produce meaningful and reliable results.

Efficiency and Productivity: Enforcing data validation rules streamlines the data entry process. Users can confidently enter data without second-guessing themselves, leading to increased productivity and reduced frustration.

Maintaining Data Quality Over Time: As spreadsheets evolve and are used over time, data validation rules help maintain data quality. They prevent the gradual degradation of data integrity due to unintentional errors or omissions.

Customization for Specific Needs: Data validation rules can be tailored to suit specific business requirements. Whether it’s limiting date ranges, constraining values within a defined set or ensuring numeric data falls within specified bounds, rules can be customized to address unique data challenges.

Adaptability to Changing Data Sources: When data comes from various sources, validation rules provide a consistent framework for evaluating and accepting incoming data. This adaptability is essential for data consolidation and reporting across diverse datasets.

Incorporating data validation rules into your spreadsheet workflow is not just a best practice; it’s a fundamental strategy for data reliability, accuracy and consistency. By investing the effort upfront to establish and maintain these rules, you create a solid foundation for data-driven decision-making, analysis and reporting. In essence, data validation rules are your allies in the pursuit of trustworthy and dependable data within your spreadsheets.

You can also read more about this here: System Administrator … – University Of Rhode Island Applicant Portal

Charts and Graphs

Visualize financial data using charts and graphs to gain insights and make informed decisions.

Visualizing financial data through charts and graphs is a powerful practice that transcends mere numbers and transforms raw data into meaningful insights. This data visualization approach not only enhances comprehension but also empowers individuals and organizations to make informed and strategic financial decisions. Here’s a more in-depth exploration of why visualizing financial data is invaluable:

Clarity and Simplicity: Charts and graphs distill complex financial information into clear, concise visuals. They replace rows of numbers with intuitive representations, making it easier for stakeholders to grasp trends, patterns and outliers at a glance.

Time-Saving: Instead of poring over extensive spreadsheets, stakeholders can quickly extract key information from charts and graphs. This efficiency allows for faster decision-making and the ability to allocate more time to analysis and strategy.

Spotting Trends: Line charts and time series graphs excel at illustrating trends over time. Visualizing financial data in this way helps identify growth trajectories, seasonal patterns and potential areas of concern that might be less evident in tabular data.

Comparative Analysis: Bar charts, scatter plots and pie charts facilitate comparisons. Whether it’s comparing revenue across quarters, assessing the distribution of expenses or evaluating the performance of different investment portfolios, visualizations offer a visual basis for analysis.

Identifying Anomalies: Outliers, anomalies or irregularities in financial data can have a significant impact on decision-making. Visualizations can highlight these data points, prompting further investigation or action when necessary.

Scenario Planning: Visualizations can be used to model different financial scenarios. By adjusting variables and parameters in financial models, stakeholders can visually assess the potential outcomes of various decisions, aiding in risk assessment and strategic planning.

Enhancing Presentations: Visualizations are invaluable in presentations and reports. They engage the audience, convey complex information more effectively and support the narrative. Effective data visualization can make your financial presentations more compelling and persuasive.

Interactive Dashboards: Interactive dashboards take data visualization to the next level. They allow users to customize and explore financial data on their own, gaining deeper insights and answering specific questions in real time.

Real-Time Monitoring: Financial dashboards equipped with real-time data feeds enable organizations to monitor their financial health and performance continuously. This proactive approach allows for timely adjustments and interventions when necessary.

Data-Driven Decisions: Visualizations encourage data-driven decision-making. When decision-makers can see the impact of choices on charts and graphs, they are more likely to make informed decisions grounded in evidence and analysis.

Communication and Collaboration: Visualizations transcend language barriers, making financial data more accessible to diverse stakeholders. Whether you’re communicating with non-financial teams or collaborating with partners, visualizations enhance shared understanding.

Goal Tracking: Visualizations can be used to track progress toward financial goals and targets. Goal attainment can be graphically represented, motivating teams and individuals to work toward shared objectives.

In conclusion, visualizing financial data is an essential tool for gaining deeper insights, facilitating informed decisions and effectively communicating financial information. It empowers individuals and organizations to navigate the complex landscape of finance with confidence, turning data into actionable intelligence and strategic advantage.

To expand your knowledge on this subject, make sure to read on at this location: Budget of the U.S. Government

Regular Backups

Regularly back up your financial spreadsheets to prevent data loss.

“Regularly backing up your financial spreadsheets is not just a precaution; it’s a crucial step in safeguarding your financial data and ensuring business continuity. In today’s digital age, where financial transactions, budget tracking and financial analysis are heavily reliant on spreadsheets, data loss can be catastrophic.

Here’s why consistent backups matter:

Protection Against Hardware Failures: Computers and storage devices can fail unexpectedly. If your financial spreadsheets are stored solely on your local device, you risk losing all your critical financial data in case of hardware failure. Regular backups ensure that even if your primary device crashes, your financial information remains secure and accessible.

Defense Against Human Errors: Mistakes happen. Whether it’s accidental deletion, overwriting or data corruption, human errors can wreak havoc on your spreadsheets. Regular backups create a safety net, allowing you to restore previous versions and recover lost or corrupted data quickly.

Security Against Cyber Threats: Cyberattacks like ransomware can lock you out of your own data. Having backups stored separately from your primary system ensures that you can regain access to your financial information without having to pay a ransom or lose critical data.

Compliance and Audit Trails: In many industries, compliance requirements demand data retention and auditing capabilities. Regular backups help you meet these requirements by preserving historical financial data and providing a clear audit trail.

To effectively protect your financial spreadsheets, consider the following best practices:

Automate Backups: Use automated backup solutions or cloud services that offer scheduled backups, ensuring that your data is consistently and securely saved.

Offsite Storage: Store backups in an offsite location or in the cloud. This protects your data from physical disasters like fires, floods or theft.

Version Control: Maintain multiple versions of backups so that you can access historical data if needed.

In conclusion, backing up your financial spreadsheets is not just a precautionary measure; it’s a proactive step in safeguarding your financial stability. Regular backups offer peace of mind, protect against unexpected disasters and ensure that your financial data remains accessible and intact, even in the face of adversity.”

If you’d like to dive deeper into this subject, there’s more to discover on this page: Using Access or Excel to manage your data – Microsoft Support

In conclusion, spreadsheet programs are indispensable tools for office finance professionals. Whether you’re managing budgets, analyzing financial data or preparing reports, the right spreadsheet program can simplify complex tasks, enhance accuracy and improve collaboration. By choosing the best-suited spreadsheet program for your needs and mastering its features, you can elevate your office finance tasks to new levels of efficiency and effectiveness.

In the world of office finance, spreadsheet programs stand as the unsung heroes, offering indispensable capabilities that transform the way financial professionals operate. Let’s delve deeper into the enduring value and the strategic advantages they bring to the table:

Holistic Financial Management: Spreadsheet programs are like command centers for financial professionals. They enable you to consolidate data, create comprehensive budgets and manage financial resources across departments or projects. With a holistic view, you can make informed decisions that align with your organization’s financial objectives.

Data Analysis Mastery: Beyond mere data entry, spreadsheet programs provide powerful data analysis tools. You can uncover trends, patterns and outliers through functions, formulas and pivot tables. This data-driven insight is essential for strategic planning and risk assessment.

Precision and Accuracy: In the realm of finance, precision is paramount. Spreadsheet programs ensure that calculations are error-free and consistent. This accuracy is invaluable when handling complex financial models, forecasts and reconciliations.

Custom Reporting: Financial professionals often need to generate custom reports tailored to specific stakeholders. Spreadsheet programs allow you to create dynamic and visually appealing reports that convey complex financial information in a clear and understandable manner.

Collaborative Efficiency: Collaboration is at the heart of finance and spreadsheet programs facilitate it seamlessly. You can share workbooks, enable real-time editing and track changes, ensuring that financial data is accurate and up-to-date for all team members.

Scenario Modeling: Financial decision-making often involves assessing various scenarios and their potential impact. Spreadsheet programs enable you to build scenario models that help you evaluate alternatives and make well-informed choices.

Budgetary Control: Managing budgets is a critical function for finance professionals. Spreadsheet programs provide the tools to set, monitor and analyze budgets, allowing you to identify variances and take corrective actions promptly.

Risk Assessment: Spreadsheet programs aid in risk assessment and mitigation. By modeling potential risks and evaluating their financial consequences, you can develop strategies to minimize exposure and protect the financial health of your organization.

Compliance and Audit Trails: In regulated industries, compliance is non-negotiable. Spreadsheet programs can assist in maintaining compliance by offering features like audit trails, which track changes to financial data and ensure transparency.

Time Savings: Finance professionals deal with vast amounts of data. Spreadsheet programs automate calculations, reducing the time spent on repetitive tasks. This efficiency frees up time for in-depth analysis and strategic decision-making.

Adaptability: As financial landscapes evolve, spreadsheet programs evolve with them. You can adapt your spreadsheets to address new financial challenges, regulatory changes or reporting requirements without the need for extensive retraining or software migration.

Continuous Learning: Becoming proficient in spreadsheet programs is a lifelong learning journey. As you master their features and functions, you empower yourself to tackle increasingly complex financial tasks and become an asset to your organization.

In conclusion, spreadsheet programs are the unsung heroes of office finance. They are not just tools; they are strategic assets that simplify complexity, enhance accuracy and promote collaboration. Mastering the capabilities of the right spreadsheet program empowers finance professionals to make data-driven decisions, manage budgets effectively and navigate the ever-changing financial landscape with confidence and competence. In the world of finance, the spreadsheet program is your trusty companion on the path to success.

Don’t stop here; you can continue your exploration by following this link for more details: OMB Circular A-123 – Management’s Responsibility for Internal …

More links

For additional details, consider exploring the related content available here Chapter 3: Budgeting, Financial Accounting for Local and State …